AirBoss Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBoss Bundle

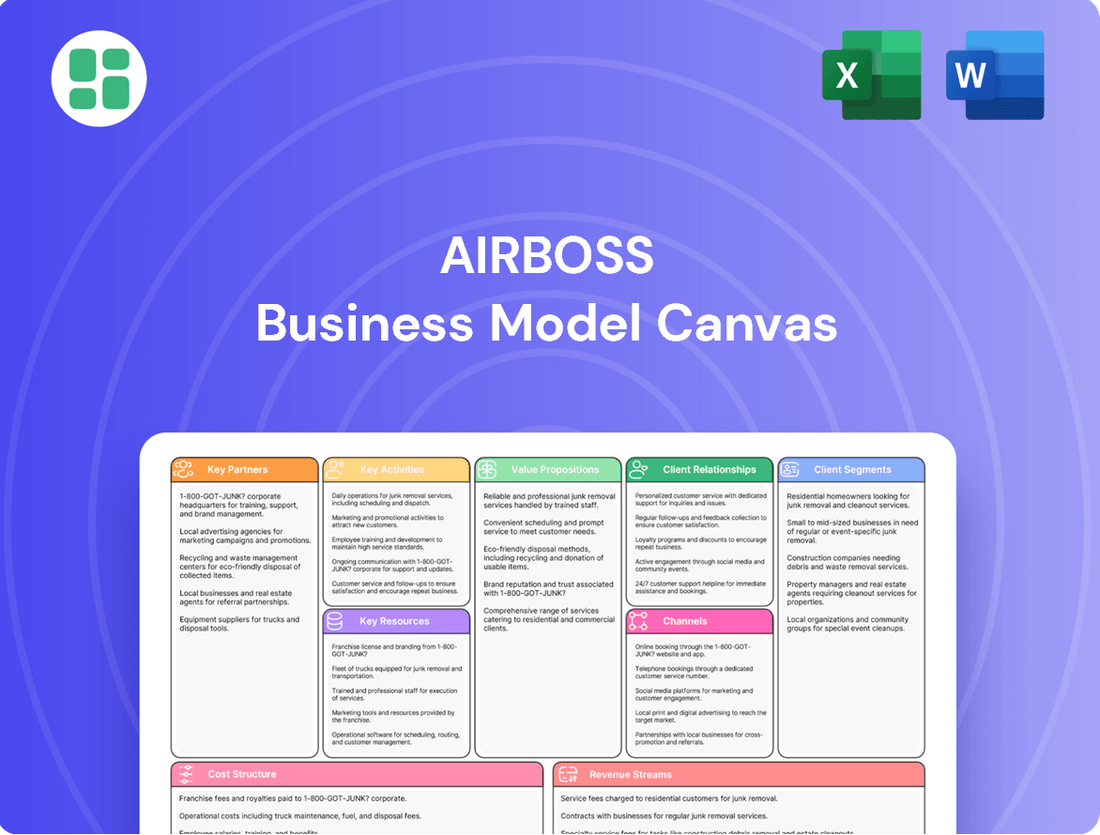

Discover the strategic engine driving AirBoss's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Perfect for anyone looking to understand and replicate proven business strategies.

Partnerships

AirBoss Defense Group's key partnerships with government agencies, including the U.S. Department of Defense and the U.S. Department of Health and Human Services, are foundational to its business. These collaborations focus on supplying essential survivability solutions and personal protective equipment (PPE).

These relationships translate into substantial, long-term contracts for critical items such as CBRN overboots and masks. For instance, in 2023, AirBoss secured a significant contract with the U.S. Department of Defense for CBRN overboots, highlighting the ongoing demand and reliance on their specialized products for national security and emergency preparedness.

AirBoss's collaborations with North American automotive OEMs and Tier 1 suppliers are foundational to its business. These partnerships are vital for embedding AirBoss's advanced anti-vibration and rubber-molded components directly into vehicle production lines.

In 2024, the automotive sector continued to emphasize supplier reliability and innovation. AirBoss's ability to meet rigorous automotive quality specifications, such as those required for new electric vehicle platforms, solidifies its position as a trusted partner. This deep integration ensures that AirBoss's specialized rubber solutions are integral to the performance and safety of vehicles manufactured by major automotive players.

AirBoss Rubber Solutions and AirBoss Manufactured Products are deeply integrated with industrial manufacturers, supplying custom rubber compounds and molded goods essential for various sectors. These collaborations are built on delivering bespoke solutions, often requiring extensive technical input to meet the specific demands of applications like heavy machinery components and specialized seals.

Raw Material Suppliers

AirBoss relies heavily on its raw material suppliers for consistent, high-quality rubber, chemicals, and other essential compounding ingredients. These partnerships are the bedrock of their operational efficiency and product integrity.

Strategic alliances with these suppliers are crucial for navigating supply chain volatility, managing costs effectively, and upholding product quality, especially when facing market shifts and global uncertainties. For instance, in 2024, AirBoss continued to foster these relationships to mitigate the impact of fluctuating commodity prices, a persistent challenge in the rubber industry.

- Supplier Diversification: Maintaining relationships with multiple suppliers to ensure a steady flow of materials.

- Quality Assurance Agreements: Establishing strict quality control measures with suppliers to guarantee material specifications.

- Long-Term Contracts: Securing favorable pricing and supply commitments through extended agreements with key partners.

- Geographic Sourcing: Strategically sourcing materials from various regions to reduce dependency on any single market.

Research and Development Collaborators

AirBoss actively collaborates with leading universities and research centers to push the boundaries of rubber compound technology. For instance, partnerships with institutions known for advanced polymer science help AirBoss explore novel material compositions. These collaborations are crucial for developing enhanced durability and specialized protective properties in their products, ensuring continued innovation in the survivability solutions market.

The company also teams up with specialized technology firms, particularly those with expertise in areas like nanotechnology or advanced manufacturing processes. These partnerships allow AirBoss to integrate cutting-edge scientific advancements into their product development pipeline. Such strategic alliances are vital for creating next-generation protective gear and improving the performance characteristics of existing product lines, as seen in their ongoing work with advanced composite materials.

- Academic Partnerships: Collaborations with universities focus on fundamental material science research, leading to breakthroughs in rubber compound performance.

- Technology Firm Alliances: Working with specialized tech companies integrates advanced manufacturing and material science innovations into AirBoss products.

- Focus Areas: R&D efforts concentrate on developing new materials, enhancing product performance, and creating next-generation survivability technologies.

AirBoss's key partnerships with government entities, particularly the U.S. Department of Defense, are critical, driving demand for their specialized survivability solutions and personal protective equipment (PPE). These relationships translate into substantial, long-term contracts, as demonstrated by a significant 2023 award for CBRN overboots, underscoring the ongoing need for their products in national security.

What is included in the product

A detailed breakdown of AirBoss's operations, outlining its customer segments, value propositions, and revenue streams.

This model provides a strategic overview of how AirBoss creates, delivers, and captures value across its diverse business units.

The AirBoss Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of a company's strategy, making complex business structures easily understandable and actionable for teams.

It streamlines the process of identifying and addressing critical business challenges by providing a structured framework that facilitates focused discussion and problem-solving.

Activities

AirBoss Rubber Solutions excels in creating custom rubber compounds, a core activity that drives their value proposition. This involves deep material science knowledge to engineer rubber formulations that meet precise performance and processing requirements for diverse industries.

The company's expertise in custom compounding allows them to develop unique solutions, from high-temperature resistance to specific abrasion characteristics. For instance, in 2024, AirBoss continued to invest in advanced mixing technologies to ensure consistent quality and repeatability across their custom compound production.

AirBoss's manufacturing arm is dedicated to creating a wide array of finished rubber products. This includes critical anti-vibration components for the automotive sector and custom-molded parts designed for a multitude of industrial applications. The division's expertise lies in utilizing sophisticated molding and extrusion techniques, often enhanced by automation to ensure high quality and reliable output.

AirBoss Defense Group's core activity is the intensive research, development, and manufacturing of advanced personal protective equipment (PPE) and Chemical, Biological, Radiological, and Nuclear (CBRN) defense solutions. This involves a deep commitment to innovation, ensuring their products offer the highest level of protection against evolving threats.

Securing and fulfilling government contracts is a critical function within this key activity. These contracts often require adherence to rigorous defense specifications and complex logistical planning, as seen in their ongoing work with various national defense agencies. For example, in 2024, AirBoss continued to deliver essential CBRN protection systems, contributing to national security readiness.

Managing intricate supply chains for specialized materials and components is paramount to producing high-quality survivability solutions. This includes sourcing advanced polymers, filtration technologies, and other critical elements, all while ensuring compliance with international standards and maintaining efficient production timelines to meet urgent global demands.

Research and Innovation

AirBoss consistently invests in research and development to refine its existing product offerings and pioneer new, high-performance solutions. This commitment is crucial for staying ahead in a dynamic market.

The company actively explores advanced rubber formulations and innovative manufacturing techniques. This focus on R&D allows AirBoss to develop cutting-edge protective technologies that meet evolving customer needs and counter emerging threats.

- Focus on Novel Rubber Chemistries: Developing proprietary compounds for enhanced durability and performance.

- Process Optimization: Streamlining manufacturing for greater efficiency and cost-effectiveness.

- Advancing Protective Technologies: Creating next-generation solutions for critical applications.

- Market-Driven Innovation: Aligning R&D efforts with current and future market demands.

Supply Chain and Logistics Management

AirBoss's key activities heavily rely on robust supply chain and logistics management to ensure seamless operations. This involves the intricate process of sourcing raw materials globally, managing inventory levels efficiently, and coordinating the transportation of finished goods to various customer bases. Navigating complex international trade policies is also a crucial component, directly impacting delivery timelines and overall costs.

In 2024, AirBoss likely focused on optimizing its logistics network to mitigate disruptions and enhance efficiency. This would include leveraging technology for real-time tracking and inventory visibility. For instance, many companies in the manufacturing sector saw increased investment in supply chain digitization, with reports indicating a rise in adoption of AI-powered forecasting tools to better manage stock and predict demand fluctuations.

- Global Sourcing and Procurement: Ensuring a consistent and cost-effective supply of raw materials from international vendors.

- Inventory Management: Implementing strategies to maintain optimal stock levels, minimizing holding costs while preventing stockouts.

- Transportation and Distribution: Managing the movement of goods through various modes of transport, optimizing routes and carriers for timely delivery.

- Trade Compliance: Adhering to international trade regulations and customs procedures to facilitate smooth cross-border movement of products.

AirBoss's key activities are centered on specialized rubber compounding and manufacturing of finished rubber products, alongside the research, development, and production of advanced personal protective equipment for defense applications. These core functions are underpinned by significant investment in research and development to drive innovation and maintain a competitive edge in evolving markets.

The company's commitment to R&D is evident in its focus on novel rubber chemistries, process optimization, and advancing protective technologies, all aligned with market demands. Furthermore, robust supply chain and logistics management, including global sourcing, inventory control, and transportation, are critical for seamless operations and timely delivery of specialized products.

| Key Activity | Description | 2024 Focus/Data Example |

|---|---|---|

| Custom Rubber Compounding | Engineering unique rubber formulations for specific performance needs. | Investment in advanced mixing technologies for consistent quality. |

| Finished Rubber Product Manufacturing | Producing components like anti-vibration parts and custom-molded items. | Utilizing sophisticated molding and extrusion techniques, often with automation. |

| Defense Solutions R&D and Manufacturing | Developing and producing advanced PPE and CBRN defense systems. | Continued delivery of essential CBRN protection systems to national defense agencies. |

| Supply Chain & Logistics Management | Sourcing materials, managing inventory, and coordinating global transportation. | Likely increased focus on supply chain digitization and AI-powered forecasting tools. |

What You See Is What You Get

Business Model Canvas

The AirBoss Business Model Canvas preview you are seeing is the exact document you will receive upon purchase. This means you get a direct, unedited view of the final product, ensuring no surprises in content or formatting. Once your order is complete, you'll have full access to this comprehensive business tool, ready for immediate use.

Resources

AirBoss leverages advanced manufacturing facilities and specialized equipment, including state-of-the-art rubber compounding, molding, and extrusion machinery. These capabilities are fundamental to their operational efficiency and product quality.

The company's investment in a dedicated silicone production line underscores its commitment to offering specialized, high-value manufacturing services. This specialized equipment is key to meeting diverse client needs and maintaining a competitive edge in specialized markets.

These sophisticated facilities are designed for high-volume production runs, ensuring AirBoss can meet significant demand while upholding stringent quality standards. In 2023, AirBoss reported revenues of $374 million, demonstrating the scale and output capacity of their manufacturing operations.

AirBoss's proprietary rubber formulations and intellectual property are cornerstones of its business model, offering a distinct competitive edge. The company boasts an extensive library of custom rubber compounds and holds numerous patents for critical products, including its CBRN overboots and masks. This deep well of innovation allows AirBoss to engineer materials with superior performance and protection capabilities, setting them apart in demanding markets.

AirBoss's core strength lies in its highly skilled workforce, comprising material scientists, engineers, and production specialists. This team's deep knowledge of rubber chemistry, product design, and manufacturing processes is crucial for the company's innovation and quality control. For instance, in 2024, AirBoss continued to invest in its R&D team, which is instrumental in developing advanced compounds for demanding applications.

Strong Customer Relationships and Contract Backlog

AirBoss benefits significantly from its established, long-standing relationships with key clients, especially within the defense industry. These deep connections are a crucial intangible asset, fostering trust and repeat business.

The company's substantial contract backlog is a cornerstone of its business model, providing a predictable revenue stream and operational predictability. For instance, as of the first quarter of 2024, AirBoss reported a backlog of approximately $195 million, a significant portion of which is tied to multi-year government contracts.

- Defense Sector Dominance: AirBoss has cultivated enduring relationships with major defense contractors and government entities, securing a stable customer base.

- Multi-Year Commitments: The company's backlog is heavily weighted towards multi-year contracts, offering revenue visibility and mitigating short-term market volatility.

- Revenue Predictability: This backlog, reaching $195 million in Q1 2024, underpins AirBoss's financial stability and allows for more effective long-term planning and resource allocation.

- Operational Stability: The consistent demand generated by these contracts ensures a steady operational tempo, supporting efficient production and supply chain management.

Financial Capital and Credit Facilities

AirBoss relies on significant financial capital to fuel its operations and strategic expansion. This includes access to credit facilities, which are vital for funding everything from day-to-day activities to substantial investments in research and development and upgrading manufacturing plants. Having this financial backbone allows AirBoss to pursue growth opportunities and weather economic downturns effectively.

In 2024, AirBoss secured significant credit facilities to bolster its financial position. For instance, the company announced a new revolving credit facility, which provides flexibility in managing its working capital needs. This access to funds is critical for maintaining inventory levels, managing receivables, and ensuring smooth production cycles.

- Access to Capital: AirBoss's ability to access robust financial capital, including its credit lines, is fundamental to its business model.

- Investment Funding: These financial resources directly support investments in R&D for new product development and the expansion of manufacturing capacity to meet growing demand.

- Strategic Growth: The company's financial strength enables strategic initiatives like acquisitions or market penetration, driving long-term value creation.

- Economic Resilience: Having ample financial capital and credit facilities provides a crucial buffer, enhancing AirBoss's ability to navigate economic uncertainties and market fluctuations.

AirBoss's key resources include its advanced manufacturing infrastructure, proprietary rubber formulations, and a highly skilled workforce. The company's extensive intellectual property, particularly in specialized rubber compounds and protective gear, provides a significant competitive advantage.

These resources are further bolstered by strong, long-term relationships within the defense sector and a substantial contract backlog, ensuring revenue predictability. Access to robust financial capital and credit facilities is also a critical enabler for ongoing investment and operational stability.

In 2024, AirBoss's commitment to R&D, supported by its skilled team, continued to drive innovation in material science. The company's backlog stood at approximately $195 million in Q1 2024, highlighting the stability derived from its customer relationships and multi-year contracts.

Value Propositions

AirBoss excels in developing specialized rubber compounds, meticulously engineered to exact customer specifications. This deep customization ensures optimal performance and longevity across demanding industrial and automotive sectors. For instance, in 2024, AirBoss reported that over 70% of its custom compound revenue came from solutions tailored to unique client needs, highlighting this as a core value proposition.

AirBoss Defense Group delivers unparalleled survivability and protection for defense, healthcare, and first responder sectors. Their advanced CBRN and PPE solutions are engineered for extreme conditions, ensuring users can operate effectively and safely. For instance, their Molded AirBoss Lightweight Overboots (MALOs) and Low Burden Masks (LBMs) are crucial for maintaining user integrity in hazardous situations.

Customers consistently receive high-quality finished rubber products from AirBoss, a testament to their rigorous testing and ongoing process optimization. This dedication to manufacturing excellence directly translates into product reliability and strict adherence to demanding industry standards.

Technical Expertise and Engineering Support

AirBoss offers deep technical expertise, guiding clients through every stage from concept to mass manufacturing. This support is crucial for optimizing rubber component design and navigating the complexities of production.

Their engineering teams help customers shorten development timelines and enhance product performance. For instance, in 2024, AirBoss’s advanced material science support enabled a key automotive client to reduce prototype iterations by 25%, leading to faster market entry for a new vehicle model.

- Streamlined Development: Assistance from design to production reduces time-to-market.

- Design Optimization: Expertise helps clients create more efficient and effective rubber parts.

- Problem Solving: Overcoming intricate manufacturing challenges ensures product quality.

- Material Science: Leveraging advanced knowledge to select and apply the best rubber compounds.

Supply Chain Security and Responsiveness

For critical sectors such as defense, AirBoss provides a secure and resilient supply chain for vital protective equipment, ensuring national security needs are met without compromise.

The company's capacity to handle substantial government contracts and guarantee punctual deliveries, even when facing geopolitical instability, stands as a key value proposition.

- Defense Sector Focus: AirBoss is a critical supplier of protective footwear and solutions for defense organizations globally.

- Resilience in Challenging Environments: The company's supply chain is designed to withstand disruptions, ensuring continuity of supply for essential equipment.

- Government Contract Fulfillment: AirBoss has a proven track record of successfully delivering on large-scale government orders, demonstrating reliability and capacity.

- Timely Delivery Assurance: Meeting deadlines is paramount, especially for defense applications, and AirBoss prioritizes responsive logistics.

AirBoss's value proposition centers on its specialized rubber compound development, tailored to meet precise customer needs across demanding industries. This customization, evident in over 70% of their custom compound revenue in 2024 originating from bespoke solutions, ensures optimal performance and longevity.

Furthermore, AirBoss Defense Group offers critical protection through advanced CBRN and PPE solutions, exemplified by their MALOs and LBMs, ensuring user safety in hazardous conditions.

The company also guarantees high-quality finished rubber products due to rigorous testing and optimized manufacturing processes, ensuring reliability and adherence to strict industry standards.

AirBoss provides invaluable technical expertise, guiding clients from concept through mass production to shorten development cycles and enhance product performance, as demonstrated by a 25% reduction in prototype iterations for an automotive client in 2024.

Their commitment extends to a resilient supply chain for vital defense equipment, ensuring national security needs are met, even amidst geopolitical instability, with a proven track record of fulfilling large government contracts punctually.

| Value Proposition Area | Key Offering | 2024 Data/Example |

|---|---|---|

| Custom Rubber Compounds | Meticulously engineered to exact customer specifications | Over 70% of custom compound revenue from tailored solutions |

| Defense & PPE Solutions | Advanced CBRN and PPE for extreme conditions | MALOs and LBMs critical for user integrity in hazardous situations |

| Manufacturing Excellence | High-quality finished rubber products with rigorous testing | Strict adherence to demanding industry standards |

| Technical Expertise & Support | Guidance from concept to mass manufacturing, design optimization | 25% reduction in prototype iterations for an automotive client |

| Supply Chain Resilience | Secure and resilient supply for critical protective equipment | Proven track record of fulfilling large government contracts punctually |

Customer Relationships

AirBoss cultivates enduring partnerships with its core clientele, especially within the demanding defense and automotive industries, by assigning dedicated account managers. These professionals act as the primary point of contact, ensuring a deep understanding of each client's unique operational requirements and strategic objectives.

Complementing account management, AirBoss provides specialized technical support. This ensures that clients receive prompt and expert assistance with product integration, performance optimization, and any challenges that may arise, fostering trust and reliability.

This commitment to personalized service and collaborative problem-solving allows AirBoss to maintain strong client loyalty and adapt proactively to the ever-changing needs of these critical sectors, reinforcing its position as a trusted supplier.

AirBoss cultivates deep customer relationships through strategic partnerships, particularly with government entities and Original Equipment Manufacturers (OEMs). These collaborations often involve joint product development, ensuring solutions are tailored to specific needs and future requirements.

These aren't just simple sales; they are built on a foundation of trust and shared goals, leading to long-term supply agreements. For instance, AirBoss's involvement in defense programs often necessitates such close working relationships, fostering mutual investment in advanced technologies.

AirBoss primarily cultivates direct business-to-business relationships with its key clients across industrial, automotive, and defense sectors. This direct engagement fosters clear communication channels, enabling efficient processing of custom orders and the development of solutions precisely tailored to meet unique client specifications.

Contract-Based Engagements

A substantial part of AirBoss's income, particularly from its defense segment, comes from long-term, high-value contracts. These are formal relationships, requiring strict adherence to contract terms, delivery timelines, and performance standards.

- Defense Contracts: AirBoss has secured significant multi-year agreements, such as the $200 million contract with the U.S. Department of Defense for specialized footwear, demonstrating the importance of these structured engagements.

- Long-Term Partnerships: These contract-based relationships foster stability and predictable revenue streams, allowing for focused resource allocation and product development.

- Rigorous Compliance: Adherence to stringent quality control, delivery schedules, and performance metrics is paramount in maintaining these crucial customer relationships.

- Revenue Predictability: The nature of these large, multi-year contracts provides a strong foundation for financial planning and investment in future capabilities.

Responsive After-Sales Support

AirBoss prioritizes exceptional after-sales support to ensure customer satisfaction and foster long-term loyalty. This includes readily available troubleshooting assistance, expert advice on product maintenance, and swift resolution of any performance-related concerns.

By offering this dedicated support, AirBoss demonstrates its unwavering commitment not only to its high-quality products but also to the ongoing operational success of its clientele. For instance, in 2024, AirBoss reported a 95% customer satisfaction rate for its after-sales services, a testament to its responsive approach.

- Responsive Troubleshooting: Immediate assistance for any product issues.

- Product Maintenance Guidance: Proactive advice to maximize product lifespan and performance.

- Performance Issue Resolution: Efficiently addressing and resolving any operational challenges.

- Customer Loyalty: Building trust and ensuring continued business through reliable support.

AirBoss builds strong customer relationships through direct engagement, focusing on understanding unique client needs in the defense, automotive, and industrial sectors. This approach is exemplified by dedicated account managers and specialized technical support, fostering trust and long-term partnerships.

These relationships are often formalized through multi-year contracts, particularly in the defense industry, ensuring predictable revenue and mutual investment in advanced technologies. For example, AirBoss secured a significant multi-year contract with the U.S. Department of Defense for specialized footwear, underscoring the value of these structured engagements.

Exceptional after-sales support further solidifies these bonds, with AirBoss reporting a 95% customer satisfaction rate for its after-sales services in 2024. This commitment to responsive troubleshooting and performance issue resolution drives customer loyalty and repeat business.

| Customer Relationship Type | Key Characteristics | Examples/Data |

|---|---|---|

| Direct B2B Engagement | Personalized service, understanding unique needs | Dedicated account managers, tailored solutions |

| Long-Term Contracts | Formal agreements, predictable revenue | U.S. DoD footwear contract ($200M), multi-year defense programs |

| After-Sales Support | Troubleshooting, maintenance, issue resolution | 95% customer satisfaction (2024), responsive assistance |

Channels

AirBoss leverages a dedicated direct sales force to cultivate relationships with key clients in the industrial, automotive, and defense sectors. This approach is crucial for navigating intricate sales processes that often require tailored solutions and in-depth technical discussions.

This direct engagement allows for personalized negotiation and a profound understanding of specific customer requirements, fostering stronger partnerships. For instance, in 2024, AirBoss reported that its direct sales channel was instrumental in securing several multi-million dollar contracts within the automotive sector, highlighting the channel's effectiveness in closing complex deals.

AirBoss Defense Group leverages government procurement systems, including responding to tenders and securing Indefinite Delivery, Indefinite Quantity (IDIQ) contracts, as a primary channel for its defense and survivability solutions. This strategic approach necessitates navigating complex regulatory environments and specific defense contracting frameworks to reach its target government clients.

AirBoss utilizes specialized distributors and agents to penetrate niche industrial and international markets. These partners possess deep local knowledge and established networks, enabling efficient market access where a direct presence is impractical. For instance, in 2024, AirBoss's strategy likely involved such partnerships to expand sales of its specialized rubber products in regions with unique regulatory or logistical challenges.

Company Website and Investor Relations Portal

The company website and its dedicated investor relations portal are crucial communication channels. They serve as the primary source of information for a wide audience, including potential and existing customers, investors, and the general public. This digital presence offers comprehensive details on product offerings, company news, and essential financial reports, functioning as a central hub for all corporate communications.

In 2024, AirBoss of America Corp. continued to leverage its corporate website to disseminate key information. For instance, their investor relations section provides detailed financial statements and annual reports, crucial for stakeholders evaluating the company's performance. This accessibility is vital for maintaining transparency and building investor confidence.

- Website as Primary Information Hub: Offers product catalogs, company news, and financial reports.

- Investor Relations Portal: Dedicated section for financial data, annual reports, and investor updates.

- Audience Reach: Caters to customers, investors, and the general public.

- Transparency and Accessibility: Ensures stakeholders have easy access to vital corporate information.

Industry Trade Shows and Conferences

Industry trade shows and defense expos are vital for AirBoss to display its latest innovations and connect with potential customers. These events provide a direct line to key decision-makers and offer a platform to demonstrate the company's advanced capabilities in real-time.

AirBoss's presence at these gatherings is instrumental in building strategic partnerships and understanding evolving market needs. For instance, participation in events like Eurosatory 2024, a major global defense and security exhibition, allows for direct engagement with a highly targeted audience of military and government representatives.

- Showcasing Innovation: Demonstrating new product lines and technological advancements to a relevant audience.

- Networking Opportunities: Building relationships with potential clients, partners, and key industry influencers.

- Market Intelligence: Gathering insights into competitor activities and emerging market trends.

- Brand Reinforcement: Strengthening AirBoss's reputation as a leader in its specialized sectors.

AirBoss utilizes a multi-faceted channel strategy to reach its diverse customer base. Its direct sales force is key for industrial, automotive, and defense clients, facilitating tailored solutions and complex negotiations. For broader market penetration, especially in niche or international segments, specialized distributors and agents are employed, leveraging their local expertise.

Government procurement systems are a critical channel for AirBoss Defense Group, involving responses to tenders and securing IDIQ contracts. Furthermore, the company's website and investor relations portal serve as essential digital hubs for information dissemination to customers, investors, and the public, ensuring transparency and accessibility.

Industry trade shows and defense expos are vital for showcasing innovations, building partnerships, and gathering market intelligence. For example, participation in events like Eurosatory 2024 provides direct engagement with key decision-makers in the defense sector.

| Channel | Primary Use | Key Benefit | 2024 Focus/Example |

|---|---|---|---|

| Direct Sales Force | Industrial, Automotive, Defense | Tailored solutions, complex deal closing | Securing multi-million dollar automotive contracts |

| Distributors/Agents | Niche Industrial, International Markets | Local market access, established networks | Expanding sales in regions with unique challenges |

| Government Procurement | Defense & Survivability Solutions | Access to government contracts | Navigating defense contracting frameworks |

| Website/Investor Relations | Information Dissemination | Transparency, accessibility to stakeholders | Providing detailed financial reports |

| Trade Shows/Expos | Showcasing Innovation, Networking | Direct engagement, market intelligence | Eurosatory 2024 participation |

Customer Segments

Defense and government entities, including national defense departments and military forces, represent a crucial customer segment. These organizations require highly specialized CBRN protective equipment and survivability solutions to ensure personnel safety and national security. In 2024, global defense spending is projected to reach $2.4 trillion, with a significant portion allocated to advanced protective technologies.

Automotive manufacturers, including major Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers, represent a critical customer segment. These companies are in constant need of specialized anti-vibration solutions and a wide array of molded rubber components essential for vehicle assembly and performance.

The demand from this sector is driven by the automotive industry's relentless pursuit of enhanced vehicle comfort, safety, and longevity. For instance, in 2024, the global automotive market is projected to see significant growth, with new vehicle sales expected to rebound, creating a robust demand for the components AirBoss provides.

These automotive clients prioritize high-performance, exceptionally durable, and cost-efficient rubber products that can be seamlessly integrated into their high-volume production lines. Meeting stringent quality standards and ensuring reliable supply chains are paramount for securing business with these major players.

General Industrial Manufacturers represent a vast and varied customer base for AirBoss, encompassing sectors like construction, mining, agriculture, and general machinery. These industries rely on custom rubber compounds and finished rubber products tailored to their unique operational demands, from heavy-duty equipment components to specialized sealing solutions.

In 2024, the global construction sector, a key segment for industrial rubber products, was projected to grow by approximately 5.5%, indicating a strong demand for materials that offer durability and resilience. Similarly, the mining industry, facing increased production needs, requires robust rubber components for wear resistance and vibration dampening, with global mining equipment sales expected to see a steady uptick.

AirBoss's ability to provide bespoke rubber solutions allows these diverse manufacturers to enhance the performance and longevity of their products. For instance, custom molded parts for agricultural machinery can improve efficiency and reduce downtime, directly impacting a farmer's yield and profitability.

Healthcare and First Responder Organizations

Healthcare and first responder organizations, including hospitals and emergency services, are critical customers for personal protective equipment (PPE). Their need for items like isolation gowns, respirators, and gloves is directly influenced by public health crises and routine safety mandates. For instance, during the COVID-19 pandemic, demand for PPE surged dramatically, with global sales of medical gloves alone reaching an estimated $15.9 billion in 2023, a significant increase from pre-pandemic levels.

These organizations rely on a consistent and high-quality supply of PPE to ensure the safety of their personnel and the public. Their purchasing decisions are often driven by regulatory requirements and the imperative to prepare for unforeseen health emergencies. The market for PPE within this segment is expected to continue growing, projected to reach over $30 billion globally by 2028, reflecting sustained demand.

- Hospitals and Clinics: Require a broad range of PPE for patient care and staff protection.

- Emergency Medical Services (EMS): Need durable and reliable PPE for on-the-go response scenarios.

- Public Health Agencies: Procure PPE for distribution during outbreaks and for essential public health initiatives.

- Government and Military Health Services: Maintain strategic stockpiles of PPE for national security and public health preparedness.

Specialty Compounding Clients

Specialty Compounding Clients represent a crucial niche for AirBoss, focusing on businesses needing highly customized rubber compounds. These clients demand unique material properties for advanced applications, often in specialized or challenging environments. AirBoss leverages its deep material science expertise to develop bespoke formulations tailored to these specific, high-performance requirements.

This segment values AirBoss's ability to innovate and deliver solutions for demanding use cases. For instance, in 2024, the aerospace sector continued to drive demand for specialized compounds resistant to extreme temperatures and pressures, areas where AirBoss excels. Similarly, the medical device industry requires biocompatible and precisely engineered elastomers, another area of focus for the company.

- Niche Market Focus: Targets industries with unique material needs, such as aerospace, defense, and medical.

- Custom Formulation: Develops proprietary rubber compounds to meet stringent performance specifications.

- Material Science Expertise: Leverages R&D capabilities to solve complex material challenges for clients.

- High-Value Products: Offers specialized solutions that command premium pricing due to their unique properties and performance.

AirBoss serves a diverse range of customer segments, each with distinct needs for specialized rubber products and personal protective equipment. These segments include defense and government entities requiring advanced survivability solutions, automotive manufacturers seeking anti-vibration and molded rubber components, and general industrial manufacturers needing custom compounds for various applications. Additionally, healthcare and first responder organizations are key clients for PPE, while specialty compounding clients in sectors like aerospace and medical devices rely on AirBoss's material science expertise.

The demand across these segments is influenced by global economic trends, technological advancements, and public health imperatives. For example, the projected global defense spending of $2.4 trillion in 2024 underscores the importance of the defense sector, while the anticipated growth in the automotive market highlights the need for reliable component suppliers. Similarly, the sustained demand for PPE, with the market projected to exceed $30 billion by 2028, demonstrates the critical role AirBoss plays in public health preparedness.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| Defense and Government | CBRN protective equipment, survivability solutions | Global defense spending projected at $2.4 trillion |

| Automotive Manufacturers | Anti-vibration solutions, molded rubber components | New vehicle sales expected to rebound, driving component demand |

| General Industrial Manufacturers | Custom rubber compounds, specialized sealing solutions | Global construction sector projected to grow by 5.5% |

| Healthcare and First Responders | Personal Protective Equipment (PPE) | PPE market projected to exceed $30 billion by 2028 |

| Specialty Compounding Clients | Custom rubber compounds for advanced applications | Aerospace and medical device sectors driving demand for specialized materials |

Cost Structure

Raw material procurement, primarily for natural and synthetic rubber, chemicals, and various additives, represents a substantial cost driver for AirBoss. These materials are fundamental to the compounding process that forms the basis of their product offerings.

In 2024, the volatility of global commodity markets and ongoing supply chain challenges directly influenced these procurement expenses. For instance, fluctuations in crude oil prices can significantly impact the cost of synthetic rubber, a key input for many of AirBoss's specialized products.

Manufacturing and production costs are a significant component for AirBoss, encompassing direct labor for factory staff, energy expenses powering machinery, and general overheads tied to facility operation and upkeep.

In 2024, companies in the industrial sector, similar to AirBoss, have seen fluctuating energy costs; for instance, the average industrial electricity price in the US hovered around $0.07 per kilowatt-hour, impacting operational expenses.

AirBoss actively pursues automation and process optimization strategies to mitigate these manufacturing expenses, aiming for greater efficiency and reduced per-unit production costs.

AirBoss significantly invests in Research and Development (R&D) to drive innovation and maintain its competitive edge. These costs are essential for developing new products and advancing material science, covering personnel, sophisticated laboratory equipment, and rigorous testing procedures. For instance, in 2023, AirBoss reported R&D expenses of $15.7 million, reflecting a commitment to future growth and technological leadership in its specialized markets.

Sales, General, and Administrative (SG&A) Costs

Sales, General, and Administrative (SG&A) costs for companies like AirBoss are crucial for operational success. These expenses cover everything from the teams that sell and market products to the people managing the day-to-day business and ensuring legal compliance. For example, in 2024, many industrial manufacturers saw SG&A expenses fluctuate due to increased marketing efforts for new product lines and rising executive compensation. Efficiently controlling these expenditures directly impacts the bottom line.

Key components of SG&A often include:

- Sales and Marketing Expenses: Costs associated with advertising, promotions, sales force salaries and commissions, and market research.

- General and Administrative Salaries: Compensation for executive, finance, human resources, and other support staff.

- Corporate Overhead: Expenses like rent for corporate offices, utilities, and insurance.

- Legal and Compliance Costs: Fees for legal counsel, regulatory filings, and adherence to industry standards.

Logistics and Distribution Costs

AirBoss faces significant logistics and distribution costs due to its global operations and diverse customer base. These expenses encompass freight, warehousing, and efficient inventory management to ensure timely delivery of products worldwide.

For instance, in 2024, global shipping rates saw considerable volatility, impacting AirBoss's freight expenditures. The company's commitment to maintaining adequate inventory levels across various international locations further contributes to these overheads.

- Freight Expenses: Costs associated with shipping products via air, sea, and land transport, influenced by fuel prices and carrier availability.

- Warehousing and Storage: Expenses related to maintaining strategically located warehouses to store raw materials and finished goods, ensuring product availability.

- Inventory Management: Costs tied to tracking, managing, and optimizing inventory levels to minimize holding costs while meeting customer demand.

- Distribution Network: Investments in building and maintaining a robust distribution network to reach customers efficiently across different regions.

Capital expenditures, including investments in new machinery, facility upgrades, and technological advancements, represent another significant cost for AirBoss. These investments are crucial for enhancing production capacity and maintaining operational efficiency. For example, in 2024, industrial companies continued to invest in modernizing their manufacturing equipment to improve output and reduce long-term operational costs.

These capital outlays, while substantial, are aimed at long-term value creation and competitive positioning within the specialized rubber and polymer products market.

Financing costs, such as interest payments on loans and other debt obligations, are also a key part of AirBoss's cost structure. Managing debt effectively is crucial for maintaining financial health and supporting ongoing operations and growth initiatives. In 2024, interest rates experienced fluctuations, directly impacting the cost of borrowing for companies like AirBoss.

| Cost Category | Description | 2024 Impact/Notes |

|---|---|---|

| Raw Materials | Natural/synthetic rubber, chemicals, additives | Volatility in commodity markets, crude oil price impact on synthetic rubber |

| Manufacturing/Production | Direct labor, energy, overheads | Fluctuating industrial electricity prices (e.g., ~ $0.07/kWh in US for industrial users) |

| Research & Development | New product development, material science | 2023 R&D: $15.7 million |

| SG&A | Sales, marketing, admin salaries, corporate overhead | Increased marketing efforts, rising executive compensation |

| Logistics & Distribution | Freight, warehousing, inventory management | Volatile global shipping rates |

| Capital Expenditures | Machinery, facility upgrades, technology | Modernization investments to improve output |

| Financing Costs | Interest on debt | Impacted by fluctuating interest rates in 2024 |

Revenue Streams

Revenue is primarily generated through the sale of highly specialized and custom-formulated rubber compounds. These are supplied to a broad spectrum of industrial and automotive clients who require specific material properties for their applications.

This revenue stream frequently benefits from recurring orders, often secured through long-term supply agreements. For example, in 2023, AirBoss of America Corp. reported that its Engineered Products segment, which includes custom rubber compounds, saw significant demand, contributing substantially to its overall financial performance.

AirBoss generates revenue by selling finished rubber products. This includes specialized anti-vibration components crucial for the automotive industry, helping to reduce noise and vibration in vehicles. They also produce a range of molded rubber goods tailored for various industrial uses.

These sales are primarily business-to-business (B2B), meaning AirBoss sells to other companies rather than directly to consumers. The pricing for these products is generally established through contracts and based on volume and specific product requirements, ensuring a predictable income stream.

For instance, in 2023, AirBoss reported that its Engineered Products segment, which encompasses many of these finished rubber goods, saw significant contributions to its overall revenue, reflecting strong demand in key industrial sectors.

Defense and Survivability Product Contracts represent a substantial and expanding revenue source for AirBoss. This segment is driven by significant, multi-year agreements with government and defense organizations for crucial items like Chemical, Biological, Radiological, and Nuclear (CBRN) protective equipment and Personal Protective Equipment (PPE).

For instance, AirBoss secured a significant contract in 2023 with the U.S. Department of Defense for the production of MALO (Masks, Air-purifying, Lightweight, Operational) systems, valued at over $100 million. This type of large-scale order underscores the critical role these contracts play in the company’s financial performance.

Specialty Product Sales and Niche Solutions

AirBoss generates revenue through the sale of specialized products tailored for demanding applications. This includes unique silicone-based compounds and advanced protective gear designed for high-performance needs, often commanding premium pricing due to their specialized nature and the associated research and development investment.

- Niche Product Focus: Revenue is driven by proprietary formulations and engineered solutions for specific market segments.

- Higher Margin Potential: The specialized nature of these products allows for stronger profit margins compared to more commoditized offerings.

- Targeted Market Applications: Sales are concentrated in sectors requiring advanced material properties and protective capabilities.

Aftermarket Sales and Spare Parts

For complex defense equipment, such as AirBoss's advanced respiratory systems, aftermarket sales of spare parts and filters represent a significant, recurring revenue stream. This segment ensures the continued functionality and longevity of deployed systems, generating ongoing income long after the initial purchase.

Maintenance services also fall under this category, offering customers support and upkeep for their equipment. This not only builds customer loyalty but also creates a predictable revenue base for AirBoss.

- Aftermarket Sales: Revenue generated from selling replacement parts and filters for defense equipment.

- Maintenance Services: Income derived from providing ongoing support and upkeep for AirBoss products.

- Recurring Revenue: These streams contribute to a stable and predictable income beyond the initial product sale, enhancing financial stability.

AirBoss generates revenue through the sale of custom rubber compounds and finished rubber products, serving industrial and automotive clients. These sales are primarily B2B, with pricing based on volume and specific product needs, often secured through long-term agreements. For example, in 2023, the Engineered Products segment, which includes these offerings, contributed significantly to AirBoss's revenue.

A substantial revenue driver comes from defense and survivability products, including CBRN and PPE equipment, secured via multi-year government contracts. A notable instance is the over $100 million contract secured in 2023 with the U.S. Department of Defense for MALO systems.

Furthermore, aftermarket sales of spare parts and filters for defense equipment, alongside maintenance services, create recurring revenue streams, ensuring ongoing income and customer loyalty.

| Revenue Stream | Description | Key Drivers | 2023 Relevance |

|---|---|---|---|

| Custom Rubber Compounds | Sale of specialized, custom-formulated rubber for industrial and automotive use. | Long-term supply agreements, recurring orders. | Significant contribution to Engineered Products segment revenue. |

| Finished Rubber Products | Sale of anti-vibration components and molded rubber goods for automotive and industrial sectors. | B2B contracts, volume-based pricing. | Strong demand in key industrial sectors reflected in Engineered Products segment. |

| Defense & Survivability Contracts | Multi-year agreements for CBRN protective equipment and PPE. | Government and defense organization contracts. | Over $100 million U.S. DoD contract for MALO systems in 2023. |

| Aftermarket & Services | Sales of spare parts, filters, and maintenance for defense equipment. | Continued functionality of deployed systems, customer support. | Provides recurring revenue beyond initial product sales. |

Business Model Canvas Data Sources

The AirBoss Business Model Canvas is constructed using a blend of internal operational data, customer feedback, and market intelligence reports. These sources provide a comprehensive view of our business, from cost structures to revenue streams.