AIRBUS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIRBUS Bundle

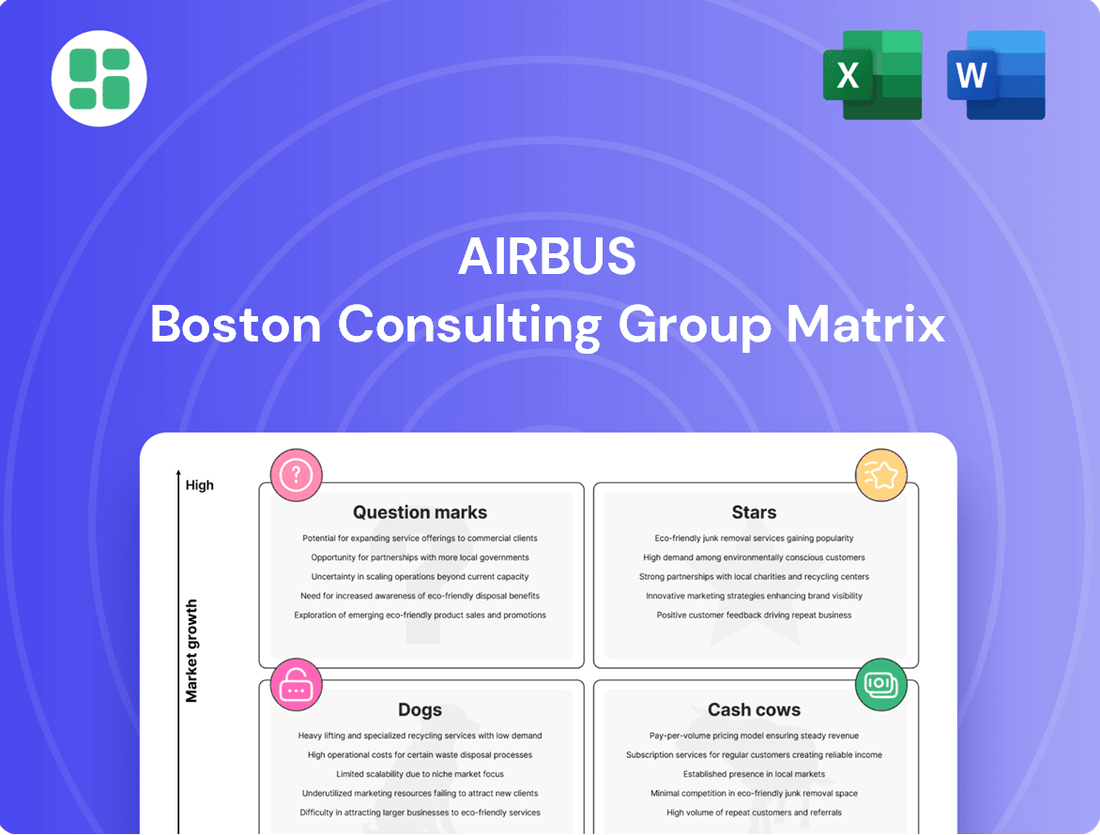

Curious about Airbus's product portfolio performance? This glimpse into their BCG Matrix reveals how their aircraft models stack up as Stars, Cash Cows, Dogs, or Question Marks in the competitive aerospace market. Don't miss the full strategic picture!

Unlock the complete Airbus BCG Matrix to gain a comprehensive understanding of each aircraft family's market share and growth potential. Purchase the full report for actionable insights to optimize your investment and strategic planning.

This preview offers a taste of the strategic clarity the full Airbus BCG Matrix provides. Dive into detailed quadrant analysis and data-driven recommendations to navigate the complexities of the aviation industry and make informed decisions.

Stars

The A320neo family, including the A321XLR, is a star performer for Airbus, dominating the single-aisle market. As of March 2025, Airbus had a substantial backlog of 8,726 commercial aircraft, with the A320neo family forming a significant portion of this. This strong demand is prompting Airbus to increase production, aiming for 75 aircraft per month by 2027.

In the first quarter of 2025, Airbus delivered 106 A320 Family jets, underscoring the family's importance to the company's commercial success. The A321XLR, in particular, is a key growth driver, catering to the increasing demand for longer-range, more efficient narrow-body aircraft.

The A350 Widebody Program, including the freighter variant, is a strong contender in the high-growth widebody aircraft market. This segment is fueled by rising international travel and a consistent need for fuel-efficient, long-haul planes. Airbus is targeting a production increase to 12 aircraft monthly by 2028, a move that underscores the program's star potential.

The introduction of the A350F is poised to significantly enhance the program's market standing. While facing some supply chain challenges, the A350 continues to attract new orders and demonstrate substantial value. For instance, Airbus delivered 9 A350 units in the first quarter of 2025, reflecting ongoing demand.

Airbus Helicopters is a dominant force in the civil and parapublic sectors, holding an impressive preliminary 57% market share as of 2024. This leadership is further underscored by 450 net new orders received in 2024, signaling robust market expansion and strong customer confidence.

The company's success is driven by the consistent performance of key models such as the H145 and H160. Growing demand from critical areas like emergency medical services and various public sector operations reinforces Airbus Helicopters' position as a Star in the BCG matrix.

Airbus A220 Program

The Airbus A220 program is a significant growth driver for Airbus, positioned as a Star in the BCG matrix. This aircraft family is crucial for capturing the high-demand market for efficient, smaller single-aisle jets, effectively expanding Airbus's footprint in regional and shorter-haul routes.

Airbus is aggressively scaling A220 production, aiming for a rate of 14 aircraft per month by 2026. This ramp-up reflects the strong market appetite for the A220's fuel efficiency and passenger comfort. As of late 2024, the A220 boasts a substantial order backlog, underscoring its market appeal and future revenue potential.

Despite facing some supply chain headwinds that have impacted delivery schedules, the A220's strategic importance for diversifying Airbus's narrow-body portfolio and its strong order book confirm its Star status. The program is expected to continue its upward trajectory, contributing significantly to Airbus's market share in the 100-150 seat segment.

- Production Target: 14 aircraft per month by 2026.

- Market Segment: High-growth for efficient, smaller single-aisle aircraft.

- Strategic Importance: Expands Airbus's reach in regional markets and diversifies fleet offerings.

- Outlook: Strong order book and continued demand signal significant future potential.

Airbus Defence & Space (Air Power and Connected Intelligence)

Airbus Defence & Space's Air Power segment, notably featuring the Eurofighter Typhoon, is experiencing a significant uplift. This growth is fueled by a global resurgence in defense budgets and a push for military modernization. The division's performance in Q1 2025 reflected this momentum, with an 11% revenue jump and enhanced Adjusted EBIT.

The strong order intake for Air Power programs underscores a robust market and Airbus's prominent position in critical defense technologies. This suggests the segment is a key growth driver for the company.

- Eurofighter Typhoon: Continues to be a cornerstone of European air defense, with ongoing modernization and potential new export orders.

- Defense Spending Trends: Global defense expenditures are on the rise, benefiting companies like Airbus Defence & Space. For instance, NATO members are increasing their defense commitments.

- Q1 2025 Performance: Airbus Defence & Space reported an 11% revenue increase and improved Adjusted EBIT, highlighting the Air Power segment's contribution.

- Connected Intelligence: While not detailed in the provided talking points, this area represents a strategic focus for future growth, integrating advanced digital solutions into defense platforms.

The A320neo family, including the A321XLR, is a star performer for Airbus, dominating the single-aisle market. As of March 2025, Airbus had a substantial backlog of 8,726 commercial aircraft, with the A320neo family forming a significant portion of this. This strong demand is prompting Airbus to increase production, aiming for 75 aircraft per month by 2027.

In the first quarter of 2025, Airbus delivered 106 A320 Family jets, underscoring the family's importance to the company's commercial success. The A321XLR, in particular, is a key growth driver, catering to the increasing demand for longer-range, more efficient narrow-body aircraft.

The Airbus A220 program is a significant growth driver for Airbus, positioned as a Star in the BCG matrix. This aircraft family is crucial for capturing the high-demand market for efficient, smaller single-aisle jets, effectively expanding Airbus's footprint in regional and shorter-haul routes.

Airbus is aggressively scaling A220 production, aiming for a rate of 14 aircraft per month by 2026. This ramp-up reflects the strong market appetite for the A220's fuel efficiency and passenger comfort. As of late 2024, the A220 boasts a substantial order backlog, underscoring its market appeal and future revenue potential.

| Aircraft Program | BCG Category | Key Drivers | 2024/2025 Data Points | Outlook |

|---|---|---|---|---|

| A320neo Family (incl. A321XLR) | Star | Dominant single-aisle market share, strong demand for efficiency and range | 8,726 aircraft backlog (March 2025), 106 deliveries Q1 2025 | Production ramp-up to 75/month by 2027 |

| A350 Widebody Program (incl. A350F) | Star | High-growth widebody market, fuel efficiency, freighter variant launch | 9 deliveries Q1 2025 | Production ramp-up to 12/month by 2028 |

| Airbus Helicopters | Star | Civil and parapublic sector dominance, key model performance | 57% preliminary market share (2024), 450 net new orders (2024) | Continued strong demand from EMS and public sectors |

| A220 Program | Star | High demand for efficient, smaller single-aisle jets | Substantial order backlog (late 2024) | Production target of 14/month by 2026, continued market share growth |

| Air Power (Eurofighter Typhoon) | Star | Resurgence in defense budgets, military modernization | 11% revenue jump and improved Adjusted EBIT (Q1 2025) | Ongoing modernization and potential export orders |

What is included in the product

This BCG Matrix overview for Airbus analyzes its product portfolio, categorizing aircraft families into Stars, Cash Cows, Question Marks, and Dogs to inform strategic investment decisions.

A clear, one-page overview of Airbus's business units within the BCG matrix readily identifies underperforming areas, relieving the pain of strategic uncertainty.

Cash Cows

Airbus Services, encompassing maintenance, repair, overhaul, and training, stands as a prime example of a Cash Cow within Airbus's portfolio. This segment generates consistent and substantial profits, fueled by the vast global fleet of Airbus aircraft and helicopters requiring ongoing support. The recurring revenue stream is a significant advantage, ensuring financial stability.

With a substantial installed base, Airbus Services benefits from a high market share in a relatively mature, low-growth industry. This positions it perfectly as a Cash Cow, demanding minimal investment for expansion while delivering robust cash flows. For instance, in 2023, Airbus reported a significant portion of its revenues coming from its Services division, highlighting its ongoing profitability.

The Airbus A330 family, a cornerstone of widebody aviation, functions as a significant cash cow for the company. Despite its maturity, the program continues to generate substantial and stable revenue streams. This reliability stems from consistent production and enduring customer interest, especially in the upgraded A330neo variant.

Airbus is currently managing production of the A330 at a rate of approximately four aircraft monthly, a pace designed to balance supply with existing demand. Looking ahead, there's a strategic plan to ramp this up to five units per month by 2029, reflecting sustained and growing customer appetite for this proven platform.

The A330's strong market standing, built on years of operational success and passenger appeal, translates directly into healthy profit margins. This established reputation ensures a predictable and robust cash flow, solidifying its role as a dependable earner for Airbus.

The A400M military transport aircraft program represents a significant cash cow for Airbus Defence and Space. Its revenue is bolstered by consistent deliveries to various military clients and lucrative long-term support agreements. For instance, by the end of 2023, Airbus had delivered 54 A400M aircraft, with a substantial order backlog ensuring continued revenue generation.

Legacy A320ceo Fleet Support

The legacy A320ceo fleet represents a significant cash cow for Airbus. Its vast installed base ensures substantial recurring revenue from aftermarket services, spare parts, and ongoing technical support. This segment is characterized by stable, high-margin cash flows with minimal need for new capital investment.

Despite the industry's shift towards the A320neo, the operational longevity of the existing A320ceo fleet guarantees a persistent demand for Airbus's support services. This sustained demand translates into predictable and profitable revenue streams.

- Installed Base: Over 4,500 A320ceo family aircraft are still in service globally as of early 2024.

- Aftermarket Revenue: This segment typically contributes billions of dollars annually to Airbus's top line.

- Profitability: Aftermarket services often boast higher profit margins compared to new aircraft sales.

- Low Investment: Continued support requires operational investment rather than significant R&D or manufacturing upgrades.

Eurofighter Typhoon (Sustainment and Modernization)

The Eurofighter Typhoon remains a significant cash cow for Airbus, even as a mature platform. Its ongoing sustainment and modernization programs, coupled with follow-on orders from established European customers, generate substantial and consistent revenue. These long-term government contracts cover essential upgrades, maintenance, and support services, capitalizing on the aircraft's extensive operational presence across various air forces.

The program's profitability is underpinned by its robust installed base, ensuring a reliable income stream within the Defence and Space segment. For instance, in 2024, the Eurofighter program continued to secure key contracts, such as the Tranche 4 production for Germany and Spain, further solidifying its revenue generation capabilities.

- Sustainment Revenue: Ongoing maintenance and support contracts provide predictable cash flow.

- Modernization Programs: Upgrades like the upcoming CAP550 enhance capabilities and drive new revenue.

- Follow-on Orders: Existing customers continue to place orders, extending production and support lifecycles.

- Installed Base Leverage: A large fleet size across multiple nations ensures continued demand for services.

The legacy A320ceo family, with over 4,500 aircraft still flying globally as of early 2024, continues to be a robust cash cow. This extensive installed base drives substantial recurring revenue from aftermarket services and spare parts, typically contributing billions annually to Airbus's top line with higher profit margins than new aircraft sales. These services require operational investment rather than significant new capital.

| Aircraft Family | Status | Key Cash Cow Attributes | Estimated Installed Base (Early 2024) | Annual Revenue Contribution (Estimated) |

|---|---|---|---|---|

| A320ceo | Mature | High aftermarket revenue, stable demand for support, high profit margins on services | > 4,500 | Billions of USD |

| A330 | Mature | Consistent production, strong customer interest (especially A330neo), healthy profit margins | ~1,500+ | Billions of USD |

| Eurofighter Typhoon | Mature | Long-term government contracts, sustainment and modernization programs, significant installed base across European air forces | > 600 | Billions of USD |

| A400M | Growth/Mature | Consistent deliveries, lucrative long-term support agreements, substantial order backlog | 54 delivered by end of 2023 | Hundreds of Millions to Billions of USD |

Preview = Final Product

AIRBUS BCG Matrix

The AIRBUS BCG Matrix preview you are currently viewing is the precise, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just the complete strategic analysis ready for your immediate use. You're looking at the exact same high-quality report that will be delivered to you, designed for professional application in strategic planning and competitive analysis.

Dogs

The Airbus A380 program, despite its initial promise as a flagship superjumbo jet, has been firmly categorized as a Dog in the BCG matrix. Production of the A380 ceased in 2021, a definitive indicator of its declining market relevance. This cessation was driven by factors such as exceptionally high operating costs and significant limitations in airport compatibility, which restricted its operational flexibility for airlines.

The market's trajectory has decisively shifted towards more fuel-efficient, point-to-point aircraft, leaving the A380 behind. While some airlines saw a temporary demand surge for the A380 in the post-pandemic travel recovery, this was largely a short-term solution to capacity needs rather than a sign of renewed long-term viability. Consequently, the A380 remains an end-of-life product line with no new aircraft sales and persistent operational challenges for its existing operators.

The older A330ceo variants are positioned as Dogs in the BCG matrix for Airbus. While these aircraft remain in service and are supported by Airbus, their market for new sales is shrinking as airlines prioritize newer, more fuel-efficient models like the A330neo. For instance, in 2023, Airbus delivered 64 A330neo aircraft, signaling a clear shift in customer preference away from the older ceo models.

Certain legacy space programs within Airbus's portfolio are likely positioned as Dogs in the BCG Matrix. Airbus's 2023 financial statements revealed charges and adjustments specifically linked to these older space initiatives, signaling projects that are either underperforming or nearing the end of their lifecycle. For instance, the company has been transparent about the financial impact of legacy satellite programs that may not align with current market demands or technological advancements.

These legacy programs typically represent areas with low market share and minimal growth potential, demanding significant resource allocation without promising substantial future returns. This status makes them prime candidates for strategic decisions such as divestiture or a deliberate reduction in further investment, allowing Airbus to redirect capital towards more promising ventures.

Specific Niche Military Older Aircraft

Within Airbus's Defence and Space segment, certain niche military older aircraft programs, distinct from major platforms like the A400M or Eurofighter, could be classified as Dogs. These specialized aircraft often cater to very specific military needs, limiting their broader appeal and export opportunities. For instance, programs focused on legacy reconnaissance or specialized transport roles might fall into this category.

The financial outlook for these niche programs is typically subdued. High operational and maintenance costs can offset limited revenue streams, and the market for such specialized, aging platforms is often stagnant or declining. This results in a low market share and minimal projected future revenue growth, characteristic of the Dog quadrant in the BCG matrix.

- Limited Export Potential: Many older niche military aircraft are designed for specific national requirements, making them less attractive to international buyers.

- High Maintenance Costs: As these aircraft age, spare parts become scarce and expensive, driving up operational expenses.

- Low Growth Market Segments: The specific military roles these aircraft fulfill may be in segments experiencing very low or no new order growth.

- Minimal Future Revenue: Consequently, these programs contribute little to current revenue and offer negligible potential for future financial returns.

Outdated Design/Testing Programs with No Commercial Viability

Outdated design or testing programs with no commercial viability are considered Dogs in the BCG matrix for Airbus. These are past research and development initiatives or demonstrator projects that failed to translate into marketable products. They consumed valuable resources, including significant R&D investment and engineering hours, without capturing any market share or generating future revenue streams. For instance, while specific discontinued programs are often proprietary, the aerospace industry historically sees numerous experimental projects that don't reach commercialization. These projects, once identified as non-viable, are typically divested or minimized to prevent further resource drain.

These initiatives represent cash traps for Airbus. They tie up capital and personnel that could be better allocated to more promising ventures within the company's portfolio. The strategic decision to exit or minimize such programs is crucial for optimizing resource allocation and focusing on areas with higher potential for growth and profitability. By shedding these underperforming assets, Airbus can redirect its efforts towards innovations that align with current market demands and future strategic objectives.

- Resource Drain: Past R&D projects that never reached commercialization represent significant sunk costs.

- Lack of Market Share: These initiatives failed to capture any market presence or generate sales.

- Cash Trap Identification: Such programs are classified as Dogs because they consume resources without future revenue potential.

- Strategic Divestment: Airbus, like other major aerospace firms, strategically exits or minimizes these non-viable projects to reallocate capital.

Certain legacy space programs within Airbus's portfolio are likely positioned as Dogs in the BCG matrix. Airbus's 2023 financial statements revealed charges and adjustments specifically linked to these older space initiatives, signaling projects that are either underperforming or nearing the end of their lifecycle. These legacy programs typically represent areas with low market share and minimal growth potential, demanding significant resource allocation without promising substantial future returns.

Within Airbus's Defence and Space segment, certain niche military older aircraft programs, distinct from major platforms like the A400M or Eurofighter, could be classified as Dogs. These specialized aircraft often cater to very specific military needs, limiting their broader appeal and export opportunities. The financial outlook for these niche programs is typically subdued, with high operational and maintenance costs offsetting limited revenue streams.

Outdated design or testing programs with no commercial viability are considered Dogs in the BCG matrix for Airbus. These are past research and development initiatives or demonstrator projects that failed to translate into marketable products, consuming valuable resources without capturing any market share or generating future revenue streams. These initiatives represent cash traps for Airbus, tying up capital and personnel that could be better allocated to more promising ventures.

The older A330ceo variants are positioned as Dogs in the BCG matrix for Airbus. While these aircraft remain in service and are supported by Airbus, their market for new sales is shrinking as airlines prioritize newer, more fuel-efficient models like the A330neo. In 2023, Airbus delivered 64 A330neo aircraft, signaling a clear shift in customer preference away from the older ceo models.

| Aircraft/Program | BCG Category | Rationale | Key Data Point (2023/2024) |

| Airbus A380 | Dog | Production ceased in 2021; high operating costs; limited airport compatibility; market shift to fuel-efficient aircraft. | No new aircraft sales in 2023/2024. |

| Airbus A330ceo | Dog | Market preference shifting to A330neo; shrinking new sales market. | Airbus delivered 64 A330neo aircraft in 2023, indicating declining demand for ceo variants. |

| Legacy Space Programs | Dog | Underperforming or nearing end-of-lifecycle; low market share and growth potential; significant resource allocation without substantial future returns. | Charges and adjustments related to legacy space initiatives noted in 2023 financial statements. |

| Niche Military Older Aircraft Programs | Dog | Specific military roles; limited broader appeal and export opportunities; subdued financial outlook; high maintenance costs. | Low market share and minimal projected future revenue growth for specialized, aging platforms. |

| Outdated R&D/Testing Programs | Dog | Failed to commercialize; consumed resources without market share or revenue; cash traps. | Significant R&D investment and engineering hours without commercialization. |

Question Marks

The CityAirbus NextGen project positions Airbus within the burgeoning Urban Air Mobility (UAM) market, a sector characterized by high growth potential but currently holding a low market share for Airbus. This ambitious venture demands significant investment and faces substantial technological hurdles before achieving commercial viability.

Airbus's recent decision to pause the demonstrator program underscores the inherent risks and the substantial capital expenditure required. The pause is attributed to the need for further advancements in battery technology, a critical component for the successful operation of electric vertical takeoff and landing (eVTOL) aircraft like CityAirbus NextGen.

Airbus's ZEROe project is a bold initiative to develop hydrogen-powered commercial aircraft, targeting a significant long-term shift towards decarbonizing aviation. This ambitious undertaking represents a high-investment, high-potential future growth area for Airbus, though it currently holds no market share.

The project's development is in its early research and development phases, and Airbus has recently adjusted its timeline, pushing the potential entry into service to the late 2040s. This indicates the substantial technological hurdles and ongoing investment required to bring this innovative concept to fruition.

The Future Combat Air System (FCAS) is a prime example of a Question Mark in the BCG Matrix for Airbus. It's a groundbreaking, multinational defense initiative designed to create a next-generation combat air capability, tapping into a market with significant long-term growth potential as nations modernize their air forces.

However, FCAS is currently in its formative stages, demanding massive research and development investment with no immediate revenue streams to offset these costs. The program is laden with substantial technological hurdles and complex political considerations among participating nations, increasing its risk profile and placing it firmly in the Question Mark category.

New Generation Satellite Constellations/Services Ventures

New generation satellite constellations and innovative early-stage services ventures for Airbus are positioned as Stars in the BCG matrix. These are characterized by high growth potential within the expanding space sector, but currently have a low market share. For instance, the global satellite services market was projected to reach approximately $270.5 billion by 2024, indicating a robust growth trajectory for new entrants if they can secure a foothold.

These ventures require substantial capital investment for development and deployment, reflecting their high resource demands. Despite the upfront costs, the aim is to capitalize on emerging trends such as low-Earth orbit (LEO) broadband constellations and advanced Earth observation services. By 2025, the LEO satellite market alone is expected to see significant expansion, driven by demand for global connectivity.

- High Investment Needs: Significant upfront capital is required for developing and launching new satellite constellations and advanced services.

- Emerging Market Capture: These ventures target rapidly growing segments of the space market, such as LEO broadband and specialized data services.

- Future Growth Potential: Success hinges on capturing future demand and establishing a strong market position in these nascent but promising areas.

- Innovation-Driven: Ventures often involve cutting-edge technology and novel service models to differentiate in a competitive landscape.

Advanced Autonomous Flight Technologies

Advanced autonomous flight technologies represent a significant investment for Airbus, fitting squarely into the Question Mark category of the BCG matrix. While the potential for revolutionizing aviation is immense, offering enhanced efficiency and safety, these technologies are still largely in the research and early development phases. Airbus's commitment to this area, evidenced by significant R&D spending, aims to unlock future aviation paradigms, but the path forward involves substantial investment and navigating complex regulatory landscapes.

The high growth potential is undeniable, with projections suggesting autonomous systems could dramatically reduce operational costs and improve air traffic management. For instance, the global market for autonomous aviation is anticipated to reach tens of billions of dollars by the late 2030s. However, current market share is effectively zero for truly advanced autonomous systems beyond current autopilot capabilities, necessitating a strategic approach to development and market entry.

- High R&D Investment: Airbus is dedicating substantial resources to the development of advanced autonomous flight systems, recognizing the long-term strategic importance.

- Uncertain Market Share: As these technologies are in early stages, there is no current market share to analyze, making them a classic Question Mark.

- Regulatory Hurdles: Significant regulatory approvals are required before widespread adoption of advanced autonomous flight, posing a considerable challenge.

- Future Growth Potential: The long-term vision includes transforming air travel, promising substantial market growth and operational efficiencies.

Question Marks in Airbus's BCG Matrix represent ventures with high growth potential but low current market share, demanding significant investment and facing considerable uncertainty. These are often in the early stages of development, requiring substantial R&D to overcome technological and market entry challenges.

The CityAirbus NextGen and ZEROe projects exemplify this, targeting nascent but high-growth sectors like Urban Air Mobility and hydrogen-powered aviation, respectively. Similarly, advanced autonomous flight technologies and the Future Combat Air System (FCAS) are in their infancy, requiring massive capital outlay with uncertain returns in the near term.

These initiatives are crucial for Airbus's long-term strategy, aiming to shape future markets and achieve competitive advantage. However, their success is contingent on navigating technological complexities, regulatory landscapes, and securing sustained investment to transition them into Stars or Cash Cows.

The global UAM market, for example, is projected to grow substantially, with some estimates suggesting it could reach over $20 billion by 2030, highlighting the potential for ventures like CityAirbus NextGen if they achieve commercial viability.

| Venture | Market Growth Potential | Current Market Share | Investment Needs | Key Challenges |

|---|---|---|---|---|

| CityAirbus NextGen | High (UAM) | Low | High | Technology, Regulation, Infrastructure |

| ZEROe Project | High (Decarbonized Aviation) | Low | Very High | Hydrogen Tech, Infrastructure, Certification |

| FCAS | High (Defense Aviation) | Low | Very High | Technology, Geopolitics, Interoperability |

| Autonomous Flight | High (Aviation Efficiency) | Low | High | Technology, Safety, Regulation |

BCG Matrix Data Sources

Our BCG Matrix for Airbus is built on a foundation of robust data, integrating Airbus's annual financial reports, extensive market research on the aerospace sector, and official industry growth forecasts.