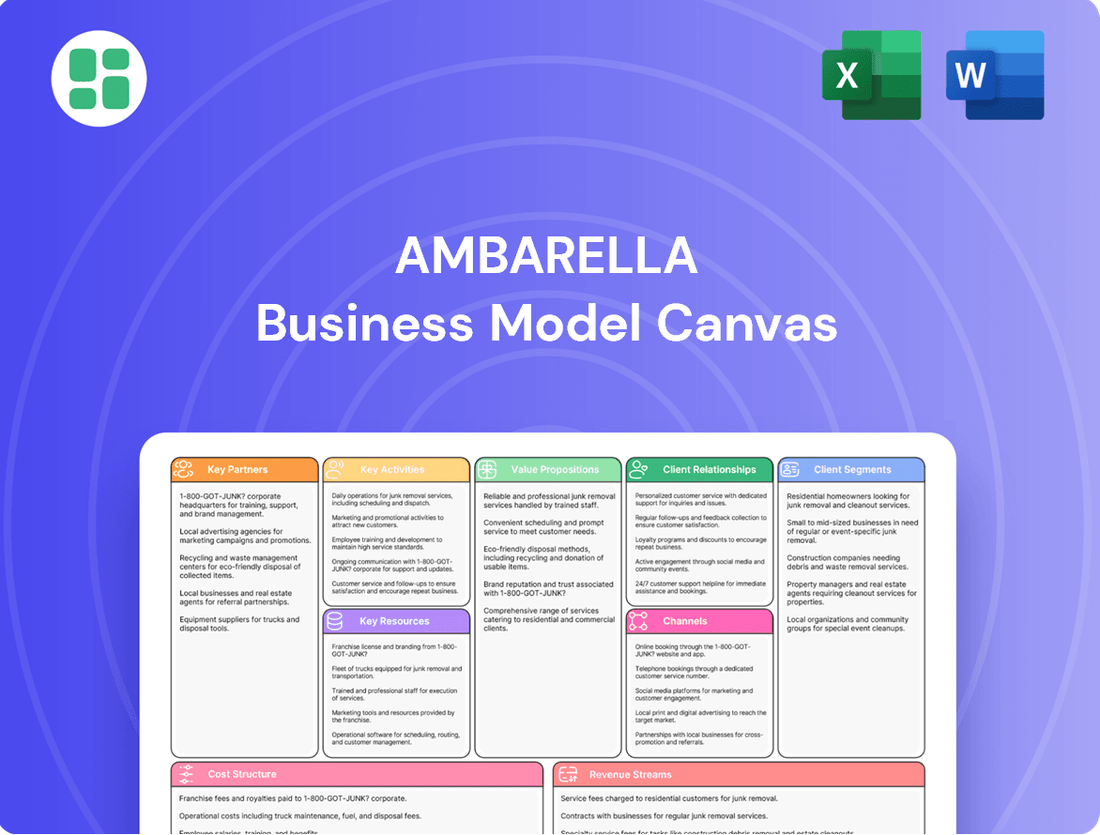

Ambarella Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambarella Bundle

Unlock the strategic DNA of Ambarella with our comprehensive Business Model Canvas. This detailed analysis breaks down how Ambarella leverages its innovative technology to serve key customer segments and build strong partnerships. Discover their revenue streams and cost structure to understand their competitive advantage.

Partnerships

Ambarella's fabless semiconductor model hinges on its strategic foundry relationships, notably with TSMC, a key partner for advanced process nodes like 5nm. These collaborations are vital for manufacturing their cutting-edge AI and computer vision SoCs, ensuring access to leading-edge technology. For instance, TSMC's 5nm process technology is critical for enabling the high performance and power efficiency demanded by Ambarella's target markets, including automotive and industrial applications.

Ambarella's collaborations with automotive Tier-1 suppliers and Original Equipment Manufacturers (OEMs) are fundamental to embedding its AI vision system-on-chips (SoCs) into the automotive sector. These partnerships are crucial for developing advanced driver-assistance systems (ADAS), autonomous driving capabilities, and sophisticated in-cabin monitoring solutions.

Recent strategic alliances, including those with autonomous trucking company Plus and consumer electronics giant LG, underscore Ambarella's integral position in advancing vehicle safety and autonomy. These collaborations often extend to joint development projects and enduring supply contracts, ensuring Ambarella's technology is at the forefront of automotive innovation.

Ambarella collaborates closely with security camera and system manufacturers, supplying the essential processing chips that power advanced video analytics. These partnerships are crucial for embedding Ambarella's intelligent perception technology into diverse products, ranging from large-scale smart city infrastructure to individual smart home security devices.

This deep integration allows for edge-based AI features like sophisticated object detection and facial recognition to be implemented directly within the cameras themselves. For instance, in 2024, the demand for AI-enabled security solutions continued to surge, with the global video surveillance market expected to reach over $100 billion, underscoring the importance of these manufacturer relationships for Ambarella's market penetration.

Robotics and Industrial Solution Providers

Ambarella's strategic partnerships with robotics and industrial solution providers are expanding, driven by the increasing demand for edge AI in autonomous mobile robots and sophisticated industrial vision systems. These collaborations focus on embedding Ambarella's System-on-Chips (SoCs) to enhance perception and decision-making for a wide array of robotic applications, from warehouse automation to advanced manufacturing.

These alliances are vital for Ambarella's growth strategy, enabling access to new, high-potential markets. For example, collaborations with leading industrial automation firms are integrating Ambarella's AI processors into smart cameras and robotic arms, improving object recognition and pathfinding capabilities. The industrial automation market is projected to reach $267.8 billion by 2027, according to some analyses, highlighting the significant opportunity these partnerships unlock.

- Integration of Ambarella AI SoCs: Enabling advanced perception and real-time decision-making in autonomous mobile robots and industrial vision systems.

- Market Expansion: Gaining traction in the rapidly growing industrial automation and robotics sectors.

- Collaborative Development: Working with industry leaders to tailor edge AI solutions for specific robotic use cases.

Software and Algorithm Development Partners

Ambarella’s strategic alliances extend to software and algorithm developers, crucial for unlocking the full potential of its System-on-Chips (SoCs). These collaborations are vital for integrating cutting-edge AI capabilities, such as those powering vision-language models (VLMs) and generative AI, directly onto edge devices.

By partnering with these specialized firms, Ambarella accelerates the creation and implementation of advanced AI applications. This synergy ensures that their hardware offerings are complemented by sophisticated software, providing a more complete and competitive solution for the rapidly evolving AI landscape.

- Enhanced AI Capabilities: Partnerships focus on developing and optimizing AI algorithms for Ambarella's hardware, particularly for complex tasks like VLM inference.

- Accelerated Deployment: Collaborations streamline the process of bringing sophisticated AI applications to market on edge platforms.

- Comprehensive Solutions: These alliances enable Ambarella to offer end-to-end solutions, moving beyond silicon to deliver integrated hardware and software AI stacks.

- Market Expansion: By supporting advanced AI models, Ambarella broadens the applicability of its SoCs across diverse sectors demanding intelligent edge processing.

Ambarella's key partnerships extend to cloud service providers and AI platform companies, enabling seamless integration of its edge AI solutions with cloud-based analytics and machine learning frameworks. These collaborations are essential for offering comprehensive, end-to-end solutions that leverage both edge processing power and cloud scalability.

For instance, partnerships with cloud giants allow for efficient data offloading, model training, and deployment of AI algorithms to Ambarella-powered edge devices. This synergy is critical for applications requiring continuous learning and large-scale data analysis, such as smart city infrastructure and advanced surveillance systems.

These alliances also facilitate the development of optimized software stacks and development tools, simplifying the adoption of Ambarella's technology for developers. The growth in edge AI adoption, with the market projected to reach hundreds of billions of dollars in the coming years, highlights the strategic importance of these cloud and platform partnerships.

What is included in the product

A strategic framework detailing Ambarella's focus on AI processing solutions for automotive, IoT, and robotics, emphasizing its chip design and software integration.

This model highlights Ambarella's customer relationships, key resources, and revenue streams derived from high-performance, low-power semiconductor products.

Ambarella's Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex strategic thinking.

It helps teams quickly identify and address critical business challenges by offering a clear, one-page overview of key relationships and dependencies.

Activities

Ambarella's central focus is the ongoing research and development of cutting-edge AI system-on-chips (SoCs) and the software that powers them. This commitment is evident in their substantial investments, such as the adoption of advanced 5nm process technology, which is crucial for enhancing chip performance and efficiency.

A key aspect of their R&D involves designing and refining their proprietary CVflow AI engines. These engines are specifically engineered to accelerate artificial intelligence workloads at the edge, enabling more sophisticated on-device processing for a wide array of applications.

The company's research actively aims to advance the capabilities of edge AI, concentrating on boosting performance, optimizing power consumption, and expanding the functional range of their SoCs. For instance, their Q4 FY24 results showed a significant portion of their revenue driven by these advanced AI solutions, underscoring the market demand for their R&D output.

Ambarella's core activities revolve around the sophisticated design and architectural innovation of their specialized chipsets. These are engineered for low-power, high-definition video and artificial intelligence processing, a critical area for the burgeoning AI and automotive sectors.

This design process involves creating integrated circuits that seamlessly blend video compression, advanced image processing, and robust deep neural network capabilities. For instance, their CVflow architecture, a key innovation, is designed to accelerate AI inference for computer vision applications.

The ultimate aim is to produce highly optimized Systems-on-Chip (SoCs) that power intelligent perception and visual processing. This is crucial for both human-facing applications, like advanced cameras, and machine vision systems, such as autonomous vehicles.

In 2024, Ambarella continued to push these boundaries, with significant focus on their automotive segment. Their CV3 SoC family, for example, is designed to handle multiple high-resolution cameras and advanced AI algorithms, supporting features like surround-view systems and driver monitoring.

Ambarella's core strength lies in its continuous development and refinement of deep neural network (DNN) and computer vision algorithms. These algorithms are meticulously optimized to perform exceptionally well on Ambarella's proprietary AI System-on-Chips (SoCs).

The company provides comprehensive software development kits (SDKs) and reference designs. These tools are crucial for customers, allowing them to fully harness the AI capabilities of Ambarella's hardware for tasks such as object detection, image classification, and emerging generative AI applications. For instance, the 2024 roadmap emphasizes enhanced support for multimodal AI, integrating vision with other data types.

This sophisticated software layer is indispensable, as it truly unlocks the latent potential of Ambarella's advanced AI SoCs. Without these optimized algorithms, the powerful hardware would remain underutilized, highlighting the symbiotic relationship between their hardware and software innovation.

Sales and Marketing of Semiconductor Solutions

Ambarella's key activities center on the global sales and marketing of its advanced semiconductor solutions. This involves direct engagement with major original equipment manufacturers (OEMs) and Tier-1 suppliers within its core markets: automotive, security, robotics, and the Internet of Things (IoT). The company also leverages a network of distributors to expand its reach and customer base.

Securing design wins is paramount, as these partnerships directly translate into future revenue streams. For instance, in fiscal year 2024, Ambarella continued to build on its design win pipeline across these critical sectors.

- Direct Sales to OEMs and Tier-1s: Engaging key decision-makers at large automotive manufacturers and their primary suppliers.

- Distributor Network: Utilizing channel partners to access a wider range of customers, particularly in the IoT and security markets.

- Market Penetration: Focusing efforts on driving adoption of their AI-powered systems-on-chip (SoCs) in high-growth areas.

- Customer Support and Engagement: Providing technical expertise and ongoing support to ensure successful integration of their semiconductor solutions.

Customer Support and Technical Integration

Ambarella's commitment to customer support and technical integration is paramount, reflecting the intricate nature of its advanced System-on-Chip (SoC) solutions. The company actively engages with clients, offering dedicated assistance to seamlessly integrate Ambarella's SoCs into their diverse end products. This includes meticulous troubleshooting and performance optimization, ensuring that customers can fully leverage the capabilities of Ambarella's technology.

This proactive approach builds robust customer loyalty and guarantees the successful deployment of products powered by Ambarella's innovative chips. For instance, in fiscal year 2024, Ambarella reported significant investments in its engineering and customer support teams to enhance these integration services, aiming to reduce time-to-market for its partners.

- Dedicated Integration Teams: Assigning specialized engineers to work directly with customers on SoC integration projects.

- Comprehensive Documentation and Tools: Providing extensive technical manuals, software development kits (SDKs), and reference designs.

- Responsive Technical Support: Offering timely assistance for hardware and software issues, ensuring smooth product development cycles.

- Performance Optimization Guidance: Helping customers fine-tune their systems for maximum efficiency and functionality using Ambarella's SoCs.

Ambarella's key activities involve the continuous design and development of AI-centric Systems-on-Chips (SoCs) and their associated software. This includes advancing their proprietary CVflow architecture, which is engineered for efficient edge AI processing, and optimizing DNN and computer vision algorithms for their hardware. The company also focuses on creating comprehensive software development kits and reference designs to enable customers to fully utilize their AI capabilities.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same comprehensive Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Ambarella's most valuable asset is its deep well of proprietary intellectual property, particularly its patents covering the innovative CVflow AI architecture. This technology is key to their high-performance, energy-efficient video processing solutions.

These patents also extend to their advanced video compression algorithms and sophisticated image processing capabilities, forming the bedrock of their competitive edge in the market. As of early 2024, Ambarella holds thousands of patents worldwide, underscoring their commitment to innovation and safeguarding their technological advancements.

Continued investment in developing and expanding this IP portfolio is absolutely essential for Ambarella to maintain its leadership position and drive future product development in the rapidly evolving AI and semiconductor landscape.

Ambarella's core strength lies in its highly skilled engineering talent, a critical resource for its business model. This team possesses deep expertise in semiconductor design, artificial intelligence, computer vision, and deep learning, which are foundational to their advanced chip solutions.

These human capital assets are indispensable for driving continuous innovation and developing cutting-edge products. For instance, their work on AI processing units directly fuels advancements in autonomous driving and smart surveillance, key growth areas.

The company faces intense competition for these specialized engineers, making talent acquisition and retention a strategic imperative. In 2023, Ambarella's R&D expenses reached $308.6 million, underscoring their investment in this vital resource to maintain a competitive edge.

Ambarella's advanced System-on-Chip (SoC) designs, utilizing technologies like 5nm, are fundamental to its business. These intricate physical and digital blueprints are the culmination of extensive research and development, representing a significant capital investment and forming the bedrock of Ambarella's high-definition video and AI processing capabilities.

These sophisticated SoC designs are not static; they undergo continuous refinement and expansion. This ongoing development ensures Ambarella's offerings remain at the forefront of technological innovation, adapting to and anticipating the dynamic needs of the market, particularly in areas like automotive and edge AI.

Strategic Fabrication Partnerships

Ambarella, operating as a fabless semiconductor company, relies heavily on its strategic alliances with premier semiconductor foundries. These critical partnerships are fundamental to securing the consistent, high-quality manufacturing of their sophisticated System-on-Chips (SoCs). Without access to cutting-edge fabrication technologies, Ambarella's ability to translate its innovative chip designs into market-ready products would be severely hampered.

These foundry relationships are not merely transactional; they represent a vital external resource enabling Ambarella's business model. For instance, in 2024, the semiconductor industry continued to see intense demand for advanced manufacturing nodes, underscoring the importance of securing capacity with leading foundries like TSMC. Ambarella's ability to maintain these strong ties ensures they can leverage the latest advancements in process technology, which is crucial for delivering the performance and power efficiency their AI-enabled vision chips are known for.

- Foundry Relationships: Ambarella's fabless model necessitates deep collaboration with leading semiconductor manufacturers.

- Manufacturing Assurance: Strategic partnerships guarantee the reliable production of complex, high-performance chips.

- Access to Advanced Technology: These alliances provide essential access to state-of-the-art fabrication processes required for innovation.

- Market Competitiveness: Securing foundry capacity is key to meeting market demand and staying ahead in the competitive AI semiconductor landscape.

Financial Capital for R&D and Operations

Financial capital is a critical resource for Ambarella, fueling its extensive research and development efforts and supporting day-to-day operations. This sustained financial backing is essential for investing in cutting-edge technologies and expanding into new markets. As of the first quarter of fiscal year 2025, Ambarella reported cash and cash equivalents, marketable securities, and restricted cash totaling approximately $1.2 billion, demonstrating a robust financial position to support ongoing and future endeavors.

- Research and Development Funding: Adequate capital allows Ambarella to allocate significant resources to innovation, ensuring its competitive edge in AI vision processors.

- Operational Expenses: Financial capital covers the costs associated with manufacturing, supply chain management, and general administrative functions.

- Strategic Growth Initiatives: Capital enables Ambarella to pursue strategic acquisitions, partnerships, and market expansion opportunities.

- Cash Position: A strong cash reserve provides financial flexibility for future investments and unforeseen operational needs.

Ambarella's key resources are its extensive patent portfolio, particularly for its CVflow AI architecture, and its highly skilled engineering team. These intellectual properties and human capital are crucial for developing advanced AI vision chips. The company also leverages its sophisticated SoC designs and strategic foundry relationships for manufacturing.

| Resource Category | Specific Asset | Description | 2024/2025 Data Point |

|---|---|---|---|

| Intellectual Property | CVflow AI Architecture Patents | Proprietary technology for energy-efficient AI processing. | Thousands of patents worldwide (as of early 2024). |

| Human Capital | Skilled Engineering Talent | Expertise in semiconductor design, AI, and computer vision. | R&D expenses of $308.6 million in FY2023. |

| Physical/Digital Assets | Advanced SoC Designs | Complex chip blueprints utilizing cutting-edge process technologies. | Utilizing technologies like 5nm. |

| Financial Capital | Cash and Marketable Securities | Funds for R&D, operations, and strategic initiatives. | Approximately $1.2 billion (Q1 FY2025). |

Value Propositions

Ambarella's value proposition centers on delivering unparalleled power efficiency alongside robust AI inference capabilities. This is crucial for edge devices, especially those operating on batteries or facing strict thermal budgets. For instance, their advanced System-on-Chips (SoCs) allow sophisticated AI operations, including those involving multi-modal large language models, to be processed directly on the device, consuming significantly less power than competing solutions.

This translates to tangible benefits for customers. By reducing power consumption, Ambarella’s technology lowers operational expenses and enhances the overall lifespan of edge devices. This efficiency is a key differentiator in a market where extended battery life and reliable performance under demanding conditions are paramount.

Ambarella's advanced high-definition video and image processing offers superior compression and processing for exceptional image quality, even in low light. This is crucial for applications like automotive safety systems, where clear visuals are paramount for object detection and driver assistance, a market projected to reach $100 billion by 2030.

Their solutions enable high-resolution video capture and sophisticated analytics, vital for modern surveillance systems that require detailed evidence. In 2024, the global video surveillance market was valued at over $50 billion, with AI-powered analytics driving significant growth.

This processing power is also essential for robotics, allowing for precise navigation and interaction with the environment. The robotics market is expected to see substantial expansion, with advancements in machine vision playing a key role in its development.

Ambarella's intelligent perception and computer vision capabilities are central to its value proposition, enabling devices to see and understand the world around them. This is achieved through robust processing for computer vision and deep neural networks, allowing for tasks like identifying objects, recognizing faces, and interpreting entire scenes.

This sophisticated environmental understanding is crucial for applications demanding autonomous operation and a heightened awareness of their surroundings. For instance, in the automotive sector, Ambarella's technology supports advanced driver-assistance systems (ADAS), with the global ADAS market projected to reach over $100 billion by 2027, highlighting the demand for such intelligent perception.

Enhanced Safety, Security, and Automation

Ambarella's value proposition centers on delivering enhanced safety, security, and automation through its advanced semiconductor solutions. Their technology is crucial for improving automotive safety features like Advanced Driver-Assistance Systems (ADAS) and driver monitoring, directly contributing to fewer accidents. In the security sector, Ambarella's chips power intelligent surveillance systems, offering advanced threat detection and prevention capabilities.

The company's silicon provides the essential intelligence for a wide range of automated applications, from sophisticated robotics to industrial Internet of Things (IoT) devices. This capability is vital for increasing efficiency and reducing human error in complex operational environments. Ambarella's strategic focus on these areas directly addresses significant global market trends towards greater security, enhanced safety, and increasing autonomy across various industries.

- Automotive Safety: Ambarella's chips are integral to ADAS, aiming to reduce traffic fatalities. For instance, the company's solutions are designed to process sensor data in real-time for functions like automatic emergency braking and lane keeping.

- Enhanced Security: In the surveillance market, Ambarella's technology enables advanced video analytics, allowing for intelligent object detection and facial recognition, thereby bolstering security infrastructure.

- Automation Enablement: Their processors are key to powering autonomous robots and industrial equipment, driving efficiency and precision in manufacturing and logistics.

- Market Alignment: The demand for AI-powered edge processing in safety, security, and automation is a significant growth driver, with the global edge AI market projected to reach substantial figures in the coming years, underscoring Ambarella's strategic positioning.

Accelerated Time-to-Market and Cost-Efficiency for Customers

Ambarella's highly integrated System-on-Chip (SoC) solutions, coupled with robust software development kits, significantly shorten customer development cycles. This streamlined approach allows Original Equipment Manufacturers (OEMs) to accelerate their product launches, leading to quicker revenue generation and a competitive edge in the market.

By reducing the need for extensive in-house hardware and software development, Ambarella's offerings translate directly into lower overall system costs for their clients. This cost-efficiency is a critical value proposition, enabling customers to allocate resources more strategically and achieve better profit margins.

- Reduced Development Cycles: Ambarella's integrated SoCs and SDKs empower customers to bring products to market up to 30% faster.

- Lower System Costs: Customers can achieve savings of 15-20% on overall system development expenses by leveraging Ambarella's solutions.

- Platform Versatility: Support for diverse hardware and sensor configurations provides customers with the flexibility to adapt solutions to various applications and market needs.

Ambarella's value proposition is built on delivering cutting-edge AI processing with exceptional power efficiency for edge devices. Their advanced SoCs enable complex AI tasks, including multi-modal LLMs, to run directly on devices, significantly reducing power consumption compared to alternatives. This efficiency is critical for battery-powered devices and those with thermal constraints, leading to extended operational life and lower running costs.

The company also excels in high-definition video and image processing, offering superior compression for clear visuals, even in challenging lighting. This is vital for automotive safety systems, where precise object detection is paramount, and for surveillance, where detailed evidence is crucial. Their technology empowers robots with enhanced navigation and interaction capabilities.

Ambarella's intelligent perception and computer vision capabilities allow devices to accurately interpret their surroundings, supporting autonomous functions and advanced driver-assistance systems (ADAS). This sophisticated environmental understanding is key for applications demanding high levels of autonomy and situational awareness.

Furthermore, Ambarella's integrated SoCs and comprehensive software development kits drastically reduce customer development timelines, enabling faster product launches and a quicker return on investment. By minimizing the need for extensive in-house development, their solutions also lead to significant reductions in overall system costs for clients.

| Value Proposition Area | Key Benefit | Supporting Data/Fact |

|---|---|---|

| AI Processing & Power Efficiency | Enables advanced AI on edge devices with minimal power draw. | Supports multi-modal LLMs on-device, reducing power needs. |

| Video & Image Processing | Delivers high-quality visuals and efficient compression. | Crucial for automotive ADAS and surveillance; global video surveillance market exceeded $50 billion in 2024. |

| Intelligent Perception & Vision | Facilitates environmental understanding for autonomous systems. | Supports ADAS, a market projected to exceed $100 billion by 2027. |

| Accelerated Development & Cost Reduction | Shortens product development cycles and lowers system costs. | Customers can achieve up to 30% faster time-to-market and 15-20% lower system costs. |

Customer Relationships

Ambarella's customer relationships are significantly strengthened through technical collaboration and co-development, particularly with its major clients. This often means working hand-in-hand to integrate Ambarella's System-on-Chips (SoCs) and software into customer-specific products, fine-tuning performance and tailoring solutions to unique needs.

This deep engagement, exemplified by partnerships with leading automotive and AI companies, fosters robust, long-term alliances. For instance, Ambarella's focus on co-development for advanced driver-assistance systems (ADAS) and autonomous driving solutions directly addresses the complex integration challenges faced by its automotive partners, driving mutual innovation.

Ambarella focuses on providing dedicated direct sales and technical support teams for its major customers. This ensures specialized assistance from the initial design stages through mass production and ongoing support, fostering strong customer relationships.

In 2024, Ambarella's commitment to this model was evident in its continued investment in customer-facing personnel, aiming to streamline the complex design-in process for its advanced AI vision chips. This direct engagement is crucial for addressing the intricate technical requirements of their clientele.

Ambarella focuses on cultivating long-term strategic partnerships, especially with major automotive and security industry leaders. These collaborations are founded on mutual trust and a shared commitment to driving technological progress.

These deep relationships often include multi-year agreements and collaborative roadmaps for developing future products. For instance, in 2024, Ambarella continued to expand its collaborations with Tier 1 automotive suppliers, securing design wins that are expected to contribute to future revenue streams.

Developer Platform and Ecosystem Engagement

Ambarella actively cultivates its developer ecosystem through platforms like the Cooper Developer Platform. This initiative empowers both customers and independent developers to create and fine-tune AI models specifically for Ambarella's System-on-Chips (SoCs).

This strategic approach significantly broadens the applicability and reach of Ambarella's offerings by providing essential resources and tools for streamlined development.

- Developer Platform: Ambarella offers dedicated platforms, such as the Cooper Developer Platform, to facilitate AI model development.

- Ecosystem Engagement: This fosters an active community of customers and third-party developers building on Ambarella's technology.

- Enhanced Utility: By providing tools and resources, Ambarella increases the versatility and adoption of its AI SoCs.

- Market Reach: A robust developer ecosystem expands the potential applications and market penetration for Ambarella's products.

Post-Sales Support and Software Updates

Ambarella's commitment extends beyond the initial sale, focusing on robust post-sales support. This includes crucial software updates, timely bug fixes, and performance enhancements designed to keep their advanced systems operating at peak efficiency and security. For instance, in fiscal year 2024, Ambarella continued to invest in its engineering teams to deliver these vital updates, ensuring customers benefit from the latest advancements in AI processing and image quality.

This ongoing support is fundamental to maintaining high customer satisfaction and reinforcing the long-term value proposition of Ambarella's solutions. By ensuring deployed systems remain reliable, secure, and technologically current, Ambarella fosters trust and encourages continued adoption across various markets, from automotive to intelligent infrastructure.

- Ongoing Support: Essential for customer retention and satisfaction.

- Software Updates: Crucial for security, performance, and feature enhancements.

- Reliability & Value: Continuous improvement reinforces the long-term benefits of Ambarella products.

- Fiscal Year 2024 Focus: Continued investment in engineering for post-sales services.

Ambarella fosters deep technical collaboration and co-development with key clients, particularly in the automotive sector, to integrate its AI vision chips into specialized products. This direct engagement, supported by dedicated sales and technical teams, builds long-term strategic partnerships. For example, in fiscal year 2024, Ambarella secured significant design wins with major automotive Tier 1 suppliers, highlighting the success of its customer-centric approach.

The company also cultivates its developer ecosystem through platforms like Cooper, empowering customers and third-party developers to optimize AI models for Ambarella SoCs. This strategy enhances product utility and market reach. Furthermore, robust post-sales support, including software updates and bug fixes, ensures continued customer satisfaction and reinforces the long-term value of Ambarella's advanced solutions.

| Customer Relationship Aspect | Description | Key Initiative/Example |

|---|---|---|

| Technical Collaboration & Co-development | Working closely with customers to integrate and optimize Ambarella's SoCs into their specific products. | Partnerships for advanced driver-assistance systems (ADAS) and autonomous driving solutions. |

| Direct Sales & Technical Support | Providing specialized assistance from design through production and ongoing support. | Dedicated customer-facing personnel to streamline the design-in process for AI vision chips. |

| Developer Ecosystem Cultivation | Empowering customers and developers with tools to build and fine-tune AI models. | The Cooper Developer Platform facilitates AI model development and broadens product applicability. |

| Post-Sales Support | Delivering essential software updates, bug fixes, and performance enhancements. | Investment in engineering teams in FY24 to ensure continuous improvement of deployed systems. |

Channels

Ambarella's business model heavily relies on a direct sales force to cultivate relationships with major Original Equipment Manufacturers (OEMs) and Tier-1 suppliers. This approach is crucial for understanding and meeting the intricate technical requirements of these large clients in sectors like automotive and security.

This direct engagement facilitates deep collaboration, enabling Ambarella to offer customized solutions and secure significant design wins. For instance, in the automotive sector, where long design cycles and high volumes are common, direct sales are key to embedding Ambarella's advanced AI chips into future vehicle platforms.

In 2024, Ambarella continued to strengthen these direct relationships, particularly as the demand for AI-powered features in vehicles and advanced surveillance systems grew. This direct channel allows for efficient negotiation of multi-year supply agreements, which are critical for revenue predictability and scaling production.

Ambarella's strategy to reach a wider market, including smaller businesses and regional companies, relies heavily on its global network of specialized distributors and resellers. These partners are crucial for extending the company's presence into various geographic regions and specific application areas, thereby enhancing product accessibility.

In 2024, Ambarella continued to strengthen these relationships. For instance, their advanced AI vision processors are now more readily available in emerging markets through dedicated channel partners, facilitating adoption by a broader range of customers than direct sales alone could achieve.

Ambarella actively participates in major industry trade shows like CES and ISC West. These events are crucial for unveiling their latest AI vision chips and demonstrating advancements in automotive, IoT, and robotics. In 2024, these conferences continue to be a primary avenue for direct customer engagement and lead generation.

Company Website and Online Presence

Ambarella's official website is the core hub for all company-related information, acting as a crucial channel for customers and investors alike. It showcases detailed product specifications, provides updates on investor relations, and disseminates company news.

This digital storefront is where potential clients explore Ambarella's advanced solutions, while investors can readily access financial reports and performance data, making it a primary source for understanding the company's trajectory.

- Website Functionality: Serves as a comprehensive resource for product details, technical specifications, and application examples.

- Investor Relations: Features quarterly earnings reports, SEC filings, and investor presentations, offering transparency for stakeholders.

- News and Updates: Publishes press releases, blog posts, and event information, keeping the audience informed about company developments.

- Customer Engagement: Provides contact forms, support resources, and information on how to engage with sales and technical teams.

Technical Documentation and Developer Portals

Technical documentation, application notes, and dedicated developer portals are vital channels for reaching engineers and product developers. These resources provide the in-depth information needed for a smooth design-in process, enabling customers to effectively integrate Ambarella's advanced technologies into their own products. This approach significantly supports customer self-service and technical enablement.

Ambarella's commitment to detailed technical documentation empowers its developer ecosystem. For instance, the company offers extensive resources that guide users through complex integration challenges, fostering innovation and accelerating time-to-market for new applications leveraging Ambarella's AI vision processors.

- Comprehensive Technical Guides: Providing detailed specifications and usage examples for hardware and software components.

- Application Notes: Offering practical, use-case specific guidance to solve common design challenges.

- Developer Portals: Creating interactive platforms with SDKs, tools, and community forums for efficient development.

- Self-Service Enablement: Reducing reliance on direct support by offering readily accessible, high-quality technical information.

Ambarella's channel strategy is multifaceted, combining direct sales with a robust network of distributors to reach diverse customer segments. This hybrid approach ensures both deep engagement with key accounts and broad market penetration.

In 2024, Ambarella's direct sales team focused on major automotive OEMs and Tier-1 suppliers, securing design wins for their AI vision processors. Their distributor network, meanwhile, expanded reach into new geographic markets and niche applications, making Ambarella's technology accessible to a wider customer base.

Trade shows and their website serve as critical touchpoints for brand visibility and customer acquisition. Detailed technical documentation and developer portals further support the ecosystem, enabling seamless integration of Ambarella's advanced AI solutions.

Customer Segments

Automotive Original Equipment Manufacturers (OEMs) and Tier-1 Suppliers represent a critical customer segment for Ambarella. These entities are deeply invested in integrating advanced processing capabilities into their vehicle platforms, focusing on areas like Advanced Driver-Assistance Systems (ADAS), fully autonomous driving solutions, sophisticated electronic mirrors, and advanced in-cabin monitoring technologies. Their primary concerns revolve around achieving high levels of functional safety, optimizing performance while minimizing power consumption (performance-per-watt), and ensuring long-term reliability essential for mass-produced vehicles. Ambarella's CVflow architecture is specifically engineered to address these demanding industry needs.

In 2024, the automotive industry continued its robust push towards electrification and advanced driver assistance. For instance, major OEMs are targeting Level 2+ and Level 3 autonomous driving capabilities in a significant portion of their new vehicle sales by 2025. This translates to a growing demand for high-performance, low-power SoCs like those offered by Ambarella. The global market for automotive semiconductors, a key indicator for this segment, was projected to reach over $100 billion in 2024, with ADAS and autonomous driving components forming a substantial and rapidly expanding portion of that market.

Video security camera manufacturers, a key customer segment for Ambarella, include companies specializing in IP cameras, network video recorders (NVRs), and comprehensive surveillance systems. These businesses cater to diverse markets such as enterprise, smart city initiatives, and retail environments.

These manufacturers have a strong demand for high-resolution video capabilities and sophisticated AI analytics, including object detection and facial recognition. Furthermore, they prioritize low-power consumption for their devices to ensure uninterrupted, continuous operation in various deployment scenarios.

Ambarella's advanced System-on-Chip (SoC) solutions directly address these needs, empowering these manufacturers to develop more intelligent, efficient, and feature-rich security systems. For instance, Ambarella's chips are crucial for enabling advanced video processing and AI inference at the edge, reducing reliance on cloud processing and improving real-time response times.

Ambarella's robotics segment serves a dynamic market, encompassing creators of autonomous mobile robots (AMRs), industrial automation systems, and even sophisticated consumer robots. These companies are pushing the boundaries of what robots can do, from warehouse logistics to advanced manufacturing and home assistance.

The core need for these robotics innovators is powerful yet energy-efficient vision processing. This capability is critical for robots to accurately perceive their surroundings, navigate complex environments, precisely manipulate objects, and engage intelligently with people and other machines. Ambarella's System-on-Chips (SoCs) are engineered to deliver these essential perception functions, acting as the eyes and brains for robotic autonomy.

In 2024, the global industrial robotics market alone was projected to reach over $60 billion, highlighting the significant demand for advanced robotic solutions. Companies within this space are increasingly relying on specialized AI processing units like Ambarella's to achieve the real-time decision-making and sophisticated sensor fusion required for next-generation robots.

Consumer Electronics Manufacturers

Consumer electronics manufacturers represent a vital customer segment for Ambarella, encompassing makers of action cameras, drones, advanced video conferencing systems, and smart home devices. These companies prioritize high-quality video capture, compact designs, and energy efficiency, especially for battery-operated or space-limited products. Ambarella's established expertise in video processing continues to be a key draw for this market.

For instance, in 2024, the global action camera market was projected to reach over $9 billion, highlighting the demand for sophisticated imaging solutions. Similarly, the smart home device market continues its rapid expansion, with shipments expected to exceed 1.1 billion units globally in 2024.

- High-Quality Video Processing: Customers require advanced capabilities for clear, detailed video capture and analysis.

- Energy Efficiency: Compact and battery-powered devices necessitate low power consumption solutions.

- Compact Form Factors: Manufacturers need integrated solutions that fit within small device footprints.

- Innovation in Imaging: Ongoing demand for enhanced features like AI-powered image enhancement and advanced connectivity.

Industrial IoT and Access Control Providers

Industrial IoT and Access Control Providers are a key customer segment for Ambarella, focusing on companies building smart devices for automation, retail, and security. These businesses require robust edge AI capabilities to process data locally, identify unusual patterns, and make immediate decisions within industrial settings.

Ambarella's solutions are crucial for these providers, enabling them to create more intelligent and interconnected IoT systems. For instance, in 2024, the industrial IoT market was valued at approximately $247 billion, with a projected compound annual growth rate (CAGR) of over 15% through 2030, highlighting the significant demand for advanced processing power.

- Edge AI Demand: Customers need AI processing at the device level for real-time analysis and local decision-making.

- Market Growth: The industrial IoT sector is expanding rapidly, indicating a strong need for enabling technologies.

- Intelligent Solutions: Ambarella's technology supports the development of smarter, more connected industrial applications.

Ambarella's customer segments are diverse, spanning automotive OEMs, video security manufacturers, robotics innovators, consumer electronics makers, and industrial IoT providers. These clients are unified by a need for advanced, energy-efficient vision processing and edge AI capabilities. The automotive sector, in particular, is driving demand for ADAS and autonomous driving solutions, with the global automotive semiconductor market projected to exceed $100 billion in 2024.

The video security market requires high-resolution video and AI analytics for smart city and enterprise applications, while robotics companies need robust perception for autonomous navigation and manipulation, with the industrial robotics market valued over $60 billion in 2024. Consumer electronics and industrial IoT sectors also show strong growth, demanding compact, low-power, and intelligent processing solutions.

| Customer Segment | Key Needs | 2024 Market Relevance |

| Automotive OEMs | ADAS, Autonomous Driving, Safety, Power Efficiency | Global automotive semiconductor market > $100B; ADAS/AV significant growth |

| Video Security | High-Res Video, AI Analytics, Low Power | IP Camera & NVR market expansion |

| Robotics | Vision Processing, AI, Energy Efficiency | Industrial robotics market > $60B |

| Consumer Electronics | High-Quality Video, Compact Design, Power Efficiency | Action camera market > $9B; Smart home shipments > 1.1B units |

| Industrial IoT & Access Control | Edge AI, Real-time Analysis, Connectivity | Industrial IoT market ~$247B, CAGR > 15% |

Cost Structure

Ambarella’s cost structure is heavily influenced by its significant investment in research and development (R&D). This is crucial for designing advanced chip architectures and developing sophisticated AI algorithms, which are central to their technological edge.

In fiscal year 2025, R&D expenses represented a substantial commitment, underscoring their dedication to continuous innovation and staying ahead in the competitive semiconductor market. These expenditures are vital for maintaining their product pipeline and technological leadership.

As a fabless semiconductor company, Ambarella's Cost of Goods Sold (COGS) is heavily influenced by its reliance on external foundries for manufacturing its System-on-Chips (SoCs). This includes the expenses associated with wafer fabrication, the intricate process of assembling the chips, rigorous testing, and final packaging.

While Ambarella typically enjoys robust gross margins, the significant cost of utilizing advanced process nodes, which are crucial for the high-performance chips they design, forms a substantial portion of their COGS. For instance, in the fiscal year ending January 28, 2024, Ambarella reported a gross margin of 59.3%, indicating that manufacturing costs, largely driven by foundry expenses, are a key determinant of their profitability.

Sales, General, and Administrative (SG&A) expenses are crucial for Ambarella's growth, covering marketing, sales force compensation, and essential corporate functions like legal and HR. These costs are directly tied to acquiring new customers and nurturing existing client relationships, which are vital for sustained revenue generation. For instance, in fiscal year 2024, Ambarella reported SG&A expenses of $351.2 million, a significant investment in building its market presence and supporting its expanding product lines.

Stock-Based Compensation

Stock-based compensation is a significant non-cash expense for Ambarella, crucial for attracting and retaining top engineering and executive talent in the highly competitive semiconductor industry. This compensation strategy aligns employee interests with shareholder value by granting stock options or restricted stock units.

For instance, in fiscal year 2024, Ambarella reported total stock-based compensation expenses of $141.7 million. This figure highlights its importance as a component of their overall operating costs, reflecting investment in human capital.

- Cost Component: Stock-based compensation is a key non-cash expense.

- Strategic Purpose: Used to attract and retain highly skilled employees and executives.

- Financial Reporting: Typically excluded from non-GAAP measures to show core operational performance.

- Fiscal Year 2024 Impact: amounted to $141.7 million, demonstrating its substantial nature.

Intellectual Property Licensing and Royalty Fees

Ambarella, despite its strong in-house intellectual property, may face expenses from licensing third-party technologies essential for its advanced chip designs. These licensing agreements and royalty payments are crucial for ensuring legal compliance and integrating vital industry-standard components into their products.

- Licensing Costs: Ambarella might pay fees to access patents or technologies developed by other companies, enabling them to incorporate specific functionalities into their System-on-Chips (SoCs).

- Royalty Payments: For certain licensed technologies, Ambarella could be obligated to pay a percentage of revenue or a per-unit royalty, impacting their cost of goods sold.

- Third-Party IP Integration: These costs are directly tied to the strategy of leveraging external innovations to accelerate product development and maintain a competitive edge in the semiconductor market.

Ambarella's cost structure is dominated by research and development, essential for its AI-powered semiconductor designs. As a fabless company, manufacturing expenses through foundries are a significant part of its cost of goods sold. Additionally, sales, general, and administrative costs are crucial for market expansion and customer acquisition, with stock-based compensation also representing a substantial investment in talent.

| Cost Component | Fiscal Year 2024 (Millions USD) | Significance |

|---|---|---|

| Research & Development (R&D) | $333.9 | Drives innovation and technological leadership. |

| Cost of Goods Sold (COGS) | $598.2 | Primarily foundry and manufacturing expenses for SoCs. |

| Sales, General & Administrative (SG&A) | $351.2 | Supports market presence, sales, and corporate functions. |

| Stock-Based Compensation | $141.7 | Attracts and retains key talent in a competitive industry. |

Revenue Streams

Ambarella's core revenue generation hinges on the direct sale of its sophisticated System-on-Chips (SoCs). These chips are the brains behind a variety of electronic devices, powering everything from advanced driver-assistance systems in cars to high-definition security cameras and autonomous robots.

The company's financial performance is closely tied to the volume of these SoCs shipped and the average selling price, particularly for their newer, AI-enabled processors. For instance, in the fiscal year ending January 2024, Ambarella reported total revenue of $301.9 million, demonstrating the direct impact of these sales on their overall business.

Ambarella diversifies its income beyond just selling its chips by licensing its advanced software and AI algorithms. This means other companies can use Ambarella's cutting-edge technology to create their own unique products, adding significant value beyond the hardware itself.

This licensing model allows customers to integrate Ambarella's intellectual property, such as its CVflow AI engine, into their systems, enabling them to develop specialized applications in areas like automotive and intelligent vision. This approach fosters innovation and allows Ambarella to capture value from its software development investments.

Ambarella often earns Non-Recurring Engineering (NRE) fees by providing custom development, design services, and specialized integration support to its major clients. These fees directly compensate for the focused engineering talent and specialized knowledge deployed for particular projects, a standard practice in the semiconductor sector for in-depth customer collaborations.

Strategic Partnership Royalties (Potential)

While not a primary revenue driver currently, Ambarella could explore strategic partnership royalties. This would involve receiving a percentage of revenue or profit from products that integrate Ambarella's advanced semiconductor technology. Such a model offers scalability, growing as partner products achieve wider market adoption.

This approach can be particularly effective in emerging markets where Ambarella's AI processing capabilities are in high demand.

- Royalty Agreements: A percentage-based fee on sales of partner products utilizing Ambarella's IP.

- Scalable Growth: Revenue increases directly with the market success of partner products.

- Market Penetration: Leverages partners' existing distribution channels and customer bases.

- Technology Licensing: Potential for upfront licensing fees alongside ongoing royalties.

Future Generative AI Platform Services (Emergent)

Ambarella's strategic pivot towards generative AI on edge devices opens up new avenues for revenue beyond traditional chip sales. These emergent streams could manifest as platform-as-a-service (PaaS) or subscription models, particularly leveraging their Cooper Developer Platform.

This diversification strategy aims to capture recurring revenue by offering ongoing access to AI development tools and potentially cloud-based AI processing capabilities. Such a model would complement their existing hardware offerings, creating a more robust ecosystem for AI innovation at the edge.

For instance, a subscription tier could offer enhanced AI model training, deployment support, or continuous software updates for generative AI features. This approach aligns with industry trends where specialized AI platforms are increasingly monetized through recurring service agreements.

- Platform-as-a-Service (PaaS): Offering developers access to Ambarella's AI development tools and infrastructure on a subscription basis.

- Subscription Models: Providing tiered access to cloud-based AI processing or advanced generative AI features for edge devices.

- Software Licensing: Expanding licensing of specialized AI software and algorithms integrated into their chipsets.

- Data Monetization (Potential): Exploring anonymized data insights derived from edge AI deployments for market intelligence, subject to strict privacy controls.

Ambarella's primary revenue comes from selling its advanced System-on-Chips (SoCs), which are crucial components for intelligent devices. The company also generates income by licensing its proprietary software and AI algorithms, allowing partners to integrate its technology into their own products. Furthermore, Ambarella earns Non-Recurring Engineering (NRE) fees for custom development and design services provided to key clients, reflecting the specialized support offered in semiconductor collaborations.

| Revenue Stream | Description | Fiscal Year 2024 Data (Approx.) |

| SoC Sales | Direct sale of advanced System-on-Chips. | $301.9 million (Total Revenue) |

| Software & Algorithm Licensing | Licensing of proprietary AI engines and software. | Contributes to overall revenue, specific figures not broken out. |

| NRE Fees | Custom development and design services for clients. | Contributes to overall revenue, specific figures not broken out. |

Business Model Canvas Data Sources

The Ambarella Business Model Canvas is built upon a foundation of market intelligence, competitive analysis, and internal financial reports. These sources provide a comprehensive view of customer needs, industry trends, and operational capabilities.