AIRBUS Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIRBUS Bundle

AIRBUS masterfully crafts its product portfolio, from wide-body jets to regional aircraft, ensuring innovation and passenger comfort are paramount. Their strategic pricing reflects value and market positioning, while their extensive global distribution network ensures accessibility for airlines worldwide. Ready to uncover the full story of their promotional brilliance and how these elements create a powerful market presence?

Dive deeper into AIRBUS's marketing engine by exploring their sophisticated product development, competitive pricing strategies, and expansive place in the global aviation market. Understand how their promotional campaigns resonate with a discerning clientele and drive demand for their cutting-edge aircraft.

Unlock a comprehensive understanding of AIRBUS's marketing prowess with our in-depth 4Ps analysis. Discover how their product innovation, pricing architecture, distribution channels, and promotional tactics converge to maintain their leadership in the aerospace industry. Get the full, actionable insights you need.

Product

Airbus's commercial aircraft portfolio is a cornerstone of its market strategy, featuring a broad spectrum of models designed for diverse aviation needs. The highly successful A320 family, including the fuel-efficient neo variants, remains a dominant force in the narrowbody market, with over 10,000 deliveries as of early 2024. This range, from the A319 to the A321XLR, offers airlines flexibility across various route lengths.

Beyond narrowbodies, Airbus offers the A220 for regional routes and the widebody A330 and A350 families. The A330neo and A350, including the new A350F freighter, represent Airbus's commitment to long-haul efficiency and passenger experience. In 2023, Airbus delivered 735 commercial aircraft, a testament to the demand for its comprehensive product line.

Airbus's helicopter products offer a comprehensive range from light single-engine to heavy twin-engine rotorcraft, serving both civil and military sectors. Their diverse lineup, including popular models like the H125 and the versatile H225, caters to a broad spectrum of operational needs.

The company experienced robust demand in 2024, with significant order intake reflecting the market's confidence in Airbus's helicopter solutions. This strong performance underscores their position as a global leader in rotorcraft manufacturing.

Innovation remains a key focus, with Airbus actively developing advanced technologies such as hybrid-electric powertrains. This commitment to future-proofing their product line ensures they remain at the forefront of the helicopter industry.

Airbus's Defense and Space Systems division offers a robust portfolio beyond commercial aircraft, encompassing vital military transport like the A400M and advanced satellite systems. This segment is actively adapting, with a strategic push in 2024 and 2025 towards enhancing efficiency and addressing new security challenges, particularly in cybersecurity and strategic airlift. For instance, the A400M program continues to be a cornerstone, with ongoing deliveries and upgrades bolstering its capabilities in global logistics and humanitarian aid operations.

The division's product strategy emphasizes innovation and responsiveness to evolving geopolitical landscapes. Investments are being channeled into next-generation technologies, including space-based surveillance and resilient communication networks. In 2024, Airbus secured significant contracts for satellite constellations and defense electronics, underscoring the market's demand for its advanced solutions. This focus aims to solidify Airbus's position as a key player in a sector increasingly driven by technological superiority and integrated defense capabilities.

Extensive Service Offerings

Airbus offers a comprehensive suite of services beyond aircraft sales, encompassing maintenance, repair, and overhaul (MRO), pilot and technician training, and ongoing operational support. These services are vital for ensuring aircraft safety, maximizing flight hours, and extending the overall lifespan of Airbus’s extensive global fleet. This focus on after-sales support is a key differentiator and revenue stream.

The company's commitment to its customers extends throughout the aircraft lifecycle. For instance, Airbus provides digital solutions and fleet management tools to optimize airline operations. In 2023, Airbus's Services division saw significant growth, with revenues reaching €11.6 billion, up from €10.5 billion in 2022. This growth was particularly strong in helicopter services, which experienced a notable increase in demand for maintenance and support packages.

Airbus's service offerings are strategically designed to enhance customer loyalty and generate recurring revenue. Key service components include:

- Fleet Management Solutions: Digital tools and analytics to optimize aircraft performance and maintenance scheduling.

- Training and Simulation: Comprehensive programs for pilots, maintenance crews, and cabin staff across various Airbus models.

- Maintenance, Repair, and Overhaul (MRO): Global network of facilities providing certified maintenance services to keep aircraft airworthy and efficient.

- Spare Parts and Logistics: Ensuring timely availability of genuine parts to minimize aircraft downtime.

Innovation and Sustainability Focus

Airbus is making significant investments in research and development, channeling substantial resources into areas crucial for the future of aviation. This includes a strong focus on decarbonization, with advancements in sustainable aviation fuels (SAF) and the development of hydrogen propulsion systems. For instance, in 2023, Airbus continued its flight tests for its ZEROe demonstrator aircraft, a key step towards a hydrogen-powered commercial flight by 2035.

The company's strategic vision centers on pioneering next-generation aircraft technologies while simultaneously upgrading its current product portfolio. This involves enhancing aerodynamics and structural efficiency to align with increasingly stringent market demands and ambitious sustainability targets. Airbus aims to lead the industry in developing cleaner, more efficient aircraft solutions.

Key initiatives and achievements include:

- Continued investment in SAF: Airbus is working with partners to increase SAF availability and adoption, aiming for 10% SAF usage in commercial flights by 2030.

- Hydrogen propulsion development: The company is actively pursuing hydrogen-powered aircraft concepts, with ongoing research and flight testing of demonstrators.

- Digital transformation: Airbus is integrating digital technologies across its operations, from design and manufacturing to customer service, to improve efficiency and innovation.

- Product enhancements: Ongoing improvements to existing aircraft families, such as the A320neo and A350, focus on fuel efficiency and reduced emissions through aerodynamic and structural upgrades.

Airbus's product strategy is defined by a diverse and technologically advanced portfolio across commercial aircraft, helicopters, and defense systems. The company continuously innovates, focusing on fuel efficiency, passenger comfort, and sustainability. This broad offering ensures Airbus meets a wide array of global customer needs.

The commercial aircraft division is anchored by the highly successful A320 family, including the fuel-efficient neo variants, and the long-haul A330 and A350. In 2023, Airbus delivered 735 commercial aircraft, demonstrating strong market demand. The company is also a leader in helicopters, with popular models like the H125 serving diverse civil and military applications.

Airbus's Defense and Space division provides critical military transport like the A400M and advanced satellite systems, with a strategic focus on cybersecurity and enhanced capabilities in 2024-2025. Their commitment to innovation is evident in ongoing development of hydrogen propulsion and sustainable aviation fuels, aiming for a hydrogen-powered commercial flight by 2035.

| Product Category | Key Models | 2023 Deliveries/Performance | Strategic Focus |

|---|---|---|---|

| Commercial Aircraft | A320 family (incl. neo), A220, A330, A350 | 735 total commercial aircraft delivered | Fuel efficiency, sustainability (SAF, hydrogen), A321XLR |

| Helicopters | H125, H135, H145, H160, H225 | Strong order intake and demand in 2024 | Versatility, advanced avionics, new rotorcraft development |

| Defense & Space | A400M, Eurofighter, Satellite Systems, Spacecraft | Ongoing A400M deliveries and upgrades; significant satellite/defense electronics contracts in 2024 | Next-gen technologies, cybersecurity, resilient communication networks, strategic airlift enhancement |

What is included in the product

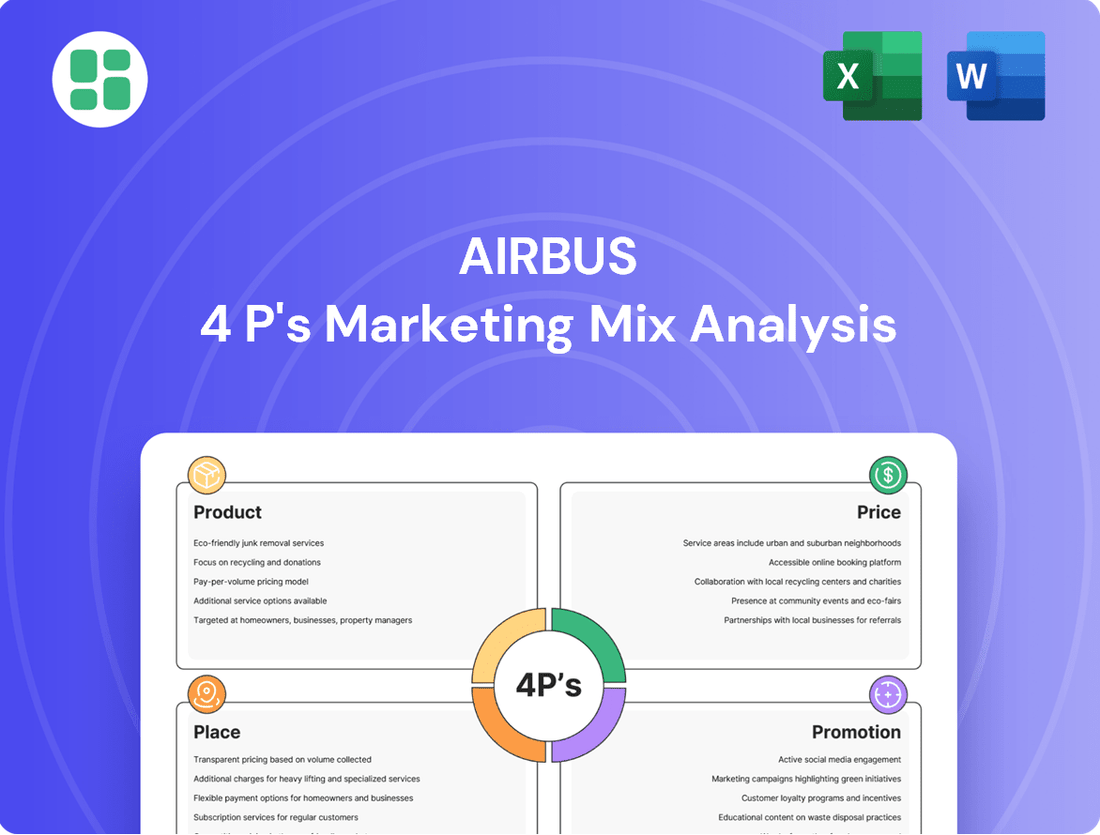

This analysis provides a comprehensive breakdown of AIRBUS's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and competitive advantages.

It's designed for professionals seeking to understand AIRBUS's marketing approach, utilizing real-world examples and strategic implications.

Provides a clear, concise overview of Airbus's 4Ps marketing strategy, simplifying complex decisions and alleviating the pain of information overload for busy executives.

Offers a structured framework to analyze Airbus's marketing efforts, effectively addressing the challenge of understanding and communicating strategic choices to diverse teams.

Place

Airbus predominantly employs a direct sales strategy, bypassing intermediaries to connect with commercial airlines, government agencies for defense procurements, and private aviation clients. This direct engagement enables the tailoring of complex aircraft solutions to specific customer needs and cultivates enduring partnerships, a cornerstone of their market approach.

In 2023, Airbus delivered 735 commercial aircraft, a significant portion of which were sold directly to major global carriers, underscoring the effectiveness of this model in securing large-volume orders and establishing deep customer loyalty. Their defense sector also relies heavily on direct negotiations with national governments for substantial contracts, such as the recent agreements for A400M transport aircraft with various European nations.

Airbus maintains a strategic global network of delivery centers and final assembly lines, crucial for its Place in the marketing mix. This includes key sites in Tianjin, China, and Mobile, Alabama in the US, complementing its established European operations. This widespread infrastructure ensures efficient aircraft delivery to a global customer base and underpins the company's ability to scale production effectively.

Airbus actively cultivates strategic partnerships and alliances to broaden its market presence and enrich its product portfolio, especially within niche defense and space domains. These collaborations are instrumental in acquiring advanced technologies and accessing new geographical markets. For instance, Airbus Helicopters' partnership with Mahindra Defence Systems in India aims to bolster local manufacturing and supply chains for defense programs.

These alliances are vital for integrating cutting-edge capabilities and securing footholds in targeted national markets. A prime example is the agreement with TUSAŞ for the Hürjet jet trainer program, which facilitates knowledge transfer and co-development, strengthening both companies' positions in the military aviation sector. Such strategic moves allow Airbus to leverage external expertise and share development costs, ultimately enhancing its competitive edge.

Extensive After-Sales Support Network

Airbus's commitment to an extensive after-sales support network is a cornerstone of its 'place' strategy, ensuring aircraft are operational and customers are satisfied globally. This network is vital for maintaining product availability and providing essential services.

This global infrastructure is critical for ensuring customer loyalty and operational continuity. Airbus's support spans maintenance, repair, spare parts, and technical assistance, keeping fleets flying efficiently.

- Global Reach: Airbus operates a vast network of service centers and spare parts distribution hubs strategically located worldwide to minimize downtime for its airline customers.

- Training Excellence: The company provides comprehensive training programs for pilots and maintenance crews, ensuring safe and efficient operation of its aircraft.

- Customer Support: In 2024, Airbus reported a significant increase in its customer support activities, reflecting the growing global fleet and the importance of responsive service.

- Digitalization: Airbus is increasingly leveraging digital tools and predictive maintenance solutions to enhance its after-sales support capabilities, aiming for greater efficiency and proactive problem-solving.

Participation in Industry Events and Forums

Airbus strategically leverages its presence at premier global aerospace gatherings, such as the Paris Air Show and the Farnborough Airshow, to directly engage with a vast network of industry stakeholders. These events are crucial for demonstrating its latest aircraft and technological advancements, fostering relationships with airlines and defense ministries, and solidifying its competitive edge. In 2024, for instance, Airbus secured significant orders at these events, underscoring the direct commercial impact of such participation.

These forums are not merely for showcasing; they are vital for business development and market intelligence. Airbus utilizes these opportunities to:

- Showcase new products and technologies: Demonstrating innovations like the A321XLR or advancements in sustainable aviation fuels.

- Engage with potential customers: Holding direct meetings with airline executives and government officials to discuss future needs and potential deals.

- Negotiate and secure deals: Finalizing purchase agreements and partnerships that drive revenue and market share.

- Reinforce market leadership: Projecting an image of innovation, reliability, and commitment to the future of aerospace.

Airbus's "Place" strategy is deeply rooted in its direct sales approach and extensive global service network. This ensures aircraft reach customers efficiently and are supported throughout their lifecycle. Key to this is their network of assembly lines and delivery centers, alongside a robust after-sales support infrastructure that includes maintenance, repair, and training facilities.

| Aspect | Description | 2023/2024 Data/Relevance |

|---|---|---|

| Direct Sales & Partnerships | Bypassing intermediaries for direct engagement with airlines, governments, and private clients. Cultivating strategic alliances for technology and market access. | 735 commercial aircraft delivered in 2023, largely through direct sales. Partnerships like the one with Mahindra Defence Systems in India for helicopter manufacturing. |

| Global Infrastructure | Strategically located final assembly lines and delivery centers (e.g., Tianjin, Mobile). Extensive after-sales support network for maintenance, spare parts, and technical assistance. | Continued investment in expanding production capacity and support capabilities globally. Increased customer support activities reported for 2024. |

| Market Presence & Engagement | Active participation in major aerospace events like the Paris Air Show and Farnborough Airshow for direct customer engagement and deal finalization. | Significant order wins at 2024 airshows, demonstrating the effectiveness of direct engagement and product showcasing. |

Full Version Awaits

AIRBUS 4P's Marketing Mix Analysis

The preview you see here is the exact same comprehensive AIRBUS 4P's Marketing Mix Analysis document you'll receive instantly after purchase—no surprises, just complete insights.

This is the actual, ready-to-use AIRBUS 4P's Marketing Mix Analysis you'll download immediately after checkout, ensuring you get the full picture.

You're viewing the exact version of the AIRBUS 4P's Marketing Mix Analysis you'll receive—fully complete and ready for your strategic planning.

Promotion

Airbus prioritizes building enduring trust and strong relationships with its diverse clientele, including airlines and governments, as a core element of its promotional efforts. This commitment underpins their long-term partnership approach.

Direct engagement is key, with dedicated sales teams and customer support actively involved in communication and problem-solving. This ensures that each stakeholder receives tailored attention and effective solutions.

In 2024, Airbus continued its focus on customer support, reflecting a strategic investment in relationship management. This approach is vital for securing future orders and maintaining market leadership in a competitive aerospace industry.

Airbus strategically employs targeted advertising, focusing on industry publications and professional networks to reach key decision-makers in aviation and defense. In 2024, digital marketing spend across the aerospace sector saw an estimated 8% increase, with platforms like LinkedIn being crucial for B2B engagement.

The company cultivates a robust digital presence, leveraging its website and social media channels to showcase innovations and company values. By mid-2025, Airbus's social media engagement metrics, particularly on platforms like X (formerly Twitter) and YouTube, are expected to reflect continued growth in audience interaction and content reach.

Airbus leverages public relations and media relations to showcase its innovation and market leadership. For instance, following the successful launch of the A321XLR in 2024, Airbus held numerous press briefings highlighting its fuel efficiency and range, directly impacting its order book and investor confidence.

In 2024, Airbus reported a significant increase in media mentions related to its sustainability initiatives, particularly its hydrogen-powered aircraft development. This proactive communication strategy, including participation in COP29 discussions, aimed to position Airbus as a frontrunner in eco-friendly aviation, a key factor for its B2B and B2C brand perception.

Airbus's strategic engagement with media outlets in 2024, including major aerospace journals and financial news platforms, resulted in positive coverage of its order backlog, which stood at over 8,600 aircraft by the end of Q3 2024. This consistent positive narrative reinforces its strong market position and attracts continued investment.

Industry Trade Shows and Summits

Airbus actively participates in key industry events like the Paris Air Show and Farnborough Airshow, which are crucial for its promotional strategy. These gatherings, often attracting hundreds of thousands of attendees, serve as major platforms for showcasing new aircraft models, signing significant deals, and engaging with a global audience of customers, suppliers, and industry influencers.

These trade shows are essential for Airbus to announce new orders and partnerships, directly impacting its sales pipeline and market visibility. For instance, at the 2023 Paris Air Show, Airbus secured a substantial order for 150 A320neo family aircraft from Indigo Partners, highlighting the direct commercial impact of such events.

- Product Showcase: Demonstrating aircraft capabilities and technological advancements to potential buyers and the public.

- Order Announcements: Finalizing and publicizing significant aircraft sales, boosting company reputation and financial outlook.

- Networking: Connecting with key stakeholders, including airline executives, government officials, and industry partners.

- Market Intelligence: Gathering insights on competitor activities and emerging industry trends.

Sustainability and Innovation Communication

Airbus actively communicates its dedication to sustainability, highlighting advancements in decarbonization and future aircraft technologies such as hydrogen propulsion and Sustainable Aviation Fuel (SAF) capabilities. This focus on innovation and environmental responsibility is a key differentiator in the market.

The company is investing heavily in these areas, aiming to lead the industry's transition to cleaner aviation. For instance, Airbus is developing its ZEROe concept aircraft, targeting entry into service around 2035, which will be powered by hydrogen. This commitment resonates with increasing global demand for eco-friendly travel solutions.

Airbus's communication strategy emphasizes its role in shaping the future of flight, aligning with regulatory pressures and consumer preferences for sustainable options. This proactive approach positions Airbus as a forward-thinking leader in aerospace.

- Sustainability Focus: Airbus is committed to reducing aviation's environmental impact through initiatives like the ZEROe program.

- Innovation Pipeline: Development of hydrogen-powered aircraft and increased SAF compatibility are central to their future product strategy.

- Market Differentiation: Strong communication on sustainability efforts sets Airbus apart from competitors and appeals to environmentally conscious stakeholders.

- Industry Alignment: Airbus's messaging aligns with global decarbonization goals and the growing demand for greener air travel.

Airbus's promotional strategy centers on building strong customer relationships through direct engagement and exceptional support, ensuring tailored solutions for airlines and governments. This focus on partnership is crucial for securing long-term business and maintaining market leadership.

Targeted digital marketing and public relations efforts in 2024 highlighted Airbus's innovations, particularly its sustainability initiatives like the ZEROe hydrogen-powered aircraft project. By mid-2025, its social media engagement is expected to show continued growth, reflecting its commitment to eco-friendly aviation and positioning it as an industry leader.

Participation in major industry events like the Paris Air Show remains a cornerstone, facilitating product showcases, order announcements, and crucial networking. For example, the 2023 Paris Air Show saw significant deals, underscoring the commercial impact of these platforms for Airbus.

Airbus's commitment to sustainability, including its ZEROe program and increased Sustainable Aviation Fuel (SAF) compatibility, is a key promotional differentiator, aligning with global decarbonization goals and consumer demand for greener travel.

| Promotional Activity | Key Focus Areas | 2024/2025 Data/Trends |

|---|---|---|

| Direct Engagement & Customer Support | Building long-term airline and government partnerships | Continued investment in relationship management; high customer satisfaction metrics expected. |

| Targeted Advertising & Digital Presence | Industry publications, professional networks, social media (LinkedIn, X, YouTube) | Estimated 8% increase in aerospace digital marketing spend in 2024; continued audience growth on platforms. |

| Public Relations & Media Relations | Showcasing innovation (e.g., A321XLR launch), sustainability (hydrogen, SAF), financial performance | Positive media coverage of order backlog (over 8,600 aircraft by Q3 2024); increased mentions of sustainability initiatives. |

| Industry Events | Product showcases, order announcements, networking (e.g., Paris Air Show, Farnborough) | Crucial for securing deals; 2023 Paris Air Show saw substantial orders like Indigo Partners' A320neo family purchase. |

| Sustainability Communication | ZEROe program, hydrogen propulsion, SAF | Positioning as a leader in eco-friendly aviation; aligning with regulatory pressures and consumer demand. |

Price

Airbus's pricing strategy centers on intricate, long-term contracts, moving away from static catalogue prices that proved unreflective of actual deals. These bespoke agreements are tailored to each customer, incorporating specific aircraft models, customized features, and comprehensive support packages. For instance, a significant portion of Airbus's revenue is secured through these multi-year agreements, ensuring predictable cash flow and allowing for deep customer relationships.

Airbus utilizes value-based pricing for its custom solutions, aligning aircraft prices with the significant economic and operational benefits they deliver to airlines. This approach considers factors like superior fuel efficiency, reduced maintenance costs, and enhanced passenger comfort, which translate into substantial long-term savings and competitive advantages for customers.

For instance, the Airbus A320neo family, a popular choice in 2024, offers up to 20% fuel burn reduction compared to previous generations, a key value driver. This efficiency directly impacts an airline's profitability, justifying a premium price point that reflects this ongoing operational advantage.

The pricing also incorporates the value of Airbus's extensive support network, including training, spare parts availability, and technical assistance, which are crucial for maintaining high fleet utilization and operational reliability. This holistic approach ensures that the price reflects the total lifecycle value proposition.

Airbus's pricing and profitability are directly tied to its ability to meet production ramp-up targets, which are often hampered by ongoing supply chain disruptions. For instance, the company has faced significant headwinds in securing critical components like engines and aerostructures, impacting its overall output.

These supply chain bottlenecks, a persistent issue throughout 2024 and expected into 2025, can lead to increased per-unit costs. This, in turn, forces Airbus to consider upward adjustments to aircraft prices to maintain its profit margins.

Furthermore, delays in component delivery directly translate to extended aircraft delivery timelines for customers, potentially affecting order books and future revenue streams. The strain on the supply chain in 2024, particularly for key suppliers, resulted in production rate adjustments for the A320 family, highlighting the direct link between supply chain health and pricing strategy.

Competitive and Geopolitical Factors

Airbus's pricing is significantly shaped by its intense rivalry with Boeing, a dynamic that often leads to competitive pricing strategies. Geopolitical events and trade policies also play a crucial role, with potential tariffs impacting the cost structure of aircraft production and, consequently, the final price for customers.

The commercial jet market has seen price increases, with factors like rising material, component, and labor expenses contributing to this trend. These cost escalations are further compounded by the uncertainty surrounding potential tariffs, forcing Airbus to adjust its pricing models to maintain profitability and market share.

- Competitive Landscape: Airbus faces its primary competitor, Boeing, in a market where price is a significant differentiator for large commercial aircraft orders.

- Geopolitical Impact: Trade tensions and geopolitical instability can lead to increased costs through tariffs or supply chain disruptions, directly affecting aircraft pricing.

- Cost Inflation: Rising costs for raw materials, advanced components, and skilled labor in 2024 and early 2025 have put upward pressure on commercial jet prices.

- Tariff Uncertainty: The potential imposition of tariffs on aircraft parts or finished goods introduces further pricing volatility for Airbus and its customers.

Inclusion of Services and Financing Options

Airbus's pricing strategy often extends beyond the aircraft itself, incorporating comprehensive service packages. These bundles typically include vital after-sales support like maintenance programs, pilot and technician training, and ongoing technical assistance, often presented with attractive bundled pricing. This approach aims to provide a complete, value-added solution for customers, simplifying acquisition and operational management.

To facilitate large aircraft purchases, Airbus actively offers or arranges various financing solutions and flexible credit terms. This is crucial for airlines, particularly those in emerging markets, to manage the significant capital outlay. For instance, in 2023, Airbus continued to work with export credit agencies and financial institutions to structure deals, making its latest aircraft models, such as the A320neo family, more attainable.

The inclusion of services and flexible financing options is a key component of Airbus's market offering, directly impacting the overall price perception and accessibility of its products. This strategy is designed to reduce barriers to entry for major fleet investments.

- Bundled Services: Aircraft often come with integrated maintenance, training, and support packages, enhancing long-term value.

- Financing Facilitation: Airbus actively supports clients by offering or arranging financing and credit terms for substantial aircraft acquisitions.

- Global Accessibility: These pricing and financing structures are vital for making Airbus's advanced aircraft accessible to a diverse global customer base.

Airbus's pricing is deeply influenced by its value-based approach, reflecting the long-term economic benefits airlines gain from fuel efficiency and operational advantages. For example, the A321neo's enhanced fuel burn compared to older models directly supports its premium pricing. The company also bundles essential services like maintenance and training, creating a comprehensive value proposition that extends beyond the aircraft itself.

Supply chain challenges in 2024 and projected into 2025 have increased per-unit costs, prompting price adjustments to safeguard profit margins. Furthermore, intense competition with Boeing and geopolitical factors like potential tariffs add complexity, necessitating adaptable pricing strategies to maintain market share and profitability.

| Aircraft Family | Estimated List Price (USD Billion) - 2024/2025 | Key Value Drivers |

|---|---|---|

| A220 | 0.081 - 0.091 | Fuel efficiency, lower operating costs, passenger comfort |

| A320neo Family | 0.101 - 0.130 | Up to 20% fuel burn reduction, extended range, cabin innovation |

| A330neo | 0.250 - 0.300 | Fuel efficiency, increased range, passenger experience |

| A350 XWB | 0.317 - 0.370 | Advanced aerodynamics, lightweight materials, fuel savings, passenger comfort |

| A380 | 0.446 | Capacity, passenger experience (production ended, but residual value impacts market) |

4P's Marketing Mix Analysis Data Sources

Our AIRBUS 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, industry publications, and market intelligence. We leverage information on product development, pricing strategies, global distribution networks, and marketing communications to provide an accurate view of their market approach.