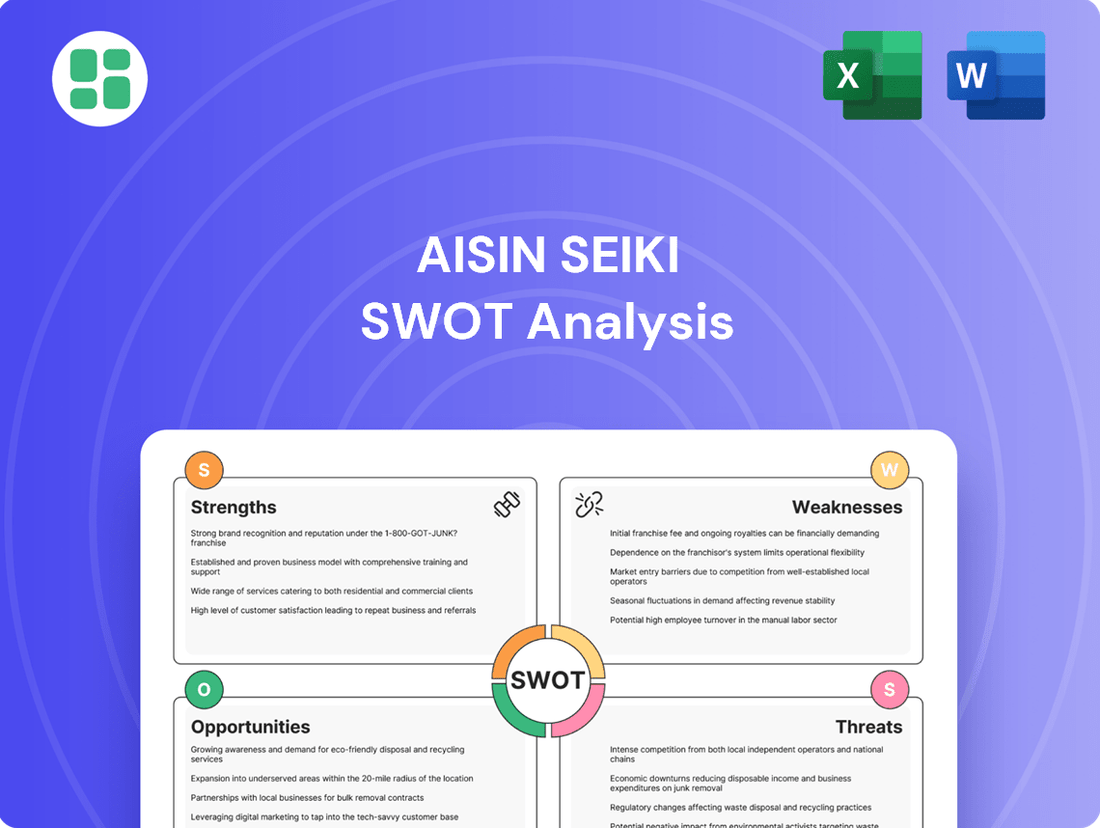

Aisin Seiki SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

Aisin Seiki's robust market position is underpinned by its strong brand reputation and technological innovation, but it faces challenges from increasing competition and evolving industry demands. Understanding these dynamics is crucial for any stakeholder looking to navigate the automotive supply chain.

Want to dive deeper into Aisin Seiki's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Aisin Corporation's extensive product portfolio is a significant strength, encompassing a wide spectrum of automotive components such as drivetrain, brake, chassis, body, and engine-related parts. This breadth allows them to serve diverse vehicle types, from passenger cars to commercial vehicles, ensuring broad market penetration.

This comprehensive product offering inherently reduces the company's dependence on any single automotive segment, providing a crucial layer of stability. For instance, in the fiscal year ending March 2024, Aisin's Automotive segment revenue was ¥3,196.5 billion, demonstrating its core strength while its diversification efforts are also notable.

Furthermore, Aisin's strategic expansion beyond the automotive sector into areas like energy systems, housing, and lifestyle products significantly diversifies its revenue streams. This diversification acts as a powerful buffer against the inherent cyclicality and potential downturns within the automotive industry, bolstering overall financial resilience.

Aisin boasts a robust global footprint with operations spanning 17 countries and 36 aftermarket locations, enabling localized product development and agile responses to regional market demands. This extensive network is crucial for serving diverse customer bases and maintaining a competitive edge.

Recent strategic investments, like the expansion of its Stratford, Ontario plant and a new EV parts joint venture in Windsor, Canada, underscore Aisin's dedication to enhancing its worldwide manufacturing capacity and supply chain resilience. These moves are vital for adapting to evolving automotive technologies and market trends.

Aisin is demonstrating a strong commitment to the future of automotive by heavily investing in electrification and advanced technologies. This strategic focus is crucial as the industry shifts towards electric vehicles (EVs) and increasingly intelligent systems.

The company's proactive approach is underscored by its planned investment of ¥500 billion (approximately US$3.4 billion) over the next three years. These funds are earmarked for expanding its portfolio of battery electric vehicle (BEV) products, eAxles, battery frames, and sophisticated braking systems, positioning Aisin at the forefront of this transformation.

Evidence of this forward-thinking strategy is seen in Aisin's collaboration with Subaru to develop eAxles, a key component for EVs. Furthermore, the company is actively developing integrated electric drive units, such as the Xin1, showcasing its dedication to creating innovative solutions for the evolving automotive market.

Robust R&D and Innovation Focus

Aisin Seiki demonstrates a significant commitment to research and development, consistently investing in innovation across key automotive sectors. This dedication is reflected in their robust patenting activities, with a particular emphasis on advanced technologies such as door control systems, object detection, driving assistance, and automated parking solutions. For example, Aisin's patent filings in the first half of 2024 showed a notable increase in areas related to electrification and autonomous driving.

The company's R&D efforts extend to critical areas for future mobility, including enhancing energy efficiency in electric vehicles and developing sophisticated thermal management systems. Furthermore, Aisin is actively exploring emerging technologies, such as perovskite solar cells, as part of its broader strategy to achieve carbon neutrality. This forward-looking approach ensures Aisin maintains a competitive edge and remains a leader in automotive technological advancements.

- Patent Focus: Door control devices, object detection, driving assistance, automatic parking systems.

- EV Efficiency: Efforts to improve energy efficiency in electric vehicles.

- Thermal Management: Development of advanced thermal management systems.

- Emerging Tech: Exploration of perovskite solar cells for carbon neutrality initiatives.

Resilient Financial Performance and Strategic Financial Management

Aisin's financial performance remains remarkably robust, even amidst broader market uncertainties. For the fiscal year concluding March 31, 2025, the company achieved an impressive 18.5% year-over-year surge in net profit, totaling approximately $752.1 million. This resilience highlights effective operational management and strategic foresight.

Furthermore, Aisin is actively implementing strategic financial initiatives designed to bolster shareholder value. These include a recent stock split, coupled with planned share repurchases and subsequent cancellations. Such measures underscore a commitment to enhancing investor returns and demonstrating financial discipline.

- Resilient Profitability: Net profit increased by 18.5% year-over-year to $752.1 million for FY2025.

- Shareholder Value Enhancement: Strategic actions include a stock split and planned share repurchases.

- Proactive Financial Management: Demonstrates a forward-thinking approach to financial health and investor relations.

Aisin's extensive product portfolio is a significant strength, covering a wide range of automotive components like drivetrain, brake, chassis, body, and engine parts. This broad offering allows them to cater to various vehicle types, from passenger cars to commercial vehicles, ensuring widespread market reach.

This comprehensive product range naturally reduces reliance on any single automotive segment, providing crucial stability. For example, in the fiscal year ending March 2024, Aisin's Automotive segment revenue reached ¥3,196.5 billion, showcasing its core strength while also highlighting diversification efforts.

Aisin's financial performance remains robust, with net profit for the fiscal year ending March 31, 2025, surging by 18.5% year-over-year to approximately $752.1 million. This resilience points to effective operational management and strategic foresight.

The company is also actively enhancing shareholder value through strategic financial moves like a recent stock split and planned share repurchases and cancellations, demonstrating a commitment to investor returns and financial discipline.

| Financial Metric | Value (FY ending March 2025) | Year-over-Year Change |

| Net Profit | ~$752.1 million | +18.5% |

| Automotive Segment Revenue | ¥3,196.5 billion (FY ending March 2024) | N/A |

What is included in the product

Delivers a strategic overview of Aisin Seiki’s internal and external business factors, highlighting its strong market position and technological capabilities while also identifying potential challenges in evolving automotive trends.

Aisin Seiki's SWOT analysis helps pinpoint areas for improvement, like mitigating supply chain risks and capitalizing on EV opportunities.

Weaknesses

Aisin Seiki's heavy reliance on the automotive sector, despite its diversification efforts, leaves it vulnerable to market downturns. A significant portion of its revenue, often exceeding 70%, stems from automotive components, making it directly susceptible to shifts in global vehicle production and consumer purchasing habits.

For example, in the fiscal year ending March 2024, Aisin reported a notable impact from the slowdown in automotive production, particularly in key markets like China and Europe. Reduced vehicle output in China and a decrease in powertrain unit sales across Europe directly translated into revenue declines for Aisin in those specific regions, highlighting the company's sensitivity to industry-wide fluctuations.

Aisin Seiki's global operations are vulnerable to escalating geopolitical tensions and trade disputes, notably the U.S. tariffs on imported vehicles and auto parts that took effect in April 2025. These tariffs, potentially reaching 25% on light vehicles and related components, directly threaten Aisin's profitability and sales volumes within the crucial North American market.

The imposition of these trade barriers compels Aisin to consider significant and potentially expensive strategic realignments, such as relocating production facilities to countries not subject to these tariffs, in order to safeguard its market position and mitigate financial impact.

Aisin operates in an automotive supplier market characterized by intense global competition. Major players such as Cummins, Magna, and Valeo are constant rivals, pushing Aisin to maintain its edge. The growing influence of Chinese suppliers, whose market share increased from 21% in 2024 to an estimated 30% by early 2025, further intensifies this pressure, impacting Aisin's profitability and market standing.

Supply Chain Disruptions and Bottlenecks

Aisin has faced significant supply chain disruptions and bottlenecks, impacting its capacity to fulfill customer orders. These challenges can result in production slowdowns and higher operating expenses, ultimately affecting both profitability and customer loyalty. The inherent vulnerability of global automotive supply networks remains a persistent hurdle for the company.

For instance, the semiconductor shortage, which heavily impacted the automotive industry throughout 2021 and 2022, directly affected Aisin's component production. While the situation has seen some improvement, the lingering effects and the potential for future disruptions continue to pose a risk. Data from S&P Global Mobility indicated that the chip shortage alone caused an estimated 11.3 million fewer vehicles to be produced globally in 2021, a figure that reverberated through the entire supply chain, including component manufacturers like Aisin.

- Production Delays: Disruptions lead to extended lead times for Aisin's products.

- Increased Costs: Bottlenecks can drive up logistics and raw material expenses.

- Customer Dissatisfaction: Inability to meet demand can erode customer trust.

- Global Supply Chain Fragility: Geopolitical events and unforeseen circumstances continue to threaten stable supply.

Significant Investments Required for EV Transition

Aisin Seiki's pivot to electric vehicles (EVs) necessitates significant financial outlays. The company is channeling billions into research and development for battery electric vehicles (BEVs) and intelligent systems, a massive undertaking that strains its resources.

This substantial investment in electrification is a delicate balancing act, as Aisin must simultaneously manage and maintain its existing internal combustion engine (ICE) component businesses. This dual focus on both future and legacy technologies can place considerable pressure on the company's financial capacity in the near to mid-term, impacting short-term profitability and cash flow.

- Capital Expenditure: Billions earmarked for BEV and intelligent product development and manufacturing upgrades.

- Dual Strategy Strain: Balancing investment in new EV technologies with the continued support of ICE component businesses.

- Financial Resource Allocation: Potential for stretched financial resources due to the high costs associated with this transition.

Aisin Seiki's significant dependence on the automotive sector, even with diversification efforts, makes it susceptible to industry downturns. A substantial portion of its revenue, often exceeding 70%, is tied to automotive components, directly exposing the company to fluctuations in global vehicle production and consumer spending. This concentration means that a slowdown in car manufacturing, as seen in fiscal year ending March 2024 with impacts in China and Europe, directly affects Aisin's financial performance.

The company also faces challenges from intense global competition, with rivals like Cummins, Magna, and Valeo. Furthermore, the rising market share of Chinese suppliers, projected to increase from 21% in 2024 to 30% by early 2025, intensifies competitive pressure and can impact Aisin's profitability.

Aisin's substantial investments in electric vehicle (EV) technology require significant capital, potentially straining financial resources. Balancing these investments with the ongoing support for its internal combustion engine (ICE) component businesses creates a dual strategic strain, impacting short-term profitability and cash flow.

| Weakness Category | Specific Issue | Impact/Data Point |

| Market Dependence | Reliance on Automotive Sector | Over 70% of revenue from automotive components. |

| Competitive Landscape | Intensifying Competition | Chinese suppliers' market share grew from 21% (2024) to an estimated 30% (early 2025). |

| Financial Strain | EV Investment Costs | Billions invested in BEV and intelligent systems R&D and manufacturing. |

| Operational Risk | Supply Chain Fragility | Lingering effects of semiconductor shortages impacting production capacity. |

Same Document Delivered

Aisin Seiki SWOT Analysis

The preview you see is the actual Aisin Seiki SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report offers a comprehensive look at the company's internal strengths and weaknesses, as well as external opportunities and threats. It's designed to provide actionable insights for strategic planning.

Opportunities

The global automotive industry's accelerated pivot towards electrification is a major tailwind for Aisin. With a strong focus on components like eAxles, battery frames, and integrated electric drive units, Aisin is well-positioned to capitalize on this trend. The increasing consumer and regulatory demand for greener transportation solutions directly translates into a growing market for Aisin's specialized electrified offerings.

The resurgence of interest in hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) presents a renewed avenue for Aisin to deploy its comprehensive suite of electrified powertrain components. This dual focus on both full electric and hybrid technologies allows Aisin to maximize its market penetration and leverage its existing expertise across a broader spectrum of the evolving automotive landscape.

Aisin's strategic overhaul of its global aftermarket services presents a significant growth opportunity. The company is aiming to transform into a comprehensive provider of both parts and services, moving beyond its traditional manufacturing role.

A key development is the merger of AWTEC and AWA's aftermarket units into Aisin Aftermarket & Service of America Inc., effective April 2025. This consolidation is designed to streamline operations and broaden the product portfolio to include a wider range of maintenance products, not just those for Aisin's own brands.

This strategic move is expected to enhance customer experience by offering a more integrated service solution and significantly expand Aisin's market reach within the aftermarket sector.

Strategic partnerships offer Aisin significant growth avenues. For instance, its joint development of eAxles with Subaru, a key player in the automotive industry, allows for shared technological expertise and cost efficiencies in a rapidly evolving EV landscape. This collaboration is vital for staying competitive in the electric mobility sector.

Further expanding its global reach, Aisin's joint venture with Minth Group for EV parts manufacturing in North America is a prime example of leveraging partnerships for market penetration. This venture, established to cater to the growing North American EV market, aims to bolster Aisin's manufacturing capabilities and supply chain resilience in a critical region, potentially capturing a larger share of the projected multi-billion dollar EV components market by 2025.

Technological Advancements in Vehicle Intelligence and Safety

Aisin's strategic focus on vehicle intelligence, encompassing integrated vehicle control, advanced sensing capabilities, and AI-driven systems, is a significant opportunity. This push into smart mobility allows Aisin to tap into new market segments and cater to the growing demand for enhanced safety and convenience features.

The company's innovative developments, such as the 'Intelligent Pillar Unit' and the 'Generative AI-Powered LBS Agent,' highlight its capacity to deliver cutting-edge solutions. These offerings are designed to enrich the driving and passenger experience, aligning perfectly with the industry's trajectory towards smarter, more connected vehicles.

The global market for Advanced Driver-Assistance Systems (ADAS), a key component of vehicle intelligence, is projected to reach over $100 billion by 2028, indicating substantial growth potential for Aisin's related technologies. For instance, by 2024, it's estimated that over 90% of new vehicles sold in major markets will feature some form of ADAS. Aisin's investments in these areas position it to capture a significant share of this expanding market.

- Expanding Market Reach: Aisin's vehicle intelligence initiatives open doors to the rapidly growing smart mobility sector.

- Product Innovation: Developments like the 'Intelligent Pillar Unit' and AI-powered agents offer unique value propositions.

- Industry Alignment: These advancements directly support the global shift towards autonomous and connected vehicles.

- Market Growth: The ADAS market, a direct beneficiary of these technologies, is experiencing robust expansion, with significant growth expected through 2028.

Strengthening Regional Management and Localization

Aisin's strategic move to bolster its regional management and embrace localization, notably with the creation of a dedicated India Division, offers a significant opportunity for enhanced operational agility. This shift allows for more tailored responses to diverse market demands and emerging customer trends in key growth areas.

By empowering local leadership and adopting region-based management, Aisin can unlock greater market responsiveness. This approach is particularly crucial in rapidly expanding economies where understanding nuanced local preferences is paramount for success.

- Enhanced Market Responsiveness: Local leaders can better interpret and act upon region-specific market dynamics.

- Improved Customer Engagement: Tailored strategies can resonate more deeply with local customer needs and expectations.

- Agile Decision-Making: Decentralized management can lead to quicker adaptation to local challenges and opportunities.

- Leveraging High-Growth Regions: The India Division, for instance, positions Aisin to capitalize on the subcontinent's burgeoning automotive market, which is projected to see continued robust growth through 2025 and beyond.

Aisin is strategically positioned to benefit from the automotive industry's electrification trend, with a particular focus on eAxles and integrated electric drive units. The company's expansion into aftermarket services, exemplified by the April 2025 merger of AWTEC and AWA's aftermarket units, aims to create a more comprehensive service offering beyond its traditional manufacturing role.

Threats

The electric vehicle (EV) component manufacturing sector is experiencing a surge in competition, with numerous companies now vying for significant market share. This crowded landscape poses a direct challenge to Aisin's eAxle development, potentially leading to downward pressure on pricing and impacting overall profitability.

Furthermore, the fast-paced evolution of EV technology necessitates substantial and ongoing investment in research and development. Staying at the forefront of innovation requires continuous R&D spending to maintain a competitive edge, a factor that could strain resources.

Global economic uncertainties, including a slowdown in the electric vehicle (EV) market and broader production declines affecting Japanese automakers, present a considerable threat to Aisin Seiki. These external pressures can directly impact the company's sales volumes and profitability.

Aisin's financial performance reflects these challenges, with a reported decline in net profit for the nine-month period of fiscal year 2024/25. Revenue also experienced a drop, a situation partly attributed to reduced vehicle production by its key automotive clients.

Should these economic headwinds persist or intensify, the demand for vehicles, and consequently for Aisin's components, could be further depressed. This continued pressure on demand would undoubtedly impact Aisin's financial results negatively.

The specter of escalating trade protectionism, exemplified by potential U.S. tariff increases to 20%, casts a long shadow over Aisin's global operations. This uncertainty directly impacts financial planning and introduces significant cost volatility.

Geopolitical tensions and a broader trend toward protectionism threaten to fracture Aisin's intricate global supply chains. Such disruptions can lead to increased logistics costs and material shortages, directly affecting Aisin's ability to offer competitive pricing in key markets.

Rapid Technological Shifts and Disruption

The automotive sector's rapid technological evolution, particularly in electrification and autonomous driving, presents a significant threat. Aisin Seiki's continued success hinges on its ability to adapt swiftly to these changes. Failure to invest adequately in emerging technologies could render current product lines obsolete, impacting market share and revenue streams. For instance, the global automotive market for advanced driver-assistance systems (ADAS), a key area of disruption, was projected to reach over $100 billion by 2025, highlighting the scale of investment required.

Managing the delicate balance between investing in future-oriented technologies and ensuring profitability from existing product portfolios is a critical challenge. This requires strategic resource allocation and a keen understanding of market trajectories. The increasing demand for software-defined vehicles, for example, necessitates a shift in R&D focus and manufacturing capabilities, potentially straining current operational budgets. Companies that fail to pivot effectively risk being outpaced by more agile competitors.

Specific threats include:

- Obsolescence of traditional powertrain components: As the industry shifts towards EVs, Aisin's established expertise in internal combustion engine (ICE) components may face declining demand.

- Competition from new tech entrants: Technology companies and startups are entering the automotive space with innovative solutions, challenging established suppliers.

- High R&D costs for new technologies: Significant capital investment is required to develop and scale up production for electrification, autonomous systems, and connected car features.

- Supply chain disruptions for new materials and components: Sourcing new materials like rare earth elements for batteries or advanced semiconductors can be volatile and costly.

Supply Chain Volatility and Raw Material Price Fluctuations

Ongoing global supply chain disruptions, exacerbated by geopolitical events and logistical challenges, pose a significant threat to Aisin's production. For instance, the semiconductor shortage that persisted through 2023 continued to impact automotive component manufacturers, potentially affecting Aisin's output and delivery schedules.

Fluctuations in the prices of key raw materials, such as steel, aluminum, and rare earth metals, directly impact Aisin's cost of goods sold. Commodity prices have shown considerable volatility; for example, the price of steel, a critical input for many automotive parts, experienced significant swings in 2024, directly squeezing profit margins for manufacturers like Aisin.

- Supply chain disruptions: Continued vulnerability to shortages of essential components, particularly semiconductors.

- Raw material price volatility: Exposure to unpredictable price increases for steel, aluminum, and other key inputs.

- Geopolitical impacts: Potential disruptions stemming from international trade disputes or regional instability affecting material sourcing.

- Logistical challenges: Rising shipping costs and potential delays in transportation impacting inventory management and production timelines.

The intensifying competition in the electric vehicle (EV) component manufacturing sector, particularly for eAxles, presents a significant threat, potentially driving down prices and impacting Aisin's profitability. Rapid technological advancements in EVs necessitate substantial and continuous R&D investment to maintain a competitive edge, a challenge that could strain financial resources. Global economic uncertainties, including a slowdown in the EV market and broader production declines experienced by Japanese automakers, directly threaten Aisin's sales volumes and overall financial health.

Aisin's financial performance in the nine-month period of fiscal year 2024/25 reflects these pressures, with a reported decline in net profit and revenue, partly due to reduced vehicle production from key clients. The potential for escalating trade protectionism, such as a hypothetical 20% U.S. tariff increase, introduces significant cost volatility and uncertainty into Aisin's global financial planning and operations.

Geopolitical tensions and a growing trend toward protectionism risk fragmenting Aisin's complex global supply chains, leading to increased logistics costs and potential material shortages. This could hinder Aisin's ability to offer competitive pricing in crucial markets. The automotive industry's swift technological evolution, especially in electrification and autonomous driving, poses a major threat; failure to invest adequately in these areas could render current product lines obsolete, impacting market share and revenue. For instance, the global market for advanced driver-assistance systems (ADAS) was projected to exceed $100 billion by 2025, underscoring the scale of investment needed.

The obsolescence of traditional internal combustion engine (ICE) components due to the industry's shift to EVs is a clear threat, potentially diminishing demand for Aisin's established product lines. The rise of new tech entrants and startups offering innovative automotive solutions challenges established suppliers like Aisin. Developing and scaling new technologies for electrification, autonomous systems, and connected car features requires high R&D costs, impacting capital allocation. Furthermore, sourcing new materials and advanced components, such as rare earth elements for batteries or semiconductors, can be volatile and costly, posing supply chain risks.

| Threat Category | Specific Examples/Impacts | Relevant Data/Context (2024/2025) |

|---|---|---|

| Market Competition | Intensifying competition in EV component manufacturing, especially eAxles. | Increased number of players entering the EV component space, potentially leading to price wars. |

| Technological Disruption | Rapid evolution of EV technology; need for continuous R&D investment. | Global ADAS market projected to exceed $100 billion by 2025; significant investment required for electrification and autonomous features. |

| Economic Headwinds | Global economic uncertainties; slowdown in EV market; production declines by Japanese automakers. | Reported decline in Aisin's net profit and revenue for the nine-month period of FY2024/25 due to reduced client production. |

| Trade Protectionism | Potential U.S. tariff increases (e.g., to 20%); geopolitical tensions. | Impacts financial planning and introduces cost volatility; threatens global supply chains, increasing logistics costs and material shortages. |

| Supply Chain Vulnerabilities | Obsolescence of ICE components; sourcing new materials; semiconductor shortages. | Semiconductor shortage persisted through 2023, impacting automotive component manufacturers. Volatility in prices of steel, aluminum, and rare earth metals. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to provide a robust and insightful evaluation of Aisin Seiki.