Aisin Seiki Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

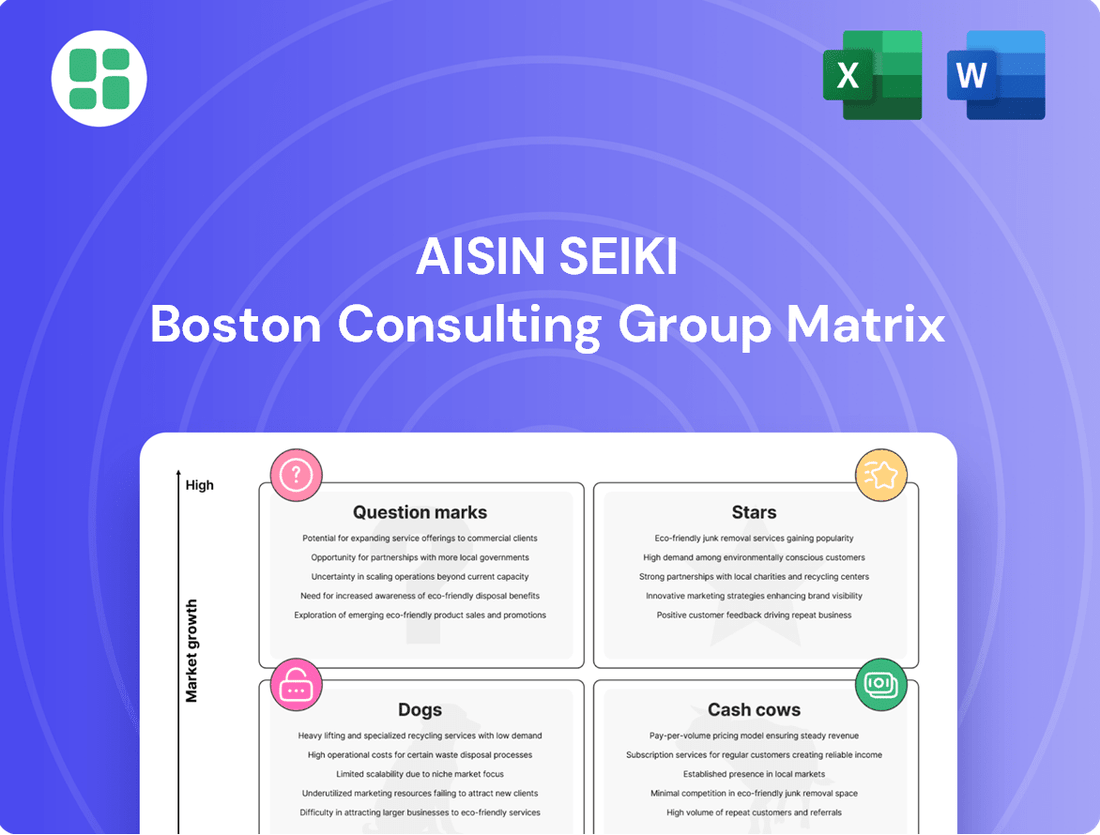

Curious about Aisin Seiki's product portfolio performance? Our BCG Matrix analysis offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock strategic advantages and make informed decisions about resource allocation and future investments, dive into the comprehensive breakdown. Purchase the full BCG Matrix for a complete, actionable roadmap.

Stars

Aisin's eAxles are a cornerstone of their strategy in the burgeoning electric vehicle sector, boasting a significant market presence. Their collaboration with BluE Nexus to supply Suzuki's e VITARA exemplifies this, securing a strong foothold in a high-growth area. This strategic focus is backed by substantial global production investments, solidifying Aisin's leadership in electrified automotive components.

Aisin's collaboration with Mitsubishi Electric Mobility is a strategic move to develop advanced electric drive modules for the burgeoning xEV market. This partnership, targeting a launch in the latter half of the 2020s, positions Aisin to capitalize on the accelerating demand for electrified powertrains.

The focus on next-generation xEVs signifies Aisin's commitment to innovation in a high-growth sector. By combining their technological strengths, Aisin and Mitsubishi Electric are poised to offer competitive solutions that cater to the evolving electrification requirements of global automakers.

As vehicles increasingly embrace electrification and autonomous features, Aisin's advanced braking systems are seeing a surge in demand. These sophisticated systems, which seamlessly integrate with Advanced Driver-Assistance Systems (ADAS), are pivotal for improving vehicle safety and overall performance, directly supporting the industry's move towards self-driving technology.

Aisin's commitment to innovation in this critical area is evident through their continuous development and showcase of cutting-edge braking solutions. For instance, in 2024, the company highlighted its integrated braking systems designed to work with Level 2 and Level 3 autonomous driving capabilities, a testament to their forward-thinking approach.

Integrated Vehicle Control Systems

Aisin's Integrated Vehicle Control Systems, leveraging intelligent and electric units, are pivotal in enhancing electricity consumption, driving performance, and overall safety. These systems are designed to orchestrate the complex interactions within modern electric and intelligent vehicles, a rapidly expanding segment of the automotive industry.

The company's focus on this area directly addresses the increasing demand for optimized vehicle efficiency and a superior user experience. For instance, in 2024, the global market for Advanced Driver-Assistance Systems (ADAS), a key component of integrated control, was projected to reach over $40 billion, indicating strong growth potential.

- Contribution to Efficiency: Aisin's systems aim to reduce energy usage in EVs through precise management of powertrain, braking, and steering.

- Performance Enhancement: By integrating control, Aisin improves acceleration, handling, and responsiveness in intelligent vehicles.

- Safety Advancements: These systems are crucial for enabling features like autonomous driving and collision avoidance, bolstering vehicle safety.

- Market Relevance: The increasing adoption of EVs and autonomous technology underscores the strategic importance of integrated vehicle control for Aisin.

Carbon Neutrality Solutions (Product-Level)

Aisin Seiki is heavily invested in product-level carbon neutrality solutions, targeting a high-growth market fueled by environmental regulations and consumer preferences. Their strategy includes reducing power consumption across vehicle systems, notably through electrified powertrains and energy management systems like ENE-FARM. This focus aligns with their ambitious goal of achieving carbon neutrality in their products by 2050, signaling substantial future investment in this area.

Key product-level initiatives contributing to carbon neutrality include:

- Electrified Powertrain Components: Development of advanced electric motors, inverters, and battery management systems designed for maximum energy efficiency.

- Energy Management Systems: Innovations like ENE-FARM, which efficiently converts city gas into electricity and heat, reducing reliance on fossil fuels and lowering carbon footprints for households.

- Lightweight Materials and Design: Incorporating lighter materials and optimizing designs to decrease overall vehicle weight, thereby improving fuel efficiency and reducing emissions.

Aisin's eAxles and advanced braking systems for electric and autonomous vehicles are positioned as Stars in the BCG matrix. These products operate in high-growth markets driven by electrification and ADAS adoption. For instance, the global ADAS market was projected to exceed $40 billion in 2024, highlighting the significant growth potential for Aisin's related components.

What is included in the product

This BCG Matrix overview analyzes Aisin Seiki's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic recommendations for investment, holding, or divestment based on market share and growth potential.

A clear BCG Matrix visualizes Aisin Seiki's portfolio, identifying underperforming "Dogs" and guiding resource allocation away from them.

Cash Cows

Aisin Seiki's conventional automatic transmissions are a cornerstone of their business, firmly planted in the Cash Cows quadrant of the BCG Matrix. As a leading global supplier, Aisin consistently holds a substantial portion of the market for these traditional systems.

Even with the rise of electric vehicles, conventional automatic transmissions are still the standard in the vast majority of passenger cars worldwide. This widespread adoption ensures a steady and significant stream of revenue for Aisin, making it a reliable source of cash flow.

The company's expertise lies in producing transmission systems for high-volume vehicle manufacturing. While this segment is mature, its profitability remains robust, underscoring its status as a dependable Cash Cow for Aisin Seiki. In 2024, the global market for automatic transmissions, while facing EV competition, still represented billions in sales, with Aisin a major player.

Aisin's drivetrain components for hybrid vehicles (HEVs/PHEVs) represent a significant cash cow. The company enjoys a robust market position, capitalizing on the reenergized growth of hybrids, particularly in markets where full electric vehicle (BEV) adoption is proceeding at a more measured pace. This segment benefits from Aisin's deep-seated expertise and established ties with leading automotive manufacturers.

The consistent profitability of these hybrid drivetrain components stems from leveraging existing capabilities, requiring relatively modest new investment. For instance, in 2024, the global hybrid vehicle market is projected to reach approximately $350 billion, with a compound annual growth rate (CAGR) of over 10% through 2030, underscoring the sustained demand Aisin is well-positioned to meet.

Aisin Seiki's established engine-related products, encompassing components for both conventional and hybrid powertrains, act as significant cash cows. These products benefit from a mature market position with consistent demand from established vehicle manufacturers and the aftermarket sector.

The company's substantial market share in this core automotive segment translates into reliable revenue and profit generation. For instance, in fiscal year 2024, Aisin reported consolidated net sales of ¥4,859.8 billion, with a significant portion attributed to its powertrain segment, highlighting the enduring strength of these foundational offerings.

Standard Chassis and Body Parts

Aisin's standard chassis and body parts are its cash cows. As a major Tier One automotive supplier, Aisin produces a vast range of these essential components for numerous vehicle models. These products are known for their high production volumes and deeply entrenched market positions, making them substantial revenue generators for the company.

This segment operates in a mature, low-growth market, yet it consistently provides a stable and reliable source of cash flow for Aisin. In 2023, Aisin's automotive segment, which heavily features these parts, reported net sales of ¥2,897.6 billion, underscoring the financial strength of these established product lines.

- High Volume Production: These parts are manufactured in large quantities to meet global demand.

- Established Market Presence: Aisin holds significant market share in these product categories.

- Stable Revenue Generation: They contribute reliably to the company's overall financial performance.

- Low Growth, High Cash Flow: Characterized by maturity, this segment is a consistent cash generator.

Traditional Automotive Aftermarket Parts

Aisin's traditional automotive aftermarket parts business, particularly in cooling systems and established drivetrain components, is a strong Cash Cow. This segment boasts a high market share due to a vast installed base of vehicles, ensuring consistent demand for replacement parts.

Aisin is actively refining its aftermarket strategy, focusing on streamlining services to further entrench its dominant position. This strategic overhaul aims to enhance efficiency and customer satisfaction within this mature, yet highly profitable, segment.

- High Market Share: Aisin holds a significant portion of the aftermarket for its core components.

- Stable Demand: The large number of vehicles in operation guarantees a steady need for replacement parts.

- Strategic Streamlining: Efforts to optimize aftermarket services are reinforcing its Cash Cow status.

- Profitability: This segment consistently generates substantial revenue and profits for the company.

Aisin Seiki's conventional automatic transmissions and hybrid drivetrain components are prime examples of its Cash Cows. These segments benefit from robust market positions and consistent demand, particularly as hybrid technology sees renewed interest. The company's established expertise and strong relationships with automakers ensure a steady revenue stream from these mature yet profitable areas. In 2024, the global hybrid vehicle market's projected growth further solidifies the strength of these offerings.

| Product Segment | BCG Category | 2024 Market Insight | Aisin's Position |

|---|---|---|---|

| Conventional Automatic Transmissions | Cash Cow | Still dominant in most passenger vehicles globally. | Leading global supplier with substantial market share. |

| Hybrid Drivetrain Components (HEVs/PHEVs) | Cash Cow | Global market projected to reach ~$350 billion in 2024, with >10% CAGR. | Strong market position, leveraging expertise and established ties. |

Delivered as Shown

Aisin Seiki BCG Matrix

The Aisin Seiki BCG Matrix you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This comprehensive analysis, detailing Aisin Seiki's product portfolio within the BCG framework, is ready for immediate strategic application without any watermarks or demo content. You can confidently use this preview as a direct representation of the professional-grade document that will be yours to download and implement in your business planning.

Dogs

Sales of traditional internal combustion engine (ICE) powertrain units, especially for markets like Europe and China, have seen a downturn. This is largely because these regions are rapidly transitioning to electric vehicles (EVs).

Aisin's historical strength in hybrid electric vehicles (HEVs) has become a challenge in China, where battery electric vehicles (BEVs) now represent more than 50% of new car sales. This shift has resulted in decreased demand and surplus capacity within Aisin's conventional powertrain divisions.

This situation points to a market that is experiencing low growth, and potentially even decline. Consequently, Aisin's market share in these traditional segments could be shrinking as the industry moves away from ICE technology.

While Aisin Seiki is a powerhouse in transmission technology, its manual transmission components likely reside in the Dogs quadrant of the BCG Matrix. The global market for manual transmissions is shrinking, with estimates suggesting a market share below 15% in 2024, a stark contrast to the growing dominance of automatics, CVTs, and DCTs.

Specific manual transmission parts, especially those catering to passenger vehicles, face limited growth potential. If Aisin's market share in these particular niche components is not commanding, they would indeed be classified as Dogs, representing low market share in a low-growth industry.

As the automotive industry pivots towards electrification and stricter emissions regulations, Aisin's older engine components that don't meet current standards are likely experiencing reduced demand. These legacy parts, while perhaps once profitable, may now represent a shrinking market share and generate minimal returns. For instance, components designed for internal combustion engines that are less fuel-efficient could be particularly vulnerable as automakers prioritize hybrid and electric powertrains.

Niche Non-Automotive Products with Low Market Share and Growth

Aisin Seiki's diversification extends beyond automotive components into sectors like housing and lifestyle products, as well as industrial equipment. Within these non-automotive segments, certain niche products might be classified as dogs if they exhibit low market share and minimal growth potential. These could include specialized components for building automation systems or unique industrial machinery parts that haven't achieved widespread adoption.

The limited availability of specific financial data for these niche non-automotive products makes it challenging to pinpoint exact market share or growth rates. However, their absence from Aisin's primary growth narratives suggests they are not significant revenue drivers for the company. For instance, if a particular line of smart home sensors or specialized factory automation tools saw less than 2% annual growth in the 2024 fiscal year and held a market share below 5%, they would likely fit the dog category.

- Niche Housing Products: Specialized components for smart home integration or energy-efficient building systems with limited market penetration.

- Industrial Equipment: Unique machinery or parts for specific manufacturing processes that haven't scaled to become market leaders.

- Lifestyle Products: Any non-automotive consumer goods that have failed to capture significant market share or demonstrate consistent sales growth.

Components for Discontinued or Low-Volume Vehicle Platforms

Aisin Seiki, a major automotive component supplier, manufactures parts for a vast range of vehicles. For platforms that are no longer in high production or have been discontinued, the demand for their specialized components naturally diminishes.

These components, designed for niche or older models, would typically exhibit a low market share. Consequently, they contribute minimally to Aisin's overall revenue, placing them in the 'Dog' category of the BCG matrix.

For instance, if Aisin produced a specific transmission for a sedan model that ceased production in 2023, the sales volume for that transmission would plummet. In 2024, such components represent a challenge for inventory management and capital allocation.

- Low Market Share: Components for discontinued or low-volume platforms generally hold a very small percentage of the overall automotive component market.

- Declining Demand: As vehicle production phases out, the need for these specific parts decreases significantly.

- Minimal Revenue Contribution: These products often generate little profit and are not growth drivers for the company.

- Strategic Challenge: Managing inventory and potential obsolescence for these items requires careful planning.

Aisin Seiki's manual transmission components, especially those for passenger vehicles, are firmly in the Dogs quadrant. With the global market share for manual transmissions dipping below 15% in 2024, these parts face a shrinking demand. If Aisin's share within this niche is also modest, these components represent low growth and low market share for the company.

Legacy internal combustion engine components that don't meet current emissions standards are also likely Dogs. As automakers prioritize EVs and hybrids, demand for less efficient ICE parts diminishes, leading to reduced market share and minimal returns. For example, components for older, less fuel-efficient engines would be particularly vulnerable.

Certain niche non-automotive products from Aisin, such as specialized housing components or industrial machinery parts that haven't gained significant traction, could also be classified as Dogs. If these saw less than 2% annual growth in 2024 and held under 5% market share, they would fit this category.

Components for discontinued or low-volume vehicle platforms represent another segment of Dogs. These parts naturally have low market share and declining demand, contributing minimally to Aisin's overall revenue and posing inventory management challenges.

| Product Category | Market Growth (2024 Est.) | Aisin's Market Share (Est.) | BCG Category |

| Manual Transmission Components | Negative to Low (<15% overall market) | Low to Moderate | Dogs |

| Legacy ICE Components | Declining | Low | Dogs |

| Niche Non-Automotive Products | Low (<2% for some) | Low (<5% for some) | Dogs |

| Components for Discontinued Platforms | Declining | Very Low | Dogs |

Question Marks

Aisin Seiki's involvement in perovskite solar cell demonstrations positions them within a high-growth, emerging technology sector. This aligns with a strategic focus on renewable energy, a market projected to see substantial expansion in the coming years. For instance, the global solar power market was valued at approximately $200 billion in 2023 and is expected to grow significantly, with perovskite technology being a key area of innovation.

However, perovskite solar cells represent a market where Aisin's current market share and commercial viability are still in the early stages of development. While the technology shows promise for higher efficiency and lower manufacturing costs compared to traditional silicon cells, widespread commercial adoption requires overcoming challenges related to stability and scalability. This places Aisin's perovskite efforts in a position that demands significant investment to scale production and achieve broader market penetration.

Aisin Seiki is strategically broadening its aftermarket presence by introducing new product categories such as windshield wipers, lubricants, batteries, and specialized tools. This move diversifies their portfolio beyond established proprietary brands, tapping into essential vehicle maintenance needs.

Although the automotive aftermarket is a generally robust sector, Aisin's entry into these new segments means it currently holds a relatively low market share within them. This presents a challenge, as significant investment in marketing and distribution will be necessary to build brand recognition and capture market share in these competitive areas, even with the overall market's growth potential. For example, the global automotive aftermarket was valued at approximately $450 billion in 2023 and is projected to grow steadily, indicating substantial opportunity for new entrants who can effectively penetrate the market.

Aisin is actively developing integrated sensing technologies, both inside and outside vehicles, aiming to create a secure and comfortable mobile environment that supports autonomous driving. This focus positions them within the burgeoning ADAS market, a sector experiencing significant expansion.

While Aisin's overall presence in the automotive sector is strong, their specific market share within ADAS modules, when contrasted with dedicated electronics manufacturers, is still in its growth phase. This segment requires considerable investment in research and development to foster competitive advancements.

Hydrogen-Related Components and Infrastructure

Aisin's engagement in hydrogen technology, notably through its subsidiary Konan Kogyo's participation in establishing a hydrogen station, positions it within a sector poised for significant future growth. While the global hydrogen market is projected to expand substantially, with estimates suggesting it could be worth trillions by 2050, Aisin's current market share in dedicated hydrogen components is likely modest given the early stage of infrastructure development and widespread adoption.

This segment represents a potential star in the BCG matrix, demanding ongoing investment to capture future market expansion. The International Energy Agency reported in 2024 that global hydrogen production capacity is increasing, but the infrastructure for distribution and refueling remains a bottleneck in many regions.

- Nascent Market: Aisin's involvement in hydrogen infrastructure, like the Konan Kogyo station, places it in an emerging sector.

- High Growth Potential: The hydrogen economy is anticipated to grow significantly, offering long-term opportunities.

- Low Current Share: Aisin's market share in hydrogen-specific components is likely small due to the early stage of adoption and infrastructure build-out.

- Investment Requirement: Sustained capital allocation is crucial for Aisin to capitalize on the future expansion of the hydrogen market.

Region-Based Energy Management Products and Technologies

Aisin Seiki is actively pursuing carbon neutrality goals by developing region-based energy management products and technologies, signaling a strategic move beyond its traditional automotive focus into the broader energy sector. This expansion reflects a growing global demand for sustainable energy solutions.

The market for region-based energy management is experiencing significant growth, driven by increasing environmental consciousness and government initiatives. For instance, the global smart grid market, which encompasses many of these technologies, was valued at approximately $30 billion in 2023 and is projected to reach over $80 billion by 2030, growing at a compound annual growth rate (CAGR) of around 15%.

- Market Expansion: Aisin's involvement in region-based energy management signifies a diversification strategy into non-automotive sectors.

- Growth Potential: The energy management market is a rapidly expanding sector with substantial future revenue opportunities.

- Competitive Landscape: Aisin's current market share in these specific non-automotive energy management solutions is likely nascent.

- Strategic Investment: Significant investment and market development will be crucial for Aisin to establish a strong competitive position in this segment.

Aisin's perovskite solar cell development is a prime example of a "Question Mark" in the BCG matrix. This segment operates within a high-growth, emerging technology sector, specifically renewable energy, which is projected for substantial future expansion. For instance, the global solar power market was valued at approximately $200 billion in 2023 and is expected to see continued strong growth, with perovskite technology being a key innovation driver.

However, Aisin's current market share and commercial viability in perovskite solar cells are still in their nascent stages. While the technology offers promise for improved efficiency and potentially lower manufacturing costs compared to traditional silicon, widespread commercial adoption hinges on overcoming critical challenges related to long-term stability and scalable production. This necessitates significant ongoing investment to scale manufacturing and achieve broader market penetration, positioning it as a classic Question Mark requiring careful strategic consideration and capital allocation.

| Business Unit/Product | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Perovskite Solar Cells | High | Low | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Aisin Seiki's financial reports, market share analyses, and industry growth projections to provide strategic insights.