Amcor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amcor Bundle

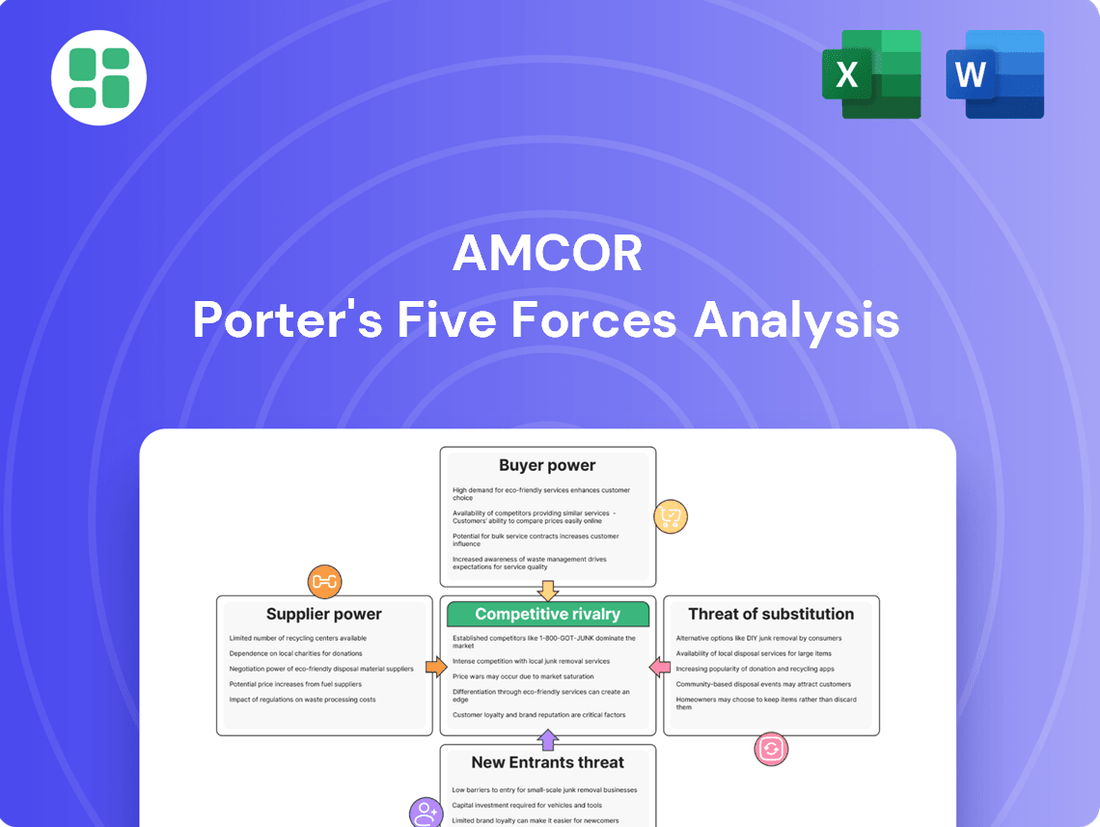

Amcor's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the significant bargaining power of its customers. Understanding these dynamics is crucial for any business operating in or investing in the packaging sector.

The complete Porter's Five Forces Analysis for Amcor delves into each of these pressures with detailed insights. Discover how the threat of substitutes and new entrants impacts Amcor's market position and unlock actionable strategies to navigate these challenges.

Ready to gain a comprehensive understanding of Amcor's competitive environment and identify key strategic advantages? Unlock the full Porter's Five Forces Analysis to drive informed decisions and secure your business's future.

Suppliers Bargaining Power

Amcor's reliance on essential raw materials like PET, PP, PE, paperboard, and aluminum makes it susceptible to supplier influence. For instance, fluctuations in the price of crude oil, a key feedstock for many plastics, directly impact resin costs. In 2024, global plastic resin prices saw significant volatility, with some grades increasing by 5-10% due to energy market shifts and production constraints, directly affecting Amcor's cost of goods sold.

Supplier concentration is a key factor influencing Amcor's bargaining power. When a few dominant suppliers control essential raw materials, like specialized resins or aluminum foil, they can dictate prices and terms, potentially squeezing Amcor's margins. This is particularly true for niche materials where Amcor, despite its vast global presence with 212 sites across over 40 countries, has limited alternative sourcing options.

Switching suppliers for Amcor’s specialized packaging components or specific raw material grades can incur substantial costs. For instance, retooling machinery to accommodate new materials or designs can represent a significant capital expenditure, potentially running into hundreds of thousands or even millions of dollars depending on the complexity.

Beyond equipment, the process of re-qualifying new materials to meet stringent food safety or pharmaceutical standards adds further expense and time, often involving extensive testing and certification. Disruptions to established production lines during the transition period can also lead to lost output and increased labor costs, impacting Amcor's operational efficiency.

These high switching costs effectively create a barrier, making it more difficult and costly for Amcor to change suppliers. Consequently, this can strengthen the bargaining power of Amcor's existing suppliers, as they are less vulnerable to losing Amcor's business due to the financial and operational implications of such a change.

Forward Integration Threat by Suppliers

Suppliers of critical materials or components could potentially integrate forward into packaging manufacturing, directly competing with Amcor. This move would allow them to capture more of the value chain and potentially offer finished packaging solutions, bypassing Amcor entirely.

While this threat is less common for suppliers of basic raw materials like pulp or resins, manufacturers of specialized components or advanced materials might consider such a strategic shift. For instance, a company producing advanced barrier films could explore manufacturing pre-formed pouches, directly entering Amcor's market.

The mere possibility of suppliers integrating forward, even if it's a remote threat, can influence Amcor's negotiating leverage. It encourages Amcor to maintain strong relationships and potentially secure long-term supply agreements to mitigate this risk.

- Forward Integration Threat: Suppliers of specialized packaging components might integrate forward, directly competing with Amcor.

- Impact on Negotiation: This potential threat can limit Amcor's bargaining power with its suppliers.

- Strategic Consideration: Amcor must monitor supplier capabilities and market trends to anticipate and counter such moves.

Uniqueness of Inputs

The uniqueness of inputs significantly impacts supplier bargaining power for a company like Amcor. When suppliers offer specialized or proprietary materials, their leverage increases because Amcor has fewer alternatives. For example, if a supplier holds patents on advanced barrier films essential for Amcor's high-performance packaging, that supplier can command higher prices or more favorable terms. This is particularly relevant as Amcor increasingly invests in sustainable packaging solutions, which often rely on novel bio-based plastics or specialized recycled content, potentially concentrating supply among a few innovative providers.

In 2024, the demand for sustainable packaging materials surged, with the global bioplastics market projected to reach approximately $15.5 billion. This growth highlights Amcor's potential reliance on a limited number of suppliers who can provide these advanced, eco-friendly inputs at scale. For instance, companies specializing in advanced chemical recycling or novel biodegradable polymers could find themselves in a strong bargaining position if Amcor's product roadmap heavily features these materials.

- Proprietary Materials: Suppliers with patented or unique formulations for coatings, resins, or films can exert considerable influence.

- Specialized Technology: Inputs requiring unique manufacturing processes or advanced technological integration give suppliers an edge.

- Sustainability Focus: Amcor's commitment to bio-based and recycled materials may concentrate supply among a few innovative providers, increasing their bargaining power.

Amcor's suppliers hold significant bargaining power due to the essential nature of their products, such as PET, PP, PE, paperboard, and aluminum. Fluctuations in crude oil prices, a key input for plastics, directly impact resin costs. In 2024, global plastic resin prices experienced notable volatility, with certain grades seeing increases of 5-10% due to energy market shifts and production constraints, directly affecting Amcor's cost of goods sold.

The concentration of suppliers for specialized materials, like advanced barrier films or specific aluminum alloys, grants them leverage over Amcor. When Amcor requires unique inputs for its high-performance packaging, it often faces limited alternative sourcing options, even with its extensive global footprint of 212 sites. This reliance on a few key providers can lead to price increases and less favorable terms for Amcor.

Switching costs for Amcor are substantial, encompassing not only potential retooling of machinery but also the rigorous and time-consuming process of re-qualifying new materials to meet stringent industry standards. These expenses, coupled with potential production disruptions, strengthen the position of existing suppliers by making it financially and operationally challenging for Amcor to change providers.

| Material Type | 2024 Price Volatility (Est.) | Key Driver | Amcor Impact |

|---|---|---|---|

| Plastic Resins (PET, PP, PE) | 5-10% increase for some grades | Crude oil prices, production constraints | Increased cost of goods sold |

| Aluminum | Moderate volatility | Global industrial demand, energy costs | Impact on packaging material costs |

| Specialized Films/Coatings | Potentially higher due to uniqueness | Proprietary technology, R&D investment | Concentrated supply, potential price leverage |

What is included in the product

This analysis dissects the competitive landscape for Amcor, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the packaging industry.

Quickly identify and mitigate competitive threats by visualizing Amcor's supplier power and buyer bargaining leverage.

Customers Bargaining Power

Amcor's significant customer concentration, particularly with large multinational corporations in sectors like food and beverage, grants these clients considerable bargaining power. For instance, in 2024, Amcor's top ten customers accounted for approximately 25% of its total revenue, a figure that highlights the influence these major players wield. Their substantial purchasing volumes enable them to negotiate favorable pricing and demand customized packaging solutions, directly impacting Amcor's profitability.

Customer switching costs are a key factor in Amcor's bargaining power of customers. While Amcor provides specialized and integrated packaging solutions, customers might incur costs when switching suppliers. These can include expenses related to redesigning packaging, conducting new product compatibility tests, or reconfiguring supply chain operations.

For commodity packaging, where differentiation is minimal, switching costs tend to be lower. This can empower customers, as they have more flexibility to move to alternative suppliers without significant financial or operational disruption. For instance, in 2023, the global flexible packaging market, a significant segment for Amcor, saw intense competition, suggesting that for certain product categories, customer leverage remains substantial.

Amcor's strength in product differentiation and customization significantly curtails customer bargaining power. By offering specialized packaging, like their sustainable and high-performance options, Amcor can command better terms. For instance, their commitment to sustainability means over 90% of their flexible packaging and 95% of their rigid packaging are recycle-ready, a feature highly valued by many clients.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for packaging companies like Amcor, especially in the consumer goods sector. These customers operate in intensely competitive markets and are constantly looking for ways to control their own expenses, which naturally leads them to demand competitive pricing from their suppliers. For instance, in 2023, the global consumer goods market faced ongoing inflationary pressures, forcing many brands to re-evaluate their supply chain costs, including packaging. This heightened focus on cost management directly impacts Amcor's pricing power.

Several factors can amplify this customer price sensitivity. Economic downturns are a prime example, as consumers and businesses alike become more cautious with their spending. Similarly, an increase in competition within the end-user markets, such as the food and beverage or healthcare industries that Amcor serves, compels those companies to seek cost reductions wherever possible. This can translate into greater negotiation leverage for customers when dealing with packaging providers.

- High Price Sensitivity in Consumer Goods: Customers in consumer goods industries are often highly price-sensitive due to competitive markets and pressure to manage their own costs.

- Demand for Competitive Pricing: This sensitivity translates into strong demands for competitive pricing from packaging suppliers like Amcor.

- Impact of Economic Conditions: Economic downturns or increased competition in end-user markets can further heighten this price sensitivity, giving customers more bargaining power.

Backward Integration Threat by Customers

The bargaining power of customers is a significant factor for Amcor, and a key element is the threat of backward integration. Large customers, especially those with substantial packaging requirements, could potentially bring their packaging production in-house. This move, while demanding significant capital and specialized knowledge, becomes a more viable consideration for high-volume, simpler packaging solutions.

This potential for customers to manufacture their own packaging directly influences their leverage in negotiations with Amcor. For instance, a major beverage producer, a significant Amcor client, might evaluate the cost savings and control gained by internalizing some of its packaging needs. While a complete takeover of Amcor's complex operations is unlikely, even partial backward integration by key clients can shift negotiation dynamics.

Consider the implications for Amcor's revenue streams. If a substantial portion of a client's packaging needs, perhaps representing a few percentage points of Amcor's total sales, were to be brought in-house, it would directly impact Amcor's top line. For example, if a top-tier customer accounting for 2% of Amcor's approximately $15 billion in annual revenue (based on 2023 figures) decided to self-manufacture a portion of their packaging, it could represent a loss of around $60 million in sales.

- Backward Integration Threat: Customers with large packaging volumes may consider producing their own packaging, impacting Amcor's sales.

- Capital & Expertise: This strategy requires significant investment and specialized knowledge, making it more feasible for less complex packaging.

- Negotiation Leverage: The potential for backward integration grants customers greater power when negotiating prices and terms with Amcor.

- Financial Impact: Even partial backward integration by major clients can lead to a notable reduction in Amcor's revenue, potentially in the tens to hundreds of millions of dollars depending on the client's size.

The bargaining power of Amcor's customers is substantial, driven by factors like customer concentration and price sensitivity. Large clients, such as major food and beverage companies, wield significant influence due to their purchasing volume, which in 2024 represented about 25% of Amcor's revenue from its top ten customers. This allows them to negotiate favorable pricing and demand tailored solutions, directly affecting Amcor's profitability and market position.

Customers' ability to switch suppliers, especially for commodity packaging, is another key determinant of their bargaining power. While Amcor offers differentiated products, lower switching costs in certain segments empower customers to seek better terms elsewhere. For example, the competitive landscape in the global flexible packaging market in 2023 underscored this leverage for some of Amcor's offerings.

The threat of backward integration, where large customers might produce their own packaging, also amplifies customer bargaining power. This is more feasible for simpler packaging needs and can lead to significant revenue impacts for Amcor. For instance, a top-tier client representing 2% of Amcor's roughly $15 billion in 2023 revenue could potentially reduce Amcor's sales by around $60 million if they brought even a portion of their packaging production in-house.

| Customer Factor | Impact on Amcor | Supporting Data (2023-2024) |

| Customer Concentration | High influence on pricing and terms | Top 10 customers ~25% of revenue (2024) |

| Switching Costs | Varies by product; lower for commodities | Competitive flexible packaging market (2023) |

| Price Sensitivity | Strong demand for competitive pricing | Consumer goods sector facing inflationary pressures (2023) |

| Backward Integration Threat | Potential loss of revenue | Top client (2% of revenue) could mean ~$60M sales impact |

Full Version Awaits

Amcor Porter's Five Forces Analysis

This preview shows the exact Amcor Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape within the packaging industry. You'll gain deep insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, all presented in a professionally formatted and ready-to-use document.

Rivalry Among Competitors

The packaging industry is intensely competitive, characterized by a broad spectrum of players ranging from massive multinational corporations to specialized regional firms and a multitude of smaller, localized businesses. This diverse competitive landscape significantly heightens rivalry for companies like Amcor.

Amcor faces formidable competition from major global entities such as Berry Global Group, Sealed Air Corporation, Ball Corporation, Crown Holdings Inc., and Mondi Group. These companies, along with many others, vie for market share across various packaging segments.

The sheer volume and varied nature of these competitors, particularly in more mature and saturated market segments, create a challenging environment. This intense rivalry often leads to price pressures and a constant need for innovation to maintain a competitive edge.

The overall growth rate of the packaging industry significantly impacts competitive rivalry. In developed markets, where growth might be slower, companies often intensify their efforts to capture existing market share, leading to more aggressive competition.

Looking ahead, the global flexible packaging market is projected to expand at a compound annual growth rate of 4.5% between 2025 and 2034. Concurrently, the rigid plastic packaging segment is anticipated to grow at a 3.6% CAGR from 2025 to 2030, highlighting specific areas of opportunity within the broader industry.

Amcor strategically navigates these dynamics by focusing on high-growth emerging markets and the increasingly important sector of sustainable packaging. This approach aims to lessen the pressure from slower growth in more mature regions and capitalize on evolving consumer and regulatory demands.

Competitors in the packaging industry frequently distinguish themselves through novel product development, eco-friendly attributes, and superior customer service. Amcor actively pursues this by focusing on developing packaging that is lighter, more easily recyclable, and reusable, supported by significant investment in research and development. For instance, in fiscal year 2023, Amcor reported capital expenditures of $768 million, a portion of which is dedicated to R&D and product innovation.

While Amcor's commitment to innovation, particularly in areas like sustainable packaging solutions, serves as a crucial differentiator, the industry's rapid pace of technological advancement and the ease with which competitors can replicate successful innovations present a constant challenge. This dynamic necessitates continuous investment in R&D to maintain a competitive edge and prevent the erosion of its unique selling propositions.

Exit Barriers

The packaging industry, including companies like Amcor, faces substantial exit barriers. High fixed costs are a primary driver, stemming from the significant investments required for manufacturing plants, specialized machinery, and intricate distribution networks. These capital-intensive assets make it difficult and costly for companies to cease operations or divest themselves from the market.

These elevated exit barriers mean that even businesses struggling with profitability often continue to operate. This persistence can lead to market overcapacity, where the supply of packaging solutions outstrips demand. Consequently, this situation fuels sustained price competition among all players, ultimately dampening overall industry profitability.

For instance, in 2024, the global packaging market was valued at approximately $1.1 trillion, with significant portions tied to tangible assets and established infrastructure. Companies within this sector have historically found it challenging to liquidate specialized equipment or redeploy large-scale manufacturing facilities without incurring substantial losses, reinforcing the inertia created by these barriers.

- High Capital Investment: Manufacturing plants and specialized machinery represent significant sunk costs, making closure or sale economically prohibitive.

- Distribution Network Complexity: Established and extensive distribution channels are costly to dismantle and difficult to replicate elsewhere.

- Operational Inertia: Underperforming firms may continue operations due to the inability to recover fixed asset costs, leading to prolonged price wars.

- Market Dynamics: Sustained overcapacity resulting from these barriers can depress profit margins across the entire industry.

Strategic Objectives of Competitors

Amcor's competitors, such as Berry Global and Sealed Air, are actively pursuing diverse strategic objectives. Berry Global, for instance, has been focused on expanding its market share through strategic acquisitions, aiming to broaden its product portfolio and geographical reach. This aggressive expansion strategy directly impacts competitive dynamics by increasing the overall market concentration.

Other players are prioritizing profitability and operational efficiency, seeking to optimize their cost structures and enhance margins. This can manifest in a focus on higher-margin product segments or investments in automation and process improvements. For example, in 2023, the global flexible packaging market, a key area for Amcor, saw companies investing heavily in advanced manufacturing techniques to drive down production costs.

Technological leadership, particularly in sustainable packaging solutions, is another critical objective. Competitors are making substantial investments in research and development for recyclable, compostable, and biodegradable materials. This drive for innovation presents a direct challenge to Amcor's market position, as companies vie to capture the growing demand for environmentally friendly packaging options. For instance, significant R&D spending by key competitors in biodegradable polymers is reshaping the competitive landscape.

- Market Share Expansion: Competitors like Berry Global are aggressively pursuing acquisitions to increase their footprint and customer base.

- Profitability Focus: Many rivals are concentrating on operational efficiencies and cost optimization to boost their bottom lines, impacting pricing strategies.

- Technological Advancement: Significant investments are being channeled into sustainable packaging innovations, creating pressure for Amcor to keep pace.

- Pricing Strategies: Competitors aiming for market dominance may employ aggressive pricing, directly challenging Amcor’s revenue streams.

Competitive rivalry within the packaging industry is fierce, driven by a large number of global and regional players. This intense competition often leads to price wars and necessitates continuous innovation, especially in the growing sustainable packaging sector. For example, the global flexible packaging market is expected to grow at a 4.5% CAGR from 2025 to 2034, intensifying the battle for market share.

Amcor's rivals, such as Berry Global and Sealed Air, are actively pursuing strategies like market share expansion through acquisitions and a strong focus on operational efficiency. This competitive pressure is further amplified by significant investments in technological advancements, particularly in eco-friendly packaging solutions, creating a dynamic and challenging market environment.

| Competitor Strategy | Focus Area | Impact on Amcor |

|---|---|---|

| Market Share Expansion (e.g., Berry Global) | Acquisitions, geographical reach | Increased market concentration, pressure on Amcor's market position |

| Profitability & Efficiency | Cost optimization, automation | Potential for aggressive pricing from rivals, margin pressure |

| Technological Leadership | Sustainable packaging R&D | Need for Amcor to match innovation pace, potential for new market entrants |

SSubstitutes Threaten

The threat of substitutes for Amcor's packaging products is significant, primarily stemming from alternative materials like glass, metal, and paper. These materials can perform similar packaging functions, offering different advantages such as perceived premium quality (glass) or recyclability (metal, paper). For instance, the global glass packaging market was valued at approximately $54.9 billion in 2023 and is projected to grow, indicating a persistent alternative.

Emerging bio-based and compostable materials also represent a growing substitute threat, driven by increasing consumer demand for sustainable packaging solutions. Companies are investing heavily in these alternatives, with the global bioplastics market expected to reach $17.9 billion by 2028. This innovation directly challenges Amcor's reliance on traditional plastics and flexible packaging, especially in sectors where environmental impact is a key purchasing factor.

The increasing adoption of reusable and refillable packaging systems poses a substantial threat of substitutes for companies like Amcor. Driven by heightened consumer environmental awareness and stricter regulations, consumers are increasingly favoring durable containers that can be returned and refilled over single-use options. This shift directly impacts the demand for traditional disposable packaging solutions.

For instance, the global reusable packaging market was valued at approximately $39.1 billion in 2023 and is projected to reach $78.8 billion by 2030, growing at a CAGR of 10.5%. This significant growth highlights a tangible move away from single-use packaging, directly challenging Amcor's core business.

The growing trend towards unpackaged or minimalist product designs, especially for items like fresh produce and bulk goods, directly challenges the need for traditional packaging solutions. This shift can significantly reduce demand for packaging materials, impacting Amcor's market share in segments where such approaches are feasible. For instance, the rise of zero-waste stores and a consumer push for reduced plastic usage are key drivers, potentially eroding Amcor's need for secondary and tertiary packaging in these growing niches.

Digital Alternatives and Service Models

Digital alternatives and service-based models can indeed diminish the demand for physical packaging in certain sectors. For instance, the widespread adoption of digital streaming services has significantly reduced the need for physical media packaging like CDs and DVDs. Similarly, the development of concentrated product forms, such as laundry detergent pods or cleaning solution concentrates, directly lowers the volume and complexity of packaging required.

While these shifts may not directly impact the majority of Amcor's primary packaging business, they signal a broader, long-term evolution in consumer behavior and product delivery. Companies are increasingly exploring ways to offer value through services or more efficient product formats, which can indirectly influence packaging needs. For example, subscription box services might consolidate items, altering packaging requirements compared to individual retail purchases.

The threat of substitutes in this context is growing, albeit gradually for many of Amcor's core markets. Consider the packaging for beverages; while digital alternatives don't replace the physical container, innovations in reusable or returnable packaging systems, driven by sustainability concerns and service-oriented models, could alter the demand for single-use packaging materials. Amcor's own investments in sustainable packaging solutions, such as those made from recycled content or designed for recyclability, are a strategic response to these evolving market dynamics and potential substitute threats.

Here's a look at how this trend might manifest:

- Digital Media Dominance: The global digital media market was valued at over $320 billion in 2023, a clear indicator of the shift away from physical formats that previously required extensive packaging.

- Concentrated Product Innovation: The market for household cleaning concentrates is projected to grow, indicating a trend toward reduced packaging material per use.

- E-commerce and Fulfillment: While e-commerce itself doesn't eliminate packaging, the focus on efficient logistics and reduced shipping volume per item can influence packaging design and material choices.

- Sustainability as a Substitute Driver: Growing consumer and regulatory pressure for sustainable solutions is encouraging the development of alternative delivery models and packaging materials that reduce waste, acting as a substitute for traditional packaging.

Cost and Performance of Substitutes

The attractiveness of substitutes for Amcor’s packaging solutions hinges significantly on their relative cost and performance. If alternative materials, such as advanced paper-based or compostable plastics, become substantially more cost-effective while delivering comparable barrier properties, shelf-life extension, and consumer appeal, the threat intensifies. For instance, fluctuations in the price of virgin plastic resins versus recycled content or bio-based alternatives directly impact this equation.

Performance is a critical differentiator; substitutes must meet stringent requirements for product protection, durability, and functionality across various applications, from food and beverage to healthcare. If alternatives fail to match Amcor’s established performance benchmarks, their threat diminishes. However, ongoing innovation in materials science is constantly closing these gaps.

Regulatory landscapes and sustainability mandates are increasingly shaping the substitute threat. For example, government initiatives promoting circular economy principles or imposing taxes on single-use plastics can make alternative, more sustainable materials more competitive. In 2024, many regions saw increased pressure on packaging producers to adopt recycled content, with targets often exceeding 30% for certain plastic packaging types, directly influencing the cost-competitiveness of traditional materials versus innovative substitutes.

- Cost-Effectiveness: Substitutes are more threatening if their total cost of ownership (including production, transport, and disposal) is lower than Amcor's solutions.

- Performance Parity: Alternatives that match or exceed Amcor’s product protection, shelf-life, and handling capabilities pose a significant threat.

- Sustainability Drivers: Growing consumer demand and regulatory pressure for eco-friendly packaging can accelerate the adoption of substitutes, even at a slightly higher initial cost.

- Material Innovation: Advances in biodegradable, compostable, and high-recycled-content materials are continually improving the performance and cost profile of substitutes.

The threat of substitutes for Amcor's packaging is amplified by advancements in materials science and evolving consumer preferences for sustainability. While traditional alternatives like glass, metal, and paper persist, emerging bio-based and compostable materials are gaining traction, driven by environmental concerns. For instance, the global bioplastics market, valued at approximately $14.4 billion in 2023, is projected to reach $25.8 billion by 2030, signaling a growing competitive landscape.

Reusable and refillable packaging systems also present a significant substitute threat, supported by increasing consumer environmental awareness and regulatory push. The global reusable packaging market was valued at around $39.1 billion in 2023 and is expected to grow substantially. Furthermore, trends like unpackaged goods and concentrated product formats reduce the overall demand for traditional packaging, impacting Amcor's market share in specific segments.

| Substitute Category | Key Characteristics | Market Trend/Data Point (2023/2024) | Impact on Amcor |

|---|---|---|---|

| Traditional Materials (Glass, Metal, Paper) | Perceived premium quality, recyclability | Global glass packaging market valued at ~$54.9 billion (2023) | Persistent competition, especially in premium segments |

| Bio-based & Compostable Materials | Sustainability, reduced environmental footprint | Bioplastics market valued at ~$14.4 billion (2023), projected to reach $25.8 billion by 2030 | Growing threat, especially where environmental impact is a key factor |

| Reusable & Refillable Systems | Reduced waste, circular economy focus | Reusable packaging market valued at ~$39.1 billion (2023) | Direct challenge to single-use packaging demand |

| Unpackaged/Concentrated Products | Minimalism, reduced material usage | Growth in zero-waste retail and household cleaning concentrates | Erodes demand for secondary and tertiary packaging needs |

Entrants Threaten

Entering the global packaging market, particularly at a scale to compete with established players like Amcor, demands significant financial outlay. Consider that in 2024, the capital expenditure for a state-of-the-art flexible packaging production line can easily range from $5 million to $15 million, not including the cost of land, buildings, and specialized raw materials.

Beyond manufacturing, establishing the necessary global supply chains and distribution networks adds another layer of substantial investment, often running into tens of millions of dollars. This high capital requirement acts as a significant deterrent, effectively limiting the number of new entrants capable of challenging incumbents.

Existing players in the rigid packaging sector, like Amcor, leverage substantial economies of scale. These scale advantages translate into lower per-unit costs for raw materials, manufacturing, and logistics, a significant hurdle for any new competitor. For instance, Amcor's global manufacturing footprint allows for bulk purchasing power, a benefit a new entrant would find difficult to replicate quickly.

New entrants face the daunting task of matching the cost efficiencies built by established firms over years of operation. This includes not only procurement but also the optimization of complex production processes. Amcor's decades of experience in areas like polymer science and high-speed filling line integration represent an intangible but powerful barrier, as replicating this expertise takes considerable time and investment.

Amcor's deep-rooted relationships with major global brands present a significant barrier to new entrants. These partnerships, forged over years of reliable service and integrated supply chain solutions, foster strong customer loyalty. For instance, Amcor's 2023 revenue reached $15.4 billion, underscoring the scale of its operations and the trust placed in it by key clients.

Regulatory Hurdles and Compliance

The packaging industry faces significant regulatory challenges that act as a barrier to new entrants. These regulations cover critical areas like food safety standards, environmental impact assessments, and specific material compositions allowed in packaging. Navigating this complex web of rules requires substantial investment in compliance, testing, and legal expertise, which can be a major deterrent for startups.

For instance, the European Union's Packaging and Packaging Waste Regulation (PPWR) proposals, expected to be finalized in 2024, aim for stricter recycling targets and mandates for recycled content. Companies entering the market must demonstrate immediate adherence to these evolving standards, adding to upfront costs and potentially slowing down market penetration. Failure to comply can result in significant fines and reputational damage.

The financial implications are substantial. A new entrant might need to allocate millions of dollars to ensure their packaging solutions meet all national and international regulatory requirements before even launching a product. This includes extensive product testing and certification processes, which can take months or even years to complete.

- Regulatory Complexity: Packaging is subject to diverse regulations covering food contact safety, environmental sustainability, and material sourcing.

- Compliance Costs: New entrants face significant expenses for testing, certification, and legal counsel to meet stringent industry standards.

- Evolving Standards: Regulations are constantly updated, as seen with the EU's PPWR proposals, requiring continuous adaptation and investment.

- Market Entry Delays: The time and resources needed for regulatory approval can significantly delay a new company's ability to bring products to market.

Access to Technology and Intellectual Property

Amcor's substantial investment in research and development, a cornerstone of its strategy, yields proprietary technologies and intellectual property in packaging innovation. For instance, Amcor reported R&D expenses of $371 million in fiscal year 2023, highlighting its commitment to technological advancement. This focus creates a significant hurdle for potential new entrants who would need to make comparable investments or secure costly licensing agreements to access similar capabilities.

The difficulty in replicating Amcor's advanced, often patented, packaging technologies presents a formidable barrier to entry. New companies may struggle to achieve the same level of product performance, sustainability features, or manufacturing efficiency without comparable R&D expenditure or access to Amcor's intellectual property portfolio.

- Proprietary Technologies: Amcor's R&D spending in FY2023 was $371 million, supporting the development of unique packaging solutions.

- Intellectual Property: Patents and trade secrets protect Amcor's innovations, making replication difficult for newcomers.

- High R&D Costs: New entrants face substantial upfront investment to develop comparable technological capabilities.

- Licensing Barriers: Accessing Amcor's advanced technologies often requires expensive licensing agreements, further increasing the cost of entry.

The threat of new entrants into the global packaging market, where Amcor operates, is generally considered low. This is primarily due to the substantial capital investment required to establish manufacturing facilities and global supply chains, often running into tens of millions of dollars. Furthermore, established players benefit from significant economies of scale and deep-rooted customer relationships, creating formidable barriers for newcomers.

New entrants must also contend with complex regulatory landscapes and the high cost of research and development to match existing technological capabilities. For instance, Amcor's 2023 R&D expenses were $371 million, highlighting the investment needed to innovate. The sheer financial and operational scale required to compete effectively significantly deters potential new market participants.

| Barrier Type | Description | Illustrative Cost/Factor |

| Capital Requirements | Establishing manufacturing and global supply chains | $5M - $15M for a single production line; tens of millions for full infrastructure |

| Economies of Scale | Lower per-unit costs through large-scale operations | Amcor's global purchasing power and optimized logistics |

| Brand Loyalty & Relationships | Established partnerships with major global brands | Amcor's $15.4 billion in 2023 revenue reflects strong client trust |

| Regulatory Compliance | Meeting diverse and evolving packaging standards | Millions in testing, certification, and legal expertise; e.g., EU PPWR |

| Technology & R&D | Developing proprietary and advanced packaging solutions | $371 million in Amcor's FY2023 R&D spending |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Amcor is built upon a robust foundation of data, including Amcor's annual reports and SEC filings, alongside industry-specific market research from firms like Euromonitor and IBISWorld.