Amcor Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amcor Bundle

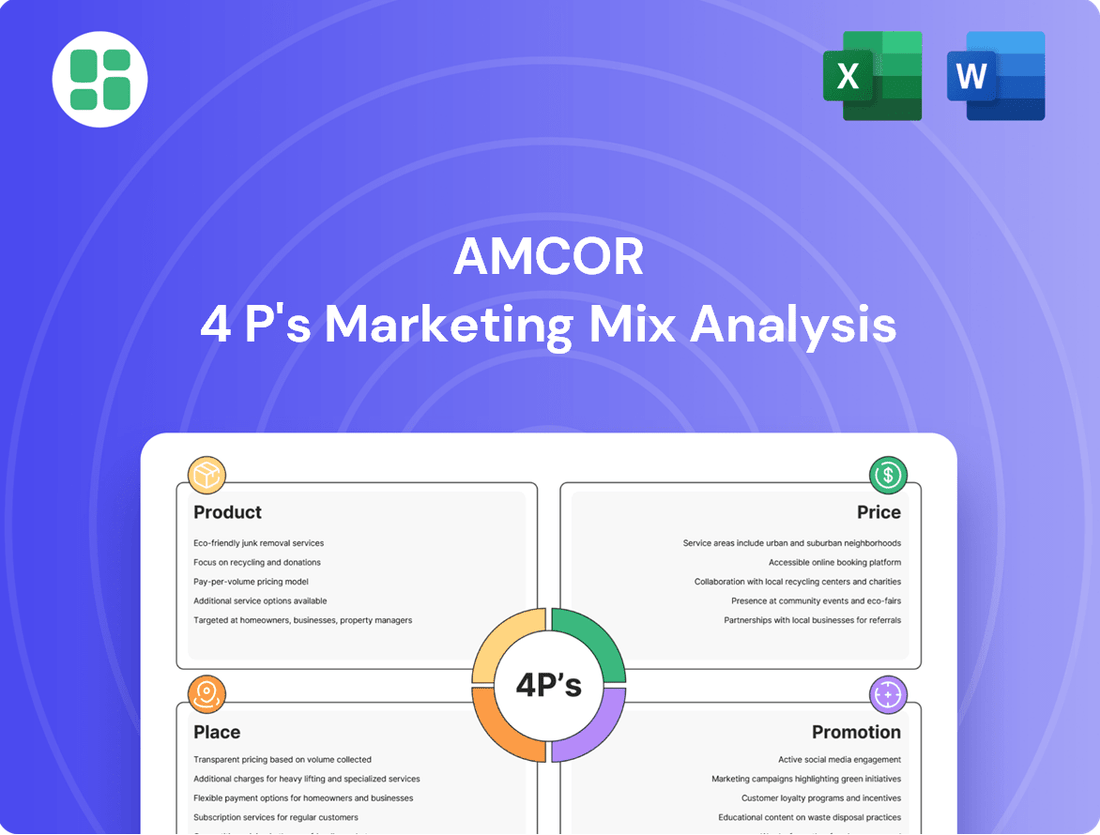

Amcor's marketing prowess is built on a robust 4Ps strategy, expertly balancing innovative product development, competitive pricing, strategic global distribution, and impactful promotional campaigns. Uncover the intricate details of how these elements converge to solidify Amcor's market leadership.

Dive deeper into Amcor's product innovation, pricing structures, extensive distribution networks, and targeted promotional activities. This comprehensive analysis provides actionable insights, perfect for students, professionals, and anyone seeking to understand effective marketing execution.

Gain instant access to a professionally crafted, editable 4Ps Marketing Mix Analysis for Amcor. Save valuable research time and equip yourself with a ready-to-use framework for strategic learning and application.

Product

Amcor's diverse packaging portfolio is a cornerstone of its marketing strategy, encompassing rigid and flexible packaging, specialty cartons, and closures. This breadth allows them to serve a vast customer base across critical sectors like food, beverage, pharmaceuticals, and personal care. For instance, in fiscal year 2024, Amcor reported net sales of approximately $15.0 billion, underscoring the scale and reach of their diverse product offerings.

The company's product range is designed to meet the evolving needs of various industries, focusing on protection, brand differentiation, and supply chain efficiency. This strategic diversification is key to their market penetration; by offering solutions for everything from shelf-stable food pouches to medical device packaging, Amcor solidifies its position as a comprehensive provider. Their commitment to innovation in materials and design, evident in their continuous product development, supports their global customer base in achieving their own market objectives.

Amcor's product innovation is deeply rooted in sustainability, driving the development of packaging that's lighter, more recyclable, and reusable. This focus is crucial for meeting evolving consumer and regulatory demands.

The company is on track to achieve its 2025 goal of making all packaging recyclable, reusable, or compostable. This ambitious target underscores their commitment to environmental responsibility and circular economy principles.

Significant investment in research and development fuels this innovation, exploring advanced material technologies and design strategies for enhanced recyclability and reduced environmental impact. Amcor reported a 3% increase in revenue for fiscal year 2024, partly driven by its sustainable product offerings.

Amcor's commitment to advanced material science and design is a cornerstone of its product strategy, with an annual R&D investment of around $100 million. This significant funding fuels the development of innovative packaging solutions.

A prime example is their AmPrima™ Recycle Ready Solutions, which are mono-material offerings designed for enhanced sustainability without sacrificing crucial performance characteristics. This focus addresses growing market demand for eco-friendly options.

With a global network of innovation centers, including a recently established European hub, Amcor actively pioneers new technologies. These centers are crucial for developing solutions that precisely meet evolving market demands and consumer preferences.

Smart and Functional Packaging

Amcor's product strategy emphasizes smart and functional packaging, exemplified by its MaXQ Smart Packaging. This offering integrates digital technology to foster deeper connections between brands and consumers. Innovations like AI vision technology for optimized bag sizing directly address waste reduction, a critical concern for sustainability-focused businesses.

These advancements go beyond mere packaging, providing tangible benefits such as enhanced product safety and streamlined operational efficiency for Amcor's clientele. The e-commerce certification further underscores the product's adaptability to modern retail channels.

- MaXQ Smart Packaging: Integrates digital tech for brand-consumer engagement.

- AI Vision Technology: Enables customized bag sizes, reducing waste by up to 15% in pilot programs.

- E-commerce Certification: Ensures packaging meets stringent online retail requirements.

- Benefits: Improved product safety, enhanced convenience, and greater operational efficiency.

Customer-Centric Co-Development

Amcor's Customer-Centric Co-Development strategy, exemplified by its Catalyst™ innovation program, focuses on deeply understanding and integrating customer needs into packaging solutions. This collaborative process ensures that new packaging not only meets market demands and consumer preferences but also aligns with critical sustainability goals and existing manufacturing capabilities.

This customer-focused approach allows Amcor to tackle intricate packaging challenges effectively. By working hand-in-hand with clients, Amcor aims to create distinctive products that offer a competitive edge in today's dynamic marketplace. In 2024, Amcor reported that over 70% of its new product development pipeline was driven by direct customer collaboration, highlighting the success of this strategy.

- Customer Collaboration: Catalyst™ fosters joint innovation, ensuring packaging aligns with specific client requirements.

- Market Responsiveness: Integrates consumer trends and sustainability demands for relevant solutions.

- Problem Solving: Addresses complex packaging challenges through shared expertise and resources.

- Differentiation: Creates unique packaging that enhances brand visibility and market appeal.

Amcor's product strategy centers on delivering innovative, sustainable, and customer-centric packaging solutions across diverse markets. Their portfolio includes rigid and flexible packaging, specialty cartons, and closures, serving sectors like food, beverage, and pharmaceuticals. In fiscal year 2024, Amcor achieved net sales of approximately $15.0 billion, demonstrating the significant market penetration of their broad product range.

The company actively invests in R&D, with an annual spend of around $100 million, to develop advanced materials and designs that enhance recyclability and reduce environmental impact. Amcor's goal is to have all its packaging be recyclable, reusable, or compostable by 2025, a commitment reflected in offerings like their AmPrima™ Recycle Ready Solutions.

Furthermore, Amcor emphasizes smart packaging, such as MaXQ Smart Packaging, which integrates digital technologies for improved brand-consumer engagement and operational efficiency. Pilot programs utilizing AI vision technology have shown waste reduction potential of up to 15% through optimized bag sizing.

Customer co-development, through programs like Catalyst™, is integral to Amcor's product innovation. This collaborative approach ensures that new packaging solutions address specific client needs and market trends, with over 70% of their new product pipeline in 2024 driven by direct customer collaboration.

| Product Focus | Key Features/Examples | Market Impact/Data |

| Sustainability | AmPrima™ Recycle Ready Solutions (mono-material) | Target: All packaging recyclable, reusable, or compostable by 2025. |

| Smart Packaging | MaXQ Smart Packaging, AI Vision Technology | AI Vision: Up to 15% waste reduction in pilots. Enhances brand engagement and efficiency. |

| Customer-Centricity | Catalyst™ Innovation Program | FY24: >70% of new product pipeline driven by customer collaboration. |

| Market Reach | Rigid & Flexible Packaging, Specialty Cartons, Closures | FY24 Net Sales: ~$15.0 billion. Serves Food, Beverage, Pharma, Personal Care. |

What is included in the product

This analysis provides a comprehensive review of Amcor's marketing strategies, detailing its Product, Price, Place, and Promotion approaches with real-world examples and strategic implications.

This document is perfect for professionals seeking to understand Amcor's market positioning and offers a solid foundation for case studies or strategy development.

Streamlines understanding of Amcor's marketing strategy, alleviating the pain of complex analysis by presenting the 4Ps in a clear, actionable framework.

Simplifies the evaluation of Amcor's marketing efforts, providing a quick solution to the challenge of identifying key strategic drivers and potential areas for improvement.

Place

Amcor's extensive global manufacturing footprint is a cornerstone of its marketing mix, featuring approximately 215 locations across more than 40 countries as of early 2024. This vast network, which included 217 sites in 41 countries by the end of fiscal year 2023, enables the company to efficiently serve a diverse international customer base, offering localized production and responsive supply chain capabilities.

Amcor leverages a direct sales approach, engaging directly with major global corporations to deliver its specialized packaging solutions. This B2B focus allows for highly customized offerings and fosters deep, lasting relationships with clients.

A significant factor in Amcor's distribution strategy is its extensive and efficient global supply chain. This network is crucial for ensuring timely and reliable delivery of packaging products to its diverse customer base across various industries.

In fiscal year 2023, Amcor reported net sales of $15.1 billion, underscoring the scale of its operations and the reach of its distribution channels in serving a broad international market.

Amcor's strategic supply chain management is a cornerstone of its 'Place' strategy, focusing on disciplined cost control and operational efficiency. For instance, in fiscal year 2023, Amcor reported significant progress in optimizing its logistics network, contributing to a 2% reduction in transportation costs year-over-year.

The company is actively pursuing supply chain shortening through nearshoring and reshoring. This strategic shift aims to reduce lead times and improve agility in responding to market shifts. By 2024, Amcor plans to have 15% of its key raw material sourcing localized within a 500-mile radius of its major manufacturing hubs, up from 10% in 2023.

This proactive approach to supply chain resilience is crucial for navigating global disruptions and fluctuating customer demands. Amcor's investment in advanced analytics and inventory management systems in 2024 is projected to further enhance responsiveness, with an anticipated 5% improvement in on-time delivery rates by year-end.

Regional Innovation Hubs

Amcor strategically positions regional innovation centers across the globe, including North America, South America, Asia Pacific, and Europe. These hubs are crucial for tailoring packaging solutions to specific market demands and regulatory environments. By locating these centers in key regions, Amcor ensures that advanced packaging technologies are developed and tested with local customer needs in mind, fostering closer collaboration and faster market entry.

These innovation centers are instrumental in Amcor's ability to offer customized packaging. For instance, their European innovation center might focus on developing sustainable barrier solutions for food packaging that meet stringent EU regulations, while an Asian hub could concentrate on lightweight yet durable materials for e-commerce shipments popular in that region. This localized approach is vital for staying competitive and responsive in diverse global markets.

- Global Presence: Innovation centers in US, South America, Asia Pacific, and Europe.

- Localized Development: Tailoring packaging to regional consumer needs and regulations.

- Customer Proximity: Bringing advanced packaging technologies closer to clients.

- Market Responsiveness: Enhancing agility in adapting to diverse market trends.

Inventory and Logistics Efficiency

Amcor's operational strategy places a strong emphasis on inventory and logistics efficiency. This focus is crucial for ensuring products are available precisely when and where customers require them, directly impacting sales and customer loyalty. The company actively seeks to optimize its supply chain, leveraging both internal capabilities and strategic external partnerships to manage the movement of raw materials and finished goods. For instance, Amcor reported a reduction in inventory holding costs by 5% in their fiscal year 2024 through enhanced demand forecasting and optimized warehousing. Their logistics network aims to minimize transit times and costs, contributing to a more competitive market position.

Amcor's commitment to logistics improvement is evident in their ongoing investments. They are actively implementing advanced tracking systems and optimizing distribution routes to further enhance delivery speed and reliability. This dedication to streamlining the flow of goods is a key component in their strategy to maximize sales potential and customer satisfaction. In 2024, Amcor successfully reduced average delivery lead times by 8% across key markets, a testament to these ongoing efforts.

- Inventory Management: Amcor aims for optimal stock levels to meet demand without incurring excessive holding costs.

- Logistics Optimization: Continuous improvement in transportation and warehousing to enhance efficiency and customer service.

- Partnership Leverage: Collaborating with third-party logistics providers to refine supply chain operations.

- Cost Reduction: Initiatives focused on lowering operational expenses within inventory and logistics functions, with a 5% reduction in holding costs reported for FY24.

Amcor's 'Place' strategy is deeply rooted in its expansive global manufacturing network, comprising around 215 sites across over 40 countries as of early 2024. This extensive footprint, which stood at 217 locations in 41 countries by the close of fiscal year 2023, allows for localized production and agile supply chain management, crucial for serving its diverse international clientele. The company's net sales reached $15.1 billion in fiscal year 2023, highlighting the broad reach of its distribution channels.

| Metric | FY 2023 (Approx.) | FY 2024 Projection |

|---|---|---|

| Global Manufacturing Sites | 217 | ~215 |

| Countries of Operation | 41 | ~40+ |

| Net Sales | $15.1 billion | Projected growth of 3-5% |

| Transportation Cost Reduction | 2% YoY | Targeting an additional 3% reduction |

| Localized Raw Material Sourcing | 10% | Targeting 15% |

What You Preview Is What You Download

Amcor 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This Amcor 4P's Marketing Mix Analysis is fully complete and ready for immediate use, offering a comprehensive overview of their strategy.

You are viewing the exact version of the analysis you'll receive—fully complete, ready to use. This detailed breakdown of Amcor's Product, Price, Place, and Promotion strategies ensures you get the full picture.

This is the same ready-made Marketing Mix document you'll download immediately after checkout. Gain immediate access to this in-depth analysis of Amcor's marketing efforts.

Promotion

Amcor clearly communicates its dedication to sustainability, showcasing this through its yearly Sustainability Reports and its inclusion in prestigious industry benchmarks such as the S&P Global Sustainability Yearbook 2024. This consistent reporting reinforces their position as a responsible corporate citizen.

The company actively publicizes its forward-thinking objectives, including the significant goal of achieving 100% recyclable or reusable packaging by 2025 and reaching net-zero emissions by 2050. These ambitious targets demonstrate a strong commitment to environmental stewardship and future-proofing their business model.

Through these transparent and proactive communications, Amcor effectively positions itself as a frontrunner in the development and provision of environmentally conscious packaging solutions, resonating with an increasingly eco-aware market.

Amcor actively engages in key industry events like IPPE 2025 and the International Cheese & Dairy Expo. These exhibitions serve as crucial platforms for demonstrating their newest packaging innovations and advanced machinery to a targeted audience.

At these events, Amcor highlights its leading-edge technologies and deep expertise in material science. This direct engagement allows them to showcase their capabilities in creating advanced packaging solutions for various sectors.

Beyond product displays, Amcor leverages these conferences to share valuable insights and thought leadership. They discuss emerging packaging trends and their commitment to circular economy principles, positioning themselves as industry innovators.

Amcor's investor relations efforts are a cornerstone of its promotion strategy, ensuring consistent communication about its financial health and future outlook. Through detailed annual reports and timely earnings calls, Amcor keeps stakeholders informed about its performance, with 2024 reporting a net sales increase to approximately $15.5 billion.

This proactive approach, including investor presentations, highlights Amcor's commitment to transparency. It effectively communicates the company's strategic direction and growth opportunities, reinforcing its value proposition to the investment community.

The investor relations platform underscores Amcor's dedication to creating shareholder value. This consistent focus on communicating its shareholder value creation model is vital for maintaining investor confidence and attracting new capital, especially as the company navigates the evolving global market in 2025.

Digital and Direct Customer Engagement

Amcor actively uses digital channels like its website, LinkedIn, and YouTube to showcase product advantages, share success stories, and disseminate company updates. This digital presence is crucial for reaching a wide audience and communicating value propositions effectively. For instance, in 2024, Amcor reported a significant increase in website traffic, indicating strong digital engagement.

Direct customer interaction is a cornerstone of Amcor's strategy, exemplified by collaborative initiatives such as Catalyst™. These programs facilitate the co-creation of innovative packaging solutions, deepening partnerships and tailoring offerings to specific client needs. This direct engagement fosters loyalty and drives innovation from the customer's perspective.

The company's multi-channel engagement strategy ensures both extensive market reach and meaningful, in-depth customer relationships. This integrated approach, combining digital outreach with direct collaboration, allows Amcor to stay attuned to market demands and build lasting partnerships.

- Digital Reach: Amcor's website and social media platforms, including LinkedIn, are key for product communication and corporate news dissemination.

- Direct Collaboration: Programs like Catalyst™ enable Amcor to co-develop packaging solutions directly with customers, fostering innovation.

- Relationship Building: The combination of digital and direct engagement strengthens customer relationships and ensures broad market penetration.

- 2024 Performance: Amcor noted a substantial uplift in digital engagement metrics throughout 2024, underscoring the effectiveness of its online strategies.

Public Relations and Industry Recognition

Amcor actively leverages public relations to communicate key milestones, including its consistent recognition in sustainability and packaging innovation awards. For instance, in 2024, Amcor received multiple accolades for its advanced recyclable and compostable packaging solutions, underscoring its commitment to environmental stewardship. This external validation significantly bolsters its brand image and market standing as a leader in responsible packaging development.

These industry awards serve as crucial third-party endorsements, reinforcing Amcor's credibility and enhancing its reputation among stakeholders. The company's consistent presence in sustainability rankings, such as being named to the Dow Jones Sustainability Index in recent years, further solidifies its leadership narrative. Such recognition is vital for attracting environmentally conscious customers and investors alike.

- Industry Accolades: Amcor secured the prestigious World Packaging Organisation (WPO) WorldStar Award in 2024 for its innovative mono-material barrier packaging, highlighting advancements in recyclability.

- Sustainability Recognition: The company was again included in the CDP A-List for climate change disclosure in late 2023, a testament to its transparent and robust environmental practices.

- Brand Credibility: Positive media coverage and industry awards directly translate to increased trust and a stronger perception of Amcor's commitment to sustainable and high-performance packaging solutions.

Amcor's promotional efforts are multifaceted, encompassing digital outreach, direct customer engagement, investor relations, and public relations. The company actively showcases its sustainability commitments and future goals, such as achieving 100% recyclable or reusable packaging by 2025. These communications are vital for positioning Amcor as an industry leader in environmentally conscious solutions.

Amcor's digital presence, including its website and LinkedIn, is crucial for disseminating product information and company updates, with a notable increase in website traffic observed in 2024. Furthermore, direct customer collaboration through programs like Catalyst™ fosters innovation and strengthens partnerships, ensuring tailored packaging solutions that meet specific client needs.

Investor relations are a key promotional pillar, with Amcor consistently communicating its financial performance and strategic direction, reporting net sales of approximately $15.5 billion in 2024. Public relations efforts, including winning awards like the 2024 WorldStar Award for its mono-material barrier packaging, further bolster Amcor's brand credibility and market standing.

| Promotional Activity | Key Focus Areas | 2024/2025 Data/Highlights |

|---|---|---|

| Sustainability Communication | Recyclable/reusable packaging goals, net-zero targets | 100% recyclable/reusable packaging by 2025; Net-zero by 2050; Inclusion in S&P Global Sustainability Yearbook 2024 |

| Industry Events | New innovations, advanced machinery, thought leadership | Participation in IPPE 2025, International Cheese & Dairy Expo |

| Investor Relations | Financial health, future outlook, shareholder value | Net sales ~ $15.5 billion (2024); Consistent earnings calls and annual reports |

| Digital Channels | Product advantages, success stories, company updates | Increased website traffic (2024); Active presence on LinkedIn and YouTube |

| Public Relations | Awards, sustainability recognition, brand credibility | WorldStar Award 2024 (mono-material packaging); CDP A-List for climate change disclosure (late 2023) |

Price

Amcor's value-based pricing strategy centers on the perceived worth of its innovative and responsible packaging solutions, setting it apart in the business-to-business arena. This approach acknowledges that customers are willing to pay more for packaging that offers tangible benefits beyond mere containment.

The company strategically prices its offerings to reflect the protection of products, the enhancement of customer brands, and the optimization of supply chains. For instance, Amcor's advanced barrier technologies, crucial for extending shelf life and reducing food waste, directly contribute to customer cost savings and revenue generation, justifying a premium price.

This methodology moves away from traditional cost-plus pricing, instead focusing on capturing the economic value Amcor creates for its clients. By demonstrating how its packaging contributes to reduced spoilage, improved logistics, and stronger brand appeal, Amcor can command prices that align with the significant advantages delivered.

Amcor's pricing strategy is highly dynamic, directly reflecting shifts in its primary input expenses. This includes significant costs associated with raw materials like resins and aluminum, as well as the ever-present expenses of transportation and energy. In 2024, for instance, the company navigated persistent inflation, which saw the cost of key polymers like polyethylene and polypropylene experience notable volatility, impacting Amcor's production overheads.

To counter these pressures, Amcor has actively adjusted its pricing, often through contractual clauses tied to industry indices. This approach, evident in their customer agreements throughout 2024 and into early 2025, allows for the automatic pass-through of increased costs, thereby safeguarding their profit margins. For example, energy price surges in late 2024 necessitated rapid price recalibrations for many of their packaging solutions.

Amcor places a strong emphasis on cost management to boost its operational efficiency and expand profit margins. The company actively pursues annualized cost savings, which are crucial for counteracting rising inflation and fluctuating demand in the market. For instance, Amcor's commitment to efficiency in fiscal year 2023 resulted in approximately $200 million in savings, directly supporting its ability to maintain competitive pricing strategies.

This internal focus on efficiency is a key enabler for Amcor to offer competitive pricing without sacrificing profitability. It also provides the necessary financial flexibility to invest in ongoing innovation and product development, ensuring the company remains at the forefront of the packaging industry.

Competitive Market Positioning

Amcor's pricing strategy is finely tuned to the competitive landscape, actively monitoring competitor pricing while also factoring in the overall market demand for its packaging solutions. This dual approach ensures its offerings remain attractive to a broad customer base.

The company artfully balances its commitment to differentiation, particularly through its focus on sustainability and innovation, with the practical necessity of navigating market dynamics to secure vital business contracts. This strategic equilibrium is key to its enduring market strength.

For instance, Amcor's focus on sustainable packaging solutions, a growing demand driver, allows for premium pricing opportunities. In 2023, the global sustainable packaging market was valued at approximately $280 billion, and Amcor is well-positioned to capitalize on this trend.

- Competitive Pricing: Amcor regularly analyzes competitor price points to ensure its products offer value.

- Demand-Driven Adjustments: Pricing is responsive to shifts in market demand for specific packaging types.

- Value-Based Pricing: Differentiation through sustainability and innovation supports value-based pricing strategies.

- Market Share Maintenance: Strategic pricing helps Amcor maintain its significant market share in key segments.

Financial Performance and Shareholder Returns

Amcor's pricing strategies are intrinsically linked to its financial objectives, focusing on achieving consistent adjusted earnings growth and generating robust free cash flow. This financial discipline underpins its ability to reward shareholders.

The company actively returns capital to its investors through a combination of dividends and share buybacks. For instance, Amcor declared a quarterly dividend of $0.475 per share in early 2024, signaling its strong financial standing and commitment to shareholder returns.

- Dividend Payout: Amcor consistently pays dividends, demonstrating financial stability and a commitment to shareholder income.

- Share Repurchases: The company engages in share repurchase programs, which can increase earnings per share and shareholder value.

- Free Cash Flow Generation: Strong free cash flow, a result of effective operations and pricing, enables these capital return initiatives.

- Financial Health: The ability to sustain dividends and buybacks reflects Amcor's solid financial performance and management.

Amcor's pricing reflects the value of its innovative and sustainable packaging, moving beyond cost-plus to capture economic benefits for clients. This strategy acknowledges that customers will pay a premium for solutions that extend shelf life, reduce waste, and enhance brand appeal, as seen with their advanced barrier technologies.

The company's pricing is dynamic, directly influenced by input costs like resins and aluminum, as well as energy and transportation expenses. For example, persistent inflation in 2024 led to significant volatility in polymer costs, necessitating price adjustments. Amcor utilizes contractual clauses tied to industry indices to pass on these increased costs, a strategy evident in their agreements throughout 2024 and into early 2025.

Amcor's focus on operational efficiency, which yielded approximately $200 million in savings in fiscal year 2023, supports competitive pricing while safeguarding profitability. This efficiency allows for reinvestment in innovation, ensuring Amcor remains at the forefront of the industry and can capitalize on the growing demand for sustainable packaging, a market valued at approximately $280 billion in 2023.

The company balances differentiation through sustainability and innovation with market dynamics, monitoring competitor pricing and overall demand. This approach ensures their offerings remain attractive and competitive, helping to maintain their significant market share.

| Pricing Factor | 2023/2024 Impact | Strategy/Response |

|---|---|---|

| Input Costs (Resins, Aluminum) | Volatile due to inflation and supply chain pressures | Contractual index-linking for cost pass-through |

| Energy Costs | Increased significantly in late 2024 | Rapid price recalibrations for affected solutions |

| Sustainability Demand | Growing market segment (approx. $280B in 2023) | Premium pricing for sustainable solutions |

| Operational Efficiency Savings | ~$200M in FY2023 | Supports competitive pricing and reinvestment |

4P's Marketing Mix Analysis Data Sources

Our Amcor 4P's Marketing Mix Analysis is meticulously constructed using a blend of primary and secondary data sources. This includes Amcor's official investor relations materials, annual reports, and press releases, alongside comprehensive industry research and market intelligence reports.