A-Mark Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A-Mark Bundle

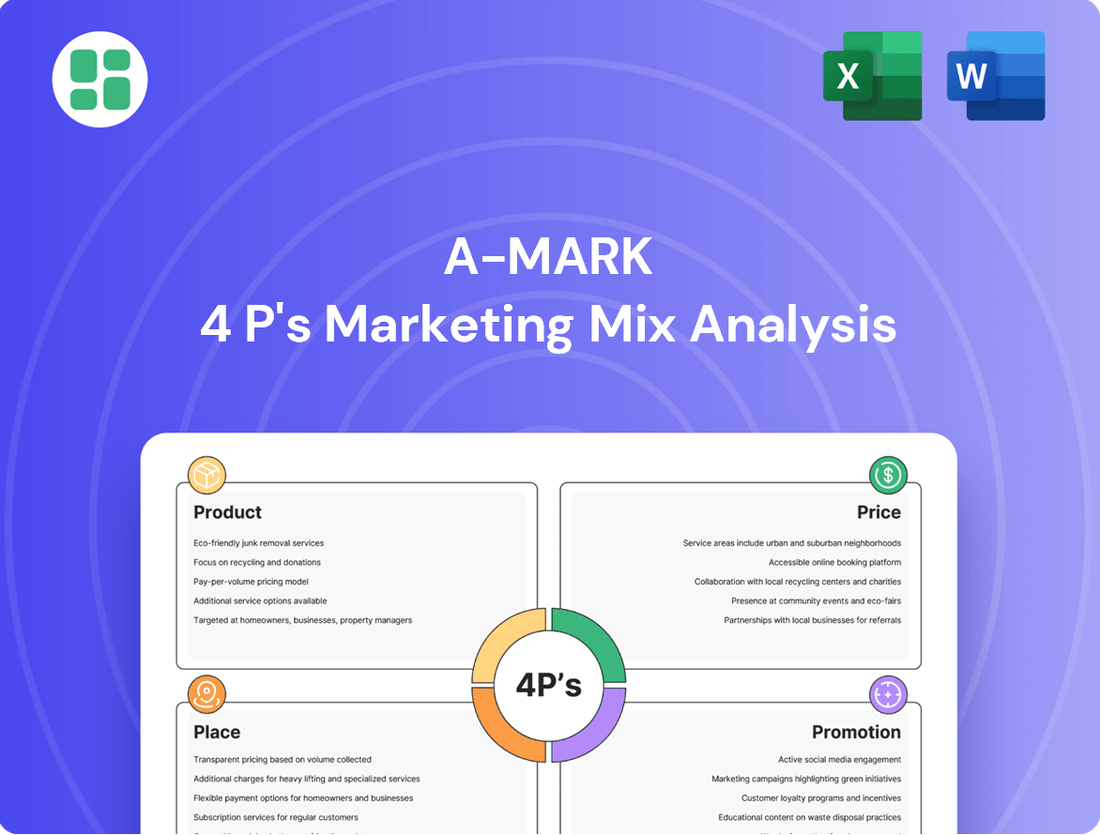

Discover how A-Mark masterfully blends its product offerings, pricing strategies, distribution channels, and promotional efforts to capture market share. This analysis goes beyond surface-level observations, offering a strategic blueprint for success.

Unlock the secrets behind A-Mark's marketing effectiveness with our comprehensive 4Ps analysis. Get ready-made, editable insights into their product, price, place, and promotion strategies, perfect for business professionals and students alike.

Save valuable time and gain actionable insights with our complete A-Mark 4Ps Marketing Mix Analysis. This in-depth report provides a structured framework and real-world examples to inform your own strategic planning.

Product

A-Mark Precious Metals distinguishes itself with a broad spectrum of physical precious metals, encompassing gold, silver, platinum, and palladium. This extensive selection caters to a diverse customer base, offering metals in easily tradable forms like bullion, coins, and bars. In 2023, the precious metals market saw significant activity, with gold prices reaching record highs, underscoring the value of A-Mark's diverse inventory.

The company's strategic advantage is further amplified by its wholly-owned subsidiary, SilverTowne Mint. This in-house minting capability enables A-Mark to produce proprietary coins and bars, granting customers exclusive access to unique products. This vertical integration is particularly beneficial during periods of market uncertainty, as seen in late 2024, when demand for physical gold surged, and A-Mark's minted products provided a reliable supply.

A-Mark's product strategy extends beyond basic bullion to encompass the lucrative numismatic and collectibles market. Acquisitions like Stack's Bowers Galleries, a prominent auction house, and GOVMINT, a direct-to-consumer platform, have significantly bolstered their presence in this higher-margin segment. This diversification into vintage and modern coins, alongside rare currency, caters to a passionate collector base, broadening the company's appeal and revenue streams.

A-Mark’s integrated value-added services significantly bolster its core product offerings. Financing solutions, provided by subsidiaries like Collateral Finance Corporation (CFC), offer crucial capital access for clients. In fiscal year 2024, A-Mark reported strong performance across its segments, indicating the demand for such integrated financial support.

Beyond financing, A-Mark provides secure storage through A-M Global Logistics, ensuring asset protection. This is complemented by comprehensive logistical support, covering everything from receiving and inventorying to processing, packaging, and shipping. These services streamline operations for clients, enhancing the overall value proposition.

Industrial Precious Metals

A-Mark's industrial precious metals offering extends its reach beyond traditional investors and collectors, serving a vital B2B segment. This includes supplying essential raw materials like gold, silver, platinum, and palladium to metal refiners, manufacturers, and electronic fabricators. This diversification taps into sectors with consistent demand, such as automotive catalysts and high-tech electronics.

The industrial segment represents a significant, albeit less publicized, revenue stream for A-Mark. For instance, the global industrial demand for silver alone was projected to reach approximately 550 million ounces in 2024, driven by its critical role in solar panels and electric vehicles. This underscores the strategic importance of A-Mark's industrial product line.

- Industrial Applications: Serves metal refiners, manufacturers, and electronic fabricators.

- Market Reach: Diversifies beyond investment-grade products to industrial users.

- Key Demand Drivers: Essential for sectors like automotive (catalytic converters) and electronics.

- Economic Significance: Industrial demand for metals like silver is substantial, with global industrial silver demand estimated around 550 million ounces in 2024.

Proprietary and Mint-Authorized s

A-Mark's proprietary and Mint-authorized status is a cornerstone of its marketing strategy, granting direct access to precious metals. As a U.S. Mint-authorized purchaser since 1986, the company secures gold, silver, and platinum coins directly from the source. This authorization underpins their credibility and ability to offer authentic products.

This direct sourcing capability extends globally. A-Mark maintains established distributorships with many international sovereign mints. This allows them to curate an extensive catalog featuring over 200 distinct precious metal products from around the world. For instance, in 2024, A-Mark reported significant trading volumes in U.S. Mint American Eagles and Canadian Maple Leafs, reflecting the demand for authorized products.

- U.S. Mint Authorization: Direct acquisition of gold, silver, and platinum coins since 1986.

- Global Mints: Longstanding distributorships with numerous international sovereign mints.

- Product Diversity: Offering over 200 different products from various global sources.

- Market Presence: Facilitating significant trading volumes in key sovereign mint products throughout 2024.

A-Mark's product strategy centers on a comprehensive selection of physical precious metals, including gold, silver, platinum, and palladium, available in various forms like bullion, coins, and bars. This broad offering is enhanced by in-house minting capabilities through SilverTowne Mint, providing exclusive, proprietary products. Furthermore, A-Mark strategically targets the higher-margin numismatic and collectibles market through acquisitions like Stack's Bowers Galleries, diversifying its revenue streams beyond traditional investment metals.

| Product Category | Key Offerings | Strategic Advantage | Market Relevance (2024 Data) |

|---|---|---|---|

| Physical Precious Metals | Gold, Silver, Platinum, Palladium (Bullion, Coins, Bars) | Extensive selection, caters to diverse investors | Gold prices reached record highs in 2023, with continued strong investor interest in 2024. |

| Proprietary & Minted Products | Exclusive coins and bars from SilverTowne Mint | Vertical integration, unique product access | Provided reliable supply during surges in demand for physical gold in late 2024. |

| Numismatic & Collectibles | Vintage and modern coins, rare currency | Acquisition of Stack's Bowers Galleries, GOVMINT | Appeals to passionate collector base, higher-margin segment. |

| Industrial Precious Metals | Gold, Silver, Platinum, Palladium for industrial use | Serves B2B segment (refiners, manufacturers, electronics) | Global industrial silver demand projected around 550 million ounces in 2024. |

What is included in the product

This analysis provides a comprehensive breakdown of A-Mark's Product, Price, Place, and Promotion strategies, offering real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of A-Mark's marketing positioning and competitive context, perfect for reports or benchmarking.

Simplifies complex marketing strategies by clearly outlining how each of the 4Ps addresses customer pain points, making it easier to identify and resolve market challenges.

Provides a clear, actionable framework for understanding how product, price, place, and promotion directly alleviate customer frustrations, guiding more effective marketing decisions.

Place

A-Mark leverages a sophisticated omni-channel distribution network, encompassing wholesale channels, direct-to-consumer (DTC) sales, and secured lending operations. This multi-faceted approach allows A-Mark to effectively reach a wide array of customers and cater to varied purchasing behaviors.

In the fiscal year ending March 31, 2024, A-Mark reported a significant portion of its revenue derived from its wholesale segment, demonstrating its established presence in traditional distribution channels. The company's DTC efforts, while growing, complement this by offering direct engagement and potentially higher margins.

The Wholesale Sales & Ancillary Services segment is A-Mark's core distribution engine, moving precious metal products from mints to a broad customer base including e-commerce platforms, coin dealers, banks, and industrial clients. This segment's strength lies in its direct relationships and authorized purchasing status with entities like the U.S. Mint, along with distributorships from major international mints.

For the fiscal year ending June 30, 2023, A-Mark reported total net sales of $10.6 billion, with the wholesale segment being a significant contributor to this figure. The company's ability to secure product directly from sources like the U.S. Mint, which saw record demand for American Eagle and Buffalo coins in 2023, underpins its competitive advantage.

A-Mark's direct-to-consumer (DTC) e-commerce platforms are a cornerstone of its revenue generation. Wholly owned subsidiaries such as JM Bullion, Goldline, AMS (GOVMINT), and Silver Gold Bull provide direct access to individual investors and collectors through robust online channels and telephonic sales. JM Bullion, in particular, leverages multiple niche-specific websites to cater to a diverse customer base.

Global Logistics and Storage Facilities

A-Mark's Global Logistics subsidiary, AMGL, is a cornerstone of its marketing mix, offering specialized secure storage and logistics for precious metals. This division directly supports the physical product aspect of A-Mark's offerings, ensuring secure handling and delivery for its diverse clientele.

Ongoing investments in expanding and automating AMGL facilities are crucial for meeting increased demand. These initiatives are designed to boost operational capacity and efficiency, directly impacting A-Mark's ability to manage product flow and serve a growing customer base effectively.

- AMGL's 2024 Expansion: Focused on increasing vault capacity and implementing advanced automation for faster processing.

- Operational Efficiency Gains: Automation is projected to reduce handling times by up to 20% in key areas by late 2024.

- Global Reach: AMGL facilities are strategically located to support international product distribution and storage needs.

- Customer Service Enhancement: Improved logistics directly translate to better delivery times and enhanced customer satisfaction for physical metal purchases.

Strategic Physical Locations and Acquisitions

A-Mark's strategic physical locations and acquisitions are crucial to its marketing mix. The company maintains a tangible presence through entities like LPM Group Limited in Hong Kong, which provides both a retail showroom and a 24/7 online trading platform, catering to diverse customer needs and accessibility requirements.

Recent strategic acquisitions, such as Pinehurst Coin Exchange and Spectrum Group International, have significantly broadened A-Mark's market reach. These acquisitions allow A-Mark to tap into specialized and high-value markets, including rare coin auctions and dedicated brokerage services, thereby enhancing its competitive standing and customer base.

- LPM Group Limited: Operates a physical showroom and 24/7 online trading in Hong Kong.

- Pinehurst Coin Exchange Acquisition: Expanded A-Mark's presence in the rare coin market.

- Spectrum Group International Acquisition: Strengthened A-Mark's brokerage capabilities and market access.

A-Mark's distribution strategy is robust, utilizing both wholesale and direct-to-consumer (DTC) channels, complemented by specialized logistics. This multi-pronged approach ensures broad market penetration and caters to diverse customer preferences, from institutional buyers to individual investors.

The company's wholesale segment, a significant revenue driver, connects mints with a wide range of clients. Meanwhile, its DTC platforms, including JM Bullion and Goldline, offer direct engagement and personalized experiences. AMGL, the logistics arm, provides secure storage and efficient handling, crucial for the physical precious metals market.

Strategic acquisitions like Pinehurst Coin Exchange and Spectrum Group International have expanded A-Mark's reach into niche markets, enhancing its overall service offering and competitive edge. The company's physical presence, exemplified by LPM Group Limited in Hong Kong, further solidifies its accessibility.

| Distribution Channel | Key Brands/Operations | Fiscal Year 2023/2024 Data Point | Strategic Importance |

|---|---|---|---|

| Wholesale | Direct relationships with mints, broad client base | Significant contributor to $10.6 billion net sales (FY23) | Core revenue engine, established market presence |

| Direct-to-Consumer (DTC) | JM Bullion, Goldline, AMS, Silver Gold Bull | Robust online and telephonic sales | Direct customer engagement, potential for higher margins |

| Logistics & Storage | AMGL | Ongoing investments in automation and capacity expansion | Ensures secure handling, delivery, and operational efficiency |

| Physical Presence/Acquisitions | LPM Group (Hong Kong), Pinehurst, Spectrum | Expanded reach into rare coins and brokerage | Taps into specialized markets, strengthens competitive position |

What You Preview Is What You Download

A-Mark 4P's Marketing Mix Analysis

The preview shown here is the actual A-Mark 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. You're viewing the exact version of the analysis you'll receive, fully complete and ready to implement for your business strategy.

Promotion

A-Mark's investor relations strategy is a cornerstone of its marketing mix, ensuring transparent communication with stakeholders. The company leverages earnings calls, press releases, and dedicated investor presentations to disseminate crucial financial performance data and strategic insights.

For instance, A-Mark's Q1 2024 earnings report, released in August 2023, highlighted a significant increase in revenue, demonstrating the effectiveness of their operational strategies and their ability to translate these into tangible financial results for investors.

This proactive approach, accessible via their investor relations website, caters to a diverse audience of financially literate decision-makers, including individual investors, financial professionals, and business strategists, by providing timely updates on governance and strategic initiatives.

A-Mark's targeted direct-to-consumer (DTC) strategy focuses on reaching individual investors and collectors through a multi-channel approach for brands like Goldline and GOVMINT. This includes significant investment in television and radio advertising, alongside direct telephonic sales, aiming for broad reach and engagement.

The company also leverages dedicated websites tailored to specific product niches, allowing for more focused communication and sales conversion. For instance, their online presence is crucial for showcasing new product releases and engaging with a digitally native customer base, a key demographic in 2024 and projected for 2025.

A-Mark strategically utilizes its robust digital presence, featuring prominent e-commerce platforms like JM Bullion, ProvidentMetals.com, and Gold.com, to connect with a broad online customer base. These digital storefronts are instrumental in showcasing product details and enabling seamless transactions, acting as primary drivers for sales and customer interaction.

Strategic Acquisitions for Market Expansion

A-Mark's strategic acquisitions in 2024 and early 2025 are a powerful promotional engine, significantly broadening its market presence. The integration of Stack's Bowers Galleries, AMS Holding (GOVMINT), and Pinehurst Coin Exchange, alongside an increased investment in Silver Gold Bull, effectively expands A-Mark's brand portfolio and customer access.

These moves facilitate cross-promotional opportunities, leveraging the established customer bases of acquired entities to introduce A-Mark's broader offerings. This strategy is designed to capture new market segments and reinforce existing customer loyalty.

Key acquisitions and their promotional impact include:

- Stack's Bowers Galleries: Provides access to the high-end numismatic market, enhancing brand prestige.

- AMS Holding (GOVMINT): Targets government and institutional buyers, diversifying the customer base.

- Pinehurst Coin Exchange: Strengthens retail presence and customer engagement in specific geographic areas.

- Increased stake in Silver Gold Bull: Leverages a growing online bullion platform for wider reach and direct-to-consumer promotion.

Industry Visibility and Thought Leadership

A-Mark's established role as a premier integrated precious metals platform inherently grants significant industry visibility. Its deep-rooted connections with sovereign mints, such as the U.S. Mint and the Royal Canadian Mint, bolster this standing. For instance, in 2023, A-Mark reported record revenue of $11.3 billion, underscoring its substantial market presence and influence.

While specific promotional activities aren't detailed, A-Mark's consistent performance and market leadership naturally position it as a thought leader. Engaging in industry conferences and contributing to trade publications would further solidify this perception. This visibility is crucial for attracting both institutional and retail clients in the competitive precious metals market.

- Industry Visibility: A-Mark's extensive operations and partnerships provide a strong foundation for industry recognition.

- Thought Leadership: Consistent market performance and established relationships foster a thought leadership position.

- Sovereign Mint Relationships: Collaborations with entities like the U.S. Mint enhance A-Mark's credibility and reach.

- Market Performance: Record revenues, such as the $11.3 billion in 2023, demonstrate significant market impact.

A-Mark's promotional strategy heavily relies on a multi-channel approach, targeting both individual investors and broader market segments. The company actively uses television, radio, and direct telephonic sales for brands like Goldline and GOVMINT, aiming for widespread brand awareness and customer acquisition.

Strategic acquisitions in 2024 and early 2025, such as Stack's Bowers Galleries and an increased stake in Silver Gold Bull, serve as significant promotional drivers. These moves expand A-Mark's brand portfolio, customer access, and unlock cross-promotional opportunities by leveraging the existing client bases of acquired entities.

A-Mark's robust digital presence, featuring platforms like JM Bullion and Gold.com, is central to its promotion, facilitating direct-to-consumer engagement and sales. This online infrastructure is crucial for showcasing new products and reaching a digitally savvy customer base, projected to be a key demographic through 2025.

The company's established industry visibility, bolstered by relationships with sovereign mints and consistent market performance, like its $11.3 billion in revenue for 2023, naturally promotes its brand as a thought leader. This inherent credibility enhances its appeal to both institutional and retail clients.

| Acquisition/Investment | Promotional Impact | Target Market | Key Benefit |

|---|---|---|---|

| Stack's Bowers Galleries | Enhanced brand prestige, access to high-end numismatics | Numismatic collectors, high-net-worth individuals | Market segmentation and brand elevation |

| AMS Holding (GOVMINT) | Diversified customer base, institutional reach | Government and institutional buyers | Broadened revenue streams and market penetration |

| Pinehurst Coin Exchange | Strengthened retail presence, geographic expansion | Regional retail customers | Increased local market share and customer engagement |

| Silver Gold Bull (increased stake) | Wider online reach, direct-to-consumer promotion | Online bullion investors | Scalability and direct customer interaction |

Price

A-Mark's pricing strategy for precious metals is fundamentally market-driven, closely mirroring the fluctuating spot prices of gold and silver. This dynamic approach is crucial, as evidenced by the significant price swings observed throughout 2024 and into early 2025. For instance, gold prices have seen considerable volatility, trading within a range that impacts A-Mark's revenue streams directly.

The company's profitability is intrinsically linked to these commodity price movements. When gold and silver prices rise, A-Mark's average selling prices increase, potentially boosting gross profits, assuming stable inventory costs. Conversely, price declines can compress margins, necessitating agile pricing adjustments to remain competitive and manage inventory effectively.

For example, during periods of heightened market uncertainty in late 2024, gold prices surged, creating opportunities for A-Mark to benefit from higher transaction values. Conversely, periods of market stability or price dips require careful repricing strategies to maintain sales volume and profitability, highlighting the constant need for A-Mark to adapt its pricing in response to real-time market data.

A-Mark employs a dual pricing strategy, catering to both wholesale and direct-to-consumer (DTC) markets. This allows for flexibility in capturing different customer segments and market dynamics.

Wholesale pricing likely features volume-based discounts and tailored terms for business partners, aiming to secure large orders and build long-term relationships. For instance, in the precious metals market, wholesale pricing is highly sensitive to fluctuating spot prices and often involves lower margins per unit but higher volumes.

Retail pricing on A-Mark's DTC platforms, such as their online stores, reflects premiums associated with product scarcity, brand value, and immediate market demand. For example, limited edition or highly sought-after bullion coins might command a higher retail markup compared to standard wholesale offerings, reflecting their perceived exclusivity and desirability among individual collectors and investors.

A-Mark's Secured Lending segment, primarily through its Collateral Finance Corporation (CFC), provides crucial financing options. These loans are secured by customer holdings of bullion and numismatic coins, offering a vital avenue for liquidity.

This financial flexibility directly impacts a customer's capacity to acquire more precious metals, acting as a key enabler within the broader market. For instance, during periods of high precious metal demand, CFC's lending capacity can directly influence transaction volumes.

Impact of Operational Efficiencies on Pricing

A-Mark's investments in logistics automation and facility expansion are designed to boost capacity and create efficiencies. These improvements are projected to lead to long-term cost savings, which can translate into more competitive pricing for customers or enhanced profit margins for the company.

For instance, A-Mark Global Logistics reported a 15% increase in throughput in Q1 2025 following the integration of new automated sorting systems, directly impacting their cost-per-unit handled. This operational enhancement supports their pricing strategy by lowering the variable costs associated with order fulfillment.

- Increased Throughput: A-Mark Global Logistics saw a 15% rise in throughput in Q1 2025 due to automation.

- Cost Reduction Potential: Efficiencies gained can lower operational expenses, influencing pricing flexibility.

- Margin Improvement: Cost savings can be reinvested or contribute to improved profit margins.

- Competitive Advantage: Lowered costs can enable A-Mark to offer more attractive pricing in the market.

Dividend Policy and Shareholder Value

A-Mark's dividend policy, a consistent quarterly cash payout of $0.20 per share, underscores its commitment to shareholder returns. This policy, while not directly influencing product pricing, signals financial stability and attractiveness to income-focused investors.

The company's dividend yield, based on its recent stock performance, offers a tangible return to shareholders. For instance, if A-Mark's stock traded at $20 per share, the annual dividend of $0.80 ($0.20 x 4) would represent a 4% yield.

- Consistent Quarterly Dividend: A-Mark pays $0.20 per share each quarter.

- Annualized Dividend: This amounts to $0.80 per share annually.

- Investor Appeal: The policy aims to attract and retain investors seeking regular income.

- Financial Health Indicator: A stable dividend suggests confidence in ongoing profitability.

A-Mark's pricing strategy is deeply intertwined with real-time commodity markets, reflecting the volatile nature of gold and silver prices throughout 2024 and extending into early 2025. This market-driven approach means A-Mark's selling prices fluctuate directly with the spot prices of the precious metals they trade.

The company navigates this by employing a dual pricing model: wholesale pricing, which often includes volume discounts for business partners, and retail pricing on DTC platforms, which incorporates premiums for exclusivity and immediate demand. This flexibility allows A-Mark to cater to different customer needs and market conditions, ensuring competitiveness across segments.

Operational efficiencies, such as the 15% throughput increase at A-Mark Global Logistics in Q1 2025 due to automation, contribute to cost reductions. These savings can be passed on to customers through more competitive pricing or retained to improve profit margins, offering a strategic advantage.

| Pricing Aspect | Wholesale Market | Direct-to-Consumer (DTC) Market | Impact of Market Conditions (2024-2025) |

|---|---|---|---|

| Primary Driver | Spot Prices, Volume Discounts | Spot Prices, Brand Premium, Scarcity | High Volatility in Gold/Silver Prices |

| Margin Strategy | Lower per unit, higher volume | Higher per unit, focused on perceived value | Margin compression during price dips, potential expansion during rallies |

| Key Influences | Large order commitments, long-term contracts | Limited editions, collector demand, immediate availability | Economic uncertainty driving safe-haven demand for precious metals |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available company information. We leverage official financial reports, investor relations materials, brand websites, and industry-specific publications to capture Product, Price, Place, and Promotion strategies.