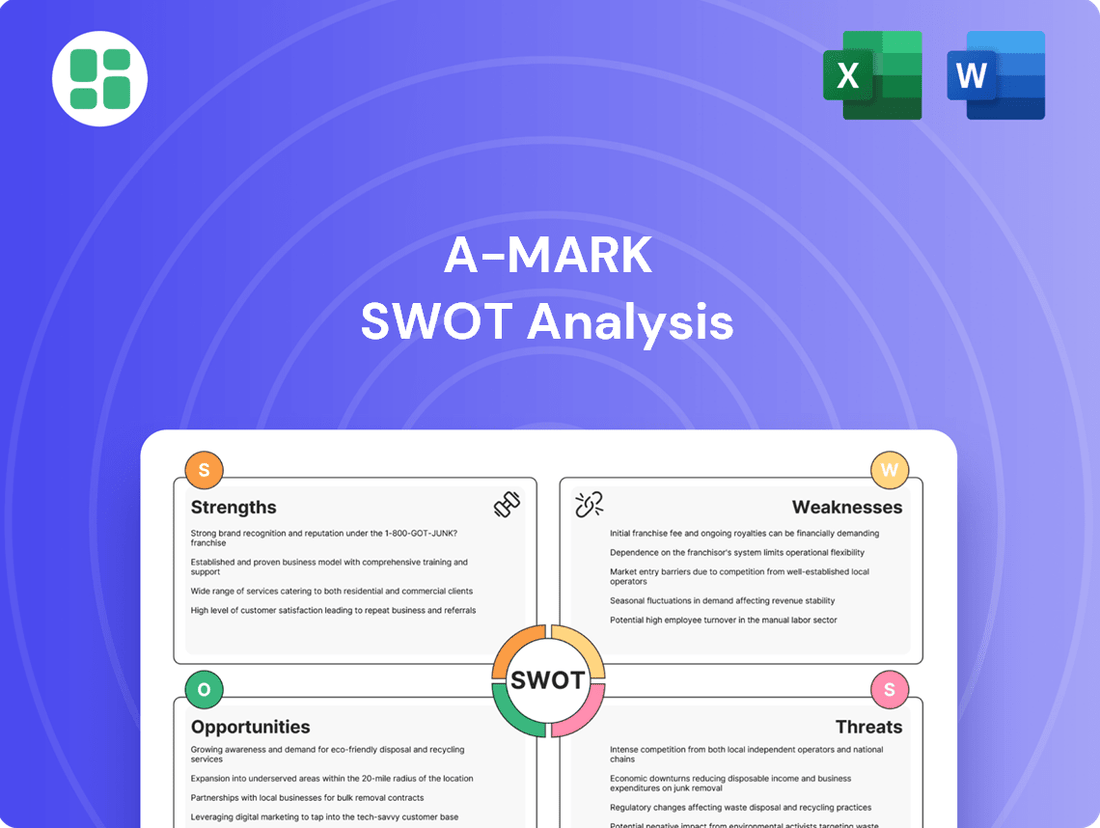

A-Mark SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A-Mark Bundle

A-Mark's robust market presence and established brand are significant strengths, but understanding the competitive landscape and potential regulatory shifts is crucial. Our full SWOT analysis dives deep into these factors, offering actionable strategies to leverage opportunities and mitigate threats.

Want the full story behind A-Mark's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

A-Mark's core strength lies in its fully integrated precious metals platform, which covers everything from wholesale trading and e-commerce to crucial services like financing, storage, and logistics. This end-to-end control allows A-Mark to capture more value across the entire supply chain and cater to a global clientele with a broad spectrum of offerings.

This integrated model proved particularly resilient during the fiscal year ending March 31, 2024, where A-Mark reported record revenue of $11.9 billion, demonstrating its ability to perform robustly even amidst fluctuating market conditions. The company's diversified revenue streams, facilitated by this comprehensive platform, contributed to a net income of $114.1 million for the same period.

A-Mark's strength lies in its extensive product and service portfolio, covering gold, silver, platinum, and palladium in forms like bullion, coins, and bars. This broad offering ensures it can meet diverse customer demands across the precious metals market.

The company further diversifies by providing crucial value-added services such as financing, hedging, and secure storage solutions. This comprehensive approach caters to a wide spectrum of clients, from individual investors to major financial institutions, reducing dependence on any single revenue stream.

A-Mark has strategically grown through key acquisitions, notably integrating LPM Group Limited to establish a significant presence in the Asian market. This move, coupled with the acquisition of Spectrum Group International, which includes the well-regarded Stack's Bowers Galleries, and AMS Holding, LLC, has effectively broadened A-Mark's reach into the lucrative premium collectible and numismatic sectors.

These strategic moves are designed to bolster A-Mark's competitive standing, opening doors to higher-margin luxury segments and creating a platform for enhanced cross-selling opportunities. The company anticipates substantial operational synergies from these integrations, aiming to streamline processes and improve overall efficiency.

Strong Direct-to-Consumer (DTC) Growth

A-Mark's direct-to-consumer (DTC) segment is a major strength, fueled by strategic acquisitions and online expansion. Subsidiaries like JM Bullion, Goldline, AMS, and Silver Gold Bull have brought in hundreds of thousands of new customers, demonstrating substantial reach. The acquisition of the gold.com domain further bolsters its online presence, creating a more direct channel to retail investors.

This DTC focus offers a stable revenue source and fosters direct relationships with an expanding customer base. For instance, JM Bullion, a key part of this strategy, reported significant year-over-year revenue growth in recent periods, underscoring the segment's success. This direct engagement allows A-Mark to better understand and cater to the evolving needs of individual precious metals buyers.

- Expanded Customer Base: Hundreds of thousands of new customers acquired through DTC subsidiaries.

- Enhanced Online Presence: Acquisition of gold.com domain strengthens direct retail investor reach.

- Resilient Revenue Stream: DTC segment provides stable income and direct customer engagement.

- Brand Synergy: Integration of acquired brands under a unified DTC strategy.

Established Market Position and Relationships

A-Mark's enduring presence in the precious metals market, dating back to 1965, has cultivated deep-rooted relationships. This longevity translates into significant competitive advantages, particularly through its official distributorships with major government mints worldwide.

As an Authorized Purchaser for the U.S. Mint, A-Mark gains privileged access and a direct channel for sourcing key products. These established connections are not merely historical; they represent a vital ongoing strength, enabling A-Mark to operate as a leading integrated platform for precious metals.

- Established History: Founded in 1965, A-Mark possesses decades of experience.

- Key Distributorships: Holds official distributorships with major global government mints.

- U.S. Mint Authorization: An Authorized Purchaser for the U.S. Mint, ensuring direct sourcing.

- Integrated Platform: Leverages its position as a leading integrated platform for competitive advantage.

A-Mark's integrated precious metals platform is a significant strength, encompassing wholesale trading, e-commerce, financing, storage, and logistics. This comprehensive approach allows for greater value capture across the supply chain and caters to a global customer base with diverse needs.

The company's diversified revenue streams, supported by its broad product and service portfolio including gold, silver, platinum, and palladium, contribute to its financial resilience. For the fiscal year ending March 31, 2024, A-Mark achieved record revenue of $11.9 billion and a net income of $114.1 million, highlighting its robust performance.

Strategic acquisitions, such as LPM Group Limited and Spectrum Group International (including Stack's Bowers Galleries), have expanded A-Mark's reach into the Asian market and the premium collectible sectors. These moves enhance its competitive standing and create cross-selling opportunities.

A-Mark's direct-to-consumer (DTC) segment, bolstered by acquisitions like JM Bullion and Goldline, has brought in hundreds of thousands of new customers and strengthened its online presence, providing a stable revenue source and direct customer engagement.

| Metric | FY 2024 (ending Mar 31) | Significance |

|---|---|---|

| Total Revenue | $11.9 billion | Record revenue, demonstrating market strength. |

| Net Income | $114.1 million | Profitability achieved amidst market conditions. |

| DTC Customer Acquisition | Hundreds of thousands | Indicates strong growth in direct retail engagement. |

What is included in the product

Delivers a strategic overview of A-Mark’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

A-Mark's SWOT analysis provides a clear, actionable framework to identify and address potential business challenges, alleviating the pain of uncertainty.

Weaknesses

A-Mark's reliance on precious metals means its fortunes are tied to the often-turbulent price swings of gold, silver, platinum, and palladium. This inherent volatility can significantly impact the company's financial performance.

For instance, a sharp downturn in metal prices directly affects the value of A-Mark's inventory and can compress its trading margins, ultimately squeezing profitability. Recent financial reports have highlighted how fluctuating market conditions have influenced earnings, underscoring this vulnerability.

The precious metals distribution sector inherently deals with very thin operating margins. This means even small changes in market conditions or how much it costs to run the business can significantly impact profitability. For A-Mark, this is a constant challenge.

A-Mark's gross profit margin has shown a downward trend, reflecting the difficulty in staying profitable when prices are unpredictable and demand isn't as strong. For instance, in the fiscal year ending June 30, 2023, A-Mark reported a gross profit margin of 1.9%, a decrease from 2.5% in the prior year. This highlights how sensitive their earnings are to market fluctuations.

To generate substantial net income, A-Mark must maintain very high sales volumes. Even a slight dip in sales or a small increase in costs can erase potential profits due to these narrow margins.

A-Mark's significant holdings of precious metals, while essential for its business, expose the company to considerable inventory risks. Fluctuations in the market price of gold, silver, and other metals can lead to substantial depreciation, impacting the value of these assets. For instance, during periods of market volatility, the value of A-Mark's inventory could decline sharply.

Financing this large inventory necessitates considerable borrowing, resulting in significant interest expenses. In the prevailing high-interest-rate environment of 2024-2025, these carrying costs can place a considerable drag on A-Mark's profitability. The company's financial reports in late 2024 and early 2025 likely reflect this pressure, with interest expenses potentially rising as a percentage of revenue.

Dependence on Market Liquidity

A-Mark's reliance on market liquidity is a significant vulnerability. Factors such as ongoing tariff concerns and broader economic uncertainties can directly impede the company's ability to trade precious metals and execute transactions smoothly. This reduced liquidity can translate into wider bid-ask spreads, making it more expensive to buy and sell, and potentially leading to trading losses.

The ease of doing business in the precious metals sector is intrinsically tied to how readily assets can be bought and sold. When market liquidity dries up, A-Mark may find it harder to manage its inventory and fulfill customer orders efficiently. For instance, during periods of heightened geopolitical tension or economic downturns, trading volumes can shrink, making it challenging for companies like A-Mark to operate at optimal capacity.

- Market Liquidity Fluctuations: Sensitive to external economic and geopolitical factors impacting trading volumes.

- Execution Challenges: Lower liquidity can lead to difficulties in executing large transactions at desired prices.

- Potential for Trading Losses: Reduced market depth can widen spreads, increasing the cost of trading and potential for losses.

- Operational Impact: Difficulty in managing inventory and fulfilling orders efficiently during illiquid periods.

Operational Challenges in Volatile Markets

Even with its integrated platform, A-Mark encounters operational hurdles in unpredictable markets. These conditions can depress premiums and dampen consumer interest in specific offerings, impacting profitability. For instance, during periods of significant price swings in precious metals, managing inventory and sales becomes more complex, potentially leading to reduced margins.

The company's ability to navigate supply chain disruptions and fluctuating demand is crucial. In 2024, the precious metals market experienced notable volatility, with gold prices fluctuating by over 10% within a single quarter. This environment necessitates agile inventory management and sales strategies to mitigate risks and capitalize on opportunities, which can strain operational resources.

- Supply Chain Strain: Volatility can disrupt the flow of precious metals, impacting A-Mark's ability to meet demand consistently.

- Inventory Management Complexity: Fluctuating prices require sophisticated inventory tracking and valuation, increasing operational overhead.

- Demand Sensitivity: Consumer demand for certain precious metal products, like silver or platinum, can be particularly sensitive to market downturns, affecting sales volumes.

A-Mark's profitability is heavily influenced by the volatile nature of precious metals prices, impacting inventory valuation and trading margins. For instance, the company's gross profit margin decreased to 1.9% in fiscal year 2023 from 2.5% in the prior year, highlighting this sensitivity.

The company faces significant inventory risk due to its substantial holdings of precious metals. Market price fluctuations can lead to sharp declines in asset values, as seen during periods of heightened market volatility in 2024.

High borrowing costs associated with financing large inventories are a concern, especially in the elevated interest rate environment of 2024-2025, potentially increasing interest expenses as a percentage of revenue.

A-Mark's operations are vulnerable to market liquidity issues, which can widen trading spreads, increase transaction costs, and potentially lead to trading losses, as experienced during periods of economic uncertainty.

Same Document Delivered

A-Mark SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of A-Mark's internal strengths and weaknesses, alongside external opportunities and threats. This detailed analysis is designed to equip you with actionable insights for strategic decision-making.

Opportunities

Global economic and geopolitical uncertainties are fueling a strong appetite for safe-haven assets. Inflation concerns and the anticipation of potential interest rate cuts in 2025 further bolster the appeal of precious metals like gold and silver. This sustained demand provides a significant tailwind for A-Mark's core business of precious metals trading and related services.

A-Mark's strategic acquisitions of Spectrum Group International and AMS Holding, LLC in recent years have significantly bolstered its presence in the high-margin collectibles market, particularly in luxury and collectible coins. This move diversifies revenue streams beyond traditional precious metals, tapping into a segment known for its enhanced profitability. For instance, the precious metals sector, while stable, often operates on tighter margins compared to niche collectibles. This expansion positions A-Mark to leverage cross-selling opportunities, offering a broader suite of products to its existing clientele and attracting new customers interested in tangible assets with potential appreciation.

The precious metals industry is increasingly moving online, attracting new demographics like Gen Z who are engaging with gold via digital avenues. This digital shift presents a significant opportunity for companies with a strong online footprint.

A-Mark is well-positioned to leverage this trend through its established e-commerce platforms, JM Bullion and Gold.com. These platforms allow access to a wider customer base, including younger investors who prefer digital transactions.

Continued investment in logistics automation by A-Mark further enhances its ability to serve this growing digital demand efficiently. In 2023, e-commerce sales in the U.S. reached over $1.1 trillion, demonstrating the substantial market potential for digitally-native businesses.

Potential for Further Strategic Acquisitions

A-Mark has a clear strategy focused on mergers and acquisitions to bolster its global presence and solidify its market leadership. This proactive approach to M&A is a significant opportunity for growth.

The current market environment, described by A-Mark's CEO as softer, could present advantageous opportunities to acquire smaller competitors or businesses that offer complementary services. Such strategic moves can accelerate expansion and enhance market share.

- Strategic M&A: A-Mark's stated objective to expand internationally and consolidate its leadership through acquisitions remains a key opportunity.

- Favorable Market Conditions: A softer market in 2024 and 2025 could allow for more attractive valuations of potential acquisition targets.

- Consolidation Play: Acquiring smaller players or businesses with synergistic capabilities can drive significant future growth and market dominance.

Leveraging Global Supply Chain Disruptions

Persistent supply deficits in precious metals, particularly silver and platinum, are projected to continue through 2024 and into 2025, driven by geopolitical factors and reduced mining output. For instance, global silver mine production saw a slight decline in 2023, and forecasts for 2024 suggest a similar trend, exacerbating existing shortages. These ongoing supply chain challenges inherently create upward pressure on metal prices and simultaneously boost demand for dependable distributors capable of navigating these complexities.

A-Mark, with its established global network and strong relationships with mints worldwide, is strategically positioned to capitalize on these market dynamics. The company's ability to secure consistent supply amidst scarcity allows it to meet the escalating demand from investors and industrial consumers alike.

- Securing Supply: A-Mark's established mint relationships provide an advantage in securing limited metal inventories.

- Meeting Demand: The company can fulfill increased customer orders driven by price appreciation and supply concerns.

- Price Volatility: Higher metal prices translate to greater revenue potential for distributors like A-Mark.

- Market Share Growth: Reliability in a disrupted market can attract new customers and increase market share.

A-Mark's strategic acquisitions have broadened its reach into the high-margin collectibles market, particularly luxury and collectible coins, diversifying revenue beyond traditional precious metals. This expansion into collectibles, which often command higher profit margins than bulk precious metals, positions A-Mark to leverage cross-selling opportunities and attract a wider customer base interested in tangible assets with appreciation potential.

The increasing digitalization of the precious metals industry presents a significant opportunity for A-Mark, given its robust e-commerce platforms like JM Bullion and Gold.com. These platforms are crucial for reaching younger demographics, such as Gen Z, who prefer digital transactions and online engagement with assets like gold. The continued investment in logistics automation further enhances A-Mark's capacity to efficiently serve this growing digital demand, mirroring the substantial market growth seen in U.S. e-commerce, which surpassed $1.1 trillion in 2023.

Persistent supply deficits in precious metals like silver and platinum, projected to continue through 2024 and 2025 due to geopolitical factors and reduced mining output, create upward price pressure and boost demand for reliable distributors. A-Mark's established global network and strong mint relationships enable it to secure consistent supply amidst scarcity, allowing it to meet escalating demand from investors and industrial consumers.

The current market environment, characterized by a softer tone in 2024 and 2025, offers advantageous opportunities for A-Mark to pursue strategic mergers and acquisitions. Acquiring smaller competitors or businesses with complementary services can accelerate expansion, enhance market share, and consolidate A-Mark's leadership position in the precious metals and collectibles sectors.

Threats

A significant and sustained drop in precious metal prices, particularly gold and silver, poses a primary threat to A-Mark's profitability. For instance, gold prices saw a notable decline in early 2024, dipping below $2,000 per ounce at times, impacting the valuation of holdings. Such a decline would reduce the value of its substantial inventory, compress trading margins, and could deter investor demand for precious metals.

The precious metals market, though niche, sees competition from a spectrum of entities, from fellow wholesale distributors and burgeoning online platforms to established financial giants. This diverse competitive landscape necessitates continuous adaptation and innovation for A-Mark to maintain its standing.

Intensifying competitive pressures are evident in A-Mark's Q1 2025 performance. Despite achieving revenue growth, the company experienced a measurable decline in market share during that quarter, underscoring the significant challenge posed by rivals in capturing and retaining customer segments.

The precious metals sector faces a dynamic regulatory landscape, impacting companies like A-Mark. Evolving rules around anti-money laundering (AML) and international trade present ongoing challenges. For instance, in 2024, the Financial Action Task Force (FATF) continued to emphasize robust AML frameworks, requiring significant investment in compliance technology and personnel for businesses operating globally.

Shifts in trade policies, such as potential adjustments to tariffs or import/export regulations, could directly affect A-Mark's operational costs and logistical complexities. Increased compliance burdens, often stemming from new legislation or stricter enforcement, can translate into higher overheads and necessitate greater resources dedicated to ensuring adherence to all applicable laws.

Economic Downturns and Reduced Discretionary Spending

Economic downturns pose a significant threat to A-Mark. A widespread recession or periods of financial instability can directly impact consumer demand for precious metals, particularly within the direct-to-consumer market. This is because precious metals, while often seen as a safe haven, may face reduced discretionary investment during severe economic contractions.

For instance, historical data from 2022 and 2023 showed fluctuations in precious metal demand linked to inflation concerns and interest rate hikes, indicating consumer sensitivity to broader economic conditions. Should a similar or more pronounced downturn occur in late 2024 or 2025, A-Mark could experience a slowdown in sales as consumers prioritize essential spending over investment in assets like gold and silver.

- Reduced Consumer Demand: Economic instability can lead consumers to cut back on non-essential purchases, impacting sales of precious metals.

- Impact on Investment: Even as a safe haven, precious metals might see less investment during severe downturns due to overall reduced disposable income.

- Market Volatility: Economic uncertainty often correlates with increased volatility in commodity markets, including precious metals, which can deter some investors.

Cybersecurity Risks and Operational Security

A-Mark's reliance on integrated digital platforms and significant e-commerce operations exposes it to substantial cybersecurity risks. A data breach or operational security lapse, such as the theft or loss of high-value precious metals, could severely damage its reputation and financial standing. For instance, the global cybersecurity market was projected to reach over $345 billion in 2024, highlighting the pervasive nature of these threats.

Operational security is equally critical, given A-Mark's role in handling physical assets. The potential for theft or loss of precious metals directly impacts inventory and profitability. In 2023, the precious metals market experienced significant volatility, making robust security measures paramount to mitigate losses from such events.

- Cybersecurity Vulnerabilities: A-Mark's digital infrastructure is a prime target for cyberattacks, with potential for data breaches impacting customer information and financial transactions.

- Operational Security Lapses: The physical handling of precious metals presents risks of theft or loss, directly affecting inventory value and company assets.

- Reputational Damage: Security incidents can erode customer trust and severely harm A-Mark's brand image, leading to decreased business.

- Financial Impact: Breaches or asset losses can result in significant financial penalties, recovery costs, and lost revenue, impacting overall performance.

A significant threat to A-Mark is the potential for a substantial decline in precious metal prices, as seen with gold dipping below $2,000 per ounce at times in early 2024. This price volatility directly impacts inventory valuation and trading margins. Furthermore, A-Mark faces intense competition from various players, including online platforms and financial institutions, as evidenced by a noticeable market share decline in Q1 2025 despite revenue growth.

Regulatory changes, particularly around anti-money laundering (AML) as emphasized by the FATF in 2024, necessitate ongoing investment in compliance. Economic downturns also pose a risk, as historical data from 2022-2023 shows consumer sensitivity to inflation and interest rates, potentially reducing demand for precious metals in late 2024 and 2025. Finally, cybersecurity threats are a major concern, with the global market projected to exceed $345 billion in 2024, and operational security lapses involving physical assets could lead to significant financial and reputational damage.

| Threat Category | Specific Risk | Impact on A-Mark | Relevant Data/Example |

| Market Price Volatility | Sustained drop in precious metal prices | Reduced inventory valuation, compressed margins | Gold prices below $2,000/oz in early 2024 |

| Competition | Increased rivalry from online platforms and financial giants | Market share erosion, pressure on pricing | Market share decline in Q1 2025 |

| Regulatory Environment | Stricter AML and trade regulations | Increased compliance costs, operational complexity | FATF emphasis on robust AML frameworks (2024) |

| Economic Conditions | Recessions and financial instability | Reduced consumer demand, lower investment | Consumer sensitivity to rates/inflation (2022-2023) |

| Cybersecurity & Operational Security | Data breaches, theft/loss of physical assets | Reputational damage, financial losses | Global cybersecurity market > $345 billion (2024) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from A-Mark's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic assessment.