A-Mark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

A-Mark Bundle

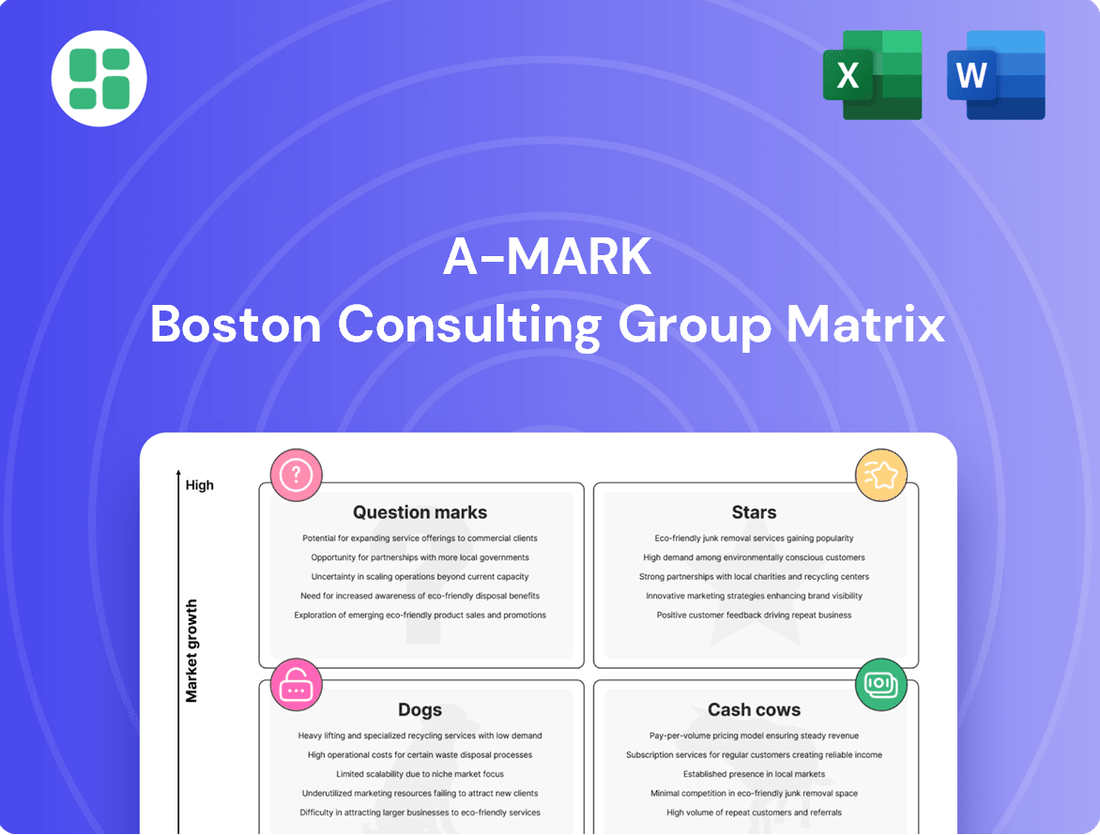

Curious about how a company's product portfolio stacks up? The BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for strategic decisions. Understand where to invest and where to divest with this powerful analytical tool.

Unlock the full potential of strategic planning by purchasing the complete BCG Matrix. Gain detailed quadrant analysis, actionable insights, and a clear understanding of your company's market position to drive informed business growth.

Stars

A-Mark's strategic acquisitions of Spectrum Group International, Pinehurst Coin Exchange, and AMS Holding are significantly expanding its presence in the higher-margin collectible coin market.

This segment is showing robust growth, with A-Mark reporting a substantial 1,489% year-over-year increase in new direct-to-consumer customers in Q3 FY2025, a surge largely attributed to these new ventures.

These moves firmly establish A-Mark as a key player in the expanding luxury asset sector, capitalizing on increasing demand for tangible investments.

The Direct-to-Consumer (DTC) segment is a significant growth driver for A-Mark, contributing 19% to consolidated revenue in fiscal Q3 2025. This expansion highlights A-Mark's successful strategy in capturing a larger share of the burgeoning online precious metals market. The company's focus on DTC channels is well-aligned with market trends.

The U.S. Bullion & Precious Metal eCommerce market is poised for substantial growth, with projections indicating a 5-10% expansion in 2025. This robust market outlook provides a fertile ground for A-Mark's DTC operations to thrive and increase their revenue contribution. A-Mark is well-positioned to capitalize on this upward trend.

A-Mark's strategic move to increase its ownership in Silver Gold Bull (SGB) significantly bolsters its international DTC presence. This expansion not only broadens its reach but also reinforces its strong market share within this rapidly growing e-commerce channel, demonstrating a commitment to global DTC leadership.

Gold bullion and products represent a star in A-Mark's BCG matrix. Gold prices hit record highs in 2024, with projections indicating continued growth into 2025. This surge is fueled by inflation concerns, anticipated interest rate decreases, and strong demand from central banks.

As a major integrated precious metals platform, A-Mark benefits significantly from this trend. The company holds a substantial market share in the gold sector, contributing considerably to its overall revenue. This positions gold as a key high-growth asset for A-Mark.

Strategic Expansion in Asia

A-Mark is strategically expanding its footprint in Asia, a region that currently represents a significant portion of the global precious metals market. In 2023, the Asia-Pacific region accounted for approximately 60% of global gold demand, driven by robust investment and industrial use.

The company's initiative includes establishing a trading office and a Direct-to-Consumer presence in Singapore, a key financial hub. This move is designed to capitalize on the burgeoning demand and increasing investments within the Asian market.

- Asia Pacific Dominance: The Asia Pacific region holds a commanding share of the global precious metals market, with demand fueled by both investment and industrial applications.

- Singapore Hub: A-Mark is establishing a trading office and Direct-to-Consumer presence in Singapore to tap into this high-growth market.

- Market Capture: This expansion is a calculated step to secure substantial market share in a rapidly developing geographical segment.

- 2023 Data: In 2023, the Asia-Pacific region saw roughly 60% of global gold demand, underscoring the market's potential.

Platinum Products

Platinum products are poised for a strong showing, earning their place as a potential star in A-Mark's BCG Matrix. The outlook for the platinum market in 2025 is particularly bright, with projections pointing towards a persistent undersupply. This scarcity is a key driver for price stability and enhances platinum's attractiveness as an investment. For instance, the World Platinum Investment Council (WPIC) has consistently highlighted supply deficits in recent reports, with the 2024 forecast suggesting a continued imbalance.

A-Mark, as a leading distributor of precious metals, is strategically positioned to benefit from these favorable market conditions. The company's extensive network and established relationships allow it to effectively meet the growing demand for platinum. This demand, coupled with the inherent undersupply in the market, creates a compelling scenario for platinum products within A-Mark's portfolio.

- Projected Platinum Market Performance: Anticipated strong performance in 2025.

- Supply-Demand Dynamics: Continued undersupply expected, supporting prices.

- A-Mark's Position: Well-positioned as a comprehensive precious metals distributor.

- Investment Appeal: Growing demand in an undersupplied market enhances appeal.

Gold bullion and products are a clear Star in A-Mark's BCG matrix, driven by record high prices in 2024 and continued growth projections for 2025. This surge is supported by inflation concerns, expected interest rate decreases, and robust central bank demand, making gold a high-growth asset for A-Mark.

A-Mark's strategic expansion into Asia, which accounted for approximately 60% of global gold demand in 2023, further solidifies gold's star status. The establishment of a trading office and DTC presence in Singapore is designed to capture this burgeoning demand.

Platinum products also show strong potential as a Star, with the 2025 market outlook anticipating persistent undersupply. This scarcity, highlighted by organizations like the World Platinum Investment Council, enhances platinum's investment appeal and A-Mark's ability to meet growing demand.

| Segment | BCG Category | Key Drivers | A-Mark's Position | Outlook |

| Gold Bullion & Products | Star | Record 2024 prices, inflation hedge, central bank demand, Asian market growth | Major integrated platform, significant market share | Continued growth into 2025 |

| Platinum Products | Potential Star | Projected undersupply in 2025, increasing investment demand | Leading distributor, strong network | Strong performance expected |

What is included in the product

Strategic framework categorizing business units by market share and growth to guide investment decisions.

The A-Mark BCG Matrix provides a clear, visual snapshot of your portfolio, eliminating the pain of indecision about where to focus resources.

Cash Cows

A-Mark's wholesale distribution of precious metals, including gold, silver, platinum, and palladium bullion, is its established cash cow. This segment, a core part of its Wholesale Sales & Ancillary Services, operates in a mature market where A-Mark leverages its dominant position, built on deep relationships with sovereign mints and a vast dealer network.

This business consistently delivers significant revenue and robust cash flow, acting as the stable financial engine for the company. While volume growth might not be as rapid as emerging areas, its reliability and substantial contribution make it a cornerstone of A-Mark's overall financial health.

Silver bullion is a cornerstone for A-Mark, consistently generating substantial revenue. Despite minor shifts in volume, the enduring demand from industrial sectors, especially solar panel manufacturing, and sustained investor interest solidify its position. In 2023, A-Mark reported distributing approximately 24.3 million ounces of silver bullion, highlighting its significant role in the market.

A-Mark's precious metals storage services, operated through its A-M Global Logistics (AMGL) subsidiary, represent a classic Cash Cow in the BCG matrix. This segment generates a consistent, recurring revenue stream from a global clientele seeking secure safekeeping for their precious metals holdings.

As a mature and vital ancillary service for precious metals investors, these storage solutions boast a significant market share within A-Mark's customer base. The ongoing investment required for maintenance is relatively low, allowing for predictable and substantial cash flow generation.

Collateralized Lending Segment

A-Mark's Secured Lending segment, primarily operated by its subsidiary Collateral Finance Corporation (CFC), functions as a cash cow by offering loans secured by precious metals like bullion and numismatic coins.

This specialized financial service targets a defined market of dealers, investors, and collectors. Although loan volumes can vary, the segment maintains a significant market share within its niche, consistently generating interest income that supports A-Mark's overall financial stability.

- Segment Focus: Loans backed by tangible assets such as gold, silver, and collectible coins.

- Market Position: Dominant player in a specialized, mature niche market.

- Revenue Generation: Consistent interest income stream, contributing reliably to company profits.

- Financial Performance (Illustrative): While specific 2024 figures for this segment are not publicly detailed in isolation, A-Mark's overall revenue for the fiscal year ending April 30, 2024, was $9.0 billion, indicating the scale of operations across its various segments.

SilverTowne Minting Operations

SilverTowne Minting Operations represent a significant Cash Cow for A-Mark. This wholly-owned subsidiary offers in-house minting for proprietary coins and bars, ensuring a reliable product flow, particularly when demand surges or sovereign mints face limitations. In 2024, A-Mark reported that its minting segment contributed significantly to its overall revenue, with SilverTowne's efficient operations directly impacting profitability.

This mature, high-market-share capability is a cornerstone of A-Mark's integrated business model. It not only guarantees a consistent supply but also helps maintain stable profit margins, even amidst market fluctuations. The operational efficiency derived from SilverTowne’s minting directly supports A-Mark's ability to meet customer demand promptly.

- Mature Business: SilverTowne Minting is a well-established operation with a proven track record.

- High Market Share: It holds a substantial position within A-Mark's product offerings.

- Stable Margins: The in-house capability contributes to consistent and predictable profitability.

- Supply Chain Control: Ensures product availability, a critical advantage during volatile market conditions.

A-Mark's wholesale precious metals distribution is its primary cash cow, a mature business with a dominant market position. This segment consistently generates substantial revenue and robust cash flow, underpinning the company's financial stability. In the fiscal year ending April 30, 2024, A-Mark reported total revenue of $9.0 billion, with wholesale distribution forming the largest portion of this figure.

Silver bullion distribution is a particularly strong performer within this cash cow segment. The enduring demand from industrial applications, like solar panel manufacturing, and sustained investor interest ensure consistent sales volumes. A-Mark distributed approximately 24.3 million ounces of silver bullion in 2023, a testament to its market penetration.

The company's secured lending operations, through Collateral Finance Corporation (CFC), also function as a cash cow. This niche business provides loans secured by precious metals, generating reliable interest income. While specific 2024 segment data isn't isolated, the overall scale of A-Mark's operations, as evidenced by its $9.0 billion in total revenue for FY2024, indicates the significant contribution of these stable income streams.

| Segment | BCG Classification | Primary Revenue Driver | Key Metric | 2024 Financial Context |

| Wholesale Precious Metals Distribution | Cash Cow | Sales volume of gold, silver, platinum, palladium | Ounces Distributed | Core contributor to $9.0 billion FY2024 revenue |

| Silver Bullion Distribution | Cash Cow | Industrial and investor demand | Ounces Distributed (24.3M in 2023) | Significant portion of wholesale revenue |

| Secured Lending (CFC) | Cash Cow | Interest income on loans secured by precious metals | Loan Portfolio Value | Stable income stream supporting overall profitability |

Preview = Final Product

A-Mark BCG Matrix

The A-Mark BCG Matrix report you are currently previewing is the identical, fully unlocked document you will receive immediately after your purchase. This means no watermarks, no incomplete sections, and no demo content—just the complete, professionally formatted analysis ready for your strategic decision-making.

Dogs

Palladium products represent a 'Dog' within A-Mark's BCG Matrix. The palladium market is projected to experience a downturn in 2025, largely driven by the automotive sector's transition away from traditional internal combustion engine vehicles, a primary consumer of palladium in catalytic converters.

Although A-Mark is involved in palladium distribution, its market share in this particular precious metal is anticipated to be modest when contrasted with gold and silver. The overall decline in the palladium market further solidifies its classification as a 'Dog' category, indicating low growth and a potentially weak competitive position.

Before A-Mark's strategic shift towards higher-margin collectibles, some of its older or less sought-after numismatic coin inventory likely fit the Dogs quadrant. These items, characterized by low demand and slow sales, represented a challenge for inventory management. For instance, in 2023, a portion of A-Mark's legacy inventory might have shown a turnover rate significantly below the company average for collectibles, indicating a weak market position.

A-Mark has been strategically pruning its product offerings, a move that directly impacts its BCG matrix analysis. Discontinued or low-demand bullion forms, such as certain obscure commemorative coins or less popular metal compositions, would have occupied the 'Dog' quadrant. These items typically exhibit low market share and minimal growth potential, making them candidates for divestment to focus resources on more profitable segments.

Less Strategic Regional Wholesale Channels

Within A-Mark's extensive wholesale network, some smaller, less strategic regional channels might be experiencing sluggish growth. These partnerships could be considered Dogs if they demand resources without yielding substantial market share or driving significant revenue. For instance, a specific regional distributor in a mature market might represent a low-growth, low-market-share segment.

- Stagnant Growth: Certain regional wholesale channels may show minimal year-over-year revenue increases, potentially lagging behind A-Mark's overall growth targets.

- Limited Market Penetration: These channels might struggle to expand their reach within their respective territories, indicating a need for strategic review.

- Resource Drain: If these underperforming channels consume a disproportionate amount of A-Mark's sales, marketing, or operational resources relative to their contribution, they could be candidates for divestment or restructuring.

- Example Scenario: Consider a regional partnership that, in 2023, contributed less than 0.5% to A-Mark's total wholesale revenue while requiring dedicated account management resources.

Outdated Traditional Marketing Campaigns

Outdated traditional marketing campaigns that fail to integrate with A-Mark's digital strategies represent a potential 'Dog' in the BCG matrix. These campaigns, often characterized by diminishing returns, struggle to gain traction in today's digitally-focused market. For instance, a print advertising campaign that doesn't drive online traffic or sales would fall into this category.

Such initiatives typically exhibit low market share and low growth potential. Their continued investment, despite poor performance, leads to high costs relative to their impact. A-Mark's focus on e-commerce and direct-to-consumer digital channels means that resources allocated to these legacy efforts are likely not yielding optimal results.

- Low Market Share: Traditional campaigns often reach a shrinking audience compared to digital alternatives.

- Low Growth Rate: The channels themselves are often in industries with stagnant or declining growth.

- High Cost, Low ROI: Legacy media buys can be expensive without a measurable digital conversion.

- Resource Drain: Funds and attention diverted to these campaigns detract from more effective digital strategies.

Dogs in A-Mark's BCG Matrix represent products or business units with low market share and low growth potential. These are often cash traps, requiring investment to maintain but generating minimal returns. A-Mark's strategy involves identifying and managing these 'Dogs' to free up resources for more promising ventures.

The palladium market, as previously noted, exemplifies a 'Dog' for A-Mark due to projected market downturn and A-Mark's modest share. Similarly, certain legacy numismatic coins with low demand and slow turnover also fit this classification. These products, while part of A-Mark's history, now represent a strategic challenge.

Furthermore, outdated marketing efforts that fail to align with A-Mark's digital-first approach are considered 'Dogs.' These campaigns consume resources without delivering significant ROI, unlike more effective digital strategies. Identifying and phasing out such initiatives is crucial for optimizing resource allocation.

A-Mark's approach to 'Dogs' focuses on strategic divestment or restructuring. This allows the company to concentrate capital and management attention on its 'Stars' and 'Question Marks,' aiming for future growth and market leadership. The goal is to streamline operations and enhance overall profitability.

Question Marks

A-Mark includes copper bullion in its product lineup, tapping into a market that saw significant growth in 2024. The demand for copper is surging, fueled by its essential role in renewable energy infrastructure, like solar panels and wind turbines, and the ever-expanding electronics sector. For instance, electric vehicles (EVs) are projected to use considerably more copper than traditional cars, with estimates suggesting up to 4 times as much, a trend that strongly supports the bullish outlook for copper.

Despite this promising market, A-Mark's core business is centered on precious metals. This strategic positioning implies that A-Mark's current market share within the copper sector is likely small. Consequently, copper bullion fits the profile of a 'Question Mark' in the BCG matrix—it operates in a high-growth industry with substantial future potential, but its market penetration and established presence are yet to be proven.

New high-tech trading platforms and digital innovations in the precious metals market represent potential Stars for A-Mark. These advancements, including blockchain solutions and sophisticated analytics, cater to a growing segment of tech-savvy investors, offering enhanced accessibility and trading efficiency. For instance, the global fintech market was projected to reach $1.15 trillion in 2024, indicating a strong appetite for digital financial solutions.

While these digital offerings are in their nascent stages, with currently low market penetration, they hold significant promise for future growth. A-Mark’s investment in developing these cutting-edge platforms positions them to capture a share of this expanding market. The precious metals sector itself saw significant digital adoption, with online trading volumes increasing by an estimated 20% year-over-year in 2023, underscoring the potential for these innovations.

While A-Mark has a strategic focus on Asia for its direct-to-consumer (DTC) precious metals expansion, exploring other emerging international markets presents a significant growth avenue. These regions often have a burgeoning middle class with increasing disposable income, creating demand for tangible assets like gold and silver. For instance, Latin America, particularly countries like Brazil and Mexico, shows promising potential due to a growing interest in wealth preservation and diversification beyond traditional financial instruments.

Entering these new territories is inherently speculative, requiring substantial investment to build brand awareness and establish operational infrastructure. A-Mark would need to navigate varying regulatory landscapes and consumer preferences, much like its initial foray into Asian markets. However, the potential reward lies in capturing early market share in regions where DTC precious metals sales are less saturated, offering a chance to replicate the success seen in more established markets.

Full Integration and Synergy Realization from Recent Acquisitions

The successful integration of recent acquisitions, including SGI, Pinehurst, and AMS Holding, into A-Mark's existing infrastructure is crucial for realizing anticipated cross-selling opportunities and operational synergies. This strategic move into potentially high-growth, higher-margin markets positions A-Mark as a Question Mark, as capturing substantial market share necessitates significant ongoing investment and astute strategic management.

A-Mark's 2024 performance highlights the potential and challenges of these integrations. For instance, the company reported a notable increase in revenue driven by these acquisitions, with specific segments showing promising growth trajectories. However, the realization of full synergy benefits is still in progress, impacting overall profitability in the short term.

- Integration Progress: Ongoing efforts focus on harmonizing systems and processes across SGI, Pinehurst, and AMS Holding to unlock operational efficiencies.

- Synergy Capture: Realizing cross-selling opportunities between acquired entities and A-Mark's core business is a key objective, with initial data suggesting positive customer uptake in certain areas.

- Investment Needs: Continued investment in technology and personnel is required to fully leverage the capabilities of the acquired businesses and achieve projected market share gains.

- Market Dynamics: The high-growth market segment targeted by these acquisitions presents both opportunity and risk, demanding agile strategic adjustments to competitive pressures and evolving customer demands.

Specialized Precious Metals Derivatives/Financial Products

A-Mark's expansion into specialized precious metals derivatives and financial products could position it as a Star in the BCG matrix, assuming successful market penetration. This area represents a potentially high-growth, albeit nascent, market segment. For instance, the global precious metals derivatives market, encompassing futures, options, and swaps, saw significant activity in 2024, driven by inflation hedging and geopolitical uncertainty. A-Mark's current market share in these complex instruments is likely small, necessitating substantial investment in technology and specialized talent to compete effectively.

- Market Potential: The global precious metals market is vast, with derivatives playing a crucial role in price discovery and risk management.

- Competition: Established financial institutions and specialized commodity trading firms dominate this space.

- Investment Needs: Developing sophisticated trading platforms and attracting expert derivative traders requires significant capital outlay.

- Risk/Reward: High potential returns are balanced by the inherent complexity and volatility of derivative markets.

A-Mark's foray into copper bullion, while operating in a high-growth sector, represents a Question Mark due to its current limited market share. Similarly, the company's strategic acquisitions, while promising, require significant ongoing investment to achieve their full potential and capture substantial market share, also classifying them as Question Marks. These ventures, though in nascent stages, offer substantial future growth prospects if managed effectively.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data, including financial statements, market share reports, industry growth rates, and competitive intelligence, to provide a robust strategic framework.