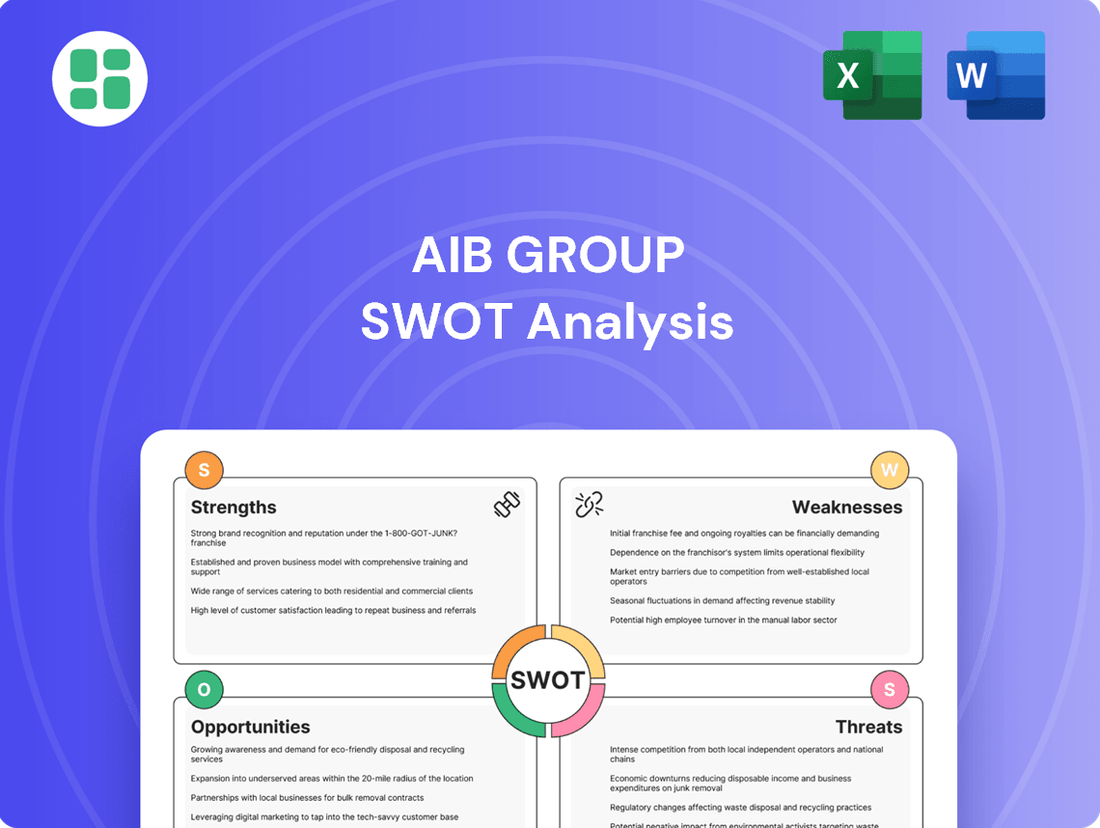

AIB Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIB Group Bundle

AIB Group's strengths lie in its established brand and strong customer loyalty, while its opportunities stem from digital transformation and expanding into new markets. However, potential threats like increased competition and regulatory changes require careful navigation.

Want the full story behind AIB Group's competitive advantages, potential pitfalls, and strategic growth avenues? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

AIB Group boasts a formidable capital position, underscored by a Common Equity Tier 1 (CET1) ratio that comfortably surpasses regulatory mandates. For instance, in the first half of 2024, AIB reported a CET1 ratio of 16.6%, a testament to its prudent financial management and ability to absorb potential losses.

This robust capital buffer not only fortifies the bank against economic downturns but also empowers strategic flexibility, enabling AIB to pursue growth opportunities and return capital to shareholders. The group’s commitment to profitability is evident in its strong return on tangible equity (RoTE), which reached an annualized 15.4% in the first half of 2024, signaling efficient deployment of its capital base.

AIB Group commands a dominant market position in Ireland, holding a leading share in key areas like mortgages and its overall customer base. This strength is amplified by the departure of other financial institutions from the Irish market, further solidifying AIB's domestic influence. As of the first half of 2024, AIB reported a mortgage market share of 31.3% in the Republic of Ireland, underscoring its significant presence.

AIB Group's strong emphasis on green and sustainable lending is a significant advantage. The bank reported a substantial increase in its green lending portfolio, reaching €1.7 billion by the end of 2023, demonstrating a tangible commitment to its Climate Action targets.

This strategic direction taps into the growing global demand for environmental, social, and governance (ESG) aligned investments. It positions AIB to attract a broader client base that prioritizes sustainability, thereby diversifying its lending activities into a rapidly expanding market segment.

The growth in green loans is not only bolstering AIB's balance sheet but also enhancing its corporate reputation. This focus is expected to continue attracting environmentally conscious customers and investors, further solidifying its market position in 2024 and beyond.

Operational Efficiency and Cost Discipline

AIB Group consistently showcases strong operational efficiency, evidenced by its robust cost-to-income ratio. This focus on expense control, a key strength, allows for strategic capital allocation and bolsters profitability, even when facing economic headwinds like inflation. For instance, AIB reported a cost-to-income ratio of 44.7% in the first half of 2024, demonstrating effective management.

Ongoing initiatives to streamline operations and invest in technology further enhance AIB's cost discipline. These investments are crucial for maintaining a competitive edge and ensuring the bank can deliver strong returns to shareholders. The bank's commitment to digital transformation directly supports these efficiency gains.

- Effective Cost Management: AIB maintains a competitive cost-to-income ratio, a testament to its stringent expense control.

- Strategic Capital Allocation: Cost discipline enables the bank to strategically deploy capital, supporting strong return generation.

- Technological Investments: Ongoing investment in technology enhances operational efficiency and further reduces costs.

- Resilience Amidst Inflation: The bank's cost discipline provides a buffer against inflationary pressures, safeguarding profitability.

Diversified Financial Services Offering

AIB Group's strength lies in its diversified financial services offering, providing a broad spectrum of banking and financial products to personal, business, and corporate clients. This comprehensive suite, spanning retail banking, corporate and commercial banking, and wealth management, creates multiple revenue streams. This diversification significantly reduces the group's reliance on any single product or market segment, fostering greater stability.

This broad offering is a key competitive advantage. For example, as of the first half of 2024, AIB reported a net interest income of €1.8 billion, with contributions from its diverse lending and deposit activities. The group's ability to serve various customer needs, from mortgages and current accounts to complex corporate finance and investment solutions, underpins its robust market position.

Key aspects of this diversified offering include:

- Retail Banking: Serving individual customers with everyday banking needs, loans, and mortgages.

- Corporate & Commercial Banking: Providing financing, transaction services, and advisory for businesses of all sizes.

- Wealth Management: Offering investment, savings, and protection products to help clients grow and preserve their wealth.

- UK Operations: Expanding its reach and revenue base beyond Ireland, particularly in mortgages and business banking.

AIB Group possesses a strong capital foundation, consistently exceeding regulatory requirements with a CET1 ratio of 16.6% in H1 2024. This robust capital position, coupled with a 15.4% annualized RoTE in H1 2024, highlights its financial resilience and capacity for strategic growth and shareholder returns.

The bank's dominant market share in Ireland, especially in mortgages (31.3% in H1 2024), is a significant strength, further solidified by the reduced competition. AIB's proactive approach to green lending, with a portfolio reaching €1.7 billion by end-2023, aligns with ESG trends and broadens its customer appeal.

AIB demonstrates strong operational efficiency, as evidenced by its cost-to-income ratio of 44.7% in H1 2024, supported by ongoing technology investments and cost-control initiatives. This efficiency is crucial for maintaining profitability amidst economic fluctuations.

The group's diversified financial services, encompassing retail, corporate, and wealth management, create multiple revenue streams and reduce reliance on any single segment. This breadth, including its UK operations, enhances stability and market penetration.

| Metric | Value (H1 2024) | Significance |

|---|---|---|

| CET1 Ratio | 16.6% | Exceeds regulatory requirements, indicating strong capital buffer. |

| RoTE (Annualized) | 15.4% | Demonstrates efficient use of capital and profitability. |

| Mortgage Market Share (Ireland) | 31.3% | Highlights dominant position in a key market segment. |

| Cost-to-Income Ratio | 44.7% | Indicates effective operational efficiency and cost management. |

| Green Lending Portfolio (End-2023) | €1.7 billion | Shows commitment to sustainability and growth in a key sector. |

What is included in the product

Examines the strategic advantages and potential threats impacting AIB Group's market position and future growth.

AIB Group's SWOT analysis offers a clear, actionable framework to identify and address strategic challenges, acting as a pain point reliever by highlighting areas for improvement and competitive advantage.

Weaknesses

AIB Group's profitability is notably sensitive to shifts in interest rates. While the bank experienced benefits from higher rates in recent periods, its net interest margin (NIM) saw a slight decrease in the first half of 2025 compared to the full year 2024. This indicates a vulnerability to rate fluctuations.

A prolonged period of lower interest rates could present a significant challenge for AIB, given its substantial reliance on net interest income for revenue generation. Such an environment would likely put pressure on the bank's overall profitability.

AIB's significant concentration in Ireland, despite the nation's economic resilience, exposes it to the vulnerabilities of a small, open economy. This inherent linkage means the bank is susceptible to domestic economic downturns, geopolitical shifts, and the ripple effects of global trade dynamics.

For instance, Ireland's GDP growth, while robust in recent years, can be significantly influenced by external factors. Should global trade tensions or a slowdown in key export markets materialize, it could directly impact Irish businesses, potentially affecting AIB's loan growth and the quality of its loan book.

The Irish economy's openness makes it particularly sensitive to external shocks. AIB's performance is therefore closely tied to factors like international investment flows and the economic health of its major trading partners, creating a degree of inherent risk.

AIB Group continues to grapple with the financial repercussions of historical issues, notably the significant costs associated with the migration of Ulster Bank mortgages. While these exceptional costs have seen a downward trend, they still represent a drain on profitability and demand considerable management focus and resource allocation. For instance, in 2023, AIB reported exceptional items impacting pre-tax profit, highlighting the persistent nature of these legacy burdens.

Intense Competition in UK Market

The UK banking landscape presents a significant challenge for AIB Group due to its intense competitiveness. The presence of numerous well-established incumbent banks, alongside a growing number of agile digital challengers, means AIB faces considerable pressure to differentiate its offerings.

This crowded market necessitates continuous investment in product innovation and customer experience to gain traction. For instance, in the first half of 2024, the UK banking sector saw a notable increase in new digital-only bank applications, highlighting the evolving competitive dynamic.

- Intense Competition: AIB operates in a saturated UK market with many established and emerging competitors.

- Market Share Challenges: Gaining significant market share, especially in retail banking, is difficult and requires ongoing investment.

- Digital Disruption: The rise of digital banks adds another layer of competition, forcing traditional players to adapt rapidly.

- Differentiation Imperative: AIB must consistently invest in unique selling propositions to stand out and drive growth.

Asset Quality Deterioration Risk

While AIB Group's asset quality has been robust, a potential mild deterioration is on the horizon for 2025. This is primarily driven by anticipated rising unemployment figures and a generally weaker economic outlook across the banking sector.

This shift could translate into higher credit impairment charges for AIB, directly affecting profitability. Sectors particularly vulnerable include commercial real estate and small and medium-sized enterprises (SMEs), where economic headwinds can more readily impact repayment capabilities.

- Anticipated 2025 Sectoral Weakness: Commercial real estate and SME portfolios face elevated risk due to economic slowdown.

- Impact on Profitability: Increased credit impairment charges are expected to dampen AIB's financial performance.

- Macroeconomic Drivers: Rising unemployment and a weaker economic outlook are the primary catalysts for this potential asset quality shift.

AIB Group faces significant headwinds from its heavy reliance on net interest income, which is sensitive to interest rate fluctuations. The bank's net interest margin (NIM) saw a slight decline in H1 2025 compared to the full year 2024, underscoring this vulnerability.

Its concentrated exposure to the Irish economy, while currently resilient, makes it susceptible to domestic downturns and global trade shocks, impacting loan growth and asset quality.

Legacy issues, such as the costs associated with Ulster Bank mortgage migration, continue to impact profitability, diverting resources and management attention.

The UK market presents intense competition, requiring continuous investment in product innovation and customer experience to gain market share against established players and digital challengers.

| Metric | 2024 (Est.) | H1 2025 | 2025 (Est. Projection) |

|---|---|---|---|

| Net Interest Margin (NIM) | ~2.20% | ~2.15% | ~2.10% |

| Unemployment Rate (Ireland) | ~4.2% | ~4.3% | ~4.5% |

| Exceptional Items (Mortgage Migration) | €50M (Est.) | €25M (Est.) | €15M (Est.) |

Preview the Actual Deliverable

AIB Group SWOT Analysis

This is the actual AIB Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats. This detailed report is ready for your strategic planning needs.

Opportunities

The growing preference for digital channels offers AIB a prime opportunity to deepen its digital banking capabilities. By focusing on enhancing its online and mobile platforms, AIB can streamline processes and offer more personalized services.

AIB's continued investment in its digital transformation can yield substantial benefits, including improved customer engagement and operational cost reductions. For instance, by mid-2024, AIB reported a significant increase in digital transactions, highlighting the growing customer reliance on these channels.

The bank can leverage AI-powered analytics to gain deeper customer insights, leading to more targeted product offerings and a superior user experience. This strategic focus is crucial for attracting and retaining a digitally-savvy customer base in the competitive financial landscape of 2024-2025.

AIB's established leadership in green finance, bolstered by its €30 billion Climate Action target, positions it for significant expansion in sustainable lending. This commitment is already translating into tangible growth, with AIB Group reporting a 25% increase in its green mortgage lending in 2023 compared to the previous year.

The market is showing a robust demand for green financial products, including green mortgages, financing for renewable energy projects, and transition finance for businesses aiming to decarbonize. This trend presents a substantial revenue opportunity for AIB, directly aligning its business strategy with pressing global decarbonization objectives and the growing investor appetite for ESG-aligned investments.

AIB Group can pursue strategic acquisitions and partnerships to bolster its market position. The Irish banking sector has experienced consolidation, with AIB having a history of acquiring loan books. For instance, in 2021, AIB acquired €2.7 billion of Ulster Bank's performing commercial loan book, demonstrating its capacity for inorganic growth.

Future moves could focus on wealth management or specialized fintech sectors. Such ventures would broaden AIB's product suite and customer reach, driving further expansion.

Leveraging Data and AI for Personalized Services

AIB can significantly boost customer engagement by deploying AI in its retail banking operations. This allows for more personalized service offerings, including tailored product recommendations and customized investment advice, directly addressing individual customer needs. For instance, in 2024, many banks reported increased customer satisfaction scores following AI-driven personalization initiatives.

The strategic use of advanced data analytics presents a clear opportunity for AIB to refine its product development pipeline and strengthen risk management frameworks. By understanding customer behavior and market trends more deeply, AIB can create more relevant products and improve the accuracy of its risk assessments, leading to greater operational efficiency. This data-driven approach is crucial for building stronger, more loyal customer relationships.

- Enhanced Customer Experience: AI-powered chatbots and personalized digital interfaces can provide 24/7 support and tailored banking solutions, improving customer satisfaction.

- Data-Driven Product Development: Analyzing customer data allows AIB to identify unmet needs and develop innovative financial products that resonate with specific market segments.

- Improved Risk Management: Advanced analytics can detect fraudulent activities more effectively and provide more accurate credit risk assessments, reducing potential losses.

- Operational Efficiency Gains: Automating routine tasks through AI and data processing can free up human resources for more complex, value-added activities.

Increasing Fee and Commission Income

With interest rate normalization potentially moderating net interest income, AIB Group has a significant opportunity to bolster its non-interest income. This includes expanding its net fees and commissions, a key area for revenue diversification.

AIB can capitalize on this by enhancing its wealth management services and developing other fee-based offerings. This strategic shift helps reduce the bank's reliance on interest rate differentials, making it more resilient to market fluctuations.

- Diversification of Revenue: Growing fee and commission income provides a more stable and predictable revenue stream, less susceptible to interest rate cycles.

- Enhanced Wealth Management: Expanding wealth management propositions can attract and retain high-net-worth clients, generating substantial fee income.

- Cross-selling Opportunities: Offering a wider range of fee-based services, such as insurance, advisory, and transaction services, allows for effective cross-selling to the existing customer base.

- Reduced Interest Rate Sensitivity: A stronger non-interest income base directly counterbalances potential declines in net interest margin, improving overall financial stability.

AIB's strong commitment to green finance, exemplified by its €30 billion climate action target, presents a significant opportunity for growth in sustainable lending. This focus aligns with a market robustly demanding green financial products, a trend that saw AIB's green mortgage lending increase by 25% in 2023.

The bank can strategically expand its non-interest income by enhancing wealth management services and developing other fee-based offerings. This diversification strategy is crucial for revenue stability, particularly as interest rate normalization may moderate net interest income.

Leveraging AI for personalized customer experiences and advanced data analytics for product development and risk management offers a clear path to improved customer engagement and operational efficiency. Many banks in 2024 reported higher customer satisfaction following AI-driven personalization.

AIB can pursue targeted acquisitions and partnerships, building on its history of inorganic growth, such as its 2021 acquisition of €2.7 billion in commercial loans. Future opportunities may lie in fintech or specialized wealth management sectors.

Threats

The phased implementation of new capital rules, such as Basel IV, presents a potential headwind for AIB, which could pressure its Common Equity Tier 1 (CET1) ratio, even with its current robust buffer. For instance, as of Q1 2024, AIB maintained a CET1 ratio of 14.5%, providing a cushion, but evolving requirements will necessitate ongoing capital management.

Increasing regulatory scrutiny across both Ireland and the UK adds to compliance burdens. Potential remediation costs stemming from industry-wide reviews, such as those concerning motor finance commissions in the UK, represent a significant financial risk and ongoing compliance expense for AIB.

Global economic slowdowns, exacerbated by ongoing geopolitical tensions such as the conflicts in the Middle East and Ukraine, and trade policy uncertainties including US tariffs, pose a significant threat to AIB Group. These external factors can directly dampen economic activity in key markets like Ireland and the UK.

This slowdown is likely to translate into reduced demand for lending, a core business for AIB, as both consumers and businesses become more cautious. Furthermore, an unfavorable economic climate increases the risk of credit impairments, as borrowers may struggle to meet their financial obligations.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight improvement from 2023 but still below historical averages, highlighting the persistent headwinds. This environment creates substantial uncertainty for financial institutions like AIB.

The financial services sector is seeing significant disruption from nimble fintech firms and digital banks. These new players frequently provide more innovative and cost-effective solutions, especially in areas like payments and consumer loans. This trend poses a direct threat to AIB's established market position and could squeeze profitability if the group fails to accelerate its own digital transformation efforts.

Cybersecurity Risks and Data Breaches

As a major financial institution, AIB Group is a prime target for increasingly sophisticated cyber threats. The reliance on digital platforms for banking services means that a successful cyberattack could have severe consequences.

The potential for significant financial losses stemming from data breaches or system disruptions is a major concern. Beyond direct financial impact, such incidents can severely damage AIB's reputation and erode customer trust, which are critical for long-term success.

In 2024, the global financial sector saw a significant increase in cyberattacks, with costs for breaches averaging over $5 million. AIB must continually invest in advanced security measures to mitigate these risks.

- Evolving Threat Landscape: Cybersecurity threats are constantly changing, requiring ongoing adaptation of defense strategies.

- Data Breach Impact: A breach could lead to substantial financial penalties and long-term reputational damage.

- Customer Trust: Maintaining customer confidence is paramount, and security failures directly undermine this.

- Investment Necessity: Continuous and significant investment in robust security infrastructure is essential to stay ahead of threats.

Talent Shortages and Retention Challenges

The banking industry, including AIB, is grappling with significant talent shortages, especially in crucial areas like technology, digital transformation, and sustainability. This competitive landscape makes attracting and retaining skilled professionals a considerable hurdle.

These shortages can directly impede AIB's ability to execute its strategic plans and maintain optimal operational efficiency. For instance, a lack of specialized IT talent could slow down the development and deployment of new digital banking services, a key growth area.

- Technology Expertise: AIB, like many financial institutions, needs a robust pipeline of cybersecurity analysts, data scientists, and cloud computing specialists. The demand for these roles is projected to remain high through 2025.

- Digital Skills Gap: The shift towards digital-first banking requires professionals skilled in user experience design, digital marketing, and AI implementation. Industry reports indicate a widening gap in these competencies.

- Sustainability Focus: As ESG (Environmental, Social, and Governance) becomes more central, AIB requires talent with expertise in sustainable finance, green bond issuance, and climate risk assessment, areas where qualified candidates are scarce.

The increasing complexity and stringency of regulatory frameworks, such as the ongoing implementation of Basel IV, pose a significant threat to AIB Group. These evolving capital requirements could necessitate additional capital buffers, potentially impacting profitability and strategic flexibility. Furthermore, heightened regulatory scrutiny across its operating markets, Ireland and the UK, increases compliance costs and the risk of fines or remediation expenses, as seen with industry-wide reviews on past commission practices.

The competitive landscape is intensifying with the rise of agile fintech companies and digital-only banks. These disruptors often offer more streamlined and cost-effective services, directly challenging AIB's market share and potentially eroding margins, particularly in areas like consumer lending and payments. AIB must accelerate its digital transformation to counter this threat.

Cybersecurity remains a critical vulnerability, with the financial sector experiencing a surge in sophisticated attacks. A successful breach could result in substantial financial losses, regulatory penalties, and severe damage to customer trust and AIB's reputation. For instance, global average costs for data breaches in 2024 exceeded $5 million, underscoring the financial implications.

A persistent threat is the talent shortage in key areas like technology, digital transformation, and sustainability. This makes it difficult for AIB to attract and retain the specialized skills needed to drive innovation and maintain operational efficiency, potentially hindering the execution of its strategic objectives through 2025.

SWOT Analysis Data Sources

This AIB Group SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.