AirBoss Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AirBoss Bundle

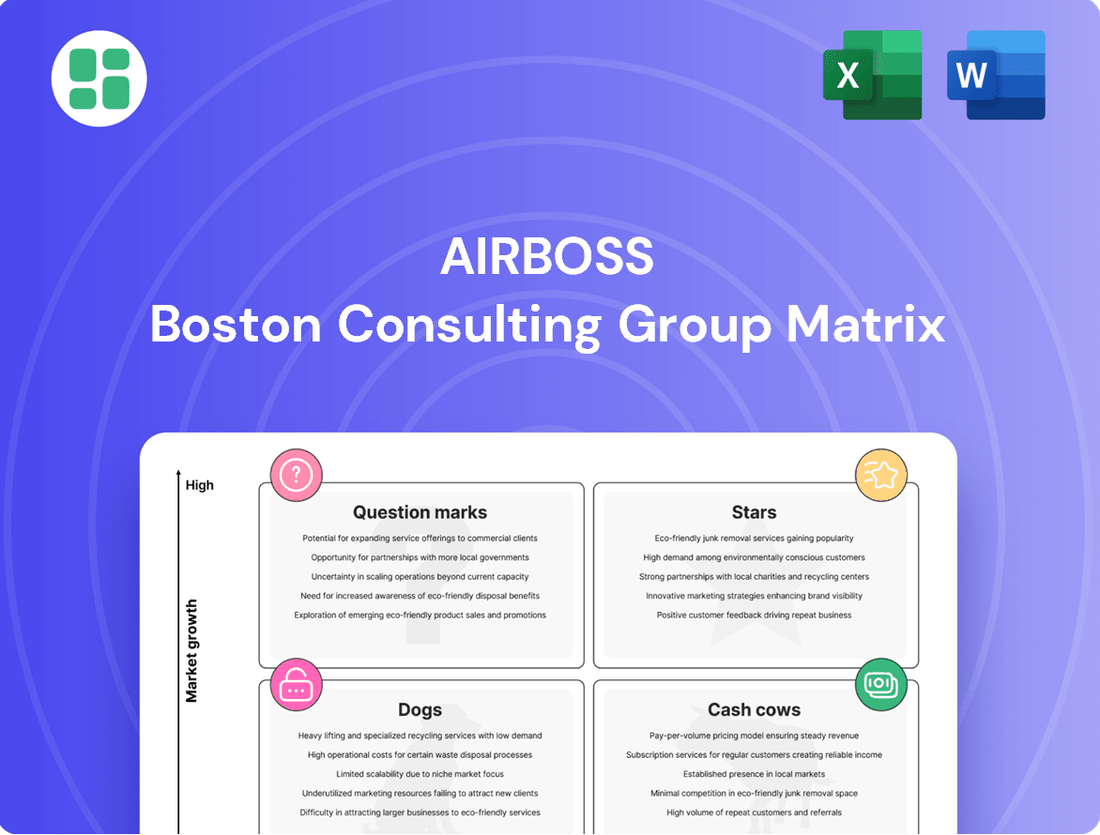

Unlock the strategic potential of the AirBoss BCG Matrix and see how its products are positioned for growth and profitability. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, providing a clear roadmap for resource allocation and future investment.

Don't settle for a glimpse; dive into the complete AirBoss BCG Matrix to gain a comprehensive understanding of each product's market share and growth rate. Purchase the full report for actionable insights and a strategic advantage in today's competitive landscape.

Stars

AirBoss's specialized CBRN defense equipment, including its Molded AirBoss Lightweight Overboots (MALOs) and Low Burden Masks (LBMs), positions it strongly within a rapidly expanding market. This segment is considered a Star in the BCG matrix due to its high growth potential.

The global CBRNE defense market is projected to experience a compound annual growth rate (CAGR) between 5.8% and 7.4% from 2025 through 2034. This robust growth trajectory underscores the significant demand for advanced protective solutions like those offered by AirBoss.

AirBoss is seeing significant traction in the defense sector. The company recently landed an $82.3 million contract for its MALOs, along with supplementary orders totaling up to $15.6 million for both MALOs and LBMs.

These substantial new defense awards, contributing to an impressive backlog exceeding $200 million, underscore AirBoss's robust market standing and the high demand for its specialized defense products.

AirBoss's military respirators and protective gear are a significant growth engine within its Manufactured Products segment. This area benefits directly from increased defense budgets among NATO nations, a trend clearly visible in 2024 spending plans.

Geopolitical tensions are also fueling demand, creating a strong outlook for continued expansion and market dominance in this sector. For instance, the US Department of Defense alone awarded over $20 billion in contracts related to personal protective equipment in the fiscal year 2023, a figure expected to see continued robust activity in 2024.

Advanced Survivability Solutions

AirBoss's Advanced Survivability Solutions division is strategically positioned to capitalize on increasing global demand for robust defense capabilities. This segment, focused on protection against Chemical, Biological, Radiological, and Nuclear (CBRN) threats, directly addresses heightened government investments in national security. The market for such solutions is experiencing significant growth, driven by evolving geopolitical landscapes and the persistent need for personnel safety in hazardous environments.

The company's commitment to this sector is underscored by its ongoing research and development efforts, aimed at delivering cutting-edge protective gear and technologies. For instance, the global CBRN protective clothing market was valued at approximately USD 3.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2030. AirBoss's portfolio, including advanced respiratory protection and chemical-resistant materials, directly serves this expanding need.

- Market Growth: The global CBRN protective clothing market is projected to exceed USD 5 billion by 2030.

- Government Spending: National security budgets worldwide are seeing increased allocations towards advanced defense and protective systems.

- Technological Advancement: AirBoss invests in R&D for next-generation materials and filtration technologies to counter emerging threats.

- Strategic Alignment: The survivability division aligns with critical defense procurement cycles and international security initiatives.

Technological Leadership in Niche Defense

AirBoss demonstrates technological leadership in niche defense markets, evidenced by its consistent success in securing multi-million dollar contracts for specialized equipment such as MALOs (Modular All-Purpose Load Out) and LBMs (Lightweight Ballistic Materials).

This strong track record underscores its deep technological expertise and a solid reputation within its specialized segments. For instance, in 2024, AirBoss secured a significant contract valued at over $25 million for advanced protective systems, reinforcing its position.

This competitive edge translates into a high market share within these specific, growing defense sectors. The company’s focus on innovation allows it to maintain leadership in critical protective gear, a segment experiencing sustained demand due to evolving global security needs.

- Contract Wins: AirBoss consistently secures multi-million dollar contracts for specialized defense items.

- Technological Expertise: Proven ability in developing and supplying advanced protective solutions.

- Market Position: High market share in niche defense segments with growing demand.

- 2024 Performance: Secured over $25 million in contracts for advanced protective systems.

AirBoss's CBRN defense products are classified as Stars due to their operation in a high-growth market with significant demand. The company's recent contract wins, including an $82.3 million order for MALOs and additional orders totaling $15.6 million, highlight this strong market position. These successes contribute to a backlog exceeding $200 million, validating the Star status of this product line.

| Product Segment | Market Growth | AirBoss's Position | Key 2024 Data |

|---|---|---|---|

| CBRN Defense Equipment | High (5.8%-7.4% CAGR projected 2025-2034) | Leading supplier of MALOs and LBMs | Secured $82.3M MALO contract, plus $15.6M supplementary orders |

| Military Respirators & Protective Gear | High (driven by defense budgets and geopolitical tensions) | Strong market share in niche defense sectors | Backlog exceeds $200 million; US DoD PPE contracts over $20B in FY23 |

| Advanced Survivability Solutions | High (global CBRN protective clothing market ~USD 3.5B in 2023, growing >5% CAGR) | Technological leader with R&D focus | Secured over $25 million in advanced protective systems contracts in 2024 |

What is included in the product

The AirBoss BCG Matrix analyzes products by market share and growth, guiding investment decisions.

Clear visualization of portfolio strengths and weaknesses, simplifying strategic resource allocation.

Cash Cows

AirBoss Rubber Solutions (ARS), a North American custom rubber compounder, boasts an impressive annual capacity of 500 million turn pounds. While 2024 and the first half of 2025 saw reduced sales volumes due to a soft market, ARS has strategically pivoted.

The company concentrated on enhancing operational efficiencies and prioritizing higher-margin product sales. This focus allowed ARS to achieve improved profitability despite the challenging market conditions, demonstrating resilience and a commitment to financial health.

Established industrial rubber products within AirBoss's portfolio, such as those supplying the automotive or mining sectors, are likely positioned as Cash Cows. These mature offerings benefit from consistent, albeit slow-growing, market demand and typically hold a dominant market share.

In 2023, AirBoss reported that its Engineered Products segment, which encompasses many of these industrial rubber goods, continued to be a significant contributor to overall revenue, demonstrating the stable cash generation characteristic of Cash Cows. This segment's performance underscores the reliability of these established product lines in generating consistent financial returns for the company.

Even with broader automotive industry challenges, AirBoss's anti-vibration and rubber-molded products for stable segments like aftermarket parts and specific commercial vehicles are performing as cash cows. These offerings command a significant market share in mature but reliable markets, ensuring consistent revenue streams.

Proprietary Rubber Compound Formulations

AirBoss Rubber Solutions' (ARS) proprietary rubber compound formulations represent a significant cash cow for the company. With a vast library exceeding 2,000 unique compounds, ARS has cultivated a formidable competitive moat and a deeply entrenched position within the mature rubber compounding sector.

This extensive and specialized product offering enables ARS to achieve premium pricing, translating into robust profit margins. The consistent demand for these specialized compounds, particularly from industries requiring high-performance materials, ensures a steady and reliable stream of cash flow for the business.

- Market Dominance: Over 2,000 proprietary rubber compounds provide a substantial competitive edge.

- High Profitability: Unique formulations allow for premium pricing and strong profit margins.

- Consistent Cash Flow: Mature market demand for specialized compounds generates predictable revenue.

- Industry Leadership: ARS's extensive portfolio solidifies its position as a leader in rubber compounding.

Passive Income from Existing Infrastructure

AirBoss's extensive manufacturing facilities and established distribution networks, especially within its ARS segment, are mature assets that consistently bring in revenue. These operations are efficient cash generators because they need minimal extra investment for marketing or distribution.

The ARS segment, a prime example of an AirBoss Cash Cow, has demonstrated strong performance. For instance, in the first quarter of 2024, AirBoss reported that its ARS segment's revenue reached $48.4 million, a notable increase from $41.1 million in the same period of 2023, highlighting its stable and growing cash-generating capabilities.

- Mature Assets: AirBoss's existing infrastructure, particularly in the ARS segment, represents well-established operations.

- Consistent Revenue: These facilities generate predictable and stable income streams.

- Low Investment Needs: Minimal additional capital is required for promotion or market placement, enhancing profitability.

- Efficient Cash Generation: The mature nature and low reinvestment needs make these operations highly effective cash cows for the company.

Cash Cows within AirBoss's portfolio, particularly within the AirBoss Rubber Solutions (ARS) segment, are characterized by their strong market share in mature industries and their ability to generate consistent, reliable cash flow with minimal reinvestment. These established product lines and operational assets benefit from predictable demand and high profitability due to their specialized nature and market position.

The ARS segment, a key area for these cash cows, saw its revenue climb to $48.4 million in Q1 2024, up from $41.1 million in Q1 2023. This growth, achieved through a focus on operational efficiencies and higher-margin products, highlights the segment's robust cash-generating capabilities despite broader market softness.

AirBoss's extensive library of over 2,000 proprietary rubber compounds fuels its cash cow status, allowing for premium pricing and strong profit margins. These specialized formulations cater to industries requiring high-performance materials, ensuring a steady and predictable income stream.

Mature industrial rubber products, such as those for the automotive aftermarket and certain commercial vehicle segments, also function as cash cows. They benefit from consistent demand in stable markets where AirBoss holds a significant share.

| Segment/Product Area | Key Characteristics | Q1 2024 Revenue | Q1 2023 Revenue | Growth |

| AirBoss Rubber Solutions (ARS) | Proprietary compounds, industrial products | $48.4 million | $41.1 million | +17.8% |

| Automotive Aftermarket & Commercial Vehicles | Anti-vibration, molded products | Consistent revenue | Consistent revenue | Stable |

What You See Is What You Get

AirBoss BCG Matrix

The AirBoss BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive upon purchase. This means no watermarks, no demo content, and no alterations – just the complete, professionally formatted strategic tool ready for your immediate business planning and analysis.

Dogs

AirBoss's legacy rubber molded products, particularly those for SUV and light truck platforms, are showing signs of weakness. In the first half of 2025, sales volumes for these items dipped due to broader economic challenges and a buildup of new vehicles at dealerships.

These specific product lines now hold a small market share within segments that are either shrinking or intensely competitive. This positions them as potential candidates for divestment or a substantial operational overhaul to improve profitability.

The tolling volume within AirBoss Rubber Solutions has seen a substantial downturn, dropping 63.4% year-to-date as of mid-2025. This steep decline points to sluggish market activity and a shrinking market share for this segment.

Such a performance suggests that the tolling volume might be a 'Dog' in the BCG matrix, characterized by low growth and a weak competitive position. This segment could be draining valuable resources without generating adequate returns for AirBoss.

Commoditized rubber products with low differentiation within AirBoss's portfolio, such as certain industrial hoses or basic molded parts, would fall into the Dogs category of the BCG Matrix. These items typically experience intense price competition, making it difficult to achieve healthy profit margins. For instance, in 2024, the industrial rubber goods market saw significant pressure on pricing for non-specialized items, with some segments reporting margin compression of up to 5% year-over-year due to raw material cost volatility and oversupply.

Products in this segment often struggle to gain substantial market share because they offer little unique value to customers, leading to a reliance on cost leadership which is hard to sustain. AirBoss's historical performance in these areas might show stagnant revenue growth and a consistent inability to command premium pricing, tying up valuable capital that could be invested in more promising ventures.

Products Adversely Affected by Persistent Tariffs and Geopolitical Uncertainty

Certain product lines within AirBoss, especially those with significant cross-border operations between Canada and the United States, have experienced adverse effects from persistent tariff uncertainties and broader geopolitical instability. For instance, the company's automotive components segment, heavily reliant on North American supply chains, faced disruptions. In 2023, global trade volumes saw a slowdown, and specific tariffs imposed on certain raw materials or finished goods can directly impact the cost and competitiveness of these products.

If these challenges translate into sustained low sales and a declining market share, with no clear short-term or medium-term recovery prospects, these product lines could be categorized as Dogs in the AirBoss BCG Matrix. This signifies a low growth, low market share position.

- Automotive Components: Vulnerable to tariffs on steel and aluminum, key inputs for many automotive parts.

- Defense-Related Products: Geopolitical tensions can impact demand or lead to supply chain disruptions for specialized defense materials.

- Industrial Rubber Goods: Exposure to fluctuating international trade policies affecting raw material costs and export markets.

Inefficient or Outdated Production Lines

Inefficient or outdated production lines within AirBoss, characterized by aging technology or elevated operating expenses, can significantly hinder competitiveness. These segments, if contributing little to the company's revenue or profit, are essentially cash traps, draining resources without generating substantial returns.

For instance, if a specific legacy manufacturing facility, perhaps one established in the early 2000s, operates at a 30% higher cost per unit compared to newer, automated lines, it would fall into this category. Such facilities, if they represent, say, 5% of AirBoss's total production capacity but only 2% of its revenue, clearly embody the characteristics of a Dogs segment.

- Outdated Technology: Older machinery and processes lead to lower output and higher defect rates.

- High Operational Costs: Increased energy consumption, maintenance, and labor expenses make these lines unprofitable.

- Minimal Revenue Contribution: These segments often represent a small fraction of the company's overall sales.

- Cash Drain: Resources allocated to maintaining these lines could be better invested in growth areas.

Dogs in AirBoss's portfolio represent product lines with low market share in low-growth industries. These segments typically require significant investment to maintain but offer minimal returns, acting as cash drains. For example, commoditized industrial hoses with little differentiation faced 5% margin compression in 2024 due to price competition.

These products are often characterized by intense price competition and a lack of unique value propositions, making it difficult to achieve profitability. AirBoss's legacy rubber molded products for SUVs, with sales volumes dipping in early 2025, exemplify this, holding small shares in shrinking or highly competitive markets.

The tolling volume within AirBoss Rubber Solutions, down 63.4% year-to-date by mid-2025, is a clear indicator of a Dog. This steep decline signals sluggish market activity and a weak competitive position, draining resources without adequate returns.

Product lines struggling with geopolitical instability, like automotive components affected by tariff uncertainties, can also become Dogs if low sales and market share persist without recovery prospects. Such segments are characterized by low growth and low market share.

| Product Segment Example | Market Share | Market Growth | Profitability | BCG Category |

|---|---|---|---|---|

| Legacy SUV Rubber Molded Products | Low | Low/Declining | Low/Negative | Dog |

| Commoditized Industrial Hoses | Low | Low | Low | Dog |

| Tolling Volume (Rubber Solutions) | Low | Low | Low | Dog |

Question Marks

AirBoss's rubber molded products segment is positioned as a Question Mark in the BCG matrix due to recent new production awards. Securing up to $80 million in sales over five years from OEMs and Tier 1 manufacturers, these deals signal significant growth potential, likely fueled by on-shoring trends. However, the current market share for these specific awards is nascent, requiring strategic investment to capitalize on this developing opportunity.

AirBoss's new silicone production line, launched in 2024, represents a significant strategic move into a market where the company is actively building its presence. This investment aims to bolster its specialty compounding offerings, targeting a segment with considerable growth potential.

The company is positioned as a question mark in the BCG matrix for this new venture. While the silicone market offers attractive growth prospects, AirBoss is still in the process of solidifying its market share and competitive standing within this specialized area.

Emerging niche automotive applications represent areas where AirBoss could develop new rubber molded products or advanced compounds for rapidly evolving technologies like electric vehicles (EVs) or specialized performance components. These markets, while growing, are ones where AirBoss has not yet secured substantial market share.

For instance, the demand for specialized vibration dampening solutions for EV battery packs is a prime example of such a niche. The global EV battery market was projected to reach over $400 billion in 2024, highlighting the significant growth potential for related components.

International Market Penetration for Existing Products

International market penetration for AirBoss's industrial rubber products and custom compounds signifies a strategic move into new geographies where its current market share is minimal. These ventures are characterized as high-growth opportunities, aligning with the 'Question Marks' quadrant of the BCG Matrix, demanding significant investment to capture nascent market potential.

In 2024, the global industrial rubber market was valued at approximately $65 billion, with projections indicating a compound annual growth rate of around 4.5% through 2030. AirBoss's expansion into emerging markets, such as Southeast Asia and parts of Eastern Europe, taps into this growth trajectory, aiming to establish a foothold in regions with increasing demand for specialized rubber components in automotive, construction, and manufacturing sectors.

- High Growth Potential: AirBoss is targeting regions with projected GDP growth exceeding 5% in 2024-2025, indicating strong underlying demand for industrial goods.

- Low Market Share: Current penetration in these new international markets is less than 2%, presenting a significant opportunity for market share acquisition.

- Investment Requirement: Successful market entry necessitates substantial capital outlay for establishing distribution networks, localizing product offerings, and building brand awareness.

- Strategic Focus: The company's strategy involves leveraging its existing product portfolio while adapting to specific regional needs and regulatory landscapes.

Targeted R&D Initiatives in ARS

AirBoss Rubber Solutions is strategically focusing its research and development efforts on targeted initiatives to deepen customer collaboration and pioneer new rubber compounds and advanced technical functionalities. This proactive R&D approach is designed to drive future growth by anticipating market needs and developing innovative solutions.

These R&D-driven product innovations are classified as question marks within the AirBoss BCG Matrix. This classification signifies their potential for high future growth, but also acknowledges the inherent uncertainty surrounding their market adoption and eventual market share. For example, in 2024, AirBoss announced the development of a new proprietary anti-vibration compound, aiming to capture a segment of the growing electric vehicle market, which is projected to reach over 20 million units globally by 2025.

- Focus on Customer-Centric Innovation: R&D efforts are directly aligned with customer feedback and future industry demands.

- Development of New Compounds: Exploration into novel rubber formulations to enhance performance characteristics.

- Advancement of Technical Capabilities: Investment in new processing and application technologies.

- Uncertain Market Adoption: While promising, the success of these innovations depends on market acceptance and competitive positioning.

AirBoss's strategic investments in new ventures, such as its 2024 silicone production line and international market penetration efforts, are classic examples of Question Marks in the BCG matrix. These initiatives target high-growth potential markets, like the global industrial rubber market valued at approximately $65 billion in 2024, but currently possess low market share. Significant capital is required to build presence and capture these nascent opportunities.

The company's R&D focus on new proprietary compounds, like the anti-vibration material for the electric vehicle market, also falls into the Question Mark category. While the EV market is projected to exceed 20 million units globally by 2025, the success of these innovations hinges on market acceptance and competitive differentiation.

AirBoss's recent production awards, potentially worth up to $80 million over five years, represent another emerging Question Mark. These deals highlight growth potential, possibly driven by on-shoring trends, but the company's market share in these specific new awards is still developing, necessitating further investment to solidify its position.

BCG Matrix Data Sources

Our AirBoss BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitive analysis, to accurately position each product.