Ambarella Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambarella Bundle

Ambarella navigates a landscape shaped by intense rivalry and the constant threat of substitutes, particularly in the fast-evolving AI processing market. Understanding the nuances of buyer power and supplier leverage is crucial for any stakeholder looking to grasp Ambarella's strategic positioning.

The complete report reveals the real forces shaping Ambarella’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ambarella, a fabless semiconductor designer, faces considerable supplier bargaining power due to the high concentration of advanced foundry services. Companies like TSMC dominate the production of cutting-edge chips, including those utilizing 5nm and the developing 2nm process technologies. This limited number of advanced manufacturing partners means Ambarella has few alternatives for producing its sophisticated designs.

The reliance on a small group of foundries for leading-edge manufacturing grants these suppliers significant leverage. TSMC, for instance, commands a substantial portion of the global foundry market share, estimated to be around 55% in 2024, and is the primary provider of advanced nodes. This market dominance allows them to dictate terms, pricing, and allocation of production capacity, directly impacting Ambarella's operational costs and ability to meet market demand.

Switching semiconductor foundries presents Ambarella with significant financial and operational hurdles. These include the costs associated with redesigning chips, the lengthy process of re-qualifying new manufacturing partners, and the inherent risk of production delays that could impact product launch timelines. For instance, the semiconductor manufacturing process itself is highly specialized, and shifting between foundries can require extensive validation.

These high switching costs effectively lock Ambarella into existing foundry relationships, bolstering the bargaining power of these suppliers. This dynamic incentivizes Ambarella to cultivate and maintain stable, long-term partnerships rather than frequently exploring alternative foundry options, as the disruption and expense of such changes would be substantial.

Suppliers of proprietary intellectual property (IP) cores, specialized design tools, and unique raw materials like advanced silicon wafers or sophisticated packaging materials hold significant sway. This is particularly true when their contributions are indispensable to Ambarella's product development and there are few viable substitutes available.

Ambarella's reliance on specific components for its high-definition video processing and AI solutions directly amplifies the bargaining leverage of these niche suppliers. For instance, the demand for cutting-edge AI accelerators and image signal processors (ISPs) means that companies providing these critical elements can command higher prices or more favorable terms, impacting Ambarella's cost structure and production timelines.

Global Supply Chain Dynamics and Geopolitical Factors

Geopolitical tensions and global supply chain vulnerabilities significantly amplify the bargaining power of semiconductor suppliers, particularly those situated in politically stable regions or possessing diversified manufacturing capabilities. For Ambarella, disruptions to critical raw materials or manufacturing capacity can translate directly into increased costs and extended lead times, impacting production schedules and overall financial performance.

The semiconductor industry's reliance on a concentrated number of advanced foundries, such as TSMC, gives these suppliers considerable leverage. In 2024, for instance, continued high demand for advanced chips, coupled with ongoing geopolitical uncertainties, has maintained strong pricing power for leading foundries.

- Geopolitical Stability: Suppliers in regions with stable political environments are better positioned to ensure consistent output, enhancing their bargaining power.

- Supply Chain Concentration: The limited number of advanced semiconductor foundries means they hold significant influence over pricing and allocation.

- Raw Material Access: Control over essential raw materials like silicon wafers or rare earth elements provides suppliers with a distinct advantage.

- Manufacturing Capacity: Companies with substantial and advanced manufacturing capacity can dictate terms due to high demand and limited alternatives.

Investment in Advanced Technologies by Suppliers

Suppliers investing heavily in next-generation technologies, such as advanced packaging, Silicon Carbide (SiC), and Gallium Nitride (GaN) for power semiconductors, are increasingly influencing the market. These advanced materials are critical for high-growth sectors like AI and automotive applications, allowing these suppliers to command premium pricing due to the specialized nature and high demand for their products.

This trend is particularly evident in the booming generative AI and data center markets, where the need for efficient and powerful semiconductors is paramount. For instance, the global market for SiC power devices was estimated to reach over $6 billion in 2023 and is projected to grow substantially, indicating the significant leverage these technologically advanced suppliers possess.

- Increased R&D Spending: Suppliers are channeling significant capital into research and development for cutting-edge semiconductor technologies.

- Higher Component Costs: The adoption of advanced materials like SiC and GaN leads to higher manufacturing costs for suppliers, which are passed on to buyers.

- Technological Differentiation: Suppliers offering proprietary or superior technological solutions gain a distinct advantage, strengthening their bargaining position.

- Criticality for AI and Automotive: The essential role of these advanced components in AI accelerators and electric vehicle power systems elevates supplier power.

Ambarella’s bargaining power with suppliers is significantly constrained by the industry's reliance on a concentrated number of advanced semiconductor foundries. Companies like TSMC, which dominate the production of cutting-edge chips, hold substantial leverage due to their market share and technological capabilities. This concentration means Ambarella has limited alternatives for manufacturing its complex designs.

The high switching costs associated with changing semiconductor foundries further solidify supplier power. These costs include redesigning chips, re-qualifying manufacturing partners, and the risk of production delays. For example, the intricate nature of semiconductor fabrication means that transitioning between foundries requires extensive validation and can lead to significant operational disruptions for Ambarella.

Suppliers of proprietary intellectual property (IP) and specialized design tools also wield considerable influence, especially when their contributions are critical and substitutes are scarce. This is particularly true for components essential to Ambarella's AI and video processing solutions, allowing these suppliers to command premium pricing and favorable terms.

Geopolitical factors and supply chain vulnerabilities also amplify supplier bargaining power. Suppliers in politically stable regions or those with diversified manufacturing capabilities are better positioned to ensure consistent output, giving them an advantage in negotiations with companies like Ambarella.

| Supplier Characteristic | Impact on Ambarella | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Foundry Concentration | Limited alternatives, high reliance | TSMC's estimated 55% global foundry market share in advanced nodes |

| Switching Costs | High financial and operational barriers | Extensive validation and redesign required for foundry changes |

| IP/Specialized Tools | Criticality of unique components | Demand for advanced AI accelerators and ISPs |

| Geopolitical Factors | Amplified supplier leverage | Global supply chain uncertainties favoring stable regions |

What is included in the product

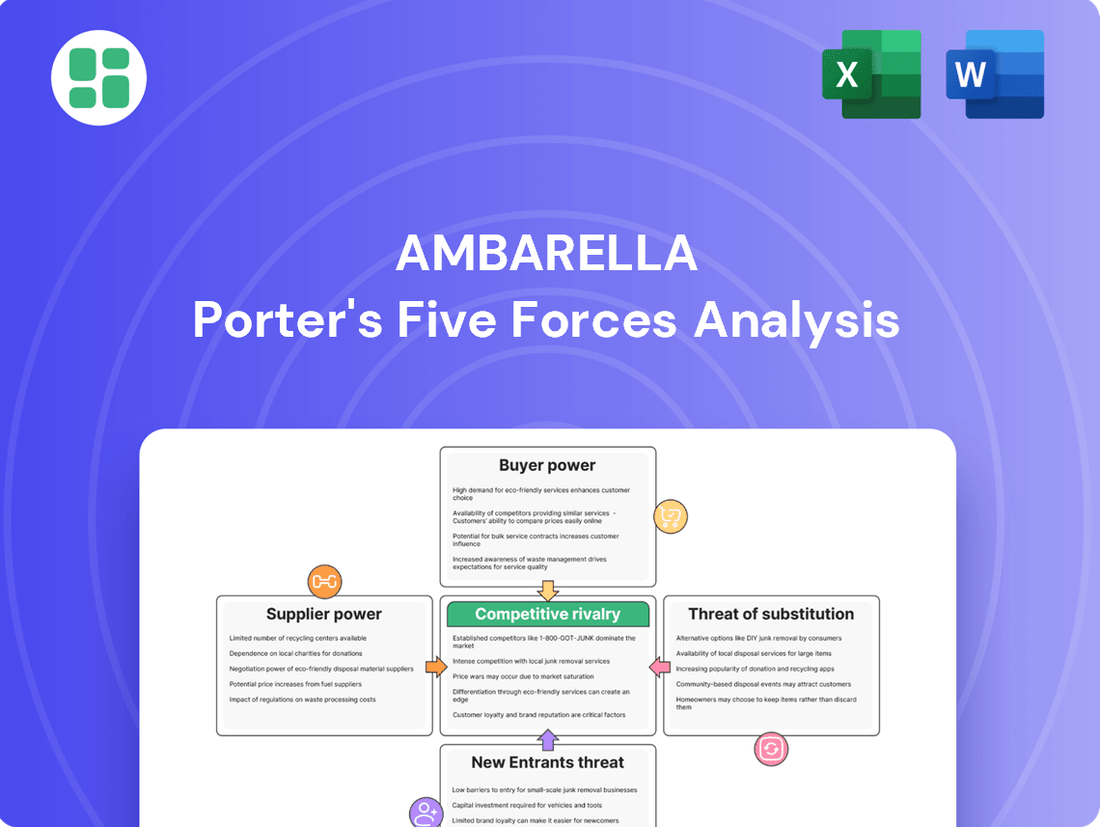

This analysis examines Ambarella's competitive environment by dissecting the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the semiconductor industry.

Effortlessly assess Ambarella's competitive landscape by visualizing the interplay of all five forces, revealing key vulnerabilities and opportunities.

Customers Bargaining Power

Ambarella serves a broad range of industries, including video security, automotive advanced driver-assistance systems (ADAS), and robotics, which diversifies its revenue streams. However, a significant portion of its direct sales are to a smaller group of large original design manufacturers (ODMs) and Tier-1 automotive suppliers.

This concentration means that a few key clients, such as WT Microelectronics and Chicony, hold substantial purchasing power. For instance, in fiscal year 2024, WT Microelectronics accounted for 20.6% of Ambarella's net sales, highlighting the impact these major customers can have on the company's financial performance and bargaining leverage.

In highly competitive sectors such as consumer electronics and the automotive industry, Ambarella's clients are constantly under pressure to lower their production costs. This environment significantly amplifies their bargaining power, as they actively seek more favorable pricing for Ambarella's advanced semiconductor solutions. For instance, in 2024, the average selling price for chips in the consumer electronics market saw a slight decline due to intense competition among device manufacturers.

Ambarella's deeply integrated System-on-Chips (SoCs) and robust software offerings significantly raise the barrier for customers looking to switch. This integration means that adopting a new chip from a competitor necessitates substantial research and development, rigorous testing, and lengthy qualification processes. For instance, in the automotive sector, where Ambarella has a strong presence, the validation cycles for new semiconductor components can extend over several years, making the cost and time investment to switch prohibitive.

Once a customer commits to an Ambarella design, the intricate integration of their chips and software creates considerable stickiness. This deep embedment reduces the customer's ability to easily shift to alternative suppliers, thereby diminishing their bargaining power. This is particularly evident in the surveillance and automotive markets where specialized hardware and software functionalities are critical for performance and compliance.

Customers' Threat of Backward Integration

The threat of backward integration by customers, particularly large automotive OEMs and major tech companies, poses a significant factor in Ambarella's bargaining power of customers. These entities often have the financial muscle and engineering talent to consider developing their own custom silicon solutions for specific video processing or AI acceleration needs, especially if they perceive Ambarella's offerings as too costly or not perfectly aligned with their long-term roadmaps.

While the complexity of Ambarella's advanced chip designs makes complete in-house development challenging for most, the *potential* for this to occur, even for select functionalities, acts as a leverage point during price negotiations. For instance, a major automotive player might explore in-house development for a specific sensor fusion algorithm, thereby reducing their reliance on Ambarella for that particular component and influencing the terms of their overall supply agreement.

- Customer Capability: Large automotive OEMs and tech giants possess substantial R&D budgets and in-house engineering teams capable of chip design.

- Strategic Importance: For critical functionalities, these customers might prioritize in-house control over supply chain and performance, even if it means higher initial investment.

- Market Dynamics: The increasing commoditization of certain chip functionalities could lower the barrier to entry for in-house development by large customers.

- Pricing Influence: The mere possibility of customers bringing chip design in-house can exert downward pressure on Ambarella's pricing and profit margins.

Demand Fluctuations in End-Markets

Customer bargaining power can significantly increase when Ambarella's key end-markets, such as the Internet of Things (IoT) and automotive sectors, experience inventory corrections or economic slowdowns. During these periods, customers tend to reduce their order volumes and actively seek more favorable pricing and contract terms. This dynamic directly impacts Ambarella's revenue streams and profitability.

Conversely, periods of robust demand for Ambarella's advanced AI-centric hardware and successful new product launches can shift the power balance back towards the company. For instance, strong demand in fiscal year 2025 for its CVflow and CV3 SoCs, which are crucial for advanced driver-assistance systems (ADAS) and AI-powered edge devices, would likely enhance Ambarella's pricing power and reduce customer leverage.

- Demand Fluctuations Impact: Periods of reduced demand in sectors like automotive and IoT can empower customers to negotiate better terms with suppliers like Ambarella.

- AI Hardware Strength: Strong market adoption of Ambarella's AI-specific chips, such as the CV3, can bolster its position and pricing power against customers.

- New Product Cycles: Successful new product introductions can create demand surges, temporarily increasing Ambarella's bargaining power.

- Market Conditions: Overall economic health and specific industry trends within Ambarella's target markets directly influence the bargaining power of its customer base.

Ambarella's customers, particularly large Original Design Manufacturers (ODMs) and Tier-1 automotive suppliers, wield significant bargaining power. This is amplified by their substantial order volumes and the competitive pricing pressures within their own industries, such as the automotive sector where average selling prices for chips saw a slight decline in 2024 due to intense market competition.

The concentration of Ambarella's sales among a few key clients, like WT Microelectronics which represented 20.6% of net sales in fiscal year 2024, further solidifies customer leverage. These major buyers can exert considerable influence on pricing and contract terms, especially during economic slowdowns or inventory corrections in end-markets like IoT and automotive.

While Ambarella's integrated SoCs and software create customer stickiness, reducing their ability to switch easily, the threat of backward integration by large customers remains a potent bargaining tool. This potential for in-house development, particularly for specific functionalities, puts downward pressure on Ambarella's pricing and profit margins.

| Customer Segment | Key Factors Influencing Bargaining Power | Impact on Ambarella | Relevant Data Point (FY24) |

| Large ODMs & Tier-1 Suppliers | Concentrated sales, pricing pressure in their markets, potential for backward integration | Downward pressure on pricing, negotiation leverage | WT Microelectronics: 20.6% of net sales |

| Automotive OEMs | Long validation cycles, high R&D capabilities, strategic importance of custom silicon | Reduced switching costs due to integration, leverage through potential in-house development | Automotive sector average selling price for chips saw slight decline |

| End-Market Dynamics (IoT, Automotive) | Inventory corrections, economic slowdowns, demand fluctuations | Increased customer negotiation power during downturns | N/A (Market condition dependent) |

Preview Before You Purchase

Ambarella Porter's Five Forces Analysis

This preview showcases the exact Ambarella Porter's Five Forces Analysis you will receive upon purchase, offering a comprehensive examination of competitive forces within the semiconductor industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This document is fully formatted and ready for immediate use, providing a professional and actionable strategic overview.

Rivalry Among Competitors

Ambarella faces intense competition in the specialized edge AI semiconductor market. Giants like Nvidia, Intel, Qualcomm, and NXP Semiconductors, with their vast resources and broad product portfolios, are significant rivals. This rivalry is amplified by the high demand for advanced, power-efficient video processing and computer vision technologies.

The semiconductor market, especially for AI-powered chips, is a hotbed of innovation. Companies are locked in a fierce race to develop the next generation of processors, pushing the boundaries of what's possible in areas like deep neural networks and advanced driver-assistance systems (ADAS). This constant evolution means Ambarella must pour significant resources into research and development just to keep pace.

For instance, in fiscal year 2024, Ambarella's R&D expenses were $303.2 million, a substantial investment reflecting the intense competitive pressure. Competitors are frequently launching new, more capable, and energy-efficient chips, and securing design wins with major customers requires Ambarella to consistently deliver cutting-edge solutions.

Competitive rivalry in the semiconductor industry, particularly for AI-enabled edge processing, is intense and largely driven by product differentiation. Companies are vying to stand out through advanced AI processing capabilities and sophisticated software stacks tailored for specific applications.

Ambarella's strategy centers on its CVflow® architecture, which is designed for efficient AI inference at the edge. This focus on specialized hardware and software, including its GenAI edge strategy, aims to carve out a niche in demanding markets like autonomous driving and robotics. For instance, in 2024, the automotive semiconductor market, a key area for Ambarella, was projected to see significant growth, underscoring the competitive pressure to offer differentiated solutions.

Market Growth and Strategic Positioning

The semiconductor market, especially segments fueled by AI and automotive advancements, is projected for robust double-digit growth, a trend that can temper intense rivalry by creating abundant space for numerous companies to thrive. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is expected to reach over $200 billion by 2030, indicating substantial expansion.

Ambarella's strategic focus on higher-growth edge AI markets, which now represent a considerable percentage of its revenue, positions the company favorably within this expanding sector. This strategic shift allows Ambarella to capitalize on emerging opportunities and potentially reduce direct competition by targeting less saturated, high-potential niches.

- Growing AI and Automotive Semiconductor Markets: These sectors are experiencing double-digit growth, offering ample room for multiple players and potentially easing competitive pressures.

- Ambarella's Strategic Pivot: The company's focus on edge AI markets, now a significant revenue contributor, strategically positions it to benefit from these high-growth areas.

- Market Expansion as a Rivalry Mitigator: The overall expansion of the semiconductor industry, particularly in AI-driven applications, can absorb the capacity and output of various competitors, thereby reducing direct head-to-head competition.

Global and Regional Competition

The competitive landscape for Ambarella is intensely global, with numerous players actively competing for market share across various geographic regions and specialized application segments. This broad reach means companies must navigate diverse market dynamics and regulatory environments simultaneously.

Within the burgeoning Advanced Driver-Assistance Systems (ADAS) domain control chip market, the competition is particularly fierce. Nvidia currently commands a substantial market share, but this dominance is being challenged by a growing number of manufacturers introducing differentiated technology pathways. This dynamic highlights significant regional and segment-specific rivalry, where innovation and strategic partnerships are crucial for gaining an edge.

- Global Reach: Companies like Qualcomm, MediaTek, and Renesas Electronics are major global competitors, vying for dominance across automotive, consumer electronics, and industrial sectors.

- ADAS Focus: In the ADAS chip market, Nvidia's strong position is being contested by players such as Qualcomm, which has been aggressively expanding its automotive offerings, and by emerging Chinese players like Horizon Robotics, focusing on localized solutions.

- Application Specialization: Competition intensifies in specific niches, such as AI-powered edge processing, where companies differentiate through specialized architectures and software stacks tailored for applications like autonomous driving, smart surveillance, and robotics.

Competitive rivalry within the edge AI semiconductor market is exceptionally high, with established giants and emerging players constantly innovating. Ambarella faces intense pressure from companies like Nvidia, Qualcomm, and Intel, all vying for dominance in AI-powered processing. This fierce competition is fueled by the rapid advancements and significant growth in sectors like automotive and consumer electronics.

The semiconductor industry, particularly the AI chip segment, is characterized by a relentless pursuit of technological superiority. Companies are investing heavily in R&D to develop more efficient and powerful processors. For example, Ambarella's R&D expenditure reached $303.2 million in fiscal year 2024, underscoring the significant investment required to remain competitive.

| Competitor | Key Strengths | Market Focus |

| Nvidia | Dominant GPU technology, broad AI ecosystem | Data center, automotive, gaming |

| Qualcomm | Strong mobile and automotive presence, integrated solutions | Automotive, mobile, IoT |

| Intel | Established CPU market, expanding AI accelerators | Data center, PC, automotive |

| NXP Semiconductors | Leading automotive and industrial supplier | Automotive, industrial, IoT |

SSubstitutes Threaten

The primary threat of substitution for Ambarella stems from alternative architectures designed for AI and video processing. These include general-purpose Graphics Processing Units (GPUs) and Application-Specific Integrated Circuits (ASICs) developed by larger, more diversified semiconductor firms.

While Ambarella excels with its highly optimized System-on-Chips (SoCs), customers may opt for these broader platforms due to their inherent flexibility across a wider range of computational tasks. For instance, NVIDIA's dominance in the GPU market, with its CUDA ecosystem, presents a significant alternative for AI workloads, even if less power-efficient for specific embedded applications.

The rise of sophisticated software-only solutions presents a significant threat of substitution for Ambarella's specialized chips in certain ADAS functionalities. As software algorithms become more advanced and efficient, they can perform tasks previously requiring dedicated hardware, potentially lowering the overall cost for automakers.

For instance, advancements in AI and machine learning algorithms allow for complex image processing and sensor fusion to be handled by more general-purpose processors, reducing reliance on highly specialized ASICs. This trend was evident in 2024, where several automotive suppliers showcased software-centric ADAS platforms that aimed to integrate functionalities like lane keeping and adaptive cruise control with less reliance on bespoke silicon.

Large ecosystem players, such as major cloud providers or automotive manufacturers, possess the resources to develop and integrate their own video processing and AI solutions. This can be seen in the automotive sector where companies like Tesla have invested heavily in their own AI chips and software stacks, reducing the need for external specialized providers. For instance, in 2024, continued advancements in in-house silicon development by leading automotive OEMs signal a growing trend towards vertical integration, potentially limiting Ambarella's market share in this segment.

Evolving Sensor Technologies and Data Fusion

Advances in sensor technology, such as LiDAR and radar, combined with sophisticated data fusion techniques, present a significant threat. These developments could alter the demand for specialized video processing chips by enabling integrated systems that handle multiple sensor inputs, potentially reducing reliance on Ambarella's core video-centric solutions.

While these evolving technologies could offer alternative ways to achieve perception and data analysis, Ambarella is actively addressing this by incorporating radar processing capabilities into its own CVflow platforms. This strategic integration aims to mitigate the threat by offering a more comprehensive, multi-modal processing solution, rather than being solely focused on video.

The threat of substitutes is amplified as these new sensor and fusion technologies mature. For instance, the automotive industry, a key market for Ambarella, is increasingly adopting sensor fusion to enhance ADAS and autonomous driving capabilities. Companies that can offer more holistic sensor processing solutions, even if they don't rely on traditional video streams as heavily, could become attractive alternatives.

- Sensor Fusion Adoption: The increasing adoption of sensor fusion in automotive and robotics markets means alternative solutions that combine LiDAR, radar, and camera data efficiently could emerge.

- Processing Burden Shift: New architectures might shift the processing burden away from dedicated video processors towards more generalized AI accelerators or integrated SoCs.

- Ambarella's Response: Ambarella's integration of radar processing into its CVflow architecture is a direct response, aiming to provide a unified solution that competes with emerging multi-sensor platforms.

Cloud-Based Video Processing

The rise of cloud-based video processing represents a potential substitute threat to Ambarella's edge AI chip business. As more workloads shift to centralized data centers, the demand for powerful on-device processing chips could diminish for specific applications. This trend, driven by scalability and cost efficiencies in the cloud, could impact Ambarella's market share in segments where cloud processing becomes a viable alternative.

For instance, while Ambarella excels at real-time, low-latency processing at the edge, certain video analytics tasks that do not require immediate results can be offloaded to the cloud. This could affect sectors like certain types of surveillance or less time-sensitive content analysis. By July 2025, it is projected that the global cloud computing market will continue its robust growth, with video processing being a significant contributor, potentially reaching hundreds of billions of dollars in value.

- Cloud Processing Adoption: Certain applications may migrate compute-intensive video processing to the cloud, reducing the need for edge AI chips.

- Reduced On-Device Demand: This shift could decrease the demand for Ambarella's high-performance, on-device processing solutions in specific market segments.

- Market Shift: The increasing cost-effectiveness and scalability of cloud infrastructure present a long-term substitute for edge computing in some video processing use cases.

The threat of substitutes for Ambarella is multifaceted, encompassing general-purpose hardware like GPUs and ASICs, advanced software-only solutions, and the growing trend of vertical integration by large tech players. These alternatives offer flexibility and can sometimes provide a more cost-effective or comprehensive solution, especially as AI and processing capabilities become more democratized.

For instance, in 2024, the automotive sector saw continued investment in in-house silicon development by major OEMs, signaling a move towards self-sufficiency in AI and video processing. This vertical integration directly challenges Ambarella's position as a specialized chip provider.

Furthermore, the increasing sophistication of software algorithms allows for complex tasks like image processing and sensor fusion to be handled by more general-purpose processors, potentially reducing the need for Ambarella's dedicated hardware. This trend is particularly relevant in ADAS functionalities where software-centric platforms are gaining traction.

The rise of cloud-based processing also presents a substitute threat, as certain video analytics tasks that don't require immediate, on-device results can be offloaded to the cloud, potentially impacting demand for edge AI chips. By July 2025, the global cloud computing market is projected to continue its strong growth, with video processing being a significant driver.

| Substitute Type | Key Players/Technologies | Impact on Ambarella | 2024/2025 Trend Example |

|---|---|---|---|

| General-Purpose Hardware | NVIDIA (GPUs), Custom ASICs | Offers flexibility, potentially lower cost for diverse workloads. | NVIDIA's CUDA ecosystem dominance for AI workloads. |

| Software-Only Solutions | Advanced AI/ML Algorithms | Reduces reliance on specialized silicon for certain ADAS functions. | Automotive suppliers showcasing software-centric ADAS platforms. |

| Vertical Integration | Tesla, Major Cloud Providers | In-house development reduces demand for external specialized chips. | Automotive OEMs investing heavily in their own AI chips and software. |

| Cloud Processing | Cloud Computing Platforms | Shifts processing from edge to cloud for non-real-time tasks. | Projected robust growth in cloud market, with video processing as a key contributor. |

Entrants Threaten

The semiconductor industry, especially for advanced chip design like Ambarella's, demands massive initial investments in research and development, sophisticated design software, and the acquisition of critical intellectual property. For instance, the average R&D spending for leading semiconductor companies in 2023 often exceeded billions of dollars, a figure that continues to climb with technological advancements.

These substantial upfront costs create a formidable barrier, making it exceptionally challenging for aspiring new entrants to establish a competitive foothold against established giants like Ambarella, which have already amortized these significant expenses over time.

The threat of new entrants into Ambarella's market is significantly dampened by the immense need for deep expertise and specialized intellectual property. Developing cutting-edge low-power, high-definition video processing and computer vision solutions requires a rare combination of highly specialized engineering talent and an extensive portfolio of proprietary patents. This makes it incredibly difficult for newcomers to quickly establish the necessary knowledge base and secure the crucial patent protection that defines Ambarella's competitive edge.

The semiconductor industry, especially for intricate System-on-Chips (SoCs) powering automotive and AI, faces protracted product development timelines. For instance, developing a new advanced automotive SoC can easily take 3-5 years from concept to mass production. This extended time-to-market creates a substantial barrier for newcomers, who must navigate significant upfront investment and a lengthy period before realizing any revenue, making it difficult to gain immediate traction against established players.

Access to Advanced Manufacturing and Supply Chains

New companies looking to enter the semiconductor market, especially those aiming for advanced chip designs, face significant hurdles in accessing state-of-the-art manufacturing facilities. Leading foundries, such as TSMC and Samsung, control the most advanced process nodes, like 5nm and the emerging 2nm, making it difficult for newcomers to secure production capacity. For instance, in 2024, TSMC's capacity for its leading-edge nodes remained highly sought after by established players, leaving little room for new entrants without substantial pre-existing relationships or massive investment.

- Limited Foundry Access: Securing capacity at advanced nodes (e.g., 5nm, 2nm) is a major barrier, as a few foundries dominate this space.

- Supply Chain Complexity: Establishing reliable partnerships across the entire semiconductor supply chain, from raw materials to packaging, is critical and time-consuming.

- High Capital Investment: The cost of developing proprietary manufacturing processes or securing foundry time for advanced nodes runs into billions of dollars, deterring many potential entrants.

- Intellectual Property Protection: Safeguarding sensitive chip designs within complex supply chains presents ongoing challenges for new companies.

Establishing Customer Relationships and Design Wins

The threat of new entrants in Ambarella's market, particularly concerning establishing customer relationships and design wins, is significantly mitigated by the deep-seated trust and proven reliability required by major Original Equipment Manufacturers (OEMs) and Tier-1 suppliers. These established players demand a long track record of consistent performance and robust technical support, making it difficult for newcomers to penetrate the market. For instance, the automotive sector, a key market for Ambarella, often involves multi-year design cycles and stringent qualification processes that favor incumbents with a demonstrated history of success. In 2023, the automotive semiconductor market alone was valued at over $50 billion, highlighting the scale of investment and relationships needed to gain traction.

New entrants would face considerable hurdles in replicating the extensive technical support and long-term partnerships that Ambarella has cultivated. Securing design wins, which are critical for sustained revenue, requires not just advanced technology but also a deep understanding of customer needs and the ability to provide tailored solutions over extended periods. The video security industry, another core segment, also places a premium on reliability and data integrity, making it challenging for unproven entities to displace established vendors. Ambarella's own success in these areas, evidenced by its strong presence in advanced driver-assistance systems (ADAS) and high-performance surveillance cameras, underscores the barriers to entry.

- High Barrier to Entry: Gaining design wins with major OEMs and Tier-1 suppliers necessitates proven reliability and extensive technical support, creating a significant hurdle for new entrants.

- Long-Term Trust: Industries like automotive and video security depend on long-term trust, which is difficult and time-consuming for new companies to establish, favoring established players like Ambarella.

- Entrenched Positions: Existing suppliers benefit from entrenched positions built on years of successful collaboration and product integration, making it challenging for newcomers to displace them.

The threat of new entrants for Ambarella is low due to the immense capital required for R&D and intellectual property, with leading semiconductor firms investing billions annually. These high upfront costs, coupled with lengthy development cycles of 3-5 years for advanced chips, make it exceptionally difficult for newcomers to compete against established players who have already recouped their initial investments.

Access to cutting-edge manufacturing facilities is a significant barrier, as limited foundry capacity at advanced nodes like 5nm and 2nm is highly sought after by incumbents. Furthermore, building trust and securing design wins with major automotive and video security clients demands a proven track record and extensive technical support, which takes years to establish, effectively locking out new competition.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Billions needed for R&D, IP, and advanced design tools. | Extremely high; deters most potential entrants. |

| Product Development Time | 3-5 years for advanced SoCs. | Significant delay in revenue generation, favors incumbents. |

| Foundry Access | Limited capacity at leading-edge nodes. | Difficult to secure production, high costs for new players. |

| Customer Relationships | Long qualification cycles and trust required. | Challenging to displace established suppliers with proven reliability. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ambarella is built upon a foundation of publicly available financial statements, investor presentations, and industry-specific market research reports. We also incorporate insights from technology trade publications and news articles detailing competitive landscapes and emerging trends.