A-Mark Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A-Mark Bundle

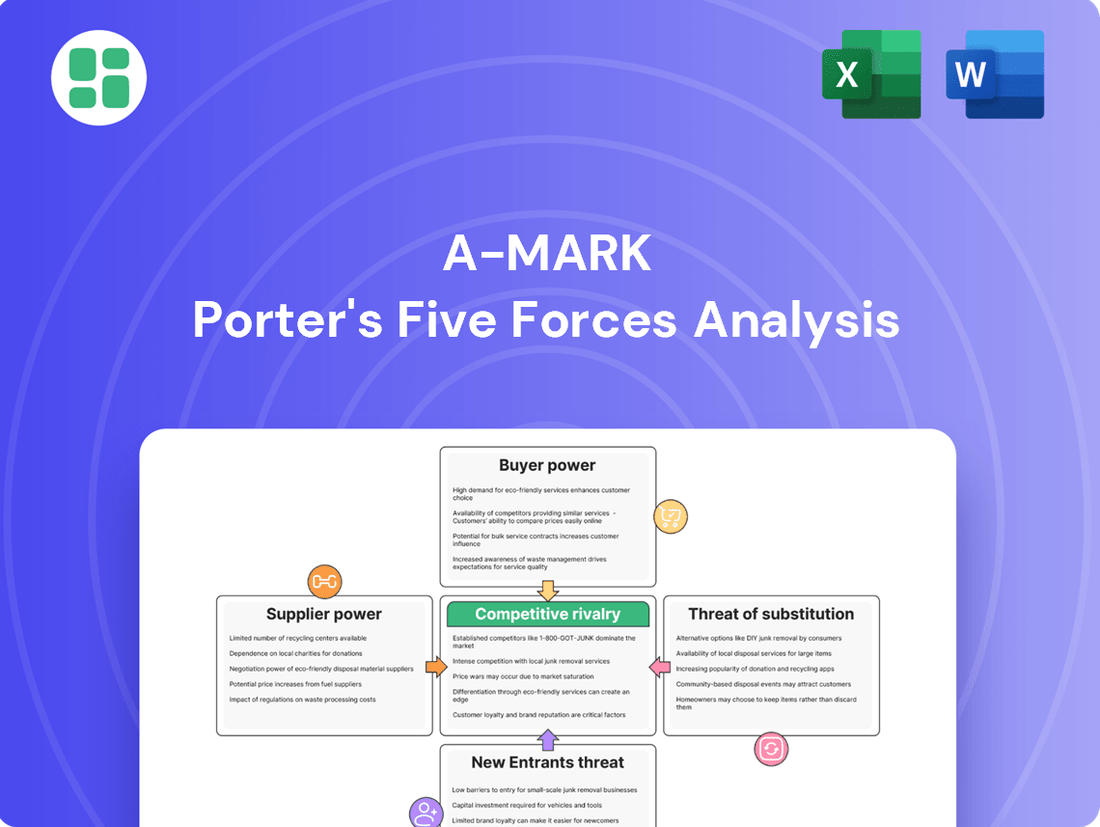

Understanding A-Mark's competitive landscape is crucial for any stakeholder. Porter's Five Forces analysis reveals how buyer power, supplier leverage, the threat of new entrants, substitutes, and industry rivalry shape A-Mark's strategic environment.

The complete report reveals the real forces shaping A-Mark’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

A-Mark's primary suppliers, such as major mining corporations and precious metal refiners, often operate within concentrated markets. This concentration means a limited number of large entities control a significant portion of the supply, granting them considerable bargaining power. For instance, in 2024, the global gold mining industry saw production dominated by a handful of major companies, with the top ten accounting for a substantial percentage of the total output. This can translate to A-Mark having fewer readily available alternatives for sourcing specific grades or quantities of precious metals, especially for large-scale transactions.

While precious metals are commodities, their inherent value and globally recognized price benchmarks, like the London Bullion Market Association (LBMA) fix, offer some buffer against extreme supplier power. A-Mark's ability to source from diverse global markets, including major producers in countries like Australia, Canada, and South Africa, further dilutes the influence of any single supplier.

For instance, in 2024, the global gold market saw production from numerous large-scale mines and recycling operations, ensuring a broad supply base. However, specific, limited-edition mint products or unique alloys might still confer a degree of pricing and availability leverage to particular suppliers, requiring A-Mark to manage these relationships carefully.

A-Mark's long-standing distributorships with sovereign mints, like the U.S. Mint since 1986, significantly bolster its position. This authorized purchaser status and deep-rooted connections mean lower switching costs for A-Mark and preferential access to products, especially crucial when supply of sovereign mint bullion tightens during market upswings.

Supplier Integration Threat is Low

The threat of forward integration by A-Mark's suppliers, such as mining companies or refiners, is considered low. This is primarily because the precious metals value chain involves distinct operational complexities and significant capital investment at each stage. For instance, a mining company's expertise lies in extraction, not in the intricate logistics and regulatory compliance of global distribution that A-Mark specializes in.

While some refiners may engage in limited direct sales, their core competency remains metal processing, not the broader distribution network. This specialization creates a barrier to entry for suppliers looking to replicate A-Mark's integrated business model. The infrastructure and expertise required for global sourcing, secure storage, and efficient distribution are substantial, making direct forward integration by suppliers a less viable strategic option.

- Low Supplier Integration Threat: Suppliers like mining companies and refiners face high barriers to entering A-Mark's global distribution business due to specialized infrastructure and expertise requirements.

- Distinct Business Models: The precious metals value chain necessitates different skill sets and capital investments for mining, refining, and distribution, limiting supplier integration potential.

- Focus on Core Competencies: Suppliers typically concentrate on their primary operations, such as metal extraction or processing, rather than diversifying into complex distribution networks.

Impact of Geopolitical and Supply Chain Issues

Geopolitical events, trade policies, and supply chain disruptions significantly impact the availability and cost of precious metals from suppliers. For instance, recent US tariffs and ongoing global conflicts can alter sourcing strategies and pricing structures. This dynamic often shifts bargaining power towards suppliers located in more stable regions or those demonstrating robustly diversified logistics networks.

The impact of these disruptions is tangible. For example, in 2023, the London Metal Exchange (LME) saw increased volatility in nickel prices, partly influenced by geopolitical tensions and supply chain uncertainties, illustrating how external factors can empower suppliers by creating scarcity or price spikes.

- Geopolitical Instability: Events like regional conflicts can disrupt mining operations and transportation routes, limiting supply and increasing costs.

- Trade Policies: Tariffs and trade disputes can make certain sourcing regions less viable, concentrating demand on fewer, more politically stable suppliers.

- Supply Chain Vulnerabilities: Disruptions from natural disasters or logistical bottlenecks can reduce the overall availability of precious metals, strengthening the position of suppliers with reliable operations.

- Supplier Concentration: When a few key suppliers control a significant portion of the market, especially in times of global uncertainty, their bargaining power naturally increases.

A-Mark's suppliers, primarily large mining corporations and refiners, hold moderate bargaining power due to market concentration. For instance, in 2024, the top ten gold mining companies controlled a significant share of global production, limiting A-Mark's alternatives for specific metal grades. While global sourcing and commodity pricing offer some leverage, unique products can still grant suppliers pricing influence.

| Supplier Characteristic | Impact on A-Mark | 2024 Data/Trend |

|---|---|---|

| Market Concentration | Moderate to High Power | Top 10 gold miners accounted for a substantial portion of global output. |

| Product Differentiation | Moderate Power (for unique items) | Limited-edition mint products or specific alloys can increase supplier leverage. |

| Global Sourcing Availability | Lowers Supplier Power | Production from diverse regions like Australia, Canada, and South Africa offers alternatives. |

| Supplier Forward Integration Threat | Low | High capital and expertise barriers prevent suppliers from entering A-Mark's distribution model. |

What is included in the product

This analysis dissects the competitive forces impacting A-Mark, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the precious metals industry.

Effortlessly identify and mitigate competitive threats with a visual, actionable breakdown of each Porter's Five Forces element.

Customers Bargaining Power

Customers, whether they are major institutional investors or individual shoppers on e-commerce platforms, exhibit a strong sensitivity to price. This is largely because precious metals are commodities traded on a global scale. Even small variations in price can significantly influence where customers choose to buy, pushing companies like A-Mark to maintain highly competitive pricing strategies.

The bargaining power of customers in the precious metals market, particularly concerning A-Mark, is significantly influenced by low switching costs. Because bullion and coins are largely standardized commodities, buyers can easily shift their business from one dealer to another without incurring substantial penalties or needing to relearn processes. This makes it simple for customers to shop around for the best available prices and terms.

This ease of switching directly empowers customers. For instance, in 2024, the average bid-ask spread for gold bullion remained competitive across major dealers, often within a tight range, allowing informed buyers to leverage price differences. When a customer can readily find comparable products elsewhere, their ability to negotiate better deals or demand more favorable terms from any single supplier, including A-Mark, is amplified.

A-Mark's diverse customer base, spanning wholesale traders, e-commerce retailers, financial institutions, and industrial users globally, significantly mitigates the bargaining power of individual customer segments. This broad reach means no single customer group holds substantial leverage over A-Mark's pricing or terms, as their revenue contributions are balanced across various sectors. For instance, in fiscal year 2023, A-Mark reported revenue of $10.7 billion, with no single customer accounting for more than 10% of total revenue, underscoring this diversification.

Growth of Direct-to-Consumer Channels

A-Mark's strategic move into direct-to-consumer (DTC) channels, exemplified by its ownership of brands like JM Bullion and GOVMINT, has significantly broadened its market access. This diversification allows A-Mark to connect with a wider customer base, bypassing traditional intermediaries.

While the DTC model increases the sheer number of individual customers, the bargaining power of any single customer within this segment remains inherently low. The vast quantity of individual transactions means that the departure or demands of one customer have a negligible impact on A-Mark's overall sales volume or pricing power.

- DTC Expansion: A-Mark's acquisition and growth of JM Bullion and GOVMINT represent a significant push into direct customer engagement.

- Customer Volume: The DTC segment inherently deals with a large number of individual buyers.

- Individual Bargaining Power: Despite the volume, each individual customer in the DTC channel possesses minimal bargaining power due to the scale of A-Mark's operations.

- Market Reach: This DTC strategy enhances A-Mark's ability to reach and serve a broader spectrum of the precious metals market directly.

Access to Value-Added Services

A-Mark's provision of integrated value-added services significantly bolsters customer loyalty, thereby diminishing the bargaining power of customers. Services like financing and logistical support, offered through entities such as Collateral Finance Corporation and A-M Global Logistics, create a comprehensive ecosystem that discourages customers from seeking alternative, potentially cheaper, providers for individual components of their precious metals transactions.

These bundled offerings foster customer stickiness by offering convenience and reducing the friction associated with managing multiple vendors. For instance, in 2024, A-Mark's ability to seamlessly integrate financing and storage solutions for large institutional clients meant these clients were less likely to be swayed by minor price differences from competitors who could not offer the same level of integrated service.

- Integrated Service Offering: A-Mark provides financing, storage, and logistics, creating a one-stop shop for precious metals needs.

- Customer Stickiness: These services reduce the incentive for customers to switch based solely on price, as switching would mean disrupting a consolidated service chain.

- Differentiation: The comprehensive nature of these value-added services differentiates A-Mark from competitors, weakening the bargaining power of customers who rely on these integrated solutions.

The bargaining power of customers for A-Mark is generally moderate, influenced by price sensitivity and low switching costs for standardized products like bullion. However, A-Mark mitigates this by serving a diverse customer base, with no single customer dominating revenue, as seen in fiscal year 2023 where no customer exceeded 10% of their $10.7 billion revenue.

A-Mark's expansion into direct-to-consumer (DTC) channels, such as JM Bullion and GOVMINT, increases customer volume but keeps individual bargaining power low due to the sheer number of transactions. Furthermore, integrated value-added services like financing and logistics, provided through subsidiaries like Collateral Finance Corporation, create customer loyalty and reduce the incentive to switch based solely on price.

| Factor | Impact on A-Mark | Supporting Data (2023/2024) |

|---|---|---|

| Price Sensitivity | High for standardized products | Competitive bid-ask spreads for gold bullion in 2024 |

| Switching Costs | Low for commodity trading | Ease of moving between bullion dealers |

| Customer Diversification | Reduces individual leverage | No single customer >10% of $10.7B revenue (FY23) |

| DTC Channels | Increases customer volume, lowers individual power | Growth in JM Bullion and GOVMINT customer base |

| Value-Added Services | Increases customer stickiness, reduces price-based switching | Integrated financing and logistics offerings |

Preview Before You Purchase

A-Mark Porter's Five Forces Analysis

This preview showcases the complete A-Mark Porter's Five Forces analysis, offering an in-depth examination of the competitive landscape for A-Mark. You are viewing the exact document that will be delivered to you instantly upon purchase, ensuring no discrepancies or missing information. This comprehensive report is professionally formatted and ready for immediate use, providing valuable strategic insights.

Rivalry Among Competitors

The precious metals market is vast, with A-Mark active in wholesale, e-commerce, and lending. While many companies participate globally, A-Mark faces competition from both large, consolidated entities and many smaller, specialized firms, creating significant rivalry in particular market niches.

The market for standard bullion products, like gold and silver bars, is intensely competitive and often centers on price. Because these are essentially commodities, buyers can easily compare offers from different dealers. This means A-Mark faces constant pressure to keep its prices sharp and its operations lean to hold onto its customers.

For instance, in 2024, the global gold market saw significant trading volumes, with the average daily trading volume in London reaching approximately $20 billion. This high liquidity underscores the ease with which customers can switch between suppliers based on even minor price differences, forcing companies like A-Mark to be exceptionally price-aware and efficient.

A-Mark's competitive rivalry is shaped by its unique approach to differentiation, moving beyond simple product offerings. The company provides a comprehensive, fully integrated platform that encompasses not only precious metals but also crucial services like financing, secure storage, and efficient logistics.

Further bolstering its distinct market position are A-Mark's in-house minting capabilities through SilverTowne Mint. This vertical integration allows for greater control over product quality and supply. Strategic acquisitions in the numismatic sector, such as Spectrum Group International, Pinehurst Coin Exchange, and AMS Holding, have broadened A-Mark's portfolio and deepened its expertise, creating a more robust and differentiated competitive offering.

Impact of Market Volatility on Performance

The precious metals market, where A-Mark operates, is inherently volatile. Fluctuations in economic indicators and geopolitical events can drastically affect revenue and profitability. This makes it challenging to predict and manage performance consistently.

A-Mark's own fiscal Q3 2025 earnings report underscored this vulnerability. The company cited volatile market conditions and ongoing tariff concerns as factors that impacted its financial results, demonstrating how external pressures directly influence competitive standing.

- Market Susceptibility: Precious metals prices are highly sensitive to global economic stability and geopolitical tensions.

- Impact on Revenue: Volatility can lead to unpredictable swings in sales volumes and margins for companies like A-Mark.

- 2024/2025 Performance Factors: A-Mark's Q3 2025 results were directly influenced by market volatility and tariff issues, illustrating real-time challenges.

- Competitive Pressure: Companies must navigate these external forces, which can create advantages or disadvantages relative to competitors.

Strategic Acquisitions and Organic Growth

A-Mark's pursuit of strategic acquisitions, such as the integration of Pinehurst Coin Exchange, Spectrum Group International, and AMS Holding in 2024-2025, significantly escalates competitive rivalry. These moves consolidate market share, creating larger, more formidable players. This aggressive expansion into higher-margin segments directly challenges existing competitors by altering the competitive landscape and potentially forcing others to adapt their own growth strategies or risk losing ground.

The impact of these acquisitions on rivalry is multifaceted. By absorbing smaller entities or merging with complementary businesses, A-Mark not only broadens its operational reach but also gains access to new customer bases and specialized product lines. This consolidation can lead to increased pricing pressure and a more intense battle for market dominance, particularly in niche segments that were previously more fragmented. For instance, the acquisition of Spectrum Group International in 2024 brought a significant expansion of A-Mark's precious metals trading and wholesale operations, directly competing with established players in those areas.

- Market Consolidation: Acquisitions lead to fewer, larger competitors, intensifying direct rivalry.

- Product Portfolio Expansion: Entry into new or higher-margin segments forces existing players to respond.

- Increased Competitive Intensity: Aggressive growth strategies can trigger price wars or innovation races.

- Strategic Response: Competitors may pursue their own M&A or focus on differentiation to counter A-Mark's moves.

Competitive rivalry within the precious metals sector is fierce, driven by both price-sensitive commodity trading and differentiated service offerings. A-Mark navigates this landscape by integrating services like financing and logistics alongside its minting capabilities, setting it apart from pure commodity dealers.

The market for standard bullion products remains highly competitive, with price being a primary differentiator. In 2024, the sheer volume of transactions, such as the billions traded daily in London, highlights how easily customers can switch suppliers, forcing A-Mark to maintain competitive pricing and operational efficiency.

A-Mark's strategic acquisitions, including Spectrum Group International in 2024, directly intensify rivalry by consolidating market share and expanding into new segments. This aggressive expansion forces competitors to either adapt their strategies or risk losing market position.

| Competitor Type | Key Competitive Factor | A-Mark's Differentiator |

|---|---|---|

| Large Consolidated Entities | Scale, Liquidity | Integrated Services, Minting |

| Smaller Specialized Firms | Niche Expertise, Agility | Broad Product Portfolio, Financial Services |

| E-commerce Platforms | Price, Convenience | Comprehensive Platform, Storage, Logistics |

SSubstitutes Threaten

Precious metals, like gold and silver, are not the only options for investors seeking to preserve wealth or diversify portfolios. Other asset classes, including stocks, bonds, real estate, and even newer digital assets like cryptocurrencies, offer alternative avenues for capital growth and risk management. The choice between these often hinges on an investor's specific market outlook, their tolerance for risk, and their desired rate of return.

In 2025, precious metals experienced a notable price increase, with gold reaching an all-time high of over $2,500 per ounce by mid-year, fueled by escalating geopolitical tensions and persistent inflation concerns. This surge underscores their traditional appeal as safe-haven assets, attracting capital away from more volatile markets. However, this performance also means that investors might weigh the potential for further appreciation against the robust returns seen in sectors like technology, where the Nasdaq Composite Index saw a 20% gain in the first half of 2025.

For investors, exchange-traded funds (ETFs) and futures contracts offer exposure to precious metals prices without the need for physical custody, potentially substituting for direct bullion purchases. In 2024, the iShares Gold Trust (IAU) saw significant inflows, reflecting this trend, while gold futures contracts continued to be a primary hedging tool.

However, central bank gold purchases, notably by countries like Poland and Hungary in 2023 and continuing into early 2024, and increasing demand for physical assets during periods of economic uncertainty continue to support the physical market. This sustained demand for tangible assets acts as a counterforce to the substitutability offered by financial instruments.

In industrial settings, precious metals like platinum and palladium are indeed vulnerable to substitutes. For instance, the automotive sector's pivot towards electric vehicles, a trend accelerating in 2024, directly reduces demand for platinum and palladium used in catalytic converters. This shift represents a significant threat, potentially impacting their market share.

Conversely, silver is experiencing a counter-trend. Its increasing use in renewable energy technologies, particularly solar panels, is a significant growth driver. In 2023, the global solar PV capacity additions reached over 400 GW, a record high, underscoring the expanding demand for silver in this sector and mitigating substitution risks.

Changing Investor Sentiment and Economic Conditions

Investor sentiment towards precious metals, like gold and silver, is highly sensitive to macroeconomic shifts. When inflation fears rise or geopolitical tensions escalate, investors often flock to these assets as a safe haven, increasing demand. For instance, during periods of high inflation, such as seen in parts of 2022 and early 2023, gold prices often saw upward pressure.

Conversely, changes in interest rates and the strength of the U.S. dollar significantly influence the attractiveness of precious metals. As interest rates climb, holding non-yielding assets like bullion becomes less appealing compared to interest-bearing investments. Similarly, a strengthening dollar can make dollar-denominated commodities like gold more expensive for holders of other currencies, potentially dampening demand.

The appeal of precious metals as a hedge is directly tied to the perceived risks in the broader financial system. For example, in 2024, expectations around the Federal Reserve's monetary policy, including potential rate cuts, will be a key driver of investor behavior. If the dollar weakens and interest rates decline, the allure of holding physical precious metals as a store of value is likely to increase.

- Investor Preference Shifts: Investor preference for precious metals as a hedge against inflation or geopolitical instability can shift with changes in economic outlook and interest rates.

- Impact of Interest Rates: Falling interest rates and a weaker U.S. dollar tend to increase the appeal of non-yielding bullion.

- 2024 Outlook: Expectations for Federal Reserve policy, including potential rate cuts, will be a significant factor influencing precious metal demand in 2024.

Evolution of Digital Currencies

The emergence of digital currencies and blockchain technology introduces a novel threat of substitutes for traditional precious metals. These digital assets are increasingly viewed by a segment of investors, particularly those comfortable with technology, as alternative stores of value and mediums of exchange. This evolving landscape means that wealth preservation strategies may need to consider these new digital options.

For instance, by the end of 2024, the total market capitalization of cryptocurrencies reached over $2.5 trillion, demonstrating significant investor adoption and a growing acceptance as an asset class. This figure highlights the increasing relevance of digital currencies as a potential substitute, drawing capital that might otherwise flow into precious metals.

- Growing Digital Asset Adoption: The increasing market capitalization of cryptocurrencies signifies a growing investor base seeking alternative stores of value.

- Technological Appeal: Blockchain technology offers perceived benefits like decentralization and accessibility, attracting a specific demographic of investors.

- Potential Diversification: Digital currencies can offer diversification benefits, potentially reducing reliance on traditional assets like gold and silver.

- Nascent but Growing Threat: While still a developing market, the rapid growth in digital currencies represents a tangible and evolving substitute for precious metals.

The threat of substitutes for precious metals is multifaceted, encompassing both traditional financial instruments and emerging digital assets. While gold and silver have historically served as safe-haven assets, investors now have a broader array of options for wealth preservation and diversification. This includes stocks, bonds, real estate, and notably, cryptocurrencies, which are increasingly capturing investor attention as alternative stores of value.

In 2024, the market capitalization of cryptocurrencies surpassed $2.5 trillion, indicating a significant shift in investor behavior and a growing acceptance of digital assets as a viable alternative to traditional investments like precious metals. This trend is further amplified by the ease of access and perceived technological advantages offered by blockchain technology, attracting a younger, tech-savvy demographic.

Furthermore, in industrial applications, precious metals like platinum and palladium face substitution threats from technological advancements. The automotive industry's accelerated shift towards electric vehicles in 2024, for instance, directly reduces the demand for platinum and palladium used in catalytic converters, impacting their market position.

Conversely, silver's role in renewable energy, particularly solar panels, presents a mitigating factor. With global solar PV capacity additions reaching over 400 GW in 2023, the demand for silver in this growing sector is substantial, offering a counter-narrative to substitution risks.

Entrants Threaten

Entering the precious metals distribution market at A-Mark's scale demands significant financial investment. Think about the sheer cost of acquiring and securely storing large quantities of gold, silver, platinum, and palladium. In 2024, the spot price of gold alone fluctuated significantly, often exceeding $2,000 per ounce, meaning a modest inventory could easily run into tens of millions of dollars. This capital intensity creates a formidable barrier for any new player hoping to compete.

Beyond just inventory, establishing the necessary infrastructure adds to the capital burden. This includes secure, insured vaulting facilities, sophisticated logistics for transportation, and robust financial systems to manage transactions and credit. These operational necessities require substantial upfront investment, making it difficult for smaller or less capitalized entities to even consider entering the market.

A-Mark's established supplier relationships, particularly its authorized purchaser status with sovereign mints, create a significant barrier for new entrants. These long-standing connections ensure consistent and preferential access to primary sources of precious metals, a crucial advantage in a market where supply can be volatile. Replicating these deep-rooted ties and securing similar preferred access would be exceptionally difficult and time-consuming for any newcomer.

A-Mark's substantial investments in its wholesale trading, e-commerce platforms, and A-M Global Logistics create significant economies of scale. These efficiencies translate into lower per-unit costs for operations and distribution, a barrier that nascent competitors would struggle to overcome. For instance, A-Mark's 2023 fiscal year saw revenue of $10.4 billion, underscoring the sheer volume of transactions and logistical expertise that smaller entrants would need years and substantial capital to replicate.

Brand Reputation and Trust

In the precious metals sector, brand reputation and trust are absolutely critical. A-Mark, founded way back in 1965, has spent decades cultivating a solid brand and a loyal customer following. This established credibility makes it tough for newcomers to gain traction.

New entrants must overcome significant hurdles in building the same level of trust that A-Mark already commands. For instance, in 2023, A-Mark reported net sales of $10.6 billion, underscoring its substantial market presence and the trust placed in it by a vast customer base.

- Brand Loyalty: Decades of consistent service and transparent dealings foster deep customer loyalty, a difficult asset for new players to replicate quickly.

- Trust as a Barrier: In an industry where financial security is paramount, a proven track record of trustworthiness acts as a substantial deterrent to new entrants.

- Reputational Capital: A-Mark's long-standing positive reputation translates into a significant competitive advantage, requiring new entrants to invest heavily in building their own.

Regulatory and Compliance Hurdles

The precious metals market, including gold and silver, is heavily regulated. For instance, in 2024, ongoing efforts to combat financial crime meant that entities dealing with precious metals faced intensified scrutiny regarding Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These compliance requirements demand substantial investment in legal expertise, robust internal controls, and sophisticated tracking systems.

Navigating these intricate legal and regulatory landscapes presents a formidable barrier for potential new entrants. The need for specialized knowledge in areas like international trade laws, sanctions compliance, and financial reporting means that startups often struggle to establish the necessary infrastructure and expertise quickly. This complexity effectively limits the number of new players that can realistically enter the market and operate successfully.

Key compliance areas that act as deterrents include:

- Anti-Money Laundering (AML) Procedures: Implementing and maintaining effective AML programs is costly and resource-intensive.

- Know Your Customer (KYC) Requirements: Verifying customer identities and assessing risk profiles adds significant operational overhead.

- Sanctions Screening: Adherence to global sanctions lists requires continuous monitoring and updating of systems.

- Reporting Obligations: Frequent and accurate reporting to regulatory bodies demands specialized accounting and legal support.

The threat of new entrants into A-Mark's precious metals distribution market is relatively low. Significant capital investment is required for inventory, secure storage, and logistics, with gold prices often exceeding $2,000 per ounce in 2024. Established supplier relationships, particularly with sovereign mints, are difficult for newcomers to replicate, providing A-Mark with preferential access to supply.

A-Mark's economies of scale, driven by its extensive wholesale trading and logistics operations, create a cost advantage that new entrants would struggle to match. For example, A-Mark's fiscal year 2023 revenue of $10.4 billion highlights the operational volume that new players would need years and substantial capital to achieve.

The industry's stringent regulatory environment, including robust Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, adds significant compliance costs and complexity. These factors, combined with the need to build brand trust in a market where reputation is paramount, create substantial barriers to entry.

Porter's Five Forces Analysis Data Sources

Our A-Mark Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources. We leverage company annual reports, SEC filings, and investor relations materials to understand internal strategies and financial health. Additionally, industry-specific market research reports and trade publications provide crucial insights into market dynamics and competitive landscapes.