A-Mark PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A-Mark Bundle

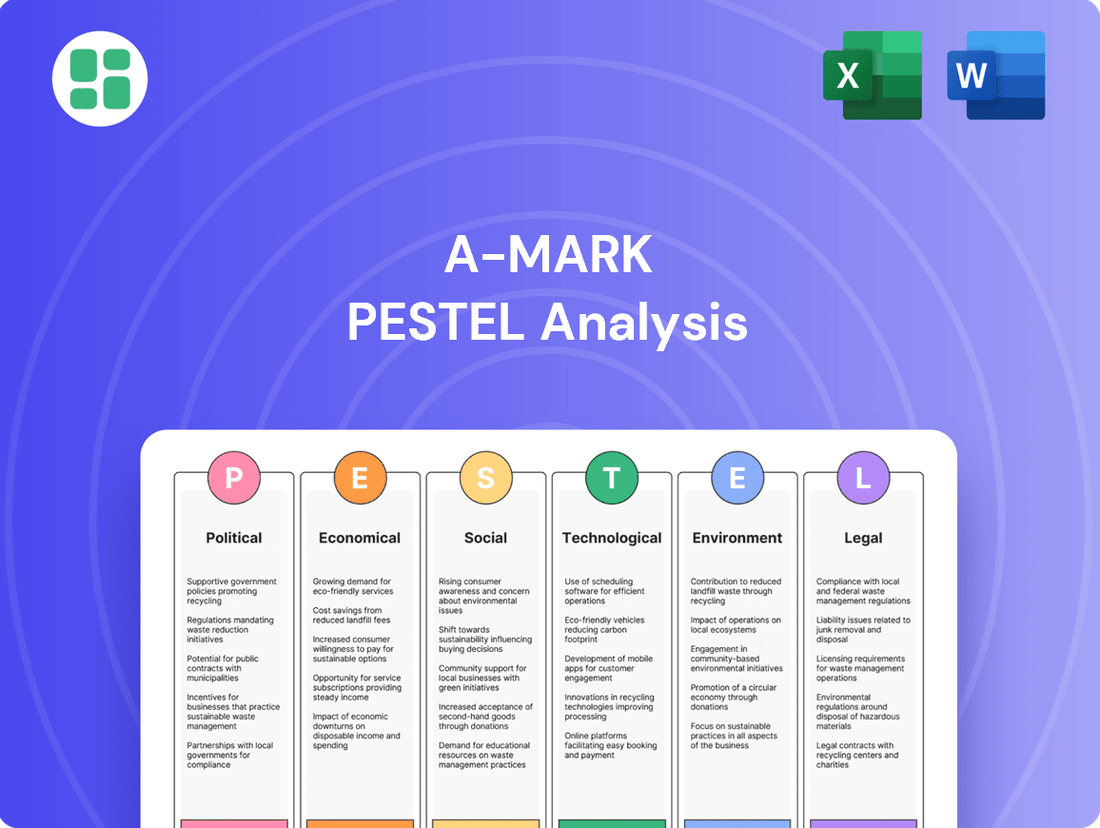

Unlock the hidden forces shaping A-Mark's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and threats. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now and make informed decisions.

Political factors

Global political stability directly impacts demand for precious metals. Periods of geopolitical tension, such as ongoing conflicts or heightened international disputes, often drive investors towards safe-haven assets like gold and silver. For instance, the continued geopolitical uncertainty in Eastern Europe and the Middle East throughout 2024 has historically correlated with increased investor interest in precious metals, potentially benefiting A-Mark's sales volume.

Trade policies significantly influence the precious metals market, impacting A-Mark's operations. For instance, the US-China trade tensions in 2019 led to increased tariffs on various goods, potentially affecting the cost of importing and exporting precious metals and related products. Changes in import/export restrictions by major economies like the United States, European Union, or China can directly alter A-Mark's sourcing costs and market access, thereby impacting profitability.

Central bank policies on gold reserves are a significant political factor impacting the gold market. Decisions by institutions like the U.S. Federal Reserve or the European Central Bank to increase or decrease their gold holdings can create substantial shifts in global demand and price. For instance, many central banks have been net buyers of gold in recent years, a trend that continued into 2023 and is projected to persist into 2024, offering a baseline of support for gold prices.

Sanctions and International Regulations

Sanctions and international regulations significantly impact A-Mark's operations by potentially disrupting supply chains and limiting access to certain markets for precious metals. The company must diligently adhere to these evolving legal frameworks, which can affect its global trading and logistics. For instance, sanctions imposed by major economies on countries involved in precious metal mining or trading can create complex compliance challenges and necessitate adjustments to sourcing and distribution strategies.

A-Mark's exposure to these risks is ongoing, particularly given the dynamic geopolitical landscape. The firm's ability to navigate these restrictions is crucial for maintaining its market position and ensuring uninterrupted service to its clients. Compliance with regulations such as those enforced by the Office of Foreign Assets Control (OFAC) in the United States is paramount, as violations can lead to severe penalties.

- Compliance Burden: A-Mark faces increased costs and operational complexity in ensuring adherence to a growing number of international sanctions and trade restrictions.

- Market Access Limitations: Sanctions can directly restrict A-Mark's ability to trade with or source metals from specific countries, impacting revenue streams and diversification.

- Supply Chain Disruptions: Geopolitical events leading to sanctions can interrupt the flow of precious metals, affecting inventory management and delivery timelines.

- Reputational Risk: Failure to comply with sanctions can result in significant reputational damage, impacting trust with partners and customers.

Financial Market Regulation and Oversight

Financial market regulation significantly shapes A-Mark's operational landscape. Recent shifts, such as the SEC's proposed rule changes for crypto asset reporting, could indirectly influence precious metals markets by altering investor behavior and the types of investment vehicles available. For instance, increased scrutiny on digital assets might lead some investors to seek more traditional safe-haven assets like gold and silver, potentially boosting demand for A-Mark's services.

Changes in commodity trading regulations, particularly those affecting derivatives and futures contracts for precious metals, directly impact A-Mark's wholesale and retail operations. For example, the Commodity Futures Trading Commission (CFTC) continuously monitors and updates rules governing these markets to ensure stability and prevent manipulation. Compliance with evolving Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, such as those reinforced by the Financial Crimes Enforcement Network (FinCEN), adds to operational complexity and cost for A-Mark.

The regulatory environment for investment vehicles involving precious metals, including ETFs and physical bullion, is also a key consideration. In 2024, the Financial Industry Regulatory Authority (FINRA) continued its focus on investor protection, which can lead to stricter disclosure requirements for firms dealing with precious metals investments. A-Mark must navigate these varying regulatory frameworks to maintain its service offerings and ensure compliance across its business segments.

- Regulatory Scrutiny: Increased oversight by bodies like the CFTC and SEC on commodity and digital asset markets can impact precious metals trading dynamics.

- Compliance Costs: Evolving KYC/AML regulations from FinCEN necessitate ongoing investment in compliance infrastructure for A-Mark.

- Investment Vehicle Changes: FINRA's focus on investor protection may lead to updated rules for precious metals ETFs and physical ownership, affecting product offerings.

Global political stability directly impacts demand for precious metals, with geopolitical tensions often driving investors toward safe-haven assets. For instance, continued geopolitical uncertainty throughout 2024 has historically correlated with increased investor interest in precious metals, potentially benefiting A-Mark's sales volume.

Trade policies significantly influence the precious metals market, impacting A-Mark's operations through tariffs and import/export restrictions. Changes in these policies by major economies can directly alter A-Mark's sourcing costs and market access.

Central bank policies on gold reserves, such as net buying trends observed through 2023 and projected into 2024, offer a baseline of support for gold prices, influencing market dynamics for A-Mark.

Sanctions and international regulations, like those enforced by OFAC, create compliance challenges and can disrupt supply chains, impacting A-Mark's global trading and logistics.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting A-Mark, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to help stakeholders identify opportunities and navigate potential threats within A-Mark's operating landscape.

Provides a clear, actionable framework to navigate complex external factors, reducing the stress of uncertainty and enabling more confident strategic decision-making.

Economic factors

Global inflation remains a significant concern, with the US Consumer Price Index (CPI) showing a 3.3% annual increase as of May 2024, down from its peak but still elevated. This persistent inflation makes precious metals like gold and silver attractive as a hedge, potentially boosting demand for A-Mark's products as investors seek to preserve wealth.

Central banks' interest rate policies directly impact this dynamic. The Federal Reserve held its benchmark interest rate steady in mid-2024, with expectations of potential cuts later in the year. Higher interest rates generally make interest-bearing assets more appealing, potentially diverting investment away from precious metals and impacting A-Mark's sales volumes.

Global economic growth is projected to moderate in 2024 and 2025. The IMF forecasts global GDP growth at 3.2% for 2024, with a slight uptick to 3.5% in 2025. However, recession risks remain, particularly in advanced economies, due to persistent inflation and tighter monetary policies. This economic environment can influence A-Mark's performance, as periods of uncertainty often increase demand for precious metals as a safe haven.

Currency fluctuations, particularly the strength of the US Dollar, significantly impact A-Mark's operations. As precious metals are primarily priced in USD, a stronger dollar generally makes these metals more expensive for buyers using other currencies, potentially dampening demand. Conversely, a weaker dollar can boost demand by making metals cheaper for international purchasers.

For A-Mark, this dynamic affects its international sales volume and the cost of acquiring inventory from non-USD sources. For instance, if the USD strengthened considerably against the Euro in late 2024, A-Mark's European clients would face higher costs for dollar-denominated gold and silver, potentially leading to reduced orders. This highlights the need for A-Mark to manage currency risk through hedging strategies to protect its profit margins on international transactions.

Investor Sentiment and Market Volatility

Investor sentiment plays a crucial role in the precious metals market, directly impacting A-Mark's business. When confidence is low and fear prevails, investors often flock to gold and silver as safe-haven assets. This increased demand can significantly boost A-Mark's trading volumes and shift client preferences towards physical bullion. For instance, during periods of geopolitical tension or economic uncertainty, such as the concerns surrounding global inflation in late 2024, there's a noticeable uptick in investor interest in precious metals.

Market volatility, often fueled by shifts in investor sentiment, creates both opportunities and challenges for A-Mark. Periods of high volatility can lead to increased trading activity as investors react to price swings, potentially benefiting A-Mark's brokerage services. However, extreme volatility can also introduce greater risk and necessitate more cautious inventory management. The VIX index, a common measure of market volatility, saw fluctuations throughout 2024, reflecting these shifting investor moods.

- Investor Confidence: Surveys in late 2024 indicated a mixed sentiment among individual investors regarding the economic outlook, with a portion expressing a preference for tangible assets like precious metals.

- Risk Appetite: A decrease in risk appetite, often seen during economic downturns or geopolitical instability, typically correlates with increased demand for gold and silver.

- Market Volatility: The S&P 500 experienced periods of heightened volatility in 2024, prompting some investors to reallocate capital towards perceived safe havens.

- Product Demand: A-Mark likely observed a rise in demand for physical gold and silver bars and coins during times of heightened market uncertainty in 2024.

Supply and Demand Dynamics of Precious Metals

The supply and demand for precious metals are critical economic factors influencing A-Mark's operations. Mining output, particularly from major producers like China, Australia, and Russia, alongside recycling efforts, dictates the available supply. Demand stems from diverse sectors: industrial applications, especially in electronics and automotive catalysts for platinum and palladium, jewelry consumption, and significant investment demand driven by economic uncertainty and inflation hedging.

Analyzing these dynamics is essential for A-Mark to effectively manage its inventory and pricing strategies. For instance, in 2024, global gold mine production was projected to remain relatively stable, while silver supply was expected to see a slight increase due to higher mine output. Conversely, demand for palladium has faced headwinds due to the shift towards electric vehicles, impacting its price and A-Mark's inventory decisions.

- Mining Output: Global gold mine production in 2024 was estimated around 3,200 tonnes, with silver production projected at over 800 million ounces.

- Industrial Demand: Platinum and palladium demand in the automotive sector, a key driver, faced challenges in 2024 due to evolving emissions standards and EV adoption rates.

- Investment Demand: Gold and silver often see increased investment demand during periods of geopolitical instability or rising inflation, impacting A-Mark’s sales volumes.

- Recycling: Scrap supply for gold and silver plays a significant role, particularly during price rallies, providing an additional source of metal for the market.

Global inflation, while moderating, remains a key economic factor. The US CPI was 3.3% year-over-year in May 2024, indicating continued price pressures that often drive investors towards precious metals as a hedge. This persistent inflation, coupled with fluctuating interest rate policies from central banks like the Federal Reserve, directly influences investment flows. The Fed's decision to hold rates steady in mid-2024, with potential future cuts, creates an environment where the attractiveness of interest-bearing assets versus tangible assets like gold and silver is constantly re-evaluated, impacting A-Mark's sales volumes.

Economic growth projections for 2024 and 2025 suggest a moderate global GDP expansion, with the IMF forecasting 3.2% for 2024. However, recession risks persist, particularly in developed economies, due to ongoing inflation and tighter monetary conditions. These macroeconomic trends create a complex landscape for A-Mark, as periods of economic uncertainty typically boost demand for precious metals as safe-haven assets, influencing trading volumes and product demand.

Currency fluctuations, especially the strength of the US Dollar, significantly affect A-Mark's international business. A stronger dollar makes dollar-denominated precious metals more expensive for non-USD buyers, potentially reducing demand. Conversely, a weaker dollar can stimulate international sales by making these assets more affordable. This dynamic necessitates careful currency risk management for A-Mark to protect its profit margins on cross-border transactions.

| Economic Factor | 2024 Projection/Data | Impact on A-Mark |

| Global Inflation (US CPI) | 3.3% (May 2024) | Increases demand for precious metals as a hedge. |

| Global GDP Growth | 3.2% (IMF 2024 forecast) | Moderate growth may increase safe-haven demand during uncertainty. |

| US Interest Rates | Held steady mid-2024, potential cuts later | Influences investor preference between interest-bearing and precious metals. |

| US Dollar Strength | Fluctuating | Affects international demand and acquisition costs. |

Same Document Delivered

A-Mark PESTLE Analysis

The preview you see here is the exact A-Mark PESTLE Analysis document you’ll receive after purchase. It’s fully formatted and ready for immediate use, offering a comprehensive overview of the external factors impacting A-Mark. You can trust that the insights and structure displayed are precisely what you'll download, ensuring no surprises.

Sociological factors

The investor landscape is shifting, with younger generations, often digital natives, showing increasing interest in tangible assets like precious metals. This demographic often prefers online platforms and expects seamless digital experiences, a trend A-Mark is addressing through its enhanced online presence and user-friendly trading tools.

A-Mark's strategy involves tailoring marketing messages and product bundles to appeal to these diverse groups, recognizing that preferences for investment channels, such as mobile apps versus traditional phone orders, vary significantly. For instance, in 2024, a notable portion of new accounts at A-Mark were opened by individuals under 40, highlighting the success of their digital outreach efforts.

Societal demand for ethically sourced precious metals is increasing, impacting A-Mark's operations. Consumers and investors alike are scrutinizing supply chains for responsible practices, making transparency crucial for maintaining client trust and brand reputation. This trend is directly linked to the growing influence of ESG investing principles, which prioritize companies demonstrating strong environmental, social, and governance performance.

A-Mark's ability to showcase responsible sourcing and align with ESG mandates is vital for its long-term success. For instance, the Responsible Jewellery Council (RJC) certification is a benchmark many clients look for, indicating adherence to ethical and social standards. As of early 2024, a significant portion of institutional investors are actively seeking ESG-compliant investments, underscoring the financial implications of these sociological shifts for companies like A-Mark.

Public trust in financial systems significantly impacts demand for tangible assets like precious metals. When confidence in traditional banking, fiat currencies, or government economic policies wavers, investors often seek alternatives. For instance, a 2024 survey indicated that only 45% of Americans expressed high confidence in the banking system, a figure that can drive interest in physical gold and silver.

A-Mark's role in providing access to physical precious metals offers a hedge against perceived instability in conventional finance. This appeal intensifies during periods of economic uncertainty or inflationary pressures, as seen in the 15% year-over-year increase in retail gold purchases reported by some dealers in late 2024.

Wealth Transfer and Generational Investment Habits

The significant ongoing wealth transfer, estimated to reach $84 trillion in the U.S. by 2045, presents a critical sociological factor for A-Mark. This demographic shift means younger generations are increasingly inheriting substantial assets, potentially altering their investment strategies and preferences. A-Mark's ability to cater to both established investors focused on wealth preservation and newer inheritors seeking growth or different asset classes will be key.

Different generations exhibit distinct investment habits, influenced by their formative economic experiences. For instance, Gen Z and Millennials, having grown up during periods of technological advancement and market volatility, may show a greater propensity for digital assets or ESG-focused investments compared to older generations who might favor traditional portfolios. Understanding and adapting to these evolving preferences is crucial for A-Mark's client acquisition and retention strategies.

- Intergenerational Wealth Transfer: An estimated $84 trillion in wealth is projected to transfer between generations in the U.S. by 2045.

- Generational Investment Preferences: Younger generations may favor digital assets and ESG investments, while older generations lean towards traditional portfolios.

- A-Mark's Positioning: The company must adapt its services to appeal to both wealth preservation needs of older investors and the evolving preferences of inheritors.

- Market Adaptation: Success hinges on A-Mark's ability to understand and serve the diverse financial goals and risk appetites across different age demographics.

Cultural and Traditional Significance of Precious Metals

Gold and silver have long held deep cultural and traditional significance across many societies, often serving as tangible symbols of wealth, status, and prosperity. In many parts of Asia, for instance, gold jewelry is a customary part of weddings and festivals, directly influencing demand. This enduring societal value means that demand for precious metals isn't solely driven by investment strategies but also by deeply ingrained cultural practices.

A-Mark, as a significant player in the precious metals market, benefits from this cultural demand. For example, in India, gold consumption for cultural events and gifting can represent a substantial portion of the annual demand. In 2023, India’s gold demand reached 748.5 tonnes, underscoring the persistent cultural pull. This highlights how A-Mark's business is intertwined with these traditional values, which can create consistent demand even during periods of economic uncertainty.

- Cultural Demand Drivers: Gold and silver are integral to many cultural ceremonies, particularly in regions like India and China, driving consistent consumer demand beyond investment motives.

- Status Symbolism: Precious metals are widely recognized globally as markers of wealth and social standing, influencing purchasing decisions for personal adornment and gifting.

- Traditional Holdings: In many cultures, precious metals are traditionally held as a store of value, passed down through generations, ensuring a baseline level of demand.

- Market Impact: Events like Diwali in India or Chinese New Year often see a significant uptick in precious metal purchases, directly impacting market volumes for companies like A-Mark.

Societal shifts, particularly the increasing demand for ethical sourcing and the growing influence of ESG investing, are reshaping consumer expectations. A-Mark must demonstrate transparency in its supply chain, as indicated by the demand for certifications like the Responsible Jewellery Council, to maintain trust and appeal to institutional investors actively seeking ESG-compliant options in 2024.

Public confidence in traditional financial systems directly impacts the appeal of tangible assets like precious metals. With a notable segment of the population expressing concerns about banking stability, as evidenced by surveys from 2024, precious metals offer a perceived hedge against economic uncertainty and inflation, driving retail demand.

The substantial intergenerational wealth transfer, projected to reach $84 trillion in the U.S. by 2045, presents a significant opportunity and challenge. A-Mark needs to cater to the evolving investment preferences of younger inheritors, who may differ from the wealth preservation focus of older generations, requiring adaptable service models.

Cultural significance remains a potent driver of precious metal demand, transcending purely investment motives. In regions like India, where gold is deeply embedded in traditions and festivals, this cultural pull ensures consistent market activity, as demonstrated by substantial annual demand figures, reinforcing the enduring value of these assets.

| Sociological Factor | Description | Impact on A-Mark | 2024/2025 Data/Trend |

|---|---|---|---|

| Generational Investment Preferences | Younger demographics often prefer digital platforms and are increasingly interested in ESG-compliant assets. | Requires A-Mark to enhance digital offerings and highlight ethical sourcing. | A notable portion of new accounts in 2024 were opened by individuals under 40, indicating success in digital outreach. |

| Ethical Sourcing & ESG Demand | Growing consumer and investor demand for transparency and responsible practices in supply chains. | Necessitates A-Mark's adherence to ethical standards and potential ESG certifications. | Significant institutional investor interest in ESG-compliant investments as of early 2024. |

| Public Confidence in Financial Systems | Fluctuations in trust in traditional banking and fiat currencies drive demand for alternative assets. | Positions precious metals as a hedge, potentially increasing A-Mark's customer base during uncertain times. | A 2024 survey showed only 45% of Americans expressed high confidence in the banking system. |

| Intergenerational Wealth Transfer | The transfer of significant wealth to younger generations may alter investment strategies and preferences. | A-Mark must adapt to cater to both wealth preservation and new investment approaches. | An estimated $84 trillion in wealth transfer projected in the U.S. by 2045. |

| Cultural Significance of Precious Metals | Deep-rooted cultural traditions and ceremonies in many societies drive consistent demand. | Provides a baseline demand for precious metals, complementing investment-driven purchases. | India's gold demand reached 748.5 tonnes in 2023, showcasing strong cultural consumption. |

Technological factors

A-Mark leverages the continuous evolution of e-commerce and digital trading platforms to enhance its global operations. The company focuses on cutting-edge web design and user experience, ensuring seamless buying, selling, and account management for its diverse clientele. This commitment to digital advancement is crucial in a market where accessibility and ease of use drive customer engagement and retention.

Blockchain technology offers significant potential for A-Mark in tracking the provenance of precious metals, ensuring ethical sourcing and supply chain transparency. This could involve immutable records of a metal's journey from mine to market, appealing to increasingly conscious consumers and investors. For instance, by mid-2025, several major commodity exchanges are expected to pilot blockchain-based tracking systems for various raw materials, potentially including precious metals.

Furthermore, the rise of digital assets, such as tokenized gold, presents A-Mark with opportunities to innovate its product offerings and reach new customer segments. These digital tokens, backed by physical gold, can facilitate fractional ownership and more accessible trading. The global market for tokenized assets was projected to reach $1.5 trillion by the end of 2024, indicating a growing appetite for such digital representations of tangible value.

Enhanced cybersecurity is paramount for A-Mark, a company handling sensitive financial data and transactions. In 2024, the financial services sector experienced a significant rise in cyberattacks, with reported losses in the billions, underscoring the need for robust defenses.

A-Mark's commitment to advanced security protocols, including multi-factor authentication and encryption, is crucial for safeguarding client information and proprietary assets. This investment directly supports trust and operational integrity in their digital platforms, a necessity given the increasing sophistication of cyber threats.

Data Analytics and Artificial Intelligence for Market Insights

A-Mark leverages advanced data analytics and artificial intelligence to sift through massive datasets, enabling more accurate market trend prediction and enhanced risk management. This technological edge allows the company to optimize pricing strategies, refine inventory levels, and proactively identify emerging business avenues.

The integration of AI and big data is crucial for A-Mark's operational efficiency. For instance, in 2024, companies across the precious metals sector are increasingly relying on predictive analytics to forecast demand fluctuations, a critical factor given the volatility of commodities like gold and silver. A-Mark's ability to process real-time sales data, global economic indicators, and geopolitical news through AI algorithms provides a significant competitive advantage.

- Predictive Analytics: A-Mark utilizes AI to forecast demand for precious metals, improving inventory management and reducing holding costs.

- Risk Mitigation: Machine learning models analyze market volatility and geopolitical events to identify and mitigate potential risks in real-time.

- Operational Efficiency: Data-driven insights inform pricing decisions and supply chain logistics, enhancing overall profitability.

- Opportunity Identification: AI algorithms scan market data to uncover niche opportunities and emerging customer segments.

Innovation in Secure Storage and Logistics

Technological advancements are significantly reshaping the secure storage and logistics landscape for precious metals, a critical area for A-Mark. Innovations in physical security, such as biometric access controls and advanced surveillance systems, are becoming standard. In 2024, the global physical security market was valued at approximately $115 billion and is projected to grow, reflecting increased investment in robust protective measures.

A-Mark actively integrates these technological improvements to safeguard client assets. This includes adopting state-of-the-art vault technologies that offer enhanced resistance to physical threats. Furthermore, sophisticated inventory management systems, often leveraging IoT sensors and real-time data analytics, are crucial for maintaining accurate and secure tracking of precious metals throughout the supply chain.

Logistical solutions are also benefiting from technological leaps. A-Mark utilizes advanced tracking systems that provide end-to-end visibility of shipments, ensuring accountability and minimizing risk. Efficient transportation methods, including specialized armored vehicles and optimized routing software, are employed to guarantee the safe and timely delivery of precious metals. The global logistics market, valued at over $9 trillion in 2024, sees continuous technological integration aimed at improving security and efficiency.

- Biometric Access Controls: Enhancing physical security with fingerprint and facial recognition technology in vault facilities.

- IoT-Enabled Inventory Management: Real-time tracking and monitoring of precious metal inventory levels and locations.

- Advanced Logistics Tracking: End-to-end visibility of shipments via GPS and secure data transmission protocols.

- AI-Powered Route Optimization: Utilizing artificial intelligence to plan the most secure and efficient transportation routes for high-value assets.

A-Mark's technological strategy centers on enhancing digital platforms, exploring blockchain for supply chain transparency, and capitalizing on tokenized assets. The company prioritizes robust cybersecurity, employing advanced analytics and AI for market prediction and risk management. Innovations in secure storage and logistics further bolster operational integrity and client asset protection.

| Technology Area | Impact on A-Mark | Relevant Data/Trends (2024-2025) |

|---|---|---|

| E-commerce & Digital Platforms | Improved customer experience, global reach | Digital trading volume in commodities expected to see continued growth, driven by user-friendly interfaces. |

| Blockchain | Supply chain transparency, ethical sourcing verification | Pilot programs for blockchain in commodity tracking are expanding, with potential for broader adoption by mid-2025. |

| Digital Assets (Tokenization) | New product offerings, fractional ownership | The tokenized asset market was projected to reach $1.5 trillion by the end of 2024. |

| Cybersecurity | Data protection, trust building | Financial services sector faced billions in losses from cyberattacks in 2024, emphasizing the need for advanced security. |

| AI & Big Data Analytics | Market forecasting, risk management, operational efficiency | Precious metals sector increasingly uses predictive analytics; AI integration enhances competitive advantage. |

| Secure Storage & Logistics | Asset protection, efficient delivery | Global physical security market valued around $115 billion in 2024; logistics market exceeds $9 trillion. |

Legal factors

A-Mark, like all precious metals dealers, operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations designed to combat financial crime. These legal frameworks mandate robust compliance programs, including thorough due diligence on customers and detailed transaction reporting to authorities.

In 2024, global efforts to enhance AML/KYC compliance intensified, with regulators focusing on virtual assets and cross-border transactions. A-Mark’s commitment to these regulations involves sophisticated identity verification processes and ongoing monitoring to detect suspicious activities, ensuring adherence to evolving international standards.

Taxation policies significantly impact precious metals investments, with capital gains tax being a primary concern for investors. For instance, in the United States, profits from selling gold or silver are generally subject to capital gains tax, which can be short-term or long-term depending on the holding period. A-Mark stays abreast of these evolving tax regulations across various jurisdictions to guide its clients effectively.

Furthermore, sales tax or Value Added Tax (VAT) can apply to precious metal transactions in many countries, adding to the overall cost of investment. As of early 2024, some European countries continue to apply VAT on bullion purchases, though specific rates vary. A-Mark's role includes providing clarity on these transactional taxes, helping clients understand the full financial picture when acquiring precious metals.

A-Mark must navigate a complex web of import/export regulations and customs duties for precious metals, impacting its international logistics and profitability. For instance, the United States imposes tariffs and requires specific declarations for precious metal imports, with rates varying by metal type and origin. Compliance with these rules, including obtaining necessary licenses, is crucial to avoid penalties and ensure smooth cross-border transactions.

Consumer Protection Laws and Fair Trading Practices

Consumer protection laws are paramount for A-Mark, especially concerning financial transactions and the burgeoning e-commerce landscape. The company must meticulously adhere to regulations governing advertising clarity, transparent disclosure of fees and terms, and robust dispute resolution mechanisms. These measures are crucial for fostering customer trust and ensuring fair trading practices, which directly impacts brand reputation and customer loyalty. For instance, in 2024, the Consumer Financial Protection Bureau (CFPB) continued its focus on fair lending practices, and companies like A-Mark must demonstrate compliance to avoid penalties and maintain market access.

A-Mark's commitment to fair trading practices means actively managing its advertising to prevent misleading claims and ensuring all product information is readily accessible and understandable. This includes clear communication about investment risks, fees, and the terms of service. By prioritizing ethical conduct and transparency, A-Mark aims to build long-term relationships with its clientele. The company's adherence to regulations like the Truth in Lending Act (TILA) and the Electronic Fund Transfer Act (EFTA) underscores its dedication to consumer well-being in all its operations.

Key areas of compliance for A-Mark include:

- Advertising Standards: Ensuring all marketing materials are truthful, not misleading, and clearly state any associated risks or costs.

- Disclosure Requirements: Providing comprehensive and easily understandable information about financial products, services, fees, and terms.

- Dispute Resolution: Establishing clear and accessible channels for customers to raise and resolve complaints effectively and fairly.

- Fair Business Practices: Operating with integrity, avoiding deceptive or unfair tactics, and treating all customers equitably.

Compliance with International Sanctions and Trade Embargoes

A-Mark, like any global financial services provider, must meticulously adhere to a complex web of international sanctions and trade embargoes. This involves ensuring no transactions are conducted with individuals, entities, or regions targeted by sanctions from bodies such as the United Nations, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC), or the European Union. Failure to comply can result in severe penalties, including substantial fines and reputational damage. For instance, OFAC's enforcement actions in 2023 alone saw over $2 billion in penalties levied against various entities for sanctions violations, highlighting the critical nature of robust compliance programs.

To navigate these legal requirements, A-Mark implements stringent internal controls and screening processes. These systems are designed to proactively identify and block any dealings with sanctioned parties. This diligence is crucial, especially considering the evolving geopolitical landscape and the frequent updates to sanctions lists. In 2024, the global regulatory environment continues to tighten, with increased scrutiny on financial institutions' anti-money laundering (AML) and sanctions compliance frameworks.

- Sanctions Screening: A-Mark utilizes advanced technology to screen all counterparties against multiple global sanctions lists, including OFAC's Specially Designated Nationals (SDN) list and Consolidated List.

- Due Diligence: Enhanced due diligence is performed on transactions involving higher-risk jurisdictions or entities to ensure full compliance with trade embargoes.

- Regulatory Updates: Continuous monitoring of regulatory changes and updates from international bodies is integral to maintaining an effective compliance program.

- Training: Regular training for staff on sanctions compliance and the identification of suspicious activities is a cornerstone of A-Mark's legal framework.

A-Mark must navigate a complex regulatory environment, including stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) laws, which were further emphasized globally in 2024 with a focus on digital assets. Taxation policies, such as capital gains and VAT on precious metals, also directly impact investment costs and require careful client guidance. Furthermore, adherence to international sanctions and trade embargoes, enforced by bodies like OFAC, is critical to avoid severe penalties, with OFAC levying over $2 billion in fines in 2023 alone for violations.

Consumer protection laws, including clear advertising and transparent fee disclosures, are vital for maintaining customer trust. A-Mark's compliance with regulations like the Truth in Lending Act and the Electronic Fund Transfer Act underscores its commitment to fair business practices. Import/export regulations and customs duties also add layers of complexity to international transactions, necessitating meticulous adherence to avoid penalties and ensure smooth operations.

| Legal Factor | Description | 2024/2025 Relevance |

|---|---|---|

| AML/KYC | Combating financial crime through customer due diligence and transaction reporting. | Intensified global focus, particularly on virtual assets and cross-border transactions. |

| Taxation | Capital gains tax on profits and sales tax/VAT on transactions. | Ongoing need for client education on evolving tax implications across jurisdictions. |

| Sanctions & Embargoes | Compliance with international restrictions on dealings with specific entities or regions. | Critical to avoid substantial fines; OFAC levied over $2B in penalties in 2023. |

| Consumer Protection | Ensuring clear advertising, transparent fees, and fair dispute resolution. | Essential for customer trust and brand reputation, with continued regulatory scrutiny. |

Environmental factors

Growing consumer and investor preference for ethically and sustainably sourced precious metals is a significant environmental factor. This trend pushes companies like A-Mark to scrutinize their supply chains, seeking partners who adhere to responsible mining practices and environmental stewardship.

For instance, the World Gold Council's 2023 report highlighted that 73% of consumers are more likely to buy gold from responsible sources, signaling a clear market shift. A-Mark's response could involve offering certified products, such as LBMA Good Delivery bars, which have stringent sourcing requirements, or partnering with refiners committed to reducing their environmental footprint.

Mining and refining precious metals carry a significant environmental footprint, encompassing substantial energy consumption, extensive water usage, and considerable waste generation. For instance, gold mining alone can require vast amounts of water; estimates suggest that producing one ounce of gold can consume up to 20,000 liters of water. While A-Mark operates as a distributor, it faces increasing indirect pressure from stakeholders and regulators to champion more sustainable practices throughout its supply chain, influencing sourcing and operational choices.

The increasing demand for supply chain transparency, particularly regarding environmental impact, presents a key challenge for A-Mark. Stakeholders are scrutinizing the ecological footprint of precious metals from sourcing to refinement. For instance, initiatives like the London Bullion Market Association's (LBMA) Responsible Sourcing Programme are pushing for greater disclosure, impacting how A-Mark operates and reports on its supply chain practices.

Recycling and Circular Economy Initiatives

Growing emphasis on recycling and circular economy principles directly impacts the precious metals industry by offering alternatives to primary mining. Initiatives focused on recovering gold, silver, platinum, and palladium from sources like electronic waste and industrial byproducts can significantly reduce the environmental footprint associated with new extraction. A-Mark, as a participant in the precious metals market, can leverage these trends by engaging in or facilitating the sourcing of recycled materials, potentially lowering operational costs and enhancing its sustainability profile. For instance, the global e-waste recycling market was valued at approximately $50 billion in 2023 and is projected to grow, presenting a substantial source of recoverable precious metals.

The circular economy model encourages the reuse and reprocessing of materials, diminishing the need for virgin resources. This shift can create new business opportunities for companies like A-Mark that are adept at managing the logistics and refining processes for recycled precious metals. By participating in these initiatives, A-Mark can contribute to a more sustainable supply chain, aligning with increasing investor and consumer demand for environmentally responsible practices. The World Economic Forum has highlighted that a circular economy could generate $4.5 trillion in economic benefits by 2030, underscoring the strategic importance of these approaches.

- E-waste Recovery: Electronic devices contain significant amounts of precious metals; for example, a ton of smartphones can contain more gold than a ton of gold ore.

- Industrial Scrap: Various manufacturing processes generate scrap materials containing precious metals, which can be efficiently refined and reintroduced into the supply chain.

- Jewelry Recycling: The established practice of recycling old or unwanted jewelry provides a consistent stream of precious metals, reducing reliance on mining.

- Regulatory Support: Governments worldwide are increasingly implementing policies to encourage recycling and the circular economy, potentially creating a more favorable operating environment for companies involved in metal recovery.

Regulatory Pressure for Environmental Compliance

The precious metals industry faces increasing regulatory scrutiny regarding environmental impact, encompassing carbon emissions and waste management. A-Mark actively monitors evolving legislation, such as potential new emissions standards for its logistics fleet and stricter waste disposal protocols for its storage facilities, to ensure ongoing compliance.

Adapting to these changes is crucial for A-Mark's operational footprint. For instance, the company is evaluating its energy consumption in vaulting operations, which could be subject to future carbon reporting requirements. This proactive approach helps mitigate risks associated with non-compliance and supports sustainable business practices.

- Monitoring Global Environmental Regulations: A-Mark tracks directives from bodies like the European Union, which has been progressively tightening environmental standards across various sectors.

- Adapting Logistics for Reduced Emissions: The company is exploring more fuel-efficient transportation methods and potentially alternative fuels for its precious metals delivery network, a sector increasingly targeted for emissions reduction.

- Waste Management Protocols: Ensuring compliance with local and international waste management regulations is paramount, particularly concerning any byproducts or materials used in the secure storage and handling of precious metals.

The increasing demand for supply chain transparency, especially concerning environmental impact, is a significant factor for A-Mark. Stakeholders are increasingly scrutinizing the ecological footprint of precious metals from sourcing to refinement. For example, the LBMA's Responsible Sourcing Programme pushes for greater disclosure, directly influencing how A-Mark operates and reports on its supply chain practices.

Growing consumer and investor preference for ethically and sustainably sourced precious metals is a key trend. This pushes companies like A-Mark to scrutinize their supply chains, seeking partners who adhere to responsible mining practices and environmental stewardship. The World Gold Council reported in 2023 that 73% of consumers prefer gold from responsible sources, indicating a clear market shift.

The precious metals industry faces growing regulatory scrutiny regarding environmental impact, including carbon emissions and waste management. A-Mark actively monitors evolving legislation, such as potential new emissions standards for its logistics fleet and stricter waste disposal protocols for its storage facilities, to ensure ongoing compliance.

The circular economy model encourages the reuse and reprocessing of materials, diminishing the need for virgin resources. This shift can create new business opportunities for companies like A-Mark that are adept at managing the logistics and refining processes for recycled precious metals. The global e-waste recycling market was valued at approximately $50 billion in 2023, presenting a substantial source of recoverable precious metals.

PESTLE Analysis Data Sources

Our PESTLE analysis for A-Mark is informed by a robust blend of financial market data from reputable sources like Bloomberg and Refinitiv, alongside regulatory updates from government bodies and industry-specific reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the precious metals market.