Aisin Seiki PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

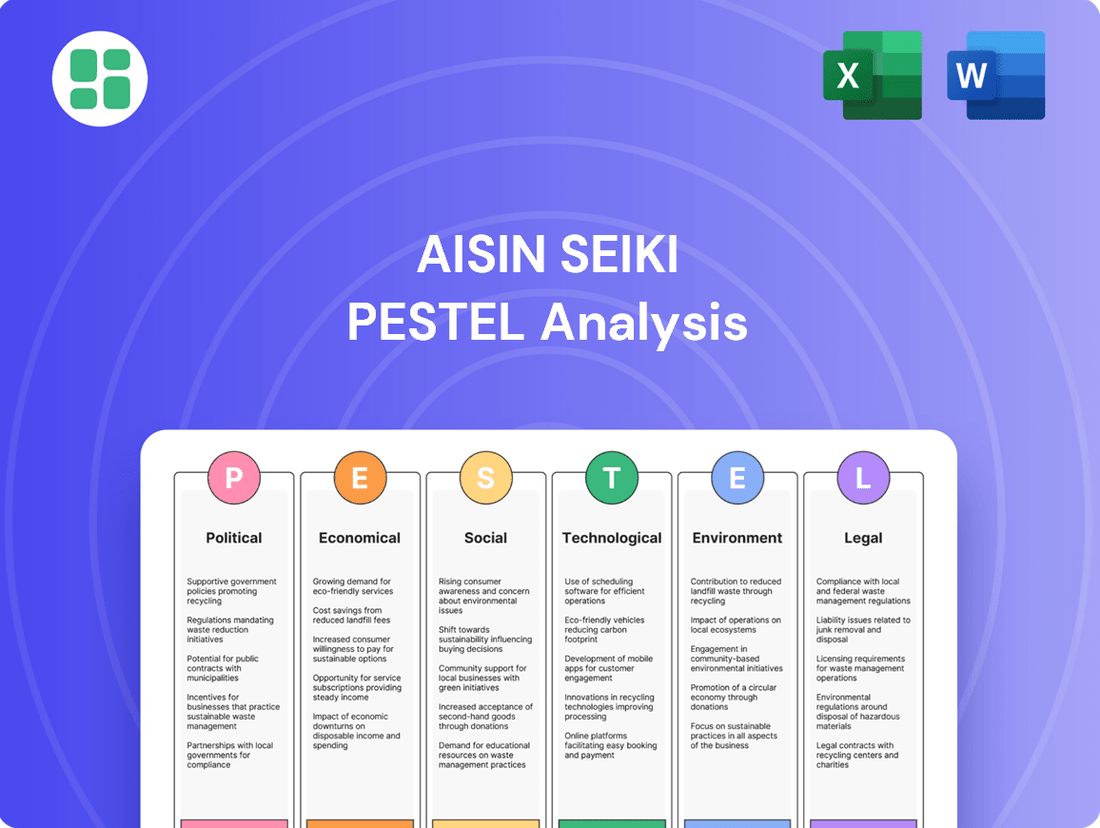

Navigate the complex external forces shaping Aisin Seiki's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting this automotive giant. Gain a strategic advantage by leveraging these expert insights to inform your own market approach. Download the full version now for actionable intelligence.

Political factors

Governments globally are tightening rules on vehicle emissions and safety, pushing companies like Aisin to innovate in cleaner and safer automotive parts. This trend is evident in the increasing number of countries mandating electric vehicles and requiring advanced driver-assistance systems.

Aisin's focus on developing e-Axles and hybrid powertrain components directly addresses these evolving regulatory demands. For instance, by 2030, the European Union aims for a 55% reduction in CO2 emissions for new cars compared to 1990 levels, a target that necessitates significant shifts in automotive technology, favoring Aisin's specialized offerings.

International trade policies and tariffs directly influence Aisin's global operations, impacting its supply chain and manufacturing decisions. For example, the imposition of tariffs by countries like the United States has historically affected Aisin's profitability. In response, the company has strategically diversified its sourcing and production, such as relocating transmission manufacturing to Mexico to navigate these trade complexities and ensure compliance.

Governments worldwide are increasingly offering incentives to boost electric vehicle (EV) adoption and build charging infrastructure. For Aisin, this translates into significant new market opportunities, particularly for its electrified components. These policy shifts are directly fueling demand for products like e-Axles and hybrid units, which are crucial to Aisin's strategic growth plans.

These incentives, such as tax credits and subsidies, are expected to drive a resurgence in interest and sales for hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs). Aisin is positioning itself to benefit from this renewed market focus, aiming to leverage its expertise in these powertrain technologies for reenergized growth throughout 2024 and 2025.

Geopolitical Tensions and Regional Stability

Geopolitical tensions and regional stability directly influence Aisin's extensive global footprint, which spans Japan, North America, Europe, China, ASEAN, and India. For instance, ongoing trade disputes or regional conflicts can disrupt supply chains for critical components, impacting Aisin's production capacity. The company's diversified manufacturing and sales presence aims to mitigate these risks, but significant geopolitical shifts, such as increased protectionism or localized instability, remain a key concern for market access and operational continuity.

The political stability of these key regions is paramount. In 2024, for example, ongoing geopolitical realignments and potential trade policy shifts in major markets like North America and Europe could introduce new operational challenges. Aisin's strategy relies on adapting to these dynamic political landscapes to ensure uninterrupted sourcing of materials and efficient distribution of its automotive components and systems worldwide.

- Impact on Supply Chains: Geopolitical instability can lead to sudden disruptions in the flow of raw materials and finished goods, affecting Aisin's production schedules and inventory management.

- Market Access: Political tensions can result in trade barriers, tariffs, or sanctions, potentially limiting Aisin's access to crucial sales markets in regions like China or Europe.

- Regional Diversification: Aisin's presence across multiple continents, including significant operations in Japan, North America, and ASEAN, provides a degree of resilience against localized political disruptions.

- Risk Mitigation: Continuous monitoring of political developments and the implementation of robust risk management strategies are essential for Aisin to navigate the complexities of global geopolitical environments.

International Partnerships and Agreements

Aisin's strategic joint ventures, like its collaboration with BMW Group and Subaru for e-Axle production, are often underpinned by international trade agreements and political stability. These partnerships are vital for Aisin's global expansion and its ability to efficiently develop and distribute advanced automotive technologies. For instance, the company's 2023 financial reports highlight significant revenue streams generated from these international collaborations, demonstrating their direct impact on Aisin's market position and technological advancement.

Political factors also influence Aisin's ability to secure resources and components through global supply chains. Agreements that promote free trade and reduce tariffs, such as those within the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) framework, can lower production costs and enhance competitiveness. Aisin's 2024 strategic outlook anticipates further integration into these global frameworks to optimize its manufacturing and distribution networks.

- Strategic Alliances: Aisin's joint ventures, such as with BMW and Subaru, leverage international political frameworks to advance e-Axle technology.

- Global Distribution: International agreements facilitate the widespread distribution of Aisin's next-generation automotive components.

- Component Sourcing: Favorable trade policies and political stability are critical for Aisin's access to global automotive component supply chains.

- Market Access: Political cooperation and trade pacts directly influence Aisin's ability to enter and thrive in key international automotive markets.

Government incentives for electric vehicles (EVs) and hybrid technologies are a significant tailwind for Aisin, directly boosting demand for its electrified components like e-Axles and hybrid units. For instance, the US Inflation Reduction Act of 2022, with its substantial EV tax credits, is expected to continue driving sales and adoption through 2024 and 2025.

Stricter emissions regulations globally, such as the EU's CO2 targets for new vehicles, compel automakers to adopt cleaner technologies, aligning perfectly with Aisin's product development in hybrid and electric powertrains. By 2035, the EU aims for a 100% reduction in CO2 emissions for new cars, a target that necessitates a complete shift away from internal combustion engines and favors companies like Aisin with strong electrification portfolios.

Trade policies and geopolitical stability remain critical for Aisin's global operations, impacting supply chains and market access. For example, the ongoing diversification of Aisin's manufacturing base, including significant investments in Mexico, aims to mitigate risks associated with tariffs and trade disputes impacting its North American operations.

Aisin's strategic joint ventures, such as its collaboration with BMW and Subaru for e-Axle production, are often facilitated by favorable international trade agreements and political stability. These partnerships are crucial for Aisin's technological advancement and market expansion, with 2023 financial reports indicating substantial revenue contributions from these global alliances.

What is included in the product

This PESTLE analysis of Aisin Seiki examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its global operations and strategic decision-making.

Provides a concise version of Aisin Seiki's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic discussions.

Economic factors

Global economic conditions are a significant driver for Aisin Seiki, as consumer spending power directly impacts new vehicle sales and, by extension, the demand for their automotive components. In 2023, global GDP growth was around 3.0%, a slight slowdown from 2022, impacting automotive markets.

Aisin Seiki's recent financial performance reflects this trend, with a slight revenue decrease reported for the fiscal year ending March 2024. This was partly due to a decline in powertrain unit sales and overall customer demand, underscoring the sensitivity of their business to a challenging economic environment.

Aisin Seiki, like many global manufacturers, is navigating significant economic headwinds from rising inflation and volatile raw material costs. For instance, the average price of steel, a key input for automotive components, saw substantial increases throughout 2024, impacting production budgets. These cost pressures directly squeeze profit margins, necessitating a sharp focus on operational efficiencies and strategic sourcing to maintain competitiveness.

Currency exchange rate fluctuations are a significant factor for Aisin Seiki. Volatility in rates directly impacts the value of its international sales and the cost of imported components. For instance, a stronger Japanese Yen can make Aisin's products more expensive for overseas buyers, potentially reducing demand, while a weaker Yen can boost reported revenues from foreign markets.

Aisin's financial disclosures often detail the impact of these currency movements. In fiscal year 2023, for example, the company reported that while a weaker Yen generally provided a tailwind to its operating profit by increasing the yen-equivalent value of its foreign earnings, significant fluctuations still presented a challenge in forecasting and managing profitability. The company actively employs hedging strategies to mitigate these risks.

Investment in Future Technologies

Aisin Seiki is strategically channeling significant capital into future technologies, particularly electrification and intelligent systems, to ensure its competitive edge and drive medium to long-term growth. This economic decision reflects a proactive response to the rapidly changing automotive industry, where innovation in these areas is paramount.

This investment is crucial for Aisin's adaptation to evolving market demands and technological advancements. For instance, the company has been a key player in developing advanced powertrain technologies, including hybrid and electric vehicle components. In fiscal year 2023, Aisin reported a substantial increase in its research and development expenditures, with a notable portion allocated to these future-oriented segments.

- Electrification Focus: Aisin is investing heavily in electric vehicle components like e-axles and battery management systems, anticipating a surge in EV production.

- Intelligent Technology Development: The company is also prioritizing advancements in autonomous driving sensors, control units, and connectivity solutions.

- R&D Allocation: Aisin's commitment to innovation is evident in its consistent R&D spending, which aims to secure technological leadership in emerging automotive trends.

- Market Responsiveness: These investments are a direct economic strategy to capture market share in the growing segments of electrified and intelligent vehicles.

Supply Chain Resilience and Cost Management Initiatives

Aisin Seiki recognizes that a robust and efficient supply chain is crucial for its economic success. The company is implementing structural reforms and cost-saving measures to boost profitability and streamline inventory management, especially in light of ongoing global supply chain volatility.

These initiatives are designed to help Aisin better absorb price fluctuations and ensure a steady flow of components. For instance, in fiscal year 2023, Aisin reported a significant increase in operating income, partly driven by these efforts to manage costs and improve operational efficiency across its diverse product lines.

- Supply Chain Optimization: Aisin is investing in technologies and partnerships to create more transparent and agile supply chains, reducing lead times and the impact of disruptions.

- Cost Reduction Programs: The company has ongoing programs targeting waste reduction and process improvements throughout its manufacturing and logistics operations.

- Inventory Management: Efforts are focused on optimizing inventory levels to balance availability with the costs of holding stock, a key factor in navigating economic uncertainty.

- Strategic Sourcing: Aisin is diversifying its supplier base and exploring regional sourcing options to mitigate risks associated with geopolitical events or natural disasters.

Economic factors significantly influence Aisin Seiki's performance, with global GDP growth directly impacting automotive demand. While global GDP growth was approximately 3.0% in 2023, a slowdown from the previous year, this trend affected automotive markets. Aisin's revenue for the fiscal year ending March 2024 saw a slight decrease, attributed to reduced powertrain unit sales and overall customer demand, highlighting the company's sensitivity to economic conditions.

Aisin Seiki faces economic challenges from persistent inflation and volatile raw material costs, impacting its profit margins. For example, steel prices, a crucial input, experienced notable increases throughout 2024, necessitating a focus on operational efficiencies and strategic sourcing to maintain competitiveness.

Currency fluctuations also play a critical role for Aisin, affecting the value of international sales and imported component costs. A stronger Yen can make Aisin's products more expensive for overseas buyers, potentially dampening demand, while a weaker Yen can boost reported revenues from foreign markets. The company actively employs hedging strategies to manage these currency risks.

| Economic Factor | Impact on Aisin Seiki | Data Point (2023/2024) |

|---|---|---|

| Global GDP Growth | Influences automotive demand and consumer spending. | Approx. 3.0% in 2023 (slowdown from 2022). |

| Inflation & Raw Material Costs | Squeezes profit margins, requires cost management. | Steel prices saw substantial increases throughout 2024. |

| Currency Exchange Rates | Affects international sales value and import costs. | Weaker Yen provided a tailwind to operating profit in FY2023. |

Preview the Actual Deliverable

Aisin Seiki PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Aisin Seiki delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a clear understanding of the external forces shaping Aisin Seiki's business landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed analysis provides actionable insights into the opportunities and threats Aisin Seiki faces in the global automotive parts market.

Sociological factors

Societal values are increasingly prioritizing sustainability, leading to a significant consumer shift towards eco-friendly transportation. This trend is evident in the growing demand for electric vehicles (EVs) and hybrid models, which directly influences Aisin Seiki's strategic direction.

By 2024, global EV sales are projected to exceed 13 million units, a substantial increase from previous years, underscoring the market's embrace of cleaner mobility. This surge in demand for electrified powertrains directly benefits Aisin, as it positions the company to supply critical components like electric motors, power control units, and hybrid transmissions.

Aisin's investment in developing advanced electrified drivetrain systems and energy-efficient solutions aligns perfectly with this consumer preference. The company's ability to innovate in this space is crucial for maintaining its competitive edge and capturing market share in the evolving automotive landscape.

Global urbanization is accelerating, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This shift significantly impacts transportation needs, potentially reducing individual car ownership in favor of shared mobility services and smaller, more fuel-efficient vehicles. Aisin, a key automotive component supplier, must innovate its product portfolio to align with these evolving urban lifestyles and environmental considerations.

In 2024, urban populations are projected to account for over 57% of the global population, a figure that continues to grow. This trend necessitates a reevaluation of traditional automotive component strategies, pushing for solutions that support electric vehicles, autonomous driving systems, and integrated mobility platforms. Aisin's ability to adapt its offerings, such as advanced powertrain components and intelligent safety systems, will be crucial for maintaining its market position in this dynamic landscape.

Aisin Seiki acknowledges the significant challenge of skill shortages, especially in advanced fields such as artificial intelligence and software development, which are crucial for its future. The company is actively investing in training programs and upskilling initiatives to ensure its workforce possesses the necessary competencies for these evolving technological landscapes.

To combat this, Aisin is prioritizing human capital development, aiming to build a robust talent pipeline. In 2024, the company reported significant investments in employee training and development programs, underscoring its commitment to bridging these skill gaps and fostering internal expertise.

Public Perception and Corporate Social Responsibility

Aisin's dedication to corporate social responsibility, particularly its environmental, social, and governance (ESG) efforts, plays a crucial role in shaping how the public views the company. Demonstrating strong environmental stewardship, for instance, by achieving recognition on CDP's 'A List' for its climate performance, bolsters its image as a conscientious global entity.

This focus on ESG is not merely for show; it directly impacts consumer trust and investor confidence. In 2023, for example, companies with robust ESG frameworks often saw better access to capital and a more favorable market valuation compared to their peers. Aisin's proactive stance in areas like reducing carbon emissions and promoting diversity within its workforce contributes to this positive public perception.

- Environmental Initiatives: Aisin actively pursues carbon neutrality goals, aiming for significant reductions in greenhouse gas emissions across its operations.

- Social Engagement: The company invests in community development programs and prioritizes employee well-being and safety, fostering a positive social impact.

- Governance Standards: Aisin upholds high standards of corporate governance, ensuring transparency, ethical conduct, and accountability to stakeholders.

- Public Recognition: Being recognized on platforms like CDP's 'A List' for environmental performance validates Aisin's commitment and enhances its public reputation.

Adaptation to Regional Consumer Preferences

Aisin Seiki's global reach hinges on its ability to understand and adapt to a wide array of regional consumer preferences. This means more than just selling the same products everywhere; it involves a deep dive into what makes consumers tick in different parts of the world. For instance, in the aftermarket segment, Aisin actively tailors its product offerings to align with specific local customer demands, ensuring relevance and desirability.

This strategic focus on regional tastes extends to expanding its portfolio beyond its own established brands. By incorporating products from other manufacturers that resonate with local markets, Aisin broadens its appeal and market penetration. This approach is vital for sustained growth, especially as consumer behaviors continue to evolve. For example, in 2024, Aisin reported a significant increase in sales from its customized aftermarket parts in Southeast Asia, directly attributed to this localized strategy.

- Regional Customization: Aisin tailors aftermarket product lines to meet specific local consumer needs, enhancing market fit.

- Portfolio Expansion: The company strategically incorporates non-in-house brands to better serve diverse regional demands.

- Market Responsiveness: Adapting to evolving consumer preferences is key to Aisin's global market success and competitive edge.

- Sales Impact: Localized strategies, like those in Southeast Asia in 2024, have demonstrably boosted sales figures for Aisin's aftermarket division.

Societal values are increasingly prioritizing sustainability, leading to a significant consumer shift towards eco-friendly transportation. This trend is evident in the growing demand for electric vehicles (EVs) and hybrid models, which directly influences Aisin Seiki's strategic direction.

By 2024, global EV sales are projected to exceed 13 million units, a substantial increase from previous years, underscoring the market's embrace of cleaner mobility. This surge in demand for electrified powertrains directly benefits Aisin, as it positions the company to supply critical components like electric motors, power control units, and hybrid transmissions.

Global urbanization is accelerating, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050. This shift significantly impacts transportation needs, potentially reducing individual car ownership in favor of shared mobility services and smaller, more fuel-efficient vehicles.

In 2024, urban populations are projected to account for over 57% of the global population, a figure that continues to grow. This trend necessitates a reevaluation of traditional automotive component strategies, pushing for solutions that support electric vehicles, autonomous driving systems, and integrated mobility platforms.

Technological factors

Aisin is a key player in the evolution of electric vehicle powertrains, focusing on advanced e-Axles and hybrid units. Their commitment to innovation is evident in their pursuit of next-generation technologies, including strategic partnerships aimed at creating more efficient and compact electric units for a range of electric vehicles.

For instance, Aisin's development of integrated e-Axles, which combine the motor, inverter, and reduction gear, streamlines EV design and improves performance. This technological advancement is crucial as the global EV market continues its rapid expansion. By 2024, the demand for these sophisticated powertrain components is expected to surge, with Aisin positioned to capitalize on this trend through its ongoing research and development efforts.

Aisin is actively contributing to the advancement of vehicle intelligence through its development of integrated control systems and sophisticated sensing technologies. These innovations are crucial for enhancing driving performance and bolstering vehicle safety.

The company's focus on these areas directly supports the progression towards autonomous driving capabilities. In 2023, the global market for advanced driver-assistance systems (ADAS), a precursor to autonomous driving, was valued at approximately $35.5 billion, with projections indicating significant growth in the coming years, underscoring the importance of Aisin's technological investments.

Aisin is deeply invested in technological advancements, particularly in lightweight materials and sophisticated manufacturing techniques, to boost vehicle efficiency and achieve environmental targets. This focus is critical for meeting increasingly stringent emissions standards and consumer demand for eco-friendly transportation.

The company's strategy includes downsizing components, a move that directly benefits from these material innovations. For instance, the adoption of advanced high-strength steels and aluminum alloys in their driveline components can lead to significant weight reductions, contributing to better fuel economy.

Furthermore, Aisin is leveraging automation and optimizing energy consumption within its production lines. In 2024, the automotive industry saw a continued push for Industry 4.0 integration, with companies like Aisin investing in smart factories to enhance production speed and reduce waste, ultimately improving their competitive edge.

Digitalization of Manufacturing and Industry 4.0

Aisin Seiki is actively integrating digitalization across its manufacturing processes, a key component of its Industry 4.0 strategy. This involves the adoption of smart factory principles and sophisticated automation systems designed to enhance efficiency and lower expenses.

The company is deploying technologies such as Autonomous Mobile Robots (AMRs) and automated assembly lines. For instance, by Q3 2024, Aisin reported a 15% increase in production line throughput at its key facilities due to the implementation of these robotic solutions, directly contributing to cost savings and improved output quality.

- Smart Factory Implementation: Aisin is investing heavily in IoT sensors and data analytics to create interconnected and intelligent production environments.

- Robotics in Automation: The use of AMRs and collaborative robots is streamlining material handling and assembly tasks, aiming for a 10% reduction in labor costs for specific operations by end of 2025.

- Efficiency Gains: Digitalization efforts are projected to boost overall equipment effectiveness (OEE) by up to 12% in pilot programs by early 2025.

- Cost Reduction: Automation and optimized processes are expected to yield significant operational cost reductions, estimated at 5-7% across affected divisions by 2025.

Software Integration and Cybersecurity for In-Vehicle Systems

The growing intricacy of automotive systems demands sophisticated software integration and rigorous cybersecurity. Aisin Seiki is actively developing control software specifically for electric vehicles, a sector projected to reach over 30 million units globally by 2025, highlighting the critical need for secure and efficient software architecture.

Aisin's strategic collaborations aim to bolster AI and software development expertise within the broader automotive ecosystem. This focus is crucial as the automotive industry increasingly relies on data-driven insights and connected services, with cybersecurity threats evolving rapidly. For instance, the automotive cybersecurity market was valued at approximately $2.5 billion in 2023 and is expected to grow substantially, underscoring the importance of Aisin's investments in this area.

- Software Complexity: Modern vehicles feature millions of lines of code, requiring seamless integration of diverse software modules for powertrain, infotainment, and driver-assistance systems.

- Cybersecurity Imperative: Protecting vehicle systems from malicious attacks is paramount, with incidents of vehicle hacking driving demand for advanced security protocols.

- AI and Connectivity: Aisin's focus on AI and software enhancement supports the trend towards autonomous driving and connected car features, which are heavily reliant on robust software foundations.

Aisin Seiki is heavily invested in technological advancements, particularly in lightweight materials and sophisticated manufacturing techniques to boost vehicle efficiency and meet environmental targets. This focus is critical for meeting increasingly stringent emissions standards and consumer demand for eco-friendly transportation.

The company's strategy includes downsizing components, a move that directly benefits from these material innovations. For instance, the adoption of advanced high-strength steels and aluminum alloys in their driveline components can lead to significant weight reductions, contributing to better fuel economy.

Furthermore, Aisin is leveraging automation and optimizing energy consumption within its production lines. In 2024, the automotive industry saw a continued push for Industry 4.0 integration, with companies like Aisin investing in smart factories to enhance production speed and reduce waste, ultimately improving their competitive edge.

Aisin Seiki is actively integrating digitalization across its manufacturing processes, a key component of its Industry 4.0 strategy. This involves the adoption of smart factory principles and sophisticated automation systems designed to enhance efficiency and lower expenses.

| Technological Factor | Aisin's Focus | Impact/Data Point |

| EV Powertrain Innovation | Advanced e-Axles, Hybrid Units | Global EV market expansion driving demand for sophisticated powertrain components. |

| Vehicle Intelligence | Integrated Control Systems, Sensing Technologies | ADAS market valued at $35.5 billion in 2023, crucial for autonomous driving progression. |

| Lightweight Materials | Advanced High-Strength Steels, Aluminum Alloys | Contributes to better fuel economy and meeting emissions standards. |

| Smart Factory/Automation | IoT, Data Analytics, AMRs | 15% increase in production line throughput at key facilities by Q3 2024 due to robotic solutions. |

| Software & Cybersecurity | EV Control Software, AI Integration | Automotive cybersecurity market valued at $2.5 billion in 2023, with significant expected growth. |

Legal factors

Aisin Seiki operates under a complex web of global environmental and emissions regulations, directly impacting its product design and manufacturing operations. These legal frameworks necessitate significant investment in cleaner technologies and sustainable practices to ensure compliance. For instance, the increasing stringency of CO2 emission standards for vehicles worldwide, such as those in Europe and China, pushes Aisin to innovate in areas like electrification and lightweight materials.

The company has proactively addressed these legal requirements by setting ambitious sustainability goals. Aisin aims for carbon neutrality in its production activities by 2035 and across its entire value chain by 2050. This commitment is a direct response to evolving regulatory landscapes and growing stakeholder expectations regarding environmental stewardship.

Aisin Seiki's global footprint means navigating a complex web of international trade laws and tariff regulations. These legal frameworks directly influence the cost of goods, market access, and overall profitability for the company's diverse product lines, from automotive components to home appliances.

For instance, the ongoing trade disputes and implementation of reciprocal tariffs in 2023 and early 2024 have demonstrably affected Aisin’s financial performance. Reports indicate that these tariffs have added to production costs and necessitated strategic shifts in sourcing and manufacturing locations to maintain competitive pricing and ensure compliance with varying national trade policies.

Aisin, as a global automotive component manufacturer, navigates a complex web of product safety and quality regulations across its diverse markets. For instance, in 2024, the European Union's General Safety Regulation (GSR) mandates advanced driver-assistance systems (ADAS) in new vehicles, directly impacting Aisin's component development for braking and chassis systems. Failure to meet these evolving standards, such as those for autonomous driving components, can lead to significant penalties and reputational damage.

Intellectual Property Rights and Patent Protection

Aisin Seiki's significant investment in R&D for areas like electrification and intelligent systems, which amounted to ¥262.9 billion in the fiscal year ending March 2024, hinges on strong intellectual property (IP) protection. This legal framework safeguards their innovations, ensuring a competitive edge in these rapidly evolving automotive sectors.

Collaborations and joint ventures, such as Aisin's partnerships in battery development, demand meticulously crafted agreements. These contracts clearly define patent ownership and technology licensing terms, preventing disputes and facilitating the smooth transfer and utilization of proprietary knowledge.

- Patent Portfolio Growth: Aisin actively manages a substantial patent portfolio, with filings increasing in key technological domains.

- Licensing Revenue: Revenue generated from technology licensing agreements contributes to Aisin's financial stability and R&D reinvestment.

- Global IP Enforcement: The company employs legal strategies to enforce its IP rights across major automotive markets worldwide.

- Trade Secret Protection: Beyond patents, Aisin implements stringent measures to protect confidential information and trade secrets integral to its manufacturing processes.

Labor Laws and Employment Regulations

Aisin Seiki operates globally, necessitating adherence to a complex web of labor laws and employment regulations across its various manufacturing and operational sites. This includes complying with minimum wage requirements, working hour limits, and health and safety standards that can differ significantly from country to country. For instance, in 2024, the average minimum wage in countries where Aisin has significant operations varied widely, from approximately $2.00 per hour in some Southeast Asian nations to over $15.00 per hour in certain European countries, impacting labor costs and operational strategies.

The company must also ensure fair treatment and uphold fundamental human rights for its workforce, including the right to organize and bargain collectively. This commitment is crucial for maintaining positive employee relations and avoiding legal disputes or reputational damage. In 2024, reports indicated that labor unions represented a significant portion of the workforce in several of Aisin's key markets, underscoring the importance of constructive engagement with employee representative bodies.

- Global Compliance: Aisin must navigate varying labor laws, including those related to working hours, overtime pay, and termination procedures, across its international operations.

- Fair Working Conditions: Ensuring safe workplaces, reasonable working hours, and equitable compensation is paramount to Aisin's operational integrity and employee morale.

- Employee Rights: Respecting employees' rights to freedom of association and collective bargaining is a legal and ethical imperative in many of Aisin's operating jurisdictions.

- Regulatory Scrutiny: Increased global focus on supply chain labor practices means Aisin faces heightened scrutiny regarding its compliance with international labor standards and human rights conventions.

Aisin Seiki navigates a complex global legal landscape, from stringent environmental regulations like CO2 emission standards impacting product design to international trade laws affecting costs and market access. The company's 2024 investments in R&D, totaling ¥262.9 billion, are protected by robust intellectual property laws, crucial for its innovations in automotive components. Furthermore, compliance with diverse labor laws and ensuring fair working conditions across its global operations remain critical for operational integrity and avoiding legal repercussions.

| Legal Area | Key Regulations/Considerations | Impact on Aisin Seiki (2024/2025 Focus) |

|---|---|---|

| Environmental | CO2 emission standards (EU, China), sustainability targets (carbon neutrality by 2035/2050) | Drives investment in cleaner tech, electrification, lightweight materials; impacts manufacturing processes. |

| Trade Law | Tariffs, trade disputes (ongoing from 2023/2024) | Affects production costs, necessitates strategic sourcing and manufacturing location adjustments. |

| Product Safety & Quality | EU General Safety Regulation (GSR) mandating ADAS, autonomous driving component standards | Requires advanced component development for braking and chassis systems; non-compliance incurs penalties. |

| Intellectual Property | Patent protection, technology licensing agreements | Safeguards R&D investments (¥262.9B in FY24), ensures competitive edge, facilitates collaborations. |

| Labor Law | Minimum wage, working hours, health & safety, freedom of association | Influences labor costs (varying minimum wages globally), necessitates fair treatment and engagement with unions. |

Environmental factors

Aisin Seiki is actively pursuing carbon neutrality, with a target for production facilities to achieve this by 2035. This commitment extends further, with a broader goal of carbon neutrality across its entire value chain by 2050.

These ambitious environmental targets are driving significant investments in sustainable technologies and operational efficiencies. For instance, in fiscal year 2023, Aisin reported a reduction in CO2 emissions from its production activities, a step towards its 2035 goal.

Aisin Seiki is committed to reducing its environmental impact, focusing on sustainable production and energy efficiency. The company is actively working to lower CO2 emissions from its manufacturing facilities. For instance, Aisin has invested in solar power generation facilities, aiming to harness renewable energy sources.

Further demonstrating this commitment, Aisin is exploring the use of biofuels to power its production lines, seeking alternatives to traditional fossil fuels. These initiatives are crucial as global regulations and consumer demand for environmentally responsible practices continue to grow, influencing operational costs and market perception.

Aisin Seiki is actively pursuing eco-friendly product development, focusing on innovations that minimize environmental impact. A prime example is their work on high-efficiency e-Axles and hybrid units, crucial components for next-generation vehicles.

These advanced systems are engineered to optimize electricity consumption, directly contributing to lower CO2 emissions in automotive applications. This strategic direction aligns with the global push for a more sustainable automotive sector, a trend that gained significant momentum through 2024 and is projected to accelerate into 2025.

Supply Chain Decarbonization Efforts

Aisin Seiki is actively extending its environmental commitment beyond its own operations by focusing on supply chain decarbonization. This involves close collaboration with its suppliers and participation in projects with national organizations to drive down emissions throughout the value chain.

The company's overarching goal is to achieve carbon neutrality across its entire ecosystem, not solely within its direct manufacturing and operational footprint. This comprehensive strategy recognizes the significant environmental impact that can occur upstream and downstream in the production process.

Key initiatives include:

- Supplier Engagement Programs: Aisin implements programs to educate and support suppliers in adopting sustainable practices and reducing their carbon emissions.

- Collaborative Decarbonization Projects: The company partners with national bodies and industry groups on projects aimed at developing and implementing decarbonization technologies and strategies within the automotive supply chain.

- Value Chain Emission Reduction Targets: Aisin is setting and working towards specific targets for reducing Scope 3 emissions, which encompass emissions from its supply chain and the use of its products.

- Promoting Green Logistics: Efforts are underway to optimize transportation and logistics within the supply chain to minimize fuel consumption and associated greenhouse gas emissions.

ESG Reporting and External Environmental Recognition

Aisin Seiki demonstrates a strong commitment to environmental stewardship through its active publication of comprehensive ESG reports. This transparency allows stakeholders to assess the company's performance and future strategies regarding environmental impact.

The company's dedication to environmental responsibility has garnered significant external validation. For instance, Aisin Seiki's consistent inclusion on CDP's 'A List' for climate change highlights its robust efforts in managing and mitigating climate-related risks and opportunities. This recognition underscores Aisin's advanced approach to environmental disclosure and performance.

- Consistent CDP 'A List' Inclusion: Aisin Seiki has been repeatedly recognized by CDP for its leadership in climate action, signifying a high level of environmental performance and transparency.

- Enhanced Stakeholder Trust: Regular ESG reporting builds credibility and fosters trust among investors, customers, and communities concerned with environmental sustainability.

- Risk Mitigation and Opportunity Identification: Proactive environmental management, as reflected in its reporting and external accolades, helps Aisin identify potential environmental risks and capitalize on emerging green business opportunities.

Aisin Seiki is deeply invested in environmental sustainability, aiming for carbon neutrality in its production facilities by 2035 and across its entire value chain by 2050. This commitment is backed by concrete actions, including investments in renewable energy sources like solar power and exploring biofuels for its operations, reflecting a proactive stance on climate change mitigation. The company's focus on eco-friendly product development, such as high-efficiency e-Axles, directly addresses the automotive industry's shift towards greener technologies, a trend that intensified through 2024 and into 2025.

| Environmental Target | Status/Progress | Key Initiative Example |

|---|---|---|

| Production Facility Carbon Neutrality | Target: 2035 | Investment in solar power generation facilities |

| Value Chain Carbon Neutrality | Target: 2050 | Supplier engagement programs for emission reduction |

| CO2 Emission Reduction (Production) | Progress reported in FY2023 | Exploring use of biofuels |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Aisin Seiki is built on a foundation of comprehensive data from reputable sources, including global economic databases, official government publications, and leading industry research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant.