Ambarella Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambarella Bundle

Ambarella's innovative chipsets are at the core of its product strategy, enabling cutting-edge AI and vision applications. This analysis delves into how their pricing reflects this technological leadership and their distribution channels ensure reach into key markets. Discover the promotional tactics that amplify their brand presence and drive adoption.

Ready to understand the complete picture of Ambarella's marketing success? Get instant access to an in-depth, editable 4Ps Marketing Mix Analysis, packed with strategic insights and actionable examples. Elevate your understanding of their market positioning and competitive edge.

Product

Ambarella's Edge AI SoCs are built on their low-power, high-definition video processing expertise, integrating advanced image processing and computer vision. These chips are designed for a wide array of applications, from automotive to smart city infrastructure, enabling intelligent decision-making directly at the device level.

The core of their offering is the CVflow AI architecture. This allows devices to process visual data with AI, performing tasks like real-time object detection and semantic segmentation. For instance, in the automotive sector, this translates to enhanced ADAS features, interpreting complex road scenarios efficiently.

Ambarella's focus on energy efficiency is crucial for edge deployments. Their SoCs are engineered to deliver high performance with minimal power consumption, a critical factor for battery-powered or always-on devices. This efficiency is a key differentiator in a market increasingly demanding sophisticated AI capabilities at the edge.

Ambarella's marketing strategy heavily leans into the automotive and IoT sectors, recognizing their significant growth potential. The company's AI computer vision chips are crucial for advanced driver-assistance systems (ADAS) and the burgeoning autonomous vehicle market. For the fiscal year 2025, Ambarella anticipates substantial revenue contributions from these areas, aiming to solidify its position as a key supplier for next-generation automotive technologies.

Within the broader IoT landscape, Ambarella is prioritizing its AI-powered solutions for video security cameras and robotics. This focus allows them to leverage their expertise in image processing and machine learning to address demanding applications. The company's commitment to expanding its presence in automotive OEM and robotics markets signifies a strategic push to diversify its revenue streams beyond traditional video security.

Ambarella's advanced AI and computer vision capabilities are a cornerstone of their marketing strategy, showcasing how their System on Chips (SoCs) power intelligent perception for both humans and machines.

The CV3-AD family, specifically engineered for automotive AI domain controllers, exemplifies this. It's built to manage complex vision processing for Level 2+ autonomous driving, supporting sophisticated algorithms that enhance safety and performance. This focus on cutting-edge perception is a key differentiator in the competitive automotive market.

A prime example of their innovation is the central 4D imaging radar architecture. Recognized with an award in 2024, this technology demonstrates Ambarella's prowess in processing raw radar data and seamlessly integrating it with other sensor inputs, creating a more robust and comprehensive understanding of the vehicle's surroundings.

Proprietary CVflow Architecture and Software

Ambarella's CVflow architecture is a significant differentiator, specifically engineered for efficient vision and AI processing. This specialized design is crucial for the demanding workloads of edge AI applications, enabling sophisticated on-device intelligence.

The company complements its hardware with comprehensive software development kits (SDKs) and reference designs. This provides Original Equipment Manufacturers (OEMs) and Tier 1 suppliers with the flexibility to integrate their unique AI algorithms, fostering innovation and tailored solutions.

This integrated hardware and software approach allows Ambarella to offer complete solutions that extend beyond basic processing. They now support advanced capabilities like vision-language models and generative AI processing directly at the edge, a key trend in 2024 and projected for 2025.

Key benefits of the CVflow architecture include:

- Optimized Performance: Tailored for AI and vision tasks, leading to higher efficiency and lower power consumption compared to general-purpose processors.

- Flexibility and Customization: SDKs and reference designs empower developers to implement custom AI models and algorithms.

- Edge AI Capabilities: Enables advanced AI processing, including vision-language and generative AI, directly on edge devices, reducing latency and reliance on cloud connectivity.

- Future-Proofing: Designed to support evolving AI workloads, ensuring relevance in the rapidly advancing AI landscape.

Continuous Innovation with New Process Technologies

Ambarella's dedication to continuous innovation is evident in its adoption of cutting-edge process technologies. By leveraging Samsung Foundry's 10nm and 5nm nodes for its current products, and with future plans for 2nm, Ambarella ensures its solutions remain at the forefront of semiconductor advancements.

This strategic use of advanced fabrication processes directly translates into superior performance for their AI chips. Specifically, it enables Ambarella to deliver exceptional AI processing performance per watt. This efficiency is paramount for the success of power-constrained edge AI applications, where battery life and thermal management are critical design considerations.

Ambarella's focus on process technology innovation supports its product development in key markets.

- Advanced Process Nodes: Utilizes Samsung Foundry's 10nm and 5nm, with future plans for 2nm.

- Performance Advantage: Achieves high AI processing performance per watt.

- Market Relevance: Crucial for power-constrained edge AI applications.

Ambarella's product strategy centers on its CVflow AI architecture, powering advanced vision and AI processing for edge devices. This includes their CV3-AD family, crucial for automotive AI domain controllers supporting Level 2+ autonomous driving. Their innovative 4D imaging radar architecture, recognized in 2024, enhances perception by integrating diverse sensor data.

The company offers comprehensive software development kits (SDKs) and reference designs, enabling customization for OEMs and Tier 1 suppliers. This integrated hardware and software approach supports emerging capabilities like vision-language and generative AI processing at the edge, a key trend for 2024-2025.

Ambarella's commitment to advanced process technology, including Samsung Foundry's 5nm and future 2nm nodes, ensures high performance per watt. This is critical for power-constrained edge AI applications in automotive and IoT, where efficiency is paramount.

| Product Category | Key Technology | Target Market | 2024/2025 Focus |

|---|---|---|---|

| Edge AI SoCs | CVflow AI Architecture | Automotive, IoT, Robotics | ADAS, Autonomous Driving, Video Security, AI Cameras |

| Automotive SoCs | CV3-AD Family, 4D Imaging Radar | Automotive OEMs, Tier 1 Suppliers | Level 2+ ADAS, Central Domain Controllers |

| Software & Tools | SDKs, Reference Designs | Developers, System Integrators | Custom AI Algorithm Integration, Edge AI Deployment |

What is included in the product

This analysis provides a comprehensive breakdown of Ambarella's marketing mix, detailing its product innovation in AI vision chips, strategic pricing, distribution channels, and promotional efforts to highlight its competitive positioning.

Provides a clear, actionable framework for understanding Ambarella's marketing strategy, alleviating the pain of complex analysis by distilling the 4Ps into a concise, easy-to-grasp format.

Simplifies the evaluation of Ambarella's product, price, place, and promotion, offering a quick solution for identifying potential gaps or opportunities in their go-to-market approach.

Place

Ambarella’s go-to-market strategy heavily relies on direct sales to Original Equipment Manufacturers (OEMs) and Tier 1 automotive suppliers. This direct engagement is crucial for integrating their advanced System-on-Chips (SoCs) into sophisticated automotive systems like Advanced Driver-Assistance Systems (ADAS) and infotainment platforms. In fiscal year 2024, Ambarella reported revenue growth driven by these key sectors, underscoring the importance of these direct relationships for their specialized semiconductor solutions.

Ambarella's global reach is significantly amplified through strategic alliances, extending beyond its direct sales efforts. Collaborations with major players like Quanta Computer, LG Electronics, and emerging automotive manufacturers such as Leapmotor are instrumental in embedding Ambarella's advanced AI chips into a wider array of sophisticated products and new vehicle platforms worldwide.

These partnerships are crucial for unlocking new geographical markets and penetrating diverse application sectors, allowing Ambarella to tap into established distribution channels and customer bases. For instance, by integrating its CVflow AI engines into LG's smart home devices or Leapmotor's electric vehicles, Ambarella gains immediate access to millions of potential end-users and accelerates its adoption curve in key growth areas.

As a fabless semiconductor company, Ambarella's supply chain management with foundries is crucial for its operations. They depend on external partners for manufacturing their advanced System-on-Chips (SoCs). This necessitates meticulous management of a global network to ensure timely production and delivery to their diverse customer base.

Ambarella's strategic partnerships with leading foundries, such as Samsung Foundry, are vital for accessing cutting-edge process technologies. In 2024, the semiconductor industry continued to navigate supply chain complexities, with advanced node manufacturing remaining a key differentiator. Ambarella's ability to secure capacity and maintain quality with partners like Samsung is a significant factor in its product competitiveness.

Presence in Key Technology Hubs

Ambarella strategically positions itself within critical technology hubs, most notably Silicon Valley. Its headquarters in Santa Clara, California, places it at the epicenter of semiconductor innovation, offering unparalleled access to a deep pool of engineering talent and fostering collaboration with leading tech companies and research institutions.

This proximity is crucial for staying ahead in the fast-paced AI and computer vision markets. For instance, as of early 2024, the Bay Area continues to be a dominant force in venture capital funding for AI startups, with significant investment flowing into companies developing cutting-edge technologies that Ambarella's solutions can support and integrate with.

- Silicon Valley Presence: Headquarters in Santa Clara, California, central to AI and semiconductor innovation.

- Talent Acquisition: Direct access to a highly skilled workforce in hardware and software engineering.

- Industry Integration: Proximity to key partners, customers, and industry events for market insights and business development.

Investor Relations and Public Information Channels

Ambarella prioritizes transparency for its financial stakeholders by making comprehensive information readily available through its dedicated investor relations website. This platform serves as a central hub, offering timely access to crucial documents like press releases, detailed earnings call transcripts, and all necessary SEC filings.

This commitment to accessibility empowers financially-literate decision-makers, including individual investors, financial professionals, and academic researchers, to conduct thorough analyses and make informed investment choices. For instance, during fiscal year 2025 (ending January 2025), Ambarella reported revenue of $800.3 million, demonstrating continued growth and providing a key data point for valuation models.

- Investor Relations Website: A primary channel for financial data, including SEC filings and earnings reports.

- Earnings Call Transcripts: Offer in-depth insights into company performance and management outlook.

- Press Releases: Announce significant company news and strategic developments.

- SEC Filings: Provide legally mandated, detailed financial and operational disclosures.

Ambarella's physical presence is strategically anchored in Silicon Valley, specifically Santa Clara, California. This prime location grants unparalleled access to a rich ecosystem of semiconductor innovation, top-tier engineering talent, and key industry collaborators. The company's proximity to major tech hubs facilitates rapid adaptation to market trends and fosters crucial partnerships, essential for its advanced AI and computer vision solutions.

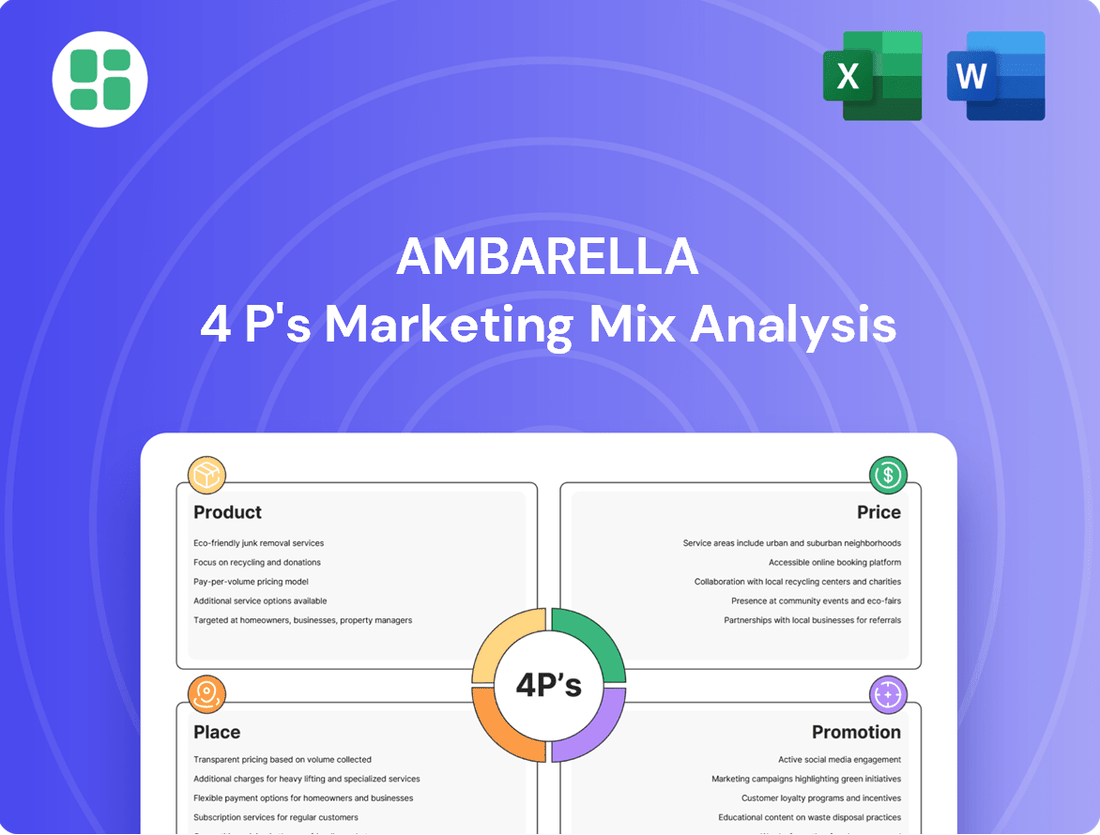

Preview the Actual Deliverable

Ambarella 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Ambarella's 4P's Marketing Mix is fully complete and ready for your immediate use, offering deep insights into their strategies.

Promotion

Ambarella leverages industry conferences like CES and ISC West to showcase its latest innovations, including the N1-655 edge GenAI SoC. These events are vital for demonstrating the company's advancements in AI processing and its commitment to pushing the boundaries of edge computing.

Participation in these key trade shows allows Ambarella to directly engage with potential customers, partners, and industry analysts, fostering valuable relationships and generating leads. The company's presence at these gatherings underscores its strategy to maintain visibility and thought leadership in the competitive semiconductor market.

In 2024, Ambarella's presence at events like CES highlighted its focus on the automotive and intelligent vision markets, showcasing solutions designed for advanced driver-assistance systems (ADAS) and AI-powered video analytics. This direct interaction is crucial for gathering market feedback and understanding evolving customer needs.

Ambarella's promotion strategy heavily features strategic partnerships, showcasing collaborations with industry leaders to boost market presence. Recent announcements highlight their work with LG Electronics on advanced in-cabin automotive solutions and with Leapmotor to advance intelligent driving systems.

These alliances serve as powerful endorsements of Ambarella's cutting-edge technology, significantly enhancing their market visibility. Joint marketing efforts and co-development projects stemming from these partnerships amplify their reach and solidify their position in competitive sectors.

Ambarella's technical publications and whitepapers are crucial for its Product strategy, effectively communicating the sophisticated capabilities of its System on Chips (SoCs) to a specialized audience of engineers and product developers. These documents delve into critical aspects like processing power, energy efficiency, and artificial intelligence features, directly addressing the needs of potential clients in the automotive, industrial, and consumer electronics sectors.

For instance, detailed whitepapers on their CVflow architecture showcase advancements in AI inference performance, a key differentiator. As of early 2024, the demand for AI-accelerated edge computing continues to surge, with projections indicating significant growth in the embedded AI market, underscoring the value of Ambarella's in-depth technical content in capturing this expanding opportunity.

Investor and Analyst Relations

Ambarella actively cultivates relationships with the financial community through consistent engagement. This includes hosting quarterly earnings calls, delivering investor presentations, and fostering analyst coverage to ensure transparency. This proactive approach helps build investor confidence by clearly communicating the company's strategic direction and financial health.

Ambarella's commitment to investor and analyst relations is demonstrated by its participation in key industry events and its ongoing dialogue with financial stakeholders. For instance, during their Q1 FY2025 earnings call in May 2024, the company provided guidance for the upcoming quarter and discussed its progress in AI processing and automotive markets. This consistent communication aims to keep the financial community informed and aligned with Ambarella's long-term objectives.

- Regular Communication: Earnings calls, investor presentations, and analyst meetings are key touchpoints.

- Strategic Vision Clarity: Efforts focus on ensuring financial stakeholders understand the company's roadmap.

- Financial Performance Transparency: Openly sharing financial results and outlook builds trust.

- Analyst Engagement: Cultivating relationships with analysts helps disseminate accurate company information.

Digital Presence and Corporate Website

Ambarella's corporate website is the primary digital storefront, offering comprehensive details on their advanced AI and computer vision semiconductor solutions. It effectively communicates their value proposition as a leader in edge AI technology, providing essential product information, technology deep dives, and corporate news.

This digital presence is crucial for engaging with a diverse audience, from potential customers and partners to investors and researchers. The site acts as a central repository for understanding Ambarella's innovative approach to AI processing, particularly in automotive, robotics, and smart infrastructure sectors.

In the fiscal year 2024, Ambarella reported revenue of $273.6 million, underscoring the importance of their online platform in driving awareness and interest in their high-performance, low-power AI chipsets. The website also features dedicated investor relations sections, providing access to financial reports and shareholder information, vital for maintaining transparency and attracting capital.

- Centralized Information Hub: The website consolidates product specifications, technology roadmaps, and company news.

- Value Proposition Communication: It clearly articulates Ambarella's specialization in edge AI for computer vision and AI applications.

- Investor Relations: Provides critical financial data and corporate updates for stakeholders.

- Key Engagement Channel: Serves as the main platform for reaching customers, partners, and the broader tech community.

Ambarella's promotional efforts are multi-faceted, focusing on industry events, strategic partnerships, technical content, investor relations, and a robust online presence. These activities aim to build brand awareness, communicate technological advantages, and foster trust with various stakeholders.

The company actively participates in major tech conferences like CES, showcasing its latest AI and computer vision solutions. For instance, at CES 2024, Ambarella highlighted its advancements in edge AI, particularly for automotive applications.

Strategic alliances, such as those with LG Electronics and Leapmotor, amplify Ambarella's market reach and validate its technology. These collaborations are crucial for demonstrating the practical application and market acceptance of their semiconductor solutions.

Financial communication is also a key promotional pillar, with regular earnings calls and investor presentations providing transparency and insight into the company's performance and strategy. In Q1 FY2025, ending May 2024, Ambarella focused on AI processing and automotive market progress.

Price

Ambarella's pricing strategy for its specialized SoCs is firmly rooted in value-based principles, reflecting the significant performance advantages and unique capabilities these chips deliver. The company's focus on low-power, high-definition, and AI-enabled video processing means its solutions are not just components but critical enablers of advanced functionalities.

These advanced SoCs are integral to markets demanding sophisticated intelligent perception, such as the automotive sector, where Ambarella's technology is crucial for ADAS and autonomous driving systems. In 2024, the automotive segment continued to be a significant driver for semiconductor companies like Ambarella, with increasing demand for AI-powered solutions.

The specialized nature and high demand in growth areas like robotics and smart surveillance further justify a premium pricing approach. This strategy allows Ambarella to capture a fair share of the value created by its innovative technology, aligning with the substantial R&D investment required to develop these cutting-edge solutions.

Ambarella strategically positions itself in niche markets within the vision silicon sector, focusing on areas where its specialized AI processing capabilities offer a distinct advantage. This approach allows them to compete effectively against larger semiconductor players by highlighting differentiated performance, especially in terms of AI processing efficiency per watt.

The company's pricing strategy reflects this competitive positioning, taking into account the broader market while underscoring the unique value proposition of their edge AI technology. For instance, Ambarella's CV3-series, launched in 2023, targets automotive and IoT applications where its advanced AI acceleration is a key differentiator, enabling sophisticated computer vision tasks at lower power consumption.

Ambarella's business-to-business model necessitates competitive pricing, and volume-based discounts are a cornerstone of their strategy for Original Equipment Manufacturers (OEMs) and Tier 1 suppliers. This approach directly aligns with the scale of their customers' production cycles.

For instance, as an automotive manufacturer ramps up production of a new vehicle model featuring Ambarella's advanced driver-assistance systems (ADAS) chips, securing significant volume discounts becomes crucial for cost management. Similarly, a major security camera manufacturer integrating Ambarella's AI vision processors into millions of units would expect preferential pricing tiers based on these substantial order quantities.

Impact of R&D Investments on Cost Structure

Ambarella's commitment to research and development is a cornerstone of its strategy, particularly in cutting-edge AI inference processors and advanced radar solutions. For instance, in fiscal year 2024, the company reported R&D expenses of $264.5 million, representing a significant portion of its operational costs.

These substantial R&D investments directly impact Ambarella's cost structure. The need to recoup these development expenditures and secure funding for ongoing innovation naturally influences their pricing strategies for their advanced semiconductor products.

- R&D Spending: Ambarella's R&D expenses were $264.5 million in FY24, highlighting a major investment in technological advancement.

- Cost Structure Impact: High R&D costs are a significant component of their overall cost of goods sold and operating expenses.

- Pricing Strategy Influence: Development costs necessitate pricing that allows for recovery and continued investment in future product cycles.

Strategic Flexibility amidst Market Cycles

Ambarella's pricing strategy must be agile to effectively manage the inherent volatility of semiconductor market cycles and evolving geopolitical landscapes. The company has demonstrated this adaptability, evidenced by its revenue rebound and increasing average selling prices (ASPs) for its edge AI products, a positive sign following earlier industry-wide inventory adjustments.

This strategic flexibility is crucial for maintaining profitability and market share. For instance, Ambarella's fiscal year 2025 (ending January 2025) projections indicate a return to revenue growth, with analysts anticipating a significant year-over-year increase. This recovery is partly attributed to improved demand and successful price management for their AI-enabled solutions.

- Revenue Growth: Ambarella's fiscal year 2025 revenue is projected to see substantial year-over-year growth, indicating a strong recovery.

- ASPs for Edge AI: The company has successfully increased average selling prices for its edge AI products, reflecting strong demand and value proposition.

- Inventory Correction Recovery: The positive performance follows a period of industry-wide inventory corrections, showcasing Ambarella's resilience.

- Geopolitical Adaptability: Pricing strategies will continue to be adjusted to account for ongoing geopolitical influences on supply chains and market access.

Ambarella's pricing is value-driven, reflecting the advanced AI and low-power capabilities of its SoCs, especially in automotive ADAS and robotics. The company leverages its specialized niche in vision silicon, offering differentiated performance against larger competitors. Volume discounts are key for OEM partners, aligning with production scales, while R&D investments of $264.5 million in FY24 necessitate pricing that supports innovation.

| Pricing Factor | Description | Impact on Ambarella's Pricing |

|---|---|---|

| Value-Based Pricing | Reflects superior performance and unique AI capabilities. | Justifies premium pricing for specialized SoCs. |

| Market Niche & Differentiation | Focus on AI processing efficiency per watt in automotive and IoT. | Enables competitive advantage and premium positioning. |

| Volume Discounts | Standard practice for large OEM and Tier 1 suppliers. | Aligns pricing with customer production volumes and cost management. |

| R&D Investment | $264.5 million in FY24 for AI processors and radar. | Drives pricing to recoup development costs and fund future innovation. |

4P's Marketing Mix Analysis Data Sources

Our Ambarella 4P analysis is grounded in official company disclosures, including SEC filings and investor presentations, alongside detailed product specifications and market intelligence reports. We also incorporate data from industry publications and competitive landscape assessments.