AIRBUS Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIRBUS Bundle

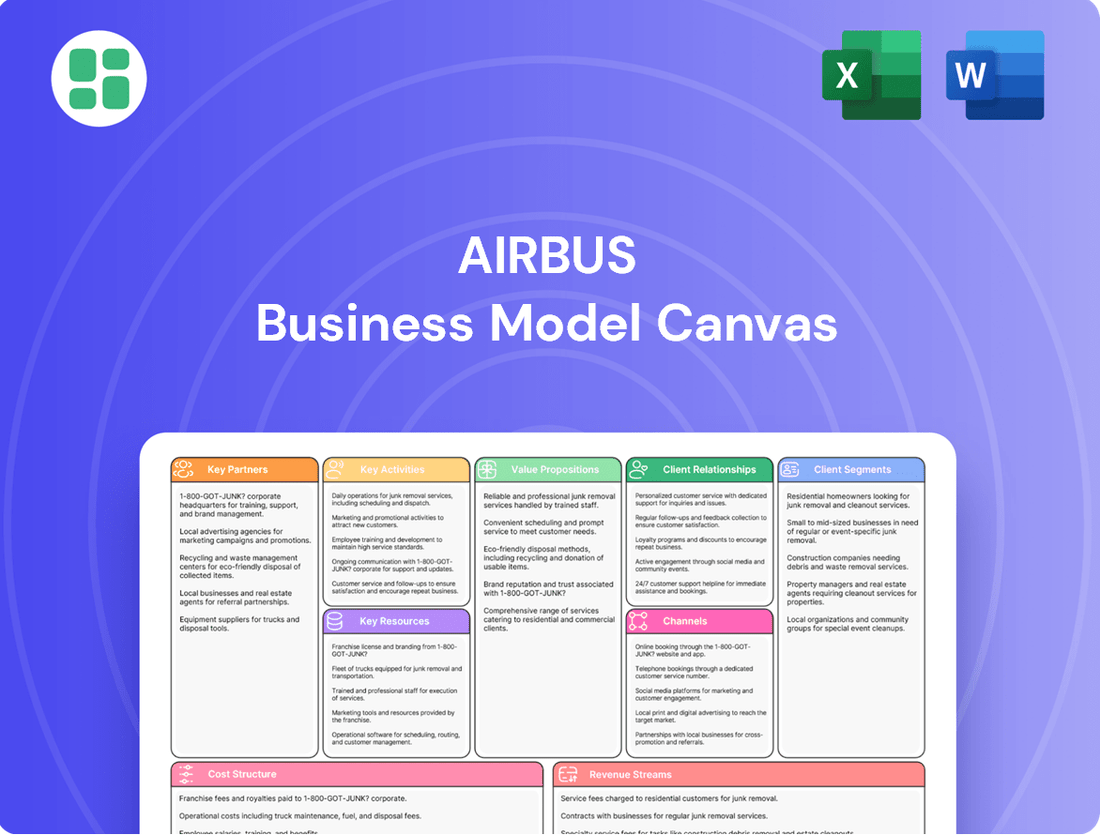

Explore the intricate strategic framework that propels AIRBUS to the forefront of the aerospace industry with our comprehensive Business Model Canvas. This detailed analysis unpacks how AIRBUS masterfully connects its value propositions to key customer segments and leverages strategic partnerships to drive innovation and profitability. Discover the core activities and revenue streams that define its market dominance.

Ready to gain a competitive edge? Unlock the complete AIRBUS Business Model Canvas, offering a granular view of its customer relationships, cost structure, and key resources. This professionally crafted document is essential for anyone seeking to understand the mechanics of a global aerospace leader and apply similar strategic thinking to their own ventures.

Partnerships

Airbus's supply chain partners are fundamental, encompassing a global network providing everything from engines and avionics to raw materials. Key relationships include those with Spirit AeroSystems for aerostructures and engine makers like CFM International and Pratt & Whitney, vital for production efficiency.

These partnerships are critical for managing production ramp-ups and navigating supply chain disruptions, ensuring the consistent availability of high-quality components. For instance, in 2023, Airbus continued to strengthen its ties with suppliers to meet increased production targets, aiming for around 800 commercial aircraft deliveries.

Airbus actively partners with leading research institutions, universities, and technology firms to fuel its innovation pipeline. These collaborations are crucial for advancing critical areas like sustainable aviation fuels (SAF) and next-generation hydrogen propulsion systems.

Notable partnerships include collaborations with TotalEnergies to accelerate SAF development and with Avolon, a major aircraft lessor, to explore the commercialization of hydrogen-powered aircraft. These alliances are instrumental in pushing the boundaries of aviation technology.

In 2024, Airbus continued to emphasize its commitment to decarbonization through these R&D collaborations. For instance, the company is a key player in the European Clean Aviation Joint Undertaking, a public-private partnership aiming to develop breakthrough technologies for zero-emission flight, with significant funding allocated for research into hydrogen and SAF technologies.

Airbus's key partnerships with governments and defense agencies are foundational, extending beyond mere customer relationships. These entities are crucial for regulatory frameworks, R&D funding, and the execution of strategic defense initiatives, particularly for military aircraft, helicopters, and space systems.

These collaborations are characterized by substantial, long-term contracts and joint development projects vital for national security and space exploration. For instance, the A400M military transport aircraft program is a prime example of such a partnership, involving significant investment and commitment from multiple launch nations.

Strategic Alliances for New Mobility

Airbus is actively forging strategic alliances to pioneer the future of air mobility, focusing on Advanced Air Mobility (AAM) and urban air mobility. These collaborations are crucial for developing innovative solutions and expanding the reach of new aviation concepts.

A prime example is the Flight Path partnership with LCI, a leading helicopter lessor. This alliance is designed to facilitate the financing and development of robust AAM ecosystems, specifically around projects like the CityAirbus NextGen. Such ventures are vital for creating the necessary infrastructure and financial models for these nascent aviation sectors.

These strategic alliances are instrumental in identifying and implementing infrastructure and financial innovations necessary for the growth of emerging aviation segments. By partnering with key players, Airbus aims to accelerate the commercial viability and widespread adoption of AAM technologies.

- Flight Path Partnership with LCI: Focuses on helicopter financing and the development of AAM ecosystems.

- CityAirbus NextGen: A key project benefiting from these strategic collaborations.

- Goal: To identify infrastructure and financial innovations for emerging aviation segments.

Airline Customers and Lessors

Airbus cultivates enduring alliances with major airlines and prominent aircraft lessors such as Delta Air Lines and Avolon. These collaborations are fundamental for gauging market demands, securing substantial aircraft orders, and jointly pioneering the development of next-generation aircraft and associated services. For instance, by 2024, Airbus had delivered over 13,800 aircraft to customers worldwide, underscoring the scale of these long-standing relationships.

These partnerships foster crucial feedback mechanisms that drive product enhancements, facilitate collaborative research into emerging technologies, and solidify commitments towards fleet modernization and ambitious sustainability objectives. Avolon, a leading lessor, placed a significant order for 25 A321neo aircraft in 2024, demonstrating continued confidence in Airbus's product development and environmental initiatives.

- Long-term relationships: Critical for market insight and order security.

- Joint development: Collaboration on future aircraft and services.

- Feedback loops: Essential for product improvement and innovation.

- Fleet modernization & sustainability: Shared goals driving partnership.

Airbus's key partnerships with governments and defense agencies are foundational, extending beyond mere customer relationships. These entities are crucial for regulatory frameworks, R&D funding, and the execution of strategic defense initiatives, particularly for military aircraft, helicopters, and space systems.

These collaborations are characterized by substantial, long-term contracts and joint development projects vital for national security and space exploration. For instance, the A400M military transport aircraft program is a prime example of such a partnership, involving significant investment and commitment from multiple launch nations.

Airbus actively cultivates alliances with major airlines and lessors, such as Delta Air Lines and Avolon. These relationships are fundamental for gauging market demands, securing aircraft orders, and jointly pioneering next-generation aircraft and services. By the end of 2023, Airbus had delivered over 13,800 aircraft to customers globally, highlighting the depth of these partnerships.

In 2024, Avolon placed a significant order for 25 A321neo aircraft, underscoring continued confidence in Airbus's product development and sustainability goals. These collaborations foster crucial feedback mechanisms that drive product enhancements and solidify commitments towards fleet modernization and ambitious environmental objectives.

| Partner Type | Key Collaborations | Impact | 2024 Focus/Data |

|---|---|---|---|

| Governments & Defense Agencies | A400M Program, National Security Initiatives | Regulatory support, R&D funding, Strategic execution | Continued involvement in defense modernization projects |

| Airlines & Lessors | Delta Air Lines, Avolon | Market insight, Order security, Joint R&D | Avolon order for 25 A321neo; Fleet modernization |

| Research Institutions & Tech Firms | TotalEnergies, European Clean Aviation JU | Innovation pipeline, Sustainable Aviation Fuels (SAF), Hydrogen propulsion | Advancing SAF and hydrogen technologies; Zero-emission flight research |

What is included in the product

A comprehensive, pre-written business model tailored to Airbus's strategy, detailing customer segments, value propositions, and key partners in aviation.

Reflects the real-world operations of a global aerospace leader, organized into 9 classic BMC blocks with full narrative and insights.

The AIRBUS Business Model Canvas provides a clear, structured framework, alleviating the pain of complex strategy by offering a visual, one-page snapshot of their entire operation.

It simplifies the daunting task of understanding AIRBUS's intricate business by condensing their strategy into a digestible and easily shareable format.

Activities

Aircraft Design and Engineering is Airbus's engine for innovation, focusing on creating and refining aircraft. This involves deep dives into aerodynamics, structural integrity, and integrating complex systems, all while exploring cutting-edge materials and manufacturing processes. This commitment to R&D is crucial for maintaining their market position and meeting ambitious sustainability targets.

In 2024, Airbus continued to invest heavily in its future aircraft programs. For instance, the A320neo family, a cornerstone of their commercial aircraft portfolio, saw ongoing enhancements to its fuel efficiency and performance. This dedication to continuous improvement in design and engineering directly impacts operational costs for airlines and reduces environmental impact.

Airbus's manufacturing and assembly operations are central to its business, involving the intricate creation and putting together of commercial aircraft, helicopters, and space systems at various locations worldwide. This demands meticulous management of production processes, stringent quality checks, and the seamless coordination of a global supply network to ensure timely aircraft deliveries.

In 2024, Airbus continued its efforts to ramp up production, particularly for its A320 family, aiming to reach a monthly rate of 75 aircraft. This ambitious goal is being pursued despite ongoing global supply chain disruptions, which have been a significant factor impacting the aerospace industry.

Airbus's sales and marketing efforts are crucial for identifying customer needs and securing new aircraft orders. This involves direct engagement with airlines, governments, and other operators worldwide, often through participation in major airshows and strategic negotiations.

The company's ability to manage a substantial order backlog is a testament to the success of these activities. For instance, Airbus reported a significant increase in its order intake throughout 2024, with a robust pipeline extending into the first half of 2025, highlighting strong market demand and effective sales strategies.

After-Sales Service and Support

Airbus's after-sales service is a cornerstone of its business, encompassing extensive maintenance, repair, and overhaul (MRO) capabilities. This vital segment ensures the ongoing airworthiness and peak operational performance of the vast global fleet of Airbus aircraft. The company also provides essential spare parts, crucial upgrades, and dedicated technical support, all contributing to customer satisfaction and operational continuity.

This commitment to comprehensive support fosters deep, long-term customer loyalty and establishes significant recurring revenue streams for Airbus. For instance, in 2023, Airbus reported a substantial increase in its Services segment, highlighting the growing importance of these offerings to its overall financial health. This growth trend in services is a consistent theme across their financial reporting, underscoring its strategic value.

- Maintenance, Repair, and Overhaul (MRO): Providing comprehensive MRO services to ensure aircraft airworthiness.

- Spare Parts and Upgrades: Supplying critical spare parts and offering technological upgrades to enhance aircraft performance and longevity.

- Technical Support: Offering expert technical assistance to airlines for operational efficiency and troubleshooting.

- Customer Loyalty and Recurring Revenue: Building long-term relationships and generating consistent income through ongoing service contracts.

Research and Development (R&D) for Future Technologies

Airbus dedicates substantial resources to Research and Development, focusing on pioneering sustainable aerospace and advancing next-generation aviation technologies. This commitment is vital for securing its position as a technological leader and for tackling the critical environmental challenges facing the industry. In 2023, Airbus announced an increase in its R&D spending, with a significant portion allocated to these future-focused initiatives.

Key R&D activities include the development of hydrogen propulsion systems, the advancement of sustainable aviation fuels (SAFs), and the creation of sophisticated digital solutions to optimize aircraft performance and operations. These efforts are directly aligned with shaping the future trajectory of aviation, making it more environmentally friendly and efficient.

Notable R&D initiatives driving this progress are the ambitious ZEROe project, aiming to introduce the world's first zero-emission commercial aircraft by 2035, and the Wing of Tomorrow program, which is developing innovative wing technologies for enhanced aerodynamic efficiency. These projects underscore Airbus's proactive approach to innovation.

- Pioneering Sustainable Aerospace: Airbus's R&D is heavily focused on developing technologies like hydrogen propulsion and sustainable aviation fuels to reduce the environmental impact of air travel.

- Technological Leadership: Significant investment in R&D ensures Airbus remains at the forefront of aviation innovation, developing next-generation aircraft and digital solutions.

- Key Initiatives: The ZEROe project targets zero-emission aircraft by 2035, while the Wing of Tomorrow program enhances aerodynamic efficiency, showcasing tangible R&D progress.

- Financial Commitment: Airbus consistently invests a substantial portion of its revenue in R&D, reflecting its strategic priority to innovate and lead the industry's transformation.

Airbus's key activities revolve around designing, manufacturing, selling, and servicing a wide range of aircraft and aerospace products. This includes continuous innovation in aircraft engineering, efficient global production, securing orders through strategic sales, and providing comprehensive after-sales support to maintain customer satisfaction and operational readiness.

In 2024, Airbus continued to push boundaries in aircraft design and engineering, with a strong emphasis on sustainability. The company is actively developing technologies for future aircraft, including advancements in hydrogen propulsion and sustainable aviation fuels. This focus ensures they remain competitive and address the growing demand for environmentally friendly air travel.

The manufacturing and assembly segment is critical, with Airbus working to increase production rates for its popular A320 family. By 2024, the company aimed to deliver 75 aircraft per month, a significant undertaking that requires robust supply chain management and stringent quality control across its global facilities.

Sales and marketing efforts in 2024 were geared towards capitalizing on strong market demand, evidenced by a substantial order backlog. Airbus actively engages with airlines and other operators to secure new orders, ensuring a healthy pipeline of business for years to come.

The after-sales service division is a vital revenue stream, providing essential maintenance, repair, and overhaul (MRO) services. This segment is crucial for ensuring the ongoing airworthiness and operational efficiency of the global Airbus fleet, fostering customer loyalty and generating recurring income.

| Key Activity | Description | 2024 Focus/Data |

| Aircraft Design & Engineering | Developing and refining aircraft, focusing on aerodynamics, structure, and new technologies. | Continued investment in A320neo family enhancements and sustainable aviation technologies. |

| Manufacturing & Assembly | Producing commercial aircraft, helicopters, and space systems globally. | Ramping up A320 family production towards a target of 75 aircraft per month. |

| Sales & Marketing | Securing aircraft orders through direct engagement and negotiations. | Maintaining a strong order backlog, extending into the first half of 2025. |

| After-Sales Service | Providing MRO, spare parts, upgrades, and technical support. | Focus on growing the Services segment for recurring revenue and customer retention. |

Delivered as Displayed

Business Model Canvas

The AIRBUS Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means all sections, data, and formatting are identical to what you will download. You can be assured that the professional, comprehensive analysis of Airbus's business model is precisely what you will acquire, ready for immediate use.

Resources

Airbus holds a substantial portfolio of patents and proprietary technologies covering aircraft aerodynamics, advanced materials, and sophisticated manufacturing techniques. This intellectual property is a cornerstone of their competitive edge, safeguarding their innovative advancements in the aerospace sector.

In 2023, Airbus reported R&D expenses of €2.5 billion, a significant investment aimed at expanding this crucial resource and maintaining technological leadership. This ongoing commitment fuels the continuous growth of their intellectual property assets.

Airbus operates a robust global network of advanced manufacturing plants and final assembly lines. This extensive infrastructure, crucial for producing complex aircraft, is strategically located across Europe, North America, and Asia.

Key facilities include major hubs like Toulouse, France, and Hamburg, Germany, alongside its North American assembly line in Mobile, Alabama. These sites are vital for the large-scale production and timely delivery of Airbus's diverse aerospace portfolio, including commercial aircraft and defense systems.

In 2023, Airbus delivered 735 commercial aircraft, a testament to the efficiency and capacity of its manufacturing and assembly operations. The company's commitment to expanding its global footprint, including investments in new capabilities, underscores the importance of these physical resources for maintaining its market leadership.

Airbus's highly skilled workforce, numbering over 130,000 employees globally as of early 2024, is its most critical asset. This human capital includes a vast pool of engineers, designers, technicians, and aerospace specialists whose collective knowledge drives innovation and operational excellence.

The deep expertise within this workforce is essential for Airbus's complex aerospace design and manufacturing processes. Their proficiency in areas like advanced materials, aerodynamics, and digital engineering enables the company to develop and produce cutting-edge aircraft, contributing significantly to its competitive edge.

This specialized talent is fundamental to Airbus's research and development efforts, allowing them to push the boundaries of aerospace technology. The ability to attract, retain, and develop these skilled individuals is paramount to the company's continued success in delivering high-quality, innovative aerospace solutions.

Financial Capital and Strong Balance Sheet

Airbus's business model relies heavily on substantial financial capital to fuel its extensive research and development initiatives, significant capital expenditures for advanced manufacturing facilities, and the management of lengthy, complex projects. A robust financial foundation is absolutely critical for an organization of Airbus's scale and ambition.

The company's strong financial health, evidenced by its substantial gross and net cash reserves, empowers it to self-finance ambitious programs and effectively weather periods of market volatility. This financial muscle is a key enabler for sustained growth and innovation.

- Financial Strength for R&D: Airbus's ability to invest heavily in research and development is directly supported by its strong balance sheet, enabling it to stay at the forefront of aerospace technology.

- Capital Expenditure Capability: Significant financial resources allow Airbus to undertake major capital expenditures for upgrading and expanding its production facilities, ensuring efficient and high-quality manufacturing.

- Project Funding and Stability: A solid financial position, including substantial cash holdings, provides the necessary stability to manage the long-term nature of aircraft development and production cycles, even during economic downturns.

- Market Resilience: Airbus reported a net cash position of €11.7 billion at the end of 2023, demonstrating its capacity to absorb shocks and continue operations and investments amidst fluctuating market conditions.

Brand Reputation and Trust

Airbus's brand reputation, built on decades of delivering safe, reliable, and innovative aircraft, is a cornerstone of its business model. This strong reputation fosters deep trust among airlines, governments, and the flying public, directly influencing purchasing decisions and long-term partnerships.

This trust translates into tangible benefits. For instance, in 2023, Airbus secured a significant order for 250 A320neo family aircraft from IndiGo, a testament to the continued confidence in their product quality and operational performance.

The company's commitment to quality and safety is not just a marketing point; it's a critical factor in maintaining market leadership. This unwavering focus allows Airbus to command premium pricing and secure a substantial share of the global commercial aircraft market.

- Safety Record: Airbus consistently emphasizes its rigorous safety standards, a key driver of customer trust.

- Reliability: The operational reliability of Airbus aircraft minimizes downtime for airlines, a crucial factor in fleet management.

- Innovation: Continuous investment in new technologies, like sustainable aviation fuel compatibility, reinforces its image as an industry leader.

- Customer Loyalty: A strong brand reputation cultivates loyalty, leading to repeat orders and long-term customer relationships.

Airbus's key resources include its extensive intellectual property, a global network of advanced manufacturing facilities, a highly skilled workforce of over 130,000 employees as of early 2024, strong financial backing with €11.7 billion net cash at the end of 2023, and a robust brand reputation for safety and reliability.

| Resource Category | Specific Examples | Significance |

|---|---|---|

| Intellectual Property | Patents in aerodynamics, advanced materials, manufacturing techniques | Safeguards innovation, provides competitive edge |

| Physical Resources | Global manufacturing plants (Toulouse, Hamburg, Mobile) | Enables large-scale production and timely delivery |

| Human Capital | Engineers, designers, technicians, aerospace specialists | Drives innovation, operational excellence, and R&D |

| Financial Resources | €11.7 billion net cash (end of 2023), R&D investment of €2.5 billion (2023) | Funds R&D, capital expenditures, and project stability |

| Brand Reputation | Safety record, aircraft reliability, customer loyalty | Fosters trust, influences purchasing decisions, supports premium pricing |

Value Propositions

Airbus champions advanced technology and innovation, evident in its fuel-efficient A320neo family, which has seen over 8,500 orders as of early 2024. The A350 XWB, featuring extensive composite materials, represents a significant leap in aircraft design and efficiency.

This dedication to innovation is further demonstrated by Airbus's active exploration of future aviation concepts, including hydrogen-powered aircraft development. These forward-thinking initiatives ensure customers receive the most state-of-the-art and sustainable aerospace solutions available.

Airbus's commitment to safety and reliability is a cornerstone of its value proposition, directly influencing customer trust and operational success. This focus is paramount for airlines, defense entities, and helicopter users, as it underpins their own operational efficiency and the confidence of their passengers and crews.

The company consistently invests in advanced technologies and rigorous testing to ensure its aircraft meet and exceed stringent global safety regulations. For instance, Airbus's continuous efforts in aircraft design and manufacturing have contributed to a strong safety record in the commercial aviation sector, a critical factor for operators like Lufthansa or Emirates.

Airbus offers a vast selection of aerospace products, from commercial planes for passenger and freight transport to a wide range of helicopters for both civilian and military use. They also provide sophisticated space and defense systems.

This extensive product line enables Airbus to meet a broad spectrum of customer needs across different sectors of the aerospace industry. For instance, in 2024, Airbus continued to be a dominant force in commercial aviation, with deliveries of its A320neo family remaining strong, a key driver of its revenue.

Global Support and Services Network

Airbus's global support and services network is a cornerstone of its value proposition, ensuring customers receive comprehensive after-sales assistance. This network covers maintenance, repair, training, and the crucial supply of spare parts, all designed to keep aircraft flying efficiently.

Customers gain significant long-term value through this extensive support system. It directly translates to operational continuity, drastically reducing costly downtime and extending the overall lifespan of their valuable assets. For instance, in 2024, Airbus reported its Services division continued to be a strong performer, reflecting the ongoing demand for its support solutions across its diverse customer base.

- Global Reach: Access to maintenance and repair facilities worldwide.

- Operational Efficiency: Minimizing aircraft downtime through rapid support and parts availability.

- Asset Longevity: Comprehensive services designed to extend the operational life of aircraft.

- Training Excellence: Providing pilots and maintenance crews with up-to-date training for safe and efficient operations.

Sustainability and Environmental Performance

Airbus is deeply committed to reducing aviation's environmental footprint, developing innovative products and solutions that directly address this. Their focus on more fuel-efficient aircraft, like the A320neo family which offers up to 15% fuel burn reduction compared to previous generations, is a prime example.

The company is also a leader in promoting sustainable aviation fuels (SAFs) and is actively pursuing zero-emission flight technologies, such as hydrogen-powered aircraft. This proactive approach caters to increasing customer demand for greener travel options and stringent regulatory requirements aimed at decarbonizing the aviation sector.

- Fuel Efficiency: Airbus's A320neo family boasts significant fuel savings, contributing to lower emissions per passenger mile.

- Sustainable Aviation Fuels (SAFs): Airbus actively supports and promotes the use of SAFs, with a goal to have 100% SAF-compatible aircraft by 2030.

- Zero-Emission Flight: The company is investing heavily in hydrogen propulsion technologies, aiming to launch a zero-emission commercial aircraft by 2035.

- Regulatory Alignment: Airbus's sustainability initiatives align with global decarbonization targets, such as those set by ICAO and the EU.

Airbus provides cutting-edge aerospace solutions, from highly fuel-efficient commercial aircraft like the A320neo family, which garnered over 8,500 orders by early 2024, to advanced helicopters and defense systems. This broad product portfolio addresses diverse global needs across civilian and military sectors.

The company's unwavering commitment to safety and reliability is paramount, fostering deep customer trust and ensuring operational excellence for airlines and other operators. Rigorous testing and adherence to stringent regulations underpin this core value.

Airbus's comprehensive global support network ensures maximum operational uptime and asset longevity for its customers. This includes maintenance, repair, and training services, vital for maintaining fleets like those operated by major carriers in 2024.

A strong focus on sustainability drives innovation, with Airbus developing fuel-efficient aircraft and pioneering zero-emission flight technologies like hydrogen propulsion, aligning with global decarbonization goals.

| Value Proposition | Description | Key Metrics/Examples |

|---|---|---|

| Innovation & Technology | Offering advanced, fuel-efficient, and next-generation aircraft and aerospace solutions. | A320neo family: Over 8,500 orders (early 2024); A350 XWB: Extensive composite materials; Hydrogen-powered aircraft development. |

| Safety & Reliability | Ensuring the highest standards of safety and operational dependability. | Strong safety record in commercial aviation; Continuous investment in advanced design and rigorous testing. |

| Broad Product Range | Providing a comprehensive selection of commercial aircraft, helicopters, and defense/space systems. | Dominant force in commercial aviation; Strong A320neo family deliveries in 2024; Diverse helicopter applications. |

| Global Support & Services | Delivering extensive after-sales support for operational continuity and asset longevity. | Worldwide maintenance and repair facilities; Services division reported strong performance in 2024; Training programs for pilots and crew. |

| Sustainability | Commitment to reducing aviation's environmental impact through eco-friendly technologies. | A320neo: up to 15% fuel burn reduction; Support for SAFs (goal of 100% SAF-compatible by 2030); Investment in hydrogen propulsion (target for zero-emission commercial flight by 2035). |

Customer Relationships

Airbus cultivates strong customer ties through specialized account management and sales teams. These dedicated professionals offer personalized support, deeply understanding each client's unique operational requirements. This approach is crucial for navigating the complexities of large aircraft orders and long-term service contracts, fostering loyalty and repeat business.

For instance, Airbus's customer-centric approach was evident in its 2023 performance, where it delivered 735 aircraft. This high volume of deliveries is underpinned by robust relationships, ensuring airlines receive the support needed for fleet integration and ongoing operations.

Airbus cultivates deep customer loyalty through extensive long-term contracts, often spanning decades, for aircraft procurement, crucial maintenance, and ongoing support services. These agreements, a cornerstone of their business model, underscore the significant, multi-year investment inherent in aerospace products and create a stable, predictable revenue stream.

Airbus offers comprehensive technical support and training, crucial for customer relationships. This includes specialized programs for pilots and maintenance personnel, ensuring they can operate and maintain Airbus aircraft efficiently. For instance, in 2024, Airbus continued its robust training initiatives, with thousands of aviation professionals undergoing skill development across its global network.

This deep technical engagement fosters trust and guarantees optimal fleet performance. By providing operational assistance, Airbus helps customers maximize the value and longevity of their aircraft investments. This commitment to post-sale support is a cornerstone of their customer-centric approach.

Collaborative Design and Customization

For significant orders or intricate defense and space ventures, Airbus frequently partners with clients in a collaborative design approach. This allows for tailoring aircraft configurations and system specifics to exact customer needs.

This bespoke development ensures the delivered product aligns perfectly with the client's unique operational context and performance demands. For instance, in 2024, Airbus continued its work on customized A330 MRTT multi-role tanker transport aircraft for various air forces, adapting communication and defensive systems based on specific operational feedback.

- Customization for Defense: Tailoring military aircraft and systems to precise operational requirements.

- Space Project Collaboration: Joint design efforts for satellites and launch vehicles, meeting specialized mission parameters.

- Client-Centric Development: Ensuring final products precisely match customer specifications and environments.

Customer Service and Feedback Loops

Airbus prioritizes strong customer relationships through dedicated customer service and active feedback mechanisms. This ensures ongoing dialogue for product enhancement and swift resolution of operational concerns, fostering loyalty and continuous improvement.

These interactions are vital for Airbus to refine its aircraft designs and services. For instance, feedback from airlines on fuel efficiency or cabin comfort directly informs future development cycles, aiming to meet evolving market demands.

- Customer Service Channels: Airbus maintains dedicated support teams and digital platforms to address customer inquiries and technical issues promptly.

- Feedback Integration: Customer feedback is systematically collected and analyzed, influencing design modifications and service upgrades.

- Loyalty Programs: Strategic partnerships and tailored support packages are offered to build long-term relationships with key airline clients.

- Operational Support: Airbus provides extensive support for aircraft maintenance, training, and spare parts, ensuring high operational availability for its fleet.

Airbus fosters deep customer relationships through long-term contracts, comprehensive support, and collaborative development, ensuring client needs are met from initial design to ongoing operations.

This commitment is vital for securing repeat business and maintaining a strong market presence. For example, in 2023, Airbus's delivery of 735 aircraft highlights the success of these relationship-building strategies.

Airbus's customer service extends to robust training programs; in 2024, thousands of aviation professionals benefited from skill development, enhancing aircraft operation and maintenance.

These initiatives build trust and ensure optimal fleet performance, maximizing the value of customer investments.

| Customer Relationship Aspect | Description | Example/Data Point |

|---|---|---|

| Dedicated Support | Specialized account management and sales teams provide personalized assistance. | Crucial for navigating complex aircraft orders and long-term service contracts. |

| Long-Term Contracts | Agreements covering procurement, maintenance, and ongoing support. | Underpinning stable, multi-year revenue streams and customer loyalty. |

| Technical Training | Programs for pilots and maintenance personnel to ensure efficient operations. | In 2024, thousands of professionals received skill development across Airbus's global network. |

| Collaborative Design | Partnerships for tailoring aircraft configurations and systems to exact needs. | Customized A330 MRTT aircraft for defense clients in 2024, incorporating operational feedback. |

Channels

Airbus heavily relies on its direct sales force for high-value transactions, engaging directly with commercial airlines, governments, and defense ministries. This channel is crucial for selling complex products like aircraft, helicopters, and space systems, where intricate negotiations and tailored solutions are paramount.

In 2024, Airbus continued to leverage this direct approach to solidify its market position, particularly in securing large aircraft orders. For instance, the company announced significant deals with airlines throughout the year, underscoring the effectiveness of its dedicated sales teams in managing these extensive relationships and customization requirements.

Airbus maintains a robust network of over 150 sales offices and customer support centers strategically positioned across more than 60 countries. This extensive global footprint, including key hubs in North America, Europe, Asia-Pacific, and the Middle East, allows for direct engagement with airline customers and defense ministries, fostering strong relationships and facilitating tailored solutions. In 2023, Airbus reported approximately 735 commercial aircraft deliveries, underscoring the effectiveness of this localized sales and support strategy in driving market penetration and customer satisfaction.

Airbus heavily utilizes major international airshows like the Paris Air Show and Farnborough Airshow as primary channels. These events are vital for unveiling new aircraft models, such as the A321XLR, and securing significant new orders. In 2023, the Paris Air Show alone saw Airbus announce orders and commitments worth tens of billions of dollars, underscoring their importance for market visibility and sales.

Online Portals and Digital Platforms

Airbus heavily utilizes its official website and dedicated online portals to connect with a global audience. These digital avenues serve as crucial hubs for disseminating company news, financial reports, and investor information, ensuring transparency and accessibility for stakeholders worldwide.

These platforms also facilitate direct engagement, enabling customers to access technical documentation, submit service requests, and even explore options for ordering spare parts. In 2024, Airbus reported a significant increase in website traffic, with over 50 million unique visitors accessing its digital resources, underscoring the importance of these channels for communication and business operations.

- Official Website: Airbus.com serves as a primary gateway for corporate information, news, and investor relations.

- Specialized Portals: Platforms like the Airbus Corporate Website and specific customer portals offer tailored content and services.

- Information Dissemination: Digital channels are key for sharing financial results, sustainability reports, and company updates.

- Customer Interaction: These portals facilitate service requests, parts ordering, and access to technical documentation for clients.

Strategic Partnerships and Distributors

Airbus leverages strategic partnerships and a robust distributor network to enhance its market penetration, particularly for specialized offerings like helicopter leasing and specific defense components. This approach allows Airbus to tap into niche markets and cater to a wider array of customers by utilizing the specialized capabilities and established reach of its partners.

For instance, in the helicopter sector, Airbus Helicopters might collaborate with leasing companies that possess deep expertise in financing and managing aircraft for diverse clients, thereby expanding Airbus's footprint in this segment. Similarly, for certain defense systems, a network of specialized distributors can provide localized support, maintenance, and sales, crucial for complex, high-value products.

- Expanded Market Reach: Distributors and partners provide access to geographical regions or customer segments that Airbus might not directly serve efficiently.

- Specialized Capabilities: Collaboration allows Airbus to offer tailored solutions, such as specialized financing for helicopter leases or localized integration services for defense systems.

- Cost Efficiency: Utilizing existing partner infrastructure can be more cost-effective than building out direct sales and support networks for every niche market.

- Risk Mitigation: Sharing the burden of market entry and customer support with partners can reduce financial and operational risks for Airbus.

Airbus utilizes major international airshows as a key channel for showcasing new products and securing significant orders. These events are critical for visibility and direct engagement with a global customer base. In 2023, events like the Paris Air Show generated billions in orders and commitments, demonstrating their substantial impact on Airbus's sales pipeline.

Customer Segments

Commercial airlines, encompassing both passenger and cargo operators, represent Airbus's most significant customer base. This segment includes everything from major national airlines to budget carriers and dedicated freight companies. In 2023, Airbus delivered 735 commercial aircraft, with a substantial portion going to these airline customers, highlighting their critical role in Airbus's revenue stream.

These airlines purchase aircraft primarily for passenger transport and the movement of goods. Their key purchasing criteria revolve around factors like fuel efficiency, passenger or cargo capacity, and overall operational reliability. For instance, the A320neo family, known for its fuel savings, continues to be a popular choice for many short-to-medium haul passenger carriers.

Governments and their defense organizations represent a crucial customer segment for Airbus. These entities procure a wide array of Airbus products, including vital military transport aircraft such as the A400M, sophisticated surveillance planes, and a range of military helicopters. Beyond aircraft, they also purchase various defense systems and associated services.

Sales to this segment are characterized by their long-term nature and often involve strategic partnerships aimed at bolstering national security capabilities. For instance, in 2023, Airbus Defence and Space reported revenues of €13.7 billion, a significant portion of which is driven by government contracts for defense platforms and systems.

Helicopter operators, a crucial customer segment for Airbus, encompass civil, military, and emergency services. Civil operators utilize helicopters for corporate transport, offshore oil and gas support, and tourism, representing a significant market for new aircraft and services.

In 2024, the global helicopter market saw continued demand from these sectors, with offshore energy operations driving a portion of new sales. Airbus Helicopters delivered 326 rotorcraft in 2023, with a substantial portion serving these diverse civil needs.

Military operators rely on Airbus helicopters for a wide array of missions, including troop transport, reconnaissance, and attack. The ongoing geopolitical landscape in 2024 continues to underscore the importance of robust defense capabilities, influencing procurement decisions.

Emergency services, such as air ambulance (EMS) and search and rescue (SAR), represent a vital segment. In 2024, the need for rapid response in disaster relief and medical emergencies highlights the critical role these helicopters play, often equipped with specialized medical interiors and rescue equipment.

Space Agencies and Satellite Operators

Airbus Defence and Space is a key partner for national and international space agencies, providing them with essential satellite systems and launch vehicles. These agencies rely on Airbus for capabilities in telecommunications, Earth observation, navigation, and scientific missions. For instance, in 2023, Airbus secured a significant contract with the European Space Agency (ESA) for the development of next-generation Earth observation satellites, highlighting the ongoing demand from governmental bodies.

Commercial satellite operators also form a crucial customer segment. They procure satellite platforms and related services from Airbus to support a wide array of commercial applications. The growing demand for high-speed internet and advanced data analytics fuels this market, with companies increasingly investing in satellite constellations. In 2024, the global satellite market is projected to reach over $380 billion, showcasing the substantial revenue potential within this sector for Airbus.

- Governmental Clients: National space agencies procuring satellite systems for defense, scientific research, and public services.

- Commercial Operators: Companies utilizing satellites for telecommunications, broadband internet, Earth observation data, and navigation services.

- Key Acquisitions: Satellite platforms, launch services, and ground segment solutions are primary offerings.

- Market Growth: The increasing demand for connectivity and data drives significant investment in satellite technology by both public and private entities.

Aircraft Leasing Companies

Aircraft leasing companies are crucial partners for Airbus, acting as major purchasers of new aircraft. These lessors acquire substantial fleets, often in the hundreds, and then make them available to airlines globally. This symbiotic relationship is vital for Airbus's sales volume and market reach.

By leasing aircraft, these companies offer airlines essential fleet flexibility and diverse financing solutions. This makes air travel more accessible and adaptable for carriers of all sizes. In 2024, the aircraft leasing market continued its robust recovery, with major lessors like AerCap, Avolon, and SMBC Aviation Capital placing significant orders with manufacturers.

For instance, AerCap, the world's largest aircraft leasing company, reported a substantial order book with Airbus, underscoring the importance of this segment. These leasing giants effectively serve as a significant indirect sales channel for Airbus, driving a considerable portion of their revenue and production planning.

- Major Lessors Drive Demand: Companies like AerCap, Avolon, and SMBC Aviation Capital are consistently among Airbus's largest customers.

- Fleet Flexibility for Airlines: Lessors provide airlines with the ability to scale their fleets up or down based on demand, without the capital burden of outright purchase.

- Financing Solutions: Aircraft leasing offers airlines alternative financing structures, crucial for managing cash flow and capital expenditure.

- Indirect Sales Channel: Leasing companies represent a substantial portion of Airbus's overall aircraft sales, facilitating wider market penetration.

Airbus's customer segments are diverse, ranging from commercial airlines and governments to helicopter operators and satellite clients. Aircraft leasing companies also play a pivotal role as major purchasers, facilitating fleet flexibility for airlines. These varied segments drive Airbus's sales across commercial aviation, defense, and space sectors.

Cost Structure

Airbus's Research & Development (R&D) is a substantial cost driver, essential for creating innovative aircraft and enhancing current models. This investment fuels the development of new aircraft like the A321XLR and advancements in areas such as hydrogen-powered flight, crucial for future sustainability. In 2023, Airbus reported R&D expenses of €2.5 billion, underscoring its commitment to technological leadership.

Airbus's manufacturing and production costs are significant, encompassing the procurement of raw materials like aluminum and composites, as well as complex components from a vast global supply chain. These costs also include the substantial labor required for assembling intricate aircraft and the ongoing expenses of operating and maintaining its extensive, high-tech manufacturing facilities. For instance, in 2023, Airbus delivered 735 commercial aircraft, a testament to the scale of its production operations.

The company's efforts to ramp up production, particularly to meet rising demand for its A320 family aircraft, directly translate into increased costs. This surge in output necessitates greater investment in materials, workforce, and the efficient utilization of its production lines. In the first quarter of 2024, Airbus reported revenues of €12.3 billion, reflecting the ongoing costs associated with its high production volume.

Airbus navigates a vast global supply chain, incurring significant expenses for the transportation of components and finished aircraft, alongside meticulous inventory management and fostering robust supplier relationships. In 2024, the company's commitment to managing these intricate logistics is a substantial operational cost.

Supply chain disruptions, a persistent challenge in the aerospace industry, directly impact Airbus's cost structure by potentially increasing expenses related to expedited shipping, production delays, and sourcing alternative materials. For instance, the ongoing geopolitical tensions in 2024 continue to highlight the vulnerability and associated cost implications of global supply chain reliability.

Sales, Marketing, and Administrative Expenses

Airbus's cost structure includes significant outlays for sales, marketing, and administrative functions. These are crucial for maintaining its global reach and securing new aircraft orders.

These expenses cover the operational costs of extensive global sales teams, impactful marketing campaigns, and participation in key aviation trade shows, all vital for brand visibility and lead generation. Furthermore, general administrative overhead, encompassing everything from executive management to legal and HR, forms a substantial part of these costs.

- Global Sales and Marketing Network: Maintaining a presence in key markets worldwide requires dedicated sales personnel and marketing initiatives.

- Trade Shows and Events: Participation in major industry events like the Paris Air Show and Farnborough Airshow incurs significant costs for booth space, staffing, and promotional activities. In 2023, for instance, such events are critical for showcasing new products and engaging with potential customers.

- Administrative Overhead: General and administrative expenses include salaries for corporate staff, office rentals, IT infrastructure, and compliance costs, which are essential for smooth business operations.

After-Sales Service and Support Costs

After-sales service and support are crucial for customer retention and ongoing revenue streams. These costs encompass providing comprehensive aftermarket services, including spare parts, maintenance, and technical support. Airbus's commitment to this area means significant investment in personnel, specialized training, and the global logistics network required for efficient parts distribution.

Operating a worldwide network of service centers also contributes substantially to these costs. In 2023, Airbus reported that its Services division, which includes aftermarket support, generated €10.1 billion in revenue, highlighting the scale of operations and associated expenses. These expenditures are vital for ensuring aircraft availability and customer satisfaction throughout the lifespan of their aircraft.

- Personnel Costs: Salaries and benefits for highly skilled technicians, engineers, and support staff.

- Logistics and Inventory: Costs associated with managing a global supply chain for spare parts, including warehousing and transportation.

- Service Center Operations: Expenses related to maintaining and operating maintenance, repair, and overhaul (MRO) facilities worldwide.

- Technical Support and Training: Investment in developing and delivering technical documentation, training programs for airline staff, and direct customer support.

Airbus's cost structure is heavily influenced by its significant investments in research and development, aiming to maintain its technological edge in the competitive aerospace market. The company also incurs substantial manufacturing and production expenses, driven by the complexity of aircraft assembly and its extensive global supply chain. Furthermore, costs associated with sales, marketing, and administrative functions are essential for its worldwide operations and customer engagement.

The ongoing efforts to increase production output, particularly for popular models like the A320 family, directly translate into higher operational costs. These include increased material procurement, workforce expansion, and the efficient management of production facilities. In the first quarter of 2024, Airbus reported revenues of €12.3 billion, indicating the scale of its ongoing production activities and associated expenses.

After-sales services and support represent another significant cost area for Airbus. This involves substantial investment in personnel, specialized training, and a global logistics network for spare parts and maintenance. In 2023, Airbus's Services division generated €10.1 billion in revenue, underscoring the scale of these operations and their associated costs.

| Cost Category | Description | 2023/2024 Relevance |

|---|---|---|

| Research & Development | Developing new aircraft and technologies (e.g., hydrogen-powered flight). | €2.5 billion R&D expenses in 2023. |

| Manufacturing & Production | Raw materials, components, labor, facility operations. | Delivered 735 commercial aircraft in 2023. |

| Supply Chain & Logistics | Component transportation, inventory management, supplier relations. | Managing intricate global logistics in 2024. |

| Sales, Marketing & Admin | Global sales teams, marketing campaigns, corporate overhead. | Essential for brand visibility and securing orders. |

| After-Sales Service & Support | Spare parts, maintenance, technical support, service centers. | €10.1 billion revenue from Services division in 2023. |

Revenue Streams

Airbus's primary revenue engine is the sale of new commercial aircraft, encompassing both passenger and cargo models. This core business serves a global clientele of airlines and aircraft leasing firms, offering a diverse fleet from the compact A220 to the long-range A350. In 2024, Airbus successfully delivered 766 commercial aircraft, underscoring the significant volume and demand for its products.

Airbus Helicopters generates revenue through the sale of a diverse portfolio of civil and military helicopters. This includes everything from light single-engine models to heavy-lift transport aircraft, catering to a wide array of customer needs across various sectors.

In 2024, Airbus Helicopters saw robust demand, securing 450 net orders. This figure reflects the ongoing global requirement for advanced rotorcraft solutions in both commercial and defense applications, underscoring the segment's significant contribution to Airbus's overall financial performance.

Airbus generates significant revenue through its Space and Defense Systems sales, which encompass a wide array of products and services. This includes the sale of vital military transport aircraft, advanced satellite systems for communication and Earth observation, and powerful launch vehicles for space missions. These offerings are primarily directed towards government entities and national space agencies worldwide.

The company experienced a positive trend in this revenue stream, with notable increases reported for the full year 2024 and continuing into the first half of 2025. This growth reflects strong demand for Airbus's defense and space capabilities in a dynamic global landscape.

Aftermarket Services and Support

Airbus generates substantial recurring revenue through aftermarket services and support. This includes vital maintenance, repair, and overhaul (MRO) operations, the crucial supply of spare parts, and the implementation of upgrades for its extensive global aircraft fleet. Furthermore, comprehensive training programs and ongoing technical support form a significant part of this revenue stream.

The growth in these service offerings directly bolsters Airbus's overall financial performance. For instance, in 2023, Airbus reported a notable increase in its Commercial Aircraft division's revenues, partly driven by the robust demand for aftermarket services. Specific figures show that the services segment is a key contributor to profitability and stability.

- Maintenance, Repair, and Overhaul (MRO): Essential for keeping aircraft operational and safe.

- Spare Parts Logistics: Ensuring timely availability of components worldwide.

- Upgrades and Modifications: Enhancing aircraft performance and extending lifespan.

- Training and Technical Support: Equipping airline crews and maintenance staff.

Training and Simulation Services

Airbus generates significant revenue by offering specialized training and simulation services to its customers. This includes comprehensive flight crew training, ensuring pilots are proficient with Airbus aircraft, as well as in-depth maintenance training for technicians. These services are crucial for operators to safely and efficiently manage Airbus products.

These offerings are vital for maintaining customer proficiency and operational excellence. For instance, in 2023, Airbus continued to expand its training capabilities, with a focus on advanced simulation technologies to enhance learning outcomes for pilots and maintenance personnel across its diverse aircraft portfolio.

Key aspects of Airbus's training and simulation revenue streams include:

- Flight Crew Training: Providing type-specific training for pilots, including initial type rating, recurrent training, and emergency procedure simulations.

- Maintenance Training: Offering technical training programs for aircraft mechanics and engineers to ensure proper upkeep and repair of Airbus aircraft.

- Simulation Services: Developing and operating full-flight simulators and other advanced training devices that replicate real-world flight conditions.

- Customer Support: Bundling training packages with aircraft sales and providing ongoing support and updates for training programs.

Beyond aircraft sales, Airbus generates substantial revenue through its aftermarket services, encompassing maintenance, repair, and overhaul (MRO), spare parts, and upgrades. This segment is crucial for ongoing customer support and fleet longevity. In 2023, the company's Commercial Aircraft division saw revenue growth partly fueled by these vital services, demonstrating their consistent contribution to profitability and stability.

Airbus also secures revenue from its Space and Defense Systems, which includes military transport aircraft, satellites, and launch vehicles, primarily serving government clients. The company experienced positive trends in this area throughout 2024 and into the first half of 2025, reflecting strong global demand for its advanced defense and space capabilities.

Furthermore, Airbus Helicopters contributes revenue through the sale of a broad range of civil and military rotorcraft. The segment achieved 450 net orders in 2024, highlighting the sustained global requirement for its advanced helicopter solutions across various sectors.

The company also offers specialized training and simulation services, ensuring pilot and technician proficiency with its aircraft. These programs are essential for operational safety and efficiency, with Airbus continually enhancing its simulation technologies to improve learning outcomes.

| Revenue Stream | Description | 2024 Highlights/Data |

|---|---|---|

| Commercial Aircraft Sales | Sale of passenger and cargo aircraft. | Delivered 766 commercial aircraft in 2024. |

| Helicopters Sales | Sale of civil and military helicopters. | Secured 450 net orders in 2024. |

| Space and Defense Systems | Sales of military aircraft, satellites, and launch vehicles. | Positive growth trends observed in 2024/H1 2025. |

| Aftermarket Services | MRO, spare parts, upgrades, training, and technical support. | Key contributor to Commercial Aircraft division revenue growth in 2023. |

| Training and Simulation | Flight crew and maintenance training, simulator operations. | Focus on advanced simulation technologies for enhanced learning. |

Business Model Canvas Data Sources

The AIRBUS Business Model Canvas is meticulously constructed using a blend of internal financial reports, comprehensive market research, and strategic analyses of the aerospace industry. These diverse data sources ensure that every facet of the canvas, from value propositions to cost structures, is grounded in factual evidence and market realities.