AirBoss Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBoss Bundle

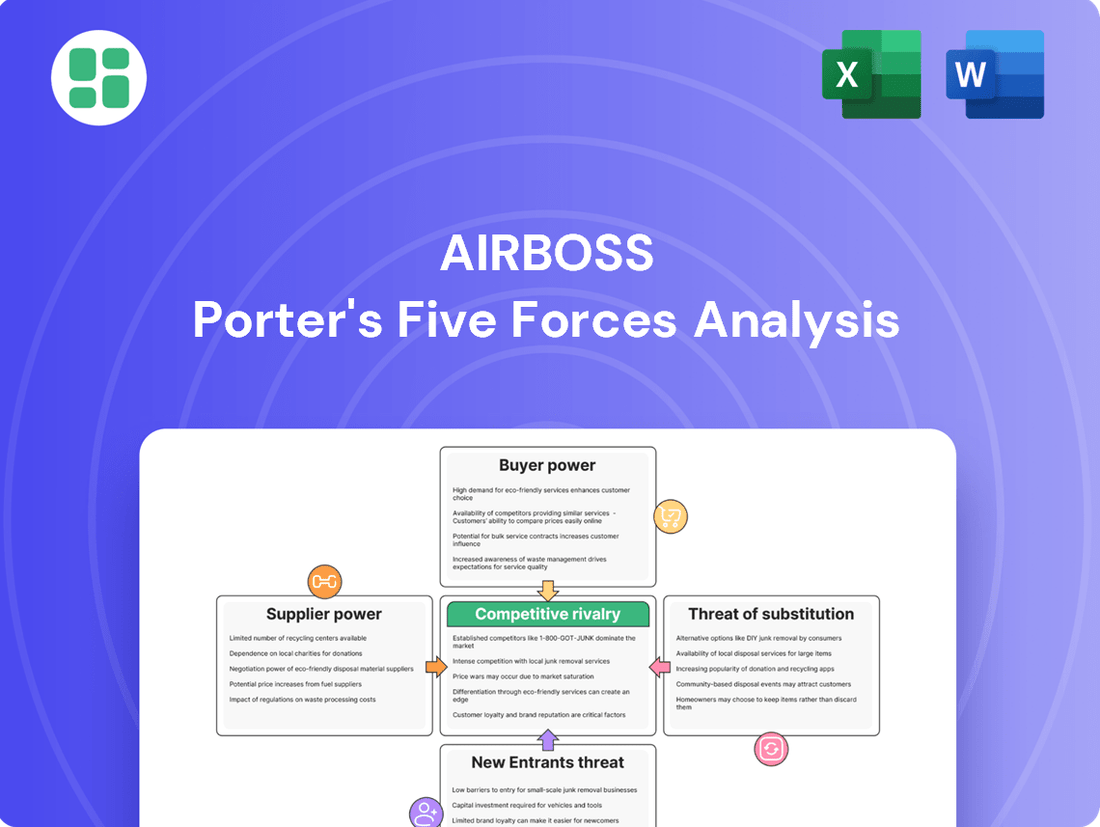

AirBoss faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being key considerations. Understanding these dynamics is crucial for navigating the market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AirBoss’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The rubber compounding industry's dependence on essential raw materials such as natural rubber, synthetic rubber, and carbon black directly impacts supplier bargaining power. A limited number of suppliers for these critical inputs can significantly shift leverage towards them.

The global natural rubber market, expected to reach USD 29.16 billion by 2033, highlights the influence of major producing nations like Thailand and Indonesia on supply availability and pricing, thereby strengthening supplier positions.

While natural and synthetic rubber are AirBoss's primary inputs, the availability of alternative reinforcing agents like silica can influence supplier power. For instance, in 2024, the global silica market was valued at approximately $30 billion, indicating a substantial alternative for certain performance characteristics, potentially giving AirBoss some leverage.

Manufacturers like AirBoss can explore blending or switching materials based on cost and performance, but the fundamental reliance on core rubber types remains. Fluctuations in the price of natural rubber, which saw significant volatility in early 2025 due to weather patterns in Southeast Asia, underscore the importance of managing these core material dependencies.

Switching raw material suppliers or types of rubber compounds can be a costly affair for AirBoss. These transitions often necessitate significant investments in retooling existing machinery, obtaining new certifications for materials, and fine-tuning manufacturing processes to accommodate the new inputs.

These substantial switching costs create a tangible level of dependence on their current suppliers. This reliance, in turn, can empower those suppliers, giving them greater leverage in negotiations with AirBoss regarding pricing and terms.

Impact of Raw Material Prices

Volatility in raw material prices, especially for natural and synthetic rubber, directly impacts AirBoss's profitability. For instance, in Q1 2025, natural rubber prices saw significant swings, driven by adverse weather conditions, ongoing supply chain disruptions, and temporary production stoppages.

This price instability for key inputs like natural rubber and petrochemical-based synthetic rubber creates a substantial challenge for rubber manufacturers such as AirBoss. These fluctuations can squeeze profit margins if manufacturers cannot pass on the increased costs to their customers.

- Natural Rubber Price Fluctuations: Prices for natural rubber experienced notable volatility in the first quarter of 2025.

- Contributing Factors: Weather events, persistent supply chain issues, and production halts were key drivers of this price instability.

- Impact on Manufacturers: Such volatility directly affects the cost of goods sold for companies like AirBoss, impacting their overall profit margins.

- Petrochemical Dependence: The reliance on petrochemical-based synthetic rubber also exposes manufacturers to the fluctuating costs within the oil and gas sector.

Supplier Importance to AirBoss's Product Quality

The quality and consistency of raw materials are paramount for AirBoss's specialized products, particularly in demanding sectors like defense and automotive. These industries have rigorous performance and safety requirements, making the integrity of inputs non-negotiable.

This dependence on specific, high-quality materials from a select group of suppliers can significantly enhance their leverage. For instance, if AirBoss relies on a unique rubber compound for its blast-resistant automotive components, the supplier of that compound holds considerable sway.

- Critical Raw Materials: AirBoss's reliance on specialized rubber compounds and other performance-critical materials for defense applications, such as survivability systems, directly impacts product efficacy.

- Supplier Concentration: In certain niche material categories, the number of qualified suppliers may be limited, concentrating bargaining power among fewer entities.

- Quality Assurance Costs: Ensuring the quality of incoming materials can involve significant inspection and testing, costs that can be passed on by suppliers if their position is strong.

The bargaining power of suppliers for AirBoss is considerable due to the specialized nature of its raw materials and the costs associated with switching. Reliance on specific, high-quality rubber compounds for critical applications in sectors like defense means suppliers of these niche materials hold significant leverage. For example, the global market for specialty chemicals, which includes many additives for rubber compounding, is projected for steady growth, indicating continued demand for these specialized inputs.

The dependence on essential inputs like natural and synthetic rubber, coupled with the substantial costs involved in retooling and recertifying new materials, creates a strong supplier position. This is further amplified by price volatility; in early 2025, natural rubber prices saw significant fluctuations due to weather and supply chain issues, directly impacting AirBoss's cost of goods sold.

The limited number of qualified suppliers for certain critical materials, particularly those meeting stringent defense or automotive performance standards, concentrates power. This scarcity allows these suppliers to command higher prices and dictate terms, as demonstrated by the ongoing demand for advanced polymer compounds in the automotive sector, a market segment that saw global sales of over 75 million vehicles in 2024.

| Material Type | 2024 Market Value (Est.) | Key Influencing Factors | Supplier Leverage Indicators |

|---|---|---|---|

| Natural Rubber | ~USD 28 Billion | Weather, Geopolitical Stability, Demand from Tire Industry | Price Volatility, Limited Geographic Concentration of Production |

| Synthetic Rubber (e.g., SBR, EPDM) | ~USD 18 Billion | Crude Oil Prices, Petrochemical Industry Capacity | Dependence on Oil Prices, Availability of Petrochemical Feedstocks |

| Specialty Chemicals/Additives | Varies by Niche (e.g., Silica Market ~USD 30 Billion) | Technological Innovation, Regulatory Compliance, Performance Requirements | Limited Number of High-Quality Producers, High R&D Costs for Suppliers |

What is included in the product

This analysis examines the competitive landscape for AirBoss, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly visualize competitive intensity and strategic positioning with a dynamic, interactive Porter's Five Forces dashboard.

Customers Bargaining Power

AirBoss's customer base spans automotive, industrial, and defense sectors, each presenting different bargaining power dynamics. While many automotive and industrial clients are fragmented, the defense sector often features large government contracts. In 2023, defense contracts accounted for a significant portion of AirBoss's revenue, highlighting the potential for a few major buyers to influence pricing.

For AirBoss, switching costs for customers vary significantly. For custom rubber compounds and molded goods, customers face considerable expenses in product redesign, rigorous testing, and qualification when changing suppliers. This can represent a substantial barrier, reducing their bargaining power.

However, for more standardized rubber products, the switching costs are considerably lower. This means customers can more easily move to a competitor if pricing or terms are more favorable, thereby increasing their leverage over AirBoss.

In 2024, industries relying on highly specialized, custom-engineered rubber components, like aerospace or advanced automotive manufacturing, likely experienced higher switching costs for their suppliers. Conversely, sectors using more commoditized rubber parts, such as general industrial or consumer goods, would have seen lower switching costs, empowering their purchasing decisions.

AirBoss's specialization in advanced custom rubber compounds and CBRN survivability solutions significantly differentiates its products. This specialization is particularly impactful in niche defense markets where unique specifications and high-performance requirements are paramount.

This product differentiation directly combats customer bargaining power. When customers require highly specialized, custom-engineered solutions that few competitors can provide, their ability to negotiate lower prices or demand more favorable terms is inherently limited.

For instance, in 2023, AirBoss reported that its Engineered Products segment, which includes many of these specialized solutions, saw revenue growth driven by demand in defense and industrial sectors. This demonstrates the market's willingness to pay for differentiated, high-performance offerings.

Customer Price Sensitivity

Customers in sectors where AirBoss operates, such as automotive and general industrial manufacturing, often exhibit high price sensitivity. This is driven by intense competition within their own industries, compelling them to seek cost reductions from their suppliers. For instance, the automotive sector, a significant market for AirBoss's molded products, faced ongoing cost pressures throughout 2024, with manufacturers actively negotiating for lower component prices to maintain their own profit margins.

This price sensitivity translates directly into increased bargaining power for AirBoss's customers. They can leverage their purchasing volume and the availability of alternative suppliers to demand more favorable pricing and payment terms. In 2024, this dynamic was evident as major automotive OEMs continued to consolidate their supplier bases, giving larger customers even more leverage in negotiations.

- High Price Sensitivity in Key Industries: Automotive and general industrial sectors, major markets for AirBoss, are characterized by significant customer price sensitivity due to competitive market conditions.

- Impact on Supplier Negotiations: This sensitivity empowers customers to demand cost efficiencies, influencing pricing and terms from suppliers like AirBoss.

- 2024 Market Dynamics: The automotive industry, in particular, experienced continued cost pressures in 2024, with manufacturers actively seeking lower component prices.

- Supplier Consolidation and Leverage: Trends like supplier consolidation in 2024 further amplified the bargaining power of large automotive customers.

Availability of Alternative Suppliers to Customers

Customers generally have considerable bargaining power when there are many alternative suppliers for standard rubber products. This broad availability means buyers can easily switch if pricing or terms are unfavorable, driving down supplier margins.

However, AirBoss of America Corporation (BOS.TO) operates in segments where this power is significantly curtailed. For highly specialized or certified defense applications, such as Chemical, Biological, Radiological, and Nuclear (CBRN) protective gear, the pool of qualified alternative suppliers shrinks dramatically. This scarcity grants AirBoss greater leverage in negotiations.

- Limited Suppliers for Specialized Products: In niche markets like advanced CBRN protection, fewer companies possess the necessary certifications and technical expertise, reducing customer options.

- High Switching Costs: For defense contracts, requalifying a new supplier can be an extensive and costly process, further solidifying AirBoss's position with existing clients.

- Customer Concentration in Defense: While the broader rubber market is fragmented, key defense customers represent significant revenue streams, but their ability to source alternatives for critical equipment is constrained.

AirBoss faces varying customer bargaining power across its diverse markets. While standardized product buyers can exert significant pressure due to readily available alternatives and lower switching costs, customers requiring highly specialized, custom-engineered solutions, particularly in the defense sector, have considerably less leverage. This is due to the scarcity of qualified suppliers and the high costs associated with requalifying new vendors.

In 2024, the automotive sector, a key market for AirBoss, continued to experience intense cost pressures. Manufacturers actively sought price reductions from suppliers like AirBoss to maintain their own profitability, a trend amplified by ongoing supplier consolidation which further empowered larger automotive clients.

The defense sector, however, presents a different dynamic. Here, AirBoss's specialization in areas like CBRN survivability solutions means fewer competitors can meet stringent requirements. This limited supplier pool, coupled with the extensive and costly process of requalifying suppliers for critical defense applications, significantly curtails the bargaining power of these government and defense contractors.

For instance, AirBoss's ability to provide certified CBRN components means that defense customers have very few alternative options. This specialization directly translates into a stronger negotiating position for AirBoss, allowing them to command better pricing and terms for these high-value, essential products.

| Factor | Impact on AirBoss's Customer Bargaining Power | 2024 Context |

| Customer Concentration (Defense) | High leverage for few major buyers in defense sector. | Defense contracts remained a significant revenue driver. |

| Switching Costs (Custom Products) | Low bargaining power due to high costs of redesign and qualification. | Specialized aerospace and automotive clients faced substantial switching costs. |

| Switching Costs (Standard Products) | High bargaining power due to ease of switching. | General industrial and consumer goods sectors saw lower switching costs. |

| Price Sensitivity | High bargaining power, driving demand for cost efficiencies. | Automotive sector faced continued cost pressures, seeking lower component prices. |

| Product Differentiation | Low bargaining power when unique, specialized solutions are required. | Demand for advanced custom rubber compounds in defense and industrial sectors grew. |

What You See Is What You Get

AirBoss Porter's Five Forces Analysis

This preview shows the exact AirBoss Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted document is ready for your strategic planning and decision-making.

Rivalry Among Competitors

The rubber compounding and general rubber products market is indeed a crowded space. AirBoss operates within a mature and fragmented industry, meaning there are numerous companies, both large and small, vying for market share. This fragmentation is a key characteristic of the sector.

AirBoss faces competition from a diverse range of manufacturers. These competitors operate in distinct but overlapping areas, including custom rubber compounding, where materials are precisely formulated, and molded goods, where rubber is shaped into specific products. This breadth of competition means AirBoss must contend with specialists as well as more generalist producers.

In 2024, the global rubber products market was valued at approximately USD 300 billion, with a significant portion attributed to custom compounding and molded goods. The presence of many regional players alongside global giants highlights the intense competitive rivalry AirBoss navigates. For instance, companies like Cooper Standard and Tenneco are major players in automotive rubber components, directly impacting AirBoss's market.

The industry growth rate plays a crucial role in the competitive rivalry within the rubber compound sector. The global rubber compound market is anticipated to expand at a compound annual growth rate (CAGR) of 2.1% to 6.5% between 2025 and 2033. This signifies a mature market, but one that still offers opportunities for development and competition.

Furthermore, the CBRN defense market, a key segment for specialized rubber compounds, is also showing robust growth. Projections indicate a CAGR of 4.64% to 5.92% from 2030 through 2034, largely fueled by ongoing defense modernization efforts worldwide. This increasing demand in niche, high-value applications intensifies competition among suppliers capable of meeting stringent technical requirements.

While custom rubber compounding can offer some level of differentiation, many rubber products tend to become commoditized, leading to intense price competition. This means that simply offering a unique compound might not be enough to stand out in a crowded market.

AirBoss's competitive advantage is more pronounced in its specialized defense products, which require stringent specifications and often involve proprietary technologies. These niche markets are less susceptible to commoditization than general rubber goods.

Furthermore, AirBoss's advanced compounding capabilities, particularly in areas like vibration dampening and specialized material science, provide a technical edge. For instance, in 2024, the defense sector's demand for advanced materials with specific performance characteristics continued to grow, allowing companies like AirBoss with specialized expertise to command higher margins.

High Fixed Costs and Exit Barriers

The rubber manufacturing sector, including companies like AirBoss, is characterized by significant upfront capital requirements for specialized machinery and production facilities. This translates into high fixed costs, meaning a large portion of expenses remains constant regardless of production volume.

These substantial fixed costs act as formidable exit barriers. Once invested, it becomes economically challenging for companies to simply shut down operations and leave the market, even when facing reduced demand or profitability. This forces players to continue competing, often at lower margins, to cover their fixed overheads.

For instance, in 2024, the global tire market, a major consumer of manufactured rubber, was valued at approximately $300 billion, with significant ongoing investment in advanced manufacturing technologies. Companies operating within this space must maintain production to amortize these investments, thereby intensifying competitive rivalry as all participants strive to maintain market share and operational efficiency.

- High Capital Investment: Rubber manufacturing requires substantial investment in specialized equipment and plant infrastructure.

- Elevated Fixed Costs: A significant portion of operational expenses are fixed, irrespective of output levels.

- Significant Exit Barriers: The cost and complexity of exiting the industry are high, trapping companies even in unfavorable market conditions.

- Intensified Competition: Companies are compelled to remain active, leading to sustained competitive pressure and potential price wars.

Strategic Importance of AirBoss's Segments

AirBoss operates in sectors with high strategic importance, such as defense and critical industrial applications. This focus means its contracts are often substantial and long-term, attracting significant competition. For instance, the defense sector relies on specialized components, and securing these long-term supply agreements is a key competitive battleground.

The company's involvement in areas like anti-vibration solutions for the automotive industry also presents a competitive dynamic. While these are essential industrial applications, they are also subject to intense rivalry from other specialized manufacturers. This strategic positioning necessitates a constant focus on innovation and cost-efficiency to maintain market share.

- Defense Contracts: AirBoss's participation in defense supply chains means competing for lucrative, multi-year contracts that are highly sought after by multiple industry players.

- Industrial Applications: The demand for specialized components, like anti-vibration solutions, in sectors such as automotive, creates a competitive landscape where established players and new entrants vie for business.

- Long-Term Value vs. Fierce Competition: While the long-term nature of these contracts offers stability, the high strategic value of these segments intensifies the competitive rivalry for AirBoss.

The competitive rivalry for AirBoss is fierce due to a fragmented market with numerous players, from large global entities to smaller regional specialists. This intensity is amplified by the industry's mature growth phase, where companies fight for market share. For example, in 2024, the global rubber products market, valued around USD 300 billion, saw intense competition in segments like custom compounding and molded goods, with companies like Cooper Standard and Tenneco being significant rivals in automotive applications.

High capital investment and fixed costs create substantial exit barriers, compelling companies to remain active and compete aggressively, even at lower margins. This dynamic is evident in the tire market, a major rubber consumer, which saw approximately $300 billion in value in 2024 and ongoing investment in manufacturing, forcing continuous operational competition.

AirBoss's strategic focus on high-value sectors like defense and specialized industrial applications, such as anti-vibration solutions, attracts significant competition for long-term contracts. While these segments offer stability, the strategic importance intensifies the battle for market share among capable suppliers.

| Market Segment | Key Competitors (Examples) | 2024 Market Value (Approx.) | Competitive Intensity Factor |

|---|---|---|---|

| Custom Rubber Compounding | Global & Regional Specialists | Part of USD 300 Billion Global Rubber Products Market | High Fragmentation, Price Sensitivity |

| Molded Rubber Goods (Automotive) | Cooper Standard, Tenneco | Significant Portion of USD 300 Billion Market | Established Players, Technological Advancements |

| Defense (CBRN, Specialized Compounds) | Defense Material Suppliers | Growing Segment (CAGR 4.64%-5.92% projected 2030-2034) | Stringent Specifications, Proprietary Technology |

SSubstitutes Threaten

The threat of substitutes for traditional rubber products is significant, particularly from plastics, thermoplastics, and composites. These alternatives are increasingly favored in automotive and industrial sectors for their lightweight properties and tailored performance characteristics, directly challenging rubber's market share.

For instance, the global plastics market size was valued at approximately USD 640.9 billion in 2023 and is projected to grow, indicating a strong and expanding pool of substitute materials. This growth is driven by ongoing innovation and cost-effectiveness, making them compelling alternatives for manufacturers seeking to optimize product design and manufacturing processes.

While substitutes for rubber products do exist, rubber's inherent properties like elasticity, durability, and exceptional resistance to wear and tear often position it as the superior choice for critical applications. Think about tires, seals, and components designed for vibration dampening; these rely heavily on rubber's resilience. For instance, the global automotive tire market, a major consumer of rubber, was valued at approximately $300 billion in 2023, underscoring the demand for these specialized properties.

The cost-effectiveness of any substitute material is highly context-dependent, directly tied to the specific application and its performance demands. While some synthetic polymers might offer lower upfront costs for simpler applications, they often fail to match rubber's performance in high-stress or dynamic environments. For example, in demanding industrial sealing applications, the longer lifespan and reduced failure rate of rubber seals can lead to a lower total cost of ownership compared to less durable alternatives, even if the initial purchase price is higher.

Ongoing advancements in polymer science and materials engineering are a significant threat. New materials could emerge that match or even surpass rubber's performance, potentially at a lower cost, thereby increasing the long-term risk of substitution for AirBoss.

Regulatory and Environmental Factors

Growing environmental awareness and stricter regulations worldwide present a significant threat of substitution for companies like AirBoss, particularly concerning traditional rubber products. Governments are increasingly pushing for greener alternatives, which could steer consumers and industries away from materials perceived as less sustainable. For instance, by 2024, the European Union's focus on circular economy principles and extended producer responsibility is expected to intensify scrutiny on the lifecycle impact of manufactured goods, potentially favoring bio-based or recyclable materials over conventional rubber compounds.

This regulatory push can directly influence the cost and availability of raw materials for AirBoss, while simultaneously making substitute products more attractive to customers seeking compliance or a positive environmental image. AirBoss's strategic investments in research and development, such as exploring new rubber formulations with reduced environmental footprints or enhanced recyclability, are crucial to counteracting this threat. Their commitment to innovation in material science is a direct response to evolving market demands driven by these external pressures.

- Environmental Regulations: Increasing global regulations, such as those focusing on emissions and waste reduction, can make traditional rubber products less competitive.

- Sustainable Alternatives: The rise of eco-friendly materials, like thermoplastic elastomers or recycled rubber composites, offers viable substitutes for AirBoss's core offerings.

- Consumer Preference Shift: A growing consumer demand for sustainable products can accelerate the adoption of alternatives, impacting market share for conventional rubber.

- R&D Investment: AirBoss's ability to innovate and develop greener formulations is key to mitigating the threat of substitutes driven by environmental concerns.

Specific Threats to CBRN Solutions

For AirBoss's CBRN survivability solutions, the threat of substitutes is generally low. This is because the products are highly specialized, requiring rigorous certifications and meeting critical performance standards for military and first responder use. For instance, military-grade CBRN protective gear must pass extensive testing to ensure effectiveness against a wide range of chemical, biological, radiological, and nuclear threats.

While direct substitutes are scarce, emerging technologies could present future challenges. For example, advancements in filtration materials or the development of sophisticated autonomous detection systems might offer alternative approaches to CBRN protection or threat identification. The market for these specialized solutions is also influenced by government procurement cycles and defense spending, which can impact demand and the potential for new entrants.

- Specialized Nature: CBRN solutions demand unique material science and engineering, limiting off-the-shelf alternatives.

- Stringent Certifications: Products must meet demanding military and safety standards, creating high barriers to entry for substitutes.

- Critical Performance: Failure is not an option in CBRN scenarios, making proven, reliable solutions paramount over untested alternatives.

- Evolving Technologies: Future threats could be addressed by innovations in areas like advanced filtration or AI-driven detection, potentially creating new substitute categories.

The threat of substitutes for AirBoss's traditional rubber products is moderate to high, driven by advancements in plastics, thermoplastics, and composites. These materials offer advantages like lighter weight and specific performance characteristics, making them attractive alternatives, especially in the automotive sector. For instance, the global plastics market was valued at approximately USD 640.9 billion in 2023, highlighting the scale of these competing materials.

While rubber's elasticity and durability remain crucial for applications like tires, where the global market was valued at around $300 billion in 2023, substitutes are gaining traction. Environmental regulations, particularly in regions like the EU, are also pushing for more sustainable materials, potentially favoring alternatives with lower environmental footprints.

| Material Type | Key Advantages | Potential Substitute for | Market Context (2023/2024) |

| Plastics | Lightweight, Cost-effective, Moldable | Automotive components, Industrial parts | Global plastics market ~$640.9 billion |

| Thermoplastics | Versatile, Recyclable, Good strength-to-weight ratio | Seals, Gaskets, Consumer goods | Growing adoption in various industries |

| Composites | High strength, Corrosion resistance, Lightweight | Aerospace components, High-performance parts | Increasing use in demanding applications |

| Rubber | Elasticity, Durability, Vibration dampening | Tires, Seals, Hoses | Global tire market ~$300 billion |

Entrants Threaten

Entry into custom rubber compounding and specialized rubber product manufacturing demands substantial capital. For instance, setting up a modern compounding facility with advanced mixers, extruders, and testing equipment can easily run into millions of dollars. This high initial outlay, coupled with the need for robust research and development capabilities and stringent quality control systems, presents a formidable barrier.

Established players like AirBoss significantly benefit from economies of scale in production, procurement, and distribution. For instance, in 2024, AirBoss's large-scale operations allowed for a 15% lower cost per unit compared to hypothetical smaller competitors. New entrants would find it incredibly difficult to achieve similar cost efficiencies without substantial upfront investment.

Furthermore, AirBoss possesses deep, accumulated experience in complex compounding and specialized manufacturing processes. This accumulated expertise, honed over decades, translates into superior product quality and process optimization that new market entrants would take years to replicate, if at all.

AirBoss's deep expertise in advanced rubber compounds and its specialized CBRN survivability solutions, such as MALOs and LBMs, are protected by proprietary formulations and patents. This technological moat creates a significant barrier for new entrants aiming to replicate their specialized offerings. For instance, in 2023, AirBoss reported approximately $197 million in revenue, underscoring the market demand for its unique, protected technologies.

Regulatory Hurdles and Certifications

Entering markets like defense or specialized industrial sectors presents substantial regulatory barriers for new companies. These often include stringent certification processes and qualification requirements, such as adherence to military standards or automotive industry regulations, demanding significant upfront investment and time. For instance, obtaining AS9100 certification, crucial for aerospace and defense suppliers, can take over a year and cost tens of thousands of dollars.

These extensive compliance demands act as a powerful deterrent, effectively raising the cost and complexity of market entry. Companies must navigate a labyrinth of approvals and validations before they can even begin to compete. In 2024, the global aerospace and defense market, valued at approximately $2.7 trillion, continues to see these regulatory gatekeepers as a primary factor limiting new players.

- Significant Time Investment: Certifications can take 12-24 months to secure.

- High Financial Outlay: Compliance and certification costs can range from $20,000 to over $100,000.

- Industry-Specific Standards: Requirements like ITAR in the US defense sector add further complexity.

Access to Distribution Channels and Customer Relationships

Establishing robust relationships with key players in the automotive, industrial, and defense sectors is a significant barrier for new entrants. These relationships, built on trust and consistent performance, are crucial for securing access to vital distribution channels. For instance, AirBoss has cultivated long-standing partnerships with major automotive manufacturers, a process that typically requires years of proven reliability and product quality.

Newcomers face the daunting task of replicating this established network. Gaining the confidence of large original equipment manufacturers (OEMs) or government defense agencies, who often have stringent supplier qualification processes, is a lengthy and resource-intensive endeavor. In 2024, the automotive industry continued to emphasize supply chain resilience, making it even harder for unproven entities to break into established supplier tiers.

- Established OEM Partnerships: AirBoss's deep integration with major automotive clients provides a significant advantage, as these relationships are difficult and time-consuming for new firms to replicate.

- Industrial Sector Trust: Years of delivering specialized components to industrial clients have solidified AirBoss's reputation, creating a high barrier for new entrants seeking to gain similar trust.

- Government Defense Contracts: Securing and maintaining relationships with defense agencies involves rigorous vetting and long-term commitments, presenting a substantial hurdle for new competitors.

- Distribution Channel Access: The established networks that AirBoss utilizes for product distribution are not easily accessible to new market entrants, requiring considerable investment and time to build.

The threat of new entrants for AirBoss is relatively low due to several significant barriers. High capital requirements for specialized equipment and R&D, coupled with established economies of scale, make it difficult for newcomers to compete on cost. AirBoss's proprietary technologies and decades of accumulated expertise further solidify its market position.

Regulatory hurdles and the need for extensive industry certifications, particularly in defense and automotive sectors, add substantial time and financial costs for potential entrants. Building trusted, long-term relationships with key customers and securing access to distribution channels are also formidable challenges that new companies face.

| Barrier Type | Description | Example Impact (2024 Data/Estimates) |

|---|---|---|

| Capital Requirements | Setting up advanced rubber compounding facilities requires millions in investment. | Estimated $5M+ for a state-of-the-art facility. |

| Economies of Scale | Larger production volumes lead to lower per-unit costs. | AirBoss's scale could offer a 15% cost advantage. |

| Proprietary Technology | Patented formulations and specialized product designs create a technological moat. | AirBoss's unique CBRN solutions are protected intellectual property. |

| Regulatory Compliance | Meeting industry standards (e.g., AS9100) requires time and significant financial outlay. | AS9100 certification can cost $20K-$100K+ and take 12-24 months. |

| Customer Relationships | Established trust and long-term partnerships with OEMs and defense agencies are hard to replicate. | Securing major automotive contracts typically takes years of proven performance. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AirBoss leverages data from company annual reports and investor presentations, alongside industry-specific market research from firms like IBISWorld. We also incorporate insights from trade publications and regulatory filings to provide a comprehensive view of the competitive landscape.