Aisin Seiki Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

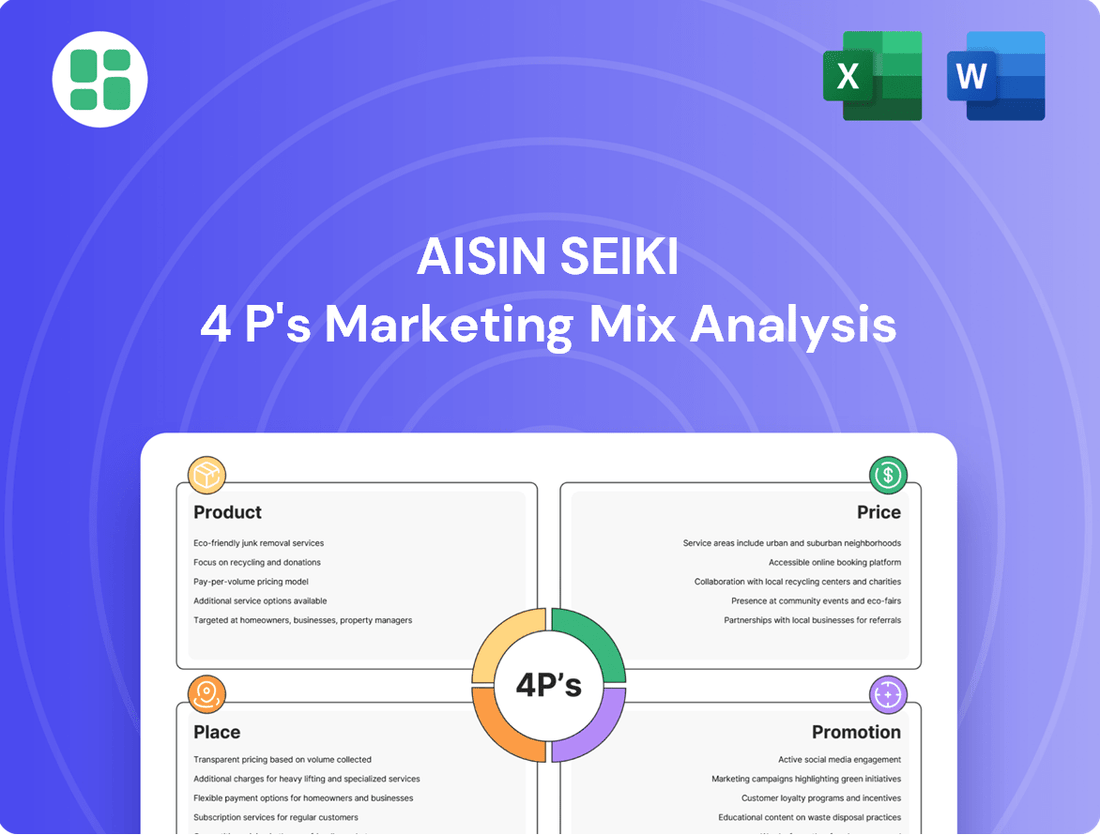

Aisin Seiki's marketing prowess is built on a robust foundation of Product, Price, Place, and Promotion. This analysis delves into how their innovative product development, strategic pricing, widespread distribution, and targeted promotions create a powerful market presence.

Discover the intricate interplay of Aisin Seiki's 4Ps and unlock actionable insights for your own marketing strategies. Get the full, editable analysis to understand their competitive edge and apply proven tactics.

Product

Aisin Seiki's product strategy centers on a vast array of automotive components, covering critical systems like drivetrains, brakes, chassis, and engines. These high-quality, reliable parts are essential for major global automakers, underscoring Aisin's commitment to performance and innovation in a rapidly changing automotive landscape.

Aisin is aggressively enhancing its product offerings for the burgeoning electric and hybrid vehicle market. Key innovations include advanced eAxles, which are integrated electric drive modules, and sophisticated cooperative regenerative braking systems designed to maximize energy recovery. These developments are central to Aisin's strategy to meet the evolving demands of sustainable transportation.

The company is deeply invested in the future of electric mobility, currently developing its second and third-generation eAxles. These next-generation units are engineered for improved efficiency and a more compact design, reflecting a commitment to cutting-edge technology. Aisin's collaborative efforts with industry leaders such as BluE Nexus and Denso underscore its strategic approach to accelerating these advancements.

This strategic pivot towards electrified and hybrid solutions is a direct response to the global imperative for carbon neutrality and the broader transition to sustainable mobility. Aisin's proactive expansion in this sector positions it as a key player in shaping the future of automotive powertrains, aligning with major automotive manufacturers' electrification targets and governmental environmental regulations.

Aisin is significantly enhancing its aftermarket presence by transforming into a holistic parts and service provider, moving beyond its established in-house brands. This strategic shift aims to offer a broad spectrum of maintenance essentials, from everyday items like wiper blades and lubricants to critical components such as batteries, and even specialized tools and equipment.

This expansion positions Aisin as a convenient one-stop destination for a wide range of automotive aftermarket requirements. For instance, the global automotive aftermarket was valued at approximately $450 billion in 2023 and is projected to grow, with Aisin's expanded offering directly targeting this burgeoning market.

Energy Systems & Solutions

Aisin's Energy Systems & Solutions segment extends its automotive prowess in thermal and power management to diverse markets. This strategic diversification includes advanced products like gas heat pump air-conditioners, a testament to their commitment to energy efficiency and broader sustainability initiatives.

These offerings are crucial for enhancing energy consumption efficiency across various applications, aligning with global environmental goals. For instance, Aisin's development of high-efficiency heat pumps directly addresses the growing demand for eco-friendly HVAC solutions. In 2024, the global market for energy-efficient HVAC systems was projected to reach over $100 billion, highlighting the significant growth potential in this sector.

This business unit plays a vital role in Aisin's revenue diversification, providing a stable income stream independent of the automotive industry's cyclical nature. The company's investment in these technologies underscores a forward-looking approach to market trends and environmental stewardship.

- Energy Efficiency: Focus on technologies like gas heat pump air-conditioners to reduce energy consumption.

- Market Diversification: Expanding beyond automotive to tap into the growing energy solutions market.

- Sustainability Goals: Contributing to broader environmental objectives through efficient energy systems.

- Revenue Streams: Creating new avenues for income to complement automotive sales.

Housing, Lifestyle & Industrial Equipment

Aisin Seiki's product portfolio extends beyond automotive components to encompass housing, lifestyle, and industrial equipment. This diversification strategy is crucial for mitigating risks tied to the cyclical nature of the automotive sector. For instance, Aisin's housing division develops products like water heaters and ventilation systems, contributing to a more stable revenue stream. In 2023, Aisin reported total net sales of ¥4,690.6 billion, with a significant portion derived from its non-automotive segments, showcasing the impact of this broad product offering.

The company leverages its core manufacturing expertise and technological innovation across these varied markets. While specific sales figures for housing, lifestyle, and industrial equipment are often aggregated, their collective contribution highlights Aisin's successful application of its capabilities in non-automotive fields. This strategic expansion into areas like advanced robotics and building materials demonstrates a commitment to long-term growth and market resilience.

- Diversified Revenue Streams: Aisin's non-automotive products, including housing and industrial equipment, provide a buffer against automotive market fluctuations.

- Technological Application: Core manufacturing and engineering strengths are effectively translated into diverse product lines, from home appliances to factory automation.

- Market Resilience: By serving multiple sectors, Aisin enhances its overall business stability and reduces reliance on any single industry.

- Growth Potential: Expansion into lifestyle and industrial segments presents opportunities for new market penetration and revenue growth.

Aisin Seiki's product strategy is a robust mix of core automotive components and strategic diversification. They are heavily invested in electric and hybrid vehicle technologies, developing advanced eAxles and regenerative braking systems to meet future mobility demands. Beyond automotive, Aisin leverages its manufacturing expertise in housing, lifestyle, and industrial equipment, creating stable revenue streams and enhancing market resilience.

| Product Category | Key Offerings | Market Focus | 2024/2025 Relevance |

|---|---|---|---|

| Automotive Components | Drivetrains, brakes, chassis, engines, eAxles | Global OEMs, EV/Hybrid Market | Continued innovation in EV powertrain components; demand driven by electrification targets. |

| Aftermarket Parts & Service | Maintenance essentials, batteries, specialized tools | Global Automotive Aftermarket | Targeting a market valued at ~$450 billion in 2023, with projected growth. |

| Energy Systems & Solutions | Gas heat pump air-conditioners | Diverse Markets, Eco-friendly HVAC | Addresses a market projected to exceed $100 billion in 2024 for energy-efficient HVAC. |

| Housing, Lifestyle & Industrial | Water heaters, ventilation systems, robotics, building materials | Residential, Industrial Sectors | Contributes to ¥4,690.6 billion in total net sales (2023), mitigating automotive sector cyclicality. |

What is included in the product

This analysis provides a comprehensive deep dive into Aisin Seiki's Product, Price, Place, and Promotion strategies, offering a professionally written, company-specific breakdown of their marketing mix.

It's ideal for managers and marketers seeking a complete understanding of Aisin Seiki's marketing positioning, grounded in actual brand practices and competitive context.

This Aisin Seiki 4P's Marketing Mix Analysis provides a clear, concise overview of how their strategies address customer pain points, offering a quick understanding of their market approach.

It serves as a valuable tool for quickly identifying how Aisin Seiki's product, price, place, and promotion decisions alleviate customer challenges, streamlining strategic discussions.

Place

Aisin Seiki's primary distribution channel is direct supply to Original Equipment Manufacturers (OEMs) globally, embedding its components directly into new vehicle production. This approach relies on a sophisticated worldwide manufacturing and logistics infrastructure to guarantee punctual deliveries and smooth integration into intricate automotive assembly lines. For instance, in 2023, Aisin reported sales of approximately ¥4.5 trillion (around $30 billion USD), underscoring the scale of its OEM relationships.

The company cultivates enduring partnerships with leading global automakers, a testament to its reliability and component quality. This deep integration means Aisin's parts are fundamental to the manufacturing processes of major brands, ensuring consistent demand and market presence. Aisin's commitment to these OEM relationships is a cornerstone of its market strategy.

Aisin Seiki’s extensive aftermarket distribution network is a cornerstone of its marketing strategy, reaching across 17 countries with 36 strategically placed locations. This global footprint allows Aisin to effectively serve a diverse customer base, ensuring that replacement parts and maintenance items are readily available. The company actively tailors its product lines to meet the specific demands of each local market, demonstrating a commitment to localized service and product relevance.

Recent efforts to optimize this network include significant strategic overhauls, such as the establishment of Aisin Aftermarket & Service of America Inc. This consolidation aims to create a more streamlined operational structure, ultimately enhancing the customer experience by improving efficiency and accessibility. Such moves are critical for maintaining Aisin's competitive edge in the aftermarket sector, which is projected to see continued growth in the coming years.

Aisin Seiki strategically positions its manufacturing plants worldwide, aiming for efficient regional market access and prompt service to original equipment manufacturers (OEMs). This global footprint is essential for maintaining competitive lead times and streamlining supply chain operations.

Recent expansions, such as increased capacity in North American facilities and new joint ventures focused on electric vehicle (EV) components, underscore Aisin's commitment to adapting to evolving automotive demands. For example, in 2024, Aisin announced significant investments in its North American EV battery component production capabilities.

These strategically located manufacturing hubs are pivotal for localized production, enabling Aisin to better respond to regional consumer preferences and regulatory landscapes. By minimizing transportation distances, the company enhances its supply chain resilience and reduces overall logistics costs.

Direct Sales to Industrial & Business Clients

For its energy systems, housing, lifestyle products, and industrial equipment, Aisin Seiki frequently utilizes direct sales or specialized distribution networks designed for industrial and business clients. This strategy is crucial for delivering tailored solutions and direct technical assistance, meeting the unique demands of non-automotive industries.

These direct channels are instrumental in fostering robust relationships with a broad spectrum of business customers. For instance, Aisin's commitment to B2B markets is reflected in its ongoing investments in specialized sales teams and technical support infrastructure, aiming to provide unparalleled service and product integration for its industrial clientele.

- Customized Solutions: Direct sales enable Aisin to engineer and deliver products that precisely match the operational needs of industrial partners, enhancing efficiency and performance.

- Technical Expertise: A dedicated sales force with deep technical knowledge ensures clients receive expert advice and support throughout the product lifecycle.

- Relationship Building: Direct engagement fosters strong, long-term partnerships, allowing Aisin to understand evolving client requirements and adapt its offerings accordingly.

- Market Penetration: Targeting specific industrial sectors through direct channels allows for focused market penetration and a deeper understanding of niche demands.

Digital B2B Platforms and Partnerships

Aisin Seiki actively utilizes digital B2B platforms and cultivates strategic partnerships to streamline its operations and extend its market reach. These digital integrations are crucial for managing its complex global supply chain and enhancing customer engagement.

A prime example of this strategy is Aisin's collaboration with Manufacture 2030, aiming to reduce carbon emissions across its supply chain. This initiative inherently relies on digital platforms for data sharing, monitoring, and performance analysis, underscoring the company's commitment to sustainable and digitally-enabled operations. Such partnerships are key to achieving greater transparency and efficiency in procurement and logistics.

- Digital Integration for Supply Chain Visibility: Aisin employs digital B2B platforms to gain real-time insights into its supply chain, improving forecasting and inventory management.

- Strategic Partnerships for Sustainability: Collaborations like the one with Manufacture 2030 leverage digital tools to track and reduce environmental impact, with a focus on data-driven decarbonization efforts.

- Enhanced Procurement and Logistics: Digital solutions facilitate smoother transactions, better communication, and optimized routing within Aisin's extensive network of suppliers and distributors.

Aisin Seiki's place strategy involves a dual approach: direct supply to global OEMs and a robust aftermarket distribution network. This ensures components are integrated into new vehicles and readily available for repairs worldwide. The company's global manufacturing presence, with facilities strategically located to serve key automotive regions, reinforces this commitment to efficient delivery and localized support.

In 2023, Aisin's sales reached approximately ¥4.5 trillion, highlighting the scale of its OEM relationships and aftermarket reach. The company's 36 aftermarket locations across 17 countries demonstrate a dedication to accessibility for maintenance and replacement needs. Recent investments in North American EV component production in 2024 further illustrate Aisin's adaptive place strategy in response to market shifts.

Preview the Actual Deliverable

Aisin Seiki 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Aisin Seiki's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Aisin Seiki leverages industry trade shows like AAPEX and Automechanika Dubai to directly showcase its latest automotive technologies and product innovations. These exhibitions are vital for communicating strategic moves, such as the significant expansion of its aftermarket product lines, which saw a notable increase in new product introductions in 2024.

These events facilitate crucial face-to-face interactions with potential clients, partners, and industry influencers, fostering business development and strengthening market presence. In 2024, Aisin reported a 15% increase in qualified leads generated from its participation in key international automotive exhibitions.

Aisin Seiki's B2B relationship marketing and technical sales are crucial, especially given its Tier 1 automotive supplier status. This strategy focuses on cultivating enduring partnerships with major automakers worldwide. These relationships are fostered through specialized sales divisions, robust technical assistance, and joint development initiatives, ensuring Aisin remains a preferred partner.

The company's technical sales approach involves deep engagement with client engineering teams. This ensures Aisin's innovative solutions precisely meet automotive manufacturers' evolving needs. For instance, Aisin's advanced powertrain components and thermal management systems are developed in close collaboration with OEMs, highlighting the technical expertise central to their sales process.

External validation, such as Aisin's consistent recognition as a General Motors Supplier of the Year, underscores the success of its B2B strategies. These accolades, often awarded based on performance, quality, and innovation, directly reinforce Aisin's market standing and solidify its trusted supplier relationships within the automotive industry.

Aisin Seiki integrates Corporate Social Responsibility (CSR) and sustainability reporting into its marketing mix, highlighting its dedication to environmental stewardship and ethical business practices. The company actively participates in global initiatives, such as achieving an A- rating from CDP for its climate change disclosures in 2023, underscoring its commitment to transparency and measurable environmental impact reduction.

This focus on sustainability and CSR enhances Aisin's brand reputation, resonating with a growing segment of investors, employees, and consumers who prioritize Environmental, Social, and Governance (ESG) principles. By publicly detailing its efforts in annual sustainability reports, Aisin demonstrates accountability and builds trust, positioning itself as a responsible corporate citizen in the global market.

Official Corporate Websites & Digital Presence

Aisin Seiki leverages its official corporate websites and digital presence to connect with a broad audience. These platforms act as key information sources, detailing company news, product offerings, and investor relations data.

The company's digital footprint is crucial for transparent communication, reaching financial analysts, prospective employees, and customers alike. Updates on press releases and recent developments ensure stakeholders remain informed about Aisin's progress.

- Global Reach: Aisin's corporate websites are accessible worldwide, providing localized content for various regions.

- Information Hub: Serves as a central repository for financial reports, sustainability initiatives, and product catalogs.

- Stakeholder Engagement: Facilitates direct communication and information dissemination to investors, media, and the public.

- Digital Transparency: Offers a clear view into the company's operations, strategy, and corporate social responsibility efforts.

Technical Publications & White Papers

Aisin Seiki leverages technical publications and white papers to showcase its advanced technological capabilities and establish thought leadership. These resources are crucial for reaching engineers, researchers, and technical decision-makers at OEM companies, effectively demonstrating Aisin's deep expertise in areas like automotive electrification and intelligent systems.

This approach aims to build credibility and highlight specific technological advancements that differentiate Aisin in the competitive automotive supply chain. For instance, Aisin's investment in R&D, which reached ¥168.9 billion in fiscal year 2023, directly fuels the content of these technical papers, underscoring their commitment to innovation.

Key areas often covered in these publications include:

- Powertrain Innovations: Detailed insights into hybrid and electric vehicle components, such as advanced transmissions and e-axles.

- Intelligent Systems: Explanations of Aisin's contributions to ADAS (Advanced Driver-Assistance Systems) and autonomous driving technologies.

- Materials Science: Research on lightweight materials and advanced manufacturing processes used in their components.

- Sustainability Efforts: White papers detailing eco-friendly manufacturing practices and the environmental impact of their product lifecycle.

Aisin Seiki actively engages in global trade shows, such as AAPEX and Automechanika, to highlight its latest automotive technologies and product expansions, noting a 15% increase in qualified leads from these events in 2024.

The company's promotion strategy heavily relies on B2B relationship marketing, focusing on cultivating partnerships with major automakers through dedicated sales divisions and technical support, reinforcing its Tier 1 supplier status.

Aisin integrates CSR and sustainability into its promotional efforts, evidenced by its A- rating from CDP for climate change disclosures in 2023, enhancing brand reputation among ESG-conscious stakeholders.

Digital platforms, including corporate websites, serve as key information hubs for news, product details, and investor relations, ensuring transparency and broad stakeholder engagement.

Technical publications and white papers showcase Aisin's expertise in areas like electrification and ADAS, supported by its significant R&D investment of ¥168.9 billion in fiscal year 2023.

| Promotional Activity | Key Focus/Benefit | 2023/2024 Data/Insight |

|---|---|---|

| Trade Shows (e.g., AAPEX) | Showcasing new technologies, product expansion | 15% increase in qualified leads in 2024 |

| B2B Relationship Marketing | Cultivating OEM partnerships, technical support | Consistent recognition as GM Supplier of the Year |

| CSR & Sustainability Reporting | Enhancing brand reputation, ESG appeal | A- rating from CDP for climate change disclosure (2023) |

| Digital Presence (Websites) | Information hub, stakeholder engagement | Key source for financial reports and company news |

| Technical Publications | Establishing thought leadership, showcasing R&D | Supported by ¥168.9 billion R&D investment (FY2023) |

Price

Aisin Seiki's pricing for core automotive components to OEMs is fundamentally value-based, driven by the superior quality, cutting-edge technology, and essential integration of its parts into vehicle architectures. This strategy acknowledges the significant performance, reliability, and fuel efficiency contributions Aisin's components deliver to the end product.

Negotiations for these components are typically structured through long-term agreements, where the agreed-upon price directly correlates with the demonstrable value and benefits Aisin's parts bring to the final vehicle's performance and market appeal.

In 2024, the automotive industry continued to see a premium placed on components that enhance fuel economy and safety, areas where Aisin excels. For instance, advanced transmission components from Aisin, crucial for improving MPG ratings, command higher prices due to their direct impact on meeting evolving emissions standards and consumer demand for efficiency.

Aisin Seiki actively participates in competitive bidding for large-volume Original Equipment Manufacturer (OEM) contracts, a process where pricing is heavily influenced by market conditions and economies of scale. These negotiations often result in complex contractual agreements that include volume discounts and long-term supply commitments, reflecting the strategic value of these partnerships. For instance, in 2024, the automotive supplier market saw intense competition, with major players leveraging their production capacities to secure key OEM deals.

For highly specialized or custom-engineered solutions, such as advanced eAxles or unique industrial equipment, Aisin Seiki likely utilizes a cost-plus pricing strategy. This method guarantees that substantial research, development, and tooling expenditures are recouped, while also securing a healthy profit. For instance, the development of a novel electric vehicle powertrain component could involve millions in R&D, which this pricing model would directly address.

Tiered Pricing for Aftermarket Parts

Aisin Seiki's aftermarket parts likely employ a tiered pricing approach, segmenting customers by volume, type (wholesalers, repair shops, consumers), and product complexity. This strategy aims to capture value across a broad customer base, acknowledging differing price sensitivities and purchasing volumes. For instance, higher volume distributors might receive preferential pricing compared to smaller independent shops.

This tiered structure enables Aisin to optimize revenue and market penetration. It allows for flexibility in accommodating various market demands while maintaining profitability. By offering different price points, Aisin can effectively manage its distribution channels and cater to the specific needs of each segment within the aftermarket.

Key aspects of Aisin's aftermarket pricing strategy likely include:

- Volume Discounts: Offering reduced per-unit costs for larger orders to incentivize bulk purchases from distributors and large repair networks.

- Customer Segmentation Pricing: Differentiating prices based on the customer's business model and purchasing power, such as wholesale versus retail.

- Product Tiering: Establishing price variations for different product categories, perhaps distinguishing between high-demand, high-margin components and more common, lower-margin maintenance parts.

- Geographic Pricing Adjustments: Potentially factoring in regional market conditions, import duties, and logistics costs to set competitive prices in different territories.

Global Economic & Currency Considerations

Aisin Seiki's extensive global footprint means its pricing is deeply intertwined with worldwide economic trends. Fluctuations in currency exchange rates, the cost of raw materials, and the economic health of various regions directly impact how Aisin prices its products to remain competitive and profitable. For instance, a strengthening Japanese Yen in early 2024 could put pressure on export prices for Aisin's automotive components, necessitating careful calibration.

The company's financial reports consistently reflect the sensitivity of its earnings to currency movements. In its fiscal year ending March 2024, Aisin noted that foreign exchange impacts significantly affected its operating income. To counter these external pressures, Aisin frequently adjusts its pricing strategies across different markets, aiming to preserve margins and ensure consistent profitability despite the volatile global economic landscape.

- Currency Impact: Exchange rate volatility, such as the Yen's movement against the US Dollar and Euro in 2024, directly influences Aisin's revenue and profitability from international sales.

- Raw Material Costs: Global commodity prices, particularly for metals like steel and aluminum used in automotive parts, affect Aisin's production costs and, consequently, its pricing decisions.

- Regional Economic Conditions: Economic growth or contraction in key markets like North America, Europe, and Asia dictates consumer demand and the ability to absorb Aisin's product pricing.

- Pricing Adjustments: Aisin strategically modifies prices in different regions to offset currency headwinds and manage the impact of rising input costs, ensuring competitive positioning.

Aisin Seiki's pricing strategy is multifaceted, adapting to market dynamics and customer segments. For OEMs, value-based pricing is paramount, reflecting the performance and technological edge of their components, often secured through long-term contracts. This approach was particularly relevant in 2024 as the automotive sector prioritized fuel efficiency and safety, with advanced transmissions commanding higher prices. For specialized parts, a cost-plus model ensures R&D investments are covered, while the aftermarket segment utilizes tiered pricing based on volume and customer type to maximize reach and profitability.

| Pricing Strategy | Target Market | Key Drivers | 2024 Relevance |

|---|---|---|---|

| Value-Based | OEMs | Quality, Technology, Performance Contribution | High demand for fuel-efficient components |

| Cost-Plus | Specialized/Custom Solutions | R&D, Tooling Costs, Profit Margin | New EV powertrain development |

| Tiered Pricing | Aftermarket (Distributors, Repair Shops, Consumers) | Volume, Customer Segment, Product Complexity | Optimizing revenue across diverse customer needs |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Aisin Seiki is grounded in comprehensive data, including official company reports, press releases detailing product launches and pricing strategies, and industry analyses of their distribution networks and promotional activities.