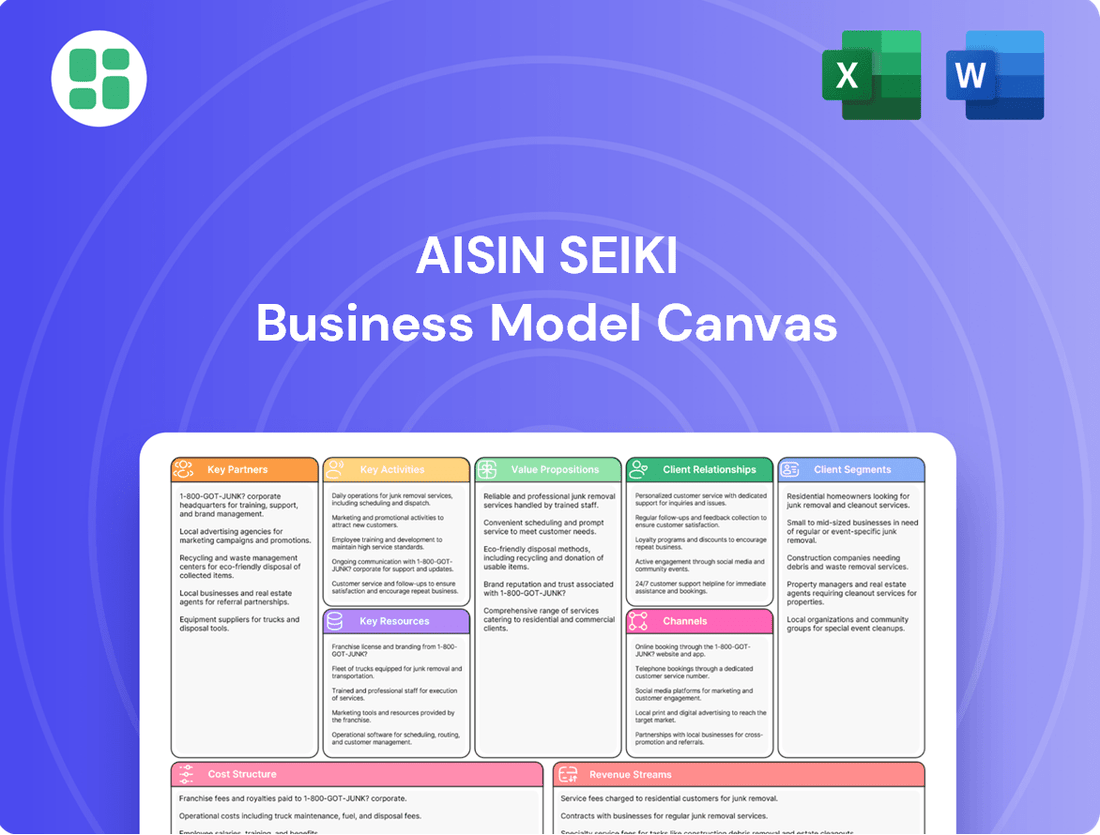

Aisin Seiki Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aisin Seiki Bundle

Discover the intricate workings of Aisin Seiki's business model with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights for strategic planning. Download the full canvas to unlock a deeper understanding of their success.

Partnerships

Aisin's key partnerships are with major global automotive OEMs, including Toyota, General Motors, Honda, Mercedes-Benz, and Subaru. These collaborations are fundamental to Aisin's business, as they involve supplying a broad range of components and ensuring their integration into new vehicle models. For instance, Aisin's transmissions are a critical component in many Toyota vehicles, reflecting a deep and enduring relationship.

These long-standing OEM relationships are vital for Aisin's market position and allow for continuous integration into new vehicle platforms. The company's deep involvement with its partners ensures it remains relevant in the evolving automotive landscape. In 2023, Toyota, Aisin's largest customer, accounted for a significant portion of its revenue, underscoring the importance of this partnership.

Beyond component supply, these collaborations extend to the joint development of future technologies, particularly in areas like vehicle electrification and advanced driver-assistance systems. This forward-looking approach ensures Aisin stays at the forefront of automotive innovation, working with partners to shape the next generation of mobility solutions.

Aisin Seiki actively pursues technology and R&D alliances, particularly focusing on advancements in vehicle electrification, intelligent systems, and achieving carbon neutrality. For instance, their collaboration with Manufacture 2030 is a prime example of their commitment to accelerating decarbonization throughout their extensive supply chain.

These strategic partnerships allow Aisin to tap into specialized external knowledge and resources, fostering the development of innovative solutions. This approach is crucial for staying ahead in a rapidly changing automotive landscape, ensuring they can effectively meet the dynamic demands of the industry.

Aisin Seiki's supply chain hinges on strong relationships with raw material suppliers and logistics experts. These collaborations are crucial for ensuring Aisin can consistently source necessary components and deliver its automotive parts globally, on time and within budget. For instance, in 2024, Aisin continued to emphasize supplier development programs aimed at enhancing quality and efficiency across its network.

The company actively works with its partners to meet evolving sustainability standards. This includes initiatives to reduce environmental impact throughout the supply chain, from material sourcing to transportation. Aisin's commitment to responsible sourcing and operational resilience in 2024 was evident in its ongoing supplier audits and collaborative improvement projects.

Aftermarket Service Network

Aisin is actively building its aftermarket service network through strategic collaborations. A key development is the formation of Aisin Aftermarket & Service of America, Inc., a new entity consolidating its transmission remanufacturing division, AWTEC, with its existing aftermarket business unit. This move aims to streamline operations and enhance service delivery.

To bolster its global presence and service capabilities, Aisin is strengthening relationships with regional sales organizations, such as Aisin Sales Latin America. Furthermore, the company is strategically acquiring business assets to solidify its aftermarket footprint. These partnerships are crucial for providing integrated parts and comprehensive service solutions worldwide.

- Aisin Aftermarket & Service of America, Inc.: A new company formed to integrate transmission remanufacturing (AWTEC) and aftermarket business units.

- Regional Sales Entities: Collaborations with entities like Aisin Sales Latin America to expand market reach.

- Acquisition of Business Assets: Strategic purchases to strengthen the company's aftermarket infrastructure and service capabilities.

- Global Parts and Service Solutions: The overarching goal is to offer a complete suite of aftermarket offerings across international markets.

Government and Industry Associations

Aisin Seiki actively collaborates with government entities and industry associations to ensure compliance with evolving regulations and to champion the adoption of new industry standards. This engagement is crucial for navigating international markets and influencing the trajectory of automotive innovation, particularly in areas like environmental sustainability and the development of advanced mobility solutions. For instance, Aisin's commitment to transparency is demonstrated through its sustainability reporting, which adheres to globally recognized frameworks such as the Global Reporting Initiative (GRI) and the Task Force on Climate-related Financial Disclosures (TCFD).

Their participation in these forums allows Aisin to contribute to policy discussions that shape the future of the automotive sector. In 2024, a significant focus for many automotive industry associations has been on the standardization of charging infrastructure for electric vehicles and the development of guidelines for autonomous driving systems, areas where Aisin is a key player.

- Regulatory Alignment: Aisin works with governments to meet environmental regulations, such as emission standards, and safety requirements for automotive components.

- Industry Standards: Collaboration with associations helps Aisin contribute to and adopt common technical specifications for new technologies, like advanced driver-assistance systems (ADAS).

- Policy Influence: Aisin's input into policy development supports initiatives for sustainable manufacturing and the growth of the electrified vehicle market.

- Sustainability Reporting: Adherence to GRI and TCFD frameworks in 2024 underscores Aisin's dedication to transparently communicating its environmental, social, and governance (ESG) performance.

Aisin's key partnerships are primarily with major automotive original equipment manufacturers (OEMs), including Toyota, General Motors, and Honda. These collaborations are crucial for supplying a wide array of components and ensuring their seamless integration into new vehicle models. For instance, Aisin's transmissions are a critical component in many Toyota vehicles, reflecting a deep and enduring relationship that significantly contributes to Aisin's revenue. In 2023, Toyota represented a substantial portion of Aisin's sales, highlighting the paramount importance of this partnership.

| Partner Type | Key Partners | Nature of Collaboration | 2023/2024 Relevance |

|---|---|---|---|

| Automotive OEMs | Toyota, General Motors, Honda, Mercedes-Benz, Subaru | Component supply, joint technology development (EVs, ADAS) | Toyota accounted for a significant revenue share in 2023; ongoing integration into new platforms. |

| Technology & R&D Alliances | Various technology firms | Advancements in electrification, intelligent systems, carbon neutrality | Collaboration with Manufacture 2030 for supply chain decarbonization. |

| Supply Chain Partners | Raw material suppliers, logistics providers | Ensuring consistent component sourcing and global delivery | Focus on supplier development for quality and efficiency in 2024; responsible sourcing initiatives. |

| Aftermarket & Service Providers | Regional sales organizations, acquired businesses | Expanding aftermarket presence, service delivery | Formation of Aisin Aftermarket & Service of America, Inc.; strengthening regional networks. |

| Government & Industry Associations | Regulatory bodies, industry groups | Compliance, standard setting, policy influence | Engagement on EV charging standards and autonomous driving guidelines in 2024; adherence to GRI/TCFD reporting. |

What is included in the product

Aisin Seiki's Business Model Canvas showcases its deep integration within the automotive supply chain, focusing on diverse customer segments like major automakers and aftermarket providers through robust manufacturing capabilities and extensive distribution channels.

This model highlights Aisin's value proposition of high-quality, innovative automotive components and systems, supported by strong partnerships and efficient cost structures.

Aisin Seiki's Business Model Canvas acts as a pain point reliver by providing a clear, one-page snapshot of their complex operations, allowing stakeholders to quickly grasp key relationships and identify areas for improvement.

Activities

Aisin Seiki's commitment to Research and Development is a cornerstone of its business model, driving innovation in automotive technology. In fiscal year 2024, the company continued to allocate significant resources towards developing cutting-edge solutions, with a particular emphasis on electrification and autonomous driving systems.

Key R&D activities in 2024 included advancements in eAxles for electric vehicles and integrated vehicle control technologies, reflecting Aisin's strategic focus on future mobility trends. The company is also actively exploring technologies for carbon neutrality, such as perovskite solar cells, demonstrating a forward-looking approach to sustainability.

Aisin Seiki's manufacturing and production is a global powerhouse, crafting a wide array of automotive components, energy systems, and lifestyle goods from its numerous facilities. This extensive network underpins its ability to serve diverse markets and customer needs.

The company is strategically revamping its worldwide production infrastructure, with significant investments in plant expansions to accommodate emerging business ventures and enhance operational efficiency. For instance, Aisin is preparing its facilities for the increased production of electrified vehicle components, a key area for future growth.

In 2024, Aisin continued its focus on optimizing existing manufacturing assets while simultaneously building capacity for new technologies. This proactive approach ensures they remain competitive and responsive to the evolving demands of the automotive and other industries they serve.

Aisin's key activities in global supply chain management involve the intricate orchestration of raw material procurement, precise inventory management, and the seamless flow of goods through efficient logistics and distribution networks. This complex undertaking is fundamental to their operational success.

Aisin is actively engaged in enhancing its supply chain efficiency and driving down costs. A prime example of this commitment is the strategic development of new logistics centers. These facilities are deliberately positioned in close proximity to their manufacturing plants, a move designed to guarantee prompt deliveries and bolster overall operational effectiveness.

Sales, Marketing, and Customer Support

Aisin Seiki's key activities in sales, marketing, and customer support are crucial for its market presence. The company engages in direct sales to Original Equipment Manufacturers (OEMs), a core channel for its automotive components. Developing targeted aftermarket sales strategies is also vital for reaching a broader customer base beyond new vehicle production.

Aisin is actively overhauling its global aftermarket strategy. This initiative aims to position Aisin as a comprehensive parts and service provider, expanding its product offerings and significantly enhancing the overall customer experience. This strategic shift is designed to capture more value in the post-sales market.

A significant aspect of this overhaul involves tailoring product lines to meet the specific needs of local markets across Aisin's extensive global operations. This localized approach ensures relevance and competitiveness. For example, in 2024, Aisin's aftermarket segment continued to see growth, driven by increased vehicle parc and a focus on quality replacement parts.

- Direct OEM Sales: Aisin maintains strong relationships with major automotive manufacturers for the supply of its components.

- Aftermarket Strategy Overhaul: The company is investing in becoming a full-service provider in the aftermarket sector.

- Global Product Localization: Product lines are adapted to suit regional demands and preferences worldwide.

- Enhanced Customer Experience: Aisin is focusing on improving service delivery and customer satisfaction across all touchpoints.

Strategic Business Restructuring

Aisin Seiki is actively engaged in strategic business restructuring, a crucial element of its evolving business model. This involves significant organizational consolidation across its North American operations, alongside the merger of its aftermarket divisions. These moves are designed to foster a more agile and resilient management framework.

The primary objectives behind these structural reforms are to boost profitability and fortify both group-level and local management capabilities. This comprehensive overhaul, termed a 'full model change,' is a proactive measure to sharpen Aisin's competitive edge and ensure its adaptability in a rapidly shifting market landscape.

For instance, in 2024, Aisin announced plans to integrate its North American subsidiaries, aiming for greater operational efficiency. This restructuring is expected to yield cost savings and streamline decision-making processes, ultimately contributing to improved financial performance.

- Organizational Consolidation: Merging various North American business units to create a unified and efficient structure.

- Aftermarket Unit Merger: Combining aftermarket operations to enhance service delivery and market reach.

- Enhanced Management System: Implementing reforms for greater flexibility, robustness, and improved profitability.

- Competitiveness Boost: Adapting to dynamic market demands through a 'full model change' strategy.

Aisin Seiki's key activities in R&D are focused on future mobility, with significant investment in electrification and autonomous driving technologies. In fiscal year 2024, this included advancements in eAxles and integrated vehicle control systems, alongside research into carbon-neutral solutions like perovskite solar cells.

The company's manufacturing and production efforts in 2024 involved optimizing existing global facilities and expanding capacity for electrified vehicle components. This strategic revamping of its production infrastructure aims to enhance operational efficiency and accommodate new business ventures.

Aisin's supply chain management in 2024 concentrated on improving efficiency and reducing costs, notably through the development of new logistics centers positioned near manufacturing plants for prompt deliveries. This strategic placement bolsters overall operational effectiveness.

Key sales and marketing activities in 2024 included a significant overhaul of Aisin's global aftermarket strategy to become a comprehensive parts and service provider. This initiative aims to enhance customer experience and capture more value in the post-sales market, with product lines tailored for local market needs.

Strategic business restructuring in 2024 involved organizational consolidation in North America and the merger of aftermarket divisions. These efforts, part of a 'full model change,' aim to boost profitability, strengthen management capabilities, and sharpen Aisin's competitive edge in a dynamic market.

| Key Activity | Focus Area | 2024 Highlight |

|---|---|---|

| Research & Development | Electrification, Autonomous Driving, Carbon Neutrality | Advancements in eAxles, perovskite solar cell research |

| Manufacturing & Production | Global Infrastructure Optimization, EV Component Capacity | Plant expansions for electrified vehicle components |

| Supply Chain Management | Efficiency Enhancement, Cost Reduction, Logistics | Development of new logistics centers near plants |

| Sales, Marketing & Customer Support | Aftermarket Strategy Overhaul, Product Localization | Becoming a full-service aftermarket provider, tailored product lines |

| Business Restructuring | Organizational Consolidation, Profitability Improvement | North American subsidiaries integration, aftermarket unit merger |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the comprehensive analysis of Aisin Seiki's operations, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain full access to this same ready-to-use document, allowing you to immediately leverage its insights.

Resources

Aisin Seiki's intellectual property, including a substantial patent portfolio and proprietary technologies, is a cornerstone of its business model. This intellectual capital is particularly strong in automotive components and emerging areas like electrification, allowing them to create innovative products such as eAxles and advanced braking systems. Aisin's commitment to research and development, evidenced by significant R&D spending, continuously bolsters this crucial resource.

Aisin Seiki leverages a vast global manufacturing footprint, encompassing numerous facilities in key regions like Japan, North America, and ASEAN. This extensive network is fundamental to its mass production capabilities, ensuring a robust global supply chain and the flexibility for localized manufacturing to cater to diverse regional market needs.

In 2024, Aisin continued its strategic focus on optimizing these facilities. For instance, the company has been investing in advanced automation and smart factory technologies to enhance efficiency and product quality across its production bases, aiming to solidify its competitive edge in the automotive components sector.

Aisin Seiki’s skilled workforce, comprising engineers, researchers, and manufacturing specialists, is a critical asset. This expertise underpins their ability to innovate and maintain high production standards.

The company’s commitment to human capital development is evident in its ongoing training programs. These initiatives ensure employees possess cutting-edge skills in design, production, and quality control, vital for their competitive edge.

In 2023, Aisin Seiki reported approximately 117,000 employees globally. This extensive talent pool is instrumental in driving the technological advancements and operational excellence that characterize the company's success.

Financial Capital

Aisin Seiki relies on substantial financial capital to fuel its ambitious growth. This capital is critical for funding extensive research and development, enabling the company to stay at the forefront of automotive technology. It also supports significant capital expenditures for expanding its manufacturing capabilities and investing in new production facilities to meet global demand.

Furthermore, Aisin's financial strength allows for strategic acquisitions, which are key to broadening its product portfolio and market reach. The company's ability to allocate resources effectively towards these growth domains and necessary structural reforms underscores its robust financial health. This financial capacity is a cornerstone supporting its long-term strategic objectives and ensuring continued innovation.

- R&D Investment: Aisin consistently invests heavily in R&D to develop next-generation automotive components and systems.

- Capital Expenditures: Significant funds are allocated to upgrade and expand manufacturing plants, incorporating advanced automation and efficiency improvements.

- Acquisitions: Financial capital facilitates strategic M&A activities to enhance technological capabilities and market presence.

- Operational Funding: Sufficient capital ensures smooth day-to-day operations, supply chain management, and employee development.

Brand Reputation and Customer Relationships

Aisin Seiki's brand reputation is a cornerstone of its business, built on a legacy of quality, reliability, and continuous innovation. This strong image is a significant intangible asset, directly influencing customer loyalty and market position.

The company cultivates deep, long-standing relationships with major automotive original equipment manufacturers (OEMs). These partnerships are crucial, ensuring recurring business and providing a stable revenue stream, underpinned by Aisin's proven track record.

Aisin's commitment to excellence is consistently recognized by industry leaders. For instance, receiving the 'Supplier of the Year' award from General Motors is a testament to their superior performance and a clear indicator of their esteemed standing among global automotive suppliers.

- Brand Reputation: Aisin is globally recognized for its high-quality automotive components and commitment to technological advancement.

- Customer Relationships: Long-term partnerships with major automakers like Toyota, Volkswagen, and General Motors provide a stable base of recurring revenue.

- Industry Recognition: Awards such as 'Supplier of the Year' from major OEMs validate Aisin's consistent delivery of quality and innovation.

- Customer Loyalty: Decades of reliable performance foster strong customer loyalty, reducing customer acquisition costs and ensuring continued demand.

Aisin Seiki's intellectual property, particularly its patents in automotive components and electrification technologies, forms a vital resource. This IP enables the creation of advanced products like eAxles and sophisticated braking systems, supported by continuous R&D investment.

The company's extensive global manufacturing network, with numerous facilities across key regions, is essential for its large-scale production capabilities. This footprint ensures a robust supply chain and manufacturing flexibility to meet diverse regional demands.

Aisin's skilled workforce, comprising specialized engineers and researchers, is a critical asset. Their expertise drives innovation and maintains high production standards, reinforced by ongoing employee training programs.

Substantial financial capital is deployed for extensive R&D, manufacturing expansion, and strategic acquisitions. This financial strength underpins Aisin's growth objectives and commitment to innovation.

Aisin's strong brand reputation for quality and reliability, coupled with deep relationships with major OEMs, ensures customer loyalty and recurring revenue. Industry accolades, such as GM's Supplier of the Year award, underscore its esteemed market position.

| Key Resource | Description | 2023/2024 Data/Examples |

|---|---|---|

| Intellectual Property | Patents and proprietary technologies in automotive components and electrification. | Focus on eAxles and advanced braking systems. Significant R&D investment. |

| Global Manufacturing Footprint | Extensive network of production facilities in key regions. | Enables mass production and localized manufacturing. Investment in automation and smart factory tech in 2024. |

| Skilled Workforce | Expertise in design, production, and quality control. | Approximately 117,000 employees globally in 2023. Ongoing training programs. |

| Financial Capital | Funding for R&D, capital expenditures, and strategic acquisitions. | Supports innovation, manufacturing expansion, and M&A activities. |

| Brand Reputation & Relationships | Legacy of quality, reliability, and strong OEM partnerships. | Awarded 'Supplier of the Year' by General Motors. Deep relationships with major automakers. |

Value Propositions

Aisin delivers a comprehensive portfolio of automotive components, encompassing critical systems like drivetrains, brakes, chassis, body, and engine parts, all recognized for exceptional quality and unwavering reliability.

This dedication to superior quality is fundamental to Aisin's value proposition, directly contributing to enhanced safety, optimized performance, and extended durability for both original equipment manufacturers (OEMs) and the drivers who rely on their vehicles.

Aisin’s robust quality management systems and continuous employee training initiatives are key drivers behind this consistent delivery of high-caliber automotive components, reinforcing their reputation in the industry.

Aisin Seiki is at the forefront of automotive technology, particularly in the burgeoning field of electrification. Their innovative eAxles are a prime example, powering both electric vehicles (EVs) and hybrid electric vehicles (HEVs), a critical component for the transition to sustainable mobility. In 2024, the automotive industry saw continued strong demand for electrified powertrains, with projections indicating significant growth in EV sales, underscoring the relevance of Aisin's offerings.

Beyond electrification, Aisin's commitment to advanced technology extends to intelligent vehicle systems. These solutions are designed to enhance driving performance and bolster safety, directly addressing consumer demand for more sophisticated and secure automotive experiences. Their substantial investments in research and development, often exceeding billions of yen annually, ensure they remain a leader in delivering these advanced features to automakers worldwide.

Aisin Seiki's product portfolio extends far beyond its foundational automotive components. The company actively develops and markets solutions in energy systems, housing and lifestyle products, and industrial equipment, demonstrating a commitment to broad market engagement. This strategic diversification is key to mitigating risks associated with reliance on any single industry, allowing Aisin to serve a more extensive customer base with integrated offerings.

In 2023, Aisin's automotive segment continued to be a significant revenue driver, but the company's expansion into other sectors is notable. For instance, their energy systems division is increasingly contributing to their overall business, particularly with the growing demand for sustainable energy solutions. This approach positions Aisin as a versatile provider capable of addressing diverse market needs.

Furthermore, Aisin's aftermarket strategy emphasizes becoming a comprehensive 'one-stop shop' for automotive parts. This initiative aims to capture a larger share of the after-sales market by offering a complete range of products, thereby enhancing customer loyalty and convenience. This focus on a diversified and integrated product offering underpins Aisin's robust business model.

Global Supply and Localized Support

Aisin's value proposition of Global Supply and Localized Support is built upon an extensive international footprint. With operations in 17 countries and 36 locations, they leverage a vast manufacturing and distribution network to ensure consistent product availability worldwide.

This global reach is complemented by a strong emphasis on localized support, allowing Aisin to tailor product offerings and technical assistance to specific regional demands. Strategic logistics centers are integral to this model, facilitating efficient delivery and responsive customer service across diverse markets.

- Global Manufacturing Footprint: Operates in 17 countries with 36 locations, ensuring broad production and distribution capabilities.

- Localized Product Adaptation: Develops product lines that meet specific regional needs and customer preferences.

- Responsive Technical Assistance: Provides dedicated support tailored to the local markets they serve.

- Efficient Logistics Network: Utilizes strategic logistics centers to optimize supply chain operations and delivery times.

Commitment to Sustainability and Carbon Neutrality

Aisin is deeply committed to sustainability, setting an ambitious target of achieving carbon neutrality by 2050. This dedication is woven into their business strategy through robust ESG (Environmental, Social, and Governance) initiatives.

Their product portfolio actively supports environmental goals, featuring eco-friendly innovations like fuel cell cogeneration systems and advanced perovskite solar cells. These offerings directly appeal to a growing segment of environmentally aware consumers and investors.

- Carbon Neutrality Goal: Targeting carbon neutrality by 2050.

- ESG Integration: Incorporating ESG principles across all business operations.

- Eco-Friendly Products: Developing and promoting solutions like fuel cell systems and perovskite solar cells.

- Supply Chain Decarbonization: Collaborating with partners to reduce the carbon footprint throughout their value chain.

Aisin Seiki's value proposition centers on delivering high-quality, reliable automotive components that enhance vehicle safety, performance, and longevity. They are also a key player in the transition to sustainable mobility through their innovative electrification technologies, such as eAxles, which are crucial for the growing EV and HEV markets. Furthermore, Aisin offers advanced intelligent vehicle systems designed to improve driving experience and safety, reflecting strong R&D investment.

Customer Relationships

Aisin Seiki cultivates deep, enduring partnerships with leading automotive manufacturers, often assigning dedicated account management teams. These relationships are forged through mutual trust, joint development efforts, and a profound comprehension of client requirements, solidifying Aisin's position as a favored supplier for new vehicle launches.

This commitment to customer collaboration is underscored by consistent accolades, such as being named a 'Supplier of the Year' by General Motors, a testament to the robust nature of these strategic alliances.

Aisin Seiki actively engages in collaborative research and development with Original Equipment Manufacturers (OEMs). This partnership allows Aisin to co-create cutting-edge technologies and customize solutions for specific vehicle architectures.

This deep collaboration ensures Aisin’s innovations are precisely aligned with OEM needs and prevailing market trends, especially within the dynamic sectors of vehicle electrification and advanced intelligent systems.

For instance, Aisin’s commitment to joint R&D is evident in its work on hybrid and electric vehicle components, where close OEM feedback directly influences product design and performance enhancements, contributing to their strong market position.

Aisin provides extensive technical support and after-sales service to ensure its automotive components perform optimally and last longer. This commitment is crucial for maintaining customer satisfaction and loyalty in the competitive automotive parts market.

In 2024, Aisin has been actively overhauling its aftermarket strategy. The company is enhancing its service offerings to transition into a comprehensive parts and service provider, a move designed to boost efficiency and ensure uninterrupted service for both its end customers and its network of suppliers.

Long-Term Contracts and Strategic Alliances

Aisin Seiki cultivates robust customer relationships primarily through long-term supply agreements. These contracts are foundational, ensuring consistent and predictable revenue streams, which is crucial for Aisin's operational stability and investment planning. For instance, a significant portion of their automotive component sales are under multi-year commitments with major car manufacturers.

Beyond standard contracts, Aisin actively pursues strategic alliances. A prime example is their ongoing collaboration with Subaru, particularly in the development and supply of eAxles for electric vehicles. This partnership signifies a shared commitment to innovation and future mobility solutions, moving beyond a simple supplier-customer dynamic to a more integrated, forward-looking relationship.

- Long-Term Supply Contracts: Aisin secures a substantial portion of its revenue through multi-year supply agreements with leading automotive OEMs, providing financial predictability.

- Strategic Alliances: Collaborations like the one with Subaru on eAxle technology highlight a deeper integration, focusing on joint development and future product roadmaps.

- Customer Integration: These relationships foster a symbiotic environment where Aisin's R&D is often aligned with the long-term strategic goals of its key partners.

Global and Localized Engagement

Aisin Seiki actively cultivates customer relationships through a dual approach, encompassing both global reach and deeply localized engagement. This strategy ensures they can effectively address the unique demands and market nuances present in diverse regions worldwide.

Their extensive global network, supported by regional sales offices, is crucial for this localized interaction. This structure allows Aisin to offer product variations and customer service that are specifically tailored to the needs of each market, fostering stronger connections.

- Global Coordination: Aisin's worldwide presence allows for consistent brand messaging and product development that meets international standards.

- Localized Support: Regional offices provide direct customer interaction, understanding local regulations, preferences, and providing timely technical assistance.

- Market Responsiveness: By being present in local markets, Aisin can quickly adapt its offerings and service based on evolving regional demands.

- Customer Feedback Integration: Localized engagement channels facilitate the collection of specific customer feedback, which is then integrated into global product improvement cycles.

Aisin Seiki's customer relationships are built on a foundation of deep collaboration and long-term commitment, particularly with major automotive manufacturers. They foster these partnerships through joint development, dedicated account management, and extensive technical support, ensuring their components are precisely tailored to client needs.

This approach is exemplified by their ongoing work with OEMs on advanced technologies like electrification, where close feedback loops drive innovation. For instance, their 2024 aftermarket strategy overhaul aims to enhance service offerings, transitioning into a comprehensive parts and service provider to boost efficiency and ensure uninterrupted support for their network.

Aisin's strategic alliances, such as their collaboration with Subaru on eAxles for electric vehicles, go beyond traditional supplier roles, focusing on shared innovation and future mobility. This deep integration ensures Aisin's R&D aligns with key partners' long-term goals, solidifying their position as a preferred supplier.

| Customer Relationship Aspect | Description | Key Benefit |

|---|---|---|

| Long-Term Supply Contracts | Multi-year agreements with major OEMs | Predictable revenue streams, operational stability |

| Strategic Alliances | Joint development, e.g., Subaru eAxles | Shared innovation, future mobility focus |

| Collaborative R&D | Co-creation of technologies with OEMs | Tailored solutions, alignment with market trends |

| Dedicated Account Management | Specialized teams for key clients | Deep understanding of client needs, trust building |

| Aftermarket Service Enhancement (2024) | Transition to parts and service provider | Increased efficiency, uninterrupted customer support |

Channels

Aisin's primary sales channel involves direct engagement with major global Original Equipment Manufacturers (OEMs) for its automotive components. This approach is crucial for integrating their parts seamlessly into new vehicle designs and production.

Dedicated Aisin sales teams and technical representatives collaborate closely with automakers throughout the entire vehicle lifecycle, from initial concept to mass production. This direct relationship ensures that Aisin's offerings meet the specific technical and performance requirements of each OEM.

In 2023, Aisin reported total sales of ¥4,538.7 billion, with a significant portion attributed to these direct OEM relationships in the automotive sector, underscoring the importance of this channel for their business.

Aisin's extensive network of global sales offices and regional subsidiaries, such as Aisin World Corp. of America and Aisin Europe, are crucial for managing client interactions and driving sales worldwide. This decentralized structure allows for a deep understanding of local market demands and facilitates tailored customer support.

In 2024, Aisin's commitment to regional presence was evident in its operations across over 20 countries, supporting its diverse product portfolio. This global footprint is key to navigating varied regulatory landscapes and fostering strong, localized business relationships, ensuring effective market penetration.

Aisin Seiki leverages a robust network of aftermarket parts distributors and retailers to ensure its products reach a wide customer base. This channel is critical for making replacement parts, maintenance items, and remanufactured components readily available to independent repair shops, service centers, and even directly to consumers.

The company's strategy focuses on accessibility, ensuring that Aisin parts are found where repairs and maintenance are performed. This includes partnerships with authorized distributors who manage inventory and logistics, as well as potential direct relationships with large retail chains.

Aisin is committed to growing its aftermarket offerings, meaning more parts and product lines will become available through these channels. For instance, in 2024, Aisin continued to emphasize its comprehensive range of braking system components and drivetrain parts for the aftermarket segment.

Online Platforms and E-commerce (Emerging)

Aisin Seiki, while historically focused on business-to-business (B2B) relationships, is actively exploring and developing online platforms. These digital avenues are crucial for disseminating product information and potentially facilitating direct sales of specific aftermarket components. This strategic move aims to boost accessibility and operational efficiency in today's digitally driven marketplace.

The company's engagement with Sheeva.AI for integrated in-vehicle payment solutions underscores its commitment to expanding its digital channel presence. This partnership suggests a forward-thinking approach to leveraging technology for customer convenience and new revenue streams.

- Digital Expansion: Aisin is investing in online platforms to enhance customer access to product catalogs and technical resources.

- B2B E-commerce: Development of specific e-commerce capabilities for aftermarket parts is a key focus.

- Partnerships: Collaboration with entities like Sheeva.AI signals a strategic push into digital payment and service integration.

- Customer Engagement: Online channels are being utilized to improve efficiency and direct interaction with a broader customer base.

Industry Trade Shows and Exhibitions

Industry trade shows and exhibitions are vital channels for Aisin Seiki. These events allow Aisin to directly display its latest automotive and industrial innovations to a targeted audience. For instance, participation in shows like AAPEX provides opportunities to connect with potential buyers and reinforce relationships with current clients.

These exhibitions are not just about showcasing products; they are key for brand building and market intelligence. Aisin leverages these platforms to demonstrate its technological prowess and gather insights into market trends and competitor activities. In 2024, major automotive shows saw significant industry investment in new technology displays, highlighting the importance of such events for companies like Aisin.

- Showcasing Innovation: Demonstrating new powertrain components, safety systems, and advanced manufacturing techniques.

- Customer Engagement: Direct interaction with automotive manufacturers and Tier 1 suppliers to discuss needs and solutions.

- Industry Networking: Building partnerships with other technology providers and suppliers.

- Brand Visibility: Reinforcing Aisin's position as a leader in automotive technology.

Aisin Seiki's channels are multifaceted, primarily driven by direct relationships with Original Equipment Manufacturers (OEMs) for automotive components, ensuring seamless integration into new vehicles. Complementing this, a robust aftermarket distribution network makes replacement parts widely accessible. The company is also actively expanding its digital presence through online platforms and strategic partnerships, aiming for greater customer reach and convenience.

| Channel Type | Primary Focus | Key Activities | 2024 Emphasis |

|---|---|---|---|

| Direct OEM Sales | Automotive Components | Technical collaboration, product integration | Strengthening relationships with major global automakers |

| Aftermarket Distribution | Replacement Parts | Wholesale to retailers, service centers | Expanding product lines for braking and drivetrain systems |

| Digital Platforms | Information & Sales | Online catalogs, potential e-commerce | Developing B2B e-commerce for aftermarket parts |

| Industry Events | Innovation Showcase | Product displays, networking | Highlighting advanced manufacturing and new technologies |

Customer Segments

Global Automotive Original Equipment Manufacturers (OEMs) represent Aisin Seiki's most significant customer base, encompassing giants like Toyota, General Motors, Honda, Mercedes Benz, and Subaru. These partnerships are crucial, with Aisin providing a vast array of components essential for the production of new vehicles across diverse segments and international markets.

In 2024, the automotive industry continued its robust recovery, with global light vehicle production projected to reach approximately 83 million units. Aisin's deep integration with major OEMs means it directly benefits from this production volume, supplying components that are critical for everything from powertrain systems to body and chassis parts.

This segment consistently emphasizes stringent requirements for superior quality, cutting-edge technological advancements, and an unwavering commitment to supply chain reliability. For instance, the increasing demand for electrified vehicles means OEMs are looking to suppliers like Aisin for innovative hybrid and electric powertrain components, a trend that saw significant investment and development throughout 2024.

Aisin Seiki's automotive aftermarket segment serves a broad customer base, encompassing parts distributors, independent repair shops, and even individual vehicle owners looking for maintenance and replacement parts. This diverse group relies on Aisin for high-quality components to keep vehicles running smoothly.

The company is actively growing its presence here, aiming to offer a complete suite of parts and services, including remanufactured components. This strategic focus acknowledges the significant market for vehicles already on the road, where reliable aftermarket support is crucial.

In 2024, the global automotive aftermarket was valued at over $450 billion, demonstrating the immense scale and opportunity within this sector. Aisin's commitment to this segment positions it to capture a substantial share of this market by providing essential parts and services.

Aisin Seiki extends its manufacturing prowess beyond the automotive sector, serving a critical role in the industrial equipment market. This segment demands highly durable and dependable components, frequently requiring bespoke solutions tailored to unique machinery and operational needs, underscoring Aisin's adaptability and advanced engineering skills. For instance, their drivetrain parts are specifically engineered for the rigorous demands of industrial applications.

Energy Sector Companies and Consumers

Aisin Seiki's reach extends into the energy sector, providing innovative solutions for both companies and consumers. This includes offering fuel cell cogeneration systems designed for residential applications, enhancing energy efficiency and sustainability at home. For instance, in 2024, the global fuel cell market was projected to reach over $10 billion, indicating a strong demand for such technologies.

The company is also actively involved in developing cutting-edge energy technologies, such as perovskite solar cells. These advanced solar cells promise higher efficiency and lower manufacturing costs compared to traditional silicon-based panels. Aisin's commitment to these areas positions them to serve a diverse customer base within the energy landscape.

- Energy Companies and Utilities: Seeking reliable and efficient power generation and storage solutions.

- Renewable Energy Developers: Looking for advanced materials and systems to improve solar and fuel cell performance.

- Commercial and Industrial Businesses: Aiming to reduce energy costs and carbon footprints with cogeneration systems.

- Residential Consumers: Homeowners interested in sustainable, cost-effective energy generation for their properties.

Housing and Lifestyle Product Consumers

Aisin Seiki's housing and lifestyle product consumers encompass builders and developers seeking integrated, high-quality home solutions, as well as individual homeowners prioritizing innovation and durability. This segment leverages Aisin's expertise in precision manufacturing for diverse applications beyond automotive.

The company's commitment to this sector is evident in its development of advanced building materials and smart home technologies. For instance, Aisin has been a key player in providing components for energy-efficient housing, aligning with growing consumer demand for sustainable living. In 2024, the global smart home market was valued at over $100 billion, a figure expected to grow significantly, reflecting strong consumer interest in connected living spaces.

- Builders and Developers: Seeking reliable, integrated building components and systems.

- End-Consumers: Homeowners interested in innovative, high-quality, and potentially smart home features.

- Focus on Quality and Durability: Consumers who value long-lasting, well-engineered products for their homes.

- Sustainability Interest: A growing segment of consumers and builders looking for eco-friendly housing solutions.

Aisin Seiki's customer segments are primarily defined by their industry and specific needs, ranging from global automotive giants to individual homeowners. The company's core strength lies in its deep relationships with Original Equipment Manufacturers (OEMs), supplying critical components for new vehicle production. Beyond new vehicles, Aisin also serves the expansive automotive aftermarket, providing parts for maintenance and repair, a market valued at over $450 billion in 2024. Furthermore, Aisin's precision engineering extends to industrial equipment and the burgeoning energy sector, including residential fuel cell systems, tapping into a global fuel cell market projected to exceed $10 billion in 2024.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Global Automotive OEMs | Require high quality, advanced technology, supply chain reliability for new vehicle production. | Benefited from ~83 million global light vehicle production units. |

| Automotive Aftermarket | Parts distributors, repair shops, vehicle owners seeking maintenance and replacement parts. | Market valued over $450 billion, highlighting demand for ongoing vehicle support. |

| Industrial Equipment | Require durable, dependable, often bespoke components for machinery. | Leverages Aisin's advanced engineering for rigorous operational demands. |

| Energy Sector | Energy companies, developers, businesses, and homeowners seeking efficient power solutions. | Addresses a fuel cell market projected over $10 billion and growing interest in advanced solar. |

| Housing & Lifestyle | Builders, developers, and homeowners prioritizing integrated, innovative, and durable home solutions. | Serves a smart home market exceeding $100 billion, with a focus on sustainability. |

Cost Structure

Aisin Seiki allocates a substantial portion of its budget to Research and Development, reflecting its commitment to innovation in areas like electrification and intelligent systems. These costs encompass salaries for its dedicated engineering and research teams, significant investments in advanced testing infrastructure, and the expenses tied to creating prototypes and pioneering new technological advancements.

For the fiscal year ending March 31, 2024, Aisin Corporation reported consolidated R&D expenses of ¥230.5 billion, a notable increase reflecting their strategic focus on future mobility solutions and next-generation technologies. This investment is crucial for maintaining their competitive edge and driving long-term growth in the rapidly evolving automotive industry.

Manufacturing and production costs represent a significant portion of Aisin Seiki's operational expenses. These include the procurement of essential raw materials like steel, aluminum, and various plastics, alongside the wages paid to their dedicated factory workforce. Energy consumption powering their production facilities and the ongoing maintenance of sophisticated machinery also contribute substantially to this cost category.

In 2024, Aisin Seiki continued its strategic focus on optimizing these manufacturing outlays. A key initiative involved efforts to reduce the consumption of raw materials, ensuring greater efficiency in their use. Furthermore, the company actively pursued improvements in logistics to streamline the supply chain and minimize associated costs, contributing to a more competitive production environment.

Aisin Seiki's global footprint necessitates substantial spending on logistics and distribution. These costs encompass the movement of parts to its numerous production facilities and the subsequent delivery of finished vehicles and components to a worldwide customer base. For instance, in the fiscal year ending March 2024, Aisin's selling, general and administrative expenses, which include distribution costs, were ¥355.6 billion.

The company actively manages these expenditures through strategic investments in advanced logistics centers. These facilities are designed to optimize warehousing, streamline inventory management, and ultimately lower the overall cost of getting products to market efficiently. This focus on operational excellence in logistics is crucial for maintaining competitiveness in the automotive supply chain.

Sales, Marketing, and Administrative (SG&A) Expenses

Aisin Seiki's Sales, Marketing, and Administrative (SG&A) expenses encompass a broad range of operational costs. These include the compensation for their dedicated sales and marketing personnel, significant investments in advertising campaigns and promotional initiatives to reach a global customer base, and essential general administrative overhead. This overhead covers executive leadership salaries, vital legal counsel, and accounting services that ensure regulatory compliance and financial integrity.

To enhance efficiency and manage its financial footprint, Aisin has been actively engaged in strategic restructuring. These initiatives are specifically designed to streamline its vast operational network and exert greater control over its fixed costs. For instance, in the fiscal year ending March 2024, Aisin reported total SG&A expenses of approximately ¥337.9 billion (around $2.2 billion USD at an average exchange rate for the period), reflecting the scale of these necessary investments and ongoing optimization efforts.

- Salaries and Benefits: Compensation for sales, marketing, and administrative staff.

- Advertising and Promotion: Costs associated with brand building and product launches.

- General and Administrative Overhead: Includes executive compensation, legal, and accounting fees.

- Restructuring Initiatives: Investments aimed at improving operational efficiency and cost control.

Capital Expenditures (CapEx)

Aisin Seiki's capital expenditures are substantial, reflecting the significant investments needed to maintain and grow its manufacturing operations. These outlays are crucial for expanding production lines, especially for components supporting the automotive industry's shift towards electrification. For instance, in the fiscal year ending March 2024, Aisin Seiki's capital investment reached ¥237.3 billion, a notable increase from ¥199.9 billion in the prior year, underscoring a strategic focus on future growth areas.

These investments cover a range of essential activities. They include upgrading existing facilities to enhance efficiency and incorporate advanced manufacturing technologies. Furthermore, significant capital is allocated to acquiring new machinery and equipment necessary for producing next-generation automotive parts, particularly those related to electric vehicles and hybrid systems.

- Manufacturing Capacity Expansion: Aisin is investing heavily in increasing its production capabilities to meet rising demand for electrified vehicle components.

- Facility Upgrades: Ongoing investments are directed towards modernizing existing plants and improving operational efficiency through technology adoption.

- Machinery and Equipment Acquisition: New machinery is being procured to support the development and mass production of advanced automotive technologies.

- Research and Development Infrastructure: Capital is also channeled into R&D facilities to foster innovation and adapt to evolving market needs.

Aisin Seiki's cost structure is dominated by manufacturing and production expenses, which include raw materials and labor. Research and Development is another significant cost, reflecting their commitment to innovation in areas like electrification. Logistics and distribution costs are also substantial due to their global operations, alongside Sales, General, and Administrative (SG&A) expenses covering marketing, salaries, and overhead.

| Cost Category | Fiscal Year Ending March 31, 2024 (¥ Billion) | Notes |

|---|---|---|

| Research & Development | 230.5 | Focus on electrification and intelligent systems. |

| Manufacturing & Production | N/A (Significant portion) | Includes raw materials, labor, energy, and maintenance. |

| Logistics & Distribution | Included in SG&A (355.6 total) | Global movement of parts and finished goods. |

| Sales, General & Administrative (SG&A) | 337.9 | Covers marketing, salaries, legal, and administrative overhead. |

| Capital Expenditures | 237.3 | Investments in manufacturing capacity, upgrades, and new machinery. |

Revenue Streams

Aisin Seiki's core revenue originates from selling a vast array of automotive original equipment (OE) components to car manufacturers worldwide. These essential parts, covering drivetrain, braking, chassis, body, and engine systems, are integrated into new vehicles as they roll off the assembly line.

This significant revenue stream is directly tied to global vehicle production figures and Aisin's standing as a leading Tier 1 automotive supplier. For instance, in the fiscal year ending March 2024, Aisin reported total net sales of ¥4,581.9 billion, with a substantial portion attributed to these OE component sales.

Aisin Seiki generates significant revenue through its aftermarket parts and service sales. This includes selling replacement parts, remanufactured components, and offering various services to the automotive aftermarket. This revenue stream is crucial for their ongoing business.

In a strategic move, Aisin is actively broadening its aftermarket product offerings. They are focusing on expanding the range of maintenance items available, aiming to become a comprehensive 'one-stop shop' for customers. This initiative is designed to boost revenue from this vital segment.

As the automotive world electrifies, Aisin's sales of electrified powertrain units, including eAxles and hybrid components, are a rapidly expanding revenue source. The company is actively boosting sales of these critical electric vehicle parts and establishing robust global production capabilities to satisfy surging demand.

Sales of Energy Systems and Related Products

Aisin diversifies its revenue through the sale of energy systems and associated products. A prime example is their ENE-FARM residential fuel cell cogeneration systems. This segment also explores innovative technologies, such as perovskite solar cells, indicating a forward-looking approach to energy solutions.

This diversification extends Aisin's business beyond its core automotive components. In fiscal year 2024, Aisin reported consolidated net sales of ¥4,538.4 billion, with their energy and lifestyle solutions segment contributing to this overall performance, though specific figures for energy systems sales are not itemized separately in high-level reports.

- Residential Fuel Cells: Sales of ENE-FARM systems provide a stable revenue stream in the home energy market.

- Emerging Technologies: Investment and potential future sales of products like perovskite solar cells represent growth opportunities.

- Diversification Strategy: This segment broadens Aisin's market reach and reduces reliance on the automotive sector alone.

Sales of Industrial Equipment and Lifestyle Products

Aisin Seiki's revenue streams extend beyond automotive components to include the sale of industrial equipment and lifestyle products. These segments, while representing a smaller portion of the company's overall income compared to its automotive business, are vital for revenue diversification.

In fiscal year 2024, Aisin Seiki reported total revenue of approximately ¥4.5 trillion. While specific breakdowns for industrial and lifestyle product sales are not always separately detailed in headline figures, these areas consistently contribute to the company's financial performance by leveraging its established manufacturing expertise.

- Industrial Equipment: Revenue generated from components for machinery used in various manufacturing sectors.

- Lifestyle Products: Sales of items related to housing and everyday living, capitalizing on Aisin's production capabilities.

- Revenue Diversification: These segments help mitigate risks associated with over-reliance on the automotive industry.

- Leveraging Core Competencies: Aisin applies its advanced manufacturing and engineering skills to these non-automotive markets.

Aisin Seiki's revenue is primarily driven by the sale of automotive original equipment (OE) components, contributing significantly to its overall financial performance. The company also garners substantial income from aftermarket parts and services, catering to the ongoing needs of vehicle owners.

Furthermore, Aisin is capitalizing on the shift towards electrification by expanding sales of electrified powertrain units, such as eAxles and hybrid components, a growing revenue stream. The company also diversifies its income through energy systems, like residential fuel cells, and the sale of industrial equipment and lifestyle products, demonstrating a multi-faceted approach to revenue generation.

| Revenue Stream | Description | Fiscal Year 2024 Relevance (Approximate) |

|---|---|---|

| Automotive OE Components | Sales of parts integrated into new vehicles. | Major contributor to ¥4,581.9 billion net sales. |

| Aftermarket Parts & Services | Replacement parts, remanufactured components, and services. | Vital for ongoing business and expanded product offerings. |

| Electrified Powertrain Units | eAxles, hybrid components for EVs. | Rapidly expanding revenue source driven by EV demand. |

| Energy Systems | Residential fuel cells (ENE-FARM), emerging tech like perovskite solar cells. | Contributes to ¥4,538.4 billion consolidated net sales, diversifying beyond automotive. |

| Industrial & Lifestyle Products | Components for manufacturing machinery, housing and living items. | Smaller but consistent contributor to overall financial performance, leveraging manufacturing expertise. |

Business Model Canvas Data Sources

The Aisin Seiki Business Model Canvas is built upon a foundation of financial reports, extensive market research, and internal operational data. These sources ensure each element, from value propositions to cost structures, is grounded in accurate and relevant information.