Algoma Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Algoma Bundle

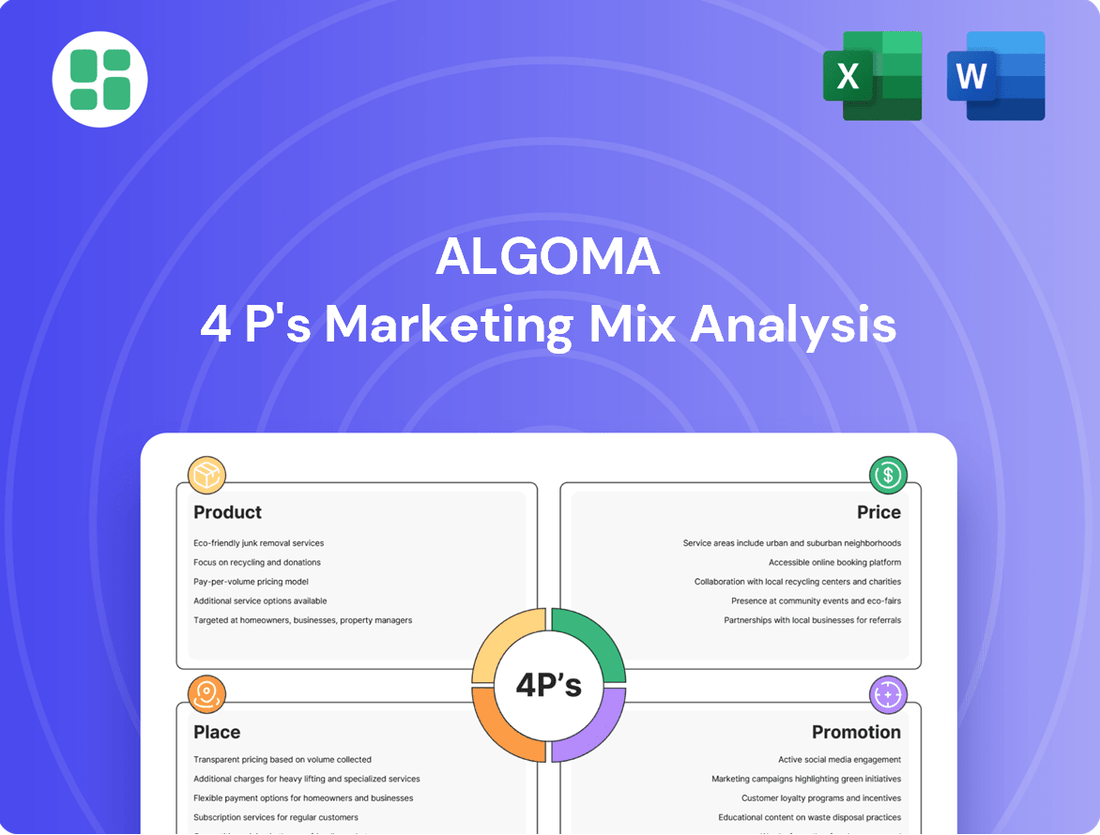

Discover how Algoma masterfully blends its product offerings, pricing strategies, distribution channels, and promotional activities to capture market share. This analysis goes beyond the surface, revealing the intricate connections that drive their success.

Unlock the full potential of your marketing knowledge. Get instant access to a comprehensive, editable 4Ps Marketing Mix Analysis for Algoma, designed to save you valuable research time and provide actionable strategic insights.

Product

Algoma Central Corporation's diverse marine transportation services are central to its marketing mix, focusing on the efficient waterborne movement of dry and liquid bulk commodities like iron ore, grain, and petroleum products. This specialization ensures reliable delivery for industrial clients, a key aspect of their product strategy.

In 2024, Algoma continued its fleet modernization, a crucial element for maintaining competitive product offerings and ensuring operational efficiency. This investment underscores their commitment to providing dependable cargo delivery services, a cornerstone of their value proposition to a wide range of industrial customers.

Algoma's product portfolio features a modern fleet of specialized dry and liquid bulk carriers. This includes self-unloading and gearless dry bulk vessels, alongside product tankers, all meticulously designed for the unique demands of the Great Lakes–St. Lawrence Seaway system. These specialized vessel types are crucial for meeting distinct cargo requirements and operational conditions, ensuring efficiency and reliability.

This focus on specialized vessel types allows Algoma to effectively cater to niche market needs, a strategy that underpins its competitive advantage in the bulk shipping sector. For instance, in 2024, Algoma Central Corporation reported a significant portion of its revenue derived from its Great Lakes trading segment, highlighting the importance of its specialized fleet in this key geographical area.

Algoma's commitment to fleet modernization is evident in its ongoing newbuild program, which includes the introduction of advanced Equinox Class vessels and product tankers. These new vessels are designed for enhanced fuel efficiency and many are equipped with methanol-ready or dual-fuel capabilities, aligning with sustainability goals and future fuel trends. This strategic investment is crucial for maintaining a competitive edge and meeting the growing demand for environmentally responsible shipping solutions.

The company has seen substantial fleet upgrades with multiple new vessels delivered in 2024 and scheduled for 2025, alongside further newbuild orders. This continuous infusion of modern tonnage not only replaces aging assets but also bolsters Algoma's overall capacity and operational efficiency. The focus on these advanced vessels directly addresses evolving customer expectations for greener and more reliable transportation services.

Strategic Joint Ventures

Algoma's product offering extends beyond its owned assets through strategic joint ventures. These partnerships, like FureBear for product tankers in Northern Europe and NovaAlgoma Cement Carriers and NovaAlgoma Bulk Holdings for global short-sea shipping, are crucial for market penetration.

These collaborations enable Algoma to diversify its service portfolio, accessing new geographic regions and cargo types. For instance, NovaAlgoma Bulk Holdings, established in 2011, has grown to operate a significant fleet, enhancing Algoma's global reach in the dry-bulk sector.

- FureBear: Operates product tankers in Northern Europe, expanding Algoma's specialized tanker services.

- NovaAlgoma Cement Carriers: Focuses on the cement shipping market, a key niche segment.

- NovaAlgoma Bulk Holdings: Targets global short-sea shipping, broadening the company's operational scope in bulk commodities.

Commitment to Sustainability and Innovation

Algoma's product strategy, particularly for its fleet, is deeply rooted in sustainability and innovation. This commitment is evident in their pursuit of fuel-efficient vessel designs and the integration of cutting-edge technologies aimed at substantially reducing carbon emissions. For instance, by 2024, Algoma Central Corporation reported a continued focus on fleet modernization, with investments in vessels designed for lower emissions and improved fuel economy, aligning with industry trends towards greener shipping solutions.

This dedication to environmental responsibility not only supports global sustainability objectives but also bolsters the long-term value and appeal of Algoma's services. Clients increasingly prioritize partners who demonstrate a strong environmental, social, and governance (ESG) profile. Algoma's proactive approach in this area positions them favorably in a market where sustainability is becoming a key differentiator.

The company actively promotes its brand as 'Your Marine Carrier of Choice™,' a tagline that encapsulates their emphasis on providing transportation services that are not only reliable and efficient but also environmentally sound. This strategic positioning resonates with a growing segment of the market that values sustainable practices in their supply chain.

Key aspects of Algoma's product commitment include:

- Fleet Modernization: Investing in new builds and retrofits to incorporate fuel-saving technologies and reduce environmental impact.

- Emission Reduction Targets: Setting and working towards ambitious goals for lowering greenhouse gas emissions per tonne-mile.

- Technological Integration: Exploring and implementing innovative solutions such as advanced hull coatings and propulsion systems for enhanced efficiency.

- Client Value Proposition: Offering sustainable shipping options that meet the evolving ESG requirements of their customer base.

Algoma's product strategy revolves around a modern, specialized fleet designed for efficiency and sustainability. This includes Equinox Class vessels and product tankers, with many built to be methanol-ready or dual-fuel, reflecting a commitment to greener shipping. The company's fleet modernization efforts continued through 2024 with new vessel deliveries and ongoing orders, enhancing capacity and operational performance.

Algoma's product offering is further diversified through strategic joint ventures like FureBear, NovaAlgoma Cement Carriers, and NovaAlgoma Bulk Holdings, expanding its reach into specialized markets and global short-sea shipping. This approach allows them to cater to niche demands and broaden their service portfolio.

The company's brand promise, 'Your Marine Carrier of Choice™,' underscores its focus on reliable, efficient, and environmentally responsible transportation. This aligns with increasing client demand for sustainable supply chain partners, positioning Algoma favorably in the market.

Algoma's product commitment is demonstrated through fleet modernization, emission reduction targets, technological integration, and a clear client value proposition centered on sustainability.

| Fleet Segment | Vessel Type | Key Features | 2024 Focus |

|---|---|---|---|

| Domestic Dry Bulk | Self-unloading dry bulk carriers | Efficient cargo handling for commodities like grain and aggregates | Continued operation of Equinox Class vessels |

| International Dry Bulk | Gearless dry bulk carriers | Global reach for bulk commodities | Expansion via NovaAlgoma Bulk Holdings joint venture |

| Product Tankers | Product tankers | Specialized for liquid bulk, including chemicals and petroleum products | Growth through FureBear joint venture, methanol-ready newbuilds |

What is included in the product

This analysis offers a comprehensive examination of Algoma's marketing strategies, dissecting its Product, Price, Place, and Promotion tactics with real-world examples and strategic insights.

Simplifies complex marketing strategies by clearly outlining Product, Price, Place, and Promotion, alleviating the pain of strategic confusion.

Place

Algoma Central Corporation's primary 'place' of operation is the extensive Great Lakes and St. Lawrence Seaway system, where it commands the largest Canadian-flagged fleet for dry and liquid bulk cargo. This strategic positioning enables Algoma to efficiently serve key industrial customers along this crucial bi-national waterway. For instance, in the first quarter of 2024, the company adjusted its operations, with a significant portion of its domestic dry-bulk fleet idled due to seasonal canal closures and winter weather, a common occurrence impacting the region's shipping schedules.

Algoma's 'Place' extends beyond domestic waters with strategic international short-sea shipping routes and key joint ventures. This global footprint includes product tankers actively serving markets in Northern Europe, demonstrating a commitment to diversified geographic operations.

The company also deploys vessels along the Canadian and U.S. East Coasts, alongside handy-size and mini-bulk carriers operating worldwide. This broad operational scope, encompassing diverse regions and vessel types, significantly enhances Algoma's market reach and reduces dependency on any single area, a crucial element in mitigating risk and capturing broader growth opportunities.

Algoma's distribution strategy is primarily direct, focusing on B2B relationships with industrial clients. This approach prioritizes efficient and reliable cargo delivery, ensuring products reach customers precisely when and where they are needed. The company’s direct vessel movements underscore a commitment to tailored logistics solutions, enhancing convenience for its industrial partners.

Optimized Fleet Deployment and Scheduling

Algoma's 'place' strategy hinges on optimizing its fleet's deployment and scheduling to ensure maximum operational efficiency. This involves careful planning to align vessel availability with market demand across its various shipping routes.

Key to this optimization is managing dry-docking schedules, which are crucial for vessel maintenance but temporarily reduce the number of available vessel days. For instance, in 2024, Algoma Central Corporation reported managing its fleet through planned maintenance, impacting vessel utilization during those periods. Strategically introducing new vessels, such as the Equinox class, is also vital to meet projected market needs and enhance service capabilities.

- Fleet Utilization: Maximizing the operational days of each vessel to serve customer needs efficiently.

- Route Optimization: Deploying vessels to the most profitable and in-demand shipping lanes.

- Maintenance Planning: Strategically scheduling dry-docking to minimize disruption to service while ensuring vessel longevity.

- New Vessel Integration: Phasing in new, more efficient vessels to meet evolving market demands and environmental standards.

Strategic Port Access and Infrastructure

Algoma's extensive network relies on strategic port access, even without outright ownership of all facilities. This allows them to efficiently connect diverse supply chains, a critical factor for bulk commodity movement.

The company's vessel fleet, including 2024 additions like the Algoma Conveyor, is designed to serve a broad spectrum of ports, from major hubs to smaller, specialized terminals. This adaptability ensures they can reach clients wherever their cargo needs to go.

- Efficient Operations: Algoma's ability to access and utilize a wide range of ports is fundamental to the smooth, cost-effective loading and unloading of bulk goods.

- Supply Chain Integration: Strategic port access ensures Algoma's role as a vital link in their customers' supply chains, facilitating the timely movement of raw materials and finished products.

- Fleet Versatility: The company's diverse fleet is equipped to handle various port infrastructures, maximizing operational flexibility and market reach.

Algoma's 'place' strategy centers on its dominant presence within the Great Lakes and St. Lawrence Seaway system, leveraging this vital waterway for its extensive Canadian-flagged fleet. This strategic positioning allows for efficient service to industrial heartlands. In early 2024, seasonal closures and winter weather led to a temporary idling of a portion of their domestic dry-bulk fleet, a typical operational adjustment for the region.

The company also extends its 'place' to international short-sea shipping and operates product tankers in Northern Europe, showcasing a diversified global footprint. This broad reach, encompassing Canadian and U.S. East Coasts and worldwide handy-size and mini-bulk operations, mitigates single-market risks and captures wider growth opportunities.

Algoma's distribution is direct, emphasizing B2B relationships for reliable cargo delivery, ensuring clients receive goods precisely when and where needed. This direct vessel deployment highlights tailored logistics. Fleet utilization and route optimization are paramount, with careful scheduling of dry-docking, like that managed in 2024, to minimize service disruption while integrating new Equinox class vessels to meet market demands.

Algoma's strategic port access, even without outright ownership, is crucial for connecting diverse supply chains and facilitating bulk commodity movement. Their fleet, including the 2024 addition Algoma Conveyor, is designed for versatility across various port infrastructures, enhancing operational flexibility and market reach.

| Operational Area | Fleet Type | Key Activity | 2024/2025 Relevance |

|---|---|---|---|

| Great Lakes/St. Lawrence Seaway | Domestic Dry-Bulk | Primary cargo transport for industrial clients | Seasonal idling due to weather; fleet optimization crucial. |

| Northern Europe | Product Tankers | Serving international markets | Key component of diversified geographic operations. |

| Canadian/U.S. East Coasts | Various | Extending market reach | Supports broad operational scope. |

| Worldwide | Handy-size & Mini-bulk Carriers | Global cargo movement | Enhances market reach and reduces single-area dependency. |

What You Preview Is What You Download

Algoma 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Algoma 4P's Marketing Mix Analysis is fully complete and ready for your immediate use, offering valuable insights into their strategy.

Promotion

Algoma Central Corporation's 'Your Marine Carrier of Choice™' branding is a cornerstone of its marketing strategy, aiming to solidify its position as a preferred partner across all stakeholder groups. This vision statement underscores their commitment to reliability and service excellence in the marine transportation sector.

This branding initiative is not just a slogan; it's integrated into their corporate communications, highlighting their dedication to being a leader in the industry. For instance, in 2023, Algoma reported a significant increase in their fleet utilization, reflecting strong customer demand and operational efficiency, thereby reinforcing their 'carrier of choice' message.

Algoma's promotional message strongly emphasizes its 125-year legacy of dependable and efficient marine shipping. This long history builds trust with clients who value consistent delivery.

The company backs this reliability with ongoing fleet upgrades. For instance, Algoma has invested significantly in new, fuel-efficient vessels, such as the Equinox class, which enhance operational efficiency and reduce costs.

This commitment to modernizing its fleet, incorporating advanced technology, directly supports Algoma's claim of being able to move cargo consistently and affordably. This operational excellence is a critical factor for its industrial customer base.

Algoma actively highlights its dedication to sustainability and environmental leadership, emphasizing ambitious Greenhouse Gas (GHG) emission reduction targets. This commitment is demonstrated through the introduction of new, eco-friendly vessels and ongoing initiatives aimed at lowering the company's carbon intensity.

By showcasing these efforts, Algoma positions itself as a responsible and forward-thinking partner, resonating with clients who increasingly prioritize sustainable supply chain practices. For instance, in 2024, Algoma continued to integrate its new Equinox-class vessels into its fleet, designed to reduce fuel consumption and emissions by approximately 25% compared to older designs.

Investor Relations and Corporate Communications

Algoma’s investor relations and corporate communications are designed to keep financially-literate decision-makers well-informed. This involves consistent delivery of financial results, such as their quarterly earnings reports and annual filings, ensuring transparency regarding performance and strategic initiatives. For instance, Algoma’s Q1 2024 results highlighted a significant increase in revenue, demonstrating their commitment to clear communication.

The company actively engages with the financial community through various channels. This includes participating in industry conferences and holding investor calls, which allows for direct dialogue about their operational progress and future outlook. These interactions are vital for building investor confidence and providing analysts with the data needed for their assessments.

Key elements of Algoma's communication strategy include:

- Regular Financial Reporting: Timely release of annual and quarterly financial statements.

- News Releases: Dissemination of material information impacting the company.

- Investor Engagement: Active participation in calls, webcasts, and conferences.

- Transparency: Clear communication of strategic direction and performance metrics.

Strategic Partnerships and Industry Presence

Algoma Central Corporation actively promotes itself through strategic alliances, notably its joint venture with Furetank for Arctic shipping, showcasing its commitment to specialized markets and global collaboration. This partnership, alongside its collaboration with DP World for terminal operations, highlights Algoma's expansive network and operational capabilities, serving as a powerful promotional signal to potential clients and investors.

Algoma's engagement in key industry forums and its cultivation of a robust professional network are crucial for enhancing its market presence. For instance, participation in events like the International Chamber of Shipping (ICS) meetings or the Canadian Marine Advisory Council (CMAC) discussions in 2024 allows Algoma to directly influence industry standards and build valuable connections. These activities not only bolster its reputation but also directly contribute to securing new business and strengthening existing partnerships, reinforcing its position as a key player in the marine transportation sector.

- Joint Ventures: Algoma's partnership with Furetank for Arctic trade signifies a strategic move into niche, high-potential markets.

- Industry Engagement: Active participation in events like the 2024 Posidonia International Shipping Exhibition in Greece provides significant visibility and networking opportunities.

- Network Building: Maintaining strong relationships with port authorities and other logistics providers, such as DP World, is vital for operational efficiency and business development.

- Reputation Enhancement: Demonstrating a collaborative approach and a commitment to industry best practices through these initiatives builds trust and attracts new commercial opportunities.

Algoma Central Corporation's promotion strategy heavily leverages its established brand, "Your Marine Carrier of Choice™," emphasizing reliability and a 125-year legacy. This is reinforced by tangible investments in fleet modernization, such as the Equinox class vessels, which offer improved fuel efficiency and reduced emissions, a key selling point for environmentally conscious clients. Their commitment to sustainability, with ambitious GHG reduction targets, is actively communicated to position them as a responsible industry leader.

Algoma also focuses on transparent communication with the financial community, delivering regular updates on performance and strategic initiatives, as seen in their Q1 2024 revenue increase. Strategic alliances, like the joint venture with Furetank for Arctic shipping, and active participation in industry forums in 2024, further bolster their market presence and reputation.

| Promotional Focus | Key Messaging | Supporting Evidence/Data |

| Brand & Legacy | Your Marine Carrier of Choice™; 125 years of reliability | Strong customer demand reflected in fleet utilization increases (2023) |

| Fleet Modernization & Efficiency | Dependable, efficient, and affordable shipping | Investment in Equinox class vessels (approx. 25% fuel efficiency gain) |

| Sustainability | Environmental leadership, GHG reduction targets | Continued integration of eco-friendly vessels (2024) |

| Financial Transparency | Clear communication of performance and strategy | Q1 2024 revenue increase; regular financial reporting |

| Strategic Partnerships | Specialized markets, global collaboration | Furetank JV for Arctic shipping; DP World collaboration |

| Industry Engagement | Influencing standards, building networks | Participation in CMAC discussions (2024); Posidonia Exhibition (2024) |

Price

Algoma Central Corporation's pricing strategy for bulk transport heavily relies on contracts, offering a predictable revenue stream. For instance, in their cement fleet, a significant portion of vessels operate under long-term time charter contracts, ensuring consistent utilization and pricing tailored to specific cargo needs and routes.

This contract-based model provides crucial stability for both Algoma and its industrial clients. These agreements are meticulously crafted, taking into account factors such as the type of cargo, the projected volume, and the designated transportation route, thereby minimizing market volatility for all parties involved.

Algoma's pricing strategy is deeply rooted in the value its customers perceive from its dependable, efficient, and environmentally conscious marine shipping. This approach allows them to position their services not just on cost, but on the overall benefits delivered to clients.

Recent investments, such as the delivery of new, fuel-efficient vessels like the Algoma Conveyor and Algoma Discovery in 2024, directly support this value-based pricing. These modern ships offer clients reduced transit times and lower operating costs due to improved fuel efficiency, potentially justifying premium pricing.

The efficiency premium is further bolstered by enhanced cargo capacity on these new builds, meaning clients can move more goods per voyage. This combination of speed, cost savings, and capacity allows Algoma to maintain competitive rates while ensuring healthy profit margins, a key aspect of their 2024 financial strategy.

Algoma's pricing strategy is deeply intertwined with fluctuating market dynamics and operational costs. For instance, the company's freight rates are adjusted to mirror the demand for commodities and the volatile costs of fuel, a significant factor in shipping operations. In 2024, fuel prices saw considerable volatility, impacting per-voyage expenses and necessitating agile rate adjustments to ensure profitability.

Operational expenses, such as the significant costs associated with dry-docking and routine maintenance, also play a crucial role in Algoma's pricing decisions. These essential expenditures, often incurred on a cyclical basis, are factored into the overall cost structure, influencing the freight rates offered to clients. The necessity of maintaining a fleet in peak condition means these costs are non-negotiable and directly impact pricing.

While segments like domestic dry-bulk shipping can experience notable volume fluctuations throughout the year, Algoma's approach involves dynamically adjusting freight rates. This ensures that revenue streams remain stable and competitive, even when market demand shifts. For example, during periods of lower demand in 2024, Algoma recalibrated rates to maintain cargo flow and revenue targets.

Furthermore, Algoma actively monitors global economic uncertainties and trade policies, including tariffs, which can significantly influence supply chain costs and overall trade volumes. These external factors are critical in shaping Algoma's pricing, as they can impact the cost of doing business and the volume of cargo available for transport in 2024 and beyond.

Competitive Landscape Considerations

Algoma operates in a highly competitive marine shipping sector, necessitating careful consideration of competitor pricing to maintain market appeal. The company strives to align its value proposition with market demands, ensuring its rates are competitive while also funding its financial objectives and fleet modernization efforts. This dynamic requires ongoing monitoring of market conditions and rivals' pricing structures.

For instance, in the dry-bulk shipping market, freight rates can fluctuate significantly based on global demand, vessel availability, and geopolitical events. As of early 2024, the Baltic Dry Index, a key benchmark, has shown volatility, with different segments experiencing varying rate changes. Algoma's pricing must adapt to these shifts to secure contracts and maintain profitability.

- Market Share Dynamics: Understanding how competitors like Canada Steamship Lines or Algoma's international counterparts are pricing their services is crucial for Algoma to retain or grow its market share in key shipping lanes.

- Cost-Plus vs. Value-Based Pricing: Algoma likely employs a blend of cost-plus pricing, ensuring operational costs are covered, and value-based pricing, reflecting the unique services and reliability it offers to customers.

- Fleet Capacity and Utilization: Competitor fleet sizes and their utilization rates directly impact supply and demand, influencing the pricing power Algoma can exert. High utilization among competitors can lead to increased rates for Algoma.

- Contractual Agreements: Many shipping services are secured through long-term contracts. Algoma's pricing within these agreements must account for projected market conditions over the contract's duration, factoring in competitor bids during the tender process.

Shareholder Value and Capital Allocation

Algoma's commitment to shareholder value, demonstrated through dividends and share repurchases, acts as an indirect indicator of its financial strength and market positioning. The company's capacity to generate robust revenues from its shipping services underpins its ability to reward investors, underscoring confidence in its operational efficiency and pricing strategies.

For instance, Algoma Central Corporation reported strong financial results for the fiscal year ending December 31, 2023. The company generated total revenue of $823.7 million, a notable increase from the previous year, reflecting healthy demand for its services. This financial performance directly supports its capital allocation decisions.

- Dividend Payouts: Algoma has consistently paid dividends, with the quarterly dividend rate maintained at $0.16 per common share as of early 2024, providing a steady income stream for shareholders.

- Share Buyback Programs: The company has also engaged in share repurchase programs, which can enhance shareholder value by reducing the number of outstanding shares and increasing earnings per share.

- Financial Health Signal: These actions collectively signal Algoma's confidence in its ongoing profitability and its ability to manage its capital effectively, directly linking financial performance to shareholder returns.

Algoma's pricing strategy is primarily contract-driven, reflecting the value of reliable bulk transport. New, fuel-efficient vessels like the Algoma Conveyor, delivered in 2024, enable premium pricing due to reduced client transit times and operating costs.

Freight rates are dynamically adjusted to account for market demand, fuel costs, and operational expenses such as maintenance. For example, in early 2024, Algoma recalibrated rates to maintain cargo flow amidst market demand shifts.

Competitive pricing is essential, with Algoma balancing market rates against its value proposition and financial objectives. Competitor pricing, fleet capacity, and contractual agreements all influence Algoma's rate setting.

Algoma's financial health, evidenced by its $823.7 million revenue in fiscal year 2023 and a consistent $0.16 quarterly dividend per common share in early 2024, supports its pricing strategies and ability to reward shareholders.

| Metric | Value (as of early 2024/FY 2023) | Impact on Pricing |

|---|---|---|

| FY 2023 Revenue | $823.7 million | Indicates strong demand and ability to command rates. |

| Quarterly Dividend | $0.16 per common share | Reflects financial stability and confidence in revenue generation. |

| New Vessel Deliveries | Algoma Conveyor, Algoma Discovery (2024) | Supports value-based pricing through efficiency gains. |

| Fuel Cost Volatility | Significant fluctuations in 2024 | Necessitates agile rate adjustments. |

4P's Marketing Mix Analysis Data Sources

Our Algoma 4P's Marketing Mix Analysis is constructed using a blend of official company disclosures, including annual reports and investor presentations, alongside insights from industry-specific databases and competitive landscape reports. This ensures a comprehensive view of Algoma's product strategies, pricing structures, distribution channels, and promotional activities.