Ambarella PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambarella Bundle

Ambarella operates in a dynamic tech landscape, heavily influenced by evolving political regulations, economic shifts, and rapid technological advancements. Understanding these external forces is crucial for anticipating market opportunities and potential challenges. Our comprehensive PESTLE analysis dives deep into these factors, providing you with the strategic intelligence needed to stay ahead.

Gain a competitive edge by leveraging our expertly crafted PESTLE analysis for Ambarella. Discover how political stability, economic growth, social trends, technological innovation, environmental concerns, and legal frameworks are shaping the company's trajectory. Download the full version now to unlock actionable insights and refine your market strategy.

Political factors

Geopolitical tensions, especially between the United States and China, continue to reshape the semiconductor landscape, directly affecting companies like Ambarella. These tensions can lead to trade tariffs and export controls on critical technologies, potentially increasing manufacturing costs and restricting market access for Ambarella's advanced AI processing chips.

In 2024, the ongoing scrutiny of supply chains, exemplified by initiatives like the US National Defense Authorization Act (NDAA) for 2025, emphasizes a push for reduced reliance on specific regions. This policy shift aims to bolster domestic semiconductor production, presenting both hurdles and strategic openings for Ambarella to align its operations with national security priorities and potentially benefit from reshoring incentives.

Governments globally are channeling significant funds into domestic semiconductor production and research. For instance, the US CHIPS and Science Act, enacted in 2022, allocated over $52 billion to boost domestic chip manufacturing and innovation. While Ambarella operates on a fabless model, these incentives can indirectly benefit the company by strengthening its manufacturing partners and fostering more resilient, localized supply chains. This could lead to a more stable, albeit potentially more expensive, operational environment.

Government regulations significantly shape the landscape for Ambarella's advanced driver-assistance systems (ADAS) and autonomous driving chips. Evolving safety standards, data privacy laws, and ethical AI guidelines directly impact product development and market entry. Compliance is paramount, necessitating substantial R&D investment to meet diverse international and regional requirements, a challenge as seen with the EU AI Act's strict rules on high-risk AI systems.

Tech Sovereignty Initiatives

The global drive for tech sovereignty is reshaping the semiconductor landscape, with nations prioritizing domestic or allied production of critical technologies. This trend directly impacts companies like Ambarella, which relies on complex global supply chains.

Countries are increasingly seeking to control semiconductor manufacturing, a move that could fragment markets and require Ambarella to navigate diverse national policies. For instance, the CHIPS and Science Act in the US, enacted in 2022 with significant funding, aims to bolster domestic chip production and R&D, influencing where companies like Ambarella might invest or source materials.

- Geopolitical Fragmentation: Tech sovereignty initiatives can lead to distinct regional technology ecosystems, potentially creating barriers for global semiconductor players.

- Supply Chain Adaptation: Ambarella may need to diversify its manufacturing and sourcing strategies to comply with varying national regulations and incentives, potentially increasing operational complexity and costs.

- Strategic Importance of Silicon: The focus on securing silicon independence underscores the critical nature of Ambarella's core AI processing technology, making it a focal point for national technology strategies.

- Increased R&D Investment: Governments promoting tech sovereignty are likely to increase R&D funding in areas like AI and advanced chip design, which could create new opportunities for collaboration or competition for Ambarella.

Intellectual Property Protection

The political environment significantly influences intellectual property (IP) protection, a critical factor for semiconductor innovators like Ambarella. Strong domestic laws and international treaties are vital for safeguarding Ambarella's patents on advanced video processing and AI technologies. For instance, the U.S. Chamber of Commerce's Global Innovation Policy Center's 2023 report highlighted ongoing challenges in IP enforcement across various global markets, directly impacting companies reliant on technological differentiation.

Weak IP enforcement in key manufacturing or market regions presents a substantial risk. This can lead to the unauthorized replication of Ambarella's proprietary designs and algorithms, eroding its competitive edge. As of early 2024, ongoing trade discussions between major economic blocs continue to shape the landscape of IP rights, with potential implications for companies operating globally.

- Global IP Enforcement Trends: Reports from organizations like the U.S. Chamber of Commerce consistently track the effectiveness of IP protection in different countries, providing crucial data for risk assessment.

- Trade Agreements and IP: International trade agreements often include provisions for IP protection, and their negotiation and revision directly impact companies like Ambarella.

- Government Support for Innovation: Political decisions regarding R&D funding and tax incentives for innovation can indirectly bolster a company's IP portfolio by fostering further technological development.

Geopolitical tensions, particularly between the US and China, continue to impact semiconductor supply chains, potentially affecting Ambarella through tariffs and export controls. Government initiatives like the US CHIPS and Science Act, with its over $52 billion allocation, aim to bolster domestic chip production, indirectly benefiting Ambarella by strengthening its manufacturing partners and fostering more resilient supply chains.

Evolving government regulations on AI and data privacy, such as the EU AI Act, directly influence Ambarella's ADAS and autonomous driving chip development, requiring significant R&D investment for compliance. Furthermore, the global push for tech sovereignty necessitates Ambarella's adaptation to diverse national policies and potential diversification of its manufacturing and sourcing strategies to navigate these fragmented markets.

Intellectual property protection remains a critical political factor, with companies like Ambarella reliant on strong domestic laws and international treaties. Reports from the U.S. Chamber of Commerce's Global Innovation Policy Center highlight ongoing challenges in IP enforcement, directly impacting Ambarella's competitive edge against potential design replication.

What is included in the product

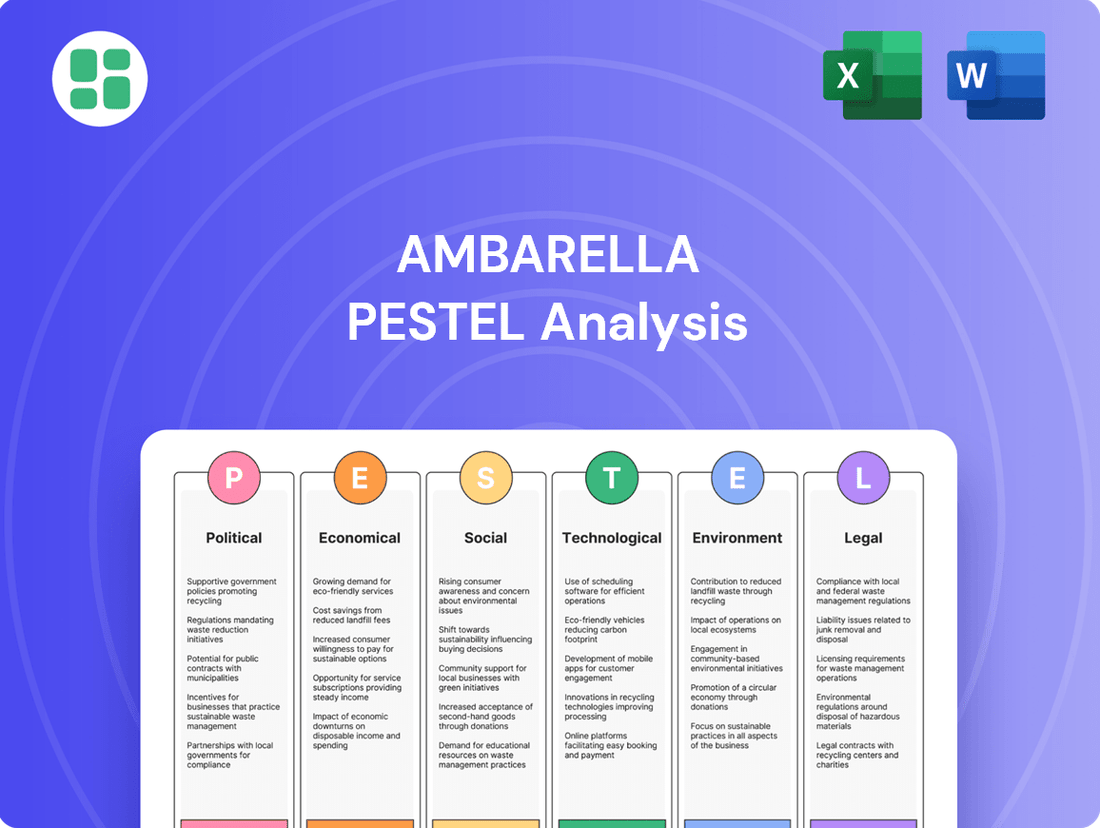

This Ambarella PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic direction.

It provides a comprehensive understanding of the external landscape, enabling stakeholders to identify potential challenges and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions on external factors impacting Ambarella's strategy.

Economic factors

The global semiconductor market is on a strong upward trajectory, with forecasts indicating it will reach an impressive $697 billion by 2025. This surge is primarily fueled by the escalating demand for artificial intelligence (AI) and advanced computing capabilities.

This robust market expansion creates a favorable economic environment for companies like Ambarella, whose specialized edge AI semiconductors are crucial components for rapidly expanding industries such as automotive, robotics, and advanced security systems.

Ambarella's own financial performance reflects this positive trend, with the company reporting fiscal year 2025 revenue of $284.9 million. This represents a significant 25.8% increase compared to the prior fiscal year, demonstrating Ambarella's successful integration into this growing semiconductor landscape.

Ambarella's strategic focus on AI inference processors for advanced driver-assistance systems (ADAS), autonomous vehicles, and robotics places it at the forefront of a rapidly expanding semiconductor market. This specialization is a significant advantage.

The company anticipates AI inference revenue to surge by over 30% in fiscal year 2025, underscoring robust demand for its high-performance, specialized chip solutions in these critical automotive and industrial sectors. This growth projection highlights the market's appetite for Ambarella's technology.

Furthermore, the widespread integration of generative AI chips into personal computers, smartphones, and enterprise edge devices presents new avenues for Ambarella. Its edge AI processing capabilities are well-suited to capitalize on this broader trend, expanding its market reach beyond automotive applications.

Despite some easing in the semiconductor market, factors like high factory infrastructure expenses and geopolitical tensions continue to threaten supply chain stability. These ongoing risks could lead to renewed component shortages, especially for older, but still crucial, manufacturing processes, potentially affecting Ambarella’s partners by late 2025 or 2026.

The cost of essential components for Ambarella's products may rise if these shortages materialize, necessitating a proactive approach to supply chain management. Maintaining flexibility and building resilience are key strategies for Ambarella to navigate these potential disruptions and ensure consistent production.

Inflation and Interest Rate Environment

Global inflationary pressures and rising interest rates directly impact Ambarella's operational costs. For instance, the US Federal Reserve's aggressive rate hikes throughout 2022 and 2023, with the federal funds rate reaching a range of 5.25%-5.50% by July 2023, increased borrowing costs for capital investments and R&D funding. This environment can squeeze profit margins if not managed effectively.

Higher inflation also influences consumer and corporate spending, which indirectly affects demand for Ambarella's semiconductor solutions. For example, a slowdown in new vehicle sales due to economic uncertainty or reduced consumer discretionary spending can dampen demand for advanced driver-assistance systems (ADAS) chips. Similarly, businesses might delay upgrades to security camera systems, impacting Ambarella's revenue streams.

Managing these macroeconomic factors is crucial for maintaining profitability and strategic growth. Ambarella’s ability to forecast and adapt to fluctuating interest rate environments and inflation levels will be key to its financial performance in 2024 and 2025.

- Inflationary Impact: Persistent inflation can increase the cost of raw materials and labor, directly affecting Ambarella's cost of goods sold.

- Interest Rate Sensitivity: Higher interest rates increase the cost of capital, making it more expensive for Ambarella to finance its research and development initiatives and potential acquisitions.

- Demand Channel Effects: Consumer and business spending slowdowns, often triggered by inflation and high rates, can reduce demand for end-products utilizing Ambarella's chips, such as automotive and smart home devices.

- Profitability Management: Successfully navigating these economic conditions requires careful cost management and strategic pricing to maintain healthy profit margins.

Competitive Landscape and Pricing Pressure

The semiconductor sector is fiercely competitive, with giants like NVIDIA, Intel, and Qualcomm actively pursuing market share in the crucial AI and automotive vision processing segments. This intense rivalry often translates into significant pricing pressures across the industry.

For Ambarella, this competitive environment directly impacts its profitability. The company reported a 60.0% GAAP gross margin in Q4 FY25, a figure that could be further challenged by aggressive pricing strategies from competitors. Maintaining a competitive edge requires a delicate balance between rapid innovation and stringent cost management.

- Intense Competition: Major players like NVIDIA, Intel, and Qualcomm are key rivals in AI and automotive vision processing.

- Pricing Pressure Impact: High competition can drive down prices, affecting gross margins.

- Ambarella's Q4 FY25 Margin: The company achieved a 60.0% GAAP gross margin in the latest reported quarter.

- Innovation vs. Cost: Continuous technological advancement must be balanced with cost control to remain competitive.

The semiconductor industry's growth, projected to hit $697 billion by 2025, provides a strong economic tailwind for Ambarella. This expansion is largely driven by the increasing adoption of AI, directly benefiting Ambarella's specialized edge AI processors used in automotive and robotics sectors.

Ambarella's revenue growth of 25.8% year-over-year to $284.9 million in fiscal year 2025 highlights its successful navigation of this favorable economic climate. The company's focus on AI inference for ADAS and autonomous vehicles is particularly well-positioned, with AI inference revenue expected to surge over 30% in FY25.

However, global inflationary pressures and rising interest rates present challenges. The US Federal Reserve's rate hikes, reaching 5.25%-5.50% by July 2023, increase capital costs and can impact consumer and corporate spending, potentially softening demand for automotive and security systems that utilize Ambarella's chips.

The semiconductor market also faces supply chain risks, with high factory infrastructure costs and geopolitical tensions posing threats of component shortages, potentially impacting production and increasing costs for Ambarella and its partners through late 2025 and into 2026.

Preview the Actual Deliverable

Ambarella PESTLE Analysis

The Ambarella PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ambarella. It provides a thorough understanding of the external forces shaping the company's strategic landscape.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering actionable insights for your business strategy.

Sociological factors

Public acceptance of autonomous technologies, including those powered by Ambarella's AI chips, is a significant hurdle. Surveys in late 2024 indicated that while interest in self-driving cars is growing, a substantial portion of the public still harbors safety concerns, with around 55% expressing some level of apprehension about riding in an autonomous vehicle.

This societal trust directly impacts the pace of regulatory approval and consumer adoption. For instance, a major autonomous vehicle pilot program in Phoenix, Arizona, faced public scrutiny following an incident in 2023, highlighting the need for robust safety demonstrations and transparent communication from companies like Ambarella to build confidence.

Ambarella's investments in advanced AI processing and its collaborations with leading automotive manufacturers are crucial for addressing these concerns. By showcasing reliable performance and transparently addressing ethical considerations, Ambarella aims to foster greater public acceptance, which is projected to be a key driver in the autonomous systems market, expected to reach over $200 billion by 2030.

Ambarella's core business, centered on video processing and computer vision, inherently involves handling extensive visual data. This raises significant data privacy concerns, especially as public awareness and societal expectations regarding data protection continue to grow. For instance, a 2024 Pew Research Center study indicated that 72% of Americans are very concerned about how companies use their personal data, a sentiment likely extending to visual data collected by AI systems.

This heightened awareness demands that Ambarella and its clients embed privacy-by-design principles deeply into their product development. Companies are increasingly scrutinized for their data handling practices, and a failure to address privacy proactively could lead to reputational damage and loss of market trust. The ethical implications of widespread surveillance and AI vision technology are a constant societal discussion, directly impacting market acceptance and potentially shaping future regulatory landscapes by 2025.

The global semiconductor industry, including companies like Ambarella, is grappling with a significant shortage of specialized talent, especially in cutting-edge fields such as artificial intelligence and computer vision. This talent scarcity directly impacts Ambarella's ability to innovate and scale its advanced chip designs.

For Ambarella, securing and keeping top-tier engineers and researchers is paramount for its success in developing high-performance AI processing solutions. The competitive landscape for these skilled professionals means companies must invest heavily in recruitment and retention strategies, potentially driving up operational costs.

The tight labor market for semiconductor engineers is a well-documented issue. For instance, reports from late 2023 and early 2024 highlighted a persistent gap between the demand for experienced semiconductor professionals and the available supply, with some estimates suggesting millions of unfilled roles globally in the tech sector.

Changing Consumer Preferences

Consumers are increasingly seeking smarter, more integrated experiences, driving demand for Ambarella's advanced semiconductor solutions. This is particularly evident in the smart home security market, where features like advanced object recognition and person detection are becoming standard expectations. For instance, the global smart home market was projected to reach over $100 billion in 2024, with security systems being a significant contributor.

The automotive sector also reflects this shift, with growing consumer interest in advanced driver assistance systems (ADAS) and autonomous driving capabilities. Ambarella's AI vision chips are crucial for enabling these features, from sophisticated parking assist to enhanced pedestrian detection. Industry analysts anticipate the ADAS market to continue its robust growth, potentially exceeding $60 billion by 2025, underscoring the demand for the underlying technology.

Furthermore, the burgeoning robotics industry, encompassing everything from industrial automation to consumer-facing service robots, relies heavily on intelligent perception and processing. Consumers are showing a greater appetite for robots that can navigate complex environments and interact intelligently. This trend highlights the importance of edge AI capabilities, where Ambarella excels, allowing devices to process data locally for faster, more efficient operation.

- Smart Home Security: Growing consumer demand for AI-powered features like facial recognition and anomaly detection in home security systems.

- Automotive ADAS: Increased consumer preference for advanced safety features, pushing automakers to integrate more sophisticated AI vision in vehicles.

- Robotics and Edge AI: A rising consumer interest in intelligent robots for various applications, requiring powerful on-device AI processing.

Ethical Considerations in AI Development

Societal scrutiny of AI's ethical implications, particularly concerning algorithmic bias and the potential misuse of surveillance technologies, is intensifying. Ambarella, as a provider of AI processing solutions, must proactively address these concerns by championing responsible AI development and ensuring its technologies support societal values and human rights.

This commitment involves implementing rigorous fairness audits and fostering transparency in its AI systems. For instance, reports in late 2024 highlighted increased public demand for accountability in AI, with surveys indicating over 60% of consumers expecting companies to disclose how their AI systems are trained and how bias is mitigated.

Navigating these ethical waters is crucial for Ambarella's long-term viability and market acceptance. The company's approach to responsible AI can directly impact its brand reputation and its ability to secure partnerships in sensitive sectors like public safety and automotive, where trust is paramount.

- Increased Public Scrutiny: Societal awareness of AI ethics, including bias and surveillance, is growing, demanding greater corporate responsibility.

- Responsible AI Development: Ambarella must prioritize ethical considerations, ensuring its AI solutions align with human rights and societal values.

- Transparency and Audits: Implementing fairness audits and maintaining transparency in AI development are key to building trust and mitigating risks.

- Market Acceptance: Proactive ethical engagement is vital for Ambarella's brand reputation and securing adoption in critical, trust-sensitive markets.

Public trust in autonomous systems remains a critical factor, with ongoing concerns about safety and reliability. As of late 2024, consumer surveys indicated that over 50% of potential users still express reservations about the safety of self-driving vehicles, directly influencing adoption rates.

This societal apprehension necessitates robust validation and transparent communication from technology providers like Ambarella. The development and deployment of AI-powered solutions must prioritize demonstrable safety and address ethical considerations to build widespread confidence.

The growing awareness of data privacy, particularly concerning visual data collected by AI systems, presents another significant sociological challenge. A 2024 study revealed that a substantial majority of consumers are highly concerned about how their personal data is utilized, a sentiment that extends to the information gathered by advanced vision technologies.

Technological factors

Ambarella's core strength lies in edge AI and computer vision, a sector experiencing explosive growth fueled by constant breakthroughs in AI algorithms and neural network processing. This technological dynamism is the bedrock of their business, demanding perpetual innovation to stay ahead.

The company's proprietary CVflow architecture and advanced 5nm AI inference processors, including the CV5, CV75, and CV3-AD family, are key differentiators. These technologies are engineered for exceptional performance and energy efficiency in intelligent perception tasks, positioning Ambarella at the forefront of on-device AI.

For instance, the CV3-AD6x family of automotive SoCs, released in late 2023, offers up to 60 TOPS of AI performance, a significant leap that underscores the pace of advancement. This commitment to continuous R&D in AI and computer vision is vital for securing Ambarella's competitive advantage in the evolving landscape.

The relentless push for AI in compact, power-limited gadgets like car systems, surveillance cameras, and robots necessitates highly integrated, low-power Systems-on-Chip. Ambarella’s expertise in processing high-definition video with minimal energy use is a significant advantage in these sectors, enabling their expansion into new edge AI opportunities.

Ambarella operates in a highly competitive AI chip market, facing formidable rivals like NVIDIA, Intel, and AMD, alongside specialized AI startups. Its strategy hinges on differentiating through energy efficiency, as evidenced by its focus on performance-per-watt. The market's immense growth potential, with projections to reach $931.26 billion by 2034, underscores the intense battle for market share.

Integration with Advanced Driver Assistance Systems (ADAS) and Autonomous Vehicles (AV)

Ambarella's strategic partnerships with automotive giants like SANY Group, Continental, and LG Electronics highlight its focus on integrating its AI domain controllers into advanced driver assistance systems (ADAS) and autonomous vehicles (AV). These collaborations are crucial for accelerating the development and deployment of intelligent driving systems, with production targets set for calendar year 2025.

The company's efforts are geared towards enabling seamless hardware and software integration, a critical requirement for the sophisticated processing demands of ADAS and AV. For instance, Ambarella's CV3-AD system-on-chip (SoC) is designed to handle the complex sensor fusion and AI inference needed for these applications.

- Strategic Alliances: Partnerships with SANY Group, Continental, and LG Electronics are key to market penetration in the automotive sector.

- Production Timelines: Aiming for production starts by calendar year 2025 demonstrates Ambarella's readiness for the next wave of automotive technology.

- Technological Integration: The company's CV3-AD SoCs are engineered for the high-performance computing required by advanced ADAS and AV features.

- Market Potential: The global ADAS market is projected to reach approximately $60 billion by 2025, showcasing the significant opportunity for Ambarella.

Evolution of 5G and IoT Infrastructure

The ongoing rollout of 5G networks, projected to connect over 3.5 billion devices globally by 2025, creates a powerful foundation for the Internet of Things (IoT). This expansion directly benefits Ambarella by providing the necessary connectivity for its edge AI processors.

The increasing demand for smart, connected devices across various sectors, such as consumer electronics and industrial automation, is a key growth catalyst. For instance, the global IoT market was valued at over $1.1 trillion in 2023 and is expected to grow significantly.

Ambarella's AI chips are designed to process data at the edge, meaning directly on the device rather than sending it to the cloud. This local processing is crucial for IoT applications where low latency is essential, such as autonomous vehicles or real-time video analytics in smart cities.

- 5G Connectivity: Facilitates higher data speeds and lower latency for IoT devices, supporting complex AI processing at the edge.

- IoT Growth: The expanding IoT ecosystem, with billions of connected devices, creates a vast market for intelligent perception solutions.

- Edge AI Demand: Increasing need for devices to analyze data locally, reducing reliance on cloud infrastructure and improving response times.

- Application Diversity: From smart surveillance cameras to advanced robotics, the utility of edge AI in IoT continues to broaden.

Ambarella's technological edge is defined by its deep expertise in edge AI and computer vision, a field experiencing rapid advancement. The company's proprietary CVflow architecture and cutting-edge AI inference processors, like the CV3-AD family, are central to its competitive positioning, offering high performance with exceptional power efficiency for intelligent perception. This focus on low-power, high-performance edge AI is critical for enabling sophisticated capabilities in devices such as autonomous vehicles and smart surveillance systems.

The company's commitment to innovation is further demonstrated by its continuous development of advanced SoCs, such as the CV3-AD6x family, which achieved up to 60 TOPS of AI performance upon its late 2023 release. This rapid pace of technological evolution is essential for Ambarella to maintain its leadership in a market driven by constant breakthroughs in AI algorithms and neural network processing.

Ambarella's technological strategy is deeply intertwined with the growth of the Internet of Things (IoT) and the ongoing rollout of 5G networks. The increasing demand for connected devices, projected to reach billions by 2025, creates a fertile ground for Ambarella's edge AI solutions, enabling real-time data processing and low-latency applications across diverse sectors.

The company's technological roadmap is heavily influenced by the evolving needs of the automotive sector, particularly in advanced driver-assistance systems (ADAS) and autonomous vehicles (AV). Ambarella's CV3-AD system-on-chip (SoC) is specifically designed to handle the complex sensor fusion and AI inference required for these applications, positioning the company to capitalize on the projected growth of the ADAS market, which is expected to approach $60 billion by 2025.

Legal factors

Ambarella's advanced video and image processing solutions, crucial for applications like video security and in-cabin monitoring, operate within a complex web of global data protection and privacy regulations. Laws such as the EU's General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA) in the US, and the Personal Information Protection Law (PIPL) in China impose strict requirements on how sensitive visual data is collected, processed, and stored. Failure to comply can lead to significant penalties, impacting market access and brand reputation.

Navigating these diverse legal landscapes necessitates robust and adaptable governance strategies. For instance, under GDPR, companies must ensure lawful processing and secure storage of personal data, which directly applies to the visual information captured by Ambarella-powered devices. Similarly, CCPA grants consumers rights regarding their personal information, including the right to know what data is collected and to opt-out of its sale. These regulations are constantly evolving, requiring continuous monitoring and updates to ensure ongoing compliance.

Ambarella's advanced chips are crucial for ADAS and autonomous driving systems, but this integration introduces significant product liability exposure. If a system malfunctions due to a chip defect or design flaw, leading to an accident, Ambarella could face substantial legal claims. For instance, in 2023, the US National Highway Traffic Safety Administration (NHTSA) investigated numerous incidents involving ADAS features, highlighting the critical nature of system reliability.

The legal landscape is rapidly evolving to encompass software and artificial intelligence. The EU's Revised Product Liability Directive, expected to be fully implemented by 2024, explicitly broadens liability to include software and AI that impact product performance. This means Ambarella must ensure its AI algorithms and software components are robust and demonstrably safe, as liability could extend beyond hardware failures.

To mitigate these risks, Ambarella must prioritize exhaustive testing and validation of its chipsets and associated software. Comprehensive documentation detailing the capabilities, operational parameters, and limitations of their solutions is essential. This proactive approach is vital, especially as regulatory bodies worldwide, including those in the US and Europe, are increasingly scrutinizing the safety and accountability of autonomous technologies.

Ambarella’s success hinges on protecting its vast intellectual property, particularly its patents covering video compression, image processing, and cutting-edge computer vision. This is crucial for maintaining its competitive edge in the fast-evolving semiconductor market.

The semiconductor landscape is rife with intellectual property disputes. Ambarella must maintain strong legal defenses to safeguard its innovations and deter competitors from exploiting its technological breakthroughs, a common challenge in this sector.

International Trade Laws and Export Controls

Ambarella operates within a landscape shaped by intricate international trade laws and stringent export controls, particularly concerning its advanced semiconductor technologies. Governments worldwide, notably the United States, impose regulations on the export of sophisticated chips that possess potential military or dual-use applications, directly impacting companies like Ambarella that design such components.

Navigating these regulations is paramount for Ambarella's continued market access and supply chain integrity. Failure to comply can result in severe penalties, including hefty fines and the revocation of export privileges. The ongoing geopolitical tensions, especially the tech rivalry between the US and China, further complicate this environment, demanding constant vigilance and adaptation from Ambarella to ensure adherence to evolving trade policies.

- Export Control Compliance: Ambarella must adhere to regulations like the US Export Administration Regulations (EAR), which govern the export of dual-use technologies.

- Geopolitical Impact: The US government's restrictions on chip sales to certain Chinese entities, such as those imposed in late 2022 and updated through 2024, directly affect the potential market for Ambarella's products.

- Supply Chain Security: Maintaining access to global foundries and component suppliers necessitates strict compliance with all international trade laws to avoid disruptions.

- Market Access: Compliance is key to ensuring Ambarella can freely sell its AI-enabled vision chips in critical international markets, including Europe and Asia.

Antitrust and Competition Laws

Ambarella operates within a semiconductor sector that has seen significant consolidation, making adherence to antitrust and competition laws paramount. For instance, the global semiconductor market saw M&A activity valued at over $100 billion in 2023, highlighting the regulatory scrutiny such deals face. The company must ensure its expansion strategies, including potential mergers, acquisitions, or strategic alliances, are meticulously vetted to prevent any perception or reality of anti-competitive practices. Failure to comply could lead to substantial fines and operational disruptions.

Navigating these complex legal landscapes requires proactive legal counsel and a deep understanding of regulations in key markets like the United States, Europe, and Asia. In 2024, regulatory bodies are increasingly focused on preventing market dominance by large players, particularly in technology sectors. Ambarella's commitment to fair competition is therefore not just a legal obligation but a strategic imperative for sustained growth and market trust.

- Regulatory Scrutiny: Antitrust authorities globally are actively monitoring M&A activity in the tech sector.

- Compliance Burden: Ambarella must invest in robust legal and compliance frameworks to navigate diverse international regulations.

- Strategic Partnerships: Joint ventures and collaborations require careful structuring to avoid antitrust concerns.

Ambarella's AI-powered vision chips are subject to a growing number of data privacy regulations globally, such as GDPR and CCPA, impacting how visual data is handled. The company faces significant product liability risks due to the critical nature of its ADAS and autonomous driving applications, with regulatory bodies like NHTSA actively investigating system malfunctions. Furthermore, evolving legal frameworks, including the EU's Revised Product Liability Directive, are extending liability to software and AI, necessitating rigorous safety and accountability measures.

Environmental factors

The escalating demands of sophisticated AI and computer vision applications translate into substantial energy consumption from specialized chips. This environmental impact is a growing concern across the tech sector.

Ambarella's strategic emphasis on developing low-power, high-efficiency System-on-Chips (SoCs) directly tackles this issue. Their solutions are designed to minimize the carbon footprint associated with AI-driven devices, aligning with broader sustainability goals.

The industry is increasingly prioritizing energy efficiency in AI chip design, with a notable trend towards optimizing performance per watt. For instance, by 2025, the energy efficiency of AI accelerators is projected to see significant improvements, driven by advancements in architecture and manufacturing processes.

The lifecycle of semiconductor products, including Ambarella's advanced chips, inherently contributes to the growing global issue of electronic waste, or e-waste. As devices become obsolete or are replaced, the components within them, such as semiconductors, enter the waste stream. This trend is amplified by the rapid pace of technological advancement in areas like AI and automotive, where newer, more powerful chips are constantly being developed.

Compliance with increasingly stringent environmental regulations concerning e-waste management and recycling presents a significant challenge and opportunity for the electronics industry. Governments worldwide are implementing stricter rules to reduce landfill waste and promote circular economy principles. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive continues to evolve, pushing for higher collection and recycling rates for electronics.

While Ambarella itself does not manufacture the final consumer electronics, it plays a crucial role within a complex global supply chain. This means Ambarella's operations and product designs must indirectly support the environmental stewardship of its downstream partners. Ensuring that its chips are designed with recyclability in mind and that its supply chain partners adhere to responsible e-waste disposal practices is becoming a key aspect of corporate social responsibility and market competitiveness.

Environmental scrutiny extends to Ambarella's entire supply chain, from raw material sourcing for semiconductors to final product distribution. Companies like Ambarella are increasingly pressured to ensure their partners and suppliers uphold sustainable and ethical sourcing practices, focusing on minimizing environmental impact and guaranteeing responsible labor conditions. For instance, the Semiconductor Industry Association (SIA) reported in 2024 that the industry is investing heavily in reducing its carbon footprint across manufacturing and supply chains.

Geopolitical risks and the increasing frequency of natural disasters pose significant threats to the supply of critical materials essential for semiconductor production. Disruptions can arise from trade disputes, regional conflicts, or extreme weather events impacting mining operations or transportation routes, as seen with various supply chain bottlenecks experienced globally in recent years.

Carbon Footprint of Manufacturing Processes

While Ambarella operates as a fabless semiconductor company, the environmental impact of its chip manufacturing, outsourced to third-party foundries, is a significant consideration. The semiconductor industry faces increasing scrutiny regarding the substantial energy consumption and associated carbon emissions from fabrication processes.

This pressure directly influences Ambarella's strategic decisions in selecting manufacturing partners and reinforces the industry-wide push towards greater sustainability. Companies like TSMC, a major foundry partner for many fabless firms, are investing heavily in renewable energy and water conservation to mitigate their environmental impact. For instance, TSMC announced plans to source 100% renewable energy by 2050, a commitment that influences its partners' own sustainability goals.

- Energy Intensity: Semiconductor fabrication plants are among the most energy-intensive manufacturing facilities globally, contributing to a significant carbon footprint.

- Foundry Sustainability Initiatives: Ambarella's choice of foundries is increasingly tied to their environmental performance and commitments to reducing greenhouse gas emissions.

- Industry-Wide Pressure: The broader semiconductor sector is responding to regulatory and consumer demands for more sustainable production methods.

Compliance with Environmental Regulations (e.g., RoHS, REACH)

Ambarella must navigate a complex web of environmental regulations like RoHS and REACH, which restrict hazardous substances in electronics. For instance, REACH, updated significantly in 2024 with new substance restrictions, requires extensive data submission for chemicals used in products sold within the EU. Failure to comply can result in significant fines and market exclusion, impacting Ambarella's ability to sell its advanced AI chips globally.

Maintaining compliance is not just a legal necessity but a strategic imperative for Ambarella. The company's commitment to these standards directly influences its brand image and its appeal to environmentally conscious customers and partners. For example, in 2024, several major electronics manufacturers faced scrutiny for non-compliance with updated RoHS directives, highlighting the ongoing importance of robust supply chain management and product testing.

- RoHS Compliance: Ensures that hazardous materials like lead, mercury, and cadmium are limited in Ambarella's semiconductor products, crucial for sales in markets like the EU and China.

- REACH Regulation: Requires registration and evaluation of chemical substances, impacting the raw materials and components used in Ambarella's chip manufacturing processes.

- Supply Chain Scrutiny: Ambarella's reliance on a global supply chain means constant vigilance is needed to ensure all suppliers adhere to environmental standards, a challenge amplified by evolving regulations in 2024-2025.

- Market Access: Adherence to these regulations is a prerequisite for market entry, directly affecting Ambarella's revenue potential in key geographical regions.

The semiconductor industry's significant energy consumption and associated carbon emissions from fabrication processes are a key environmental concern. Ambarella's selection of manufacturing partners, such as TSMC, is increasingly influenced by their sustainability commitments, including investments in renewable energy. For instance, TSMC aims to source 100% renewable energy by 2050, impacting partners' environmental goals.

| Environmental Factor | Impact on Ambarella | Industry Trend/Data (2024-2025) |

|---|---|---|

| Energy Consumption in Manufacturing | Outsourced fabrication is energy-intensive; reliance on foundries with green initiatives is crucial. | Semiconductor fabrication plants are highly energy-intensive. TSMC's 100% renewable energy goal by 2050 influences supply chain partners. |

| E-waste and Product Lifecycle | Designing for recyclability and ensuring supply chain partners manage e-waste responsibly are key. | Rapid technological advancement increases e-waste. The EU's WEEE Directive pushes for higher collection and recycling rates. |

| Hazardous Substance Regulations | Compliance with RoHS and REACH is mandatory for market access and brand image. | REACH saw significant updates in 2024 with new substance restrictions. Non-compliance can lead to fines and market exclusion. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ambarella is built on a foundation of comprehensive data from leading market research firms, industry-specific publications, and official government reports. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social trends impacting the semiconductor and automotive sectors.