Amcor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amcor Bundle

Navigate the complex external forces shaping Amcor's future with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors driving change in the packaging industry. Gain a strategic advantage by anticipating market shifts and identifying opportunities. Download the full, actionable report now and empower your decision-making.

Political factors

Governments globally are tightening rules on packaging to curb plastic waste and boost recycling. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR), effective February 2025, will enforce recyclability, minimum recycled content, and bans on specific packaging types.

Amcor is actively adapting its global strategies to meet and often surpass these changing regulations, ensuring compliance across its diverse markets.

Amcor's extensive global footprint, spanning operations in approximately 40 countries, makes it highly sensitive to evolving international trade policies and geopolitical realignments. Shifts in trade pacts, the imposition of tariffs, or alterations in import/export regulations directly influence its supply chain's efficiency and the overall cost of its products. For instance, the ongoing trade tensions between major economic blocs could lead to increased duties on raw materials or finished goods, impacting Amcor's profitability.

The global expansion of Extended Producer Responsibility (EPR) fees, frequently adjusted based on recyclability, directly impacts packaging manufacturers like Amcor. These regulations shift the financial burden for managing packaging waste at its end-of-life onto the producers themselves.

For instance, in 2024, the European Union continued to refine its EPR frameworks, with several member states introducing or updating fees that incentivize the use of more recyclable materials. Amcor, recognizing this trend, is actively participating in industry dialogues to advocate for harmonized and efficient EPR regulations, alongside promoting the necessary infrastructure to support these systems.

Antitrust and Competition Regulations

Antitrust and competition regulations significantly shape Amcor's strategic maneuvers, especially concerning market consolidation. The company's growth ambitions, often pursued through mergers and acquisitions, are continuously evaluated against these regulatory frameworks. For instance, Amcor's planned integration with Berry Global necessitated and ultimately secured approval from the European Commission, highlighting the critical role of antitrust reviews in such large-scale transactions.

These regulatory landscapes present ongoing challenges and considerations for Amcor's expansion initiatives. The potential for increased scrutiny on market concentration means that future M&A activities will likely face similar, if not more stringent, oversight. This regulatory environment directly impacts Amcor's ability to achieve scale and diversify its operations through strategic combinations.

- Regulatory Scrutiny: Antitrust and competition laws directly influence Amcor's ability to grow through mergers and acquisitions.

- Merger Approvals: Amcor's combination with Berry Global required and received European Commission antitrust clearance, demonstrating a key regulatory hurdle.

- Ongoing Consideration: Such regulatory approvals are a continuous factor in Amcor's long-term expansion and market positioning strategies.

Political Stability in Operating Regions

Amcor's global footprint, with 212 facilities across numerous countries, makes political stability a paramount concern. Stable political environments are essential for ensuring consistent operations and attracting the necessary investment for growth. For instance, in 2023, Amcor reported significant investments in its manufacturing capabilities, which are more secure in regions with predictable governance.

Political instability can manifest as regulatory shifts, trade policy changes, or even civil unrest, all of which can directly impact Amcor's supply chains and production schedules. For example, a sudden imposition of tariffs or export restrictions in a key operating region could significantly alter cost structures and market access. This unpredictability hinders long-term strategic planning.

- Geopolitical Risk Assessment: Amcor actively monitors geopolitical risks across its operating regions, which span North America, Europe, Asia Pacific, and Latin America.

- Regulatory Environment: Political stability ensures a more predictable regulatory landscape, crucial for compliance in the packaging industry.

- Investment Climate: Countries with strong political stability tend to offer a more favorable investment climate, supporting Amcor's capital expenditure plans.

- Operational Continuity: Political unrest can disrupt logistics and workforce availability, directly impacting Amcor's ability to maintain production and delivery schedules.

Governments worldwide are increasingly focused on environmental regulations, particularly concerning packaging waste and recycling. The EU's Packaging and Packaging Waste Regulation (PPWR), set to take effect in February 2025, exemplifies this trend by mandating recyclability, minimum recycled content, and banning certain packaging types. Amcor is proactively adjusting its global strategies to comply with and often exceed these evolving rules across its diverse markets.

Amcor's extensive global operations, present in approximately 40 countries, make it highly susceptible to changes in international trade policies and geopolitical realignments. Fluctuations in trade agreements, the introduction of tariffs, or modifications to import/export regulations can directly impact supply chain efficiency and product costs. For instance, ongoing trade tensions between major economic blocs could lead to increased duties on raw materials or finished goods, affecting Amcor's profitability.

The expanding global implementation of Extended Producer Responsibility (EPR) fees, often tied to recyclability, directly affects packaging manufacturers like Amcor. These regulations transfer the financial responsibility for managing packaging waste at its end-of-life to the producers. In 2024, the EU continued to refine its EPR frameworks, with several member states introducing or updating fees to incentivize the use of more recyclable materials, prompting Amcor's active participation in industry dialogues to advocate for efficient and harmonized EPR regulations.

Antitrust and competition regulations significantly influence Amcor's strategic decisions, especially regarding market consolidation. The company's growth through mergers and acquisitions is continuously assessed against these frameworks. Amcor's planned integration with Berry Global, for example, required and ultimately received approval from the European Commission, underscoring the critical role of antitrust reviews in large-scale transactions.

| Political Factor | Impact on Amcor | Example/Data (2024/2025 Focus) |

| Environmental Regulations | Increased compliance costs, drive for sustainable packaging innovation | EU PPWR (Feb 2025) mandates recyclability and recycled content; Amcor invests in new materials. |

| Trade Policies & Geopolitics | Supply chain disruptions, cost volatility, market access changes | Ongoing trade tensions could increase raw material tariffs; Amcor monitors geopolitical risks across 40+ operating countries. |

| Extended Producer Responsibility (EPR) | Financial burden for waste management, incentive for design changes | EU member states refining EPR fees in 2024 to promote recyclability; Amcor advocates for harmonized systems. |

| Antitrust & Competition Law | Constraints on M&A, need for regulatory approval | Amcor's Berry Global integration required European Commission antitrust clearance. |

What is included in the product

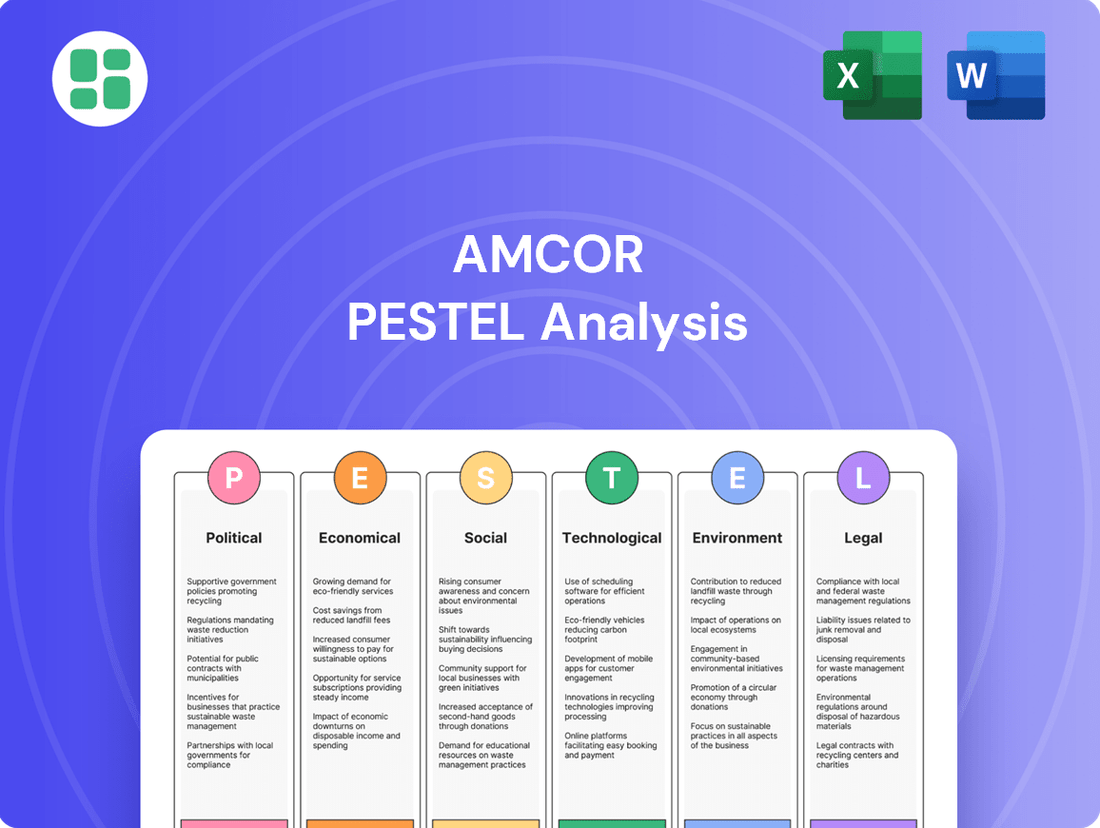

This PESTLE analysis provides a comprehensive examination of the external forces impacting Amcor, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors create both challenges and advantages for the company.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Amcor's strategic discussions.

Economic factors

Fluctuations in the cost of essential raw materials like resins for plastic packaging and pulp for paperboard directly affect Amcor's cost of goods sold. These material costs represented a significant portion of Amcor's overall expenses in fiscal year 2023, meaning even small price changes can put pressure on profit margins.

Amcor's financial reporting for fiscal year 2024 highlighted an unfavorable impact on net sales stemming from the pass-through of reduced raw material costs. This demonstrates the company's pronounced sensitivity to shifts in these key input prices.

Amcor's business is heavily influenced by the health of the global economy and how much consumers are spending. When economies are growing and people feel confident, they tend to buy more packaged goods, which directly boosts Amcor's sales volumes. For instance, after facing some weaker customer demand, Amcor saw a positive shift, reporting a return to year-on-year volume growth in the June 2024 quarter. This trend is anticipated to continue into fiscal year 2025, suggesting a strengthening economic outlook and a pickup in consumer spending.

As a global packaging leader, Amcor's financial performance is inherently linked to currency exchange rate fluctuations. These movements can impact reported revenues and profitability, even if the effect is minor in certain periods. For instance, in recent quarters, currency shifts had a slightly unfavorable impact on Amcor's net sales.

Looking ahead, Amcor's fiscal 2025 outlook suggests a more neutral stance on currency. The company's projections are based on the assumption that current exchange rates will not materially alter its reported earnings per share, indicating a degree of stability anticipated in the near term.

Inflationary Pressures and Cost Management

Rising inflation can significantly impact Amcor's operational expenses, particularly concerning labor and energy costs. These rising input prices necessitate robust cost management strategies to maintain profitability.

Amcor has proactively addressed these challenges, showcasing a strong commitment to cost control. In fiscal year 2024, the company achieved annualized cost savings exceeding $440 million. This disciplined approach to managing expenses proved crucial in offsetting the adverse effects of inflationary pressures.

The success in cost management has directly translated into improved financial performance for Amcor. Specifically, these efforts have contributed to margin expansion, with the Flexibles segment showing notable gains. This demonstrates the effectiveness of Amcor's strategies in navigating a challenging economic environment.

- Inflationary Impact: Increased costs for labor and energy pose a direct threat to Amcor's profitability.

- Cost Savings Achievement: Amcor reported annualized cost savings of over $440 million in fiscal 2024.

- Margin Expansion: Effective cost management has led to margin improvements, especially within the Flexibles segment.

Investment and Shareholder Returns

Amcor prioritizes long-term shareholder value by balancing investments in growth, acquisitions, share buybacks, and dividends. This approach aims to enhance investor returns through a robust capital allocation strategy.

The company demonstrated its commitment by returning approximately $750 million to shareholders in fiscal year 2024. This significant return underscores Amcor's focus on rewarding its investors.

Looking ahead, Amcor anticipates strong adjusted free cash flow for fiscal year 2025. This projected financial strength further solidifies its capacity to continue delivering value to shareholders.

- Shareholder Returns: Approximately $750 million returned in fiscal 2024.

- Fiscal 2025 Outlook: Expectation of strong adjusted free cash flow.

- Capital Allocation: Balanced framework including organic growth, acquisitions, repurchases, and dividends.

Global economic conditions significantly influence Amcor's sales volumes and overall financial health. A strengthening economy, as indicated by Amcor's return to year-on-year volume growth in the June 2024 quarter and positive fiscal year 2025 projections, generally translates to increased demand for packaged goods. Conversely, economic downturns can lead to reduced consumer spending, negatively impacting Amcor's top-line performance.

Amcor's profitability is directly tied to the cost of its primary raw materials, such as resins and pulp, which are subject to market price volatility. While Amcor reported an unfavorable impact on net sales in fiscal year 2024 due to passing through reduced raw material costs, this highlights the company's sensitivity to these input price fluctuations. Effective management of these costs is crucial for maintaining healthy profit margins.

Inflationary pressures, particularly on labor and energy, present ongoing challenges for Amcor's operational expenses. The company's successful implementation of cost-saving initiatives, achieving over $440 million in annualized savings in fiscal year 2024, has been instrumental in mitigating these impacts and even driving margin expansion in segments like Flexibles.

| Economic Factor | Impact on Amcor | Fiscal Year 2024/2025 Data Points |

|---|---|---|

| Global Economic Growth | Drives consumer spending and demand for packaged goods. | Return to year-on-year volume growth in June 2024 quarter; positive fiscal 2025 outlook. |

| Raw Material Costs | Affects cost of goods sold and profit margins. | Unfavorable impact on net sales from passing through reduced costs in FY24; significant portion of overall expenses. |

| Inflation (Labor & Energy) | Increases operational expenses. | Annualized cost savings exceeding $440 million in FY24; margin expansion in Flexibles segment. |

Same Document Delivered

Amcor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Amcor PESTLE analysis delves into the Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting the company, providing crucial insights for strategic planning.

Sociological factors

Consumers are increasingly prioritizing packaging that is lighter, more recyclable, and reusable, a trend fueled by heightened environmental consciousness. For instance, a 2024 Nielsen study indicated that 73% of global consumers are willing to change their purchasing habits to reduce their environmental impact, with packaging being a significant factor.

Amcor is actively responding to this societal shift by investing in innovative packaging designs and materials that align with these consumer preferences. This focus is evident in their 2025 sustainability roadmap, which targets a 25% reduction in carbon emissions and a 15% increase in the use of recycled content across their product portfolio.

This evolving consumer demand acts as a powerful catalyst for Amcor's product innovation and its overarching sustainability commitments. The company's recent launch of a new range of mono-material flexible packaging solutions, designed for enhanced recyclability, directly addresses this growing market imperative.

Consumers are increasingly prioritizing health and wellness, driving demand for specific types of packaged goods. This trend directly impacts Amcor, as it shapes consumer preferences for products with longer shelf-lives, convenient portion sizes, and, crucially for pharmaceuticals, sterile packaging. Amcor's packaging solutions are designed to meet these evolving demands across the food, beverage, and healthcare sectors.

Amcor's strategic investments, such as its advanced coating facility in Malaysia which became operational in 2024, underscore its commitment to supporting these health-conscious trends. This facility enhances Amcor's capacity to supply high-quality, sterile packaging essential for pharmaceutical and healthcare products, a segment seeing significant growth driven by global health awareness.

Global demographics are indeed shifting, with many developed nations experiencing aging populations. For instance, by 2030, it's projected that 1 in 6 people globally will be over the age of 65. This demographic trend, coupled with increasing urbanization, which saw over 57% of the world's population living in urban areas in 2021, directly influences how consumers interact with products and, consequently, their packaging needs. Amcor's focus on developing lighter, more convenient packaging solutions directly addresses these evolving consumption patterns.

Busy lifestyles are a significant driver for convenient packaging. In 2024, the demand for ready-to-eat meals and single-serving portions continues to rise, reflecting a need for portability and ease of use. Amcor's innovation in flexible packaging, such as resealable pouches and easy-open features, directly caters to consumers seeking quick and hassle-free options for their on-the-go consumption habits.

Brand Reputation and Corporate Social Responsibility

Consumers today are more attuned than ever to a company's social and environmental impact. This growing awareness directly influences purchasing choices, making a strong corporate social responsibility (CSR) profile a significant competitive advantage. Amcor's proactive stance on sustainability, including its ambitious Decarbonization Roadmap and recognition through EcoVadis Gold ratings, directly bolsters its brand image. This commitment resonates particularly well with environmentally aware consumers and businesses seeking sustainable supply chain partners.

Amcor's dedication to sustainability is not just about environmental stewardship; it's a strategic imperative that enhances brand loyalty and market appeal. For instance, in 2023, Amcor reported that 76% of its packaging solutions were recyclable or reusable, a tangible metric that speaks to its CSR efforts. This focus on responsible practices can lead to increased customer retention and attract new business from clients prioritizing ethical sourcing and production.

- Enhanced Brand Image: Amcor's commitment to sustainability, as shown by its EcoVadis Gold rating, improves its public perception.

- Consumer Preference: A significant percentage of consumers, often upwards of 60% in recent surveys, state they are willing to pay more for products from sustainable brands.

- Market Differentiation: Amcor's strong CSR performance sets it apart in a competitive packaging market, attracting environmentally conscious clients.

- Risk Mitigation: Proactive engagement with sustainability issues helps Amcor mitigate reputational risks associated with environmental concerns.

Evolving Packaging Aesthetics and Functionality

Consumer preferences are increasingly shaping packaging beyond just its environmental credentials. Expectations now heavily lean towards aesthetics, ease of use, and practical functionality. Brands are recognizing that attractive and user-friendly packaging is crucial for capturing consumer attention and fostering loyalty in a crowded marketplace.

Amcor's commitment to innovation, as demonstrated by its 'Bottles of the Year' program, underscores this shift. This initiative showcases designs that resonate with current consumer desires for simplification and personal identity. The emphasis is on packaging that is not only elegant and well-considered but also inherently sustainable, providing a superior consumer experience.

- Aesthetic Appeal: Consumers are drawn to visually pleasing packaging that reflects brand identity.

- Functional Convenience: Easy-to-open, resealable, and portion-controlled packaging enhances user experience.

- Brand Differentiation: Innovative packaging design is a key tool for brands to stand out on shelves.

- Sustainability Integration: Consumers expect eco-friendly materials and designs to be seamlessly incorporated.

Societal shifts are profoundly influencing packaging demands, with environmental consciousness at the forefront. In 2024, studies revealed that a significant majority of consumers globally are willing to alter purchasing habits to minimize environmental impact, with packaging being a key concern.

Amcor is actively adapting by investing in sustainable packaging solutions, aiming to reduce carbon emissions and increase recycled content in its products by 2025. This strategic alignment with consumer values is crucial for brand loyalty and market differentiation.

The increasing demand for health and wellness products, including those requiring sterile and convenient packaging, also shapes Amcor's innovation pipeline. Investments in advanced facilities, operational since 2024, support the supply of high-quality pharmaceutical and healthcare packaging.

Demographic changes, such as aging populations and urbanization, are also driving the need for lighter, more accessible packaging. Amcor's focus on user-friendly designs directly addresses these evolving consumer lifestyles and consumption patterns.

| Societal Factor | Impact on Packaging Demand | Amcor's Response/Data |

|---|---|---|

| Environmental Consciousness | Demand for recyclable, lighter, and reusable packaging. | 73% of global consumers willing to change habits for environmental impact (2024 Nielsen). Amcor's 2025 roadmap targets 25% carbon emission reduction and 15% recycled content increase. |

| Health & Wellness | Need for sterile, convenient, and longer shelf-life packaging. | Amcor's 2024 Malaysia facility enhances sterile packaging capacity for pharmaceuticals. |

| Demographics (Aging & Urbanization) | Preference for lighter, easy-to-handle, and portable packaging. | Over 57% of the global population lived in urban areas in 2021. Amcor develops lightweight and convenient packaging solutions. |

| Busy Lifestyles | Increased demand for ready-to-eat, single-serving, and easy-open packaging. | Amcor innovations include resealable pouches and easy-open features for on-the-go consumption. |

Technological factors

Amcor is heavily investing in R&D for advanced packaging materials, focusing on lighter, more recyclable options with higher recycled content. This strategic push includes developing recycle-ready flexible packaging and integrating both mechanically and chemically recycled materials.

These material innovations are crucial for Amcor's sustainability goals, directly contributing to a reduced carbon footprint across their product lines. For instance, their efforts in flexible packaging aim to make these widely used formats more circular, aligning with global waste reduction initiatives.

Smart packaging is evolving rapidly, with technologies like AI vision poised to revolutionize how packaging is produced and used. Imagine packaging that can adjust its size in real-time based on product needs or provide instant equipment status updates, enhancing efficiency and reducing waste. This level of integration is becoming a reality for companies like Amcor.

Amcor's commitment to this technological shift is evident in its Amcor Lift-Off program. This initiative actively seeks partnerships with startups specializing in AI for manufacturing and research and development. For instance, in 2024, Amcor announced collaborations with several AI-focused startups, aiming to integrate cutting-edge digital solutions across its operations, from product design to supply chain management.

Amcor leverages advanced automation in its manufacturing, employing cutting-edge machinery like rotary vacuum packaging systems. These systems not only boost efficiency but also incorporate real-time tracking, contributing to reduced labor costs and improved process control. This focus on automation is a key driver for enhancing overall operational performance.

The company's commitment to operational efficiency extends to its sustainability initiatives, particularly within its '4+1' decarbonization strategy. This includes significant investments in upgrading equipment, enhancing energy efficiency, and improving water and waste management. For instance, Amcor aims to reduce Scope 1 and 2 emissions by 25% by 2030, a target that inherently relies on more efficient, automated processes.

Recycling Infrastructure and Circularity Technologies

Amcor acknowledges that designing recyclable packaging is only one piece of the puzzle; robust recycling infrastructure and advanced circularity technologies are equally vital. Without effective systems to collect, sort, and reprocess materials, the potential of sustainable packaging designs is significantly diminished.

The company actively engages in advocating for and investing in the development of this crucial infrastructure. This includes collaborating with governments, waste management companies, and other industry players to build more efficient recycling pathways. For instance, Amcor's sustainability reports often detail partnerships aimed at increasing the collection rates and quality of recycled materials, ensuring that packaging is not just designed to be recycled but is actually recycled into new products.

Key areas of focus and technological advancements include:

- Enhanced Sorting Technologies: Investment in AI-powered optical sorters and advanced material identification systems to improve the accuracy and efficiency of separating different types of plastics and other packaging materials.

- Chemical Recycling Innovations: Exploration and adoption of chemical recycling processes that can break down complex or mixed plastic waste into its original monomers, creating high-quality recycled content suitable for food-grade packaging.

- Infrastructure Investment: Supporting initiatives and direct investments in Material Recovery Facilities (MRFs) and collection schemes to increase the volume of packaging that enters the recycling stream.

- Traceability and Transparency: Implementing technologies like blockchain to track recycled content throughout the supply chain, ensuring authenticity and building consumer trust in circular economy claims.

Supply Chain Digitization and Transparency

Technological advancements are reshaping Amcor's supply chain, driving digitization and enhancing transparency across its global network. These innovations are vital for navigating complex logistics and optimizing the flow of materials, ensuring efficiency and reliability. For instance, the adoption of blockchain technology in supply chains is gaining traction, with studies by Gartner predicting that by 2027, 70% of supply chain organizations will have implemented blockchain, up from less than 5% in 2020, to improve traceability and reduce fraud.

Amcor's commitment to ethical sourcing and sustainability is deeply intertwined with these technological shifts. By leveraging digital tools, the company can better monitor its supply chain for compliance with high environmental and social standards. This focus is critical for achieving Amcor's decarbonization roadmap, which often relies on technological integration to track and reduce emissions throughout the value chain. In 2023, Amcor reported that 84% of its packaging was designed to be recyclable or reusable, a target supported by the data insights gained from digitized supply chains.

- Digital Tracking: Technologies like IoT sensors and RFID tags provide real-time visibility into inventory and shipment status, minimizing delays and losses.

- Data Analytics: Advanced analytics help identify bottlenecks, predict demand, and optimize routes, leading to significant cost savings and improved efficiency.

- Supplier Collaboration Platforms: Digital platforms facilitate seamless communication and data sharing with suppliers, crucial for meeting sustainability targets and ensuring ethical practices.

- Traceability Solutions: Blockchain and other secure ledger technologies are increasingly used to provide immutable records of product origin and movement, enhancing trust and accountability.

Technological advancements are central to Amcor's strategy for developing innovative, sustainable packaging solutions, particularly focusing on materials that are lighter, more recyclable, and incorporate higher percentages of recycled content.

The company is actively integrating AI and automation into its manufacturing processes to boost efficiency, reduce waste, and enhance product quality, as seen in its Amcor Lift-Off program which partners with AI startups.

Amcor recognizes the critical need for robust recycling infrastructure and is investing in and advocating for advanced sorting and chemical recycling technologies to ensure its packaging designs are truly circular.

Digitization and advanced data analytics are transforming Amcor's supply chain, improving traceability, optimizing logistics, and ensuring ethical and sustainable sourcing practices.

| Technology Area | Amcor's Focus/Investment | Impact/Goal |

|---|---|---|

| Advanced Materials | Recycle-ready flexible packaging, mechanically and chemically recycled content integration | Reduced carbon footprint, increased circularity |

| Smart Packaging | AI vision for real-time adjustments, equipment status updates | Enhanced efficiency, waste reduction |

| Automation | Rotary vacuum packaging systems, real-time tracking | Increased efficiency, reduced labor costs, improved process control |

| Circularity Tech | AI sorting, chemical recycling, traceability (blockchain) | Improved sorting accuracy, high-quality recycled content, supply chain transparency |

| Supply Chain Digitization | IoT sensors, RFID tags, data analytics, blockchain | Real-time visibility, optimized logistics, enhanced ethical sourcing |

Legal factors

The European Union's Packaging and Packaging Waste Regulation (PPWR), set to take effect in February 2025, imposes strict mandates on Amcor, requiring enhanced recyclability, minimum recycled content percentages, and prohibiting certain types of packaging. This regulation is a pivotal legal factor shaping Amcor's product development and operational strategies across its European markets.

Amcor proactively manages its global compliance by closely tracking evolving legislation, such as the plastic taxes implemented in the United Kingdom and Spain. These measures, which can add significant costs to non-compliant packaging solutions, underscore the financial imperative for Amcor to adapt its offerings and maintain competitive market access worldwide.

Amcor's operations in food, beverage, and pharmaceuticals place it under intense scrutiny from global food contact and product safety regulations. Compliance is non-negotiable for maintaining product integrity and safeguarding consumers, directly impacting choices in materials, production methods, and quality assurance. For instance, Amcor's recent investment in a new Malaysian facility underscores its commitment to supplying sterile, high-quality packaging crucial for the healthcare sector, a market with exceptionally rigorous safety standards.

Extended Producer Responsibility (EPR) laws are becoming more common globally, directly affecting Amcor's costs and duties related to managing packaging after it's used. For instance, by 2025, many European Union countries will have strengthened EPR schemes, potentially increasing Amcor's financial contributions to recycling infrastructure.

These regulations often mandate that producers fund collection, sorting, and recycling efforts, pushing Amcor to design packaging that is easier and cheaper to process. This financial pressure encourages innovation in materials and design to reduce end-of-life management expenses.

Intellectual Property Rights and Innovation Protection

Amcor's commitment to innovation in packaging solutions hinges on robust intellectual property (IP) protection, primarily through patents and trademarks. This legal framework safeguards their significant investments in research and development, ensuring that novel materials, designs, and manufacturing processes translate into a sustainable competitive edge. Without this protection, Amcor’s R&D efforts, which are crucial for staying ahead in the dynamic packaging industry, could be easily undermined by competitors replicating their advancements.

The company actively pursues patents for its proprietary technologies, such as advanced barrier films and sustainable packaging designs. For instance, Amcor's ongoing focus on developing compostable and recyclable materials is backed by a strategy to patent these innovations. As of early 2025, Amcor continues to leverage its IP portfolio to maintain market leadership and deter infringement, which is vital for recouping R&D expenditures and funding future innovation.

- Patent Filings: Amcor consistently files patents for new packaging technologies and materials, with a notable increase in filings related to sustainable solutions in the 2024-2025 period.

- Trademark Protection: Key brand names and product lines are protected by trademarks, preventing unauthorized use and maintaining brand integrity in a competitive global market.

- R&D Investment: The legal protection of IP directly supports Amcor's substantial annual investment in R&D, estimated to be hundreds of millions of dollars, to drive product differentiation and market share.

Labor Laws and Workplace Safety Standards

Amcor's global operations, spanning 212 locations and employing 41,000 individuals, demand strict adherence to a complex web of international and local labor laws. These regulations govern everything from hiring practices and wages to employee rights and benefits, creating a significant compliance challenge.

The company places a strong emphasis on workplace safety, a critical legal and ethical imperative. This commitment is evidenced by Amcor's fiscal 2024 performance, which marked its safest year on record and achieved a notable 12% reduction in injuries. Such results underscore the effectiveness of their safety protocols and their dedication to meeting or exceeding regulatory requirements.

- Global Compliance: Amcor must navigate labor laws in numerous countries, impacting workforce management and operational costs.

- Workplace Safety: Adherence to stringent safety standards is paramount, with fiscal 2024 data showing a 12% injury reduction.

- Employee Relations: Compliance with fair labor practices and employee rights is essential for maintaining a stable workforce and avoiding legal disputes.

- Regulatory Changes: Potential shifts in labor legislation globally could necessitate adjustments in Amcor's operational strategies and human resource policies.

Amcor must navigate a dynamic legal landscape, with the EU's Packaging and Packaging Waste Regulation (PPWR) from February 2025 imposing strict recyclability and recycled content mandates. Furthermore, plastic taxes in regions like the UK and Spain directly impact operational costs, as seen in their fiscal 2024 strategies to manage these levies. Global food contact and product safety regulations are critical, influencing Amcor's material choices and production methods, especially for its healthcare packaging divisions.

| Regulation/Factor | Impact on Amcor | Timeline/Status |

| EU PPWR | Mandates recyclability, recycled content, potential bans on certain packaging. | Effective February 2025. |

| Plastic Taxes (UK, Spain) | Increases costs for non-compliant packaging; drives adaptation. | Ongoing; tracked in fiscal 2024 strategies. |

| Food Contact & Safety Laws | Dictates material choices, production, quality assurance for food, beverage, pharma. | Continuous compliance requirement. |

| Extended Producer Responsibility (EPR) | Increases Amcor's financial responsibility for post-consumer packaging management. | Strengthening in EU countries by 2025. |

Environmental factors

Amcor is actively tackling climate change, evidenced by its commitment to reducing greenhouse gas emissions. The company's ambitious short-term and net-zero targets, aiming for net-zero by 2050, have received the crucial endorsement of the Science Based Targets initiative (SBTi).

Demonstrating tangible progress, Amcor reported a significant 9% reduction in absolute GHG emissions in fiscal year 2024 when compared to the prior fiscal year. This achievement is underpinned by the company's published Decarbonization Roadmap, which details the strategic pathways Amcor is pursuing to meet its climate goals.

Amcor's commitment to a circular economy is a major environmental focus, with a goal for all its packaging to be either recyclable or reusable by 2025. This target is supported by significant progress; as of early 2024, Amcor reports that over 94% of its flexible packaging and 95% of its rigid packaging are recycle-ready.

Beyond product innovation, Amcor actively engages in developing crucial recycling infrastructure and consumer education programs. These collaborative efforts are vital for closing the loop and ensuring that sustainable packaging solutions are effectively integrated into waste management systems, thereby reducing overall waste.

Amcor is making substantial strides in its commitment to sustainability by significantly boosting its use of recycled materials. The company has already exceeded its initial target of incorporating 10% post-consumer recycled plastic by 2025, demonstrating a proactive approach to environmental responsibility.

In fiscal year 2024, Amcor procured over 254,000 metric tons of recycled material, a clear indicator of its scaled-up efforts. This move not only lessens the company's dependence on virgin plastics but also contributes to a lower carbon footprint across its product lines.

Looking ahead, Amcor has set an ambitious goal to achieve 30% recycled content in its portfolio by 2030, reinforcing its dedication to a circular economy and sustainable packaging solutions.

Renewable Energy Adoption

Amcor is actively pursuing a transition to renewable electricity sources as a core element of its decarbonization strategy. This commitment is demonstrated by significant progress in increasing renewable energy usage across its operations.

In fiscal year 2024, Amcor achieved a notable milestone, with 14% of its electricity consumption derived from renewable sources. This represents a substantial 64% surge in renewable electricity utilization compared to the prior year, underscoring the company's accelerated efforts.

The company's strategic Decarbonization Roadmap explicitly prioritizes speeding up this shift towards renewables. This focus is driven by both environmental responsibility and the growing global imperative for sustainable business practices.

- Renewable Electricity Usage: 14% of Amcor's electricity was renewable in FY2024.

- Year-over-Year Growth: This marks a 64% increase in renewable electricity consumption from the previous year.

- Strategic Priority: Accelerating the transition to renewables is a key objective outlined in Amcor's Decarbonization Roadmap.

Water and Waste Management

Amcor's commitment extends beyond just the materials used in packaging to how its own operations manage resources. Improving water and waste management at its manufacturing sites is a key focus for reducing its environmental impact. By the close of 2023, Amcor achieved a significant 46% reduction in waste compared to its 2019 baseline, demonstrating tangible progress in this area.

These operational efficiencies are crucial for minimizing the company's overall environmental footprint. Amcor's efforts are geared towards sustainable manufacturing, which includes:

- Reducing overall waste generation at production facilities.

- Implementing better water conservation and management practices.

- Achieving a 46% reduction in waste by the end of 2023 against a 2019 baseline.

- Minimizing the environmental impact of its manufacturing processes through these initiatives.

Amcor's environmental strategy centers on ambitious climate action and circular economy principles. The company aims for net-zero emissions by 2050, a target validated by the Science Based Targets initiative (SBTi). In fiscal year 2024, Amcor successfully reduced its absolute greenhouse gas emissions by 9% compared to the previous year, a testament to its detailed Decarbonization Roadmap.

A key environmental goal is ensuring all packaging is recyclable or reusable by 2025; by early 2024, over 94% of flexible and 95% of rigid packaging met this recycle-ready criterion. Amcor is also significantly increasing its use of recycled materials, surpassing its 2025 target of 10% post-consumer recycled plastic by procuring over 254,000 metric tons in FY2024, with a future goal of 30% recycled content by 2030.

The company is actively transitioning to renewable electricity, achieving 14% renewable energy usage in FY2024, a 64% increase year-over-year. Furthermore, Amcor has made strides in operational efficiency, reducing waste by 46% by the end of 2023 against a 2019 baseline, while also focusing on water management at its manufacturing sites.

| Environmental Metric | Target/Status | Data Point | Year |

|---|---|---|---|

| Net-Zero Emissions | Net-Zero by 2050 | SBTi Endorsed | Ongoing |

| GHG Emissions Reduction | Absolute Reduction | 9% reduction | FY2024 |

| Recyclable/Reusable Packaging | All Packaging | 94% flexible, 95% rigid recycle-ready | Early 2024 |

| Recycled Material Usage | Post-Consumer Plastic | Exceeded 10% target | FY2024 |

| Recycled Material Procurement | Total Recycled Material | > 254,000 metric tons | FY2024 |

| Recycled Content Goal | Portfolio Recycled Content | 30% | By 2030 |

| Renewable Electricity Usage | Percentage of Consumption | 14% | FY2024 |

| Renewable Electricity Growth | Year-over-Year Increase | 64% increase | FY2024 vs FY2023 |

| Waste Reduction | Against 2019 Baseline | 46% reduction | By end of 2023 |

PESTLE Analysis Data Sources

Our Amcor PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable market research firms, and international economic databases. This ensures a comprehensive understanding of political stability, economic trends, and regulatory landscapes impacting Amcor's operations.