AirBoss Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBoss Bundle

AirBoss's marketing mix is a carefully orchestrated symphony of product innovation, strategic pricing, efficient distribution, and impactful promotion. This analysis delves into how each element contributes to their market dominance, offering a blueprint for success.

Discover the intricate details of AirBoss's product development, pricing strategies, distribution channels, and promotional campaigns. This comprehensive report unlocks the secrets behind their competitive edge.

Ready to elevate your marketing strategy? Gain instant access to the full, editable 4Ps Marketing Mix Analysis for AirBoss and learn from a market leader's proven tactics.

Product

AirBoss Rubber Solutions (ARS) excels in creating specialized custom rubber compounds, meticulously engineered to satisfy unique client needs across diverse sectors. This focus on bespoke formulations highlights their commitment to innovation and problem-solving for specific application challenges.

With a substantial annual production capacity exceeding 500 million turn pounds, ARS demonstrates its ability to handle large-scale, demanding projects. This capacity underscores their position as a reliable partner capable of delivering consistent, high-volume compounding solutions.

ARS prioritizes technical expertise and dependable service, ensuring customers receive not only advanced rubber compounds but also a seamless and supportive experience. This dual emphasis on product quality and customer satisfaction is central to their market offering.

AirBoss Engineered Products, a key segment of AirBoss Manufacturing, is a leading supplier of custom-engineered rubber and silicone goods. These specialized products, including critical anti-vibration and noise dampening solutions, are vital for sectors like automotive, electric vehicles, heavy truck, off-highway, industrial, and defense, particularly within North America. Their focus on high-performance in challenging conditions ensures reliability and efficiency for their clients.

The demand for sophisticated vibration and noise control is escalating, driven by stricter regulations and the push for enhanced performance in vehicles and industrial equipment. For instance, the automotive sector, a major consumer of these solutions, is projected to see continued growth in electric vehicle production, a market segment that often requires specialized dampening for battery packs and powertrains. This trend is supported by industry forecasts anticipating a significant increase in EV sales throughout 2024 and into 2025, directly benefiting suppliers of molded rubber goods.

CBRN survivability solutions from AirBoss Defense Group (ADG) are critical for protecting personnel against chemical, biological, radiological, and nuclear threats. ADG, a key part of AMP, offers a range of NATO-approved gear, including their lightweight overboots and low-burden masks.

These advanced protective systems are essential for military units, emergency responders, and healthcare professionals facing hazardous environments. The demand for such solutions saw significant growth, with the global CBRN protective clothing market projected to reach USD 10.5 billion by 2027, growing at a CAGR of 6.2%.

ADG's product portfolio, featuring respirators and filtration systems, directly addresses this market need. Their commitment to providing reliable, high-performance equipment ensures operational readiness and personnel safety in the face of evolving global security challenges.

Personal Protective Equipment (PPE)

As a vital supplier, AirBoss Defense Group (ADG) provides essential personal protective equipment (PPE) like isolation gowns and examination gloves. These critical items are supplied to key government entities, including the U.S. Department of Health and Human Services (HHS) and the U.S. Strategic National Stockpile. This positioning underscores ADG's role in supporting national public health initiatives and safeguarding essential workers during emergencies.

The demand for ADG's PPE is directly tied to public health preparedness and response efforts. For instance, the U.S. government's investment in healthcare infrastructure and emergency stockpiles directly impacts the market for these products. In 2024, the global PPE market was valued at approximately $70 billion, with significant contributions from government procurement, highlighting the substantial market opportunity for suppliers like ADG.

- Government Contracts: ADG's established relationships with agencies like HHS provide a stable revenue stream and market access.

- Emergency Preparedness: The ongoing need for national stockpiles ensures consistent demand for ADG's protective gear.

- Market Growth: The global PPE market is projected to continue its expansion, driven by health concerns and regulatory requirements.

- Product Importance: Isolation gowns and patient examination gloves are fundamental to healthcare operations and emergency response protocols.

Specialized Defense Systems

AirBoss Defense Group's specialized defense systems go beyond basic personal protective equipment, offering critical solutions for high-stakes operations. Products like the Bandolier Lightweight Multi-Purpose Energetic System and extreme cold weather footwear are engineered for demanding environments.

These advanced systems are designed to enhance safety and ensure mission success for military and defense forces globally. For instance, the Bandolier system offers modularity and rapid deployment capabilities, crucial for dynamic combat scenarios. The extreme cold weather footwear provides essential thermal protection, vital for operations in polar regions, where temperatures can plummet to -40°C and below, a critical factor for troop survivability and operational effectiveness.

- Bandolier Lightweight Multi-Purpose Energetic System: Offers versatile and adaptable solutions for carrying and deploying essential equipment.

- Extreme Cold Weather Footwear: Provides superior thermal insulation and durability for operations in sub-zero temperatures.

- Targeted Application: Designed for critical missions requiring specialized protection and enhanced operational capabilities.

- Global Reach: Serves military and defense forces worldwide, addressing diverse environmental and operational challenges.

AirBoss Engineered Products focuses on custom-engineered rubber and silicone goods, such as anti-vibration and noise dampening solutions, primarily for the automotive, electric vehicle, and heavy truck sectors. This specialization addresses the growing demand for enhanced performance and regulatory compliance in these industries.

The company's product offerings are crucial for improving vehicle efficiency and passenger comfort, especially with the increasing adoption of electric vehicles. For example, the automotive sector in North America, a key market for ARS, is expected to see continued growth in EV production through 2024 and 2025, directly boosting demand for specialized dampening components.

ARS leverages its extensive compounding expertise and significant production capacity, exceeding 500 million turn pounds annually, to deliver high-quality, bespoke solutions. This capability ensures they can meet the large-scale, precise requirements of their diverse client base, reinforcing their role as a reliable partner.

The emphasis on technical service and product dependability further solidifies ARS's market position. By providing advanced materials alongside a supportive customer experience, they cater to clients seeking both performance and ease of integration for their engineered rubber components.

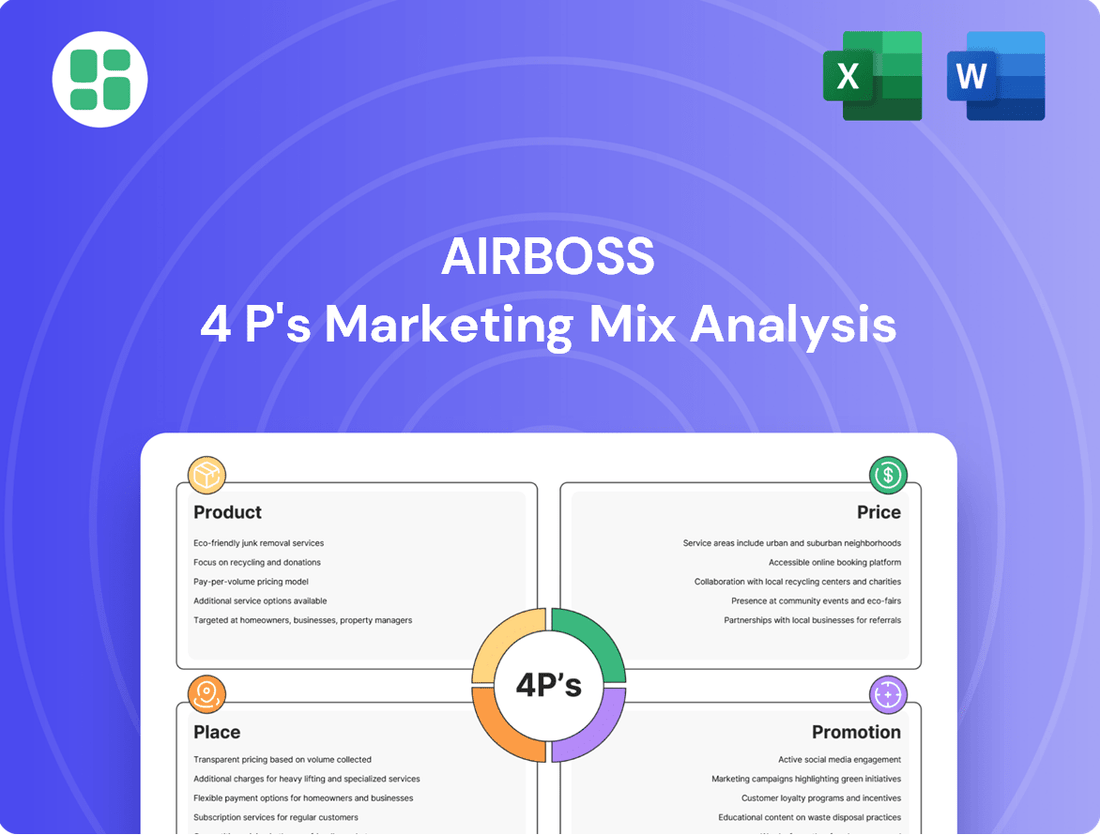

What is included in the product

This analysis provides a comprehensive breakdown of AirBoss's marketing mix, examining its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals needing a deep dive into AirBoss's marketing positioning, offering a structured and data-driven approach for reports and strategic planning.

The AirBoss 4P's Marketing Mix Analysis serves as a crucial pain point reliever by streamlining complex strategies into a clear, actionable framework.

It simplifies the understanding of product, price, place, and promotion, enabling efficient decision-making and mitigating confusion for stakeholders.

Place

AirBoss Defense Group leverages direct sales as a critical component of its marketing mix, primarily targeting federal governments and defense departments worldwide. This strategy is crucial for distributing its specialized survivability and personal protective equipment (PPE) solutions.

Significant contracts underscore this approach, including substantial agreements with the U.S. Department of Defense and the U.S. Department of Health and Human Services. Furthermore, AirBoss Defense Group also supplies its products directly to entities like the Swiss Defense Forces, demonstrating its global reach in direct government sales.

This direct channel is essential for navigating and adhering to the complex and stringent requirements characteristic of government procurement processes. It also streamlines the logistics and execution of large-scale, high-value contracts, ensuring efficient delivery of critical safety and defense equipment.

AirBoss Rubber Solutions and AirBoss Engineered Products leverage direct B2B channels, supplying their rubber compounds and molded products to original equipment manufacturers (OEMs) and Tier 1 suppliers. This direct engagement is crucial in the industrial and automotive sectors, where intricate product integration and collaborative development are paramount. For instance, in 2024, the automotive sector's demand for specialized rubber components, driven by advancements in electric vehicles and autonomous driving systems, continued to grow, presenting significant opportunities for B2B suppliers like AirBoss.

AirBoss boasts a significant global reach, primarily through its AirBoss Defense Group. This strategic positioning includes key facilities across North America, such as Quebec, New York, South Carolina, and Maryland. This expansive network is crucial for facilitating international sales and distribution.

The company's commitment to global markets is evident in its product reach. For instance, their MALO overboots are supplied to over sixty countries worldwide, demonstrating a robust international distribution capability and a strong presence in diverse defense sectors.

Resilient Supply Chain Management

AirBoss prioritizes a stable and secure supply chain, especially for its defense and PPE items, to adhere to American Made mandates. This focus is crucial for meeting government contracts and ensuring national security needs are met. The company's commitment to resilience helps mitigate risks associated with global supply chain disruptions.

Despite its general robustness, the supply chain has encountered hurdles. For instance, delays in the Bandolier system, a critical component for certain defense applications, were attributed to component constraints. This highlights the ongoing challenges in sourcing specialized parts, even for established manufacturers.

- Supply Chain Resilience: AirBoss actively builds a stable and secure supply chain, particularly for defense and PPE products.

- Government Compliance: Emphasis on meeting 'American Made' requirements for government contracts is a key driver for supply chain strategy.

- Component Constraints: Challenges, such as delays in the Bandolier system, underscore the impact of component sourcing issues.

- Risk Mitigation: The company's efforts aim to reduce vulnerabilities and ensure consistent product availability despite potential disruptions.

Strategic Location and On-Shoring Opportunities

AirBoss's manufacturing facilities are strategically positioned to capitalize on evolving market demands and logistical efficiencies. This advantageous placement is particularly relevant as the company notes a significant uptick in inquiries concerning on-shoring production. This trend suggests a growing appetite for domestic manufacturing and supply chains, a movement AirBoss is well-equipped to support with its North American footprint.

The company's operational setup directly supports the resurgence of on-shoring initiatives. For instance, in 2024, AirBoss's North American operations are geared towards providing responsive manufacturing solutions. This strategic positioning allows for quicker turnaround times and more resilient supply chains, crucial factors for businesses looking to bring production closer to home.

- Strategic North American Presence: AirBoss leverages its existing facilities to serve domestic markets efficiently.

- On-shoring Demand: The company has seen a notable increase in quote requests tied to on-shoring strategies in 2024.

- Operational Agility: Proximity to key markets enables AirBoss to adapt rapidly to shifting production needs.

AirBoss's place in the market is defined by its strategic global presence and direct distribution channels. The AirBoss Defense Group, with facilities across North America, serves as a cornerstone for its international sales, notably supplying MALO overboots to over sixty countries. This expansive footprint ensures efficient delivery of critical defense and PPE solutions worldwide.

The company's manufacturing locations are optimized for market responsiveness and logistical advantages, particularly supporting the growing trend of on-shoring. In 2024, AirBoss's North American operations are well-positioned to meet increased demand for domestic production, offering quicker lead times and enhanced supply chain resilience for clients seeking to reshore manufacturing.

| Segment | Key Markets Served | Distribution Strategy |

|---|---|---|

| AirBoss Defense Group | U.S. DoD, Swiss Defense Forces, over 60 countries | Direct Sales to Governments |

| AirBoss Rubber Solutions & Engineered Products | OEMs, Tier 1 Suppliers (Automotive, Industrial) | Direct B2B Channels |

What You Preview Is What You Download

AirBoss 4P's Marketing Mix Analysis

The preview you see here is the exact same AirBoss 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis is fully complete and ready to be implemented immediately. You're viewing the actual version, ensuring you know precisely what you're getting with your purchase.

Promotion

AirBoss's comprehensive investor relations program is a cornerstone of its marketing mix, fostering trust and transparency. This includes regular disclosures of quarterly and annual financial results, such as the reported revenue of $95.2 million for the first quarter of 2024, and detailed investor presentations.

By conducting conference calls and providing accessible information, AirBoss effectively communicates its performance and strategic vision. This proactive approach is vital for engaging a broad spectrum of financially literate stakeholders, from individual investors to institutional portfolio managers, ensuring they have the data needed for informed decisions.

AirBoss strategically utilizes significant contract wins as core promotional elements. For instance, the company leveraged an $84 million contract for Personal Protective Equipment (PPE) and an $82.3 million overboot contract as major marketing opportunities.

These substantial awards are amplified through targeted press releases and distribution via financial news channels. This approach effectively showcases AirBoss's operational strengths and solidifies its reputation as a reliable and capable supplier in the market.

AirBoss's marketing strategy heavily emphasizes direct engagement and fostering strong relationships, a crucial element given its primary focus on business-to-business (B2B) and government contracts. This approach is fundamental to securing and maintaining its position in specialized markets.

The company's proven track record, including decades of supplying essential equipment to the U.S. Federal Government and various international defense organizations, underscores its commitment to building enduring partnerships. This long-term perspective allows AirBoss to deeply understand and address the complex needs of its clientele.

For instance, AirBoss's consistent contract renewals with defense departments, such as the multi-year agreements for its advanced respiratory protection systems, highlight the trust and reliability built through direct client interaction and problem-solving capabilities. These relationships are vital for sustained business growth and market penetration.

Emphasis on Product Performance and Quality

AirBoss's marketing consistently champions its products' exceptional performance, quality, and resilience, underscoring their capacity to excel even in the harshest conditions. This dedication to durability and protection, exemplified by certifications like NATO approval, carves out a distinct advantage in niche markets.

The company's messaging, particularly around its AirBoss 4P offerings, reinforces this commitment. For instance, in 2024, AirBoss reported a significant increase in demand for its specialized protective gear, driven by heightened global security concerns and military modernization programs. This surge directly reflects the market's recognition of their product quality.

- Superior Durability: AirBoss products are engineered to withstand extreme temperatures, chemical exposure, and physical stress.

- Stringent Quality Control: Adherence to rigorous testing protocols ensures products meet and exceed industry and military standards.

- Proven Survivability: Real-world deployments and certifications like NATO approval validate the effectiveness of AirBoss's protective solutions.

- Market Differentiation: The emphasis on performance and quality sets AirBoss apart from competitors in the specialized defense and industrial safety sectors.

Digital Presence and Industry Participation

AirBoss actively manages its digital footprint through an informative corporate website and a specialized AirBoss Defense Group site. These platforms are crucial for disseminating company news, detailing product offerings, and providing essential investor relations information. This digital strategy ensures accessibility for stakeholders seeking the latest updates.

The company's engagement with industry-specific publications, such as mentions in Rubber News, suggests a strategic approach to industry participation. This presence in trade media indicates an effort to connect with relevant audiences and maintain visibility within its operational sectors. Such participation is often linked to broader strategies involving industry events and conferences.

- Corporate Website: Central hub for company news and investor resources.

- AirBoss Defense Group Site: Dedicated platform for defense-specific product information.

- Industry Media Presence: Participation in trade news like Rubber News implies broader industry engagement.

- Targeted Audience Reach: Digital and media presence aims to connect with key stakeholders and potential clients.

AirBoss leverages significant contract wins as key promotional tools, effectively highlighting its capabilities and market position. For instance, the $84 million PPE contract and an $82.3 million overboot contract served as substantial marketing opportunities, amplified through targeted press releases and financial news channels.

The company's promotion strategy is deeply rooted in building trust and transparency through robust investor relations, including regular financial disclosures like the $95.2 million revenue reported for Q1 2024. This commitment to open communication ensures stakeholders are well-informed about performance and strategic direction.

Direct engagement and relationship building are central to AirBoss's promotion, particularly for its B2B and government contracts. This focus is reinforced by a history of supplying essential equipment to the U.S. Federal Government and international defense organizations, demonstrating a commitment to long-term partnerships and client needs.

AirBoss consistently promotes its products' superior durability, quality, and resilience, often validated by certifications like NATO approval. This emphasis on performance, especially in demanding conditions, differentiates them in specialized defense and industrial safety markets, as seen in the increased demand for protective gear in 2024 due to global security concerns.

| Promotional Element | Description | Example/Data Point |

|---|---|---|

| Investor Relations | Fostering trust through transparent financial reporting and strategic communication. | Q1 2024 Revenue: $95.2 million; Regular investor presentations and conference calls. |

| Major Contract Wins | Utilizing large contract awards as key marketing opportunities. | $84 million PPE contract; $82.3 million overboot contract. |

| Direct Engagement & Partnerships | Building long-term relationships with government and B2B clients. | Decades of supply to U.S. Federal Government; Multi-year renewals for respiratory protection systems. |

| Product Quality & Performance | Highlighting durability, resilience, and high standards. | NATO approval; Increased demand for protective gear in 2024. |

Price

AirBoss's pricing strategy heavily relies on long-term, contract-based agreements, especially within its defense sector. These multi-year deals provide a foundation of predictable revenue, a key element for financial stability and strategic planning.

For instance, the company secured an $84 million contract for Personal Protective Equipment (PPE) and an $82.3 million contract for MALO overboots. These significant agreements underscore the volume-based and specialized nature of their government contracts, directly impacting their pricing structure.

AirBoss strategically employs value-based pricing for its specialized rubber compounds and survivability solutions. This approach ensures pricing aligns with the critical performance and advanced technology embedded in products designed for high-stakes environments. For instance, their solutions for CBRN defense and demanding industrial applications command premiums due to their unparalleled reliability and safety, directly translating to enhanced operational effectiveness and reduced risk for clients.

AirBoss operates in markets where competition is a significant factor, even with its specialized product lines. For instance, within the industrial rubber products sector, companies like Carlisle Companies and Cooper Standard are key competitors, often vying for similar contracts. AirBoss's pricing must therefore be carefully calibrated, taking into account competitor price points and the prevailing market demand, ensuring it remains attractive without undervaluing its offerings.

The company's strategic diversification across various industrial segments, such as automotive, mining, and defense, is a crucial element in navigating these competitive landscapes. This broad market presence, as evidenced by its varied customer base in 2024, helps to buffer against the inherent volatility and cyclical downturns that can impact businesses focused on a single industry. This approach allows for more stable revenue streams and a stronger overall market position.

Impact of Economic Conditions on Pricing Flexibility

AirBoss's pricing flexibility is directly tied to economic conditions. When the broader economy faces headwinds or market softness, the company's sales and margins can feel the pinch, especially in areas like rubber solutions and rubber molded products. For instance, in 2023, many industrial sectors experienced slower growth, which can translate to reduced demand for AirBoss's offerings.

To navigate these challenges, AirBoss must be strategic with its pricing. Proactive adjustments are key to counteracting market difficulties and keeping profits healthy. This means carefully analyzing cost structures and market demand to set prices that are competitive yet sufficient to maintain profitability.

- Economic Headwinds: Broader economic downturns can suppress demand, limiting pricing power.

- Market Softness Impact: Reduced volumes in key segments like rubber solutions directly affect revenue and margin potential.

- Proactive Pricing: The need for adaptive pricing strategies to offset market challenges is paramount.

- Cost Management: Efficient cost control is essential to protect profitability when sales volumes are under pressure.

Strategic Focus on Margin Improvement

AirBoss is strategically prioritizing margin enhancement through refined purchase and pricing tactics. This proactive approach aims to position the company advantageously in the market.

Recent initiatives, including the acquisition of Ace Elastomer, are designed to bolster growth in higher-margin specialty compounding. This move also strengthens AirBoss's raw material purchasing influence, directly contributing to improved profitability.

- Focus on Specialty Compounding: Ace Elastomer acquisition targets higher-margin segments.

- Enhanced Buying Power: Increased scale improves raw material procurement terms.

- Pricing Strategy Optimization: Proactive pricing aims to capture greater value.

- Profitability Drive: These actions are geared towards boosting overall financial performance.

AirBoss's pricing strategy is a blend of contract-based stability and value-driven premiums. For its defense contracts, like the $84 million PPE deal and $82.3 million MALO overboots agreement, pricing is largely dictated by volume and long-term commitments. In contrast, specialized rubber compounds and survivability solutions leverage value-based pricing, reflecting their critical performance and advanced technology, commanding higher margins in demanding sectors.

The company must remain competitive, balancing its specialized offerings against rivals such as Carlisle Companies and Cooper Standard. Economic conditions also play a significant role, with market softness in 2023 impacting demand and necessitating adaptive pricing to maintain profitability.

AirBoss is actively pursuing margin enhancement, exemplified by the Ace Elastomer acquisition, which bolsters its position in higher-margin specialty compounding and increases raw material purchasing influence.

| Product/Segment | Pricing Basis | Key Influences | Example Contracts (Approximate Value) |

|---|---|---|---|

| Defense (PPE, Overboots) | Contract-based, Volume | Long-term agreements, Government demand | $84M (PPE), $82.3M (MALO) |

| Specialty Rubber Compounds | Value-based | Performance, Technology, Safety, Risk Reduction | CBRN Defense, Industrial Applications |

| Industrial Rubber Products | Market-driven, Competitive | Competitor pricing, Market demand, Economic conditions | Automotive, Mining sectors |

4P's Marketing Mix Analysis Data Sources

Our AirBoss 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available company information, including financial reports, investor relations materials, and official brand websites. We also incorporate insights from reputable industry publications and competitive intelligence platforms.