Ambarella Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambarella Bundle

Ambarella's BCG Matrix provides a crucial lens for understanding its product portfolio's market share and growth potential. By categorizing its offerings into Stars, Cash Cows, Dogs, and Question Marks, you can pinpoint strategic priorities. Purchase the full BCG Matrix to unlock detailed quadrant analysis and actionable insights for optimizing Ambarella's market position and future investments.

Stars

Ambarella’s CVflow AI architecture, especially its CV3-AD chip family, is a significant player in the rapidly expanding ADAS and autonomous driving sector. These advanced SoCs, like the CV3-AD635 and CV3-AD655, are engineered for advanced driver assistance and higher levels of vehicle autonomy, with initial shipments slated for 2025.

The market for autonomous driving SoCs is experiencing robust growth, with forecasts indicating a compound annual growth rate of around 30% through 2030. This substantial expansion underscores the high-growth potential for Ambarella’s offerings in this critical automotive segment.

Ambarella’s edge AI inference processors for automotive are a major growth engine, with the automotive sector contributing two-thirds of the company's AI revenue. These advanced processors are crucial for vehicles to interpret visual data instantly, a capability that's becoming indispensable in today's automotive landscape.

The company's success in securing design wins for systems like surround view and driver monitoring highlights its expanding footprint in this rapidly growing market. For instance, in the fiscal year 2024, Ambarella reported significant traction in automotive, indicating a strong demand for their AI solutions in advanced driver-assistance systems (ADAS).

Ambarella's AI-powered computer vision solutions are becoming crucial for the rapidly growing robotics sector. Their advanced chips enable intelligent perception for autonomous mobile robots and various industrial applications, allowing robots to 'see' and understand their environment. This integration positions Ambarella in a high-growth market, especially as AI-enabled edge devices for robotics are projected for significant expansion.

Third-Generation CVflow Architecture

Ambarella's third-generation CVflow architecture is a significant driver of its Star status in the BCG matrix. This advanced architecture is specifically designed to handle transformer AI networks, a critical component for many of today's most innovative artificial intelligence applications.

This technological edge translates into tangible market advantages. By enabling efficient processing of complex AI models, CVflow allows Ambarella to deliver highly differentiated products. This is crucial for capturing market share in emerging, high-performance segments where AI capabilities are paramount.

The adoption of CVflow positions Ambarella as a leader in AI processing, particularly in areas like autonomous driving and advanced robotics. For instance, the increasing demand for sophisticated AI in automotive applications, which saw significant investment and development throughout 2024, directly benefits Ambarella's CVflow-powered solutions.

- CVflow Architecture: Enables efficient processing of transformer AI networks, crucial for modern AI applications.

- Market Differentiation: Provides Ambarella with a competitive edge in high-performance AI segments.

- Growth Driver: Facilitates expansion into rapidly growing markets like autonomous vehicles and robotics.

- Technological Leadership: Reinforces Ambarella's position as an innovator in AI silicon.

Strategic Automotive Partnerships

Ambarella's strategic automotive partnerships are crucial for its growth and market positioning. Collaborations like the one with Continental for comprehensive autonomous driving systems and with Kodiak Robotics for autonomous trucking fleets are significant. These alliances not only validate Ambarella's AI technology but also open doors to substantial market share and design wins. By teaming up with established players, Ambarella accelerates its penetration into the dynamic automotive AI sector, reinforcing its leadership.

These partnerships are a testament to Ambarella's technological prowess in the automotive space. For instance, the collaboration with Continental aims to deliver a complete, integrated autonomous driving solution, showcasing Ambarella's chips as a core component. Similarly, the work with Kodiak Robotics targets the burgeoning long-haul trucking market, a segment ripe for AI-driven automation. Such ventures are vital for securing future revenue streams and demonstrating the practical application of Ambarella's advanced processing capabilities in real-world scenarios.

- Continental Partnership: Focuses on full-stack autonomous driving solutions, integrating Ambarella's AI chips into advanced driver-assistance systems (ADAS) and autonomous driving platforms.

- Kodiak Robotics Collaboration: Targets the long-haul trucking industry, leveraging Ambarella's technology for autonomous driving capabilities in commercial fleets.

- Market Validation: These partnerships serve as crucial validation points for Ambarella's technology, demonstrating its suitability for demanding automotive applications.

- Design Wins: The collaborations are expected to translate into significant design wins, securing Ambarella's position as a key supplier in the automotive AI ecosystem.

Ambarella's CVflow AI architecture is a key driver of its Star status. This advanced technology enables efficient processing of complex AI models, particularly transformer networks, giving Ambarella a competitive edge in high-performance AI segments like autonomous driving and robotics. The company's strong traction in the automotive sector, which accounted for two-thirds of its AI revenue in fiscal year 2024, highlights the market's demand for these sophisticated solutions.

Ambarella's CVflow architecture positions it as a leader in AI processing, especially with its CV3-AD chip family designed for advanced driver-assistance systems (ADAS). The automotive AI market is growing rapidly, with projections showing a 30% CAGR through 2030, a trend that directly benefits Ambarella's innovative offerings.

The company's strategic partnerships, such as those with Continental for autonomous driving systems and Kodiak Robotics for autonomous trucking, further solidify its Star position. These collaborations validate Ambarella's technology and are expected to lead to significant design wins, reinforcing its role as a key supplier in the evolving automotive AI landscape.

Ambarella's commitment to advancing its CVflow architecture, coupled with strategic market penetration through key partnerships, underscores its strong growth potential and leadership in the AI silicon market.

| Category | Ambarella's Position | Key Strengths | Market Outlook |

|---|---|---|---|

| AI Processing Architecture | Star | CVflow architecture, efficient transformer network processing | High growth in automotive AI, robotics |

| Automotive AI Revenue | Star | Two-thirds of AI revenue from automotive sector (FY2024) | 30% CAGR projected through 2030 |

| Strategic Partnerships | Star | Continental (ADAS), Kodiak Robotics (autonomous trucking) | Validation, design wins, market access |

What is included in the product

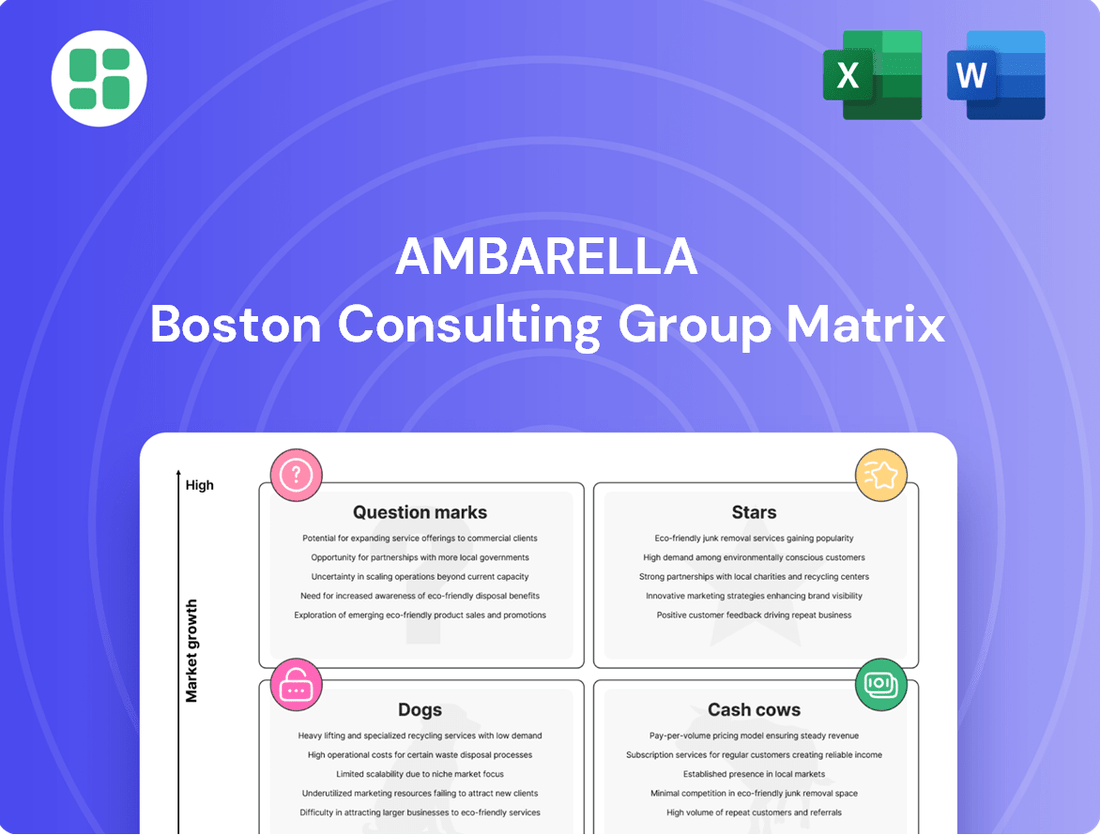

The Ambarella BCG Matrix provides a strategic overview of its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear BCG Matrix visualizes Ambarella's portfolio, quickly identifying underperforming "Dogs" to divest and high-potential "Stars" to invest in, easing strategic resource allocation.

Cash Cows

Ambarella's established professional video security System-on-Chips (SoCs) are solid cash cows, consistently bringing in revenue. The CV2 family, an earlier AI vision chip, was a powerhouse, accounting for a substantial 60% of their fiscal 2024 revenue.

Even as the company pushes into newer, higher-growth AI areas, these mature products continue to hold their ground. They provide a reliable stream of cash flow from the video surveillance market, which, while established, still sees steady growth.

Ambarella's mature IoT camera chip solutions, particularly those integrated into widely adopted, less advanced applications, function as its cash cows. These segments benefit from a solid foundation of established customers and consistent, predictable demand, underpinning the company's financial stability.

These mature product lines are instrumental in generating consistent gross margins for Ambarella. This reliable revenue stream is crucial, providing the necessary capital to fuel investments in more innovative and high-growth sectors of the company's portfolio.

For instance, in fiscal year 2024, Ambarella reported total revenue of $308.1 million, with a significant portion likely attributable to these established, high-volume product categories that offer dependable profitability.

Ambarella's core intellectual property in image processing and video compression is a true cash cow. This foundational technology, honed over many years, consistently delivers value across a broad range of markets, from automotive to consumer electronics. While not the fastest-growing segment, its deep integration into numerous products ensures a steady stream of revenue, likely through licensing agreements or sales of established, high-volume product lines with robust profit margins.

Consistent Gross Margins from Established Products

Ambarella's established products function as cash cows, consistently delivering robust gross margins. For instance, in fiscal year 2024, the company reported non-GAAP gross margins in the range of 60% to 63% across its diverse product offerings. This sustained profitability from mature product lines, even without rapid expansion, highlights their significant contribution to overall cash flow. These dependable earnings provide the financial backbone for continued investment in research and development and support day-to-day operations.

- Strong Gross Margins: Ambarella consistently achieves non-GAAP gross margins between 60% and 63% in fiscal year 2024.

- Profitability of Mature Products: Even without high growth, established product lines are highly profitable on a per-unit basis.

- Cash Generation: These high margins are a key driver of the company's cash generation.

- Funding R&D and Operations: The generated cash supports ongoing research, development, and operational activities.

Power-Efficient Video Solutions for Industrial Use

Ambarella's power-efficient video solutions for industrial applications, focusing on reliability and efficiency, are considered a Cash Cow. These offerings cater to established industrial clients, ensuring a predictable revenue stream.

This segment benefits from consistent demand, even as Ambarella invests in more advanced AI capabilities. For instance, in fiscal year 2024, Ambarella reported total revenue of $300.2 million, with a significant portion likely attributable to these stable, mature product lines.

- Stable Demand: Long-term contracts with industrial clients provide a consistent revenue base.

- Reliability Focus: Solutions prioritize efficiency and dependability over bleeding-edge AI features.

- Revenue Contribution: These products form a significant part of Ambarella's current financial stability.

Ambarella's established video security System-on-Chips (SoCs) and mature IoT camera chip solutions represent significant cash cows. The CV2 family, an earlier AI vision chip, notably accounted for 60% of their fiscal 2024 revenue, demonstrating the strong performance of these mature product lines. These offerings provide a consistent and reliable stream of cash flow, underpinning the company's financial stability and enabling investments in newer, higher-growth AI sectors.

These mature products are crucial for generating consistent gross margins, with Ambarella reporting non-GAAP gross margins between 60% and 63% in fiscal year 2024. This sustained profitability from high-volume, established product categories, even without rapid expansion, highlights their contribution to overall cash flow and supports ongoing research and development activities.

| Product Category | Fiscal Year 2024 Revenue Contribution (Approx.) | Gross Margin (Non-GAAP) | Role in BCG Matrix |

|---|---|---|---|

| Established Video Security SoCs (e.g., CV2 family) | Significant portion (CV2 family was 60%) | 60%-63% | Cash Cow |

| Mature IoT Camera Chip Solutions | Substantial | 60%-63% | Cash Cow |

| Core Image Processing & Video Compression IP | Consistent revenue stream | High | Cash Cow |

Preview = Final Product

Ambarella BCG Matrix

The Ambarella BCG Matrix preview you are viewing is the precise, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, analysis-ready report. You can confidently use this preview to understand the depth and quality of the strategic insights provided. Once purchased, this identical file will be instantly downloadable, ready for your immediate strategic planning and decision-making needs.

Dogs

Legacy consumer electronics video chips, specifically older generation video processing units originally intended for commoditized markets like action cameras or earlier drone models, fall into the Dogs category of the BCG Matrix. Ambarella has been strategically shifting its focus away from these consumer camera segments.

These legacy products are likely experiencing significant price competition, a downward trend in demand, and a diminished market share when compared to larger, more diversified players in the industry. For instance, while Ambarella's overall revenue saw growth, its consumer segment, which includes these legacy chips, has faced headwinds. In fiscal year 2024, Ambarella reported total revenue of $304.5 million, a decrease from $316.4 million in fiscal year 2023, highlighting the challenges in its legacy consumer markets.

Products focused purely on basic video compression, without any AI features, would likely fall into the Dogs category of the BCG Matrix. These solutions face a market that is rapidly moving towards intelligent vision, leaving them with little room to stand out.

This segment is experiencing slow growth, meaning these offerings are unlikely to contribute significantly to Ambarella's long-term strategy. In 2023, the global video compression market was valued at approximately $1.5 billion, but the non-AI segment within this is seeing much slower expansion compared to AI-powered solutions.

Consequently, these non-AI specific video compression products are candidates for divestiture or at least minimal future investment. Their limited differentiation and low growth potential make them a drain on resources that could be better allocated to more promising areas.

Older chip generations that struggle to integrate with Ambarella's AI CVflow architecture represent a potential 'Dog' in the BCG matrix. These products have limited avenues for upgrades to meet the burgeoning demand for intelligent processing capabilities.

With a market share likely in decline and minimal future growth prospects, these older chips tie up valuable resources. For instance, if a legacy chip generation accounted for only 2% of Ambarella's 2024 revenue, it would fall into this category, offering diminishing returns.

Products in Highly Commoditized, Low-Margin Segments

Ambarella's products in highly commoditized, low-margin segments of the semiconductor market are categorized as Dogs. These are areas where the company faces intense competition and struggles to establish significant differentiation or market leadership. For instance, Ambarella's overall market share in the broad semiconductor industry stood at a mere 0.08% in Q1 2025.

These segments are characterized by slow growth and aggressive price competition, which can tie up capital without generating substantial returns. Such products often represent a drain on resources, hindering investment in more promising areas of the business.

- Low Market Share: Ambarella's 0.08% share in the overall semiconductor market as of Q1 2025 highlights its weak position in commoditized areas.

- Intense Price Pressure: These segments are defined by fierce competition, leading to reduced profit margins.

- Limited Differentiation: Ambarella lacks unique selling propositions in these commoditized product lines.

- Cash Trap Potential: The combination of low growth and price wars can make these products a financial burden rather than a growth engine.

Solutions Affected by Cyclical Inventory Corrections

While not a distinct product line, older Ambarella System-on-Chips (SoCs) that experienced inventory corrections by customers in fiscal year 2024 and the first half of fiscal 2025 can be viewed as 'Dog' segments within the BCG framework. This situation arises when these legacy products faced stagnant demand due to channel oversupply.

These periods of overstocking and reduced demand for older SoCs would have likely generated minimal or even negative returns for Ambarella. For instance, during fiscal year 2024, Ambarella noted that certain customer inventory levels for older product families were being adjusted, impacting short-term revenue recognition.

- Cyclical Inventory Impact: Older Ambarella SoCs faced demand slowdowns in FY2024 and H1 FY2025 due to customer inventory rebalancing.

- Stagnant Demand: Oversupply in the distribution channel led to periods of stagnant demand for these legacy products.

- Minimal/Negative Returns: These 'Dog-like' revenue streams contributed little to profitability, potentially resulting in losses during the correction phases.

Ambarella's legacy consumer video chips, especially older, non-AI processing units, are firmly in the Dogs category. These products face intense price competition and declining demand as the market shifts towards intelligent vision. For example, Ambarella's overall revenue dipped to $304.5 million in fiscal year 2024, reflecting challenges in these mature consumer segments.

Products focused solely on basic video compression, lacking AI capabilities, also represent Dogs. The global video compression market, valued around $1.5 billion in 2023, is increasingly dominated by AI-enhanced solutions, leaving these older technologies with limited growth prospects.

Older chip generations that cannot integrate with Ambarella's AI CVflow architecture are prime candidates for the Dogs quadrant. These chips have minimal upgrade potential and are likely experiencing declining market share, tying up resources with little prospect of significant returns.

Ambarella's presence in highly commoditized, low-margin semiconductor areas also places them in the Dogs category. These segments are characterized by aggressive price wars and a lack of differentiation, with Ambarella holding a small overall market share, estimated at 0.08% in Q1 2025.

| Category | Key Characteristics | Ambarella Examples | Market Context | Financial Implication |

| Dogs | Low market share, slow growth, high competition, low profitability | Legacy consumer video chips, non-AI compression SoCs, older chip generations | Commoditized markets, declining demand for older tech | Resource drain, potential divestiture candidates |

Question Marks

Ambarella's N1 series System-on-Chips (SoCs), showcased at CES 2025, are specifically engineered to bring generative AI and large language models to the edge. This positions Ambarella to tap into a rapidly expanding market characterized by significant future growth potential.

While this edge AI segment is burgeoning, Ambarella's current market share within this specialized, advanced technology area is still developing. Substantial investment will be crucial for Ambarella to establish a strong foothold and effectively compete against established, larger semiconductor companies.

Ambarella's ambition extends to higher levels of autonomous driving (L3-L4+), a segment poised for significant growth. However, while their CV3-AD family is geared towards L2+, their actual market penetration in these more advanced autonomous systems is still developing.

This space is intensely competitive, with giants like Mobileye and Nvidia already commanding substantial market presence. Ambarella's substantial investments in this area are a positive indicator, but the ultimate success in terms of market share and sustained profitability remains an open question for 2024 and beyond.

Ambarella is strategically targeting high-growth sectors like smart cities and autonomous mobile robots (AMRs) with its advanced AI solutions, including the N1-655 SoC. These markets represent significant future revenue potential, but Ambarella's market share is still nascent, requiring substantial research and development investment to customize offerings and secure customer adoption.

Cooper Developer Platform

The Cooper Developer Platform, launched in January 2024, represents Ambarella's strategic move to bolster its AI capabilities. This platform aims to simplify and accelerate the development process for customers utilizing Ambarella's System-on-Chip (SoC) offerings. While it's a vital component for future market penetration and building a robust developer ecosystem, its direct impact on revenue and market share is still nascent, necessitating ongoing investment.

As a potential question mark in Ambarella's BCG Matrix, the Cooper Developer Platform requires significant nurturing. Its success hinges on attracting a critical mass of developers and translating that engagement into tangible product adoption. By January 2025, Ambarella reported that over 500 developers had registered on the platform, indicating early traction but highlighting the need for continued support to convert this interest into sustained revenue streams.

- Platform Launch: January 2024

- Developer Adoption: Over 500 registered by January 2025

- Strategic Goal: Streamline AI development and foster ecosystem growth

- BCG Matrix Classification: Potential question mark due to early stage of revenue generation

New Verticals Requiring Specialized AI Vision

Ambarella is venturing into new, specialized industrial AI vision sectors like specific medical equipment and unique industrial automation. These areas offer significant growth opportunities but demand considerable investment in custom-built solutions and educating the market to gain meaningful traction. The success in these emerging fields is not assured, presenting a high-risk, high-reward scenario for the company.

These new verticals are critical for Ambarella's future growth but are currently in their early stages. For instance, the global medical imaging market, which includes AI-powered vision, was projected to reach over $30 billion by 2024, indicating the potential scale. However, penetrating these markets requires deep understanding of regulatory landscapes and specific application needs, which can be resource-intensive.

- High Growth Potential: Specialized industrial AI vision markets offer substantial upside, driven by increasing automation and precision needs across various industries.

- Significant Investment Required: Developing tailored AI solutions for niche applications, like advanced medical diagnostics or complex robotic guidance, necessitates R&D and market development expenditures.

- Market Education is Key: Introducing novel AI vision capabilities in specialized fields often requires educating potential customers on the benefits and applications, a process that can be time-consuming and costly.

- Uncertain Success: The inherent novelty and specific demands of these new verticals mean that market adoption and competitive positioning are not guaranteed, leading to higher risk profiles.

Ambarella's N1 series SoCs, targeting edge AI, and their CV3-AD family for advanced autonomous driving represent significant growth opportunities. However, these areas are characterized by developing market share and intense competition from established players. The Cooper Developer Platform aims to accelerate AI development, but its impact on revenue is still nascent, with early developer adoption showing promise but requiring continued investment to translate into market penetration.

The company's expansion into specialized industrial AI vision sectors, such as medical equipment and industrial automation, presents high-reward potential but also high risk due to the need for substantial investment in custom solutions and market education. These emerging fields are critical for future growth, but their success in gaining market share and achieving profitability remains uncertain for 2024 and beyond.

| Area of Focus | Market Potential | Current Market Share | Investment Needs | Risk Level |

|---|---|---|---|---|

| Edge AI (N1 Series) | High (Generative AI, LLMs at edge) | Developing | Significant R&D and market penetration | Medium |

| Advanced Autonomous Driving (CV3-AD) | Very High (L3-L4+ autonomy) | Nascent | Substantial investment, competitive pressure | High |

| Cooper Developer Platform | High (Ecosystem growth, developer adoption) | Nascent (Early adoption indicators) | Ongoing support and platform enhancement | Medium |

| Specialized Industrial AI Vision | High (Medical, Industrial Automation) | Nascent | Custom solutions, market education, regulatory navigation | High |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust data foundation, incorporating Ambarella's financial disclosures, market share reports, and industry growth forecasts to accurately position each product line.