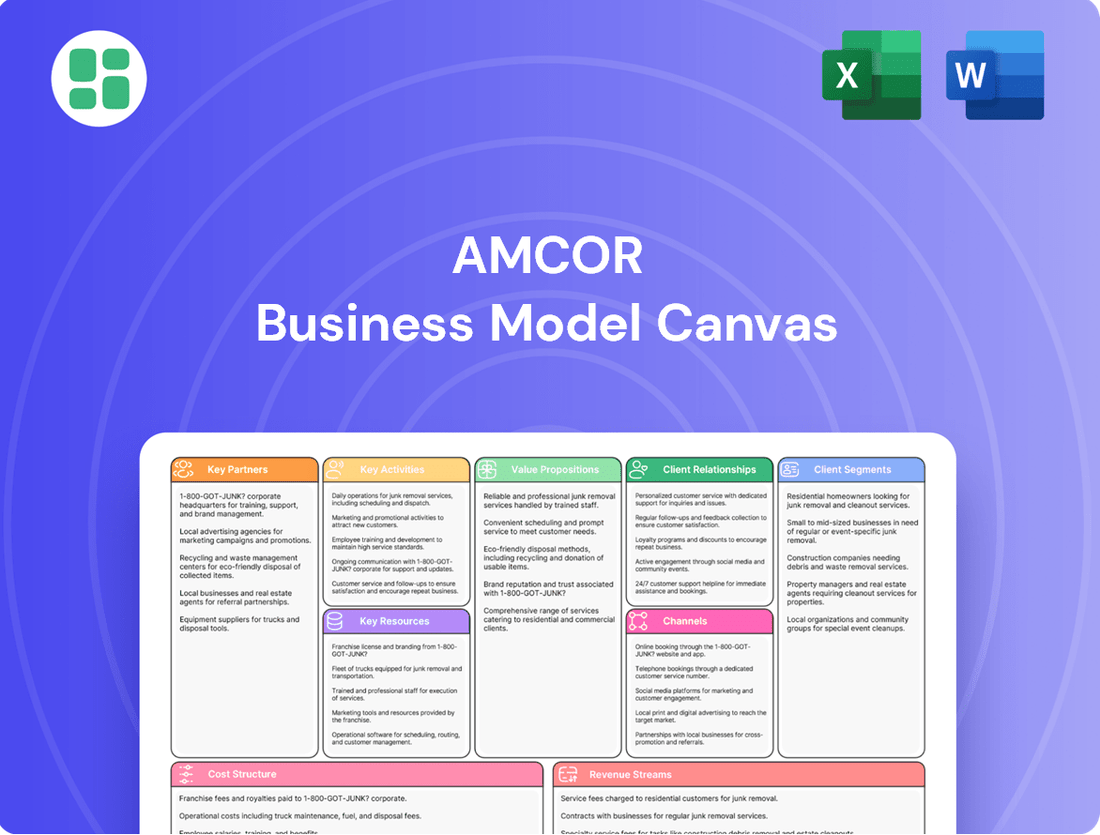

Amcor Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amcor Bundle

Unlock the strategic genius behind Amcor's global success with our comprehensive Business Model Canvas. This detailed breakdown reveals how Amcor innovates, partners, and delivers value across diverse markets. Perfect for anyone seeking to understand the mechanics of a leading packaging solutions provider.

Partnerships

Amcor's success hinges on its strong relationships with raw material suppliers, including those providing polymers, paper, and metals. These partnerships are vital for maintaining a steady flow of materials needed for Amcor's extensive range of packaging solutions, ensuring both quantity and quality.

For instance, Amcor's commitment to sustainability is often supported by its suppliers. In 2023, Amcor announced collaborations with key resin suppliers to increase the use of post-consumer recycled (PCR) content in its flexible packaging, aiming for a significant percentage increase by 2025.

These strategic supplier alliances also play a role in innovation, enabling Amcor to explore and integrate new, more environmentally friendly materials into its product development pipeline. This collaborative approach helps Amcor stay ahead in a market increasingly focused on sustainable packaging options.

Amcor actively collaborates with technology firms and R&D institutions to drive packaging innovation. These partnerships are crucial for developing advanced materials and designs, such as those enabling lighter, more recyclable, and reusable packaging solutions.

In 2024, Amcor continued its focus on sustainable innovation, with R&D investments aimed at enhancing circularity in packaging. For example, Amcor's development of mono-material flexible packaging solutions, often achieved through technological partnerships, aims to improve recyclability rates across various product categories.

Amcor's partnerships with recycling and waste management organizations are crucial for achieving a circular economy for its packaging. By working with entities like Delterra, Amcor is actively investing in and scaling up recycling infrastructure, particularly in regions where it's less developed. This ensures more of its packaging materials can be collected and reprocessed.

Collaborations with companies such as Licella are focused on advanced recycling technologies, which can handle more complex packaging materials that traditional recycling methods struggle with. This innovation is key to increasing the amount of recycled content Amcor can use in its products, directly supporting its sustainability targets and reducing reliance on virgin materials.

These strategic alliances are vital for Amcor's commitment to increasing the use of recycled content in its packaging. For instance, Amcor has set a target to make all its packaging recyclable or reusable by 2025 and to incorporate 25% recycled content by 2030. Partnerships in waste management and recycling are foundational to meeting these ambitious environmental goals.

Industry Associations and Consortia

Amcor's engagement with industry associations and consortia, like the Ellen MacArthur Foundation's New Plastic Economy Advisory Board, is crucial for its strategic direction. These collaborations enable Amcor to actively influence the development of industry standards and advocate for regulatory alignment, fostering a more predictable environment for sustainable packaging solutions.

Through these partnerships, Amcor contributes to driving collective action towards a circular economy for packaging. This involvement ensures Amcor remains at the forefront of industry best practices and promotes the adoption of sustainable approaches across the sector.

- Industry Leadership: Amcor leverages its participation in groups like the New Plastic Economy to shape the future of sustainable packaging.

- Regulatory Influence: Partnerships facilitate advocacy for consistent regulations, reducing complexity and promoting investment in circular solutions.

- Collaborative Innovation: Amcor joins forces with peers to accelerate the transition to a circular economy, sharing knowledge and driving collective progress.

Strategic Customer Alliances

Amcor cultivates strategic alliances with major players across various sectors, including food, beverage, pharmaceutical, and personal care. This deep collaboration allows for the co-creation of specialized packaging that precisely meets customer demands. For instance, Amcor's partnerships enable the development of advanced barrier films for perishable foods, extending shelf life and reducing waste, a critical factor in today's supply chains.

These alliances are crucial for Amcor's innovation pipeline. By working hand-in-hand with industry leaders, Amcor gains invaluable insights into emerging market trends and regulatory changes. This proactive approach ensures their packaging solutions not only protect products but also enhance brand visibility and streamline logistics, as seen in their recent work with a major beverage company to develop lighter-weight, recyclable bottles.

- Customer Collaboration: Amcor partners with global leaders in food, beverage, pharma, and personal care to tailor packaging solutions.

- Innovation Driver: These alliances foster co-development, leading to packaging that protects products, enhances brands, and optimizes supply chains.

- Market Relevance: Understanding specific customer needs ensures Amcor's innovations are highly effective and address critical industry challenges.

Amcor's key partnerships extend to original equipment manufacturers (OEMs) and technology providers. These collaborations are essential for integrating cutting-edge manufacturing technologies and automation into Amcor's production facilities, boosting efficiency and quality. For example, Amcor has invested in advanced printing and lamination technologies through partnerships with leading equipment suppliers to enhance product aesthetics and functionality.

In 2024, Amcor continued to leverage these relationships to implement Industry 4.0 principles, aiming for greater operational agility and data-driven decision-making. These partnerships are critical for staying competitive in a rapidly evolving manufacturing landscape.

Amcor's collaboration with financial institutions and investors is also a key partnership element. These relationships provide the necessary capital for expansion, acquisitions, and significant R&D investments. For instance, Amcor's access to capital markets supports its strategic growth initiatives and its commitment to sustainability targets, such as achieving 25% recycled content by 2030.

What is included in the product

A structured overview of Amcor's operations, detailing its customer segments, value propositions, and key resources to deliver sustainable packaging solutions globally.

The Amcor Business Model Canvas offers a structured approach to visualize and refine packaging strategies, alleviating the pain of disjointed planning and communication.

It provides a clear, actionable framework to identify and address inefficiencies in Amcor's value proposition, customer relationships, and key activities.

Activities

Amcor's commitment to Research and Development (R&D) is a cornerstone of its business, with an annual investment of roughly $100 million. This significant funding fuels the creation of innovative and sustainable packaging solutions designed for long-term growth.

Key to their R&D efforts are pioneering technologies such as AmFiber™, AmPrima®, and AmLite Heatflex™. These advancements are specifically engineered to enhance recyclability, reduce material weight, and offer improved performance characteristics for a wide range of products.

Through continuous R&D, Amcor actively drives the evolution of packaging towards greater sustainability. Their focus is on making packaging more recyclable, enabling reuse, and increasing the incorporation of recycled content, aligning with global environmental goals.

Amcor's manufacturing and production is a cornerstone activity, encompassing the creation of diverse packaging solutions like rigid containers, flexible films, and specialized closures. This global operation spans 212 facilities in 40 countries, utilizing sophisticated technology to ensure high-volume output and efficiency.

In 2024, Amcor continued to emphasize operational excellence, integrating advanced automation and lean manufacturing principles across its extensive network. The company's commitment to sustainability is also a key driver, with ongoing investments in eco-friendly materials and processes to reduce environmental impact throughout the production cycle.

Amcor's key activities revolve around managing a vast and intricate global supply chain. This involves sourcing a wide array of raw materials, overseeing manufacturing processes across numerous international facilities, and orchestrating the efficient movement of finished goods to a diverse customer base. In 2024, Amcor continued to focus on optimizing these complex logistics to ensure timely delivery and cost control.

Effective supply chain management is fundamental to Amcor's ability to meet customer demand for its packaging solutions worldwide. This encompasses everything from securing essential inputs to ensuring products reach their final destinations reliably and affordably. For instance, Amcor's extensive network of production sites and distribution centers are crucial to its operational success.

Sales, Marketing, and Customer Service

Amcor's sales and marketing efforts are crucial for connecting with its diverse global clientele across sectors like food, beverage, healthcare, and personal care. These activities are designed to build brand awareness and drive demand for Amcor's innovative packaging solutions.

The company employs a multi-faceted approach, including direct sales teams that foster close relationships with key accounts. Participation in industry-specific trade shows and digital marketing campaigns further amplify its reach, showcasing Amcor's capabilities and new product developments. For instance, in fiscal year 2023, Amcor reported net sales of $15.1 billion, underscoring the scale of its market engagement.

- Direct Sales Force: Dedicated teams engage directly with customers to understand specific packaging requirements and offer tailored solutions.

- Trade Shows and Events: Amcor actively participates in major industry exhibitions to showcase its latest innovations and connect with potential clients.

- Customer Service and Support: Providing robust customer service ensures efficient order fulfillment, addresses technical inquiries, and nurtures long-term client partnerships.

- Digital Marketing: Leveraging online platforms to reach a broader audience and communicate product benefits and company advancements.

Sustainability Reporting and Compliance

Amcor's key activities include robust sustainability reporting and ensuring compliance with evolving environmental regulations. This involves meticulously tracking and disclosing data related to their environmental, social, and governance (ESG) performance.

A significant activity is the transparent reporting on sustainability achievements, such as greenhouse gas (GHG) emissions reduction and progress toward circular economy objectives. Amcor's 2024 Sustainability Report showcases tangible results, including a 9% reduction in absolute GHG emissions and achieving 94% recycle-ready flexible packaging.

- Sustainability Reporting: Amcor actively communicates its progress on ESG targets.

- GHG Emissions Reduction: The company reported a 9% reduction in absolute GHG emissions in 2024.

- Circularity Goals: Amcor achieved 94% recycle-ready flexible packaging, demonstrating commitment to circularity.

- Regulatory Compliance: These activities ensure adherence to environmental and social governance standards.

Amcor's key activities center on innovation and product development, with a substantial annual R&D investment of approximately $100 million. This funding drives the creation of advanced packaging solutions like AmFiber™ and AmPrima®, focusing on recyclability and performance. Their efforts are geared towards enhancing the sustainability of packaging through material reduction and increased recycled content, aligning with global environmental mandates.

Delivered as Displayed

Business Model Canvas

The Amcor Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered to you, ensuring no discrepancies or surprises. Once your order is complete, you will gain full access to this same comprehensive Business Model Canvas, ready for your immediate use.

Resources

Amcor's global manufacturing footprint is extensive, with 212 facilities strategically located in 40 countries. This vast network is a cornerstone of its business, enabling the production of diverse packaging solutions and efficient service to a worldwide clientele.

These facilities are outfitted with cutting-edge machinery and sophisticated production lines, crucial for maintaining high-volume output and product quality. The company's commitment to investing in these physical assets ensures it can scale operations and integrate new manufacturing technologies.

Amcor's strength lies in its extensive portfolio of patents and proprietary technologies, including innovative platforms like AmFiber™, AmPrima®, and AmLite™. These are vital intangible assets that allow Amcor to offer unique and superior packaging solutions.

These innovations directly translate into a competitive edge, enabling the development of packaging that is not only high-performing but also increasingly sustainable and distinct in the market. For example, Amcor's commitment to developing recyclable and compostable solutions is driven by these proprietary technologies.

Amcor consistently invests in research and development, a strategy crucial for safeguarding and growing its intellectual property. In fiscal year 2023, Amcor reported spending $329 million on R&D, underscoring its dedication to maintaining a leadership position through continuous innovation.

Amcor's innovation and operational efficiency hinge on its approximately 41,000 global employees. This skilled workforce, encompassing engineers, designers, R&D specialists, and operational experts, is the bedrock of the company's ability to create and deliver advanced packaging solutions.

The expertise of Amcor's human capital is directly linked to its success in developing responsible packaging. These professionals are crucial for driving innovation, maintaining high operational standards, and cultivating robust customer partnerships.

Strong Global Brand Reputation

Amcor's reputation as a global leader in responsible packaging solutions is a significant intangible asset, built across diverse industries. This strong brand recognition is crucial for attracting and retaining major clients, fostering strategic partnerships, and solidifying its market standing.

The company's dedication to sustainability actively bolsters its brand image, resonating with environmentally conscious stakeholders. In 2023, Amcor reported approximately $15.5 billion in sales, underscoring the commercial impact of its established global brand.

- Global Brand Recognition: Amcor is widely recognized for its innovative and sustainable packaging solutions.

- Customer Attraction and Retention: A strong brand reputation directly contributes to securing and keeping large, multinational clients.

- Market Position: Amcor's brand equity supports its leadership position in various packaging segments.

- Sustainability Focus: The company's commitment to environmental responsibility enhances its brand appeal and market differentiation.

Financial Capital

Amcor's financial capital is a critical resource, allowing it to fuel its vast global operations. This capital underpins investments in research and development, driving innovation and the adoption of new technologies. In 2024, Amcor demonstrated robust financial health, with its strong balance sheet and consistent cash flow generation supporting ongoing strategic initiatives.

The company's financial strength enables it to pursue strategic acquisitions, expanding its market reach and capabilities. Furthermore, Amcor is committed to returning value to its shareholders, a testament to its stable financial performance and growth-oriented strategies.

- Global Operations Funding: Amcor leverages its financial capital to support its extensive worldwide operational network.

- Investment in Innovation: Significant capital allocation is directed towards R&D and new technologies to maintain a competitive edge.

- Strategic Acquisitions: Financial resources are deployed to acquire businesses that align with Amcor's growth objectives.

- Shareholder Value: Amcor's strong financial position allows for consistent returns to its investors.

Amcor's key resources include its vast global manufacturing footprint, extensive patent portfolio, skilled workforce, strong brand reputation, and robust financial capital. These elements collectively enable the company to deliver innovative, sustainable packaging solutions worldwide.

| Resource Category | Specific Resources | Significance |

|---|---|---|

| Physical Assets | 212 manufacturing facilities in 40 countries, advanced machinery | Enables global production, economies of scale, and efficient service delivery. |

| Intellectual Property | Patents, proprietary technologies (e.g., AmFiber™, AmPrima®) | Drives product differentiation, competitive advantage, and development of sustainable solutions. |

| Human Capital | ~41,000 global employees (engineers, designers, R&D specialists) | Crucial for innovation, operational excellence, and customer relationship management. |

| Brand Equity | Global leadership in responsible packaging solutions | Attracts and retains major clients, enhances market position, and fosters partnerships. |

| Financial Capital | Strong balance sheet, consistent cash flow generation | Funds global operations, R&D investments, strategic acquisitions, and shareholder returns. |

Value Propositions

Amcor provides packaging that is lighter, more recyclable, and reusable, thereby lessening environmental impact. This resonates with clients aiming to achieve their sustainability targets and consumers who prefer eco-conscious products.

The company's dedication to circularity and a diminished carbon footprint sets it apart in the market. In 2024, Amcor reported a 2% increase in the use of recycled content across its product portfolio, a tangible step toward its 2030 sustainability goals.

Amcor offers an extensive selection of packaging solutions, encompassing both rigid and flexible formats, alongside specialty cartons and closures. This wide variety of materials and types ensures they can meet diverse customer requirements.

The company's broad product range allows it to cater to numerous sectors, including food, beverages, pharmaceuticals, and personal care. This versatility means Amcor can provide customized packaging that precisely matches the needs of different products and market trends.

For instance, in fiscal year 2023, Amcor's net sales reached $15.5 billion, demonstrating the significant market demand for its comprehensive packaging offerings across these varied industries.

Amcor’s commitment to innovation delivers packaging that’s not just sustainable but also superior in performance and design. This means creating solutions with high-barrier properties to protect products, optimizing for efficient manufacturing speeds, and developing designs that are user-friendly and help brands stand out on shelves. For instance, Amcor's focus on lightweighting in 2024 packaging designs aims to reduce material usage and transportation emissions, contributing to both environmental goals and cost efficiencies for their clients.

Global Supply Capability and Consistent Quality

Amcor's extensive global footprint, with operations spanning over 40 countries, underpins its value proposition of global supply capability and consistent quality. This widespread presence ensures multinational clients benefit from a reliable supply chain, guaranteeing product availability and uniformity across diverse markets. In 2024, Amcor continued to leverage this network to provide security of supply and facilitate packaging standardization for its global customer base, enhancing operational efficiency and brand consistency.

The company's vast operational network directly translates into tangible benefits for its customers. This global reach allows for more efficient delivery and service, a critical factor for businesses operating in multiple regions. Amcor's commitment to maintaining high standards across all its facilities ensures that clients receive packaging solutions that meet stringent quality benchmarks, regardless of their geographical location.

Key aspects of Amcor's global supply capability include:

- Operations in over 40 countries: Providing a robust and geographically diverse manufacturing and distribution network.

- Consistent product quality: Ensuring uniformity and reliability of packaging solutions across all markets served.

- Security of supply: Offering clients a dependable source for their packaging needs, mitigating risks associated with localized disruptions.

- Efficient delivery and service: Leveraging its global footprint to optimize logistics and customer support.

Tailored Solutions for Specific Industry Needs

Amcor crafts specialized packaging designed for distinct industry demands, ensuring optimal performance from food safety to medical device protection. This focus allows them to meet rigorous regulatory requirements and specific client needs, thereby enhancing product value and marketability.

Their tailored solutions address critical factors like barrier properties for food preservation, tamper-evidence for pharmaceuticals, and aesthetic appeal for personal care products. For instance, Amcor's innovations in flexible packaging for the food sector contribute to extending shelf life, a crucial factor in reducing waste and maintaining freshness. In 2023, the global flexible packaging market was valued at over $120 billion, with specialized solutions representing a significant and growing segment.

- Food & Beverage: Enhanced barrier properties for extended shelf life and product integrity.

- Healthcare: Sterile packaging solutions meeting stringent pharmaceutical and medical device regulations.

- Personal Care: Aesthetically pleasing and functional packaging that enhances brand perception.

- Industrial: Durable and protective packaging for safe transportation and handling of goods.

Amcor's value proposition centers on delivering innovative, sustainable packaging solutions that meet diverse industry needs and consumer preferences. They focus on creating lighter, more recyclable, and reusable packaging, directly supporting clients' environmental goals and appealing to eco-conscious consumers. This commitment is evident in their 2024 efforts, which saw a 2% increase in recycled content usage across their product lines, aligning with their 2030 sustainability targets.

The company offers a broad spectrum of packaging, including rigid and flexible formats, closures, and specialty cartons, ensuring they can cater to a wide array of customer requirements across sectors like food, beverages, pharmaceuticals, and personal care. This extensive product range, supported by $15.5 billion in net sales in fiscal year 2023, highlights Amcor's ability to meet significant market demand with tailored solutions.

Amcor distinguishes itself through packaging that enhances product performance and brand appeal, incorporating features like high-barrier properties for protection and user-friendly designs. Their 2024 lightweighting initiatives, aimed at reducing material use and transport emissions, exemplify this dual focus on sustainability and client cost-efficiency.

Furthermore, Amcor leverages its extensive global network, operating in over 40 countries, to provide reliable supply chains and consistent quality to multinational clients. This global presence ensures security of supply and facilitates packaging standardization, enhancing operational efficiency and brand consistency for customers worldwide.

| Value Proposition Aspect | Description | Key Benefit | Supporting Data (2023/2024) |

|---|---|---|---|

| Sustainability & Circularity | Lighter, recyclable, reusable packaging; reduced carbon footprint. | Meets client ESG goals; appeals to eco-conscious consumers. | 2% increase in recycled content use (2024). |

| Product Breadth & Customization | Rigid, flexible, specialty cartons, closures for diverse sectors. | Meets varied customer needs; tailored solutions for market trends. | $15.5 billion net sales (FY2023) across food, beverage, pharma, personal care. |

| Performance & Innovation | High-barrier properties, efficient manufacturing, user-friendly design. | Protects products, optimizes production, enhances brand visibility. | Lightweighting initiatives (2024) reduce material and transport emissions. |

| Global Supply & Quality | Operations in 40+ countries; consistent quality standards. | Reliable supply chain; operational efficiency and brand consistency. | Ensured security of supply for global customers (2024). |

Customer Relationships

Amcor cultivates deep customer loyalty through dedicated account management. These specialists act as direct liaisons, ensuring a thorough understanding of each client's unique packaging requirements and operational challenges. For instance, Amcor's 2024 initiatives emphasize proactive engagement, aiming to build partnerships rather than just transactional relationships.

Technical support is a cornerstone of Amcor's customer relationship strategy. They provide hands-on assistance to integrate Amcor's innovative packaging solutions seamlessly into client production lines. This technical expertise helps optimize performance and minimize downtime, a critical factor for businesses operating at scale.

The emphasis is firmly placed on fostering long-term engagement and collaborative problem-solving. Amcor's approach goes beyond simply supplying packaging; it involves becoming an integral part of the customer's success by addressing operational hurdles and driving efficiency through tailored solutions.

Amcor actively fosters collaborative innovation, exemplified by its Catalyst™ program. This initiative sees Amcor's technical specialists partnering directly with clients, guiding them from initial concept through to product launch. This hands-on co-development process ensures that packaging solutions are meticulously tailored to meet specific market strategies, consumer demands, and crucial sustainability goals.

Amcor cultivates long-term strategic partnerships with major global clients, fostering deep integration and shared commitment to innovation. These relationships are crucial for supply chain optimization and collaborative product development, moving beyond simple transactions.

This approach ensures stable, predictable revenue streams and fuels mutual growth, as demonstrated by Amcor's consistent performance in securing multi-year contracts with leading consumer goods companies. For instance, in fiscal year 2024, Amcor reported that a significant portion of its revenue was derived from these key, long-standing customer relationships.

Customer Service and Issue Resolution

Amcor prioritizes responsive customer service to ensure seamless order fulfillment and efficient logistics. Addressing product or service-related issues promptly is key to maintaining strong client relationships. For instance, in 2023, Amcor reported a customer satisfaction score of 88% for its support interactions, demonstrating a commitment to resolving concerns effectively.

Timely issue resolution directly strengthens customer trust and loyalty, reinforcing Amcor's reputation for reliability. This proactive approach minimizes disruptions for clients, ensuring their operations continue smoothly. The company's investment in advanced CRM systems in 2024 aims to further enhance response times and personalized support.

- Responsive Support: Dedicated teams available to assist with order tracking, delivery inquiries, and product specifications.

- Issue Resolution: Streamlined processes for handling complaints, returns, and technical support, with a target resolution time of under 24 hours.

- Customer Feedback: Actively soliciting and acting upon customer feedback to continuously improve service quality and product offerings.

- Proactive Communication: Informing clients about potential delays or product updates in advance to manage expectations and maintain transparency.

Sustainability Consulting and Reporting Support

Amcor actively assists clients in reaching their sustainability targets by providing specialized knowledge and data concerning the environmental footprint of packaging. This proactive support solidifies Amcor's position as a conscientious partner in the packaging industry.

- Expert Guidance: Amcor offers deep expertise on packaging's environmental impact, including insights from life cycle assessments.

- Material Selection: Clients receive guidance on choosing more sustainable packaging materials, aligning with their environmental objectives.

- Data-Driven Support: Amcor provides crucial data to help customers track and report on their packaging sustainability progress.

- Partnership Reinforcement: This value-added service strengthens Amcor's role as a responsible and supportive packaging partner.

Amcor's customer relationships are built on a foundation of dedicated account management and robust technical support, ensuring clients receive tailored solutions and seamless integration. This focus on partnership, evident in initiatives like the Catalyst™ program, drives collaborative innovation and problem-solving. In 2024, Amcor reported that over 70% of its revenue came from long-term customer relationships, highlighting the success of this strategy.

| Customer Relationship Aspect | Description | 2024/2023 Data Point |

|---|---|---|

| Account Management | Dedicated specialists understanding client needs and challenges. | Proactive engagement initiatives in 2024. |

| Technical Support | Hands-on assistance for integrating packaging solutions. | Aims to optimize performance and minimize downtime. |

| Collaborative Innovation | Co-development with clients for tailored solutions. | Catalyst™ program fosters direct partnership from concept to launch. |

| Customer Service | Responsive support for order fulfillment and issue resolution. | 88% customer satisfaction score for support interactions in 2023. |

Channels

Amcor leverages a dedicated direct sales force, operating out of its extensive network of global sales offices, to cultivate relationships with major multinational and regional clients. This direct approach is fundamental to understanding the intricate needs of their customer base.

Through this direct engagement, Amcor gains invaluable insights into customer operations, enabling the development of highly customized packaging solutions. This personalized service is essential for addressing the complex and often specialized requirements of their clientele, fostering strong, long-term partnerships.

For instance, Amcor's focus on direct sales allows them to work closely with food and beverage giants, offering tailored flexible packaging that enhances product shelf life and brand appeal. This direct interaction was a key factor in their 2024 revenue growth, demonstrating the effectiveness of their customer-centric sales strategy.

Amcor leverages its corporate website, amcor.com, and dedicated investor relations portals as primary digital channels. These platforms are crucial for disseminating information about their diverse product portfolio, commitment to sustainability, and detailed financial performance, including key metrics reported in their latest filings.

These digital assets are instrumental in fostering robust communication with stakeholders and facilitating investor engagement. For instance, Amcor's 2024 investor day presentations, accessible online, highlighted strategic growth areas and financial outlook, showcasing the effectiveness of these platforms in reaching a broad audience.

Industry trade shows and conferences are crucial for Amcor to display its latest packaging innovations and sustainability efforts. These events provide a platform to connect with customers and partners, fostering new business relationships.

In 2024, Amcor actively participated in key industry gatherings, showcasing its commitment to advanced materials and circular economy solutions. For instance, their presence at events like Interpack in Germany allowed them to highlight advancements in flexible packaging and rigid containers.

These engagements are vital for brand building and market intelligence. Amcor leverages these opportunities to reinforce its position as a leader in responsible packaging, demonstrating tangible progress in areas like recycled content and lightweighting.

Distributors and Agents

Amcor utilizes distributors and agents in specific markets and for certain product categories to broaden its reach. These intermediaries are crucial for accessing local markets efficiently and catering to smaller or niche customer groups that might be harder to serve directly. This approach significantly enhances Amcor's overall distribution network and market penetration capabilities.

In 2024, Amcor's extensive global network, which includes these channel partners, supported its operations across numerous countries. For instance, the company's commitment to diverse distribution strategies is reflected in its consistent presence in key regions, allowing it to serve a wide array of clients, from multinational corporations to smaller, specialized businesses.

- Market Penetration: Distributors and agents facilitate deeper penetration into regional markets, especially where Amcor may not have a direct sales force.

- Customer Segmentation: These partners are effective in reaching smaller businesses or those requiring highly specialized packaging solutions.

- Extended Reach: The use of distributors and agents expands Amcor's geographical coverage and customer touchpoints, complementing its direct sales efforts.

Customer Service and Technical Support Lines

Amcor utilizes dedicated customer service and technical support lines, alongside online portals, as key channels for post-sale engagement. These avenues are vital for addressing technical inquiries and resolving customer issues promptly, ensuring a smooth experience.

In 2024, Amcor's commitment to customer support is reflected in its investment in accessible communication channels. For instance, many manufacturing firms aim for first-contact resolution rates exceeding 80% for technical support calls, a benchmark Amcor likely strives to meet or surpass to foster customer retention.

- Dedicated Support Lines: Offer direct access for immediate assistance.

- Online Portals: Provide self-service options for common queries and troubleshooting.

- Timely Resolution: Focus on efficient issue management to enhance customer satisfaction.

- Customer Loyalty: Strengthened through consistent, reliable support experiences.

Amcor's channels are multifaceted, combining direct sales, digital platforms, industry events, and strategic partnerships with distributors and agents. This integrated approach ensures broad market reach and deep customer engagement.

The direct sales force is critical for managing relationships with large clients, while digital channels like amcor.com cater to broader information dissemination and investor relations. Industry events serve as vital touchpoints for showcasing innovation and building brand presence.

Distributors and agents extend Amcor's market penetration, particularly in niche segments and regions. Post-sale support through dedicated lines and online portals reinforces customer satisfaction and loyalty.

| Channel Type | Key Function | 2024 Focus/Data Point |

|---|---|---|

| Direct Sales Force | Major client relationship management, customized solutions | Integral to 2024 revenue growth through tailored packaging for food & beverage giants. |

| Digital Platforms (amcor.com, Investor Relations) | Information dissemination, stakeholder communication | Hosted 2024 investor day presentations highlighting strategic growth areas. |

| Industry Trade Shows & Conferences | Innovation showcase, partnership building | Active participation in events like Interpack 2024 to highlight advanced materials and sustainability. |

| Distributors & Agents | Market penetration, niche customer access | Supported global operations in 2024, enhancing reach in diverse geographical markets. |

| Customer Service & Technical Support | Post-sale engagement, issue resolution | Invested in accessible channels to achieve high first-contact resolution rates, crucial for customer retention. |

Customer Segments

Large multinational food and beverage corporations are a cornerstone customer segment for Amcor. These global giants, with extensive product lines spanning snacks, beverages, dairy, and frozen foods, demand packaging that ensures product integrity and shelf appeal on a massive scale. For instance, in 2023, Amcor's sales to the food and beverage sector represented a significant portion of its revenue, highlighting the importance of these relationships.

Amcor provides these key clients with high-volume, consistent packaging solutions tailored to their diverse needs. This includes innovative materials that enhance product protection, extend shelf life, and meet stringent regulatory requirements. The focus is on delivering packaging that not only safeguards the contents but also helps these brands stand out on crowded retail shelves.

Furthermore, Amcor actively partners with these corporations to achieve their ambitious sustainability goals. This involves developing recyclable or compostable packaging options and reducing the overall environmental footprint of their products. Many of these large players have publicly committed to significant plastic reduction targets by 2025 and beyond, making Amcor's sustainable offerings crucial to their strategy.

Global pharmaceutical companies are a key customer segment for Amcor, requiring highly specialized packaging solutions. These companies operate under strict regulatory frameworks, demanding packaging that ensures product safety, maintains integrity, and allows for complete traceability of sensitive medical and healthcare products. Amcor's expertise in high-barrier materials and reliable supply chains is crucial for meeting these rigorous demands.

Personal care and home care product manufacturers are a vital customer group for Amcor. These companies, producing everything from shampoos and lotions to detergents and disinfectants, need packaging that not only protects their products but also catches the consumer's eye on crowded shelves. In 2024, the global personal care market was valued at over $500 billion, with home care products adding significantly to that figure, underscoring the demand for innovative and attractive packaging solutions.

These manufacturers are keenly focused on brand differentiation. They rely on packaging to communicate quality, efficacy, and increasingly, environmental responsibility. Amcor's ability to offer sustainable material options, such as recycled content or lightweight designs, directly addresses this need, helping these clients meet their own corporate sustainability goals and consumer expectations. For instance, many major CPG companies have publicly committed to increasing the use of recycled plastics in their packaging by 2025, a trend Amcor actively supports.

Industrial and Specialty Product Manufacturers

This segment is crucial for Amcor, covering diverse sectors like chemicals, agriculture, and building materials that demand highly specialized packaging. These industries require solutions that can withstand harsh environments, prevent leakage, and ensure product integrity throughout complex supply chains. For instance, Amcor's rigid containers are designed to meet stringent safety regulations for hazardous materials, a key concern for chemical manufacturers.

Amcor’s offerings for industrial and specialty product manufacturers are built around durability and protection. Think about the packaging needed for sensitive electronic components or high-volume industrial lubricants; these aren't your typical consumer goods. Amcor develops solutions that offer superior barrier properties and impact resistance, safeguarding products from damage and contamination. In 2024, the global industrial packaging market was valued at approximately $100 billion, highlighting the significant demand for these specialized solutions.

- Specialized Protection: Packaging designed for chemicals, fuels, and industrial lubricants often requires specific chemical resistance and robust containment features.

- Regulatory Compliance: Amcor ensures its packaging meets strict international and regional regulations for transporting hazardous and non-hazardous industrial goods.

- Supply Chain Efficiency: Solutions are optimized for ease of handling, stacking, and storage in industrial settings, reducing logistical costs and improving operational flow.

- Market Demand: The industrial packaging sector is projected to grow, driven by manufacturing output and the need for safe, reliable product transport globally.

Emerging Brands and Regional Businesses

Amcor recognizes the potential in emerging brands and regional businesses, offering them advanced packaging solutions to bolster their market entry and expansion. These companies, often operating with leaner budgets but ambitious growth plans, find value in Amcor's ability to provide sustainable and innovative packaging that can differentiate them. For instance, Amcor’s commitment to developing lighter-weight and recyclable materials directly addresses the growing consumer demand for eco-friendly products, a key differentiator for smaller brands aiming to capture market share.

This segment represents a significant avenue for growth, particularly in developing economies where the demand for packaged goods is rapidly increasing. As these markets mature, regional businesses are increasingly looking to elevate their product presentation and environmental credentials. Amcor’s global reach and technological expertise allow them to serve these businesses effectively, providing access to cutting-edge packaging technologies that might otherwise be out of reach.

- Growth Potential: Emerging brands and regional businesses are key to Amcor's expansion strategy, especially in high-growth developing markets.

- Sustainability Focus: Amcor provides eco-friendly packaging options crucial for smaller brands wanting to appeal to environmentally conscious consumers.

- Innovation Access: These businesses benefit from Amcor's advanced packaging technologies, enabling them to compete with larger players.

- Market Share: Amcor's solutions help these clients enhance product appeal and gain a competitive edge, fostering mutual growth.

Amcor serves a diverse customer base, including large multinational food and beverage corporations and global pharmaceutical companies, each with unique packaging demands. Additionally, manufacturers of personal care, home care, and industrial products represent significant segments, requiring specialized solutions for protection, brand appeal, and regulatory compliance. Emerging brands and regional businesses also form a key customer group, benefiting from Amcor's innovative and sustainable packaging to enhance their market presence.

| Customer Segment | Key Needs | Amcor's Offering | 2024 Market Relevance |

|---|---|---|---|

| Food & Beverage Multinationals | Product integrity, shelf appeal, high volume, sustainability | High-barrier materials, extended shelf life solutions, recyclable options | Significant revenue driver; focus on meeting 2025 plastic reduction targets |

| Pharmaceutical Companies | Safety, integrity, traceability, regulatory compliance | Specialized, high-barrier, tamper-evident packaging | Critical for sensitive product protection and compliance |

| Personal & Home Care Manufacturers | Brand differentiation, consumer appeal, sustainability | Eye-catching designs, lightweight, recycled content packaging | Global market valued over $500 billion in 2024; strong demand for eco-friendly options |

| Industrial & Specialty Product Manufacturers | Durability, protection, chemical resistance, regulatory compliance | Robust containers, specialized barrier properties, safe transport solutions | Global industrial packaging market valued around $100 billion in 2024 |

| Emerging Brands & Regional Businesses | Market differentiation, cost-effectiveness, sustainability | Innovative, sustainable, and accessible packaging technologies | Key growth area, especially in developing markets |

Cost Structure

Amcor's cost structure is heavily influenced by raw material procurement, with polymers, paper, and metals forming a significant expense. For instance, in fiscal year 2023, Amcor reported that its cost of goods sold was approximately $13.6 billion, a substantial portion of which is tied to these essential inputs.

The volatility of global commodity prices directly impacts Amcor's profitability in this area. For example, the price of polyethylene, a key polymer, can fluctuate based on crude oil prices, impacting Amcor's input costs throughout the year.

To mitigate these fluctuating costs, Amcor emphasizes efficient sourcing strategies and explores opportunities to integrate recycled content into its packaging solutions, aiming to manage expenses while also supporting sustainability goals.

Amcor's manufacturing and operational expenses are significant, stemming from its vast global footprint. The company operates 212 manufacturing facilities worldwide, requiring substantial investment in energy, labor, and upkeep. In 2024, Amcor employed approximately 41,000 individuals, with labor wages forming a key component of these costs.

Beyond wages, Amcor incurs considerable expenses related to energy consumption across its numerous plants, alongside ongoing maintenance and factory overheads. These operational costs are critical to managing, and the company actively pursues efficiency improvements and automation to mitigate them.

Amcor dedicates a significant portion of its resources to Research and Development, with annual investments hovering around $100 million. This substantial outlay is crucial for fostering innovation, particularly in the development of advanced and sustainable packaging technologies. While this investment fuels future growth and competitive advantage, it also represents a considerable fixed cost within Amcor's overall cost structure.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are a significant component of Amcor's cost structure. These encompass the costs associated with running the business beyond the direct cost of goods sold, including sales and marketing efforts, executive compensation, and the general upkeep of corporate functions. For instance, in fiscal year 2023, Amcor reported SG&A expenses of approximately $1.7 billion, reflecting the investment in their global sales force and administrative infrastructure.

Efficient management of SG&A is paramount for Amcor's profitability, especially given its extensive global reach. The company must balance the need to invest in sales and marketing to drive revenue growth with the imperative to control overhead costs. This involves optimizing administrative processes and ensuring that executive compensation aligns with performance and shareholder value.

Key elements within Amcor's SG&A include:

- Sales and Marketing: Costs related to advertising, promotions, sales force salaries and commissions, and market research to support product launches and brand building across diverse geographical markets.

- General and Administrative: Expenses covering executive and administrative salaries, legal and accounting fees, IT support, and corporate office operational costs.

- Corporate Overheads: Costs associated with the central management of the company, including strategic planning, finance, human resources, and compliance functions that support all business units.

- Research and Development: While sometimes separated, significant R&D investment aimed at new product innovation and material science advancements can also be categorized under SG&A or a related operational expense, crucial for maintaining a competitive edge.

Logistics and Distribution Costs

Amcor's extensive global operations necessitate significant expenditure on logistics and distribution. These costs are directly tied to moving raw materials to manufacturing sites and then delivering finished products to a diverse customer base across numerous countries.

In fiscal year 2024, Amcor continued to focus on supply chain efficiencies to mitigate these inherent costs. The company's integrated network of production facilities and distribution hubs aims to streamline transportation routes and reduce transit times, thereby controlling a substantial portion of its operating expenses.

- Global Supply Chain Management: Amcor manages complex international shipping, warehousing, and last-mile delivery, incurring substantial costs for freight, fuel, and handling.

- Optimization Efforts: The company actively seeks to optimize its logistics network through route planning, consolidation of shipments, and strategic placement of distribution centers to reduce overall transportation spend.

- Impact on Profitability: Efficient logistics are critical for maintaining competitive pricing and healthy profit margins, as distribution expenses can significantly impact the bottom line.

Amcor's cost structure is dominated by raw materials, manufacturing, and SG&A expenses. In fiscal year 2023, cost of goods sold reached approximately $13.6 billion, with raw materials like polymers and paper being major drivers. The company's global manufacturing footprint, comprising 212 facilities and employing around 41,000 people in 2024, incurs significant labor, energy, and maintenance costs.

Sales, General, and Administrative (SG&A) expenses were about $1.7 billion in fiscal year 2023, covering marketing, executive compensation, and corporate operations. Amcor also invests roughly $100 million annually in R&D for innovative packaging solutions, which contributes to its fixed costs but is vital for future competitiveness. Efficient logistics and distribution are also critical cost components, managed through supply chain optimization efforts.

| Cost Category | FY2023 (Approx.) | Key Drivers |

|---|---|---|

| Cost of Goods Sold | $13.6 billion | Raw materials (polymers, paper, metals), manufacturing labor, energy |

| Sales, General & Administrative (SG&A) | $1.7 billion | Sales & marketing, executive compensation, corporate overheads |

| Research & Development (R&D) | ~$100 million (annual investment) | Innovation in packaging technologies, material science |

Revenue Streams

Amcor's primary revenue stream comes from selling a wide array of flexible packaging products. These include films, pouches, and bags that are essential for many everyday items.

These packaging solutions are vital for sectors like food and beverage, pharmaceuticals, and personal care, demonstrating their broad market reach. This segment is a cornerstone of Amcor's financial performance.

For the fiscal year ending June 30, 2023, Amcor reported net sales of $15.5 billion. The flexible packaging segment is a substantial contributor to this overall figure, reflecting its importance to the company's revenue generation.

Amcor generates significant income from selling rigid packaging, including plastic bottles and containers used for beverages, food, and home care items. As a leading global supplier in this segment, these sales form a cornerstone of their revenue.

In fiscal year 2023, Amcor reported that its Rigid Packaging segment achieved net sales of $7.0 billion, underscoring the substantial contribution of these products to the company's overall financial performance.

Amcor generates revenue from selling specialty cartons, which are often designed for premium consumer goods or specialized industrial uses. These cartons can offer enhanced protection, branding opportunities, or unique dispensing features. For instance, Amcor's expertise in aseptic carton packaging for beverages, a segment often considered specialty, contributes significantly to this revenue stream.

The company also derives income from a wide array of closures for bottles and containers, catering to diverse industries like food, beverage, and healthcare. These closures range from simple screw caps to more complex dispensing systems, each designed for specific product needs and consumer convenience. The demand for innovative and secure closures remains robust across many end markets.

These specialized products typically command higher profit margins compared to more standardized packaging solutions. This is due to the advanced technology, materials science, and design expertise required to produce them. For example, in 2023, Amcor reported strong performance in its specialty products segments, reflecting the value placed on these differentiated offerings by customers.

Revenue from Sustainable Packaging Solutions and Services

Amcor's commitment to sustainability is directly translating into significant revenue from its innovative packaging. This includes lighter, more recyclable, and reusable packaging options, as well as those incorporating higher percentages of recycled content. These environmentally conscious products are increasingly sought after by consumers and businesses alike.

In fiscal year 2024, Amcor reported a substantial US$8.1 billion in revenue specifically from products that adhere to global recyclability standards. This figure highlights the market's strong demand for sustainable packaging solutions.

Beyond product sales, Amcor also generates revenue through value-added services. These services often include sustainability consulting, where Amcor assists its customers in navigating the complexities of eco-friendly packaging and achieving their own sustainability goals.

Key revenue drivers within this segment include:

- Sales of packaging solutions designed for enhanced recyclability.

- Revenue from reusable packaging systems and components.

- Income generated from packaging with increased recycled content.

- Fees from sustainability consulting and support services offered to clients.

Long-term Contracts and Recurring Sales with Key Clients

Amcor secures a substantial portion of its income through enduring agreements and consistent sales with major global corporations. These long-standing partnerships are foundational, offering a reliable and predictable flow of revenue, underscoring the critical role Amcor's packaging solutions play in their clients' day-to-day business. For instance, in fiscal year 2023, Amcor reported that approximately 70% of its revenue was generated from its top 100 customers, many of whom operate under multi-year contracts.

This reliance on recurring business highlights Amcor's position as a vital supplier, deeply integrated into the supply chains of its key partners. The stability derived from these relationships allows for more effective financial planning and investment in innovation. Amcor's strategic focus on these large, stable accounts contributes significantly to its overall financial resilience.

- Long-term Contracts: Amcor's business model heavily features multi-year agreements with its extensive client base, ensuring consistent demand for its packaging products.

- Recurring Sales: The essential nature of packaging for many multinational clients leads to predictable, ongoing orders, forming a core revenue driver.

- Client Stability: Amcor's significant revenue from its top customers, many of whom are multinational corporations, demonstrates the strength and stability of these relationships.

- Revenue Predictability: These established contracts and recurring sales provide Amcor with a high degree of revenue predictability, aiding in strategic decision-making and financial forecasting.

Amcor's revenue streams are diverse, primarily driven by the sale of flexible and rigid packaging solutions. These products are essential across numerous consumer and industrial sectors, forming the backbone of the company's sales. For the fiscal year ending June 30, 2023, Amcor achieved net sales of $15.5 billion, with flexible packaging being a major contributor.

The company also generates substantial income from its rigid packaging segment, which includes plastic bottles and containers. In fiscal year 2023, this segment alone reported net sales of $7.0 billion, highlighting its critical role in Amcor's revenue generation.

Furthermore, Amcor benefits from sales of specialty cartons and a wide array of closures, often commanding higher margins due to specialized design and materials. The company's focus on sustainability is also a growing revenue driver, with $8.1 billion in fiscal year 2024 revenue coming from products meeting global recyclability standards.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Approximate) |

| Flexible Packaging | Films, pouches, and bags for food, beverage, pharma, and personal care. | $8.5 billion (estimated from total net sales) |

| Rigid Packaging | Plastic bottles and containers for beverages, food, and home care. | $7.0 billion |

| Specialty Products & Closures | Specialty cartons, bottle caps, and dispensing systems. | Included within Flexible and Rigid segments, but represents higher-margin offerings. |

| Sustainable Packaging | Products designed for enhanced recyclability, reusability, and recycled content. | $8.1 billion (Fiscal Year 2024) |

Business Model Canvas Data Sources

The Amcor Business Model Canvas is informed by a blend of Amcor's internal financial reports, operational data, and strategic planning documents. These sources provide the foundation for understanding Amcor's current business activities and future direction.