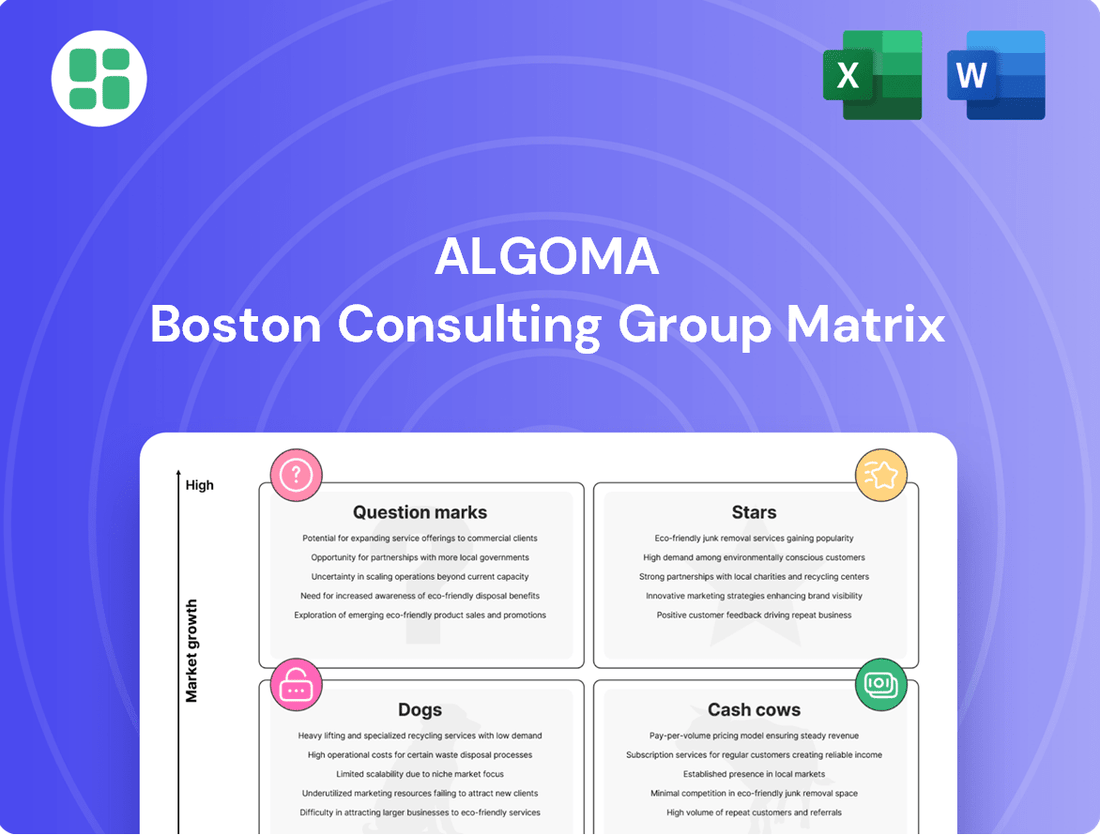

Algoma Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

Unlock the strategic power of the Algoma BCG Matrix to pinpoint your company's market position. Understand which products are poised for growth and which require careful consideration. Purchase the full report for a comprehensive analysis and actionable strategies to optimize your portfolio.

Stars

Algoma's FureBear joint venture, featuring newbuild dual-fuel product tankers, clearly fits the Star category within the BCG matrix. This strategic investment, with five vessels delivered by early 2025 and another five by early 2026, taps into the growing demand for environmentally conscious shipping in Northern European markets.

The two new 37,000 DWT ice-class product tankers, Algoma East Coast and Algoma Acadian, are significant assets for Algoma, having been delivered in Q2 2025. These vessels are on long-term charters with Irving Oil, a key player in the energy sector.

These tankers bolster Algoma's presence in the Canadian and U.S. east coast markets, vital for fuel distribution. The long-term charters ensure a stable revenue stream and a strong market position in a segment characterized by consistent demand, even with potentially moderate overall growth.

The inclusion of new technology and the expansion into key markets solidify these product tankers as Stars in Algoma's portfolio. This classification reflects their strong market share and growth potential within their specialized niche.

Algoma's ongoing fleet renewal with the Equinox Class vessels, set to conclude with the Algoma Endeavour's delivery in early 2025, positions this segment as a Star. This twelfth and final vessel completes a significant modernization effort.

These Equinox Class vessels represent a substantial leap forward, offering a 40% improvement in carbon intensity and advanced fuel efficiency. This makes Algoma a frontrunner in sustainable domestic dry-bulk shipping.

This strategic modernization not only enhances environmental performance but also solidifies Algoma's dominant position within the crucial Great Lakes-St. Lawrence Seaway market, ensuring efficient service to key industrial sectors.

Methanol-Ready Ocean Self-Unloaders

Algoma's investment in three methanol-ready Kamsarmax-based ocean self-unloaders, slated for delivery between 2025 and 2027, firmly places these vessels in the Star quadrant of the BCG matrix for the international ocean shipping market. This strategic move anticipates future regulatory shifts and customer demand for greener shipping solutions.

These new builds are engineered to set the standard for the next generation of self-unloaders, a segment where Algoma already holds a significant position. By targeting the world's largest pool of ocean self-unloaders, Algoma aims to capture substantial market share.

- Market Position: These vessels are designed to lead the international ocean self-unloader market.

- Growth Potential: The methanol-ready technology signifies high growth prospects in a transitioning industry.

- Investment Timing: Deliveries between 2025 and 2027 align with anticipated market demand for sustainable shipping.

- Competitive Edge: Being at the forefront of eco-friendly vessel technology provides a distinct advantage.

Strategic Growth Initiatives in Global Short Sea Shipping

Algoma's strategic growth in global short sea shipping, exemplified by the addition of two 8,800 DWT mini-bulkers in 2025 and 2026, positions this segment as a Star. This expansion targets growth and market diversification across dry-bulk, cement carrier, and handy-size fleets.

The company's commitment to international markets and securing long-term charters underscores its ambition to capture increasing market share in developing niches within the short sea shipping sector.

- Fleet Expansion: Addition of two 8,800 DWT mini-bulkers in 2025 and 2026.

- Market Diversification: Operations span dry-bulk, cement carriers, and handy-size vessels.

- Growth Focus: Initiatives aimed at expanding market presence and capturing share in international waters.

- Strategic Commitments: Utilization of long-term charters to secure market position.

Algoma's FureBear joint venture and Equinox Class vessels are prime examples of Stars in their respective markets. These investments, with newbuilds entering service through early 2026 and fleet modernization concluding in early 2025, represent strong market positions and significant growth potential. The focus on advanced technology, such as dual-fuel capabilities and improved carbon intensity, drives their Star classification.

The three methanol-ready Kamsarmax-based ocean self-unloaders, with deliveries scheduled between 2025 and 2027, also qualify as Stars. These vessels are poised to lead in the international ocean self-unloader market, leveraging their eco-friendly design and Algoma's established presence in this segment.

Furthermore, the expansion into global short sea shipping with two 8,800 DWT mini-bulkers in 2025 and 2026 solidifies this area as a Star. This strategic move diversifies Algoma's operations and targets growth in international waters.

| Segment | BCG Category | Key Drivers | Recent/Upcoming Developments |

|---|---|---|---|

| FureBear Joint Venture (Dual-Fuel Product Tankers) | Star | Growing demand for eco-friendly shipping, long-term charters | Five vessels delivered by early 2025, five by early 2026 |

| Equinox Class Vessels | Star | Fleet modernization, 40% carbon intensity improvement, dominant Great Lakes position | Final vessel, Algoma Endeavour, delivered early 2025 |

| Methanol-Ready Ocean Self-Unloaders | Star | Next-generation vessel technology, targeting largest ocean self-unloader pool | Deliveries between 2025-2027 |

| Global Short Sea Shipping (Mini-Bulkers) | Star | Market diversification, expansion into international markets | Two 8,800 DWT mini-bulkers in 2025 and 2026 |

What is included in the product

The Algoma BCG Matrix categorizes business units based on market share and growth, guiding strategic decisions.

The Algoma BCG Matrix provides a clear visual of your portfolio, relieving the pain of strategic indecision.

Cash Cows

Algoma's Great Lakes dry-bulk carrier operations represent a classic Cash Cow within its business portfolio. This segment, responsible for transporting essential commodities such as iron ore, grain, coal, and salt across the Great Lakes and St. Lawrence Seaway, benefits from a mature market with consistent, albeit potentially low-growth, demand.

The fact that this fleet is fully booked for the 2025 season underscores its strong market position and the reliability of its services. This high utilization rate translates into predictable and robust cash flow, a hallmark of a Cash Cow. For instance, in 2024, Algoma reported significant cargo volumes, reflecting sustained activity in key sectors like steel production and agriculture.

Algoma's established Great Lakes liquid bulk product tanker operations are a prime example of a Cash Cow. This segment, primarily serving domestic Canadian routes, benefits from consistent demand for petroleum product transportation, ensuring high vessel utilization. In 2024, these tankers are projected to maintain strong performance, reflecting their mature market position.

Algoma's involvement in the international Ocean Self-Unloaders segment, where it owns vessels in the world's largest pool, clearly positions this as a Cash Cow. This segment demonstrated robust earnings in 2024, driven by high fleet utilization rates.

Despite a planned dry-docking schedule for some vessels in 2025, Algoma's strong market standing and the consistent demand for key commodities like aggregates, gypsum, and salt ensure a reliable stream of cash flow from this operation.

Long-Term Charter Contracts in Cement Fleet

Algoma's cement fleet, primarily operating under long-term time charter contracts within its Global Short Sea Shipping segment, represents a significant Cash Cow. These contracts are the bedrock of its stability.

The predictable revenue generated from these long-term agreements insulates Algoma from the volatility of the spot market. This stability is a hallmark of a mature business with a strong market position.

For instance, in 2024, Algoma's Global Short Sea Shipping segment continued to benefit from the consistent performance of its cement fleet. The company reported that a substantial portion of its cement vessels were secured by multi-year charters, ensuring a reliable revenue stream. This strategy minimizes the need for aggressive marketing efforts, as client relationships are already well-established and demand is consistent.

- Stable Earnings: Long-term charter contracts provide predictable revenue, reducing financial uncertainty.

- Low Promotional Costs: Established client relationships minimize the need for extensive marketing and sales investment.

- Market Resilience: The fleet's commitment to charters shields earnings from short-term market fluctuations.

- Contribution to Overall Business: The steady income from the cement fleet supports investments in other, potentially higher-growth, business segments.

Commercial Real Estate Holdings

Algoma's commercial real estate holdings, while not their core focus, function as a Cash Cow within their business portfolio. These properties generate consistent, albeit slow-growing, revenue streams, bolstering the company's overall cash flow. Once operational, these assets demand minimal further investment, contributing to their "cash cow" status. For example, as of the first quarter of 2024, Algoma reported stable rental income from its existing commercial properties, contributing positively to its financial stability.

- Stable Revenue: Existing commercial real estate assets provide a predictable income source.

- Low Growth, High Cash Flow: While not experiencing rapid expansion, these properties are efficient cash generators.

- Reduced Investment Needs: Established properties require less ongoing capital expenditure.

- Contribution to Stability: These holdings offer a reliable component of Algoma's financial health.

Algoma's dry-bulk and liquid bulk carrier operations are prime examples of Cash Cows, leveraging mature markets with consistent demand. Their high utilization rates, as seen with full bookings for the 2025 season and strong 2024 performance, translate into predictable and robust cash flow. These segments benefit from established market positions and reliable service, ensuring a steady income stream for the company.

Full Transparency, Always

Algoma BCG Matrix

The Algoma BCG Matrix preview you see is the identical, unwatermarked document you will receive upon purchase. This comprehensive analysis tool is designed to provide immediate strategic clarity, allowing you to effectively categorize your business units for optimal resource allocation. Once bought, you'll possess the complete, professionally formatted matrix, ready for immediate integration into your business planning and decision-making processes.

Dogs

Older, less efficient vessels in competitive niches, especially where Algoma isn't a market leader, would fall into the Dogs category of the BCG Matrix. These ships often face higher operating expenses and struggle to attract consistent, profitable business, leading to a low market share and minimal cash flow contribution.

Within Algoma's Handy-Size Bulker operations, vessels or routes consistently achieving lower market rates or utilization than their peers in the stable global short sea shipping segment are classified as Dogs. These assets may be operating at break-even or incurring higher operational costs than revenue generated, signaling limited potential for future growth.

For instance, if Algoma's average daily charter rate for a specific handy-size bulker route in 2024 was $10,000, while the industry average for similar routes was $12,000, this would indicate underperformance. Such a disparity, if persistent, suggests these operations are likely consuming more cash than they bring in, fitting the Dog quadrant.

Segments with declining cargo volumes, particularly where Algoma holds a low market share, can be categorized as Dogs in the BCG Matrix. For instance, if Algoma's involvement in the trans-Pacific container trade, a market dominated by larger carriers, experiences a continued downturn in volume, and Algoma's share remains minimal, this segment would fit the Dog profile. Such a situation means these operations generate little revenue and might even consume resources without promising future growth.

Legacy Assets with High Dry-Docking Requirements

Legacy assets with high dry-docking requirements represent vessels approaching the twilight of their operational life. These ships necessitate frequent and costly maintenance, resulting in extended periods of inactivity, known as off-hire days. This directly impacts revenue generation.

For instance, Algoma's first quarter 2025 financial report highlighted an increase in dry-docking days, which negatively affected earnings in certain operational segments. Such older assets, while still part of the fleet, tend to drag down overall efficiency and drain capital without contributing significantly to market expansion or future growth prospects.

- High Maintenance Costs: Older vessels often incur higher repair and dry-docking expenses.

- Reduced Fleet Efficiency: Frequent off-hire days lower the overall utilization rate of the fleet.

- Cash Consumption: These assets tie up capital that could be reinvested in newer, more productive units.

- Limited Growth Contribution: They offer little to no potential for increasing market share or driving future revenue.

Non-Core, Underperforming Investments

Non-core, underperforming investments within Algoma's BCG Matrix represent ventures outside its primary marine transportation business that have struggled to gain traction or deliver substantial returns. These might include minor, diversified interests that divert management focus and capital without achieving significant market presence or profitability. Such assets are typically prime candidates for divestment to enable a strategic reallocation of resources towards core competencies.

For instance, if Algoma had a small, ancillary logistics technology startup that, by the end of 2024, had not demonstrated a clear path to profitability or market share growth, it would fit this category. Such an investment, consuming resources without contributing meaningfully to overall company performance, would be a prime candidate for divestment to streamline operations and enhance focus on its established marine shipping segments.

- Underperforming Ventures: Investments outside core marine transportation that have failed to generate significant returns.

- Resource Drain: These ventures consume management attention and capital without achieving market relevance.

- Divestment Candidates: Typically considered for sale to re-focus resources on primary business strengths.

- Strategic Refocusing: Divesting these assets allows for a more concentrated effort on profitable core operations.

Dogs in Algoma's BCG Matrix represent business units or assets with low market share and low growth prospects. These are typically older, less efficient vessels or non-core investments that consume resources without generating significant returns. For example, a specific Handy-Size Bulker route in 2024 that consistently underperformed industry averages, earning $10,000 daily against a $12,000 industry average, exemplifies a Dog. These segments require careful management, often leading to divestment to reallocate capital to more promising areas.

| Asset Type | Market Share | Growth Rate | Profitability | BCG Category |

|---|---|---|---|---|

| Older Bulkers (Specific Routes) | Low | Low/Declining | Low/Negative | Dog |

| Ancillary Logistics Tech (2024) | Low | Low | Low/Negative | Dog |

| Legacy Vessels (High Maintenance) | Low | Low | Low/Negative | Dog |

Question Marks

The deployment of new methanol-ready tankers, like the Fure Vesborg, into nascent international markets positions them as Question Marks within Algoma's BCG matrix. While the technology and vessel type suggest future Star potential due to the growing demand for greener shipping solutions, their current market share in these new segments is still being established.

Significant investment is crucial to solidify their position. This includes securing consistent cargo contracts, fostering strong client relationships, and building a robust market presence. For instance, the global methanol fuel market is projected to reach USD 32.1 billion by 2030, indicating substantial growth potential that Algoma aims to capitalize on with these vessels.

Algoma's exploration of new international short-sea shipping routes and emerging niche markets would be classified as Question Marks in the BCG Matrix. These ventures, while offering high growth potential, currently represent a small market share for Algoma. For instance, if Algoma were to investigate a new route connecting the Baltic Sea to North African ports, this would fit the Question Mark category due to its unproven nature and the substantial investment needed for market development and establishing partnerships.

Investments in advanced decarbonization technologies like alternative fuels (e.g., methanol, ammonia) and autonomous shipping represent potential high-growth areas for Algoma. However, these innovations currently exhibit low market adoption and substantial development costs, placing them in the Question Marks category of the BCG Matrix.

For instance, the International Maritime Organization (IMO) has set ambitious greenhouse gas reduction targets, with a goal of net-zero emissions by or around 2050. This regulatory push, coupled with increasing investor and customer demand for sustainable solutions, drives the need for Algoma to explore these nascent technologies.

While Algoma's dedication to sustainability and innovation is evident, the significant upfront investment and uncertain return on investment for these cutting-edge solutions mean they are still in their early, speculative stages of development and adoption within the marine transportation sector.

Expansion into New Steel Industry Business for Domestic Dry-Bulk

The expansion into a significant new domestic steel industry business for Domestic Dry-Bulk in 2025 positions this initiative as a Question Mark within the BCG framework. While the broader Domestic Dry-Bulk segment might be a Cash Cow, this specific new venture requires careful consideration due to its nascent stage and potential for growth alongside inherent uncertainties.

Securing and nurturing these new client relationships within the domestic steel sector is critical. This expansion necessitates initial investment and carries an uncertain immediate market share until these operations are fully established and proven. For instance, if these new steel clients require specialized handling or dedicated vessel capacity, the upfront costs could be substantial, impacting short-term profitability.

- Uncertain Market Share: The success of the new domestic steel business is contingent on market acceptance and competitive positioning, making its immediate market share unpredictable.

- Investment Requirements: Significant upfront investment may be needed for new equipment, operational adjustments, or dedicated logistics to serve the steel industry effectively.

- Operational Complexity: Integrating new steel industry clients might introduce logistical complexities or require specialized handling procedures, impacting operational efficiency initially.

- Potential for Growth: Despite the uncertainties, this expansion offers substantial long-term growth potential if market needs are met and strong client relationships are built.

Unproven Real Estate Development Opportunities

Unproven real estate development opportunities for Algoma would represent potential Question Marks on the BCG matrix. These are ventures into new or speculative property types where Algoma currently has no established market presence.

These opportunities exist within the broader real estate market, which is generally growing. However, for Algoma, these specific development types would be new territory, meaning an unproven market share. Significant capital would be needed for these projects, and the risk of not achieving expected returns would be considerably higher than in its established business areas.

- High Capital Requirement: New developments, especially in emerging sectors, demand substantial upfront investment. For instance, a large-scale mixed-use development in a burgeoning urban area could easily require hundreds of millions in capital.

- Uncertain Market Adoption: The success of speculative property types, such as advanced sustainable housing or niche commercial spaces, hinges on future market demand and acceptance, which is inherently difficult to predict.

- Algoma's Untested Market Share: Entering a new development niche means starting from zero market share. Unlike its existing portfolio, Algoma would not benefit from brand recognition or established customer relationships in these new areas.

- Increased Risk Profile: Without a proven track record in these specific development types, the probability of project delays, cost overruns, and ultimately, lower-than-anticipated returns is elevated.

Question Marks in Algoma's BCG matrix represent business ventures with high growth potential but currently low market share. These are typically new products, services, or market entries that require significant investment to develop and establish a competitive position.

The success of these ventures is uncertain, and they consume considerable resources without guaranteed returns. Algoma's strategic focus is to carefully evaluate these Question Marks, investing in those with the most promising future to transform them into Stars.

For example, Algoma's investment in new methanol-ready tankers for nascent international markets and its exploration of new domestic steel industry business are prime examples of Question Marks. These initiatives are in their early stages, demanding substantial capital and facing unproven market acceptance.

The company must nurture these areas, aiming to increase market share and eventually achieve profitability, aligning with the broader trend of sustainable and specialized shipping solutions. The global market for alternative marine fuels, like methanol, is expected to see substantial growth, with projections indicating a market value of USD 32.1 billion by 2030, underscoring the potential of such ventures.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, and industry growth rates, to accurately position each business unit.