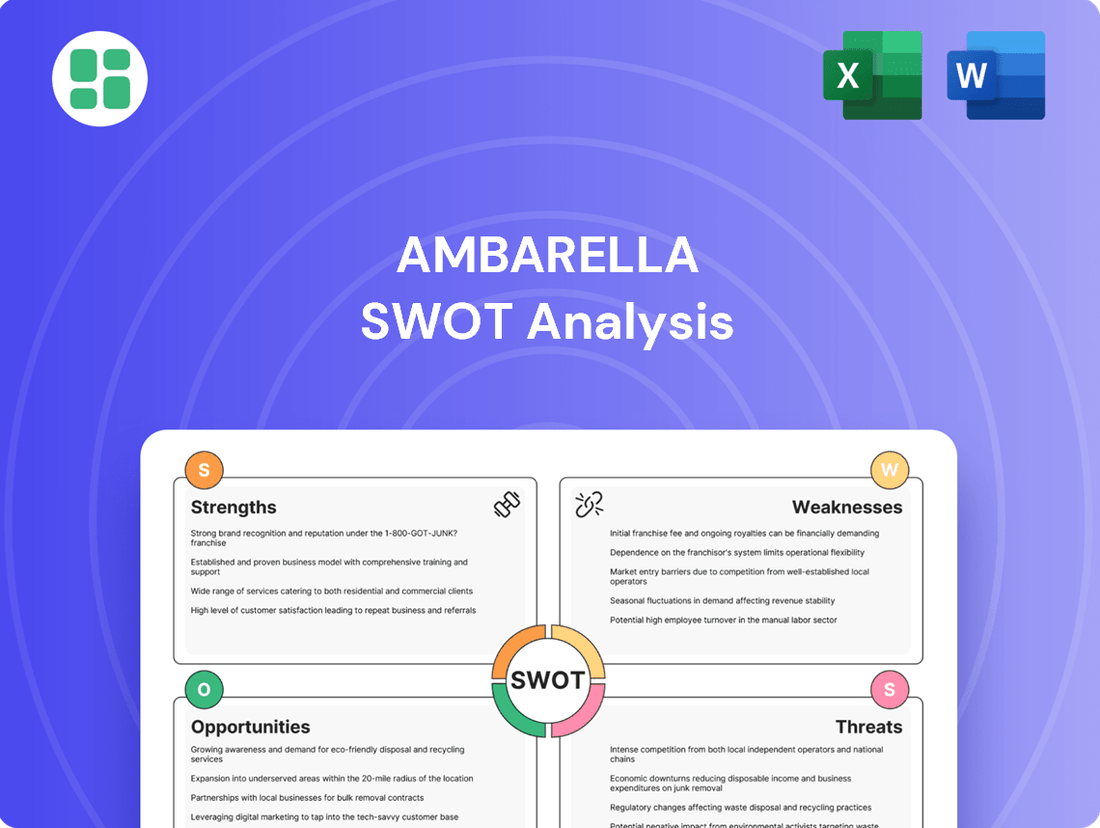

Ambarella SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambarella Bundle

Ambarella's innovative AI vision chips position it strongly in booming markets like automotive and IoT. However, intense competition and supply chain vulnerabilities present significant challenges.

Want the full story behind Ambarella's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ambarella's core strength lies in its specialized expertise in AI and computer vision, particularly in developing low-power, high-definition video processing solutions. This focus allows them to create highly efficient Systems-on-Chip (SoCs) that are critical for intelligent perception in diverse markets.

Their CVflow architecture, especially the third generation, is a significant differentiator, engineered to efficiently handle transformer AI networks. This capability positions Ambarella to capitalize on the growing demand for next-generation automotive AI and generative AI applications, reflecting a forward-looking approach to technological advancement.

Ambarella is experiencing robust growth in the automotive market, with its AI processors becoming integral to ADAS, electronic mirrors, and driver monitoring systems.

The company's CV3-AD AI SoCs and Oculii AI 4D Imaging Radar Technology are gaining traction, evidenced by recent design wins with prominent automotive partners like Plus and SANY Group.

These strategic collaborations highlight Ambarella's expanding footprint and increasing adoption within the rapidly evolving automotive sector, particularly in advanced driver assistance and autonomous driving solutions.

Ambarella's core strength is its exceptional power efficiency in delivering AI capabilities at the edge. This means their chips can handle complex artificial intelligence tasks using very little energy, which is crucial for battery-powered devices or applications where heat is a concern.

This low-power, high-performance approach allows sophisticated AI to run directly on devices like security cameras and autonomous vehicles. For instance, their CVflow architecture is designed for efficient computer vision processing, enabling features like object detection and tracking with minimal power draw, a key advantage in the rapidly growing edge AI market.

Strong Research and Development Investment

Ambarella demonstrates a powerful commitment to innovation through substantial research and development (R&D) investments. As of January 31, 2024, a significant portion of its workforce, around 75%, is dedicated to R&D efforts. This focus fuels continuous advancements in their core AI inference processors and radar solutions.

This strategic R&D allocation allows Ambarella to actively explore and integrate emerging technologies. Their pipeline includes work on vision-language models and generative AI, positioning them to maintain a leading edge in the rapidly evolving AI hardware sector.

- High R&D Employee Ratio: Approximately 75% of Ambarella's workforce was engaged in R&D as of January 31, 2024.

- Focus on Core Technologies: Continuous investment in AI inference processors and radar solutions.

- Exploration of New AI Frontiers: Active development in vision-language models and generative AI.

- Market Leadership Potential: Commitment to innovation strengthens their position at the forefront of advanced technology.

Strategic Partnerships and Collaborations

Ambarella's strategic partnerships are a significant strength, enabling it to embed its AI systems into a wide array of automotive and intelligent edge devices. The company has forged crucial alliances with automotive manufacturers like Lotus and Leapmotor, alongside Tier-1 suppliers such as Continental and Plus, and technology giants like LG Electronics. These collaborations are instrumental in broadening market penetration and speeding up the development of advanced autonomous driving and AI-powered solutions.

- Automotive Integration: Partnerships with automakers like Lotus and Leapmotor allow direct integration of Ambarella's AI chips into next-generation vehicles, targeting the rapidly growing ADAS and autonomous driving markets.

- Supply Chain Access: Collaborations with Tier-1 suppliers such as Continental and Plus provide access to established automotive supply chains, facilitating broader adoption of Ambarella's technology.

- Ecosystem Development: Alliances with tech firms like LG Electronics and SANY Group help build a robust ecosystem around Ambarella's AI platforms, fostering innovation and expanding application possibilities in intelligent systems.

Ambarella's core strength is its specialization in AI and computer vision, particularly in developing low-power, high-definition video processing solutions. Their CVflow architecture, especially the third generation, is a key differentiator, efficiently handling advanced AI networks and positioning them for growth in automotive AI and generative AI applications. The company is seeing strong uptake in the automotive sector for ADAS, electronic mirrors, and driver monitoring systems, with recent design wins further solidifying their market presence.

A significant strength is Ambarella's commitment to innovation, with approximately 75% of its workforce dedicated to R&D as of January 31, 2024. This focus fuels advancements in AI inference processors and radar solutions, with active development in vision-language models and generative AI. Strategic partnerships with automotive manufacturers like Lotus and Leapmotor, along with Tier-1 suppliers such as Continental and Plus, are critical for embedding their AI systems into a wide range of devices and expanding market reach.

| Key Strength | Description | Supporting Data/Fact |

| AI & Computer Vision Expertise | Specialized in low-power, high-definition video processing and efficient AI inference. | CVflow architecture designed for advanced AI networks. |

| R&D Investment | High proportion of workforce dedicated to research and development. | ~75% of workforce in R&D as of Jan 31, 2024. |

| Automotive Market Traction | Growing adoption in ADAS, electronic mirrors, and driver monitoring systems. | Design wins with partners like Plus and SANY Group. |

| Strategic Partnerships | Collaborations with key players to embed AI solutions. | Partnerships with Lotus, Leapmotor, Continental, and LG Electronics. |

What is included in the product

Delivers a strategic overview of Ambarella’s internal and external business factors, highlighting its technological strengths in AI vision processing and the competitive landscape.

Uncovers potential market threats and competitive weaknesses, enabling proactive mitigation strategies.

Weaknesses

Ambarella has faced consistent GAAP net losses, reporting a deficit of $117.1 million for the fiscal year ending January 31, 2025, and $169.4 million for the prior fiscal year. These persistent losses, even with revenue increases, suggest underlying profitability challenges that could deter investors focused on bottom-line performance.

Ambarella's revenue is susceptible to the boom-and-bust cycles common in the semiconductor industry. This means the company can experience significant swings due to inventory adjustments or broader economic downturns impacting demand for its chips.

A prime example of this vulnerability was seen in the fiscal year ending January 31, 2024, where Ambarella's revenue dropped by a substantial 32.9% compared to the previous year. Although fiscal year 2025 indicated a recovery, this inherent unpredictability makes precise financial forecasting and maintaining steady financial performance a persistent challenge.

Ambarella's financial health is closely tied to securing new design wins and the subsequent market performance of its clients' products. This reliance creates a vulnerability; a slowdown in new design acquisitions or a failure of customer products to achieve commercial success can significantly hinder Ambarella's revenue growth.

For instance, in fiscal year 2024, Ambarella's revenue saw a 13% decrease year-over-year, reaching $271.6 million, underscoring the impact of a challenging market environment and the inherent risks of depending on customer product cycles.

Intense Competition from Larger Players

Ambarella faces formidable competition from tech giants like NVIDIA, Texas Instruments, Qualcomm, and Intel (through its Mobileye division). These larger entities benefit from substantial economies of scale and significantly larger research and development budgets, which can allow them to offer more competitive pricing, particularly in areas outside of Ambarella's AI-focused strengths.

The sheer market presence and diversified product offerings of these competitors can present a challenge to Ambarella's market share, especially when customers seek integrated solutions rather than specialized components. For instance, NVIDIA's broad AI ecosystem and Qualcomm's extensive mobile and automotive connectivity solutions offer a more comprehensive package that can be attractive to large-scale buyers.

- NVIDIA's Dominance in AI: NVIDIA's GPUs are widely adopted for AI training and inference, giving it a significant edge in the burgeoning AI processing market.

- Texas Instruments' Broad Portfolio: TI offers a vast array of analog and embedded processing products, allowing it to serve a wider range of customer needs across various industries.

- Qualcomm's Automotive and Mobile Strength: Qualcomm's established presence in automotive infotainment and mobile chipsets provides a strong foundation for expanding into related areas.

- Intel/Mobileye's ADAS Leadership: Mobileye holds a leading position in advanced driver-assistance systems (ADAS), a key market Ambarella is also targeting.

Market Capitalization and Scale Limitations

Ambarella's market capitalization, hovering around $2.7 billion as of mid-2024, positions it as a mid-cap player. This smaller scale, when compared to semiconductor giants, can present challenges. It might restrict its capacity to aggressively compete on pricing or to make the same breadth of investments in research and development as larger competitors.

This size difference could also impact its resilience during economic downturns, potentially making it less able to absorb market shocks compared to its more substantial rivals. Consequently, Ambarella's competitive positioning might be affected by these scale limitations.

- Market Cap: Approximately $2.7 billion (mid-2024).

- Industry Standing: Mid-cap company, smaller than many semiconductor industry leaders.

- Competitive Disadvantages: Potential limitations in price competition, R&D investment breadth, and ability to withstand market downturns compared to larger rivals.

Ambarella's consistent GAAP net losses, amounting to $117.1 million for fiscal year ending January 31, 2025, highlight profitability challenges. This financial performance, despite revenue growth, could be a deterrent for investors prioritizing bottom-line results.

The company's revenue is vulnerable to the semiconductor industry's cyclical nature, leading to potential significant swings in income. For instance, revenue declined 32.9% in fiscal year ending January 31, 2024, demonstrating this inherent unpredictability.

Ambarella's reliance on new design wins and the market success of its clients' products creates a dependency that can hinder growth if these factors falter. A 13% year-over-year revenue decrease in fiscal year 2024 to $271.6 million illustrates this risk.

Formidable competition from tech giants like NVIDIA and Qualcomm, with their larger R&D budgets and economies of scale, presents a significant challenge. These competitors offer broader solutions, potentially impacting Ambarella's market share, especially outside its AI-focused niche.

| Weakness | Description | Impact |

|---|---|---|

| Consistent Net Losses | GAAP net losses of $117.1M (FY25) and $169.4M (FY24) | Deters investors focused on profitability; signals underlying operational challenges. |

| Revenue Cyclicality | Susceptible to semiconductor industry boom-and-bust cycles | Leads to unpredictable revenue streams; FY24 saw a 32.9% revenue drop. |

| Customer Product Dependency | Revenue tied to new design wins and client product success | Vulnerable to market shifts and client product failures; FY24 revenue down 13%. |

| Intense Competition | Faces giants like NVIDIA, Qualcomm, TI, Intel/Mobileye | Disadvantage in pricing and R&D investment breadth; larger competitors offer integrated solutions. |

Same Document Delivered

Ambarella SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Ambarella's Strengths, Weaknesses, Opportunities, and Threats. This detailed analysis is designed to provide actionable insights for strategic planning.

Opportunities

The automotive semiconductor market is a powerhouse of growth, with projections indicating a compound annual growth rate (CAGR) of around 10% through 2028, reaching over $100 billion. This expansion is fueled by the increasing demand for electric vehicles, advanced connectivity features, and crucially, AI-powered safety systems. Ambarella is strategically positioned to capitalize on this trend, leveraging its expertise in advanced driver-assistance systems (ADAS), electronic mirrors, and the burgeoning autonomous driving sector.

Ambarella's proprietary CVflow SoCs are designed for high-performance AI processing, essential for the complex computations required in autonomous driving. Coupled with its Oculii™ radar technology, which enhances perception capabilities even in challenging environmental conditions, Ambarella offers a compelling solution for automakers. For instance, the company has secured design wins with major Tier 1 automotive suppliers, indicating strong market adoption of its AI-powered automotive solutions.

The market is increasingly calling for powerful processing directly on devices, a trend fueled by the move from simple image recognition to more complex tasks like running smaller Large Language Models (LLMs) and generative AI applications at the edge. This shift is creating significant opportunities for companies like Ambarella.

Ambarella's specialized edge AI processors, such as their new N1 series, are perfectly positioned to capitalize on this demand. These processors are designed to handle sophisticated AI workloads in diverse sectors including robotics, smart city infrastructure, and dedicated on-premise AI solutions, unlocking new possibilities like multimodal AI capabilities.

Ambarella is strategically expanding beyond its established security camera and automotive sectors, targeting burgeoning markets like OEM automotive and robotics with its advanced AI computer vision technology. This move is designed to unlock significant new revenue opportunities and diminish dependence on its current core businesses.

By entering these diverse fields, Ambarella aims to leverage its AI expertise to address evolving industry needs, potentially capturing market share in areas experiencing rapid technological advancement. For instance, the automotive industry's push towards autonomous driving and advanced driver-assistance systems (ADAS) presents a substantial growth avenue for Ambarella's silicon solutions.

Potential for Strategic Acquisition

Ambarella's exploration of a potential sale, with reports indicating interest from private equity and industry competitors, presents a significant opportunity. This strategic move could lead to a substantial premium for shareholders, reflecting the company's value in the burgeoning automotive and AI sectors. For instance, in early 2024, the semiconductor industry saw several high-profile acquisitions, such as Broadcom's acquisition of VMware for $69 billion, highlighting the appetite for strategic consolidation.

A successful acquisition would inject much-needed capital and resources, enabling Ambarella to accelerate its product development and expand its market reach. This could be particularly impactful in the competitive AI chip market, where scaling and R&D investment are critical for success. The company's focus on advanced driver-assistance systems (ADAS) and AI processing units positions it as an attractive target for firms looking to bolster their presence in these high-growth areas.

The potential benefits extend beyond financial returns, offering Ambarella access to synergistic technologies and broader distribution channels. This could accelerate the adoption of its innovative solutions and solidify its competitive standing.

- Attracts interest from PE firms and rivals: Reports suggest active pursuit by entities aiming to enhance automotive and AI portfolios.

- Potential for significant shareholder premium: A sale could unlock substantial value for investors.

- Access to greater resources and scale: An acquirer could provide the capital for accelerated growth and market penetration.

- Strengthened market position: Integration with a larger entity could offer broader reach and competitive advantages.

Leveraging Advanced AI Architectures (e.g., Transformers)

Ambarella's third-generation CVflow architecture is a significant opportunity, as it's purpose-built for efficient processing of transformer AI networks. This is crucial for the burgeoning fields of next-generation automotive AI and generative AI, areas experiencing rapid growth and innovation.

This architectural advantage empowers Ambarella's customers to readily port their proprietary algorithms and neural networks onto the CVflow platform. This capability fosters significant customer differentiation and can accelerate the adoption of Ambarella's solutions within advanced AI systems, potentially capturing market share in these high-growth segments.

- Transformer AI Efficiency: CVflow's design optimizes transformer networks, a key driver for advanced AI.

- Customer Algorithm Portability: Enables clients to deploy their unique AI models, fostering customization.

- Market Acceleration: Facilitates faster adoption of next-gen automotive and generative AI applications.

Ambarella's focus on next-generation AI, particularly its CVflow architecture optimized for transformer networks, presents a significant opportunity. This allows for efficient processing of complex AI models crucial for advanced automotive applications and generative AI. The company's ability to enable customers to port their proprietary algorithms onto the CVflow platform fosters differentiation and can accelerate market adoption.

The automotive sector's rapid evolution towards autonomous driving and enhanced ADAS features creates a substantial growth avenue for Ambarella's AI-centric silicon solutions. Furthermore, Ambarella's strategic expansion into robotics and other edge AI markets diversifies its revenue streams and taps into emerging high-growth segments.

Reports indicating interest from private equity and industry rivals in acquiring Ambarella signal a potential for significant shareholder value realization. Such a transaction could provide the company with increased capital and resources to accelerate product development and expand its market reach in the competitive AI chip landscape.

| Opportunity Area | Key Driver | Ambarella's Advantage |

|---|---|---|

| Next-Gen Automotive AI & Generative AI | Demand for advanced AI processing | CVflow architecture optimized for transformer networks |

| Automotive Sector Growth | ADAS & autonomous driving adoption | Specialized AI SoCs for automotive applications |

| Market Diversification | Growth in robotics & edge AI | Expansion into new high-growth segments |

| Potential Acquisition | Industry consolidation & AI portfolio enhancement | Attractive target due to AI expertise and market position |

Threats

The semiconductor landscape, especially for AI-powered edge computing, is fiercely contested. Established players like NVIDIA and AMD are broadening their product portfolios, posing a risk of eroding Ambarella's competitive edge in price and performance.

Furthermore, aggressive pricing strategies from competitors in China and Taiwan, particularly in less AI-intensive market segments, could put significant pressure on Ambarella's profit margins. For instance, the global semiconductor market saw revenue growth of approximately 5.5% in 2024, reaching an estimated $600 billion, a figure that highlights the scale of competition and the constant need for differentiation.

Global economic and political instability, including escalating trade tariffs and restrictions, particularly concerning China, presents a substantial threat to Ambarella's intricate supply chain and pricing strategies. The company's reliance on global manufacturing and component sourcing makes it particularly vulnerable to these geopolitical shifts.

Such disruptions can lead to significant project delays and inflated production costs, directly impacting Ambarella's ability to meet customer demand and fulfill orders efficiently. For instance, in late 2023, ongoing trade tensions continued to cast a shadow over semiconductor supply chains, with companies reporting increased lead times and higher component expenses.

These challenges can erode profit margins and hinder the company's revenue growth, as evidenced by the broader semiconductor industry's experience with supply chain volatility throughout 2023 and early 2024, which saw some companies reporting a 5-10% increase in raw material costs due to these factors.

Ambarella's expansion hinges on AI integration across IoT, automotive, and edge computing sectors. However, this growth is susceptible to wider economic shifts and potential slowdowns in these key markets. For instance, a general cooling of the semiconductor industry, which saw significant demand in 2023 and early 2024, could translate into reduced orders for Ambarella's advanced chips.

A downturn in automotive production, a critical segment for Ambarella, could directly impact sales. If consumer spending tightens, leading to fewer new car purchases, this would naturally decrease demand for the sophisticated AI-enabled systems Ambarella provides. Such a scenario could force inventory adjustments and dampen Ambarella's revenue trajectory, as seen in previous industry cycles where oversupply followed periods of high demand.

Rapid Technological Obsolescence

The semiconductor and AI sectors are defined by incredibly fast technological evolution, meaning product lifecycles are quite short. Ambarella faces a constant need to innovate, rolling out new and improved solutions to stay ahead of the curve and maintain its competitive edge.

A significant threat is the potential for Ambarella to fall behind if it doesn't accurately predict future market needs or develop cutting-edge technologies. For instance, the increasing demand for more sophisticated AI processing capabilities requires continuous R&D investment. Failing to keep pace could result in outdated products, leading to a decline in market share.

- Market Dynamics: The semiconductor industry's average product lifecycle can be as short as 18-24 months for cutting-edge components, demanding rapid iteration.

- AI Advancement: The complexity of AI algorithms is escalating, with industry analysts predicting a doubling of AI model parameter sizes annually, requiring more powerful and efficient processing.

- Competitive Landscape: Competitors are heavily investing in AI-specific hardware, with major players reportedly allocating over 30% of their R&D budgets to AI-related advancements in 2024.

Dependence on Foundry and Assembly Contractors

Ambarella, operating as a fabless semiconductor company, places significant trust in external partners for its manufacturing processes, including foundries, assembly, and testing. This dependency exposes the company to the operational schedules and capacity constraints of these critical third-party providers.

Potential disruptions or acute shortages in manufacturing capacity could directly impede Ambarella's ability to fulfill production targets and meet customer demand. For instance, in early 2024, the semiconductor industry continued to navigate tight foundry capacity in certain advanced nodes, a situation that could have directly impacted companies like Ambarella if they faced unexpected demand surges or if their primary foundry partners prioritized other clients.

- Foundry Reliance: Ambarella outsources all wafer fabrication, a common but inherently risky model in the semiconductor industry.

- Capacity Constraints: The global semiconductor shortage, while easing in some segments, still presents challenges in securing sufficient foundry and assembly capacity for advanced process nodes.

- Scheduling Priority: Ambarella's production is subject to the scheduling priorities of its contract manufacturers, potentially leading to delays if demand outstrips available capacity.

- Cost Volatility: Fluctuations in foundry and assembly costs, driven by supply and demand dynamics, can impact Ambarella's gross margins.

Intense competition from established players like NVIDIA and AMD, who are expanding their AI-focused product lines, poses a significant threat to Ambarella's market position. Aggressive pricing from competitors, particularly in less advanced segments, could also squeeze profit margins. The rapid pace of technological advancement in AI and semiconductors necessitates continuous innovation, and falling behind in R&D could lead to product obsolescence and market share erosion.

Geopolitical instability, including trade tensions and tariffs, particularly concerning China, creates substantial risks for Ambarella's global supply chain and pricing strategies. Economic downturns or slowdowns in key markets like automotive and IoT could also dampen demand for Ambarella's advanced chips. Furthermore, Ambarella's reliance on third-party foundries for manufacturing exposes it to potential capacity constraints and scheduling conflicts, which could disrupt production and hinder its ability to meet customer orders.

| Threat Category | Specific Threat | Potential Impact | Data Point/Example |

|---|---|---|---|

| Competition | Established AI chipmakers expanding portfolios | Erosion of market share, pricing pressure | NVIDIA and AMD are increasing investment in AI accelerators, aiming for broader market penetration in 2024-2025. |

| Market Dynamics | Rapid technological obsolescence | Reduced product relevance, R&D cost increases | Semiconductor product lifecycles can be as short as 18-24 months for cutting-edge components. |

| Geopolitics | Trade tariffs and restrictions | Supply chain disruptions, increased costs | Ongoing trade tensions in late 2023 led to reported increases in lead times and component expenses for some semiconductor firms. |

| Economic Factors | Slowdown in key end markets (e.g., automotive) | Reduced order volumes, revenue decline | A projected slowdown in global automotive production growth for 2025 could directly impact Ambarella's sales. |

| Operational Risks | Foundry capacity constraints | Production delays, inability to meet demand | Tight foundry capacity for advanced nodes persisted into early 2024, affecting chipmakers' ability to scale production. |

SWOT Analysis Data Sources

This Ambarella SWOT analysis is constructed using a robust blend of data, including official financial filings, comprehensive market research reports, and expert industry analysis. These sources provide a well-rounded and data-driven perspective, ensuring the insights are both accurate and strategically relevant.