Algoma Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

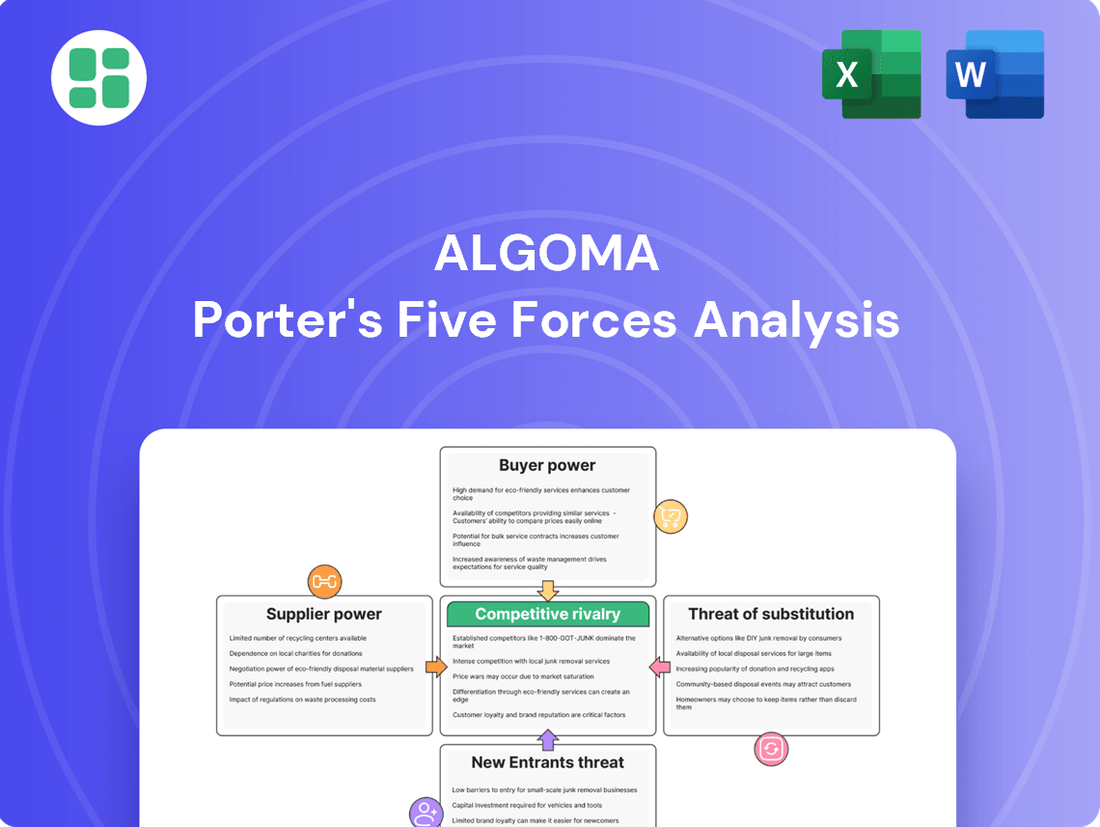

Algoma's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the significant threat of substitute products. Understanding these dynamics is crucial for navigating its market effectively.

This brief overview only hints at the depth of analysis. Unlock the full Porter's Five Forces Analysis to explore Algoma’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Algoma Central Corporation's commitment to fleet modernization, including the addition of new Equinox Class vessels and ongoing construction for 2025 and beyond, highlights a dependency on specialized shipbuilders. This reliance grants these suppliers significant leverage.

The substantial investment required for acquiring new vessels means that shipbuilders possessing the expertise to construct advanced, fuel-efficient ships are in a strong bargaining position. Limited global capacity for such specialized construction further amplifies their power.

Fuel is a significant operating expense for marine transportation firms like Algoma Central Corporation. In 2024, the price of Very Low Sulphur Fuel Oil (VLSFO), a common marine fuel, fluctuated, with average prices in key bunkering ports ranging from approximately $600 to $750 per metric ton, depending on the region and market conditions. This volatility directly impacts Algoma's profitability, as fuel costs can represent a substantial portion of their total operating expenditures.

While specific supplier concentration data for Algoma's fuel procurement isn't publicly detailed, the global nature of energy markets and the requirement for specialized marine fuels grant considerable leverage to fuel providers. These suppliers can influence costs through pricing strategies and availability, especially during periods of geopolitical instability or supply chain disruptions. For instance, disruptions in major oil-producing regions in early 2024 led to temporary spikes in crude oil prices, which subsequently translated to higher marine fuel costs.

Algoma's strategic emphasis on operating fuel-efficient vessels and actively exploring alternative fuel sources, such as methanol or ammonia, is a direct response to mitigate the bargaining power of fuel suppliers. By investing in newer, more efficient tonnage and investigating cleaner fuel options, Algoma aims to reduce its reliance on traditional, price-volatile fuels and gain greater control over its energy costs, thereby lessening the influence of fuel providers on its financial performance.

Algoma Porter's Q1 2025 financial report showed a substantial increase in operating losses, directly linked to elevated layup costs and an unusually high number of vessels undergoing planned dry-docking. This situation underscores the significant bargaining power wielded by shipyards and maintenance providers.

These essential service providers are critical for maintaining Algoma Porter's fleet, ensuring regulatory compliance, and keeping vessels operational. The necessity of their services, especially during periods of extensive maintenance, amplifies their leverage in negotiations.

Skilled Labor Shortages in Marine Industry

The marine industry, including operators like Algoma, is grappling with significant skilled labor shortages. This scarcity is driven by difficulties in attracting new talent and intense competition for experienced personnel from other industries. For instance, in 2024, reports indicated a growing gap between the demand for certified mariners and the available workforce.

This shortage of properly skilled shipboard employees directly impacts operational efficiency. It can lead to service delays and interruptions, hindering Algoma's capacity to fully utilize its domestic fleet. Consequently, the bargaining power of the existing labor force increases as their specialized skills become more critical.

- Labor Scarcity Impact: Skilled worker shortages in 2024 have been a recurring theme across various maritime sectors, affecting recruitment and retention.

- Operational Disruptions: Delays and interruptions are a direct consequence, potentially limiting Algoma's vessel utilization rates.

- Supplier Bargaining Power: The scarcity empowers labor unions and individual skilled workers, allowing them to negotiate for better terms and compensation.

Technology and Component Providers

Algoma's pursuit of technological upgrades, such as advanced fuel efficiency systems and real-time vessel tracking, enhances the bargaining power of specialized technology and component suppliers. These providers offer critical, often proprietary, systems for navigation, engine management, and operational monitoring, making Algoma dependent on their expertise and offerings.

For instance, in 2024, the maritime technology sector saw continued investment in digitalization and sustainability solutions. Companies like Wärtsilä and ABB, key players in marine propulsion and automation, reported strong order books driven by demand for more efficient and environmentally friendly vessel operations. This trend suggests that suppliers of such advanced systems can command higher prices or favorable terms due to the specialized nature of their products and Algoma's reliance on them for competitive advantage.

- Specialized Marine Technologies: Suppliers of advanced navigation, engine control, and monitoring systems hold significant power due to the niche nature of their products.

- Innovation Dependence: Algoma's commitment to innovation means it relies on a limited number of providers for cutting-edge solutions.

- Market Trends: The growing demand for maritime digitalization and sustainability in 2024, as evidenced by strong performance from major marine technology providers, strengthens supplier leverage.

Algoma Central Corporation faces considerable bargaining power from its suppliers, particularly shipyards and providers of specialized marine technologies. The high cost and limited availability of advanced shipbuilding expertise, as demonstrated by the demand for Equinox Class vessels, place shipbuilders in a strong negotiating position. Similarly, suppliers of critical, often proprietary, technological systems for navigation and engine management benefit from Algoma's reliance on innovation to maintain a competitive edge.

Fuel suppliers also exert significant influence, with marine fuel prices fluctuating based on global energy markets and geopolitical events. For example, VLSFO prices in 2024 ranged from $600 to $750 per metric ton, impacting Algoma's operating costs. Furthermore, skilled labor shortages in the maritime sector in 2024 have amplified the bargaining power of both maintenance providers and the existing workforce, leading to increased operational costs and potential service delays.

| Supplier Category | Factors Influencing Bargaining Power | Impact on Algoma | 2024 Data Point/Trend |

|---|---|---|---|

| Shipbuilders | Specialized expertise, limited global capacity, high investment costs | Increased vessel acquisition costs, potential delays | Demand for advanced vessels like Equinox Class |

| Fuel Providers | Global energy market volatility, geopolitical risks | Fluctuating operating expenses, potential supply disruptions | VLSFO prices: $600-$750/metric ton (average) |

| Maintenance/Dry-docking Services | Critical need for fleet upkeep, regulatory compliance | Elevated operational losses due to high dry-docking costs | Q1 2025 report cited increased losses from dry-docking |

| Technology Suppliers | Proprietary systems, dependence on innovation | Higher costs for advanced systems, reliance on specific providers | Strong market for maritime digitalization and sustainability solutions |

| Skilled Labor | Labor shortages, essential skills for operations | Increased labor costs, potential operational disruptions | Growing gap between demand and supply for certified mariners |

What is included in the product

This analysis dissects the competitive forces impacting Algoma, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its industry.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Algoma Central Corporation's diverse industrial customer base, spanning sectors like steel, agriculture, mining, construction, and petroleum, generally limits the bargaining power of any single client. Because revenue is spread across many industries, no one customer segment holds significant sway over Algoma's pricing or terms. This diversification prevents individual buyers from leveraging their importance to extract concessions, thereby strengthening Algoma's position.

Algoma Central Corporation places a strong emphasis on providing resilient service and efficient, reliable, and sustainable marine transportation solutions. This focus directly impacts the bargaining power of its customers, particularly large industrial clients who depend on the timely delivery of raw materials.

For these clients, the assurance of reliability is often more critical than minor price fluctuations. For instance, in 2023, Algoma's fleet of 30 vessels, including bulk carriers and product tankers, facilitated the movement of millions of tons of essential commodities. A disruption in this supply chain, even for a short period, could lead to significant production downtime and financial losses for industrial customers, thereby reducing their willingness to switch carriers based solely on marginal cost savings.

Fluctuations in customer demand significantly impact Algoma's bargaining power. When demand for key commodities like steel and agricultural products dips, customers can leverage this to negotiate better shipping rates. For example, in 2024, a softer dry-bulk market and reduced shipments of salt and construction materials gave customers more leverage.

Long-term Contracts for Stability

Algoma Central Corporation actively manages customer bargaining power by securing long-term time charter contracts. This strategy is particularly evident in their cement carrier fleet and for new product tankers, where agreements with clients like Irving Oil are in place. These multi-year commitments lock in revenue streams and significantly diminish the immediate ability of customers to negotiate more favorable terms.

These long-term contracts provide Algoma with a predictable revenue base, insulating them from the short-term fluctuations and demands that individual customers might otherwise exert. For instance, the cement fleet's contracts ensure consistent utilization and pricing, offering a stable foundation for financial planning. This approach directly counters the bargaining power that customers could wield in a more spot-market-driven environment.

- Long-term contracts reduce customer leverage by locking in rates and service commitments.

- Clients like Irving Oil are part of these stable, multi-year agreements for product tankers.

- The cement fleet benefits from these contracts, ensuring consistent revenue and operational stability.

- This strategy mitigates the immediate bargaining power of customers by creating long-term dependencies.

Geographic and Infrastructure Constraints

Customers in the Great Lakes and St. Lawrence Seaway region often find their options for transporting bulk commodities restricted. The specialized infrastructure required for this type of shipping, coupled with the inherent cost-effectiveness of marine transport, means that switching to alternative methods like rail or trucking can be prohibitively expensive or simply impractical for large volumes.

This geographic and infrastructural lock-in significantly dampens customers' bargaining power. They are less able to exert pressure on Algoma or other carriers by threatening to move their business elsewhere, as viable alternatives are scarce within this vital trade corridor.

- Limited Alternatives: The reliance on specialized ports and vessels within the Great Lakes system restricts customer choice.

- Cost Inefficiency: Shifting large bulk cargo away from the seaway often incurs higher costs and logistical complexities.

- Infrastructure Dependency: The existing infrastructure makes marine transport the most efficient and often the only feasible option for many customers.

Algoma's diverse customer base across steel, agriculture, and mining generally limits the bargaining power of any single client. Their reliance on Algoma's specialized marine transport in the Great Lakes, where alternatives are costly and impractical, further reduces customer leverage. This situation is reinforced by long-term contracts, like those with Irving Oil, which lock in rates and service, significantly diminishing immediate customer negotiation power.

In 2023, Algoma's fleet of 30 vessels moved millions of tons of commodities, highlighting the critical nature of their service. While a softer market in 2024, particularly for salt and construction materials, offered some customers more leverage, Algoma's strategic use of multi-year contracts, such as for its cement carriers and new product tankers, provides a strong countermeasure against excessive customer demands.

| Customer Segment | Dependence on Marine Transport | Contractual Protection | Impact on Bargaining Power |

|---|---|---|---|

| Steel Producers | High (raw material import/export) | Varies; some long-term agreements | Moderate; dependent on volume and contract terms |

| Agricultural Sector | High (grain, fertilizer transport) | Seasonal, some longer-term charters | Moderate to High; sensitive to market demand |

| Construction Materials | High (aggregate, cement) | Often long-term for cement, variable for others | Low to Moderate; infrastructure lock-in is key |

| Petroleum/Refining | High (product tankers) | Long-term contracts (e.g., Irving Oil) | Low; stability of service is paramount |

Full Version Awaits

Algoma Porter's Five Forces Analysis

This preview showcases the complete Algoma Porter's Five Forces Analysis, identical to the document you will receive immediately after purchase. You're viewing the actual, professionally crafted report, ensuring no surprises or placeholder content. Once your transaction is complete, you'll gain instant access to this fully formatted and ready-to-use strategic assessment of Algoma's competitive landscape.

Rivalry Among Competitors

Algoma Central Corporation boasts the largest fleet of dry and liquid bulk carriers on the Great Lakes-St. Lawrence Seaway, underscoring its established market leadership. In 2024, Algoma's fleet comprised 30 vessels, a significant portion of the total regional capacity. This dominance, however, means intense competition exists as other carriers strive to capture market share within this vital North American trade route.

While the global dry bulk shipping arena features numerous large players like Berge Bulk and Pacific Basin, the Great Lakes and St. Lawrence Seaway market presents a more concentrated competitive landscape. This regional focus means fewer, more specialized operators dominate, making direct comparisons to the broader global market less straightforward.

Within this niche, Fednav stands out due to its specialized expertise in navigating challenging ice conditions prevalent in the Great Lakes and Seaway. This capability creates a distinct competitive advantage, allowing Fednav to operate year-round when others might be restricted, a critical factor for clients reliant on consistent supply chains in the region.

Algoma Central Corporation is actively engaged in a substantial fleet modernization initiative. The company plans to introduce several new, advanced vessels into its fleet throughout 2024 and 2025. This proactive investment in cutting-edge, fuel-efficient ships directly pressures rivals to similarly upgrade their operations to remain competitive in terms of cost and service quality.

Economic Sensitivity and Cargo Volume Fluctuations

The Great Lakes shipping sector, including companies like Algoma Porter, is highly sensitive to the overall health of the economy. When the economy is strong, demand for commodities such as iron ore, grain, and limestone typically rises, leading to increased cargo volumes. Conversely, economic downturns can significantly reduce this demand.

The 2024 navigation season, while showing robust cargo movement overall, also highlighted specific market pressures. For instance, the iron ore segment experienced a downturn in 2024 and projections for 2025 suggest continued challenges in this area. This indicates a competitive landscape where fluctuations in demand for key materials directly impact shipping performance and profitability.

- Economic Downturns: Reduced industrial activity and consumer spending during economic slowdowns directly decrease the need for raw materials, impacting cargo volumes.

- Commodity Price Volatility: Fluctuations in global commodity prices can alter the cost-effectiveness of Great Lakes shipping versus other transportation methods.

- Sector-Specific Demand: Performance is heavily tied to the health of sectors that rely on bulk commodities, such as construction (limestone) and manufacturing (iron ore).

- 2024/2025 Trends: A notable decline in iron ore shipments observed in 2024, with expectations of similar pressures in 2025, underscores the competitive impact of shifting commodity demand.

Focus on Sustainability and Technology as Differentiators

Competitive rivalry in the marine transport sector is intensifying as companies leverage sustainability and technology for differentiation. Algoma's proactive stance on decarbonization and adoption of advanced digital solutions, such as AI-powered route optimization, sets it apart. This focus not only appeals to environmentally conscious clients but also drives operational efficiencies.

Rivals are compelled to respond by increasing their own investments in green technologies and digital transformation to maintain market share. For instance, the global maritime industry saw significant investment in alternative fuels and vessel upgrades throughout 2023 and early 2024, indicating a broader industry trend driven by competitive pressures and regulatory demands.

- Algoma's investment in advanced ballast water treatment systems contributes to its environmental differentiation.

- Competitors are pressured to match Algoma's fuel efficiency initiatives, with many exploring hybrid or electric propulsion systems.

- The adoption of real-time data analytics for fleet management is becoming a key battleground for operational superiority.

- Industry reports from 2024 highlight a growing demand for sustainable shipping solutions, directly impacting competitive strategies.

The competitive rivalry within Algoma Central Corporation's operating environment is robust, driven by a concentrated group of specialized carriers on the Great Lakes-St. Lawrence Seaway. Companies like Fednav, with its ice-navigating capabilities, present a direct challenge by offering year-round services that others may not match. Algoma's significant fleet modernization, including new vessel introductions planned through 2025, forces competitors to invest in their own fleets to maintain parity in efficiency and service quality.

| Competitor | Fleet Size (Approx.) | Key Differentiator | 2024 Focus |

|---|---|---|---|

| Algoma Central Corporation | 30 vessels | Largest fleet, modernization program | New vessel deployment, efficiency |

| Fednav | Significant fleet | Ice-strengthened vessels, year-round operation | Specialized cargo handling |

| Lower Lakes Towing | Multiple vessels | Regional expertise, diverse cargo | Operational reliability |

SSubstitutes Threaten

For bulk commodities like iron ore, grain, coal, and salt, shipping via the Great Lakes and St. Lawrence Seaway offers a compelling cost advantage over land-based options. This cost-effectiveness stems from the sheer volume marine vessels can carry in a single trip.

Consider salt transport: moving the same tonnage by rail would necessitate a significantly greater number of rail cars, increasing logistical complexity and overall expense. This inherent capacity advantage makes marine transport a highly efficient and economical choice for these large-volume movements.

While rail and truck transportation are present alternatives, they often struggle to match the sheer volume and cost-efficiency of bulk sea freight for commodities like iron ore and grain. For instance, a single large bulk carrier can transport thousands of tons of cargo, a feat requiring numerous rail cars or trucks, leading to higher per-ton-mile costs and significant logistical complexities for those modes.

The Great Lakes-St. Lawrence Seaway System is a highly specialized marine highway. Its extensive network of ports, canals, and locks is purpose-built for bulk cargo, making it a unique logistical asset. This specialized infrastructure creates significant barriers for potential substitute modes of transport.

The efficiency and directness offered by the Seaway are challenging for land-based alternatives like rail and trucking to fully match for bulk commodities. For instance, in 2023, the Seaway handled approximately 38.1 million metric tons of cargo, demonstrating its substantial capacity and reach. This established system's ability to move large volumes cost-effectively significantly dampens the threat of substitution.

Environmental and Sustainability Advantages

Marine shipping's inherent environmental friendliness presents a significant barrier to substitutes. It is widely recognized as the most eco-conscious method for transporting bulk goods, boasting considerably lower emissions per ton-mile when contrasted with road or rail transport. For instance, in 2024, maritime shipping accounted for approximately 2.8% of global CO2 emissions, a figure that remains substantially lower per unit of cargo moved than other modes.

As businesses globally intensify their focus on supply chain sustainability and reducing their carbon footprint, this inherent advantage of marine transport diminishes the appeal of alternatives that carry a higher environmental cost. Companies are increasingly prioritizing suppliers and logistics partners who demonstrate strong environmental credentials, making greener shipping options more attractive.

- Lower Emissions: Marine shipping emits significantly less CO2 per ton-mile than trucking or rail.

- Sustainability Focus: Growing corporate emphasis on ESG (Environmental, Social, and Governance) factors favors maritime transport.

- Regulatory Tailwinds: International and national regulations are pushing for greener shipping practices, further solidifying its advantage over less regulated or higher-emission alternatives.

Intermodal Integration rather than Pure Substitution

The threat of substitutes for marine transport in Algoma is often mitigated by intermodal integration. Instead of direct replacement, marine services frequently become a crucial link within broader supply chains, connecting seamlessly with rail and road networks at port facilities. This collaborative dynamic highlights marine transport's essential function for moving bulk commodities across the region.

This integration means that pure substitution is less probable. For instance, in 2024, a significant portion of Canadian grain exports, a key commodity for Algoma, moved via Great Lakes-St. Lawrence Seaway vessels before transferring to rail or truck for final delivery to international markets. This reliance on a multi-modal approach solidifies marine transport's position.

- Intermodal Chains: Marine transport is often a component of larger logistics networks, not a standalone service easily replaced.

- Commodity Dependence: Bulk goods like iron ore and grain rely heavily on cost-effective waterborne transport, making direct substitution challenging.

- Infrastructure Links: Port infrastructure facilitates the transfer to other modes, fostering integration rather than competition.

The threat of substitutes for marine transport, particularly for bulk commodities like iron ore and grain, is significantly low for Algoma. The specialized infrastructure of the Great Lakes-St. Lawrence Seaway system, designed for massive cargo volumes, is difficult for land-based alternatives like rail and trucking to replicate cost-effectively. For example, in 2023, the Seaway moved over 38 million metric tons of cargo, showcasing its capacity that substitutes struggle to match.

Marine shipping's inherent environmental advantage further solidifies its position. It offers considerably lower emissions per ton-mile compared to road or rail, a factor increasingly important for businesses focused on sustainability. In 2024, maritime shipping's share of global CO2 emissions remained low relative to cargo volume, making it a preferred choice over higher-emission alternatives.

Instead of direct substitution, marine transport often integrates with other modes. This intermodal approach, where vessels connect with rail and road networks, highlights marine transport's essential role within broader supply chains. This reliance, evident in 2024 Canadian grain exports utilizing the Seaway before onward rail or truck transport, makes pure substitution improbable.

| Transport Mode | Cost-Effectiveness for Bulk (Relative) | Environmental Impact (CO2 per Ton-Mile) | Infrastructure Specialization |

|---|---|---|---|

| Marine (Great Lakes-St. Lawrence Seaway) | High | Low | High |

| Rail | Medium | Medium | Medium |

| Truck | Low | High | Low |

Entrants Threaten

The sheer cost of acquiring or constructing new vessels, particularly specialized bulk carriers and tankers, presents a substantial barrier to entry in the shipping industry. For instance, Algoma Central Corporation's ongoing fleet modernization program, a significant multi-billion-dollar undertaking, underscores the immense capital investment needed. This financial hurdle makes it exceedingly difficult for new companies to enter the market and compete effectively with established players.

Operating on the Great Lakes and St. Lawrence Seaway means grappling with a dense web of regulations. These aren't just minor guidelines; they cover everything from environmental protection and safety protocols to international maritime laws. For instance, new decarbonization targets, like those being discussed for 2024 and beyond, add another layer of complexity and cost.

Meeting these stringent requirements, including the capital investment needed for compliance and the ongoing operational expenses, acts as a substantial barrier. Any new entrant would face significant upfront costs and a steep learning curve to simply get their operations off the ground legally and safely.

Established players like Algoma benefit from deeply entrenched relationships with ports and cargo owners, a significant barrier for newcomers. Their extensive experience navigating the seasonal and complex Great Lakes system is not easily replicated. For instance, in 2024, Algoma's fleet of 30 vessels, including 12 self-unloading bulk carriers, demonstrated its operational scale and existing network.

Need for Specialized Fleet and Ice Navigation Capability

The threat of new entrants for Algoma Porter is significantly reduced by the substantial capital investment required for specialized vessels. Operating in the Great Lakes-St. Lawrence Seaway system demands ice-class tankers and vessels adhering to Seaway-max dimensions, a costly undertaking for newcomers. For instance, building a new, state-of-the-art bulk carrier can easily exceed $50 million, a prohibitive cost for many potential competitors.

This need for specialized fleet and ice navigation capability creates a formidable barrier. Companies lacking established assets or the financial wherewithal to acquire them face immense challenges in entering this market.

- High Capital Expenditure: Acquiring ice-class vessels and meeting Seaway-max dimensions requires millions in upfront investment.

- Operational Expertise: Navigating the unique and often harsh conditions of the Great Lakes-St. Lawrence Seaway demands specialized knowledge and experience.

- Fleet Modernization Costs: The ongoing need to update and maintain a specialized fleet adds to the long-term financial burden for potential entrants.

Challenges in Acquiring Skilled Labor

The marine industry is experiencing a significant shortage of skilled labor, making it challenging for new entrants to build a competent workforce. This difficulty in recruiting and retaining experienced shipboard employees acts as a substantial barrier, as a qualified crew is essential for safe and efficient operations.

In 2024, the International Maritime Organization (IMO) highlighted the increasing demand for certified maritime professionals, with a notable gap in experienced officers and engineers. This scarcity means new companies would struggle to find the necessary talent, potentially leading to higher recruitment costs and longer operational ramp-up times.

- Skilled Labor Shortage: The marine sector faces a growing deficit in experienced seafarers.

- Recruitment & Retention Challenges: Attracting and keeping qualified personnel is increasingly difficult for all industry players.

- Operational Impact: A lack of skilled staff directly impacts safety and efficiency, posing a risk for new entrants.

- Barrier to Entry: The difficulty in assembling an experienced team significantly raises the cost and complexity for new companies to enter the market.

The threat of new entrants for Algoma is considerably low due to the immense capital required for specialized vessels and the complex regulatory environment of the Great Lakes. Building a new, ice-class bulk carrier could easily cost upwards of $50 million, a significant deterrent for potential competitors entering the market in 2024.

Existing players like Algoma also benefit from established relationships with ports and cargo owners, alongside deep operational expertise in navigating the unique Great Lakes-St. Lawrence Seaway system. This ingrained network and experience are difficult and costly for newcomers to replicate, further solidifying Algoma's position.

Furthermore, the marine industry's ongoing skilled labor shortage, with a noted gap in experienced officers and engineers as highlighted by the IMO in 2024, presents another substantial barrier. New entrants would face significant challenges and higher costs in assembling a competent and qualified crew.

| Barrier | Estimated Cost/Impact | 2024 Relevance |

|---|---|---|

| Specialized Vessel Acquisition | $50M+ per vessel | High capital requirement remains a constant deterrent. |

| Regulatory Compliance | Significant ongoing operational costs | Increasing environmental and safety regulations add complexity. |

| Operational Expertise | Years to develop | Navigating seasonal and harsh conditions requires deep experience. |

| Skilled Labor Shortage | Higher recruitment costs, longer ramp-up | Difficulty in finding qualified crew impacts new entrants' operational readiness. |

Porter's Five Forces Analysis Data Sources

Our Algoma Porter's Five Forces analysis is built upon a foundation of credible data, including Algoma Steel's annual reports, industry-specific market research, and relevant trade publications to capture the competitive landscape.

We leverage publicly available financial statements, analyst reports, and news archives to thoroughly assess the bargaining power of suppliers and buyers, as well as the threat of new entrants and substitutes impacting Algoma.