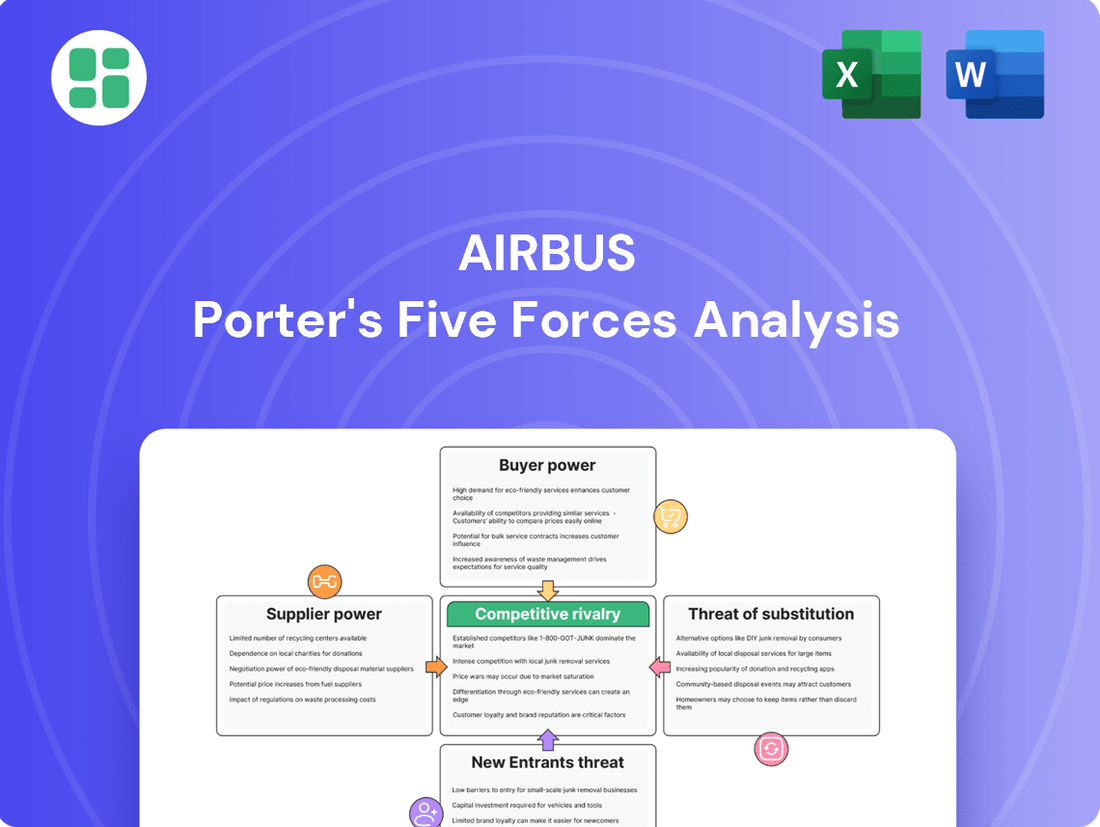

AIRBUS Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIRBUS Bundle

AIRBUS operates in a fiercely competitive aerospace landscape, where intense rivalry among existing players and the significant bargaining power of large airline customers shape its market. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex industry.

The complete report reveals the real forces shaping AIRBUS’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Airbus faces significant supplier power due to the concentration of key component providers. For instance, the commercial aircraft engine market is dominated by a mere three major players: Pratt & Whitney, GE Aviation, and Rolls-Royce. This limited supplier base means these companies hold substantial leverage over Airbus.

The high degree of specialization required for aircraft engines and advanced avionics creates substantial barriers to entry for new suppliers. Consequently, Airbus has few viable alternatives when sourcing these critical parts, increasing the bargaining power of its existing suppliers. The cost and complexity associated with switching suppliers further solidify this power dynamic.

Recent events highlight this supplier leverage. For example, in 2023 and early 2024, Airbus experienced significant production delays directly attributed to shortages of specific engine components, particularly from Pratt & Whitney. These disruptions impacted delivery schedules for the A320neo family, demonstrating how supplier constraints can directly affect Airbus's operational capacity and financial performance.

Changing suppliers for major components like fuselage sections or engines for Airbus involves significant costs. These include redesigning interfaces, re-certifying new parts with aviation authorities, and re-tooling manufacturing processes, all of which are inherently time-consuming and expensive in the highly regulated aerospace sector.

These substantial switching costs effectively limit Airbus's flexibility and consequently bolster the bargaining power of its established, key suppliers. For instance, disruptions stemming from issues with a supplier such as Spirit AeroSystems, a major supplier of fuselage sections for Airbus, can directly impede Airbus's production schedules and delivery commitments.

The uniqueness and differentiation of inputs significantly bolster supplier bargaining power for Airbus. Many critical components, such as advanced avionics and specialized engine parts, are proprietary and demand highly specific technological expertise. For instance, the complex hydraulic systems essential for aircraft operation rely on suppliers with deep, specialized knowledge that is not easily replicated.

This inherent uniqueness means Airbus faces challenges in finding alternative suppliers who can match the quality, performance, and reliability of existing providers. This dependency grants suppliers considerable leverage, especially when these inputs are vital for the final product's airworthiness and operational efficiency. In 2023, the aerospace industry continued to see consolidation among key component suppliers, further concentrating this power.

Threat of Forward Integration by Suppliers (Limited but Present)

While direct forward integration by major component suppliers into full aircraft manufacturing is highly improbable due to the colossal capital investment and stringent regulatory hurdles, a more plausible scenario involves integration into sub-assembly or specialized module production. For instance, a supplier of advanced avionics or propulsion systems might expand its capabilities to offer integrated cockpit solutions or complete engine nacelles, thereby capturing more value. This would increase their leverage by offering a more comprehensive, ready-to-install package.

The threat of forward integration by suppliers for Airbus, though limited, is a factor that necessitates careful supplier relationship management. The sheer scale and complexity of aircraft production create significant barriers to entry for suppliers wishing to manufacture entire aircraft. However, in specific high-value component areas, suppliers might possess the technical expertise and financial capacity to move further up the value chain. For example, a leading engine manufacturer could potentially offer integrated propulsion systems that include more than just the core engine.

- Limited Integration Potential: Suppliers are unlikely to enter full aircraft manufacturing due to extreme capital and regulatory barriers, as evidenced by the decades-long dominance of established players like Airbus and Boeing.

- Sub-Assembly & Module Focus: Forward integration is more likely to occur at the sub-assembly or module level, where suppliers can offer more integrated solutions for specific aircraft sections.

- Value Capture Threat: Such integration could allow suppliers to capture additional value, potentially increasing their bargaining power by offering more comprehensive packages to aircraft manufacturers.

Impact of Supply Chain Resilience Efforts

Airbus is actively addressing supplier power by taking steps to bring critical work packages in-house, such as its planned acquisition of certain Spirit AeroSystems operations. This move aims to bolster its supply chain resilience and improve overall production capabilities.

Despite these strategic initiatives, Airbus continues to grapple with persistent supply chain challenges. Bottlenecks, including shortages of key parts and raw materials, remain a significant hurdle, notably impacting the production ramp-up for popular aircraft families like the A320neo and A350.

- Supplier Power Mitigation: Airbus's planned acquisition of Spirit AeroSystems work packages is a direct effort to gain more control over critical components and reduce reliance on external suppliers.

- Ongoing Challenges: In 2024, Airbus reported that supply chain disruptions, particularly concerning engine components and fuselage sections, continued to constrain its ability to meet delivery targets, impacting its revenue growth projections.

- Production Impact: The A320neo family, a key revenue driver, experienced delivery delays in early 2024 due to these supply chain issues, highlighting the continued influence of suppliers on Airbus's operational performance.

Airbus faces substantial bargaining power from its suppliers, particularly for critical components like engines and avionics, due to market concentration and high switching costs. The limited number of qualified suppliers for specialized parts, such as the three major engine manufacturers (Pratt & Whitney, GE Aviation, Rolls-Royce), grants them significant leverage. This power is further amplified by the proprietary nature and unique technological demands of many aircraft components, making it difficult for Airbus to find alternative sources. Consequently, supplier constraints, as seen with production delays attributed to engine component shortages in late 2023 and early 2024, directly impact Airbus's delivery schedules and financial performance.

| Supplier Category | Key Players | Impact on Airbus | Example Data (2023/2024) |

|---|---|---|---|

| Aircraft Engines | Pratt & Whitney, GE Aviation, Rolls-Royce | High dependence, significant pricing power, production delay impact | Engine component shortages led to A320neo family delivery delays in early 2024. |

| Avionics & Control Systems | Honeywell, Collins Aerospace, Thales | High specialization, proprietary technology, limited alternatives | Complex avionics require deep, specific expertise, limiting supplier options. |

| Fuselage Sections | Spirit AeroSystems | Critical supplier, production disruption impact | Issues with fuselage suppliers directly impacted Airbus's production capacity in 2023. |

What is included in the product

This analysis dissects the competitive forces impacting Airbus, evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the aerospace industry.

Instantly identify competitive threats and opportunities with a visually intuitive Porter's Five Forces analysis, streamlining strategic planning for Airbus.

Customers Bargaining Power

Airbus's customer base is dominated by a select group of major global airlines, cargo operators, and government defense ministries. These entities are few in number but consistently place extremely large, high-value orders, making them crucial to Airbus's revenue streams.

This concentrated customer base grants significant bargaining power to individual buyers. Each major airline or defense ministry represents a substantial portion of Airbus's annual sales, meaning their purchasing decisions have a considerable impact on the company's financial performance. For instance, in 2023, Airbus delivered 735 commercial aircraft, with a significant portion of these going to its largest clients, highlighting the concentrated nature of its sales.

The bargaining power of customers in the commercial aircraft sector is significantly amplified by the immense value and volume of each transaction. Deals for commercial aircraft routinely range from hundreds of millions to several billion dollars, making every single sale a cornerstone of Airbus's financial health and revenue streams.

This substantial financial commitment grants customers considerable leverage. They can, and do, negotiate for highly favorable pricing structures, extensive customization options to meet specific operational needs, and robust, long-term after-sales support agreements. These demands directly impact Airbus's profit margins and shape its strategic planning, from product development to service offerings.

While switching between aircraft manufacturers involves some costs, such as pilot training and maintenance infrastructure, these are often mitigated by competitive pricing and incentives from rivals like Boeing.

Airlines can leverage the duopoly by switching orders between Airbus and Boeing to secure more favorable terms, a common practice in the industry.

This ability to switch, even with associated costs, significantly empowers customers in their negotiations with aircraft manufacturers.

Customer Knowledge and Information Symmetry

Airlines and defense contractors, as Airbus's primary customers, are incredibly sophisticated. They possess deep market insights, advanced technical understanding, and a thorough grasp of what competitors offer. This means they aren't easily swayed and know the value of what they're buying.

This high level of information symmetry significantly limits Airbus's power to set prices or dictate terms. Customers are well-informed about competitive pricing, expected performance benchmarks, and the latest technological developments, making them tough negotiators.

- Informed Buyers: Major airlines and defense organizations conduct extensive due diligence, comparing specifications, lifecycle costs, and financing options from multiple manufacturers.

- Market Transparency: Information regarding aircraft performance, fuel efficiency, and maintenance costs is widely available, leveling the playing field.

- Negotiating Leverage: The ability of customers to readily access and compare data empowers them to negotiate favorable terms, pushing down prices and demanding higher service levels.

Threat of Backward Integration (Limited)

The threat of backward integration for Airbus customers, primarily airlines, is extremely low. The immense capital investment, sophisticated technology, and stringent regulatory hurdles involved in aircraft manufacturing make it practically impossible for airlines to produce their own planes. For instance, the development cost for a new aircraft like the A320neo family runs into billions of dollars, a barrier far beyond the scope of any airline's core business.

Despite this limited threat of backward integration, airlines wield significant bargaining power over Airbus. This power allows them to heavily influence aircraft design specifications and negotiate favorable delivery timelines. Their ability to secure long-term service agreements also shapes Airbus's operational strategies and aftermarket services.

- Limited Backward Integration: Airlines lack the capital, technology, and regulatory expertise to manufacture aircraft, making backward integration infeasible.

- Customer Influence: Airlines leverage their purchasing power to dictate design specifications and delivery schedules for new aircraft.

- Service Agreement Power: Long-term service contracts negotiated by airlines significantly impact Airbus's aftermarket business and customer relationships.

Airbus's customers, primarily large airlines and defense entities, possess substantial bargaining power due to the concentrated nature of the market and the high value of each transaction. Their ability to negotiate favorable terms, including pricing and customization, significantly influences Airbus's profitability and strategic decisions.

The duopolistic nature of the commercial aircraft market, with Boeing as the main competitor, further empowers these customers. They can leverage competitive offers to secure better deals, even after accounting for switching costs. This dynamic is evident in the ongoing competition for major fleet orders, where airlines often play manufacturers against each other.

For example, in 2023, Airbus and Boeing were in intense competition for significant orders from airlines like United Airlines and Emirates, underscoring the customers' leverage in securing competitive pricing and favorable terms. The sheer scale of these orders, often numbering in the dozens or hundreds of aircraft, means each deal represents billions of dollars, amplifying customer influence.

Customers' deep market knowledge and technical expertise also contribute to their strong negotiating position. They thoroughly understand aircraft performance, lifecycle costs, and available incentives, making them informed buyers who are difficult to sway on price or terms.

| Customer Type | Bargaining Power Factors | Impact on Airbus |

|---|---|---|

| Major Airlines | Concentrated buyer base, high order volume, competitive alternatives (Boeing), switching costs mitigation, informed decision-making | Price concessions, customized aircraft configurations, favorable financing and service agreements, influence on product development |

| Defense Ministries | Strategic importance, large single orders, specific technical requirements, long-term relationships | Customization for defense needs, negotiated pricing for specialized aircraft, long-term support contracts |

Full Version Awaits

AIRBUS Porter's Five Forces Analysis

This preview shows the exact, professionally written AIRBUS Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape for the aviation giant. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive document is ready for your immediate use, offering a thorough understanding of the forces shaping Airbus's strategic environment.

Rivalry Among Competitors

The commercial aircraft sector is essentially a duopoly, with Airbus and Boeing holding sway over roughly 90-95% of the global market for large commercial jets. This tight concentration means competition is incredibly intense.

This rivalry fuels constant innovation and aggressive pricing as both companies battle for dominance in key segments like narrow-body jets (A320neo versus the 737 MAX) and wide-body aircraft (A350 competing with the 787 and upcoming 777X).

Airbus operates in an industry defined by monumental fixed costs, particularly in research and development, advanced manufacturing infrastructure, and stringent regulatory certification. These substantial upfront investments, often running into billions of euros for new aircraft programs, create formidable exit barriers.

The sheer scale of capital required means that exiting the market is exceptionally difficult and financially punitive. For instance, the A320neo family development alone involved billions in investment. This compels established players like Airbus to persist and compete fiercely, even when market conditions are challenging, to amortize these massive sunk costs over the long lifecycle of their products.

Airbus and Boeing are locked in a perpetual race to differentiate their products. This involves significant investment in technological advancements, aiming for better fuel efficiency and enhanced passenger comfort. For instance, Airbus's A320neo family offers up to 15% fuel savings compared to previous models, a direct response to market demands and competitive pressures.

Slow Industry Growth (for large aircraft)

The market for large commercial aircraft, while showing signs of recovery after the pandemic, generally experiences moderate growth. This slower pace means that established players, like Airbus, face intensified rivalry for every new order. Instead of relying on a rapidly expanding pie, companies must fight harder for their slice.

The commercial aircraft market is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% to 5.1% between 2024 and 2029. This moderate expansion underscores the reality that competition is fierce for market share, as companies cannot simply depend on overall market growth to boost their own sales.

- Intensified competition for market share due to moderate industry growth.

- Projected CAGR for the commercial aircraft market: 4.5-5.1% (2024-2029).

- Existing players must aggressively compete for new orders rather than relying on market expansion.

Global Reach and Geopolitical Influence

Airbus and Boeing's intense rivalry is deeply intertwined with global politics and trade. Both companies rely on extensive international supply chains and manufacturing bases, making them susceptible to geopolitical shifts, trade disputes, and varying government regulations. For instance, in 2024, ongoing trade discussions between the US and Europe continued to shape the competitive environment, impacting aircraft orders and delivery schedules.

The ability of both manufacturers to navigate these complex geopolitical landscapes is crucial for maintaining their market positions. Airbus's consistent order book, even amidst global uncertainties, demonstrates its strategic agility. In the first half of 2024, Airbus reported a significant increase in its commercial aircraft order backlog, underscoring its resilience in securing new business despite international trade tensions.

- Global Manufacturing Footprint: Both Airbus and Boeing operate extensive manufacturing and assembly facilities across multiple continents, creating complex interdependencies and exposure to diverse regulatory environments.

- Geopolitical Sensitivity: Trade policies, tariffs, and bilateral agreements between major economic blocs directly influence aircraft sales and production, as seen in ongoing US-EU trade dialogues affecting the aerospace sector.

- Government Support and Influence: National governments often provide substantial support to their domestic aerospace champions, influencing competitive dynamics through subsidies, research funding, and favorable procurement policies.

- Order Intake Resilience: Airbus's strong order intake in 2024, despite geopolitical headwinds, highlights its effectiveness in managing international relations and securing long-term contracts across various global markets.

The competitive rivalry for Airbus is characterized by an intense duopoly with Boeing, controlling 90-95% of the large commercial aircraft market. This dynamic forces both manufacturers into constant innovation and aggressive pricing strategies to capture market share, particularly in key segments like narrow-body and wide-body jets.

The substantial investments required for aircraft development, estimated in the billions for new programs, create high exit barriers, compelling existing players to compete fiercely to recoup these sunk costs. This rivalry extends to technological advancements, with Airbus's A320neo family, for example, offering significant fuel efficiency improvements as a competitive differentiator.

The commercial aircraft market's moderate projected growth, with a CAGR of 4.5-5.1% between 2024 and 2029, means that competition for each new order is heightened. Companies cannot rely on market expansion alone and must actively vie for every available contract.

Geopolitical factors significantly influence this rivalry, with trade policies and government support impacting global operations. Airbus's strong order backlog in the first half of 2024, despite international trade tensions, demonstrates its strategic resilience in securing business across diverse markets.

| Key Competitor | Market Share (Large Commercial Jets) | Key Competitive Focus | Recent Performance Indicator (2024) |

| Boeing | ~45-50% | Product differentiation, fuel efficiency, new aircraft development (e.g., 777X) | Navigating production challenges and order adjustments. |

| Airbus | ~45-50% | Fuel efficiency (A320neo family), passenger comfort, order book expansion | Reported significant increase in commercial aircraft order backlog in H1 2024. |

SSubstitutes Threaten

High-speed rail presents a significant threat to short and medium-haul air travel, directly impacting demand for aircraft like Airbus's A220 and A320 families. In 2023, the European rail network continued its expansion, with countries like Spain investing heavily in new high-speed lines, making city-to-city travel increasingly competitive with flying.

This trend is expected to accelerate. For instance, the proposed high-speed rail link between London and Birmingham, though facing delays, aims to drastically cut journey times, making it a more attractive alternative to flying between these major hubs. As rail infrastructure becomes more efficient and environmentally conscious, it erodes the convenience and perceived value of short-haul flights, potentially dampening Airbus's order book for narrow-body aircraft in these segments.

The rise of virtual communication technologies presents a significant threat of substitutes for certain segments of air travel, particularly business travel. The widespread adoption of platforms like Zoom and Microsoft Teams, further propelled by the pandemic, has demonstrated their efficacy in replacing in-person meetings. In 2024, the global virtual collaboration market was valued at over $70 billion, a testament to its growing role in business operations.

While these technologies cannot fully substitute for leisure travel or the necessity of air cargo, they can reduce the frequency of business-related flights. This reduction directly impacts airline revenue and, by extension, the demand for new aircraft from manufacturers like Airbus. For instance, a reduction in business travel could lead to fewer orders for wide-body aircraft typically used on long-haul international routes, which often carry a higher proportion of business passengers.

If alternative transportation modes, such as high-speed rail or improved road infrastructure, become substantially more cost-effective or offer greater convenience for specific travel needs, they could divert passengers from air travel. For instance, a traveler might opt for a train journey if the total door-to-door time, including airport transfers and security, is comparable to or shorter than flying, especially for medium-haul routes.

The growing emphasis on environmental impact also plays a role; a lower carbon footprint associated with ground transportation can sway environmentally conscious travelers. In 2023, the European Union saw significant investment in high-speed rail networks, with projects like the France-Spain cross-border line aiming to offer a competitive alternative to short-haul flights.

Limited Direct Substitutes for Long-Haul/Cargo

The threat of substitutes for large commercial aircraft, particularly in the long-haul and cargo sectors, is remarkably low. For international travel and the movement of goods across vast distances, airplanes offer unparalleled speed and efficiency that other modes of transport simply cannot match. This inherent advantage significantly strengthens Airbus's position in these key markets, as there are few, if any, viable alternatives that can fulfill the same role.

Consider the logistics landscape in 2024. While sea freight remains crucial for bulk goods, its transit times are measured in weeks, not hours. Rail and road transport are limited by geography and infrastructure, making them impractical for intercontinental movement. This lack of direct, comparable substitutes means that demand for wide-body passenger jets and dedicated air freighters, the core of Airbus's business, is likely to remain robust.

- Unmatched Speed: Air travel drastically reduces transit times for passengers and time-sensitive cargo compared to sea, rail, or road.

- Global Reach: Aircraft are the only practical method for rapid, direct transportation between continents.

- Capacity: Large commercial aircraft, especially freighters, can transport significant volumes of goods efficiently.

- Limited Alternatives: For long-haul, high-value, or time-critical shipments, direct substitutes offering similar speed and reach are virtually non-existent.

Future Technologies (e.g., AAM)

Emerging aviation technologies, such as Advanced Air Mobility (AAM) and electric vertical takeoff and landing (eVTOL) aircraft, represent a potential, albeit long-term, threat of substitutes. While these concepts are still in their early stages, they could eventually offer alternative solutions for very short-haul travel and urban air mobility.

These nascent technologies, while not directly challenging Airbus's current commercial aircraft fleet, could significantly alter localized air transport markets. For instance, by 2024, significant investment continues to pour into eVTOL development, with companies like Joby Aviation and Archer Aviation securing substantial funding and progressing towards certification. This indicates a growing potential for these new forms of air travel to capture niche markets.

- AAM and eVTOL Development: Continued investment and technological advancements in electric propulsion and autonomous flight systems are key drivers.

- Urban Air Mobility Potential: These technologies aim to provide faster, more direct travel within congested urban areas, potentially substituting for short car or train journeys.

- Long-Term Market Impact: While not an immediate threat to large commercial aircraft, AAM could redefine regional and intra-city air travel over the next decade.

For Airbus, the threat of substitutes is most pronounced in short to medium-haul travel, where high-speed rail offers a compelling alternative. As of 2024, European nations continue to expand their rail networks, making ground travel increasingly competitive. Virtual communication also erodes demand for business travel, a key segment for aircraft manufacturers.

However, for long-haul international routes and air cargo, substitutes are virtually non-existent. The speed and global reach of air travel remain unmatched by sea, rail, or road, solidifying Airbus's dominance in these sectors. This lack of viable alternatives supports sustained demand for their wide-body aircraft.

Emerging technologies like eVTOLs pose a potential, long-term threat for very short-haul and urban mobility. While not impacting current commercial aircraft sales, significant investment in this area by 2024 suggests a future shift in localized air transport markets.

| Substitute Category | Impact on Airbus | Key Drivers | 2024 Relevance |

|---|---|---|---|

| High-Speed Rail | Moderate (Short/Medium Haul) | Infrastructure Investment, Environmental Concerns, Journey Time | Continued expansion in Europe, e.g., Spain's AVE network growth. |

| Virtual Communication | Moderate (Business Travel) | Technology Adoption, Cost Savings, Efficiency | Global virtual collaboration market exceeding $70 billion. |

| Sea/Road/Rail Freight | Low (Long Haul/Time-Sensitive Cargo) | Speed, Global Reach, Infrastructure Limitations | Sea freight transit times measured in weeks, not hours. |

| AAM/eVTOL | Low (Current), Potential (Future) | Technological Advancements, Urban Congestion | Substantial funding for eVTOL development by companies like Joby Aviation. |

Entrants Threaten

The aerospace manufacturing industry demands colossal upfront investments in research, development, manufacturing facilities, and complex supply chains, creating an almost insurmountable financial barrier for new entrants. For instance, the development of a new commercial aircraft program, like Airbus's A320neo family, can cost upwards of $15 billion. This enormous capital requirement means that only well-established entities with substantial financial backing can even consider entering this market.

A new player would need billions of euros and decades to establish the necessary infrastructure and expertise to compete with Airbus. Building a global supply chain, securing certifications, and developing the technical prowess to produce safe and efficient aircraft takes an extraordinary amount of time and resources. For example, it took decades for Airbus to reach its current market position, a timeline that is prohibitive for most potential competitors.

The threat of new entrants for Airbus is significantly mitigated by the extensive regulatory and certification hurdles. Developing and certifying a new aircraft model is a multi-year, highly complex process, requiring immense capital investment and specialized expertise. For instance, the certification process for a new large commercial aircraft can easily span five to ten years and cost billions of dollars, a daunting prospect for any potential newcomer.

Established aerospace giants like Airbus leverage immense economies of scale, a significant barrier for newcomers. Their vast production volumes, global supply chains, and extensive R&D investments translate into considerably lower per-unit costs for aircraft. For instance, in 2023, Airbus delivered 735 aircraft, a testament to its production capacity and the cost efficiencies derived from such scale.

New entrants face the daunting task of replicating these cost advantages. Without achieving comparable production volumes, they would struggle to match Airbus's pricing power, making it exceptionally challenging to gain market share. The experience curve also plays a crucial role; as Airbus produces more aircraft, its processes become more refined and efficient, further reducing costs over time.

Access to Distribution Channels and Customer Relationships

Airbus maintains deeply entrenched relationships with key global airlines and government entities. These connections are forged through years of demonstrated reliability, comprehensive after-sales support, and robust maintenance infrastructure. For any new competitor, replicating this level of trust and access to established distribution networks, which often include significant order backlogs, presents a formidable barrier.

New entrants would struggle immensely to establish comparable customer loyalty and secure the vital distribution channels that Airbus currently commands. The existing network of service centers, training facilities, and long-term supply agreements acts as a significant deterrent, making it exceptionally difficult for newcomers to penetrate the market effectively.

- Established Airline Partnerships: Airbus has secured multi-year deals with major carriers, ensuring a steady stream of orders and predictable revenue. For instance, in 2023, Airbus announced significant orders from airlines like IndiGo for A320neo family aircraft, totaling hundreds of planes.

- Government and Defense Contracts: Beyond commercial aviation, Airbus holds crucial contracts with governments for military transport and other defense-related aircraft, a segment new entrants would find hard to break into without established security clearances and proven capabilities.

- After-Sales Support Network: The sheer scale and global reach of Airbus's maintenance, repair, and overhaul (MRO) network are critical. This extensive support system, developed over decades, is a significant competitive advantage that new players cannot easily replicate.

Proprietary Technology and Brand Reputation

Airbus's formidable proprietary technology and deeply entrenched brand reputation present a significant barrier to entry for new players in the commercial aircraft manufacturing market. Decades of investment in research and development have resulted in a vast repository of intellectual property and specialized engineering know-how that is incredibly difficult and time-consuming to replicate. For instance, Airbus's commitment to innovation is reflected in its ongoing development of sustainable aviation technologies, aiming for a 30% reduction in CO2 emissions by 2030 compared to 2005 levels, a target that requires substantial upfront investment and expertise.

The trust and brand recognition Airbus has cultivated over many years, particularly concerning safety and reliability, are invaluable assets. Potential new entrants would face the immense challenge of not only matching Airbus's technological capabilities but also building a comparable level of customer confidence and market acceptance. While China's COMAC is a notable emerging competitor, its path to challenging Airbus's established position, particularly in Western markets, involves navigating these significant hurdles of technological maturity and brand equity. For example, COMAC's C919 aircraft, while a significant achievement, is still in the early stages of global market penetration and certification compared to Airbus's extensive portfolio.

- Proprietary Technology: Airbus holds extensive patents and trade secrets in areas like aerodynamics, materials science, and aircraft systems, representing a substantial R&D advantage.

- Brand Reputation: Airbus is globally recognized for its commitment to safety and quality, a reputation built over decades of successful aircraft delivery and operations.

- Capital Investment: Establishing the necessary manufacturing facilities, supply chains, and certification processes for commercial aircraft requires billions of dollars in capital, a prohibitive cost for most new entrants.

- Emerging Competition: While COMAC is a developing rival, its current market share and global reach are significantly smaller than Airbus's, highlighting the existing barriers.

The threat of new entrants in the commercial aircraft manufacturing sector is exceptionally low due to immense capital requirements, reaching tens of billions of dollars for a new aircraft program. This financial barrier, coupled with the multi-year, multi-billion dollar certification processes, effectively deters most potential competitors. For example, the development and certification of a new large commercial aircraft can easily take a decade and cost over $15 billion.

Established players like Airbus benefit from significant economies of scale, with 2023 deliveries of 735 aircraft, which translates into lower per-unit costs that are nearly impossible for newcomers to match. Furthermore, deeply entrenched relationships with airlines, built on decades of reliability and comprehensive support networks, create substantial hurdles for any new entrant seeking market access and customer loyalty.

Proprietary technology and a strong brand reputation for safety and quality, cultivated over many years, also act as significant deterrents. While emerging competitors like COMAC are present, their global market penetration and technological maturity are still considerably behind established giants, underscoring the high barriers to entry.

| Barrier | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | Colossal upfront investment needed for R&D, manufacturing, and supply chains. | Development of a new commercial aircraft program can exceed $15 billion. |

| Regulatory & Certification Hurdles | Lengthy and complex multi-year processes requiring specialized expertise and capital. | Certification for a new large commercial aircraft can span 5-10 years and cost billions. |

| Economies of Scale | Cost advantages derived from high production volumes and global operations. | Airbus delivered 735 aircraft in 2023, enabling significant cost efficiencies. |

| Brand Reputation & Customer Loyalty | Established trust, safety record, and long-term relationships with airlines. | Decades of successful operations and a strong safety record build invaluable brand equity. |

| Proprietary Technology | Intellectual property, specialized engineering know-how, and ongoing R&D investments. | Ongoing development of sustainable aviation technologies requires substantial expertise and investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Airbus is built upon a foundation of diverse and credible data sources, including Airbus's annual reports, financial disclosures, and investor relations materials. We also incorporate industry-specific market research reports, aviation sector publications, and data from reputable financial information providers to ensure a comprehensive understanding of the competitive landscape.