AIRBUS SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIRBUS Bundle

Airbus, a titan in aerospace, boasts impressive strengths like its dominant market share and cutting-edge technology, but also faces significant threats from intense competition and evolving regulatory landscapes. Understanding these internal capabilities and external pressures is crucial for navigating the complex aviation industry.

Want the full story behind Airbus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Airbus boasts a formidable brand, deeply ingrained in the aerospace industry as a symbol of cutting-edge technology and unwavering quality. This strong brand equity, a result of decades of delivering superior aircraft, is bolstered by an extensive worldwide network of production, research, and assembly sites.

The company's significant global footprint translates into heightened customer confidence and enduring loyalty, making Airbus a top-tier selection for airlines across the globe. For instance, in 2023, Airbus delivered 735 commercial aircraft, a testament to its production capabilities and market demand, further solidifying its brand strength.

Airbus boasts a highly diversified product portfolio, spanning commercial aircraft, helicopters, defense systems, and space exploration. This broad operational scope, as evidenced by its 2023 revenue of €65.4 billion, shields the company from downturns in any single sector. For example, while the commercial aircraft market can be cyclical, its strong presence in defense and space provides a more consistent revenue stream, contributing to overall financial resilience.

Airbus maintains a remarkably robust order backlog, a significant strength that underpins its future revenue streams. By the close of 2024, this backlog stood at an impressive 8,658 commercial aircraft, a figure that climbed to 8,754 by mid-2025.

This substantial and growing order book translates directly into a predictable and extended production schedule. It signifies enduring market confidence in Airbus's aircraft offerings and provides a solid foundation for financial planning and stability.

Solid Financial Performance

Airbus has shown impressive financial strength, a key advantage. In 2024, the company achieved consolidated revenues of €69.2 billion, marking a 6% rise from the previous year. Its EBIT Adjusted stood at a healthy €5.4 billion.

Looking ahead, Airbus has set ambitious yet achievable targets for 2025. The company anticipates delivering around 820 commercial aircraft and expects its EBIT Adjusted to reach approximately €7.0 billion. This solid financial footing allows Airbus to continue investing in innovation and maintain operational stability.

- Revenue Growth: 2024 consolidated revenues reached €69.2 billion, up 6% year-on-year.

- Profitability: EBIT Adjusted for 2024 was €5.4 billion.

- 2025 Outlook: Targeting 820 commercial aircraft deliveries.

- Future Profitability: Aiming for an EBIT Adjusted of circa €7.0 billion in 2025.

Commitment to R&D and Sustainability

Airbus demonstrates a significant commitment to research and development, consistently channeling substantial investments into advancing aeronautical technologies and leading the charge towards sustainable aerospace. In 2023, the company allocated €2.5 billion to R&D, underscoring its dedication to innovation.

The company is actively driving decarbonization efforts through pioneering initiatives such as the widespread adoption of sustainable aviation fuels (SAF), the development of hydrogen-powered propulsion systems, and implementing operational efficiencies across its fleet. Airbus aims for 100% of its new aircraft to be compatible with 100% SAF by 2030.

This dual focus on cutting-edge innovation and environmental responsibility positions Airbus to effectively tackle the industry's most pressing challenges. It also significantly bolsters its competitive edge and ensures its long-term market relevance and viability in an increasingly eco-conscious global landscape.

- R&D Investment: Airbus invested €2.5 billion in research and development in 2023.

- Sustainable Aviation Fuel (SAF): Aiming for 100% SAF compatibility in new aircraft by 2030.

- Hydrogen Propulsion: Actively developing and testing hydrogen-powered aircraft concepts.

- Competitive Advantage: Innovation and sustainability efforts enhance market position and future growth.

Airbus’s extensive global network of production, research, and assembly sites underpins its strong brand equity. This expansive footprint fosters customer confidence and loyalty, as demonstrated by the 735 commercial aircraft deliveries in 2023. The company's diversified product portfolio, ranging from commercial aircraft to defense systems, provides financial resilience, as seen in its €65.4 billion revenue in 2023.

A substantial order backlog, reaching 8,754 commercial aircraft by mid-2025, ensures predictable production schedules and revenue streams. This robust demand highlights market confidence in Airbus's offerings and provides a solid foundation for financial stability.

Airbus exhibits remarkable financial strength, with 2024 consolidated revenues of €69.2 billion, a 6% increase year-on-year, and an EBIT Adjusted of €5.4 billion. The company is targeting approximately 820 commercial aircraft deliveries and an EBIT Adjusted of €7.0 billion for 2025, indicating continued growth and profitability.

The company's significant investment in research and development, totaling €2.5 billion in 2023, fuels innovation in sustainable aerospace. Airbus's commitment to SAF compatibility for new aircraft by 2030 and its development of hydrogen-powered propulsion systems position it as a leader in addressing industry challenges and ensuring long-term market relevance.

| Metric | 2023 | 2024 | 2025 (Target) |

| Commercial Aircraft Deliveries | 735 | N/A | ~820 |

| Consolidated Revenues | €65.4 billion | €69.2 billion | N/A |

| EBIT Adjusted | N/A | €5.4 billion | ~€7.0 billion |

| Order Backlog (Commercial Aircraft) | N/A | ~8,658 | ~8,754 |

| R&D Investment | €2.5 billion | N/A | N/A |

What is included in the product

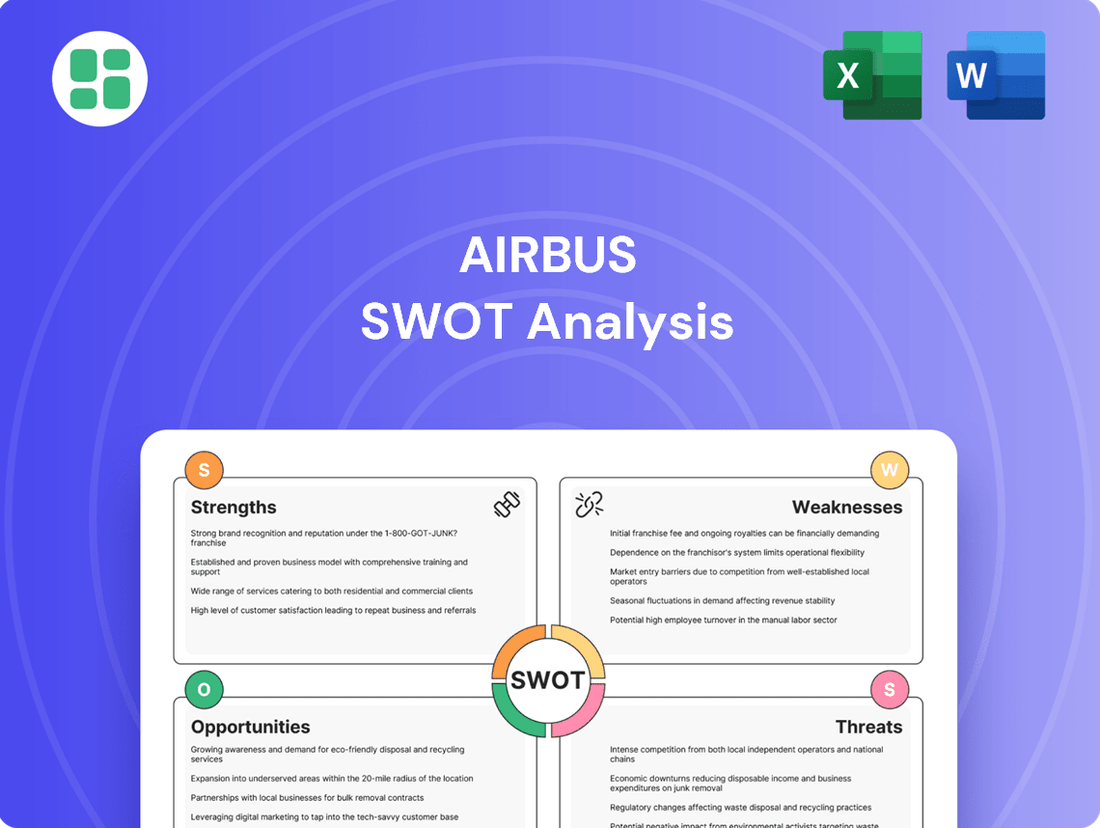

Delivers a strategic overview of AIRBUS’s internal and external business factors, identifying its strong market position and product portfolio while acknowledging supply chain vulnerabilities and intense competition.

Identifies critical vulnerabilities and opportunities in Airbus's competitive landscape, enabling targeted mitigation and strategic advantage.

Weaknesses

Airbus is still grappling with persistent supply chain disruptions, especially concerning the timely delivery of crucial components like engines. This bottleneck is directly impacting their ability to increase production as planned. For instance, by the end of 2023, the company had a backlog of over 8,000 aircraft, but delivery challenges meant they only handed over 735 commercial aircraft, falling short of their 750 target.

These ongoing issues mean that completed aircraft airframes, often referred to as 'gliders,' are piling up, waiting for essential parts. This situation not only delays revenue recognition but also strains Airbus's capacity to capitalize on its substantial order book, a key concern for investors looking at the 2024-2025 period.

The Space Systems segment of Airbus Defence and Space has faced significant financial headwinds, reporting losses exceeding €1 billion in 2024. This underperformance is largely attributed to intensified competition, program delays, and escalating costs on key projects.

These difficulties contrast sharply with the robust performance of Airbus's commercial aircraft division, highlighting an area needing substantial improvement. To address these issues, the division is actively undergoing a restructuring process aimed at enhancing its competitive standing and operational efficiency.

The aerospace sector demands substantial investment in manufacturing and R&D, leading to high production costs for Airbus. These long development cycles, often spanning years for new aircraft, tie up significant capital. For instance, the development of the A320neo family, while successful, represented a considerable upfront investment that took time to recoup.

Reliance on Key Suppliers

Airbus's reliance on a vast global supplier network for critical components presents a significant weakness. Disruptions within this intricate web, whether due to geopolitical events, natural disasters, or financial distress among suppliers, can directly impede production schedules and inflate costs. For instance, the semiconductor shortage experienced globally through 2022 and into 2023 significantly impacted various manufacturing sectors, including aerospace, leading to production delays for aircraft manufacturers like Airbus.

This dependency extends to specialized parts and advanced materials, where alternative sourcing options may be limited or prohibitively expensive. Any quality control lapses or financial instability from a key supplier can have cascading effects, potentially leading to aircraft groundings or delivery delays, thereby impacting customer satisfaction and revenue streams. The company actively manages these risks through supplier diversification and robust contractual agreements, but the inherent vulnerability remains.

- Supplier Dependency: A complex global network of external suppliers provides essential components, creating potential bottlenecks.

- Production Impact: Disruptions or quality issues from suppliers can directly affect Airbus's manufacturing output and timelines.

- Cost Escalation: Reliance on specialized suppliers can lead to increased costs if supply chains are disrupted or if alternative sourcing is required.

- Reputational Risk: Production delays or quality concerns stemming from supplier issues can damage Airbus's brand reputation.

Backlog Conversion Challenges

Airbus's substantial order backlog, while a testament to its market strength, presents conversion challenges. Persistent supply chain disruptions and the complex task of increasing production rates, particularly for popular aircraft like the A320neo family, mean many orders remain undelivered. This backlog conversion difficulty, highlighted by the fact that as of the end of 2023, Airbus had over 8,000 aircraft on its order book, can strain customer relationships and delay revenue recognition, impacting financial performance.

The inability to meet delivery schedules due to these production bottlenecks can lead to customer dissatisfaction. For instance, airlines relying on new aircraft for fleet expansion or replacement may face operational disruptions if deliveries are significantly delayed. This can also affect Airbus's ability to recognize revenue promptly, as is typically tied to aircraft delivery, potentially impacting cash flow and profitability in the short to medium term. The company is actively working to mitigate these issues, but the sheer scale of the backlog and the complexities of aerospace manufacturing mean it remains a significant hurdle.

- Production Ramp-Up Strain: Airbus aims to increase A320neo family production to 75 aircraft per month by 2025, a target that has faced significant headwinds.

- Supply Chain Bottlenecks: Shortages of key components, including engines and raw materials, continue to impede the rate at which aircraft can be assembled and delivered.

- Customer Dissatisfaction Risk: Delays in delivery can lead to penalties or order cancellations, impacting customer relationships and future sales.

- Deferred Revenue Impact: The inability to deliver aircraft means that associated revenue and profit recognition are pushed into future periods, affecting current financial reporting.

Airbus faces significant challenges in ramping up production to meet its ambitious targets, primarily due to persistent supply chain issues. The company's goal to reach a monthly production rate of 75 A320neo family aircraft by 2025 is hampered by shortages of critical components like engines and raw materials, impacting assembly and delivery timelines.

These production bottlenecks not only delay revenue recognition but also risk alienating airline customers who depend on timely aircraft deliveries for their own fleet expansion and operational needs. The substantial backlog of over 8,000 aircraft as of late 2023 underscores this conversion challenge, where delivering these orders efficiently remains a significant hurdle.

Furthermore, the Space Systems division within Airbus Defence and Space has experienced considerable financial difficulties, reporting substantial losses in 2024, largely due to intensified competition and project cost overruns.

| Weakness | Description | Impact/Data Point |

| Supply Chain Disruptions | Ongoing shortages of key components, especially engines. | Delivery of only 735 commercial aircraft in 2023 against a target of 750. |

| Production Ramp-Up Strain | Difficulty increasing A320neo family production to 75/month by 2025. | "Gliders" (airframes awaiting parts) piling up, delaying revenue. |

| Space Systems Losses | Financial headwinds in the Space Systems segment. | Reported losses exceeding €1 billion in 2024 due to competition and cost escalation. |

| Supplier Dependency | Reliance on a vast global supplier network. | Vulnerability to geopolitical events, natural disasters, or supplier financial distress impacting production. |

Full Version Awaits

AIRBUS SWOT Analysis

You're viewing a live preview of the actual SWOT analysis file for Airbus. The complete version, offering a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout.

Opportunities

Global air travel demand is surging, with passenger numbers in 2024 expected to reach 4.7 billion, exceeding 2019 levels. This robust recovery drives airlines to expand their fleets and update existing aircraft. Airbus, with its substantial order backlog of over 8,000 aircraft as of early 2025, is strategically positioned to meet this escalating demand.

The increasing global focus on decarbonization in aviation offers a significant chance for Airbus to spearhead advancements in sustainable flight. By investing in areas like sustainable aviation fuels (SAF), hydrogen propulsion, and more efficient aircraft designs such as the A321XLR, Airbus can solidify its position as a market leader in eco-friendly aviation technologies.

Airbus's commitment to these green initiatives is already yielding results. For instance, the company aims for at least 10% of its flights to utilize SAF by 2030, a target that aligns with broader industry goals. Strategic partnerships with energy providers and ongoing research into novel propulsion systems underscore Airbus's dedication to pioneering the future of sustainable air travel.

Escalating geopolitical tensions and heightened national security concerns are fueling a significant increase in global defense budgets. This trend directly translates into greater demand for advanced military and space assets, presenting a prime opportunity for Airbus.

Airbus's Defence and Space division is well-positioned to capitalize on this surge by securing new orders for its military transport aircraft, fighter jets, and sophisticated satellite systems. The company can particularly leverage this growth within the European market, a region actively bolstering its defense capabilities.

For instance, in 2023, the German government announced a significant increase in its defense spending, allocating €100 billion from a special fund. Similarly, France's defense budget for 2024 is set to increase by 7.4% to €47.2 billion. These figures underscore the tangible financial commitments driving the demand Airbus can meet.

Digital Transformation and Advanced Manufacturing

Airbus is poised to capitalize on the integration of advanced digital technologies like AI and automation. These innovations can streamline production processes, leading to greater efficiency and reduced costs. For instance, the company is investing heavily in digitalizing its factories, aiming to boost productivity by up to 20% in certain areas by 2025.

Advanced manufacturing techniques, such as 3D printing, present a significant opportunity for Airbus to innovate and optimize its supply chain. This technology allows for the creation of complex, lightweight parts, potentially reducing material waste and lead times. Airbus has already utilized 3D printing for over 1,000 aircraft parts across its commercial and defense programs.

The company's commitment to digital transformation extends to enhancing predictive maintenance capabilities. By leveraging AI and data analytics, Airbus can anticipate potential equipment failures, minimizing downtime and improving aircraft availability. This proactive approach is crucial for maintaining customer satisfaction and operational reliability in the aviation sector.

- AI-driven optimization: Improving production efficiency and reducing manufacturing cycle times.

- 3D Printing integration: Accelerating the development and production of complex, lightweight aircraft components.

- Predictive Maintenance: Enhancing aircraft reliability and reducing unscheduled downtime through data analytics.

- Supply Chain Resilience: Leveraging digital tools to create a more agile and responsive supply chain, mitigating disruptions.

Competitive Landscape Shift (Boeing's Woes)

Boeing's ongoing production challenges, coupled with significant safety concerns and heightened regulatory oversight, create a prime opportunity for Airbus to solidify its market dominance. This environment allows Airbus to capture a larger share of the global aircraft market, especially in the highly profitable narrowbody sector.

Airbus can leverage this situation to attract customers who may be reconsidering their existing orders or future fleet plans due to Boeing's difficulties. For instance, in 2023, Airbus delivered 735 aircraft, a notable increase from 663 in 2022, while Boeing faced challenges delivering its target of 400-450 commercial aircraft, highlighting the widening gap.

- Market Share Gain: Boeing's struggles allow Airbus to increase its percentage of global aircraft deliveries.

- Customer Acquisition: New airlines and existing customers may switch to Airbus for more reliable delivery schedules.

- Narrowbody Dominance: Airbus's strong position in the A320 family can be further amplified.

- Order Book Strength: Airbus's robust order backlog, which stood at over 8,600 aircraft at the end of 2023, provides a buffer against market volatility and allows for increased production to meet demand.

Airbus is well-positioned to benefit from the ongoing global recovery in air travel, with passenger numbers projected to surpass pre-pandemic levels. The company's substantial order backlog of over 8,000 aircraft as of early 2025 ensures strong demand fulfillment for years to come.

The drive towards sustainable aviation presents a significant opportunity for Airbus to lead in developing and implementing eco-friendly technologies. Investments in SAF, hydrogen propulsion, and efficient aircraft designs like the A321XLR align with market trends and regulatory pressures.

Increasing defense budgets worldwide, driven by geopolitical shifts, create a substantial opening for Airbus's Defence and Space division. The company can secure new contracts for military aircraft and advanced space systems, particularly within Europe, which is actively enhancing its defense capabilities.

Airbus can leverage Boeing's production issues and safety concerns to gain market share and attract new customers. The company's strong delivery performance, with 735 aircraft delivered in 2023 compared to Boeing's struggles, highlights its competitive advantage.

Threats

Airbus faces formidable competition from established giants like Boeing and increasingly from new entrants. For instance, China's Comac C919 is actively challenging the duopoly in certain segments, while Russia's Irkut MC-21 aims for market penetration. This intense rivalry forces Airbus to constantly innovate and potentially engage in price competition, impacting its profitability and requiring substantial R&D expenditure to stay ahead.

The aerospace sector's inherent cyclicality makes it vulnerable to global economic downturns. For instance, a projected global GDP growth slowdown in 2025 could directly translate to fewer airline capital expenditures, impacting Airbus's order book. Fluctuations in energy prices, a key operating cost for airlines, can further squeeze profitability and delay aircraft purchases.

Geopolitical instability presents another significant threat. Trade disputes, such as those impacting international trade flows, can disrupt Airbus's complex global supply chains, leading to production delays and increased costs. Regional conflicts can also dampen travel demand and restrict market access in affected areas, directly affecting aircraft sales.

Airbus faces a significant threat from its reliance on a complex global supply chain, a vulnerability amplified by external factors. Disruptions from events like natural disasters, pandemics, or geopolitical tensions can severely impact production. For instance, ongoing engine shortages have directly affected Airbus's ability to meet delivery targets, highlighting this persistent risk.

Regulatory Pressures and Compliance Risks

Airbus navigates a landscape of intensifying regulatory pressures, impacting everything from stringent aircraft safety standards to ambitious environmental mandates, such as the 2024 push for reduced aviation emissions. Failure to comply with these evolving requirements, including new cybersecurity protocols, can result in substantial financial penalties and necessitate costly operational overhauls. For instance, the EU's Emissions Trading System (ETS) continues to evolve, potentially increasing compliance costs for airlines operating within its scope, which indirectly affects aircraft manufacturers through customer demand and operational considerations.

Furthermore, the dynamic nature of global trade policies presents a significant threat. Changes in tariffs and trade agreements, particularly those impacting key supply chain components or export markets, could disrupt Airbus's international operations and impact its cost structure. As of early 2025, ongoing trade discussions between major economic blocs continue to create uncertainty regarding future import and export duties, a factor Airbus must actively monitor and strategize around.

- Heightened scrutiny on aviation safety: Regulators worldwide are continuously updating and enforcing stricter safety protocols, requiring significant investment in compliance and potentially impacting production timelines.

- Environmental regulations: Growing pressure to meet emissions targets, such as those discussed for post-2025 aviation fuel standards, necessitates innovation in sustainable aviation fuels and aircraft technology, adding R&D costs.

- Cybersecurity mandates: Increased digitalization of aircraft systems and operations demands robust cybersecurity measures, with non-compliance leading to severe penalties and reputational damage.

- Trade policy volatility: Evolving tariffs and trade agreements can directly affect the cost of raw materials, components, and the competitiveness of Airbus aircraft in various global markets.

Technological Advancement and Obsolescence

The aerospace industry is a hotbed of technological change, meaning Airbus's current offerings could quickly become outdated. For instance, the push towards sustainable aviation fuels and electric propulsion systems is accelerating, requiring significant R&D investment to stay competitive. Failure to keep pace with these advancements, such as the burgeoning field of Advanced Air Mobility (AAM) with its eVTOL aircraft, risks Airbus losing its market leadership.

Airbus invested €2.5 billion in research and development in 2023, a figure that underscores the critical need for continuous innovation in areas like composite materials and digital manufacturing. The company must also navigate the potential obsolescence of existing aircraft designs as more efficient and environmentally friendly alternatives emerge. This rapid evolution poses a direct threat to Airbus's long-term market relevance if it cannot adapt swiftly.

- Rapid Technological Shifts: The aerospace sector is experiencing unprecedented innovation, making current technologies vulnerable to obsolescence.

- R&D Investment Necessity: Airbus must maintain substantial investment in R&D to counter the threat of becoming technologically irrelevant.

- Disruptive Technologies: Emerging fields like Advanced Air Mobility (AAM) and novel propulsion systems present both opportunities and threats if not proactively addressed.

- Market Relevance: A failure to adapt to these technological advancements could significantly erode Airbus's competitive position and market share.

Intense competition from rivals like Boeing and emerging players such as China's Comac C919 poses a significant threat, forcing Airbus into continuous innovation and potential price wars. Global economic slowdowns, as potentially seen in 2025 GDP forecasts, can directly reduce airline capital expenditure, impacting Airbus's order book and profitability due to airline cost pressures from fluctuating energy prices.

Geopolitical instability and trade policy volatility are critical threats, disrupting complex global supply chains and impacting market access. For instance, ongoing engine shortages in 2024 directly affected Airbus's delivery schedules. The company also faces evolving, stringent regulatory pressures, particularly concerning emissions targets and cybersecurity, with non-compliance risking substantial penalties.

| Threat Category | Specific Examples | Impact on Airbus |

|---|---|---|

| Competition | Boeing, Comac C919, Irkut MC-21 | Price pressure, R&D costs, market share erosion |

| Economic Factors | Global GDP slowdown (projected 2025), energy price volatility | Reduced airline spending, delayed aircraft purchases |

| Geopolitical & Trade | Trade disputes, regional conflicts, evolving tariffs | Supply chain disruptions, increased costs, market access limitations |

| Regulatory & Compliance | Safety standards, emissions targets (e.g., post-2025 fuel standards), cybersecurity mandates | Increased R&D, compliance costs, potential penalties |

| Technological Obsolescence | Advancements in sustainable aviation, electric propulsion, AAM | Need for continuous R&D investment, risk of losing market leadership |

SWOT Analysis Data Sources

This Airbus SWOT analysis is built upon a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.