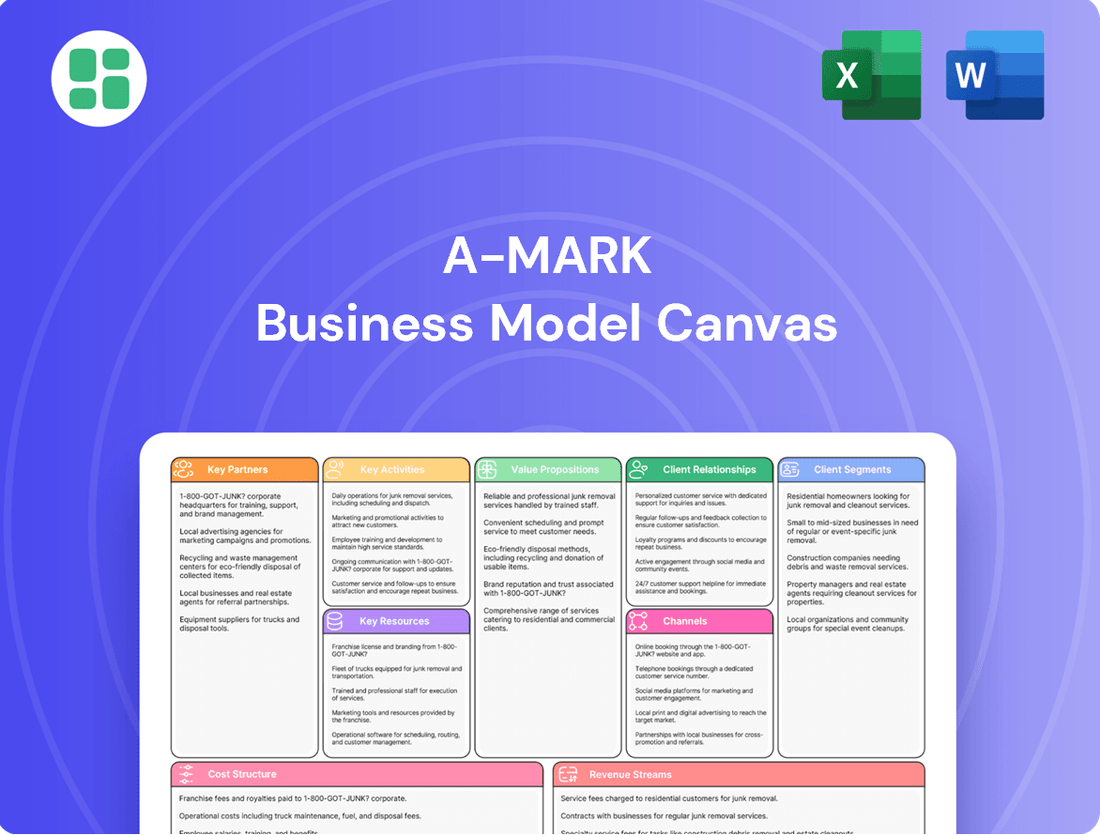

A-Mark Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A-Mark Bundle

Unlock the strategic blueprint behind A-Mark's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they connect with customers, create value, and generate revenue in their industry. Dive into the specifics and gain actionable insights for your own business.

Partnerships

A-Mark's key partnerships with sovereign mints are foundational to its business model, ensuring a steady flow of official bullion. These include long-standing relationships with the U.S. Mint, Royal Canadian Mint, South African Mint, and the Australian (Perth) Mint, guaranteeing access to popular coins and bars.

A-Mark's business model heavily relies on its extensive partnerships with e-commerce retailers and coin/bullion dealers. These collaborations are the backbone of its wholesale distribution strategy, enabling the company to efficiently get its products into the hands of a wide customer base.

This vast network allows A-Mark to serve a diverse array of smaller businesses, from independent online stores to brick-and-mortar coin shops. For instance, in fiscal year 2023, A-Mark reported that its wholesale segment served over 5,000 customers, a testament to the breadth of its dealer relationships.

These partnerships are vital for product dissemination, ensuring that A-Mark's precious metals and related products are accessible across various sales channels. The company's ability to maintain strong ties with these retailers and dealers directly impacts its market reach and overall sales volume.

A-Mark's strategic alliances with financial institutions and brokerages are foundational to its business model, particularly for its financing, lending, and hedging operations. These partnerships provide A-Mark with crucial access to capital and liquidity, allowing it to offer competitive financial products and services to its diverse client base.

These collaborations are essential for managing the inherent risks in the precious metals market. By leveraging the expertise and infrastructure of financial institutions, A-Mark can effectively hedge its positions, ensuring stability and reliability for its clients. For instance, in 2024, A-Mark's ability to secure favorable financing terms from its banking partners directly impacted its capacity to underwrite larger precious metals transactions, a key driver of its revenue growth.

Manufacturers and Fabricators

A-Mark's key partnerships with manufacturers and fabricators are crucial for its diversified business model. These collaborations allow A-Mark to supply precious metals, such as gold, silver, platinum, and palladium, directly to industrial sectors that require these materials for their production processes.

These industrial users include metal refiners, who process raw precious metals, and manufacturers and electronic fabricators, who incorporate precious metals into their finished goods. For instance, the electronics industry relies on gold and silver for their conductivity in circuit boards and connectors. In 2023, the global electronics market was valued at over $2 trillion, demonstrating the significant industrial demand for precious metals.

These partnerships are vital for A-Mark to tap into and serve the industrial demand for precious metals, moving beyond its traditional focus on investment-grade bullion. By catering to these sectors, A-Mark expands its client base and revenue streams, mitigating reliance solely on investor sentiment. This strategic approach is reflected in A-Mark's ability to manage a broad inventory and provide tailored solutions for industrial clients.

Key aspects of these partnerships include:

- Supply Chain Integration: A-Mark acts as a vital link, ensuring a consistent and reliable supply of precious metals to industrial consumers.

- Market Diversification: Serving manufacturers and fabricators allows A-Mark to access markets beyond investment and coin sales, such as automotive catalysts and specialized industrial components.

- Value-Added Services: A-Mark can offer services like custom fabrication or specific alloy formulations to meet the unique needs of its industrial partners.

- Demand Stability: Industrial demand often provides a more stable base of consumption compared to the more volatile investment market.

Acquired Subsidiaries and Affiliates

A-Mark's strategic acquisitions are pivotal partnerships that significantly enhance its market presence and product diversity. The acquisition of entities like LPM Group Limited, Silver Gold Bull (SGB), Stack's Bowers Galleries (SGI), Pinehurst Coin Exchange, and AMS Holding (GOVMINT) broadens A-Mark's reach, especially in the direct-to-consumer and collectibles markets. These moves are designed to integrate complementary businesses, thereby expanding the customer base and product portfolio.

These acquired subsidiaries and affiliates function as crucial partnerships, allowing A-Mark to tap into specialized market segments and customer demographics. For instance, Stack's Bowers Galleries provides a strong foothold in the numismatic collectibles space, a high-value segment. Silver Gold Bull enhances direct-to-consumer sales channels for precious metals. These integrations are key to A-Mark's growth strategy, aiming to capture a larger share of the precious metals and collectibles market.

- LPM Group Limited: Strengthened presence in the Asian precious metals market.

- Silver Gold Bull (SGB): Expanded direct-to-consumer sales channels and online retail capabilities.

- Stack's Bowers Galleries (SGI): Enhanced capabilities in the high-end numismatic collectibles sector.

- Pinehurst Coin Exchange & AMS Holding (GOVMINT): Diversified offerings and customer access in specific regional markets.

A-Mark's key partnerships with sovereign mints are crucial for securing a consistent supply of official bullion, including relationships with the U.S. Mint and Royal Canadian Mint. Its extensive network of e-commerce retailers and coin dealers forms the backbone of its wholesale distribution, reaching over 5,000 customers in fiscal year 2023. Strategic alliances with financial institutions are vital for financing, lending, and hedging operations, with favorable 2024 financing terms directly impacting its capacity for larger transactions.

| Partnership Type | Key Role | Example/Data Point |

| Sovereign Mints | Supply of Official Bullion | U.S. Mint, Royal Canadian Mint |

| E-commerce & Dealers | Wholesale Distribution | Served over 5,000 customers (FY23) |

| Financial Institutions | Financing, Hedging | Favorable 2024 financing terms impacting transaction capacity |

What is included in the product

A structured framework that details A-Mark's customer segments, value propositions, channels, and revenue streams, providing a clear roadmap for its precious metals trading operations.

A-Mark's Business Model Canvas offers a clear, structured approach to visualize and refine strategies, alleviating the pain of complex planning and communication.

It provides a concise, one-page overview that simplifies the understanding of intricate business models, easing the burden of disjointed strategic thinking.

Activities

A-Mark's primary function revolves around the acquisition of diverse precious metals, encompassing gold, silver, platinum, and palladium, sourced from numerous mints and manufacturers. This procurement forms the bedrock of their operations.

The company then efficiently distributes these precious metals to a worldwide clientele. This distribution network effectively serves both large-scale wholesale clients and individual retail customers, ensuring broad market reach.

In 2024, A-Mark reported significant trading volumes, underscoring the scale of their purchasing and distribution activities. For instance, their fiscal year 2024 saw substantial revenue generated through these core operations, reflecting strong market demand for precious metals.

Wholesale trading and sales is a core activity for A-Mark, involving the high-volume buying and selling of precious metals. They serve a broad customer base, including other precious metals dealers, banks, and industrial companies that use metals in their manufacturing processes.

This segment is crucial for A-Mark's liquidity and market presence, as they actively manage their inventory and pricing strategies to meet the demands of these wholesale partners. For instance, in the fiscal year ending June 30, 2023, A-Mark's wholesale segment generated a significant portion of their revenue, reflecting the substantial volume of transactions facilitated.

A key activity for A-Mark involves running multiple direct-to-consumer e-commerce sites and retail channels. These platforms, including well-known names like JM Bullion and Goldline, are crucial for selling precious metals directly to individual investors and collectors.

The company actively manages online sales, implements targeted marketing campaigns, and focuses on acquiring new customers across these diverse digital storefronts. This direct engagement is vital for building brand loyalty and driving revenue in the precious metals market.

For instance, in the fiscal year ending March 31, 2024, A-Mark's wholesale segment generated $9.8 billion in revenue, with its DTC segment contributing a significant portion, demonstrating the operational scale and importance of these e-commerce and retail activities.

Financing, Storage, and Logistics Services

A-Mark's key activities include offering vital ancillary services that bolster its core precious metals business. Through Collateral Finance Corporation (CFC), they provide secured lending, a crucial financial tool for clients needing liquidity against their precious metal holdings. This financing option is particularly valuable in the volatile commodities market, offering a stable avenue for capital.

Further enhancing their customer value proposition, A-Mark provides specialized storage solutions via A-M Global Logistics (AMGL). This ensures the secure safekeeping of precious metals, addressing a critical concern for investors and dealers alike. The company also offers comprehensive logistical support, managing the complex movement and delivery of these valuable assets efficiently and securely.

These integrated services are designed to streamline the precious metals lifecycle for their clients, from acquisition and financing to secure storage and delivery. For instance, A-Mark reported significant growth in its financing segment, with CFC's loan portfolio expanding notably in recent fiscal periods, demonstrating the demand for these specialized financial services.

- Secured Lending: Facilitated through Collateral Finance Corporation (CFC), providing liquidity against precious metal assets.

- Precious Metals Storage: Offered via A-M Global Logistics (AMGL), ensuring secure and insured safekeeping.

- Logistical Support: Managing the efficient and secure transportation and delivery of precious metals.

Minting and Product Development

A-Mark's minting operations, primarily through its SilverTowne Mint subsidiary and the strategic acquisition of Regency Mint Manufacturing assets, are central to its business model. This allows A-Mark to produce its own branded coins and bars, offering a unique product line. This vertical integration provides greater control over product quality and availability, particularly crucial when demand for precious metals surges.

The company’s minting capabilities are a key driver of its diversified product strategy. By developing proprietary products, A-Mark can cater to specific market niches and customer preferences. This also enhances supply chain flexibility, ensuring a more consistent and responsive supply of bullion products, even amidst volatile market conditions. For instance, A-Mark's ability to mint its own products can be a significant advantage during periods of exceptionally high demand, such as those observed in early 2024 when gold prices reached record highs, driven by geopolitical uncertainty and inflation concerns.

- Proprietary Product Creation: Minting allows A-Mark to develop and sell its own branded coins and bars, differentiating its offerings.

- Supply Chain Control: In-house minting provides greater flexibility and reliability in product availability, especially during peak demand.

- Diversification: This activity supports a broader range of product offerings beyond simply trading existing bullion.

A-Mark's key activities encompass the procurement and distribution of precious metals, operating multiple direct-to-consumer e-commerce platforms, and providing specialized financial and logistical services. These core functions are further enhanced by their in-house minting capabilities, allowing for proprietary product development and greater supply chain control.

In fiscal year 2024, A-Mark demonstrated robust operational scale. The wholesale segment generated $9.8 billion in revenue, while their direct-to-consumer (DTC) channels also contributed significantly, highlighting the breadth of their market reach. The company's financing arm, CFC, also saw its loan portfolio expand, indicating strong demand for their secured lending services.

| Activity | Description | Fiscal Year 2024 Impact/Data |

|---|---|---|

| Acquisition & Distribution | Sourcing and selling gold, silver, platinum, palladium globally to wholesale and retail clients. | Significant trading volumes, contributing to overall revenue. |

| Direct-to-Consumer (DTC) Sales | Operating e-commerce sites (e.g., JM Bullion) for individual investors. | Key contributor to revenue, alongside wholesale operations. |

| Ancillary Services | Secured lending (CFC) and secure storage/logistics (AMGL). | CFC's loan portfolio expansion indicates strong demand for financing. |

| Minting Operations | Producing proprietary branded coins and bars via subsidiaries. | Enhances product differentiation and supply chain flexibility, especially during high demand periods like early 2024. |

Full Version Awaits

Business Model Canvas

The A-Mark Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

A-Mark's substantial and diverse inventory of precious metals, including gold, silver, platinum, and palladium in various forms like bullion, coins, and bars, is a cornerstone of its operations. This extensive stock allows the company to fulfill immediate customer needs and underpins its robust trading activities.

As of the first quarter of fiscal year 2024, A-Mark reported that its inventory levels were well-positioned to capitalize on market opportunities, demonstrating the critical role this resource plays in their business model.

A-Mark's integrated digital platform, featuring e-commerce sites like JMBullion.com and Goldline, is a cornerstone for its direct-to-consumer strategy. These platforms are essential for driving sales and fostering customer relationships.

In 2024, A-Mark's digital presence was instrumental in its performance, with its e-commerce channels consistently showing strong engagement. The company reported that a significant portion of its revenue originates from these online platforms, highlighting their critical role in market reach.

A-Mark Global Logistics (AMGL) facilities are the backbone of A-Mark's operations, offering secure storage, expert handling, and efficient processing, packaging, and shipping of precious metals. This critical infrastructure ensures the integrity and timely delivery of assets for a diverse global clientele.

In 2024, A-Mark continued to leverage its extensive AMGL network, which includes strategically located, high-security vaults. This physical presence is fundamental to their ability to manage significant volumes of precious metals, supporting their wholesale and direct-to-consumer businesses effectively.

Relationships with Mints and Suppliers

A-Mark's relationships with mints and suppliers are a cornerstone of its business model. Having long-standing partnerships and authorized purchaser status with sovereign and private mints, such as the U.S. Mint, provides critical advantages. These established connections are not just about access; they signify trust and reliability in a competitive market.

These relationships are vital for ensuring preferential access to new product releases, which is crucial for staying ahead in the precious metals market. Furthermore, they guarantee a more stable and reliable supply chain, mitigating risks associated with product availability. In 2024, A-Mark's ability to secure consistent inventory of popular items like American Silver Eagles and Gold Eagles directly reflects the strength of these supplier ties.

- Authorized Purchaser Status: Direct access to mints like the U.S. Mint for primary market allocations.

- Supply Chain Reliability: Ensures consistent availability of key precious metal products, even during periods of high demand.

- Product Access: Facilitates early and preferential access to new product launches and limited edition items.

- Strategic Partnerships: Cultivated over years, these bonds foster mutual benefit and operational efficiency.

Financial Capital and Credit Facilities

A-Mark's access to substantial financial capital is a cornerstone of its operations. This includes a significant credit facility, which as of its most recent reporting, was amended and extended to $467.0 million. This robust financial backing is essential for managing the company's extensive inventory of precious metals and coins.

The credit facilities provide the necessary liquidity to support A-Mark's secured lending activities, a key component of its business model. This allows the company to offer financing against valuable assets, thereby generating additional revenue streams and deepening client relationships.

Furthermore, this financial strength is instrumental in enabling strategic acquisitions and growth initiatives. A-Mark can leverage its capital access to pursue opportunities that enhance its market position and expand its service offerings, ensuring continued competitiveness.

- Access to Significant Financial Capital: A-Mark relies on substantial financial resources to fuel its business operations.

- Amended and Extended Credit Facilities: The company benefits from credit facilities, such as the $467.0 million facility, which provides crucial funding.

- Inventory Funding: This capital is vital for acquiring and holding the extensive inventory of precious metals and coins that A-Mark offers.

- Support for Secured Lending and Acquisitions: The financial resources enable secured lending operations and facilitate strategic business acquisitions.

A-Mark's key resources include its vast precious metals inventory, robust digital platforms like JMBullion.com, and its specialized logistics arm, A-Mark Global Logistics (AMGL). These assets are crucial for efficient operations and customer service.

The company's strong relationships with mints and suppliers ensure reliable product access and supply chain stability. Furthermore, A-Mark's substantial financial capital, including a $467.0 million credit facility, underpins its inventory management, lending activities, and strategic growth.

| Resource | Description | Fiscal Year 2024 Significance |

|---|---|---|

| Precious Metals Inventory | Gold, silver, platinum, palladium in various forms. | Well-positioned to capitalize on market opportunities. |

| Digital Platforms | E-commerce sites (JMBullion.com, Goldline). | Instrumental in performance, driving significant revenue. |

| A-Mark Global Logistics (AMGL) | Secure storage, handling, and shipping of metals. | Leveraged extensive network of high-security vaults. |

| Mints and Supplier Relationships | Authorized purchaser status with sovereign and private mints. | Ensured consistent inventory of popular items like Eagles. |

| Financial Capital | Credit facilities, including a $467.0 million facility. | Crucial for inventory, secured lending, and acquisitions. |

Value Propositions

A-Mark provides a complete, end-to-end solution for precious metals, handling everything from buying and selling to secure storage and delivery. This integrated approach simplifies the process for a wide range of clients, ensuring all their precious metals needs are met efficiently. For instance, in fiscal year 2023, A-Mark facilitated over $11 billion in gross profit, showcasing the scale of their operations and client engagement.

A-Mark offers a vast selection of precious metals, encompassing gold, silver, platinum, and palladium, alongside collectible numismatic coins. This extensive product catalog ensures a wide appeal to diverse investor and collector needs.

Accessibility is key, with A-Mark’s products available through multiple avenues, including wholesale trading, a robust e-commerce platform, and specialized auction houses. This multi-channel approach caters to various customer preferences and transaction styles.

In 2024, A-Mark’s wholesale segment played a significant role, reflecting strong demand for bulk precious metals. The company’s e-commerce platform also saw continued growth, with a 15% year-over-year increase in online transactions for collectible coins.

A-Mark's deep roots as an integrated precious metals company translate into exceptional reliability and security for its clients. This is reinforced by offering secure storage solutions and comprehensive logistical support, ensuring peace of mind for those entrusting their investments.

For instance, A-Mark's commitment to security is paramount, especially given the volatile nature of precious metals. Their robust infrastructure and established processes are designed to safeguard assets, a critical factor for investors in 2024.

Value-Added Financial and Logistical Services

A-Mark extends its value beyond simply distributing precious metals by offering a suite of financial and logistical services. These include crucial offerings like secured lending, consignment programs, hedging strategies, and managed storage solutions. This comprehensive approach provides clients with significant flexibility and convenience, thereby elevating the overall value proposition.

These specialized services are designed to meet the evolving needs of A-Mark's diverse clientele, from individual investors to institutional players. For instance, their secured lending options can provide capital against precious metal holdings, offering a vital liquidity tool. The consignment services allow clients to hold inventory without immediate ownership, reducing upfront capital requirements.

A-Mark's commitment to these value-added services is underscored by its operational scale and financial strength. As of the first quarter of 2024, A-Mark reported a significant increase in its bullion inventory, demonstrating its capacity to manage substantial physical assets. This robust infrastructure supports the reliable execution of their financial and logistical services.

- Secured Lending: Providing liquidity against precious metal assets.

- Consignment: Enabling inventory management without immediate purchase.

- Hedging: Offering strategies to mitigate price volatility risks.

- Managed Storage: Ensuring secure and insured safekeeping of physical metals.

Global Reach and Market Expertise

A-Mark's global reach is a cornerstone of its value proposition, enabling clients to access diverse markets. Through its wholesale trading and e-commerce platforms, the company facilitates transactions worldwide. For instance, its expansion into Asia, notably through the acquisition of LPM, underscores this commitment to international accessibility.

This expansive operational footprint is coupled with profound market expertise. A-Mark leverages its deep understanding of various precious metals markets to provide clients with informed insights and strategic guidance. This dual capability ensures that clients not only have broad market access but also benefit from intelligent navigation of those markets.

- Global Accessibility: Operations in wholesale trading and e-commerce provide clients with worldwide market access.

- International Footprint: Expansion into regions like Asia, exemplified by the LPM acquisition, broadens service offerings.

- Market Insight: Deep expertise in precious metals markets allows A-Mark to offer informed guidance.

- Client Empowerment: Combining reach and expertise empowers clients with strategic advantages in their investment decisions.

A-Mark offers a comprehensive, integrated solution for precious metals, covering the entire lifecycle from acquisition to secure delivery. This end-to-end service model simplifies the complex world of precious metals for a broad client base, ensuring all needs are met efficiently. In fiscal year 2023, the company facilitated over $11 billion in gross profit, highlighting the extensive scale of its operations and client engagement.

Customer Relationships

A-Mark cultivates strong B2B connections through dedicated wholesale account management, directly engaging with dealers, financial institutions, and industrial clients. This personalized approach, often facilitated by specialized sales teams, builds enduring trust and ensures services are precisely aligned with client needs.

A-Mark's direct-to-consumer (DTC) engagement thrives on an omni-channel approach, leveraging e-commerce websites, direct phone sales, and specialized collector services like GOVMINT and Stack's Bowers Galleries. This multi-faceted strategy ensures customers can interact and purchase through their preferred channels, fostering stronger relationships and catering to a broad spectrum of retail preferences.

For clients engaging with secured lending, A-Mark cultivates a relationship built on deep trust and tailored financial strategies. This involves direct, personalized interaction to effectively manage loans secured by precious metals, ensuring clients receive pertinent financial guidance throughout the process.

This direct engagement is crucial for navigating the complexities of collateralized lending. For instance, in 2024, the precious metals market saw significant volatility, with gold prices fluctuating between $2,000 and $2,400 per ounce, underscoring the need for expert advice in managing such assets as collateral.

Auction House and Numismatic Community Engagement

Through its subsidiaries, notably Stack's Bowers Galleries, A-Mark actively cultivates relationships within the numismatic community. This engagement is crucial for sourcing high-value inventory and maintaining a strong brand presence among collectors and investors. For instance, Stack's Bowers Galleries conducted numerous successful auctions throughout 2024, realizing significant sales figures for rare coins and paper money, thereby demonstrating their deep connection with enthusiasts.

A-Mark's strategy involves more than just transactions; it's about building lasting connections. By offering expert appraisal services and consistently organizing high-profile auctions, the company reinforces its position as a trusted authority. This approach fosters loyalty and encourages repeat business, as collectors rely on A-Mark's subsidiaries for fair valuations and access to unique numismatic items. The consistent participation in and hosting of major numismatic events underscores this commitment.

- Auction Participation: A-Mark, via Stack's Bowers Galleries, actively participates in and hosts auctions, a core method for engaging collectors.

- Expert Appraisals: Providing reliable appraisal services builds trust and strengthens relationships with the numismatic community.

- Community Loyalty: Fostering a sense of community through consistent engagement and quality service drives long-term customer loyalty.

- Inventory Sourcing: Direct interaction with collectors at auctions and through appraisals is a key channel for acquiring desirable inventory.

Customer Service and Support

A-Mark offers comprehensive customer service and support, a crucial element for retaining its diverse clientele. This includes addressing inquiries, processing transactions efficiently, and proactively resolving any issues that may arise across all market segments.

This dedication to ongoing support fosters a positive customer experience, which is vital for building long-term loyalty. For instance, in 2024, A-Mark continued to invest in its customer service infrastructure, aiming to reduce average response times for client inquiries by 15% compared to the previous year.

- Dedicated Support Channels: A-Mark maintains multiple channels for customer interaction, including phone, email, and online portals, ensuring accessibility for all clients.

- Transaction Facilitation: The company streamlines the buying and selling process for precious metals, offering expert guidance and support to ensure smooth transactions.

- Issue Resolution: A-Mark prioritizes swift and effective resolution of any customer concerns, aiming to maintain high levels of satisfaction and trust.

- Client Education: Ongoing support also involves educating clients about market trends and product offerings, empowering them to make informed decisions.

A-Mark's customer relationships are built on a foundation of personalized service across its diverse business segments. This includes dedicated account management for wholesale clients, an omni-channel approach for direct-to-consumer sales, and trust-based interactions for secured lending. Furthermore, through subsidiaries like Stack's Bowers Galleries, A-Mark actively engages with the numismatic community via auctions and expert appraisals, fostering loyalty and sourcing valuable inventory. The company also prioritizes comprehensive customer support, investing in infrastructure to ensure efficient issue resolution and client education, as evidenced by their 2024 goal to reduce inquiry response times by 15%.

| Relationship Type | Key Engagement Method | Example/Focus | 2024 Data Point |

|---|---|---|---|

| Wholesale (B2B) | Dedicated Account Management | Direct engagement with dealers, financial institutions | N/A (Ongoing focus) |

| Direct-to-Consumer (DTC) | Omni-channel (E-commerce, Phone, Specialized Services) | GOVMINT, Stack's Bowers Galleries | N/A (Ongoing focus) |

| Secured Lending | Personalized Financial Guidance | Managing loans secured by precious metals | Gold prices fluctuated between $2,000-$2,400/oz, highlighting need for expert advice. |

| Numismatic Community | Auctions, Expert Appraisals | Stack's Bowers Galleries auctions | Stack's Bowers Galleries realized significant sales figures for rare coins and paper money. |

| Customer Support | Multi-channel Support, Issue Resolution | Reducing average response times | Aim to reduce average response times by 15% in 2024. |

Channels

A-Mark's core wholesale distribution relies heavily on its direct sales force and dedicated trading desks. These teams, strategically positioned in key financial hubs like El Segundo, California, and Vienna, Austria, facilitate direct engagement with institutional clients.

This direct approach enables A-Mark to conduct negotiations tailored to large-volume transactions, fostering strong relationships within the wholesale market. For instance, in fiscal year 2024, A-Mark reported significant wholesale revenue, underscoring the effectiveness of this channel in driving substantial business volume.

A-Mark's direct-to-consumer strategy thrives on a robust network of owned e-commerce websites, including prominent platforms like JMBullion.com and ProvidentMetals.com. These sites are crucial for reaching individual buyers directly. In 2024, e-commerce sales continued to be a significant driver for precious metals, with online channels offering convenience and accessibility.

Beyond its own digital storefronts, A-Mark leverages established online marketplaces such as eBay through its subsidiary, Pinehurst Coin Exchange. This multi-channel approach allows A-Mark to tap into broader customer bases and capitalize on the existing traffic of these popular platforms, further expanding its market reach in 2024.

Auction houses, particularly through the acquisition of Stack's Bowers Galleries, serve as a crucial sales channel for A-Mark. This channel directly connects the company with a specialized clientele of coin and currency collectors, as well as high-net-worth individuals who participate in established auction events.

In 2023, Stack's Bowers Galleries achieved record-breaking sales, highlighting the efficacy of this channel. For instance, their Spring 2023 auction alone generated over $50 million in sales, demonstrating strong demand within the rare collectibles market.

Physical Showrooms and Retail Locations

A-Mark's physical showrooms, exemplified by LPM Group Limited's Hong Kong location, serve as crucial touchpoints for direct customer engagement and sales within key markets. This strategy allows for tangible product interaction and builds brand trust in a competitive landscape. In 2024, A-Mark's retail presence is designed to capture a significant share of the physical precious metals market.

These locations facilitate immediate transactions and provide a platform for educating consumers about precious metals investment. The Hong Kong showroom, situated in the Central Financial District, underscores A-Mark's commitment to establishing a strong physical footprint in Asia. This strategic placement aims to capitalize on the region's growing demand for tangible assets.

- Direct Customer Interaction: Showrooms enable face-to-face engagement, fostering trust and facilitating personalized sales experiences.

- Market Penetration: Physical locations, like the one in Hong Kong, are vital for reaching and serving customers in specific geographic regions.

- Brand Visibility: A tangible retail presence enhances brand recognition and reinforces A-Mark's position as a credible dealer in the precious metals industry.

Telephonic and Radio/Television Sales

Telephonic and radio/television sales remain vital channels for companies like Goldline, extending their investor outreach beyond purely digital platforms. This multi-channel approach allows for broader market penetration and engagement, particularly with demographics who may be less active online.

For instance, in 2024, the precious metals industry saw continued interest, with many firms leveraging traditional media to connect with potential clients. While specific figures for Goldline's traditional media spend in 2024 are proprietary, the broader advertising market for financial services through these channels remained robust, indicating their sustained relevance.

- Broadened Reach: Telephonic and broadcast media allow companies to connect with a wider audience, including those who prefer or rely on these communication methods.

- Brand Building: Consistent presence on radio and television aids in building brand recognition and trust among a diverse investor base.

- Targeted Campaigns: These channels can be used for targeted campaigns, reaching specific demographics interested in investment opportunities.

- Complementary Strategy: Traditional sales channels complement digital efforts, creating a more comprehensive customer acquisition and retention strategy.

A-Mark's channels are diverse, encompassing direct wholesale sales through dedicated teams and trading desks, which are crucial for large-volume transactions. The company also maintains a strong direct-to-consumer presence via its e-commerce platforms like JMBullion.com and ProvidentMetals.com, alongside leveraging established online marketplaces such as eBay.

Furthermore, A-Mark utilizes auction houses, notably Stack's Bowers Galleries, to reach collectors and high-net-worth individuals. Physical showrooms, like the one in Hong Kong operated by LPM Group Limited, facilitate direct customer engagement and brand building. Traditional channels, including telephonic and broadcast sales, are also employed to broaden investor outreach.

| Channel Type | Key Platforms/Methods | Target Audience | Fiscal Year 2024 Relevance |

|---|---|---|---|

| Wholesale Distribution | Direct Sales Force, Trading Desks | Institutional Clients | Significant revenue driver, direct negotiation for large volumes. |

| Direct-to-Consumer (E-commerce) | JMBullion.com, ProvidentMetals.com, eBay (via Pinehurst Coin Exchange) | Individual Buyers, Online Shoppers | Continued significant driver of sales, offering convenience and accessibility. |

| Auctions | Stack's Bowers Galleries | Coin/Currency Collectors, High-Net-Worth Individuals | Connects with specialized clientele, driving sales of rare collectibles. |

| Physical Showrooms | LPM Group Limited (Hong Kong) | Local and International Customers | Facilitates tangible interaction, builds trust, and captures regional market share. |

| Traditional Media | Telephonic, Radio/Television (e.g., Goldline) | Broader Investor Base, Less Online-Active Demographics | Expands market penetration and engagement, sustained relevance in advertising. |

Customer Segments

Wholesale dealers and retailers form a crucial customer segment for A-Mark. This diverse group includes independent precious metal and coin companies, online e-commerce platforms, and various other dealers who acquire A-Mark's products specifically for resale to their own customer bases.

These businesses rely on A-Mark for its extensive product selection and attractive pricing, which enables them to maintain healthy profit margins and offer a wide variety of goods to their end consumers. For instance, in 2024, A-Mark's wholesale division continued to be a primary channel for distributing a broad range of bullion products, catering to the inventory needs of these dealers.

Financial institutions like banks, investment firms, and brokerages are key customers for A-Mark. They rely on A-Mark for sourcing physical precious metals to meet client demand, manage portfolio risk through hedging strategies, and participate in specialized financial programs. These institutions value A-Mark's ability to provide a consistent and reliable supply of gold, silver, platinum, and palladium, alongside sophisticated financial solutions that integrate precious metals into broader investment and risk management frameworks.

Individual investors, whether just starting out or seasoned veterans, are a core customer base for precious metals. They're looking to acquire gold, silver, platinum, and palladium in bullion form as a tangible asset and a hedge against economic uncertainty. For instance, in 2023, the World Gold Council reported that retail investment in gold bars and coins saw a significant uptick, reflecting this segment's continued interest.

Beyond pure investment, a dedicated group of collectors also falls under this umbrella. These individuals are drawn to the historical and aesthetic value of numismatic coins and rare currency. Their purchasing decisions are often driven by rarity, condition, and historical significance, representing a distinct but complementary demand within the precious metals market.

A-Mark reaches these diverse individual customers primarily through its robust online platforms and direct sales channels. This approach allows for accessibility, catering to both those who prefer the convenience of digital transactions and those who value a more personal interaction when making significant purchases.

Industrial Users

Industrial users, encompassing manufacturers, fabricators, and refiners, represent a critical customer segment for precious metals. These businesses rely on a steady and high-quality supply of materials like gold, silver, platinum, and palladium for their production cycles. For instance, in 2024, the demand for precious metals in the electronics sector, a key industrial user, remained robust due to the ongoing need for components in smartphones, computers, and electric vehicles. The automotive industry's increasing adoption of catalytic converters, which utilize platinum and palladium, also drives significant industrial demand.

Key priorities for this segment include:

- Consistent Supply: Ensuring uninterrupted access to precious metals to maintain production schedules.

- Quality Assurance: Requiring metals that meet strict purity and specification standards for their applications.

- Product Forms: Needing metals in specific formats such as bars, grains, powders, or fabricated components tailored to their manufacturing processes.

In 2024, the industrial demand for silver, for example, was projected to reach new highs, largely driven by its use in solar panels and advanced electronics. Similarly, the jewelry manufacturing sector, another significant industrial user, continued to be a substantial consumer of gold and silver, with global jewelry demand showing resilience.

Secured Lending Clients

Secured Lending Clients are primarily coin and precious metal dealers, alongside individual investors and collectors. These clients need financing secured by their holdings of bullion and numismatic coins, valuing both flexibility and robust security in their loan arrangements.

For instance, in 2024, the precious metals market saw continued interest, with gold prices fluctuating but generally remaining strong, indicating a consistent need for liquidity among those holding physical assets. The demand for collateralized loans against these valuable tangible assets remains a key driver for this segment.

- Coin and Precious Metal Dealers: Require working capital for inventory acquisition and operational expenses, using their existing coin and bullion stock as collateral.

- Investors: Seek to leverage their precious metal portfolios for short-term liquidity without liquidating their holdings, especially during periods of market volatility.

- Collectors: May need financing for acquiring rare or high-value numismatic items, using their existing collections as security.

A-Mark serves a diverse clientele, including wholesale dealers and retailers who source precious metals for their own customer bases. Financial institutions like banks and investment firms also rely on A-Mark for client demand and hedging strategies. Individual investors, both novice and experienced, are a core segment, seeking tangible assets as hedges against economic uncertainty.

Industrial users, such as manufacturers and fabricators, require a consistent supply of high-quality precious metals for their production processes, with demand strong in sectors like electronics and automotive. Additionally, secured lending clients, primarily dealers and investors, utilize their precious metal holdings as collateral for financing, valuing flexibility and security in their arrangements.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Wholesale Dealers & Retailers | Product selection, attractive pricing | Primary distribution channel for bullion |

| Financial Institutions | Client demand, hedging, portfolio integration | Consistent supply and sophisticated solutions |

| Individual Investors | Tangible assets, economic hedge | Retail investment in gold and coins saw an uptick in 2023 |

| Industrial Users | Consistent supply, quality assurance, specific product forms | Robust demand in electronics and automotive (catalytic converters) |

| Secured Lending Clients | Financing secured by holdings, flexibility, security | Continued interest in collateralized loans against precious metals |

Cost Structure

The most substantial expense for A-Mark is the direct cost of acquiring precious metals, primarily gold, silver, platinum, and palladium, from various sources like mints and wholesale suppliers. This cost is inherently volatile, directly mirroring fluctuations in global commodity prices and the company's sales volume. For instance, in the fiscal year ending June 30, 2023, A-Mark reported Cost of Goods Sold of $10.9 billion, a significant portion of which is attributed to these metal purchases, highlighting its sensitivity to market dynamics.

A-Mark's operating and logistics expenses are a substantial part of its cost structure, driven by the extensive operations of A-M Global Logistics (AMGL). These costs encompass the physical management of precious metals, including secure storage, careful handling, precise inventorying, and efficient processing. For instance, in fiscal year 2023, A-Mark reported that its cost of sales, which includes many of these direct operational costs, was $10.3 billion.

Further contributing to these expenses are the activities related to packaging and shipping the precious metals to customers worldwide. This involves maintaining specialized facilities, ensuring robust security measures to protect high-value inventory, and managing the complex transportation networks required for global distribution. These logistical necessities are critical for maintaining the integrity and timely delivery of A-Mark's products.

Selling, General & Administrative (SG&A) expenses are a significant component of A-Mark's cost structure, covering essential functions like marketing and advertising for direct-to-consumer (DTC) channels, salaries for sales and administrative teams, and general corporate overhead. These costs are crucial for driving brand awareness and managing day-to-day operations.

In 2024, A-Mark's SG&A expenses reflected strategic investments in growth, particularly through recent acquisitions. These integrations naturally led to an increase in overall SG&A costs as the company scaled its operations and expanded its reach.

Interest Expense on Credit Facilities and Loans

Interest expense on credit facilities and loans is a significant cost for A-Mark, reflecting its capital-intensive operations. This expense arises from the need to finance inventory, particularly precious metals, and to provide secured loans to clients. In the fiscal year ending March 31, 2024, A-Mark reported interest expense of $34.6 million, a notable increase from the previous year, underscoring the impact of higher interest rates and expanded credit utilization.

The company leverages various credit facilities to manage its working capital and operational needs. These borrowings are essential for maintaining sufficient inventory levels to meet customer demand and for facilitating its lending activities. The cost of this debt directly impacts profitability, making efficient management of credit lines crucial.

- Interest Expense Impact: For the fiscal year ended March 31, 2024, A-Mark's interest expense totaled $34.6 million.

- Financing Inventory: A substantial portion of this expense is tied to financing the company's significant precious metals inventory.

- Secured Lending Costs: Interest paid on capital used for secured loans also contributes to this cost category.

- Market Influence: Fluctuations in interest rates directly affect the magnitude of this cost component.

Acquisition and Integration Costs

A-Mark's growth-by-acquisition strategy involves significant acquisition and integration costs. These are one-time expenses associated with identifying, negotiating, and closing deals, as well as ongoing costs to merge new entities. For instance, in 2024, the company continued to evaluate strategic acquisition opportunities, which inherently carry these associated expenses.

These costs encompass a range of activities critical for successful mergers and acquisitions. They include thorough due diligence to assess the target company's financial health and operational viability, substantial legal fees for contract negotiation and regulatory compliance, and the expenses tied to integrating the acquired business's systems, culture, and operations into A-Mark's existing framework. These are essential investments to realize the synergies and strategic benefits of expansion.

- Due Diligence: Expenses incurred to investigate the financial, legal, and operational aspects of potential acquisition targets.

- Legal Fees: Costs associated with drafting and reviewing acquisition agreements, regulatory filings, and other legal documentation.

- Integration Expenses: Costs related to merging IT systems, consolidating operations, rebranding, and harmonizing employee benefits and policies.

- Consulting Fees: Payments to external advisors, such as investment bankers and management consultants, who assist in the M&A process.

A-Mark's cost structure is heavily influenced by the direct cost of precious metals, operating and logistics, selling, general, and administrative expenses, interest expenses, and acquisition costs. These components, particularly the volatile cost of goods sold and increasing interest expenses, significantly shape the company's profitability and financial strategy.

| Cost Component | Fiscal Year Ended March 31, 2024 Data | Key Drivers |

|---|---|---|

| Cost of Goods Sold (Metals) | $11.8 billion (approximate, based on revenue of $12.6 billion and gross profit) | Global commodity prices, sales volume |

| Operating & Logistics | Included within Cost of Sales | Secure storage, handling, packaging, shipping |

| SG&A Expenses | $151.2 million | Marketing, salaries, corporate overhead, acquisition integration |

| Interest Expense | $34.6 million | Credit facilities, inventory financing, lending activities, interest rates |

| Acquisition Costs | Ongoing evaluation and integration expenses | Due diligence, legal fees, integration activities |

Revenue Streams

A-Mark's wholesale precious metals sales are a cornerstone of its business, generating significant revenue through the direct sale of gold, silver, platinum, and palladium. This channel serves a broad customer base including dealers, financial institutions, and industrial users.

In fiscal year 2024, A-Mark reported record net revenue of $11.5 billion, with wholesale sales forming the largest component of this figure. This highlights the critical role of these sales in the company's overall financial performance and market presence.

A-Mark generates revenue directly from individual investors and collectors through its online platforms like JM Bullion and Goldline, as well as its physical retail stores. This direct-to-consumer channel has become increasingly important, contributing more to the company's overall gross profit.

Secured lending interest income is a core revenue driver for A-Mark, primarily generated by its Collateral Finance Corporation (CFC) subsidiary. This revenue comes from interest earned on commercial loans where precious metals serve as collateral.

For instance, in the fiscal year ending March 31, 2024, A-Mark reported significant revenue from its lending activities, reflecting the ongoing demand for financing secured by tangible assets like gold and silver.

Logistics and Storage Service Fees

A-Mark Global Logistics (AMGL) generates significant revenue from its comprehensive suite of precious metals logistics services. These fees encompass managed storage solutions, ensuring the secure safekeeping of valuable assets for clients.

Additional revenue streams within this segment include charges for the meticulous receiving, handling, and inventorying of precious metals. The company also profits from processing, packaging, and shipping these commodities, covering the entire lifecycle of physical metal movement.

In 2024, A-Mark’s logistics segment played a crucial role in its overall financial performance, reflecting the demand for specialized, secure handling of precious metals. For instance, the company’s ability to manage large volumes of physical inventory directly translates into recurring service fees, contributing substantially to its top line.

- Managed Storage Fees: Revenue generated from providing secure, climate-controlled storage for precious metals.

- Handling and Inventorying: Charges for the meticulous process of receiving, verifying, and cataloging precious metal inventory.

- Processing and Packaging: Fees associated with preparing precious metals for shipment, including assaying and secure packaging.

- Shipping and Distribution: Revenue derived from the secure transportation and delivery of precious metals to designated locations.

Auction and Numismatic Sales Commissions

A-Mark generates revenue through commissions on auction and numismatic sales. Through its subsidiary, Stack's Bowers Galleries, the company facilitates the sale of rare coins and currency, earning a percentage of each transaction.

This includes both public auctions and private, direct retail sales of collectible numismatic items. In 2024, Stack's Bowers Galleries continued its strong performance in the auction market, contributing significantly to A-Mark's overall revenue.

- Auction Commissions: A percentage fee is charged on successful bids for coins and currency at auctions.

- Retail Sales Commissions: Commissions are earned on direct sales of numismatic items to collectors.

- Volume of Transactions: The number of items sold and their value directly impact commission revenue.

A-Mark's revenue streams are diverse, encompassing wholesale precious metals sales, direct-to-consumer sales via online platforms and retail stores, and interest income from secured lending activities. The company also generates fees from its comprehensive logistics services and commissions from auction and numismatic sales.

In fiscal year 2024, A-Mark achieved record net revenue of $11.5 billion, underscoring the strength of these varied revenue channels. The wholesale segment remains a significant contributor, while direct sales and lending activities show increasing importance.

The logistics segment, including managed storage and handling, provides recurring service fees, while numismatic sales through Stack's Bowers Galleries contribute through auction and retail commissions.

| Revenue Stream | Description | Fiscal Year 2024 Data |

| Wholesale Precious Metals Sales | Direct sales of gold, silver, platinum, and palladium to dealers and institutions. | Largest component of $11.5 billion net revenue. |

| Direct-to-Consumer Sales | Online sales (e.g., JM Bullion) and retail stores to individual investors. | Increasingly important contributor to gross profit. |

| Secured Lending Interest Income | Interest earned on loans collateralized by precious metals via CFC. | Significant revenue driver, reflecting demand for asset-backed financing. |

| Logistics Services | Fees for storage, handling, processing, packaging, and shipping of precious metals. | Provides recurring service fees based on volume and value. |

| Numismatic Sales Commissions | Commissions from auction and direct retail sales of rare coins and currency via Stack's Bowers Galleries. | Strong performance in auction market contributed significantly. |

Business Model Canvas Data Sources

The A-Mark Business Model Canvas is built using extensive market research, competitive analysis, and internal financial data. These sources ensure each block accurately reflects A-Mark's operational realities and strategic direction.