Algoma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

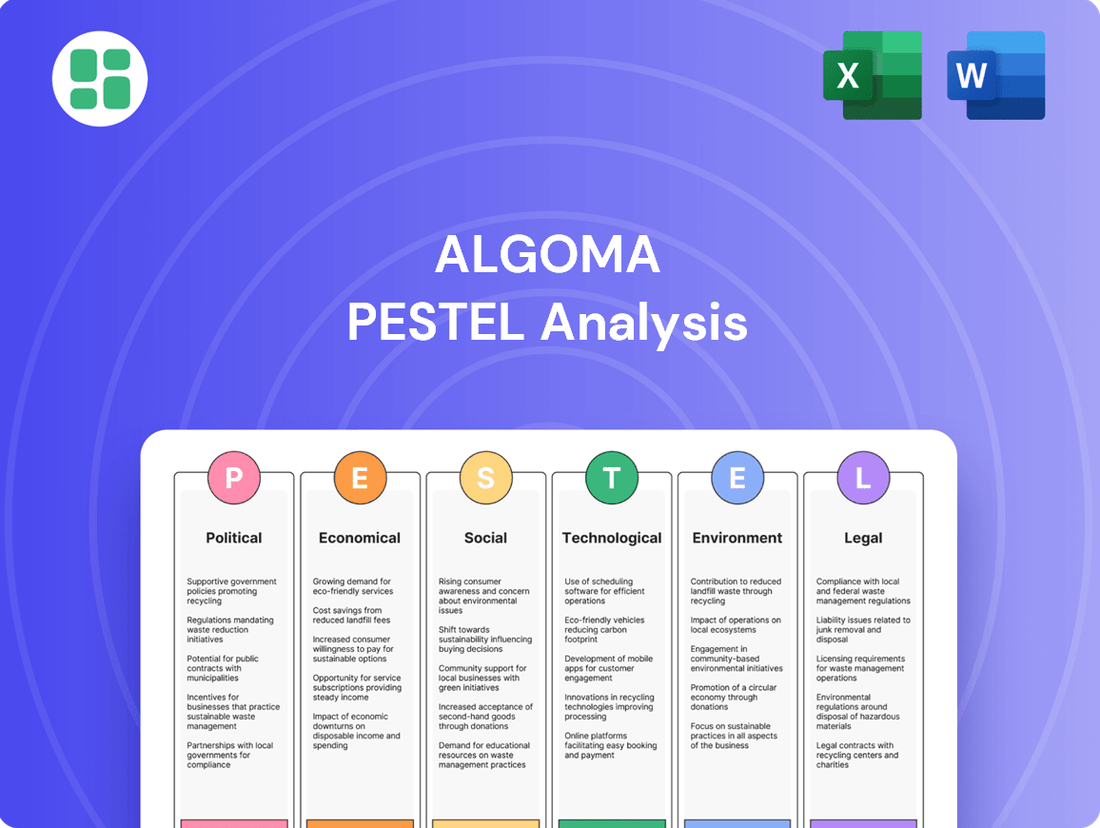

Unlock the critical external factors shaping Algoma's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and how they can be leveraged for strategic advantage. Equip yourself with actionable intelligence to navigate the complexities of Algoma's operating landscape. Purchase the full analysis now for a decisive edge.

Political factors

Algoma Central Corporation navigates a complex web of Canadian and international maritime regulations. New rules like the Marine Safety Management System Regulations (MSMR), taking effect in July 2024, mandate enhanced safety management systems for a broader range of companies and vessels, drawing from international standards.

Further regulatory shifts are on the horizon with Transport Canada's Marine Personnel Regulations, slated for 2025. These updates are designed to modernize training, certification processes, and labor standards for seafarers, impacting operational costs and human resource management.

Trade agreements like the United States-Mexico-Canada Agreement (USMCA) are vital for Algoma's shipping operations, especially given its reliance on Great Lakes and St. Lawrence Seaway routes. These agreements generally streamline cross-border commerce by lowering tariffs, which is a positive for bulk commodity movement.

However, the landscape can shift rapidly. For instance, in early 2025, there were ongoing discussions about potential new tariffs on Canadian imports into the United States. Such developments introduce volatility and could directly impact the cost and volume of goods Algoma transports, creating operational and financial uncertainty.

Government investments in port infrastructure and waterway maintenance are crucial for Algoma's operations. For instance, the St. Lawrence Seaway Management Corporation has committed over $350 million for infrastructure upgrades in the coming three years. This significant investment directly bolsters Algoma's operational efficiency and capacity.

These upgrades enhance the overall reliability and competitiveness of the Great Lakes-St. Lawrence Seaway System, which serves as a vital maritime supply chain. Improved waterways mean smoother, more predictable transit for Algoma's vessels, reducing delays and operational costs.

International Maritime Organization (IMO) Policies

The International Maritime Organization's (IMO) adoption of net-zero regulations in October 2025, effective from 2027, will mandate a global fuel standard and a greenhouse gas (GHG) pricing mechanism for large vessels. These critical policies are designed to drive a substantial reduction in shipping emissions by 2050.

For companies like Algoma, this means a significant push towards investing in zero-emission fuels and advanced technologies. The economic impact will be considerable, necessitating strategic financial planning to adapt to these new environmental requirements.

- Mandatory Global Fuel Standard: Introduced by the IMO's net-zero regulations from 2027.

- GHG Pricing Mechanism: A new carbon pricing system for large ocean-going ships.

- Emission Reduction Target: Aiming for significant GHG reductions by 2050.

- Investment in Zero-Emission Technologies: A requirement for shipping companies to comply.

Geopolitical Stability and Trade Routes

Algoma's international short-sea shipping activities are significantly impacted by global geopolitical stability and the security of key maritime trade routes. Disruptions in critical chokepoints like the Suez and Panama Canals, as seen in recent events, directly influence operational costs and transit times.

For instance, the ongoing disruptions in the Red Sea and Suez Canal throughout 2024 have caused freight rates to skyrocket. This surge, coupled with rerouting complexities, directly increases Algoma's operational expenses and impacts the efficiency of its global supply chain network.

- Increased Freight Rates: Global shipping rates saw significant volatility in early 2024, with some routes experiencing increases of over 50% due to geopolitical tensions.

- Extended Transit Times: Rerouting around conflict zones can add weeks to delivery schedules, impacting inventory management and customer delivery commitments.

- Higher Insurance Premiums: Operating in or near volatile regions often necessitates higher insurance coverage, adding to overall shipping costs.

Algoma Central Corporation operates within a framework of evolving Canadian maritime regulations, with new rules impacting safety management and seafarer standards. For example, the Marine Safety Management System Regulations (MSMR), effective July 2024, broaden requirements for safety systems, reflecting international benchmarks.

Trade agreements like the USMCA remain crucial, streamlining cross-border commerce, though potential new tariffs discussed in early 2025 could introduce volatility. Government investments in infrastructure, such as the over $350 million commitment to St. Lawrence Seaway upgrades, directly benefit Algoma by enhancing operational efficiency and reliability.

The company must also adapt to international environmental mandates, including the IMO's net-zero regulations from 2027, which will necessitate significant investment in zero-emission technologies to meet 2050 reduction targets.

What is included in the product

The Algoma PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operating landscape.

This in-depth review provides actionable insights into external forces, enabling strategic decision-making and risk mitigation for Algoma.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, ensuring everyone is aligned on external factors impacting Algoma.

Economic factors

Algoma's dry and liquid bulk shipping services are heavily influenced by commodity prices and production. For instance, iron ore prices, a key commodity for Algoma, saw significant volatility in late 2023 and early 2024, with some analysts predicting a potential softening in the latter half of 2024 and into 2025 as global demand dynamics shift.

Elevated commodity prices in 2024, driven by factors like ongoing supply chain disruptions and a rebound in industrial activity in certain regions, could bolster shipping volumes for Algoma. However, projections for a potential price correction in 2025, as indicated by some market analyses, might lead to reduced production and consequently lower demand for bulk shipping services, impacting freight rates.

Canada's economic growth, projected to be around 1.8% in 2025 according to Bank of Canada forecasts, alongside anticipated growth in the U.S., directly impacts shipping demand. Strong industrial production, especially in steel and agriculture, is a key driver for marine transportation services.

Algoma's Domestic Dry-Bulk segment is poised for increased activity in 2025. This optimism stems from securing new business within the domestic steel industry and expecting robust agricultural shipments, signaling a favorable trend for these vital sectors.

Fuel costs are a major expense for marine shipping, and Algoma is no exception. Changes in bunker fuel prices can significantly affect their bottom line. For instance, in 2023, global average bunker fuel prices saw considerable swings, impacting shipping costs across the board.

Algoma is actively addressing this by investing in newer, more fuel-efficient vessels. This strategy aims to reduce their reliance on volatile fuel prices and improve overall operational efficiency. Their ongoing fleet modernization program is a key part of mitigating this economic factor.

Interest Rates and Capital Access

Changes in interest rates directly influence Algoma's cost of capital, impacting its ability to finance fleet modernization, expansion, and the construction of new vessels. Higher rates translate to increased borrowing expenses, potentially slowing down strategic investments.

Algoma has substantial capital commitments for new vessel deliveries scheduled for 2025 and 2026. For instance, their ongoing investment in new Equinox-class lakers is a prime example of this. Access to affordable financing is therefore paramount for the successful execution of these growth initiatives and maintaining a competitive edge.

- Impact on Financing Costs: Rising interest rates increase the cost of debt, making newbuilds and fleet upgrades more expensive.

- Strategic Growth Dependence: Algoma's planned vessel deliveries in 2025-2026 are heavily reliant on favorable capital access.

- Market Competitiveness: The ability to secure capital at competitive rates influences Algoma's capacity to invest in next-generation, fuel-efficient vessels, crucial for long-term market positioning.

Freight Rates and Market Demand

Freight rates are a critical determinant of Algoma's financial performance, directly impacting its revenue streams. The company's reliance on the Great Lakes-St. Lawrence Seaway System means that fluctuations in shipping demand and pricing significantly shape its profitability.

In 2024, the Seaway experienced robust cargo activity. Key commodities like grain, potash, and liquid bulk shipments demonstrated notable increases, signaling a healthy demand for Algoma's services. For instance, total cargo tonnage through the St. Lawrence Seaway reached approximately 38.8 million tonnes in 2024, up from 37.5 million tonnes in 2023.

Looking ahead to 2025, the economic landscape presents a more complex picture. Concerns about potential tariffs and broader economic pressures introduce an element of uncertainty regarding future market demand and freight rate stability. This volatility necessitates careful monitoring of global trade policies and their downstream effects on commodity flows.

- 2024 Seaway Tonnage: Approximately 38.8 million tonnes, an increase from 2023.

- Key Cargo Growth Areas: Grain, potash, and liquid bulk shipments saw increases in 2024.

- 2025 Outlook: Uncertain economic climate with potential impacts from tariffs and trade pressures.

- Revenue Driver: Freight rates are a primary revenue generator for Algoma.

Algoma's financial health is closely tied to global commodity prices and Canadian economic performance. While 2024 saw robust shipping volumes driven by strong commodity demand, projections for 2025 suggest potential price softening and a more complex economic environment, necessitating careful navigation of fluctuating freight rates and interest costs. The company's strategic investments in fuel-efficient vessels and fleet modernization are key to mitigating these economic volatilities and maintaining competitiveness.

| Economic Factor | 2024 Data/Outlook | 2025 Outlook | Impact on Algoma |

|---|---|---|---|

| Commodity Prices | Volatile, some predictions of softening in late 2024/early 2025. | Potential price correction impacting production and shipping demand. | Affects freight rates and cargo volumes. |

| Canadian GDP Growth | Projected around 1.8% for 2025 (Bank of Canada). | Steady growth supports industrial production and shipping demand. | Directly influences demand for Algoma's services. |

| Interest Rates | Fluctuating, impacting cost of capital. | Continued influence on borrowing costs for fleet investments. | Affects financing for new vessels and modernization projects. |

| Fuel Costs | Significant swings in 2023, impacting operational expenses. | Continued volatility expected, driving need for efficiency. | Mitigated by investment in fuel-efficient vessels. |

| Freight Rates (Seaway) | Robust cargo activity in 2024 (38.8M tonnes). | Uncertainty due to economic pressures and potential tariffs. | Primary driver of Algoma's revenue. |

Same Document Delivered

Algoma PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Algoma PESTLE analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape affecting Algoma's operations and future growth.

Sociological factors

Canada's marine shipping sector faces a significant demographic challenge, with roughly 43% of its workforce expected to retire within the next ten years. This includes a substantial number of experienced officers, creating a critical gap. Companies like Algoma must address this impending wave of retirements to ensure operational continuity.

The industry anticipates a need for approximately 19,000 new workers over the coming decade to replace those retiring and meet growing demands. This presents a considerable hurdle for Algoma and others in attracting and keeping the skilled individuals necessary for efficient operations and future growth.

The Canadian marine industry faces a significant challenge with an aging workforce, making it crucial to implement proactive recruitment strategies to attract younger talent. This demographic shift requires a concerted effort to engage the next generation of workers.

Programs like 'Shipping on the Seaway' are designed to spark interest in maritime careers among youth aged 11 to 17, aiming to cultivate a pipeline of future employees and mitigate potential labor shortages in the coming years.

Societal and regulatory expectations for safety in marine operations are consistently high, demanding robust protocols and a proactive approach. Algoma's dedication to enhancing its safety performance, demonstrated by a notable reduction in its Lost Time Injury Frequency Rate (LTIFR) to 0.87 in 2025, directly addresses these critical industry standards. This commitment reflects a broader trend towards prioritizing employee well-being and operational integrity within the maritime sector.

Public Perception and Corporate Social Responsibility

Public perception of the shipping industry's environmental impact and safety record significantly shapes regulatory approaches and community engagement for companies like Algoma. Negative perceptions can lead to increased scrutiny and operational challenges, while positive views foster stronger stakeholder relationships.

Algoma's commitment to sustainability, including its efforts to reduce its carbon footprint, directly enhances its corporate social responsibility (CSR) profile. For instance, in 2023, Algoma announced plans to equip its fleet with advanced ballast water treatment systems, a move aligning with global environmental standards and improving public trust.

- Environmental Scrutiny: Public concern over maritime emissions and spills can prompt stricter regulations, impacting Algoma's operational costs and compliance requirements.

- Community Relations: Positive public perception, bolstered by strong CSR initiatives, can lead to smoother port operations and better local community relations.

- Sustainability Investments: Algoma's 2024 investments in fleet modernization, aimed at improving fuel efficiency by an estimated 15%, directly address public environmental concerns and enhance its CSR standing.

Community Relations and Local Impact

Algoma's operations across the Great Lakes and St. Lawrence Seaway mean it's deeply intertwined with the communities it serves. The company's presence directly influences local economies through job creation and business opportunities. For instance, in 2024, Algoma's fleet supported an estimated 3,000 direct and indirect jobs across its operational regions, a significant factor for these port towns.

Maintaining strong community relations is therefore paramount. This involves not only providing employment but also engaging in local initiatives and ensuring environmental stewardship. Positive relationships foster a stable operating environment and can enhance Algoma's social license to operate.

- Job Creation: Algoma's shipping activities in 2024 directly and indirectly supported approximately 3,000 jobs in Canadian and US Great Lakes communities.

- Economic Contribution: The company's operations contribute to local tax revenues and support ancillary businesses, such as port services and logistics providers.

- Community Engagement: Algoma actively participates in local events and partnerships, aiming to be a responsible corporate citizen in the communities where its vessels dock and its employees reside.

- Environmental Awareness: Sociological factors also include community expectations regarding environmental impact, driving Algoma's commitment to sustainable shipping practices.

Societal expectations for safety and environmental responsibility are paramount in the maritime industry, directly influencing Algoma's operational strategies and public image. The company's proactive approach to reducing its Lost Time Injury Frequency Rate to 0.87 in 2025 demonstrates a commitment to employee well-being, aligning with high societal safety standards.

Public perception of shipping's environmental impact is a significant driver for regulatory change and corporate accountability. Algoma's 2023 investment in advanced ballast water treatment systems and its 2024 fleet modernization, targeting a 15% fuel efficiency improvement, directly address these concerns, bolstering its corporate social responsibility profile.

Algoma's deep integration with Great Lakes communities, where its 2024 operations supported approximately 3,000 direct and indirect jobs, necessitates strong community relations. This involves not only job creation but also active participation in local initiatives and a commitment to environmental stewardship to maintain its social license to operate.

| Sociological Factor | Impact on Algoma | Supporting Data/Initiatives |

| Workforce Demographics | Labor shortages due to retirements | 43% of Canadian marine workforce to retire in 10 years; need for 19,000 new workers. |

| Safety Expectations | Need for robust safety protocols | LTIFR reduced to 0.87 in 2025. |

| Environmental Concerns | Pressure for sustainable practices | 2023: Ballast water treatment systems; 2024: 15% fuel efficiency improvement goal. |

| Community Relations | Importance of local economic contribution and engagement | Supported ~3,000 jobs in Great Lakes communities in 2024. |

Technological factors

Algoma is actively upgrading its fleet with modern, fuel-efficient vessels like the Equinox Class, which are designed to significantly reduce fuel consumption. This strategic investment in newbuilds, including product tankers, directly addresses the technological drive for enhanced operational performance and a smaller environmental footprint.

The Equinox Class vessels, for instance, are engineered with advanced hull designs and propulsion systems, contributing to an estimated 15% reduction in fuel use compared to older designs. These technological advancements are crucial for Algoma to maintain competitiveness and meet increasingly stringent environmental regulations in the shipping industry.

The maritime sector is pouring significant resources into developing alternative fuels like hydrogen, ammonia, and methanol, alongside new propulsion systems. This push is driven by increasingly strict emission reduction goals. For instance, the International Maritime Organization (IMO) aims for net-zero greenhouse gas emissions from international shipping by or around 2050.

Algoma's strategic investment in its new Kamsarmax-based ocean self-unloaders exemplifies this trend. These vessels are specifically engineered to be methanol-ready, signaling a proactive embrace of cleaner fuel alternatives to comply with evolving environmental regulations and reduce their carbon footprint.

Digitalization and automation are revolutionizing the shipping industry, with advanced navigation systems and data analytics becoming crucial for optimizing logistics and route planning. Algoma, like others, benefits from this by improving operational efficiency and reducing costs. For instance, the Canadian Coast Guard's ongoing modernization of marine navigation services, a significant technological undertaking, aims to boost both efficiency and safety across Canadian waterways, directly impacting companies like Algoma that rely on these services.

Cybersecurity in Maritime Operations

The maritime industry's growing dependence on digital systems, from navigation to cargo management, significantly elevates cybersecurity risks for both operational technology (OT) and information technology (IT) infrastructure. Protecting these interconnected systems is paramount to ensuring uninterrupted operations and safeguarding sensitive data.

Recent incidents highlight the tangible threat. For example, the 2023 cyberattack on a major shipping company disrupted port operations for days, causing significant financial losses and delays. The International Maritime Organization (IMO) has recognized this, issuing guidelines to enhance maritime cybersecurity, emphasizing the need for robust defenses against evolving threats.

The financial implications are substantial. A report from 2024 estimated that cyber incidents in the maritime sector could cost the global economy billions annually. This necessitates proactive investment in advanced security measures, including:

- Regular vulnerability assessments and penetration testing

- Implementation of multi-factor authentication across all systems

- Employee training on phishing and social engineering awareness

- Development and regular testing of incident response plans

Environmental Technology Adoption

Technological advancements are significantly shaping environmental compliance for industries like Algoma. Technologies focused on reducing emissions and managing environmental footprints, such as advanced exhaust gas cleaning systems (scrubbers), ballast water treatment systems, and the adoption of shore power connections, are no longer optional but increasingly critical for operational sustainability and regulatory adherence.

Canada's commitment to environmental stewardship is evident through its support for green shipping corridors and clean technology initiatives. For instance, the federal government has allocated substantial funding through programs designed to accelerate the adoption of these environmentally friendly technologies, directly impacting sectors like maritime shipping which Algoma operates within.

- Scrubber Technology Adoption: The global market for marine scrubbers is projected to reach approximately $10 billion by 2028, indicating a strong trend towards emission reduction technologies.

- Ballast Water Management: Compliance with the IMO's Ballast Water Management Convention necessitates significant investment in treatment systems, with global installations expected to grow substantially through 2025.

- Shore Power Infrastructure: Major ports worldwide are investing in shore power facilities, with estimates suggesting over 300 ports will offer shore power by 2025, enabling emissions-free operations while docked.

Algoma's fleet modernization, featuring Equinox Class vessels, showcases a commitment to fuel efficiency, with an estimated 15% reduction in fuel use. The company is also proactively adopting methanol-ready technology in its new Kamsarmax vessels, aligning with the maritime industry's push towards cleaner fuels like hydrogen and ammonia to meet the IMO's net-zero goals by 2050.

Digitalization is enhancing operational efficiency through advanced navigation and data analytics, while also introducing significant cybersecurity risks. The maritime sector is investing heavily in these technologies, with the global market for marine scrubbers projected to reach $10 billion by 2028 and over 300 ports expected to offer shore power by 2025.

Legal factors

Algoma operates under a strict framework of Canadian domestic maritime laws, such as the Canada Shipping Act, 2001. This legislation dictates operational standards and safety protocols for all vessels within Canadian waters. Recent updates, like the Marine Safety Management System Regulations (MSMR) effective July 2024, further refine these requirements, mandating robust safety management systems for vessels to ensure adherence to both national and international maritime standards.

The International Maritime Organization (IMO) is implementing significant environmental regulations for shipping in 2025. These include tighter controls on sulphur oxides (SOx) and particulate matter (PM) emissions, alongside more robust ballast water management. For instance, MARPOL Annex VI sets global standards that will directly affect Algoma's fleet, particularly on international routes.

Algoma must navigate a complex web of labor laws and seafarer certification requirements, with evolving standards like the anticipated Marine Personnel Regulations, 2025, posing a significant factor. These regulations dictate everything from seafarer competency and training to crucial working conditions, directly impacting Algoma's operational efficiency and human capital management.

Competition Law and Market Practices

Algoma Central Corporation operates in a highly competitive marine transportation sector, necessitating strict adherence to competition laws and anti-trust regulations. These legal frameworks are crucial for fostering fair market practices and actively preventing any monopolistic tendencies that could stifle innovation or harm consumers within the industry.

In Canada, the Competition Bureau oversees market conduct, ensuring that companies like Algoma do not engage in price-fixing or other anti-competitive agreements. For instance, in 2023, the Bureau continued its investigations into various sectors for potential anti-competitive practices, highlighting the ongoing scrutiny of market behavior.

Algoma's commitment to compliance is vital for maintaining its operational license and reputation. The company must ensure its pricing strategies, service offerings, and partnership agreements align with the Canadian Competition Act, which prohibits actions that unduly lessen competition or create monopolies.

- Regulatory Oversight: The Competition Bureau actively monitors the marine transportation industry for anti-competitive behavior.

- Compliance Requirements: Algoma must ensure its business practices, including pricing and contracts, comply with the Competition Act.

- Market Integrity: Adherence to competition law safeguards fair play and prevents market distortion.

- Impact of Non-Compliance: Violations can lead to significant fines and reputational damage, impacting future business opportunities.

Liability and Insurance Requirements

Algoma is subject to significant liability and insurance mandates, crucial for covering potential cargo damage, vessel accidents, and environmental incidents. These requirements are evolving, with updated regulations like administrative monetary penalties under Canada's Marine Liability Act and the Wrecked, Abandoned, or Hazardous Vessels Act highlighting the need for strong liability management. For instance, the Marine Liability Act, as amended, can impose substantial penalties for various maritime offenses, necessitating comprehensive insurance coverage.

The company's insurance portfolio must address risks associated with its fleet operations. This includes protection and indemnity (P&I) insurance, which covers third-party liabilities such as personal injury, property damage, and pollution. Given the increasing focus on environmental stewardship in the shipping industry, Algoma's insurance must also account for potential costs related to oil spills or other environmental damage, which can run into millions of dollars depending on the scale of the incident and regulatory fines.

- Cargo Liability: Insurance covering loss or damage to goods transported by Algoma's vessels.

- Vessel Incident Liability: Coverage for collisions, groundings, and other operational mishaps.

- Environmental Liability: Protection against costs associated with pollution incidents, including cleanup and fines.

- Regulatory Compliance: Ensuring insurance meets or exceeds requirements set by maritime authorities and international conventions.

Algoma must navigate evolving environmental regulations, particularly those concerning emissions and ballast water management, with new IMO standards taking effect in 2025. The Canada Shipping Act, 2001, and updated regulations like the Marine Safety Management System Regulations (MSMR) from July 2024, mandate strict operational and safety protocols for its fleet.

Labor laws and seafarer certification remain critical, with anticipated Marine Personnel Regulations in 2025 likely to impact competency and working conditions. Furthermore, Algoma faces stringent liability and insurance mandates, with updated penalties under the Marine Liability Act requiring comprehensive coverage for operational risks, including environmental incidents.

Environmental factors

Climate change is significantly altering the Great Lakes-St. Lawrence Seaway, impacting water levels and temperatures. For instance, the average water levels in the Great Lakes have seen considerable fluctuations, with some periods experiencing lower-than-average levels impacting draft restrictions. Warmer surface temperatures and reduced ice cover are also becoming more pronounced, potentially shortening winter navigation seasons and affecting the reliability of shipping routes essential for Algoma's operations.

The International Maritime Organization (IMO) has set ambitious goals to slash greenhouse gas (GHG) emissions, targeting net-zero operations by approximately 2050. This necessitates substantial investment in advanced, cleaner fuels and innovative technologies for shipping companies like Algoma.

New regulations, including a mandatory global fuel standard and a GHG pricing mechanism, are set to drive Algoma's ongoing decarbonization initiatives. For instance, the IMO's 2023 GHG Strategy aims for a 20% reduction in GHG intensity by 2030 compared to 2008 levels, with a stretch goal of 30%.

Algoma faces increasing environmental pressures, particularly concerning ballast water management. Amendments to the Ballast Water Management (BWM) Convention are set to take effect in February 2025, introducing stricter rules for record-keeping and treatment to curb the spread of invasive aquatic species. This means Algoma must invest in and ensure its fleet is compliant with these new global standards.

Pollution Prevention and Waste Management

Beyond just air emissions, marine companies like Algoma are increasingly focused on preventing other forms of pollution. This includes the responsible management of waste generated from operations and the critical need to prevent oil spills, which can devastate marine environments.

Canada's commitment to protecting its oceans is evident through initiatives like the Oceans Protection Plan. This plan, along with a suite of marine environmental protection regulations, sets strict requirements for companies operating in Canadian waters. Algoma, therefore, must maintain and continuously improve its waste management protocols and pollution prevention strategies to comply with these evolving standards and safeguard sensitive ecosystems.

In 2023, Transport Canada reported significant investments in the Oceans Protection Plan, focusing on enhancing marine safety and environmental protection. These investments translate into stricter oversight and the need for advanced technologies and practices for companies like Algoma to manage their environmental footprint.

- Waste Management: Implementing comprehensive systems for the segregation, treatment, and disposal of all operational waste, including ballast water and garbage.

- Spill Prevention: Investing in advanced hull monitoring, leak detection systems, and robust emergency response plans to mitigate the risk and impact of potential spills.

- Regulatory Compliance: Adhering to stringent national and international regulations, such as those outlined by the International Maritime Organization (IMO) and Transport Canada.

- Environmental Monitoring: Conducting regular assessments of discharge quality and environmental impact to ensure compliance and identify areas for improvement.

Biodiversity Protection and Ecosystem Health

Algoma's shipping operations are increasingly scrutinized for their impact on marine biodiversity, particularly concerning noise pollution's effect on marine mammals. For instance, studies in 2024 highlighted elevated underwater noise levels in key Great Lakes shipping lanes, potentially disrupting whale migration and communication patterns. This necessitates a proactive approach to environmental stewardship.

The company must align its practices with growing global and national initiatives focused on marine ecosystem health. This includes supporting efforts to restore coastal habitats damaged by industrial activity and implementing strategies to mitigate environmental effects from vessel operations. For example, Canada's commitment to protecting 30% of its marine and coastal areas by 2030, as announced in 2022, directly influences operational considerations for companies like Algoma.

- Noise Reduction Technologies: Implementing quieter propulsion systems and operational adjustments to minimize underwater noise pollution impacting marine life.

- Habitat Restoration Support: Contributing to or participating in projects aimed at restoring critical coastal and aquatic habitats along Algoma's key shipping routes.

- Environmental Impact Assessments: Conducting rigorous, ongoing assessments of shipping activities to identify and address potential threats to biodiversity and ecosystem integrity.

Environmental regulations are tightening, pushing Algoma to invest in cleaner technologies. The International Maritime Organization's 2023 GHG Strategy targets a 20% reduction in GHG intensity by 2030, influencing fleet upgrades and fuel choices.

Climate change impacts Great Lakes water levels and ice cover, potentially affecting shipping reliability. Algoma must adapt to these shifts and adhere to stricter ballast water management rules, effective February 2025, to prevent invasive species spread.

Canada's Oceans Protection Plan, with significant 2023 investments, mandates improved waste management and spill prevention for marine operators. Algoma's commitment to reducing its environmental footprint is crucial for compliance and ecosystem health.

Minimizing underwater noise pollution is also a growing concern, with 2024 studies highlighting impacts on marine mammals. Algoma is expected to adopt noise reduction technologies and support habitat restoration efforts.

PESTLE Analysis Data Sources

Our Algoma PESTLE Analysis draws on a comprehensive blend of official government publications, reputable academic research, and leading industry-specific reports. This ensures our insights into political, economic, social, technological, legal, and environmental factors are both current and authoritative.