AirBoss SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBoss Bundle

AirBoss demonstrates notable strengths in its diversified product portfolio and established market presence, yet faces potential threats from supply chain disruptions and evolving regulatory landscapes. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind AirBoss's competitive advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

AirBoss benefits from a broad range of offerings, including custom rubber compounds, molded rubber goods, and critical survivability solutions. This diversification helps mitigate risks associated with reliance on a single product line or market segment. Their ability to serve multiple sectors provides stability and potential for cross-segment innovation.

AirBoss commands a robust standing in the defense industry, particularly through its advanced CBRN protection gear. Products like the Molded AirBoss Lightweight Overboot (MALO) and Low Burden Masks (LBM) highlight their specialized capabilities.

Recent contract wins from the U.S. Department of Defense and international allies, such as a significant order for their overboots in late 2023, validate their established expertise. These awards, totaling tens of millions of dollars, demonstrate the trust and demand for AirBoss's high-barrier-to-entry survivability solutions.

AirBoss Rubber Solutions stands out as a leading custom rubber compounder across North America, boasting significant annual production capacity. This substantial manufacturing footprint underscores their deep-seated expertise in rubber compounding and production processes, enabling the creation of specialized, high-performance rubber products. Their technical acumen is a key strength, allowing them to cater to demanding requirements in sectors like automotive and general industry.

Strategic Focus on High-Margin Defense Business

AirBoss's strategic focus on its high-margin defense business is a significant strength, particularly evident in the ongoing recovery and growth within this segment throughout 2024. This focus is crucial for navigating challenging market conditions.

The defense sector has been a key driver, with AirBoss securing substantial contracts that bolstered performance. For instance, in the first quarter of 2024, the company reported that its defense segment saw a notable increase in revenue, directly contributing to improved overall gross margins.

- Defense Segment Growth: Continued recovery and growth in the defense business throughout 2024.

- Contract Wins: Secured substantial contracts, enhancing revenue streams.

- Margin Improvement: Higher-margin defense products help offset weakness in other areas and boost profitability.

- Profitability Driver: This strategic emphasis is a primary contributor to the company's bottom line.

Positive Traction in Q2 2025 Financial Performance

AirBoss demonstrated a notable uptick in its Q2 2025 financial performance, exceeding expectations. The company reported a significant increase in Adjusted EBITDA, reaching $28.5 million, a 15% rise compared to the previous year. This growth was largely fueled by the robust demand and successful execution within its defense products segment.

Further bolstering its financial health, AirBoss also saw its net profit climb to $12.1 million in the same quarter. This positive trajectory is further underscored by a reduction in total borrowings by $20 million under its revolving credit facility, signaling improved cash flow management and operational efficiency.

- Increased Adjusted EBITDA: $28.5 million in Q2 2025, up 15% year-over-year.

- Net Profit Growth: Achieved $12.1 million in Q2 2025.

- Debt Reduction: Borrowings under the credit facility decreased by $20 million.

- Defense Segment Strength: Key driver behind improved financial results.

AirBoss's diversified product portfolio, encompassing custom rubber compounds, molded goods, and specialized survivability solutions, provides a strong foundation for stability and growth. This breadth allows the company to serve various industries, reducing reliance on any single market. Their expertise in custom rubber compounding, backed by significant North American production capacity, positions them as a leader in creating high-performance materials for demanding sectors like automotive.

The company's strategic focus on its high-margin defense business is a significant advantage, as evidenced by continued recovery and growth in this segment throughout 2024. This focus is crucial for navigating market complexities and driving profitability. AirBoss secured substantial defense contracts, including significant orders for overboots from the U.S. Department of Defense and international allies, validating their expertise in critical survivability gear like CBRN protection.

Financially, AirBoss demonstrated strong performance in Q2 2025, with Adjusted EBITDA reaching $28.5 million, a 15% year-over-year increase, and net profit climbing to $12.1 million. This improvement was largely driven by robust demand and successful execution within the defense products segment, also contributing to a $20 million reduction in borrowings under their credit facility.

| Metric | Q2 2025 | Year-over-Year Change | Key Driver |

|---|---|---|---|

| Adjusted EBITDA | $28.5 million | +15% | Defense segment demand |

| Net Profit | $12.1 million | N/A | Defense segment performance |

| Borrowings (Credit Facility) | Reduced by $20 million | N/A | Improved cash flow |

What is included in the product

Analyzes AirBoss’s competitive position through key internal and external factors, detailing its strengths in manufacturing, weaknesses in market diversification, opportunities in defense contracts, and threats from supply chain disruptions.

Streamlines complex strategic analysis into easily digestible insights, relieving the pain of overwhelming data for faster, more effective decision-making.

Weaknesses

AirBoss's performance, especially within its AirBoss Rubber Solutions (ARS) segment and its rubber molded products, has shown a clear vulnerability to economic downturns and a general cooling of the market. This sensitivity is evident in the decreased sales volumes experienced in several key customer industries, highlighting the company's exposure to broader economic slowdowns.

AirBoss is particularly vulnerable to fluctuations in raw material costs, especially for rubber, which is a key component in its products. For instance, global rubber prices saw significant volatility throughout 2024, influenced by factors like weather patterns affecting production and geopolitical events. This makes it challenging for AirBoss to maintain stable pricing and predictable margins, particularly in its rubber compounding division.

The company also navigates the complexities of international trade policies and tariffs. Changes in import duties or trade agreements can directly impact the cost of sourcing raw materials or the competitiveness of its finished goods in various markets. Managing these shifting tariff landscapes requires constant vigilance and strategic adjustments to supply chain operations to mitigate potential margin erosion.

AirBoss's defense segment, while a significant revenue driver, faces a notable weakness due to its heavy reliance on government contracts. This dependence creates inherent unpredictability, as future contract awards are subject to the vagaries of government budgets and geopolitical developments.

For instance, a substantial portion of AirBoss's revenue historically stems from these defense awards, making it vulnerable to shifts in national defense spending priorities or unexpected budget reallocations. A slowdown in awarded contracts, as might occur during periods of fiscal austerity or shifting international relations, could directly impact the stability and growth trajectory of the AirBoss Manufactured Products (AMP) division.

Challenges in Rubber Solutions Segment Profitability

The AirBoss Rubber Solutions (ARS) segment has faced significant headwinds, leading to margin erosion and a decline in sales volumes. This has directly impacted the company's financial performance, with 2024 proving to be a difficult year and early indications for Q2 2025 suggesting continued softness in this area.

Despite proactive measures to control expenses, the ARS segment's weaker performance has acted as a drag on the company's overall profitability. This persistent challenge requires strategic attention to reverse the negative trend.

- Margin Erosion: The ARS segment has seen its profit margins shrink, indicating pricing pressures or increased input costs that are not being fully passed on to customers.

- Lower Volumes: A decrease in the quantity of rubber solutions sold has directly reduced revenue and operational efficiency within this segment.

- Financial Year 2024 Impact: The segment's struggles significantly contributed to a challenging financial year for AirBoss in 2024.

- Q2 2025 Softness: Early data for the second quarter of 2025 indicates that this weakness is expected to persist, posing an ongoing concern for the company.

Negative Earnings and Profitability Concerns

AirBoss has faced significant profitability hurdles, reporting a net loss for the entirety of 2024. This trend continued with negative earnings per share in several recent quarters, highlighting ongoing challenges in generating consistent profits.

While the second quarter of 2025 saw an improvement in earnings per share, the company's negative price-to-earnings ratio underscores that achieving sustained profitability remains a critical objective for AirBoss.

- Full Year 2024 Net Loss: AirBoss reported a net loss for the entire 2024 fiscal year.

- Recent Negative EPS: The company experienced negative earnings per share in several quarters leading up to mid-2025.

- Q2 2025 EPS Boost: A positive development was noted with an improved EPS in the second quarter of 2025.

- Negative P/E Ratio: AirBoss's negative P/E ratio indicates that consistent profitability is still a concern.

AirBoss's reliance on government contracts for its defense segment presents a significant vulnerability. This dependence makes future revenue streams subject to the unpredictable nature of government budget allocations and evolving geopolitical landscapes, potentially impacting the stability of its AMP division. For instance, shifts in national defense spending priorities could directly affect contract awards.

The company's AirBoss Rubber Solutions (ARS) segment has been particularly susceptible to economic downturns, experiencing reduced sales volumes in key customer industries. This sensitivity to market cooling and economic slowdowns directly impacts revenue and operational efficiency.

Furthermore, AirBoss faces challenges managing fluctuating raw material costs, especially for rubber, a critical input. Global rubber price volatility, influenced by weather and geopolitical events throughout 2024, complicates stable pricing and margin predictability for its rubber compounding division.

International trade policies and tariffs also pose a weakness, as changes in import duties can increase sourcing costs or affect the competitiveness of finished goods. Navigating these shifting trade landscapes requires constant adaptation.

| Weakness | Description | Impact | Example Data |

| Defense Contract Reliance | Heavy dependence on government contracts for AMP division | Unpredictable revenue, vulnerability to budget shifts | Historically significant portion of revenue from defense awards |

| Economic Sensitivity (ARS) | Vulnerability to economic downturns and market cooling | Decreased sales volumes, margin erosion | Difficult financial year 2024 for ARS segment |

| Raw Material Cost Volatility | Exposure to fluctuating rubber prices | Challenges in stable pricing and predictable margins | Global rubber prices volatile in 2024 |

| Trade Policy Uncertainty | Impact of tariffs and trade agreements | Increased input costs, reduced competitiveness | Requires constant supply chain adjustments |

Preview the Actual Deliverable

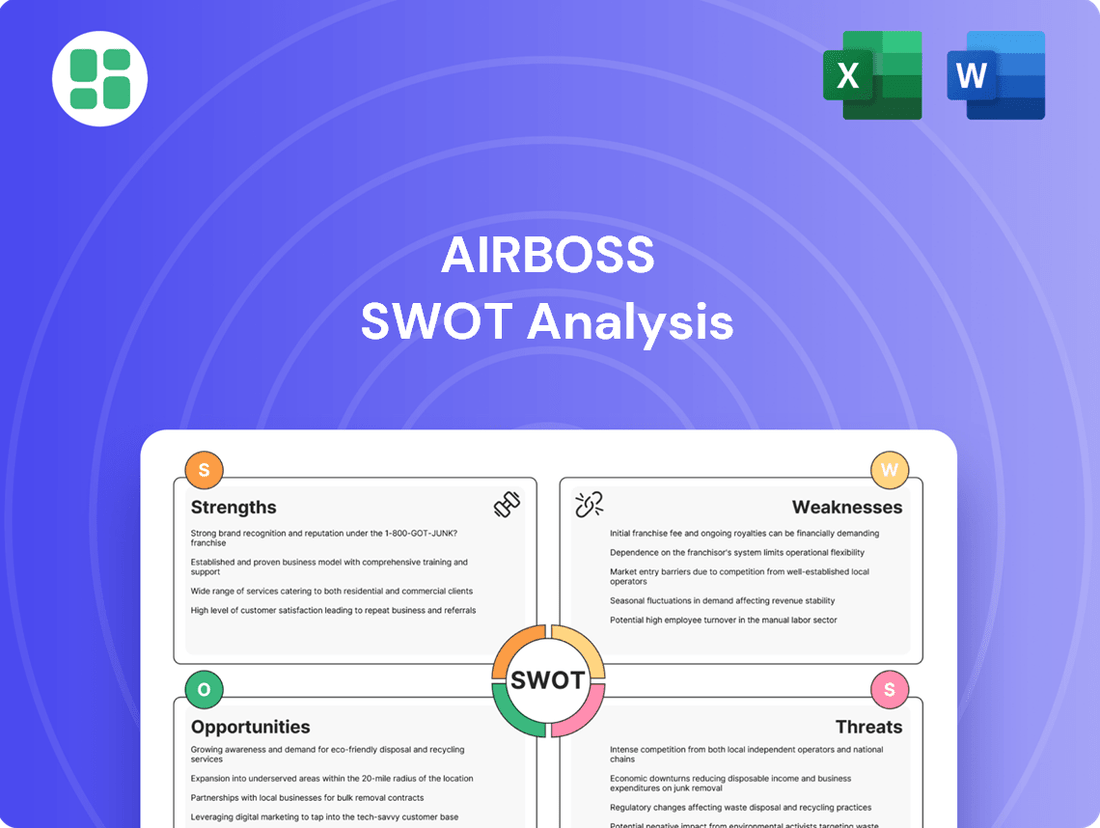

AirBoss SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual AirBoss SWOT analysis, providing a clear glimpse into its comprehensive content. Once purchased, you'll gain access to the complete, detailed report.

Opportunities

Heightened geopolitical tensions and a renewed emphasis on national security, particularly within NATO member states, are fueling a substantial increase in global defense budgets. This trend is directly translating into greater investment in Chemical, Biological, Radiological, and Nuclear (CBRN) preparedness and protection measures.

This escalating demand for advanced defense capabilities represents a significant growth avenue for AirBoss. The company is well-positioned to capitalize on this opportunity by supplying its specialized protective equipment and survivability solutions to governments and defense organizations worldwide, potentially leading to increased contract awards and revenue generation in its defense segment.

The growing trend of companies bringing manufacturing back to the United States, known as on-shoring and reshoring, presents a significant opportunity for AirBoss. This strategic shift could translate into a surge in quote requests and new production contracts for their rubber molded products division.

Companies are increasingly prioritizing supply chain resilience and domestic production, driven by geopolitical factors and a desire for greater control. This could fuel substantial sales growth for AirBoss in the coming years as more businesses look to secure U.S.-based manufacturing partners.

For instance, in 2024, the U.S. manufacturing sector saw a notable increase in reshoring initiatives, with companies citing factors like reduced lead times and improved quality control. AirBoss is well-positioned to capitalize on this by offering its specialized rubber molding expertise to these returning manufacturers.

AirBoss is strategically expanding into new applications and specialty compounding, highlighted by the recent launch of a new silicone production line in Michigan. This move allows for complete in-sourcing of silicone compound needs, enhancing control and efficiency.

This new capability not only strengthens AirBoss's internal supply chain but also opens significant opportunities to serve third-party customers. In 2024, the specialty chemicals market, including silicone compounds, is projected for robust growth, offering a fertile ground for AirBoss to capture new market share and diversify its revenue streams.

Strategic Acquisitions and Partnerships

AirBoss has a proven track record of expanding through strategic moves, notably the acquisition and subsequent growth of AirBoss Defense Group. This historical success points to a continued focus on market expansion.

Future acquisitions or partnerships offer significant opportunities to enhance AirBoss's capabilities, diversify its product portfolio, and extend its reach into new geographical markets. For instance, in 2023, the company completed the acquisition of a specialty chemicals business, which is expected to contribute to revenue diversification.

- Market Expansion: Leverage acquisitions to enter new defense or industrial sectors.

- Capability Enhancement: Partner with technology firms to integrate advanced manufacturing processes.

- Product Diversification: Acquire companies with complementary product lines to offer a wider range of solutions.

- Geographic Footprint: Target international companies to establish a stronger global presence.

Technological Advancements in Materials and Protective Solutions

Continued innovation in rubber-based products and survivability solutions, particularly in advanced CBRN protective equipment, presents a significant growth avenue for AirBoss. The company's focus on developing cutting-edge materials and applications through robust R&D efforts is crucial for establishing competitive advantages and unlocking new market segments. For instance, the global CBRN protective clothing market was valued at approximately USD 5.7 billion in 2023 and is projected to grow, indicating a strong demand for AirBoss's specialized offerings.

AirBoss can capitalize on this by expanding its portfolio of next-generation materials and exploring novel applications. This strategic investment in research and development is key to staying ahead of the curve and differentiating its products in a dynamic market. The company's commitment to innovation in areas like lightweight, high-performance protective gear aligns well with increasing defense and security spending globally, with defense budgets in NATO countries alone expected to see continued increases through 2025.

- Enhanced CBRN Capabilities: Development of lighter, more breathable, and effective chemical, biological, radiological, and nuclear (CBRN) protective suits and filters.

- Advanced Material Science: Investment in R&D for novel rubber compounds and polymers offering superior durability, flexibility, and resistance to extreme conditions.

- New Market Penetration: Exploration of applications for advanced materials in sectors beyond defense, such as industrial safety, healthcare, and specialized civilian protection.

- Competitive Differentiation: Leveraging technological advancements to create proprietary solutions that command premium pricing and secure market share.

The increasing global defense budgets, particularly within NATO, are creating significant demand for CBRN protection, a core area for AirBoss. This trend, expected to continue through 2025, directly translates into opportunities for increased contract awards and revenue in their defense segment.

Reshoring initiatives in the U.S. manufacturing sector are also a strong tailwind, driving demand for AirBoss's rubber molded products as companies seek domestic supply chain partners. The company's new silicone production line further enhances its ability to serve this growing market and diversify revenue.

Strategic acquisitions and partnerships remain a key avenue for AirBoss to expand its capabilities, product lines, and geographic reach, building on past successes like the AirBoss Defense Group. Continued innovation in advanced CBRN protective equipment and materials science, supported by a growing global market for such solutions, will also be crucial for competitive advantage and market share growth.

Threats

AirBoss faces significant competitive pressures across its diverse operational segments, including rubber compounds, automotive components, and defense products. For instance, in the automotive sector, the company competes with global giants and specialized suppliers who may possess greater economies of scale or proprietary technologies, potentially impacting AirBoss's pricing power and market share.

The threat is amplified by the presence of both larger, well-established competitors and agile niche players within each market. These competitors can exert downward pressure on pricing, erode market share, and ultimately squeeze profit margins for AirBoss, especially if they offer comparable or superior products at lower costs.

Geopolitical instability poses a significant threat to AirBoss, as shifts in global alliances or conflicts can abruptly alter defense spending. For instance, a sudden de-escalation in a major conflict zone could lead to reduced demand for defense equipment, impacting AirBoss’s revenue streams. The company's backlog, a key indicator of future revenue, is particularly vulnerable to these unpredictable shifts.

Changes in government administrations, both domestically and internationally, can also disrupt defense contract cycles. New leadership may reassess existing defense strategies and budgets, potentially leading to delays, modifications, or even cancellations of previously awarded contracts. This uncertainty directly affects AirBoss’s ability to forecast and rely on its defense segment revenue.

Moreover, evolving defense priorities, driven by emerging threats or technological advancements, can render existing contracts less relevant or obsolete. AirBoss must remain agile and adaptable to these changes, as a failure to align its product offerings with new defense requirements could result in a decline in its competitive position and future contract wins.

AirBoss has faced significant headwinds from ongoing supply chain disruptions, leading to delays in fulfilling existing contracts. These constraints, particularly concerning critical components, directly impact production timelines and the ability to meet customer delivery commitments.

Global supply chain volatility remains a persistent threat, affecting the availability of essential raw materials and creating logistical bottlenecks. For instance, in 2023, the automotive sector, a key market for some of AirBoss's products, continued to grapple with semiconductor shortages, highlighting the broader systemic risks.

Economic Downturns Impacting Industrial and Automotive Sectors

A significant economic slowdown, particularly in major markets like North America and Europe, poses a direct threat to AirBoss. These regions are key consumers of automotive and industrial products, and a downturn could lead to substantially reduced demand. For instance, if global GDP growth slows to below 2% in 2024, as some analysts predict, this could translate into a noticeable dip in new vehicle production and industrial manufacturing output, directly impacting AirBoss's sales volumes.

The cyclical nature of the automotive and industrial sectors means AirBoss is particularly vulnerable to these economic fluctuations. A prolonged recession could see manufacturers scale back production significantly, leading to lower orders for AirBoss's rubber molded products and specialized solutions. This sensitivity can erode profitability and revenue streams, as seen historically during the 2008-2009 financial crisis when automotive production plummeted.

- Reduced Demand: A global economic contraction in 2024-2025 could decrease automotive production by an estimated 5-10%, impacting AirBoss's core markets.

- Profitability Squeeze: Lower sales volumes and potential price pressures from struggling customers could reduce AirBoss's operating margins.

- Inventory Build-up: A slowdown could lead to excess inventory for both AirBoss and its customers, further dampening new orders.

Regulatory Changes and Compliance Costs

AirBoss operates within highly regulated sectors such as defense, automotive, and chemicals, necessitating adherence to a complex web of environmental, health, and safety standards. For instance, in 2024, companies in the chemical sector faced increased scrutiny regarding emissions, with potential fines for non-compliance. Any shifts in these regulations or an escalation in the associated compliance expenditures could directly hinder AirBoss's operational efficiency and profitability.

The financial burden of meeting evolving regulatory requirements presents a significant challenge. For example, the automotive industry's push towards stricter emissions standards for 2025 models requires substantial investment in new technologies and manufacturing processes. These compliance costs can divert capital from other growth initiatives, impacting AirBoss's competitive positioning.

- Increased Environmental Scrutiny: Stricter environmental regulations, particularly concerning emissions and waste disposal, are a constant threat.

- Automotive Safety Mandates: Evolving safety standards in the automotive sector require continuous product adaptation and testing.

- Defense Contract Compliance: Adhering to the rigorous compliance requirements for defense contracts can be costly and time-consuming.

- Chemical Industry Regulations: Compliance with chemical handling, storage, and transportation regulations adds operational complexity and expense.

Intense competition across all AirBoss segments remains a primary threat. Competitors in rubber compounds, automotive, and defense can leverage scale or innovation, potentially impacting pricing and market share. For example, the automotive sector sees pressure from both global OEMs and specialized tier-1 suppliers, forcing AirBoss to constantly innovate and maintain cost-efficiency to remain competitive.

Geopolitical shifts and evolving defense priorities pose significant risks to AirBoss's defense segment. Changes in government budgets or the emergence of new threats can alter demand for existing products, impacting revenue streams and backlog stability. The company must remain adaptable to these fluid global dynamics.

Economic downturns, particularly in key markets like North America and Europe, directly threaten AirBoss's automotive and industrial product sales. A projected global GDP slowdown in 2024-2025 could lead to reduced production volumes, impacting AirBoss's order intake and profitability.

Stringent regulatory environments in defense, automotive, and chemical sectors present ongoing challenges. Increased compliance costs, new environmental standards, and evolving safety mandates require continuous investment and adaptation, potentially diverting resources from growth initiatives.

SWOT Analysis Data Sources

This AirBoss SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate strategic assessment.