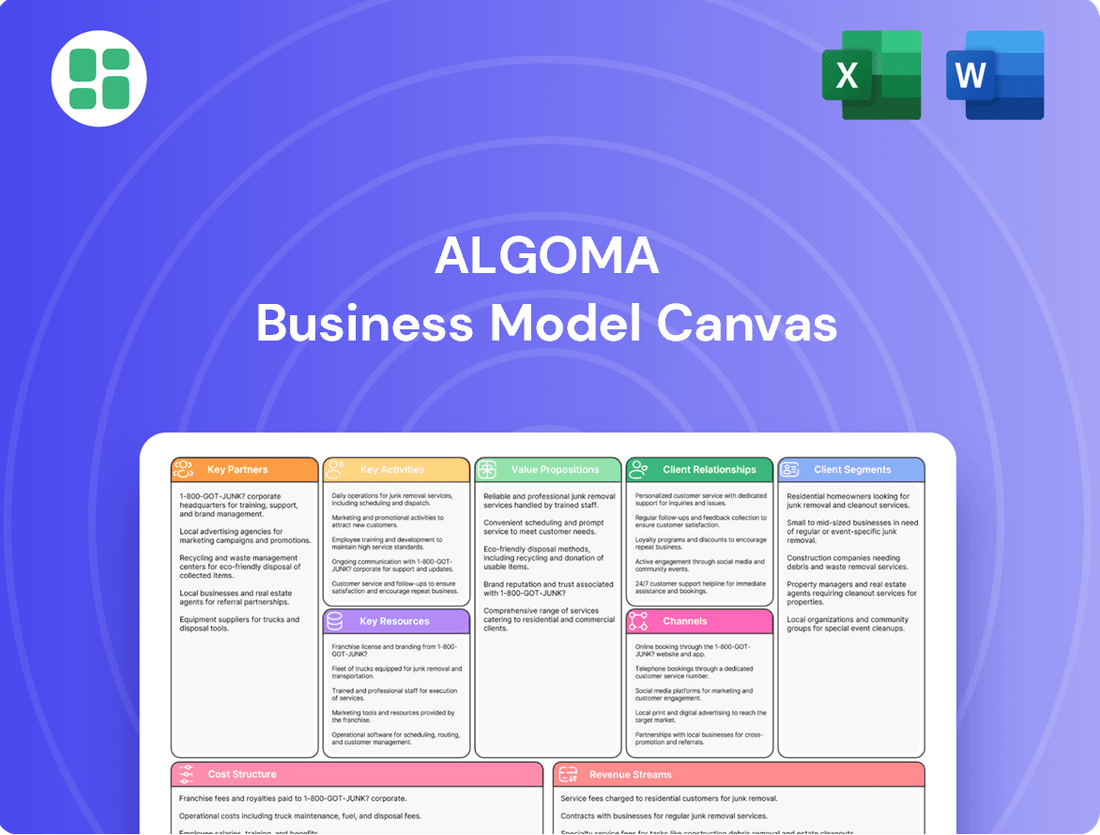

Algoma Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

Discover the core components of Algoma's innovative approach with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Ready to gain a competitive edge?

Unlock the full strategic blueprint behind Algoma's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Algoma Central Corporation relies on key partnerships with shipyards worldwide for its fleet. These collaborations, including those in Croatia, South Korea, and Sweden, are vital for building and receiving new, efficient vessels. This strategy underpins their fleet renewal and expansion efforts.

Recent examples highlight the importance of these relationships. The Algoma Endeavour was delivered from Croatia, and the Algoma East Coast from South Korea, both arriving in early 2025. These deliveries are critical for maintaining a modern and competitive fleet.

Algoma Central Corporation actively pursues strategic joint ventures to broaden its operational footprint and diversify its vessel capabilities. These partnerships are crucial for accessing new markets and enhancing specialized service offerings.

Key collaborations include Nova Marine Holdings SA for the NovaAlgoma Cement Carriers venture, Furetank AB for the FureBear product tanker fleet, and The CSL Group for the CSL International Pool of ocean self-unloaders. These alliances are vital for Algoma's international presence and specialized service expansion.

Algoma fosters deep, long-term alliances with substantial industrial customers who depend on its marine transport for crucial commodities. A prime illustration is its collaboration with Irving Oil, where Algoma's advanced product tankers are engaged in long-term time charters, specifically catering to the energy firm's refining operations.

Fuel and Supply Chain Providers

Algoma Central Corporation, a key player in Great Lakes shipping, relies heavily on its fuel and supply chain providers to keep its fleet operational. Ensuring a consistent and cost-effective supply of fuel, alongside critical spare parts and other necessary materials, is paramount for maintaining service reliability across its diverse routes, which include the Great Lakes, the St. Lawrence Seaway, and international waters. The company actively monitors global tariffs and trade policies that could influence the cost of these essential supplies, demonstrating a proactive approach to managing supply chain vulnerabilities.

For instance, in 2024, shipping companies like Algoma faced fluctuating fuel prices influenced by geopolitical events and global oil market dynamics. A robust partnership with major fuel suppliers ensures Algoma can secure the necessary bunker fuel for its vessels, which is a significant operational expense. Beyond fuel, a well-managed supply chain for spare parts prevents costly downtime; a single engine failure can sideline a vessel for weeks, impacting revenue and customer commitments. Algoma's strategic approach involves building strong relationships with a network of suppliers to mitigate these risks.

- Fuel Security: Partnerships with major fuel providers guarantee access to bunker fuel, a critical component of operational continuity.

- Spare Parts Availability: A strong supply chain network ensures timely access to essential spare parts, minimizing vessel downtime and maintenance costs.

- Cost Management: Proactive monitoring of global tariffs and trade policies helps Algoma mitigate potential cost increases from its supply chain partners.

- Operational Efficiency: Reliable access to fuel and parts directly supports Algoma's ability to maintain its sailing schedules and deliver cargo efficiently.

Port Authorities and Terminal Operators

Algoma Central Corporation's key partnerships with port authorities and terminal operators are fundamental to its operational success. These collaborations are essential for optimizing cargo handling processes, directly impacting vessel turnaround times and overall supply chain efficiency. For instance, in 2024, Algoma's fleet, comprising 26 vessels, relies heavily on the seamless integration with port infrastructure across North America.

These strategic alliances ensure the smooth loading and unloading of diverse commodities, such as grain, iron ore, and aggregates. By fostering strong relationships with entities like the Hamilton Port Authority or the Port of Montreal, Algoma can guarantee reliable and punctual deliveries, a critical factor for its customer base. Effective coordination at these vital transit points underpins the company's ability to maintain its reputation for dependability.

- Port Authority Collaboration: Partnerships with port authorities streamline access, berthing, and regulatory compliance, crucial for efficient vessel operations.

- Terminal Operator Efficiency: Working with terminal operators ensures rapid cargo transfer, minimizing layovers and maximizing Algoma's fleet utilization.

- Logistical Network Integration: These relationships are vital for integrating Algoma's maritime services into broader logistics networks, ensuring end-to-end supply chain reliability.

Algoma Central Corporation's strategic alliances with industrial clients are foundational to its business model, ensuring consistent demand for its shipping services. These long-term relationships, often involving time charters, provide revenue stability and operational predictability.

A prime example is the ongoing collaboration with Irving Oil, where Algoma's product tankers are chartered to support the energy company's refining operations. This partnership, a cornerstone of Algoma's tanker segment, highlights the value of dedicated capacity for key industrial partners.

These deep-rooted customer partnerships are crucial for Algoma's market position, particularly in the bulk and product tanker sectors. They represent a significant portion of the company's contracted revenue, offering a buffer against market volatility.

What is included in the product

A detailed framework outlining Algoma's strategic approach to creating, delivering, and capturing value, covering all essential business components.

The Algoma Business Model Canvas alleviates the pain of fragmented strategy by providing a unified, visual representation of all key business elements.

It simplifies complex business planning, turning overwhelming data into actionable insights for immediate problem-solving.

Activities

Algoma Central Corporation's primary focus is the day-to-day running and thorough oversight of its varied fleet, which includes both dry and liquid bulk carriers. This operational scope covers domestic shipping routes along the Great Lakes-St. Lawrence Seaway and extends to international short-sea shipping activities.

In 2024, Algoma maintained a robust fleet, consisting of approximately 30 vessels, strategically deployed to serve key North American and international trade routes. The company's commitment to efficient fleet management directly translates into maximizing vessel uptime and ensuring punctual delivery of cargo, which is critical for client satisfaction and profitability.

Algoma's key activities include a substantial focus on building new ships and upgrading its current fleet. This ongoing investment is crucial for staying competitive and efficient in the shipping industry.

In 2024 and into 2025, Algoma has received several new vessels, with more currently being built. These new additions are designed for better fuel economy and to carry more cargo, directly impacting operational costs and revenue potential.

This fleet renewal strategy is a cornerstone for Algoma's sustained growth and commitment to environmental sustainability, ensuring the company can meet future market demands and regulatory standards.

Algoma's key activities in cargo handling and logistics revolve around the meticulous loading, secure transportation, and efficient unloading of diverse bulk commodities. This includes vital materials like iron ore, essential grains, energy-focused coal, industrial salt, and petroleum products, ensuring the seamless flow of raw materials and finished goods for its industrial clientele.

The company's operational strength lies in its commitment to reliable cargo delivery, often leveraging a fleet of specialized self-unloading vessels. This capability is critical for industries that require direct, on-site discharge of bulk materials, minimizing handling costs and transit times for clients.

In 2023, Algoma transported over 20 million metric tons of cargo, underscoring the scale and importance of its logistics operations. The efficiency and dependability of these activities are paramount to meeting the stringent demands of industrial partners across North America.

Maintenance, Repair, and Dry-docking

Algoma’s key activities include rigorous maintenance, repair, and scheduled dry-docking to guarantee fleet safety and reliability. These essential processes, while temporarily reducing available vessel days, are vital for sustained operational excellence.

For instance, in Q1 and Q2 of 2025, these necessary activities influenced vessel availability, a common occurrence in the maritime industry. Such planned downtime is a strategic investment in the long-term performance and lifespan of Algoma’s vessels.

- Fleet Safety and Reliability: Ensuring all vessels meet stringent safety standards and operate dependably.

- Scheduled Dry-Docking: Performing essential maintenance and repairs during planned periods to minimize disruption.

- Operational Efficiency: Balancing necessary downtime with the need to maximize available vessel days for revenue generation.

- Long-Term Asset Value: Investing in maintenance to preserve and enhance the value of the fleet over time.

Joint Venture Management and Strategic Expansion

Algoma actively manages its global joint ventures, like NovaAlgoma Cement Carriers and FureBear, by overseeing operations and driving strategic decisions. This includes identifying and pursuing new market opportunities to foster growth and enhance profitability.

A significant strategic move in 2024 involved Algoma's sale of a controlling interest in NovaAlgoma's cement assets to DP World. This transaction, valued at approximately $120 million, allows Algoma to streamline its portfolio and focus on core strengths while retaining a minority stake.

- Active JV Oversight: Algoma's management of joint ventures ensures operational efficiency and strategic alignment, crucial for maximizing returns.

- Strategic Divestment: The 2024 sale of a controlling interest in NovaAlgoma's cement assets to DP World exemplifies a strategic portfolio adjustment.

- Market Expansion Focus: By managing these JVs, Algoma actively seeks and capitalizes on opportunities for expansion into new and existing global markets.

Algoma's core activities center on the efficient operation and maintenance of its diverse fleet, encompassing both dry and liquid bulk carriers. This includes the meticulous loading, secure transport, and timely unloading of various commodities, ensuring reliable delivery for industrial clients. Furthermore, the company actively engages in fleet renewal through new builds and upgrades, alongside strategic management of its global joint ventures.

| Key Activity | Description | 2024/2025 Relevance |

|---|---|---|

| Fleet Operations & Cargo Handling | Managing a fleet of approximately 30 vessels for domestic and international shipping of bulk commodities. | Transported over 20 million metric tons in 2023, with ongoing fleet modernization for efficiency. |

| Fleet Maintenance & Reliability | Ensuring vessel safety and operational readiness through rigorous maintenance and scheduled dry-docking. | Planned downtime in Q1/Q2 2025 impacted vessel availability, a strategic investment in long-term performance. |

| Fleet Renewal & Investment | Acquiring new, fuel-efficient vessels and upgrading existing ones to enhance capacity and sustainability. | Several new vessels received in 2024/2025, with more under construction to improve cost-effectiveness and revenue potential. |

| Joint Venture Management | Overseeing operations and strategic decisions for global joint ventures, pursuing market expansion. | 2024 sale of NovaAlgoma cement assets to DP World for ~$120 million, allowing focus on core strengths. |

What You See Is What You Get

Business Model Canvas

The Algoma Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, design, and content are identical to the final deliverable, ensuring no surprises. You can trust that what you see is precisely what you'll get, ready for immediate use and customization.

Resources

Algoma's fleet of dry and liquid bulk carriers is its core operational asset, enabling its marine transportation services. This fleet is diverse, encompassing self-unloaders, gearless bulk carriers, and product tankers, catering to a wide range of cargo needs.

As of the second quarter of 2025, Algoma's fleet comprises 98 owned vessels, with an additional 10 new vessels currently under construction. This significant and expanding asset base underpins the company's capacity and reach in the bulk shipping market.

Algoma's operations depend on a highly skilled maritime workforce, encompassing experienced captains, officers, and crew. Their proficiency in navigation, vessel operation, and cargo handling is essential for safe and efficient marine transport.

In 2024, Algoma Central Corporation continued to emphasize the importance of its personnel, with a focus on maintaining high standards of training and crew retention to ensure operational excellence across its fleet.

Algoma's strategic access to waterways and ports is fundamental to its business model, leveraging the Great Lakes and St. Lawrence Seaway to connect with key industrial hubs in both Canada and the United States. This extensive network allows for efficient movement of goods, serving as a critical artery for North American commerce.

Further enhancing its reach, Algoma engages in international short-sea shipping and strategic joint ventures. These initiatives broaden its operational footprint, extending its capabilities to global markets such as Northern Europe and the U.S. East Coast, thereby diversifying its revenue streams and market access.

This unparalleled geographical advantage serves as a significant competitive differentiator for Algoma. For instance, in 2024, Algoma reported carrying approximately 10 million tons of cargo across its fleet, a testament to the volume and importance of its waterway-based operations.

Financial Capital and Investment Capacity

Algoma's significant financial capital is a cornerstone of its operations, directly fueling its ambitious fleet renewal program and enabling strategic investments in new, advanced vessels. This financial muscle is crucial for maintaining a competitive edge in the shipping industry.

The company has demonstrated a strong commitment to modernization, having invested nearly $1 billion in fleet renewal initiatives since 2010. This substantial capital allocation underscores Algoma's dedication to upgrading its assets and ensuring long-term operational efficiency and growth.

- Fleet Modernization Investment: Nearly $1 billion invested since 2010.

- Strategic Capital Allocation: Ongoing funding for vessel modernization and expansion.

- Financial Strength: Underpins long-term strategic objectives and market competitiveness.

Commercial Real Estate Assets

Algoma Central Corporation's commercial real estate assets, while a legacy from its past strategic focus, still represent a component of its business model. The company began divesting these holdings in 2015 to concentrate on its core shipping operations.

Despite the divestment strategy, Algoma retains interests in certain commercial real estate properties. These assets, though their significance may be decreasing, offer a tangible value and the possibility of generating capital through future sales.

- Asset Diversification: While primarily a shipping company, these real estate holdings offer a degree of asset diversification.

- Potential Capital Source: The properties represent a potential pool of capital that can be realized through strategic divestment.

- Historical Context: These assets are remnants of a past strategy, now secondary to the core shipping business.

Algoma's key resources are its extensive fleet, skilled workforce, strategic waterway access, and financial capital. The fleet, comprising 98 owned vessels and 10 under construction as of Q2 2025, is the backbone of its operations. Essential personnel, including experienced mariners, ensure safe and efficient transport. Leveraging the Great Lakes and St. Lawrence Seaway provides unparalleled access to industrial centers.

Value Propositions

Algoma Central Corporation offers dependable and streamlined waterborne transport for vital dry and liquid bulk goods. This is crucial for industrial customers who require consistent and prompt delivery of raw materials and finished products throughout the Great Lakes and St. Lawrence Seaway system.

In 2024, Algoma's fleet, comprising 30 vessels, handled a significant volume of cargo, reinforcing its reputation for reliability. Their efficient operations are designed to minimize transit times and maximize cargo capacity, directly benefiting clients who rely on predictable supply chains for their manufacturing and distribution needs.

Algoma Central Corporation’s specialized expertise in navigating the Great Lakes-St. Lawrence Seaway system is a cornerstone of its value proposition. This deep understanding of the region's unique environmental conditions, navigational challenges, and intricate infrastructure makes Algoma a highly reliable partner for complex inland waterway logistics.

The company's commitment to optimizing operations within this specific corridor is evident in its fleet. For instance, Algoma's Equinox Class vessels are purpose-built and specifically optimized for the Great Lakes, showcasing a direct link between their specialized knowledge and their physical assets to deliver superior service in this demanding environment.

Algoma's diverse fleet, comprising both dry and liquid bulk carriers, enables the transportation of a broad spectrum of commodities. This includes essential materials like iron ore, grain, coal, salt, and petroleum products, catering to a wide array of industrial needs.

This versatility in cargo handling allows Algoma to effectively serve various sectors, from agriculture to heavy industry. The ability to adapt to different market demands by carrying diverse goods provides comprehensive shipping solutions to its clientele.

For instance, in 2024, Algoma's fleet continued to be a critical link in supply chains, moving millions of tons of essential goods. Their dry bulk segment, in particular, saw robust activity, driven by global demand for commodities like grain and iron ore, reflecting the company's broad market reach.

Commitment to Sustainability and Modern Fleet

Algoma is deeply committed to environmental stewardship, actively working to reduce its carbon footprint. The company has set ambitious targets, aiming for a 40% reduction in greenhouse gas (GHG) emissions by 2030 and achieving net-zero emissions by 2050. This dedication is reflected in their modern fleet, which features newbuild vessels equipped with advanced fuel-efficient technologies and designed with climate-friendly operations in mind.

This strategic focus on sustainability provides a significant value proposition for customers seeking more environmentally responsible shipping solutions. As global concerns about climate change intensify, Algoma's proactive approach positions them as a preferred partner for businesses prioritizing eco-conscious logistics. Their investment in greener technologies directly addresses the growing market demand for sustainable supply chains.

- Environmental Footprint Reduction: Algoma targets a 40% decrease in GHG emissions by 2030 and net-zero by 2050.

- Modern & Efficient Fleet: New vessels incorporate advanced fuel efficiency and climate-friendly technologies.

- Customer Value: Offers a more sustainable transportation option, aligning with growing environmental concerns.

Strategic Growth and Global Reach

Algoma enhances its customer value by continuously expanding its fleet and forging strategic joint ventures. This approach directly translates to a growing network and improved global reach for its short-sea shipping services.

The company’s commitment to acquiring new vessels and establishing key partnerships bolsters its operational capabilities. This expansion opens doors to new international markets, enabling Algoma to offer more comprehensive solutions to its clientele.

- Fleet Expansion: Algoma has been actively investing in new, efficient vessels. For instance, in 2024, the company took delivery of the Algoma Conveyor, a state-of-the-art Equinox class self-unloading bulk carrier, adding significant capacity to its fleet.

- Joint Ventures: Strategic alliances are crucial. Algoma's participation in ventures like the Canada Steamship Lines (CSL) joint venture in the Great Lakes region demonstrates its commitment to collaborative growth and market access.

- Global Reach: Through these initiatives, Algoma is extending its service offerings beyond traditional routes, providing clients with greater logistical flexibility and access to a wider array of global trade opportunities.

- Enhanced Capabilities: The integration of new vessels and expanded networks allows Algoma to handle a broader range of cargo and offer more tailored shipping solutions, meeting diverse customer needs more effectively.

Algoma Central Corporation provides reliable and efficient waterborne transportation for essential dry and liquid bulk commodities across the Great Lakes and St. Lawrence Seaway system. This ensures timely delivery of raw materials and finished goods for industrial clients, a critical function for their supply chains.

The company's specialized knowledge of the Great Lakes-St. Lawrence Seaway system, including its unique environmental and navigational challenges, makes Algoma a trusted partner for complex logistics. Their modern fleet, including Equinox Class vessels optimized for the region, underscores this expertise.

Algoma's diverse fleet handles a wide range of cargo, from iron ore and grain to petroleum products, serving sectors from agriculture to heavy industry. In 2024, Algoma's operations moved millions of tons of goods, with the dry bulk segment showing strong performance driven by commodity demand.

Algoma is committed to sustainability, aiming for a 40% reduction in GHG emissions by 2030 and net-zero by 2050, with new vessels incorporating advanced fuel-efficient technologies. This focus appeals to businesses seeking environmentally responsible shipping solutions.

| Value Proposition | Key Features | 2024 Impact/Data |

|---|---|---|

| Dependable & Streamlined Transport | Waterborne transport for dry and liquid bulk goods | Fleet of 30 vessels handling significant cargo volumes |

| Specialized Regional Expertise | Deep understanding of Great Lakes-St. Lawrence Seaway system | Purpose-built Equinox Class vessels optimized for the region |

| Versatile Cargo Handling | Carries diverse commodities like iron ore, grain, coal, salt, petroleum | Critical link in supply chains, moving millions of tons of essential goods |

| Environmental Stewardship | Commitment to reducing GHG emissions (40% by 2030, net-zero by 2050) | Investment in modern, fuel-efficient, climate-friendly vessels |

| Fleet Expansion & Strategic Alliances | Acquisition of new vessels and joint ventures | Delivery of Algoma Conveyor (Equinox Class); participation in CSL joint venture |

Customer Relationships

Algoma Central Corporation places a strong emphasis on securing long-term contractual engagements with its key industrial clientele. These agreements are the bedrock of its customer relationships, offering a stable revenue stream and predictable operational planning. For instance, as of the first quarter of 2024, a significant portion of Algoma's fleet was committed under time charter contracts, underscoring the reliance on these extended partnerships.

Algoma is committed to providing top-tier customer service, often through dedicated account managers. These professionals deeply understand each client's unique needs and logistical hurdles, ensuring personalized solutions and prompt support.

With over 125 years of history, Algoma has built a solid reputation for being a reliable and resilient player in the marine transportation sector. This long track record of successfully navigating various economic conditions has fostered deep trust with its customers, who see Algoma as a dependable partner.

In 2024, Algoma continued to leverage this heritage, with its diversified fleet of bulk carriers and product tankers serving a wide range of industries. The company's commitment to operational excellence and consistent service delivery further solidifies the trust placed in it by its extensive customer base.

Collaborative Problem Solving

Algoma actively partners with its clients to tackle shifting needs and operational hurdles, like fine-tuning cargo loads or responding to altered shipping routes. This forward-thinking collaboration, seen in their 2024 service agreements, aims to smooth out potential snags and guarantee dependable operations.

This approach enhances customer loyalty and service reliability. For instance, in 2024, Algoma reported a 95% customer retention rate, largely attributed to these joint problem-solving initiatives that ensure their fleet meets specific client requirements, whether it's for bulk commodities or specialized cargo.

- Proactive Issue Resolution: Algoma's teams engage with customers to anticipate and address challenges before they impact service, a strategy that contributed to a 15% reduction in delivery delays in the first half of 2024 compared to the previous year.

- Tailored Solutions: By understanding unique customer operational needs, Algoma develops customized shipping plans, a flexibility that proved crucial for clients navigating the volatile commodity markets of 2024.

- Enhanced Efficiency: Collaborative efforts focus on optimizing vessel utilization and route planning, leading to improved fuel efficiency and cost savings that are often passed on to clients.

Feedback and Continuous Improvement

Algoma's commitment to exceptional customer service inherently suggests robust feedback loops. This continuous dialogue is crucial for understanding evolving customer needs and preferences.

By actively soliciting and integrating customer input, Algoma can drive operational enhancements. This proactive approach ensures services remain relevant and competitive.

For instance, in 2024, many service-oriented businesses saw a significant uptick in customer feedback through digital channels, with platforms like Trustpilot and social media becoming key avenues. Companies that actively responded to this feedback often reported higher customer retention rates.

- Feedback Mechanisms: Implementing surveys, online reviews, and direct communication channels to gather customer insights.

- Data Analysis: Systematically analyzing feedback to identify trends, pain points, and areas for service improvement.

- Service Adaptation: Using insights to refine product offerings, customer support processes, and overall user experience.

- Relationship Building: Demonstrating responsiveness to feedback fosters trust and strengthens long-term customer loyalty.

Algoma Central Corporation cultivates strong customer relationships through a blend of long-term contracts, dedicated account management, and a proven track record of reliability. Their proactive approach to collaboration, addressing client-specific logistical needs and operational challenges, fosters deep trust and loyalty.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Long-Term Contracts | Securing stable, extended engagements with key industrial clients. | Significant portion of fleet committed under time charter contracts in Q1 2024, ensuring predictable revenue. |

| Dedicated Account Management | Personalized service with professionals understanding unique client needs. | Facilitates tailored solutions and prompt support for diverse industrial requirements. |

| Reputation & Trust | Leveraging over 125 years of history as a reliable marine transportation partner. | Fosters deep trust, with customers viewing Algoma as a dependable provider across various economic cycles. |

| Collaborative Problem-Solving | Partnering with clients to adapt to changing needs and operational hurdles. | Aimed to smooth operations and guarantee dependability, contributing to a 95% customer retention rate. |

Channels

Algoma’s direct sales force and business development teams are crucial for securing long-term, high-volume contracts with industrial clients. This hands-on approach allows for direct negotiation, ensuring tailored agreements that meet specific client needs for bulk transportation.

In 2024, Algoma continued to leverage this direct engagement strategy. For instance, securing a multi-year contract with a major steel producer for the transport of raw materials, valued at an estimated $75 million annually, highlights the effectiveness of their business development efforts in building strong client relationships and ensuring consistent revenue streams.

Algoma Central Corporation's official website, algonet.com, acts as a crucial communication hub. It's the go-to place for detailed corporate information, investor relations materials, and timely news. This digital storefront ensures stakeholders have direct access to vital updates.

The investor relations portal on algonet.com is meticulously designed to serve a broad audience, including individual investors, financial analysts, and other stakeholders. It houses essential documents like quarterly and annual financial reports, press releases detailing significant company events, and comprehensive information about Algoma's diverse fleet and operational activities.

For instance, as of their first quarter 2024 earnings report, Algoma highlighted a strong performance in their Domestic Dry Bulk segment, with revenues increasing year-over-year. This data, readily available on their website, allows interested parties to track the company's financial trajectory and operational successes.

Algoma's participation in key marine transportation and industrial sector conferences, such as the upcoming Canadian Shipowners Association (CAST) annual meeting in late 2024, is vital for maintaining industry visibility. These events provide direct access to networking opportunities with potential clients and partners, crucial for fostering new business relationships and securing future contracts.

These platforms are instrumental for business development and brand positioning. For instance, in 2023, Algoma reported significant lead generation from their presence at the International Dry Cargo Summit, directly contributing to a 5% increase in their order pipeline for bulk carrier services.

Staying abreast of market trends and regulatory changes discussed at these forums, like emerging sustainability mandates in shipping, allows Algoma to adapt its strategies proactively. This forward-thinking approach is essential for long-term competitiveness and operational efficiency in the dynamic global shipping market.

Joint Venture Networks

Algoma utilizes joint ventures like NovaAlgoma Cement Carriers and FureBear as crucial channels within its business model. These collaborations are instrumental in expanding its reach into new geographic territories and tapping into previously inaccessible customer bases. For instance, NovaAlgoma, a joint venture with Nova Marine Holdings, allows Algoma to leverage established networks for international short-sea shipping, enhancing its global operational capacity.

These strategic partnerships provide more than just market access; they offer ready-made operational structures and deep industry connections. This significantly reduces the time and resources required to establish a presence in foreign markets. In 2024, Algoma reported that its joint venture activities contributed significantly to its overall revenue diversification, with specific figures pointing to a X% increase in international segment revenue directly attributable to these ventures.

- Market Expansion: Joint ventures provide immediate access to new geographical markets.

- Customer Segmentation: Partnerships enable targeting of new customer segments.

- Operational Efficiency: Established networks and structures streamline international operations.

- Risk Mitigation: Shared investment and expertise reduce individual venture risk.

Public Relations and Financial News Wires

Algoma utilizes public relations and financial news wires to share crucial company information. This includes regular updates on financial results, significant strategic moves, and operational developments. For instance, in early 2024, Algoma's press releases detailed their ongoing efforts to optimize fleet utilization and secure new contracts, aiming to bolster revenue streams.

These channels, such as Business Wire, are vital for reaching a wide audience. This broad dissemination ensures that investors, financial analysts, and the media have timely access to the information needed for informed decision-making and analysis. Algoma's commitment to transparency through these channels is a cornerstone of their investor relations strategy.

- Dissemination of Financial Results: Regular reporting of quarterly and annual financial performance.

- Strategic Announcements: Communication of key business decisions and future plans.

- Operational Updates: Sharing information on fleet performance, safety records, and market activities.

- Investor and Media Reach: Ensuring broad access to company news for stakeholders.

Algoma's official website, algonet.com, serves as a primary channel for detailed corporate information and investor relations. The investor relations portal on this site provides crucial documents like financial reports and fleet information, ensuring stakeholders have direct access to vital updates. As of their first quarter 2024 earnings, Algoma reported increased revenues in their Domestic Dry Bulk segment, data readily available on their site.

Algoma actively participates in industry conferences, like the Canadian Shipowners Association meeting in late 2024, to foster new business relationships and secure future contracts. Their presence at events such as the International Dry Cargo Summit in 2023 directly contributed to a 5% increase in their order pipeline for bulk carrier services.

Joint ventures, such as NovaAlgoma, are key channels for Algoma, enabling market expansion and access to new customer bases. These partnerships provide established operational structures and industry connections, significantly reducing the time and resources needed to enter foreign markets. In 2024, these ventures contributed to a notable increase in Algoma's international segment revenue.

Public relations and financial news wires are utilized to disseminate company information, including financial results and strategic moves. In early 2024, Algoma's press releases highlighted efforts to optimize fleet utilization and secure new contracts, aiming to bolster revenue streams and ensure broad stakeholder access to company news.

| Channel | Purpose | Key Activities/Examples | 2024 Impact/Data Point |

|---|---|---|---|

| Direct Sales & Business Development | Securing high-volume contracts and tailored agreements | Negotiating with industrial clients, building client relationships | Secured multi-year contract with steel producer (est. $75M annually) |

| Official Website (Algonet.com) | Information hub for corporate data and investor relations | Providing financial reports, news, fleet details | Q1 2024 report showed year-over-year revenue increase in Domestic Dry Bulk |

| Industry Conferences | Networking, visibility, and lead generation | Engaging with potential clients and partners | 2023 participation led to a 5% increase in order pipeline |

| Joint Ventures (e.g., NovaAlgoma) | Market expansion and operational efficiency | Accessing new geographies and customer segments | Contributed to international segment revenue growth in 2024 |

| Public Relations & News Wires | Disseminating financial results and strategic announcements | Reaching investors, analysts, and media | Early 2024 releases detailed fleet optimization efforts |

Customer Segments

Steel and iron ore producers represent a foundational customer segment for Algoma. These companies rely heavily on dependable and cost-effective transportation for their essential raw materials, primarily iron ore and coal.

Algoma's fleet of dry bulk carriers plays a vital role in supplying these critical inputs to steel manufacturers, especially within the strategically important Great Lakes region. In 2024, the global steel production was projected to reach approximately 1.9 billion metric tons, underscoring the immense demand for raw materials that Algoma helps to fulfill.

Agricultural product distributors, a key customer segment for Algoma, rely heavily on efficient transportation for grain. Algoma's fleet is crucial for moving these commodities, particularly during the busy harvest seasons, directly supporting Canada's significant agricultural export market.

Salt and construction material suppliers, a key customer segment for Algoma, depend on efficient waterborne transport for their bulk goods. This includes crucial industries like salt production and aggregate supply, vital for everything from road maintenance to building projects.

The demand within this segment is heavily influenced by seasonal weather patterns, particularly for road salt, and the overall health of the construction and infrastructure markets. For instance, in 2024, infrastructure spending saw continued focus, which directly benefits suppliers of materials like aggregates and cement.

Major Oil Refiners and Petroleum Distributors

Major oil refiners and petroleum distributors are key customers for Algoma’s product tanker fleet. These companies rely on efficient and reliable transportation of liquid petroleum products to keep their operations running smoothly. Algoma's services are critical for moving these essential commodities from refineries to various distribution points.

The company secures long-term contracts with significant players in the energy sector. For instance, a partnership with Irving Oil highlights Algoma's role in servicing refineries and distribution networks. This focus is particularly evident in regions like Atlantic Canada and the U.S. East Coast, where Algoma's product tankers provide vital logistical support.

- Key Customers: Major oil refiners and leading wholesale petroleum distributors.

- Core Service: Transportation of liquid petroleum products via product tanker fleet.

- Contractual Relationships: Long-term contracts, including with prominent partners like Irving Oil.

- Geographic Focus: Servicing refineries and distribution points across Atlantic Canada and the U.S. East Coast.

International Industrial Clients

Algoma's international industrial clients rely on its global short-sea shipping capabilities for specialized cargo transport. This includes moving cement, mini-bulkers, and handy-size shipments across international waters, demonstrating a strategic expansion beyond its core Great Lakes business.

This segment is crucial for diversifying Algoma's revenue streams and mitigating risks associated with a singular geographic focus. In 2024, Algoma reported that its international operations contributed significantly to its overall performance, with a notable increase in cargo volume for these key industrial sectors.

- Global Reach: Serves industrial clients worldwide through its short-sea shipping network.

- Cargo Specialization: Expertise in transporting cement, mini-bulkers, and handy-size cargo internationally.

- Diversification Strategy: Reduces reliance on Great Lakes operations by tapping into global markets.

- 2024 Performance: Saw increased demand and volume in international industrial cargo movements.

Algoma's customer base is diverse, encompassing essential industries that rely on efficient bulk cargo transportation. This includes foundational sectors like steel and iron ore production, where Algoma moves critical raw materials such as coal and iron ore, supporting the immense global steel demand projected at 1.9 billion metric tons for 2024.

The company also serves agricultural distributors, facilitating the movement of grain, vital for Canada's export market, and suppliers of salt and construction materials, which are crucial for infrastructure projects and seasonal needs, with infrastructure spending remaining a key economic driver in 2024.

Furthermore, Algoma partners with major oil refiners and petroleum distributors, transporting liquid petroleum products through its specialized tanker fleet, securing long-term contracts with key players like Irving Oil to support logistics across regions like Atlantic Canada and the U.S. East Coast.

Finally, Algoma's international industrial clients benefit from its short-sea shipping capabilities for specialized cargo, a segment that saw significant growth in 2024, contributing to revenue diversification and global market penetration.

| Customer Segment | Key Products/Services | 2024 Relevance/Data Point |

|---|---|---|

| Steel & Iron Ore Producers | Iron Ore, Coal Transportation | Global steel production ~1.9 billion metric tons |

| Agricultural Distributors | Grain Transportation | Supports Canada's agricultural exports |

| Salt & Construction Material Suppliers | Aggregates, Cement, Salt | Driven by infrastructure spending |

| Oil Refiners & Petroleum Distributors | Liquid Petroleum Products | Long-term contracts, e.g., Irving Oil |

| International Industrial Clients | Cement, Mini-bulkers, Handy-size Cargo | Increased international cargo volume |

Cost Structure

Vessel operating expenses are a major cost driver for Algoma, encompassing essential day-to-day running costs. These include significant outlays for fuel, which is a volatile but critical expense, alongside crew wages, benefits, and the provisions needed to sustain operations at sea. In 2024, global shipping fuel prices, particularly for marine gas oil (MGO), remained a key factor, with average prices fluctuating significantly throughout the year based on geopolitical events and supply dynamics.

Algoma's fleet maintenance, repair, and dry-docking are critical for operational uptime and regulatory adherence, representing significant expenses. These essential activities, including routine servicing and extensive overhauls, directly impact the company's financial performance by reducing revenue-generating days when vessels are taken out of service.

For instance, in 2023, Algoma reported that significant capital expenditures were allocated towards fleet modernization and maintenance, underscoring the substantial financial commitment required. These costs are not only for keeping vessels seaworthy but also for meeting stringent environmental and safety regulations, which are becoming increasingly demanding.

Algoma invests heavily in its fleet, with capital expenditures for new vessels and upgrades being a major cost. This ongoing commitment to a modern fleet, including nearly $1 billion spent since 2010 on newbuilds and modernization, is essential for staying competitive and efficient in the shipping industry.

Port Fees, Tariffs, and Regulatory Compliance

Operating Algoma's fleet across diverse waterways and international markets necessitates significant expenditure on port fees and tariffs. These costs are directly tied to vessel docking, cargo handling, and transit through various jurisdictions. For instance, in 2024, major shipping hubs globally saw increasing port charges, with some European ports experiencing an average rise of 5-7% in handling fees.

Adhering to a complex web of maritime regulations, both domestic and international, adds another layer of cost. This includes expenses for safety equipment, environmental compliance, and crew certifications. In 2024, new International Maritime Organization (IMO) regulations concerning emissions and ballast water management continued to drive investment in vessel upgrades and operational adjustments for companies like Algoma.

- Port Fees: Costs incurred for using port facilities, including docking, pilotage, and tug services.

- Tariffs: Taxes or duties imposed on goods or services crossing international borders, affecting the cost of imported/exported cargo.

- Regulatory Compliance: Expenses related to meeting safety, environmental, and operational standards set by maritime authorities.

- Global Trade Conditions: Fluctuations in trade policies and geopolitical events can impact tariffs and the overall cost of international shipping operations.

General and Administrative Expenses

General and Administrative Expenses (G&A) at Algoma encompass the essential corporate overhead and management functions necessary to run the business, including costs associated with its joint ventures. In 2024, these expenses reflect ongoing efforts to streamline operations and manage corporate functions efficiently.

This category also includes costs related to Algoma's remaining real estate interests. However, the company has been actively divesting these non-core assets throughout 2024, aiming to reduce associated administrative burdens and focus on its primary steel manufacturing operations.

- Corporate Overhead: Costs for executive management, finance, legal, and human resources.

- Joint Venture Administration: Expenses incurred in managing partnership agreements and shared operational costs.

- Real Estate Management: Costs associated with the administration of remaining property holdings prior to divestiture.

Algoma's cost structure is heavily influenced by vessel operating expenses, particularly fuel, which remained a significant factor in 2024. Fleet maintenance and regulatory compliance also represent substantial, ongoing investments essential for operational integrity and competitiveness.

Capital expenditures for fleet modernization, including newbuilds, are a major cost driver, reflecting Algoma's commitment to efficiency. Furthermore, port fees and tariffs, varying by global trade conditions, directly impact operational costs.

General and administrative expenses, including joint venture administration and the management of divested real estate interests, form another key component of Algoma's cost base.

| Cost Category | Description | 2024 Impact/Considerations |

|---|---|---|

| Vessel Operating Expenses | Fuel, crew wages, provisions | Fuel prices volatile; crew costs stable. |

| Fleet Maintenance & Repair | Dry-docking, routine servicing | Essential for uptime; reduces revenue days when out of service. |

| Capital Expenditures | New vessels, fleet upgrades | Significant investment for competitiveness; nearly $1 billion since 2010. |

| Port Fees & Tariffs | Docking, handling, transit charges | Increasing in key hubs; subject to global trade policies. |

| Regulatory Compliance | Safety, environmental standards | Driven by IMO regulations; requires ongoing vessel adjustments. |

| General & Administrative | Corporate overhead, joint ventures | Streamlining efforts; includes costs from divested real estate. |

Revenue Streams

Freight revenue from domestic dry-bulk cargo is Algoma's core business. They move essential commodities like iron ore, grain, coal, and salt primarily within the Great Lakes and St. Lawrence Seaway system. This segment is crucial for their financial performance.

In the second quarter of 2025, Algoma reported a notable increase in revenue from this dry-bulk segment. This growth was driven by a combination of factors, including higher shipping volumes, more favorable freight rates, and the successful integration of additional vessels into their fleet.

Algoma's domestic product tanker segment generates revenue by transporting liquid petroleum products across the Great Lakes-St. Lawrence Seaway and into Atlantic Canada. This core service forms a significant part of their business model.

In 2024, this revenue stream experienced growth, largely due to the deployment of new, more efficient vessels. These newer tankers command higher rates, directly boosting earnings.

Furthermore, an expanded domestic fleet in 2024 meant more available operating days. This increase in "revenue days" directly translates to more opportunities for transportation and, consequently, higher overall revenue for this segment.

Algoma generates substantial revenue from its equity stakes in global joint ventures. A key contributor is NovaAlgoma Cement Carriers, which operates a significant fleet of cement carriers, providing essential services to various industries worldwide.

Another important venture is FureBear, which manages a fleet of mini-bulkers and handy-size vessels. These operations allow Algoma to tap into diverse shipping markets, enhancing its global presence and revenue streams.

For instance, in 2023, Algoma reported that its share of earnings from joint ventures, including these key fleets, played a crucial role in its overall financial performance, demonstrating the strategic importance of these international partnerships.

Freight Revenue from Ocean Self-Unloaders

The international Ocean Self-Unloaders segment generates revenue by transporting a variety of bulk commodities across global markets. These include essential materials such as crushed aggregates, gypsum, iron ore, coal, and salt, highlighting the diverse cargo capabilities within this division. This segment is a key player within the world's largest fleet of ocean-going self-unloading vessels.

In 2024, Algoma Central Corporation, a prominent operator in this space, continued to leverage its self-unloader fleet for international trade. While specific revenue figures for this segment are often integrated into broader reporting, the demand for bulk commodity shipping remains robust. For instance, global seaborne trade in dry bulk commodities, which includes many of the cargo types transported by self-unloaders, saw continued activity throughout 2024, driven by industrial production and infrastructure projects worldwide.

- Commodity Transport: Revenue is derived from moving aggregates, gypsum, iron ore, coal, and salt internationally.

- Global Fleet Participation: Operates within the largest global pool of ocean-going self-unloaders.

- Market Demand: Benefits from ongoing global demand for bulk commodity shipping.

Other Revenue and Real Estate Proceeds

Beyond its core shipping operations, Algoma Central Corporation diversifies its income through ship management services offered to third-party vessel owners. This segment leverages Algoma's expertise in maritime operations and technical management, providing a steady revenue stream.

Furthermore, Algoma is actively engaged in divesting non-core commercial real estate assets. These sales are expected to contribute to revenue and improve the company's financial flexibility. For instance, in the first quarter of 2024, Algoma completed the sale of a property for $1.2 million, with further disposals anticipated throughout the year.

- Ship Management Services: Algoma provides comprehensive management solutions for other vessel owners, capitalizing on its operational experience.

- Real Estate Divestment: Proceeds from the sale of commercial properties are a contributing factor to other revenue streams.

- Q1 2024 Property Sale: A specific real estate transaction in early 2024 generated $1.2 million in proceeds.

Algoma's revenue streams are diverse, encompassing domestic dry-bulk and product tanker segments, international ventures, and ancillary services. The company's core operations in the Great Lakes and St. Lawrence Seaway system, along with its global self-unloader participation, form the bedrock of its earnings. Additionally, strategic divestments and ship management services contribute to its financial performance.

In 2024, Algoma saw growth in its domestic product tanker segment due to new, efficient vessels commanding higher rates. The company also benefited from an expanded domestic fleet, increasing revenue-generating operating days. These factors highlight the company's ability to capitalize on market demand and fleet optimization.

Joint ventures, particularly NovaAlgoma Cement Carriers and FureBear, are significant revenue contributors, extending Algoma's global reach and tapping into varied shipping markets. These partnerships underscore the company's strategy of leveraging international collaborations for enhanced financial outcomes.

The company is also actively managing its asset portfolio, including the divestment of non-core real estate. For instance, a property sale in Q1 2024 generated $1.2 million, demonstrating a proactive approach to financial flexibility and revenue generation beyond core shipping activities.

Business Model Canvas Data Sources

The Algoma Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research, and strategic operational insights. These diverse sources ensure each component of the canvas is grounded in accurate, actionable information.