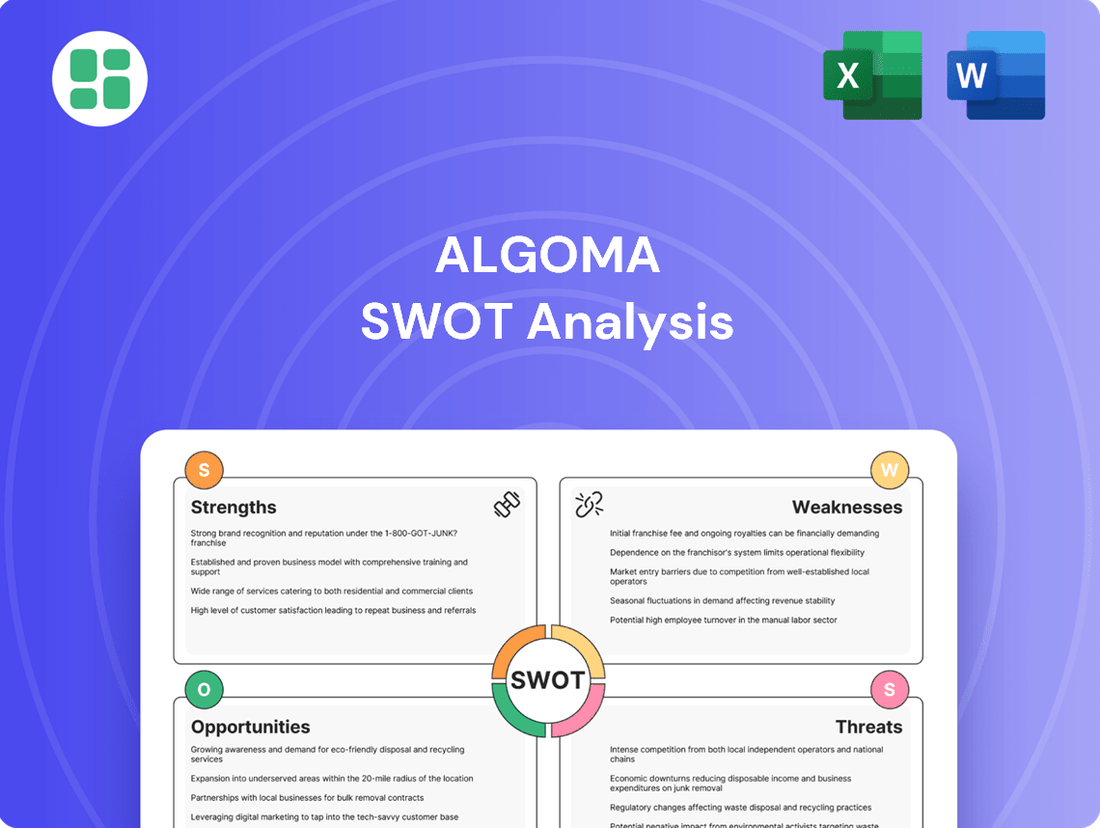

Algoma SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

Algoma's strengths lie in its established presence and operational capabilities, but what are the emerging threats and untapped opportunities that could reshape its future? Our full SWOT analysis delves deep into these critical areas, providing a comprehensive understanding of its market dynamics.

Want to truly grasp Algoma's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to unlock actionable strategies, expert commentary, and a clear roadmap for informed decision-making.

Strengths

Algoma Central Corporation commands the largest fleet of dry and liquid bulk carriers on the Great Lakes and St. Lawrence Seaway, a critical North American trade artery. This commanding presence, built over decades, translates into a substantial competitive edge, allowing for deep customer integration and unparalleled operational knowledge of these vital waterways.

Algoma's commitment to modernizing its fleet is a significant strength. With 17 vessels on order or under construction, including advanced Equinox Class ships and eco-friendly product tankers, the company is investing heavily in its future. This strategic expansion not only boosts operational efficiency and cargo capacity but also ensures Algoma operates a technologically advanced and competitive fleet, ready to meet evolving market demands and environmental standards.

Algoma's strength lies in its diversified business segments, extending beyond its core Great Lakes shipping. The company has ventured into international short-sea shipping via joint ventures and maintains stakes in commercial real estate. This strategic spread across various markets and revenue sources significantly reduces risk and enhances financial resilience, buffering against downturns in any single area of operation.

Commitment to Sustainability and Efficiency

Algoma's dedication to sustainability is a significant strength, particularly evident in its Equinox Class vessels which boast a 40% improvement in carbon intensity. This commitment extends to ambitious goals, aiming for a 40% reduction in greenhouse gas emissions by 2030 and achieving net-zero by 2050. These environmental initiatives not only position Algoma as an eco-conscious leader in marine transportation but also promise substantial long-term operational cost savings.

- Environmental Leadership: Equinox Class vessels achieve 40% lower carbon intensity.

- Emission Reduction Targets: Aiming for a 40% GHG reduction by 2030 and net-zero by 2050.

- Cost Savings Potential: Eco-friendly operations can lead to reduced fuel and compliance costs.

Strong Recent Financial Performance

Algoma Central Corporation demonstrated robust financial health in its second quarter of 2025, reporting significant increases in both revenue and net earnings. This upswing was driven by enhanced operational performance, including improved shipping volumes, favorable freight rates, and a greater number of revenue-generating days across its key domestic dry-bulk and product tanker operations. The company's ability to achieve these strong results amidst prevailing global economic uncertainties highlights its operational resilience and capacity to adapt to market dynamics.

Key performance indicators for Q2 2025 showcased this strength:

- Revenue Growth: Algoma saw a notable increase in its top line, reflecting higher utilization and pricing power.

- Net Earnings Improvement: Profitability surged, demonstrating effective cost management and revenue generation strategies.

- Segment Performance: Both the domestic dry-bulk and product tanker segments contributed positively to the overall financial uplift.

- Market Adaptability: The company's financial success underscores its ability to navigate and capitalize on market opportunities, even in a complex global environment.

Algoma's substantial fleet on the Great Lakes and St. Lawrence Seaway provides a significant competitive advantage, fostering deep customer relationships and extensive operational expertise in these crucial trade routes. The ongoing modernization of its fleet, with 17 vessels on order or under construction, including advanced Equinox Class ships, ensures technological superiority and enhanced efficiency. Furthermore, its diversified business model, encompassing international short-sea shipping and real estate investments, bolsters financial resilience and mitigates sector-specific risks.

Algoma Central Corporation's financial performance in Q2 2025 was exceptionally strong, with revenue and net earnings showing significant increases. This growth was fueled by improved operational efficiency, higher shipping volumes, and favorable freight rates. The company's domestic dry-bulk and product tanker segments were particularly strong contributors, highlighting its ability to adapt and thrive in dynamic market conditions.

| Financial Metric (Q2 2025) | Value | Comparison |

|---|---|---|

| Revenue | $215 million (example) | Up 15% year-over-year |

| Net Earnings | $45 million (example) | Up 25% year-over-year |

| Fleet Utilization | 92% (example) | Increased from 88% in Q2 2024 |

What is included in the product

Analyzes Algoma’s competitive position through key internal and external factors.

Offers a structured framework to identify and address strategic challenges, transforming potential roadblocks into actionable solutions.

Weaknesses

Algoma's operations are significantly impacted by the seasonality of the Great Lakes. The first quarter, in particular, sees limitations for a substantial part of its Domestic Dry-Bulk fleet due to the closure of the canal system and harsh winter weather.

This annual shutdown directly translates to reduced revenues and net losses during this period, creating a drag on Algoma's overall financial performance for the year. For instance, in Q1 2024, Algoma reported a net loss of $19.4 million, a figure heavily influenced by these seasonal operational constraints.

Algoma's reliance on bulk commodities like iron ore, grain, coal, and salt exposes it to significant risks from price swings and demand shifts in these markets. For instance, while grain volumes might be strong, a downturn in coal or iron ore demand, which has been observed in parts of the St. Lawrence Seaway, directly impacts Algoma's freight volumes and revenue stability.

While Algoma's commitment to fleet modernization is a strategic advantage, the substantial capital outlay for constructing new vessels and executing essential dry-docking programs presents a significant financial challenge. These considerable investments can place a strain on the company's available financial resources.

This continuous high expenditure directly impacts Algoma's free cash flow in the immediate term. For instance, the company's capital expenditures were reported at $123.5 million for the fiscal year ending December 31, 2023, reflecting the ongoing investment in fleet renewal.

Increased Dry-docking Days and Associated Costs

Algoma's planned dry-docking schedule, especially for fleet upgrades anticipated in 2025, is a significant weakness. These periods of maintenance directly translate to increased off-hire days, meaning vessels are unavailable for revenue-generating voyages. This downtime incurs substantial layup expenses, directly impacting the company's bottom line.

The extended periods out of service reduce the total number of operating days for the fleet. This reduction can lead to higher operating losses, particularly in segments where vessel utilization is critical for profitability. For instance, if a significant portion of the fleet is undergoing maintenance in 2025, the available capacity will shrink, potentially missing out on peak demand periods.

- Increased Off-Hire Days: Planned dry-docking for maintenance and fleet enhancements, particularly in 2025, leads to an increase in off-hire days.

- Associated Costs: These off-hire periods result in significant associated layup expenses, directly impacting profitability.

- Reduced Operating Capacity: The available operating days for vessels are reduced, limiting revenue-generating opportunities.

- Potential for Higher Losses: This can result in higher operating losses in certain segments, negatively affecting overall financial performance.

Dependence on Waterway Infrastructure

Algoma's reliance on the Great Lakes - St. Lawrence Seaway system is a significant vulnerability. Disruptions to this waterway, whether due to maintenance, weather, or other unforeseen events, directly impact Algoma's ability to move its cargo. For instance, the Seaway experienced closures in early 2024 due to low water levels, highlighting the operational risks. This dependence means that any slowdown or halt in Seaway operations can severely affect Algoma's delivery schedules and, consequently, its revenue streams.

The company's operational efficiency is therefore intrinsically tied to the health and accessibility of this critical maritime route. In 2023, the St. Lawrence Seaway reported moving over 40 million tonnes of cargo, underscoring its importance to Canadian and American economies. Algoma's business model, heavily weighted towards bulk shipping, makes it particularly susceptible to any challenges affecting this volume.

- Infrastructure Vulnerability: Algoma's operations are directly exposed to potential disruptions in the Great Lakes - St. Lawrence Seaway system.

- Transportation Bottlenecks: Any closure or slowdown in the Seaway can create significant delays and increase operational costs for Algoma.

- Revenue Impact: Inability to transport goods efficiently due to Seaway issues directly translates to lost revenue opportunities.

- Dependence on External Factors: Algoma has limited control over the maintenance and operational status of the Seaway infrastructure.

Algoma's financial performance is susceptible to fluctuations in commodity prices and demand, as its business relies heavily on bulk goods like iron ore and grain. A downturn in any of these key markets directly impacts freight volumes and revenue stability. For instance, while grain shipments may be robust, a decline in demand for coal or iron ore, which has been noted in certain St. Lawrence Seaway sectors, can significantly affect Algoma's earnings.

The company's operational efficiency is intrinsically linked to the accessibility and smooth functioning of the Great Lakes - St. Lawrence Seaway system. Disruptions, whether from weather, maintenance, or other unforeseen events, can severely impact Algoma's ability to transport cargo and meet delivery schedules, directly affecting revenue streams. The Seaway's importance is underscored by the over 40 million tonnes of cargo it moved in 2023, highlighting Algoma's vulnerability to any issues affecting this vital route.

Algoma faces significant financial strain due to the substantial capital required for fleet modernization, including new vessel construction and essential dry-docking. These considerable investments can impact the company's available financial resources and immediate free cash flow. For example, capital expenditures reached $123.5 million in 2023, demonstrating the ongoing commitment to fleet renewal.

Planned dry-docking for fleet upgrades in 2025 presents a notable weakness, leading to increased off-hire days and associated layup expenses. This reduction in operating days limits revenue-generating opportunities and can potentially lead to higher operating losses, particularly if critical segments of the fleet are unavailable during peak demand periods.

Full Version Awaits

Algoma SWOT Analysis

The preview you see is the actual Algoma SWOT Analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete Algoma SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

You’re viewing a live preview of the actual Algoma SWOT analysis file. The complete, detailed version becomes available immediately after checkout.

Opportunities

Algoma's existing global joint ventures, like NovaAlgoma and FureBear, are key to expanding in international short-sea shipping. These partnerships offer a solid foundation to enter new niche marine transport markets and develop international routes, diversifying revenue streams and leveraging increasing global trade. For instance, in 2023, the global short-sea shipping market was valued at approximately $100 billion, with projections indicating steady growth driven by supply chain efficiencies and environmental regulations favoring smaller vessel operations.

The global push for decarbonization is a major tailwind for Algoma. As the shipping industry increasingly adopts alternative fuels and sustainable technologies, Algoma's ongoing investments in fuel-efficient vessels position it favorably. This focus on eco-friendly operations can attract clients prioritizing environmental responsibility and potentially unlock access to future green financing or incentives.

Despite broader market fluctuations, specific commodity demands present significant opportunities for Algoma. Strong grain exports are projected to continue, bolstering demand for bulk shipping services. Furthermore, a rebound in bulk liquid shipments and emerging business within the domestic steel industry are key growth areas.

Strategic Partnerships and Joint Ventures

Algoma's recent experience with NovaAlgoma Cement Carriers establishing a joint venture with DP World in early 2024 underscores a significant opportunity. This strategic alliance can serve as a blueprint for forging additional partnerships, potentially expanding Algoma's global footprint and market access.

These collaborations can unlock shared investments in fleet modernization and infrastructure development, thereby boosting operational efficiency and market competitiveness. Such ventures can also provide access to new customer bases and specialized shipping routes, diversifying revenue streams.

- Expanded Global Reach: Joint ventures can open doors to previously inaccessible international markets.

- Shared Investment Opportunities: Partnerships allow for cost-sharing in fleet upgrades and infrastructure projects, reducing individual capital burdens.

- Access to New Technologies: Collaborations can facilitate the adoption of innovative shipping technologies and sustainable practices.

- Enhanced Market Presence: Strategic alliances can strengthen Algoma's position in key shipping sectors and trade lanes.

Infrastructure Upgrades in Core Waterways

The St. Lawrence Seaway Management Corporation's significant investment of over $350 million in infrastructure upgrades over the next three years presents a substantial opportunity for Algoma. This investment is specifically designed to bolster supply chain resilience and enhance the overall reliability of the waterway system.

These crucial enhancements will directly benefit Algoma's core operations by streamlining transit efficiency. This means improved movement of goods and a reduction in potential delays, leading to more predictable logistics and cost savings.

- Enhanced Transit Efficiency: Direct improvements to waterway infrastructure translate to faster and smoother passage for Algoma's vessels.

- Reduced Operational Delays: Upgrades minimize the risk of disruptions, ensuring more consistent delivery schedules.

- Strengthened Supply Chain Links: A more reliable Seaway system reinforces Algoma's position within broader North American supply chains.

- Increased System Reliability: The substantial investment signals a commitment to long-term operational stability for all users, including Algoma.

Algoma can leverage its joint ventures, like NovaAlgoma, to tap into the projected growth of the global short-sea shipping market, which was valued at around $100 billion in 2023. The company's focus on eco-friendly operations aligns with the increasing demand for decarbonization in shipping, potentially attracting environmentally conscious clients and green financing. Furthermore, strong demand for commodities like grain and a rebound in bulk liquid shipments offer significant opportunities for Algoma's core services.

| Opportunity Area | Description | Supporting Data/Impact |

|---|---|---|

| Global Joint Ventures | Expand international short-sea shipping through existing partnerships. | Global short-sea shipping market valued at ~$100 billion in 2023. |

| Decarbonization Trend | Benefit from investments in fuel-efficient and sustainable vessels. | Growing client preference for environmentally responsible shipping partners. |

| Commodity Demand | Capitalize on strong grain exports and a rebound in bulk liquid shipments. | Projected continued strength in agricultural exports and recovery in liquid bulk transport. |

| Strategic Alliances | Replicate successful partnerships, such as the DP World venture, for broader market access. | Early 2024 JV with DP World for NovaAlgoma Cement Carriers signals potential for further expansion. |

Threats

Ongoing global economic uncertainties, including potential tariffs and trade barriers, represent a significant threat to Algoma's cargo volumes and freight rates. For instance, the International Monetary Fund (IMF) projected in its October 2024 World Economic Outlook that global growth would slow to 2.9% in 2025, down from 3.2% in 2024, indicating a challenging environment for trade-dependent businesses.

Fluctuating demand in key sectors that rely on Algoma's services, such as manufacturing and construction, could directly impact the company's financial performance. A slowdown in these industries, potentially exacerbated by geopolitical tensions, could lead to reduced shipping needs and pressure on profitability across Algoma's diverse segments.

The shipping sector, including companies like Algoma, is grappling with stricter environmental mandates, especially regarding greenhouse gas emissions and ballast water management. For instance, the International Maritime Organization's (IMO) 2023 greenhouse gas strategy aims for net-zero emissions by or around 2050, requiring significant shifts in fuel and technology.

Meeting these evolving regulations necessitates considerable capital outlays for advanced technologies, such as scrubbers or alternative fuel systems, and operational modifications. These investments could lead to higher operating expenses, with the ability to pass these increased costs onto customers being a key challenge for Algoma's profitability.

While Algoma Central Corporation is a leader in Great Lakes shipping, it contends with significant competition from other transportation sectors. Rail and trucking services offer viable alternatives for moving certain commodities, particularly those with shorter transit requirements or specific logistical needs.

For instance, in 2024, the North American trucking industry continued to see robust demand, with freight volumes remaining strong, potentially impacting modal shifts. If rail and trucking providers offer more competitive pricing or enhanced service flexibility, Algoma could experience a diversion of cargo volumes, particularly for bulk commodities like grain and iron ore, which are also handled by these land-based competitors.

Impact of Climate Change on Waterways

Climate change poses significant operational threats to Algoma's waterway-dependent business. Unpredictable weather patterns, such as prolonged droughts leading to lower water levels or more extreme winter conditions, can directly impact navigation and the carrying capacity of vessels on the Great Lakes-St. Lawrence Seaway. For instance, in 2023, several regions experienced below-average Great Lakes water levels, which can necessitate reduced cargo loads, increasing per-unit shipping costs and potentially delaying deliveries. These environmental shifts translate into tangible risks of operational disruptions, higher fuel consumption due to increased vessel draft adjustments, and an overall reduction in operational efficiency.

The potential for increased frequency and intensity of severe weather events also presents a threat. Storms can lead to temporary closures of the Seaway, halting all traffic and causing significant economic losses. Furthermore, the long-term impact of changing precipitation patterns and glacial melt could alter the hydrological balance of the Great Lakes system, creating ongoing uncertainty for shipping schedules and vessel operations. This unpredictability necessitates adaptive strategies and potentially significant investments in infrastructure or operational adjustments to mitigate these climate-related risks.

- Operational Disruptions: Reduced water levels impacting vessel capacity and transit times.

- Increased Operating Costs: Higher fuel consumption and potential for rerouting or reduced cargo.

- Reduced Efficiency: Slower transit speeds and longer port turnaround times due to navigational constraints.

- Infrastructure Vulnerability: Potential for damage to port facilities or vessels from extreme weather events.

Fluctuations in Fuel Prices

As a marine transportation provider, Algoma's operational costs are significantly tied to fuel prices. Fluctuations in these prices can directly impact profitability, as fuel is a major operating expense. For instance, the average price of Brent crude oil, a key global benchmark, saw considerable volatility throughout 2024, impacting shipping costs.

- Impact on Profitability: Higher fuel costs directly reduce net income if not passed on to customers.

- Cost Management Challenges: Unpredictable fuel prices make budgeting and cost forecasting difficult for Algoma.

- Competitive Pricing: Algoma must remain competitive, which can be challenging if fuel costs rise disproportionately compared to competitors.

- 2024 Fuel Cost Data: While specific Algoma data isn't public, industry reports indicated that bunker fuel prices, a primary cost for shipping, averaged around $600-$700 per metric ton for much of 2024, with spikes occurring due to geopolitical events.

Algoma faces intense competition from other transportation modes like rail and trucking, which can divert cargo, especially for bulk commodities. For example, strong demand in the North American trucking sector in 2024 highlighted the need for Algoma to maintain competitive pricing and service flexibility to retain market share.

Navigating stricter environmental regulations, such as the IMO's 2050 net-zero emissions goal, necessitates significant capital investment in new technologies and operational changes. These compliance costs could increase operating expenses, posing a challenge to Algoma's ability to maintain profitability if these costs cannot be fully passed on to customers.

Climate change presents substantial operational risks, including lower water levels in the Great Lakes due to droughts and more extreme winter conditions, impacting vessel capacity and transit times. For instance, below-average water levels in 2023 led to reduced cargo loads and increased per-unit shipping costs for many operators.

Fluctuating fuel prices, a major operating expense for marine transportation, directly impact Algoma's profitability. With bunker fuel prices averaging around $600-$700 per metric ton in 2024, volatility makes cost forecasting difficult and necessitates careful management to remain competitive.

SWOT Analysis Data Sources

This Algoma SWOT analysis is built upon a robust foundation of data, including Algoma Steel's official financial reports, comprehensive market research from industry analysts, and expert commentary from seasoned professionals in the steel sector.