AIB Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIB Group Bundle

AIB Group's marketing prowess is built on a strategic foundation of Product, Price, Place, and Promotion. Discover how their innovative product offerings, competitive pricing, accessible distribution, and impactful promotional campaigns create a compelling customer experience.

Dive deeper into the intricacies of AIB Group's marketing mix and unlock actionable insights for your own business. Get the complete, ready-to-use analysis that breaks down each element for strategic advantage.

Product

AIB Group's comprehensive banking services cater to a broad spectrum of clients, encompassing personal, business, and corporate needs. This extensive offering includes everyday retail banking, robust corporate and commercial banking solutions, and sophisticated wealth management services. For instance, in the first half of 2024, AIB reported a net interest income of €1.5 billion, reflecting the demand for their diverse lending and deposit products.

Lending and deposit solutions form the bedrock of AIB Group's product strategy. This includes a comprehensive suite of offerings like mortgages, personal loans, and specialized business financing, complemented by diverse savings and current account options. These services are fundamental to AIB's customer relationships and revenue generation.

AIB has demonstrated a robust commitment to expanding its lending activities. In 2023, the group reported a significant increase in new lending volumes, with a particular emphasis on green lending initiatives. This strategic focus aligns with broader environmental goals and reflects a growing market demand for sustainable financial products.

Beyond traditional banking, AIB's Payment and Investment Services are crucial components of its marketing mix. These offerings empower customers to manage daily transactions and build long-term wealth. For instance, AIB processed over €350 billion in payments in 2023, highlighting the scale of its transaction services.

The Group's strategic inclusion of subsidiaries like Payzone enhances its payment capabilities, providing diverse and convenient solutions for consumers and businesses. AIB Life, a joint venture with Great-West Lifeco, further broadens the product suite by offering vital protection, pension, and investment products, catering to a comprehensive financial lifecycle.

Digital Innovation

AIB Group is actively investing in digital innovation to transform its product offerings and customer experience. This commitment is evident in their drive to digitize core systems and streamline how customers interact with their services, aiming for greater efficiency and accessibility.

Key initiatives include enhancing digital credit application processes and modernizing the overall channel experience. This focus ensures customers can access AIB's products and services more smoothly and quickly than ever before.

The increasing digital adoption for products like personal loans highlights a significant market trend. For instance, AIB reported a substantial year-on-year increase in digital applications for personal loans in 2024, demonstrating a clear customer preference for digital-first solutions.

- Digitization of Systems: AIB is prioritizing the overhaul of its internal systems to support a more robust digital infrastructure.

- Optimized Customer Interactions: The group is focused on improving user interfaces and workflows across all digital touchpoints.

- Digital Credit Processes: Enhancements in online loan applications and approvals are a significant area of development.

- Channel Modernization: AIB is updating its digital channels, including mobile banking and online platforms, to offer a seamless experience.

Green and Sustainable Finance Offerings

AIB's commitment to sustainability is a core strategic pillar, driving the development of its green and sustainable finance offerings. The bank actively pursues market leadership in financing the energy transition and ESG infrastructure through its dedicated 'Climate Capital' segment and a significant Climate Action Fund. This focus is directly translating into customer-facing products designed to support a low-carbon economy.

Green mortgages and loans represent a substantial portion of AIB's new lending activities. These products are specifically designed to assist customers in making environmentally conscious decisions and transitioning towards lower carbon footprints.

- Climate Capital Segment: AIB has established a dedicated segment focused on climate finance, signaling a strategic commitment to this growing market.

- Climate Action Fund: The bank manages a substantial Climate Action Fund, underscoring its investment in and support for climate-related initiatives.

- Green Mortgages and Loans: These offerings are a key component of AIB's new lending, directly enabling customers to finance sustainable projects and transitions.

AIB Group's product strategy centers on a diverse range of financial solutions, from everyday banking to specialized wealth management. The bank's offerings are designed to meet the evolving needs of personal, business, and corporate clients, with a strong emphasis on digital innovation and sustainable finance. In the first half of 2024, AIB reported a net interest income of €1.5 billion, underscoring the broad appeal and uptake of its core lending and deposit products.

Key product areas include mortgages, personal loans, business financing, and a variety of savings and current accounts, all supported by significant investment in digital channels. The group's commitment to green finance is also a defining characteristic, with products like green mortgages actively promoting environmentally conscious choices. AIB's expansion into payments and investment services, bolstered by subsidiaries like Payzone and AIB Life, further broadens its product ecosystem, aiming for a comprehensive financial lifecycle approach.

AIB's product portfolio is actively being enhanced through digital transformation, with a focus on streamlining customer interactions and improving accessibility. This includes optimizing digital credit applications and modernizing overall channel experiences, reflecting a clear customer preference for digital-first solutions. The bank saw a substantial year-on-year increase in digital applications for personal loans in 2024, demonstrating the success of these initiatives.

AIB's dedication to sustainability is evident in its product development, particularly in green and sustainable finance. The bank is a leader in financing the energy transition, with a dedicated Climate Capital segment and a significant Climate Action Fund. This strategic focus translates into customer-facing products like green mortgages and loans, directly supporting customers in their transition to a lower-carbon economy.

| Product Area | Key Offerings | 2023/H1 2024 Data Point | Strategic Focus | Digital Integration |

|---|---|---|---|---|

| Core Banking | Mortgages, Personal Loans, Business Finance, Savings & Current Accounts | Net Interest Income: €1.5 billion (H1 2024) | Meeting diverse client needs | Increasing digital applications for personal loans |

| Payments & Investments | Transaction services, Protection, Pension & Investment Products | Processed over €350 billion in payments (2023) | Comprehensive financial lifecycle | Subsidiaries like Payzone and AIB Life |

| Sustainable Finance | Green Mortgages, Green Loans | Significant increase in green lending volumes (2023) | Financing energy transition and ESG infrastructure | Products supporting low-carbon economy |

What is included in the product

This analysis provides a comprehensive overview of AIB Group's marketing mix, detailing their strategies across Product, Price, Place, and Promotion to understand their market positioning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic overwhelm.

Provides a clear, structured overview of AIB's 4Ps, reducing the effort required for market analysis and planning.

Place

AIB Group boasts a substantial physical footprint with a widespread branch network across both Ireland and the United Kingdom. This extensive network, which included approximately 170 branches as of early 2024, serves as a crucial element of their customer engagement strategy.

Despite the increasing adoption of digital banking, AIB's branches continue to be vital for customers requiring face-to-face support, specialized financial guidance, or traditional banking transactions. This physical presence underscores their commitment to serving diverse customer needs beyond digital platforms.

The bank is actively managing and optimizing its branch portfolio as part of ongoing operational efficiency efforts. This strategic approach ensures that the physical network remains relevant and cost-effective in the evolving financial landscape, with ongoing investments aimed at enhancing service delivery within these locations.

AIB's digital banking channels, encompassing its online platform and mobile app, are central to its distribution strategy. These digital touchpoints provide unparalleled convenience and accessibility, allowing customers to manage their finances anytime, anywhere. In 2024, AIB reported a significant increase in digitally active customers, with over 70% of its customer base engaging through digital channels, highlighting the importance of this robust offering.

AIB's extensive ATM network offers crucial accessibility for everyday banking needs, with over 200 ATMs across Ireland as of early 2024, facilitating convenient cash withdrawals and balance checks. This physical presence is a cornerstone of their customer service, ensuring that essential transactions are readily available beyond digital platforms.

The ATM infrastructure serves as a vital component of AIB's multi-channel strategy, working in tandem with their mobile app and physical branches to provide a seamless customer experience. This integrated approach allows customers to choose the most convenient method for their banking, whether it's a quick ATM stop or a more complex service at a branch.

Strategic Partnerships and Subsidiaries

AIB strategically employs partnerships and subsidiaries to expand its market presence and deliver specialized financial services. These collaborations are crucial for accessing diverse customer segments and enhancing its product and service portfolio.

Key examples of these strategic alliances include:

- Haven: This partnership strengthens AIB's mortgage broker channels, facilitating broader access to the housing market.

- Goodbody: AIB's acquisition of Goodbody significantly bolsters its capabilities in wealth management and investment banking, allowing for integrated financial solutions. In 2024, Goodbody reported a substantial increase in assets under management, reflecting AIB's successful integration and market penetration.

- Payzone: This venture into payment solutions diversifies AIB's offerings, providing convenient and modern transaction services to a wider customer base. Payzone's transaction volumes saw a notable uplift in late 2024, indicating growing adoption.

These strategic moves enable AIB to effectively penetrate niche markets and offer a more comprehensive suite of financial products, thereby increasing its competitive edge.

Direct Sales and Advisory Channels

For specific offerings like corporate banking and wealth management, AIB employs direct sales and specialized advisory teams. This strategy is crucial for addressing intricate financial requirements with expert advice and customized solutions.

This relationship-focused model is a cornerstone of AIB's success, particularly within its corporate banking operations. It allows for a deeper understanding of client needs and the development of bespoke financial strategies.

- Personalized Solutions: Direct advisory ensures complex financial needs are met with tailored strategies.

- Relationship Building: This approach fosters strong, long-term client relationships, especially in corporate banking.

- Expert Guidance: Dedicated teams provide specialized knowledge for intricate financial products.

AIB's 'Place' in the marketing mix is multifaceted, combining a significant physical branch network with robust digital channels and strategic partnerships. This ensures accessibility and diverse service delivery methods for its customer base.

The bank's physical presence, with around 170 branches in early 2024, caters to those preferring face-to-face interactions, while its extensive ATM network, exceeding 200 machines in Ireland by early 2024, supports essential daily transactions.

Complementing its physical assets, AIB's digital platforms saw over 70% of its customers actively engaging in 2024, demonstrating a strong shift towards online and mobile banking convenience.

Strategic alliances, such as with Haven for mortgages and the acquisition of Goodbody which boosted assets under management in 2024, further broaden AIB's reach and service capabilities across various financial sectors.

| Channel | Key Features | 2024/2025 Data Point |

|---|---|---|

| Physical Branches | Face-to-face support, specialized advice | Approx. 170 branches (early 2024) |

| ATM Network | Cash withdrawals, balance checks | Over 200 ATMs in Ireland (early 2024) |

| Digital Platforms | Online banking, mobile app convenience | Over 70% of customers digitally active (2024) |

| Partnerships (e.g., Goodbody) | Wealth management, investment banking expansion | Significant increase in assets under management (2024) |

Preview the Actual Deliverable

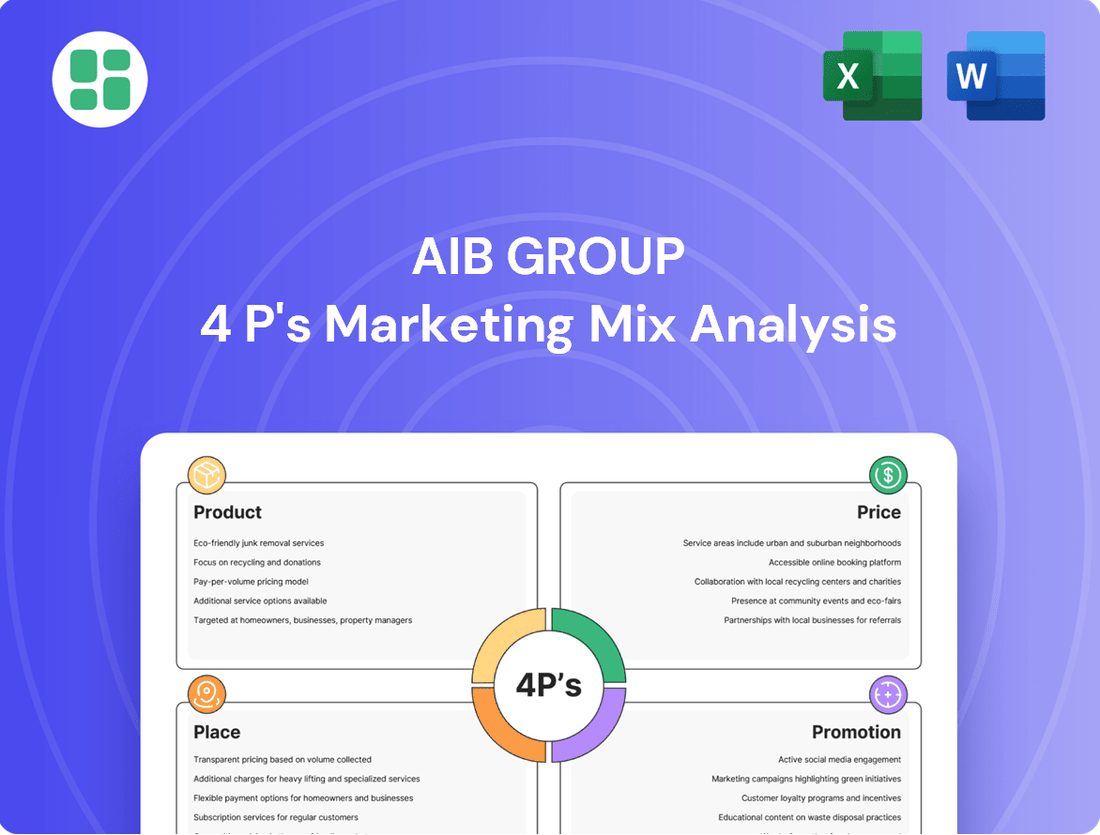

AIB Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive AIB Group 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll get the complete, ready-to-use analysis immediately.

Promotion

AIB leverages integrated marketing campaigns across multiple channels to effectively communicate its diverse product range and core brand values. This 360-degree strategy ensures a consistent message reaches consumers wherever they are.

For instance, their 'The Questions You Really Care About' campaign for mortgages spanned outdoor advertising, television spots, online platforms, and social media. This comprehensive approach aims to maximize reach and impact.

These campaigns are meticulously crafted based on thorough customer research, ensuring they connect with specific demographics, such as first-time homebuyers, by addressing their unique concerns and aspirations.

Digital and social media are central to AIB's promotional efforts, boosting customer interaction and brand visibility. The bank leverages platforms such as YouTube and various social media channels to share personalized content, fostering authentic customer dialogue and promptly answering queries.

AIB's strategic use of digital channels is evident in campaigns like 'The Toughest' for the GAA, which achieved significant reach. In 2024, this initiative alone garnered over 10 million customer engagements, demonstrating a strong connection with younger demographics and reinforcing brand loyalty.

AIB Group strategically leverages public relations and corporate communications to shape its public perception and disseminate crucial information. This involves transparently sharing financial performance, such as their reported Net Interest Income of €1.47 billion for the first half of 2024, and outlining key strategic advancements.

These communications serve to keep stakeholders, including investors and the general public, informed about AIB's operational achievements, forward-looking strategies, and dedication to environmental, social, and governance (ESG) principles. For instance, AIB's 2023 sustainability report detailed a 24% reduction in absolute financed emissions compared to 2019, underscoring their commitment to societal impact.

Sponsorships and Community Initiatives

Sponsorships are a cornerstone of AIB's promotional strategy, with a notable focus on Gaelic Games (GAA). This commitment, exemplified by campaigns like 'The Toughest', aims to foster deep brand loyalty and strengthen community connections across Ireland. For instance, AIB's sponsorship of the GAA All-Ireland Senior Football Championship has been a long-standing partnership, reinforcing its image as a supporter of Irish culture and tradition.

Beyond sports, AIB actively engages in community initiatives, demonstrating its commitment to social responsibility. A prime example is the AIB Community €1 Million Fund, which provides significant financial backing to local charities and community projects annually. In 2024, this fund continued its impactful work, supporting a diverse range of causes and highlighting AIB's dedication to making a tangible difference at a grassroots level.

- GAA Sponsorship: AIB's deep ties with Gaelic Games, including the All-Ireland Senior Football Championship, cultivate strong brand affinity and community integration.

- 'The Toughest' Campaign: This initiative has successfully repositioned AIB, enhancing its brand perception and reinforcing its connection with Irish communities through relatable storytelling.

- Community €1 Million Fund: In 2024, AIB continued its significant investment in local charities and community projects through this annual fund, impacting numerous lives across Ireland.

- Brand Perception: These sponsorships and initiatives contribute to a positive brand image, associating AIB with national pride, community support, and enduring values.

Customer-Centric Messaging

AIB's promotional messaging is increasingly geared towards its customers, emphasizing how its offerings empower individuals and businesses to reach their financial aspirations and foster long-term sustainability. This approach directly supports its updated three-year strategy, which prioritizes a stronger customer focus and the integration of green initiatives across its operations.

The core of AIB's communication strategy is to demonstrate the tangible benefits of its products and services, showcasing how they address customer needs and simplify financial management. This customer-centric approach aims to make banking feel more approachable and directly relevant to everyday life and business objectives.

- Customer Empowerment: Messaging highlights how AIB supports customers in achieving their financial goals.

- Strategic Alignment: Promotions reflect the company's three-year strategy focused on customer centricity and green business practices.

- Problem/Desire Fulfillment: Communications emphasize how AIB's solutions meet customer needs and aspirations.

- Accessibility & Relevance: The aim is to make banking services more understandable and pertinent to a wider audience.

AIB's promotional strategy is multifaceted, encompassing broad integrated campaigns, targeted digital engagement, and significant community investment. Their sponsorship of Gaelic Games, particularly the GAA All-Ireland Senior Football Championship, is a key element, fostering deep brand loyalty and community ties. The bank's commitment to social responsibility is further demonstrated through initiatives like the Community €1 Million Fund, which in 2024 continued to support numerous local projects across Ireland.

Digital channels are crucial for AIB, facilitating customer interaction and brand visibility. Campaigns like 'The Toughest' for the GAA have achieved substantial reach, with over 10 million customer engagements in 2024, effectively connecting with younger audiences and reinforcing brand loyalty. This digital focus complements their broader public relations efforts, which include transparent communication of financial performance, such as the Net Interest Income of €1.47 billion reported for the first half of 2024.

The bank's messaging increasingly centers on customer empowerment, illustrating how its products and services help individuals and businesses achieve their financial aspirations. This customer-centric approach aligns with their strategic priorities, including the integration of green initiatives. AIB's 2023 sustainability report, for example, highlighted a 24% reduction in absolute financed emissions since 2019, underscoring their commitment to ESG principles.

| Promotional Area | Key Initiatives/Examples | Impact/Data (2024/2025 Focus) |

|---|---|---|

| Integrated Campaigns | Mortgage campaigns ('The Questions You Really Care About') | Multi-channel approach (TV, outdoor, digital) for maximum reach. |

| Digital & Social Media | 'The Toughest' (GAA) | Over 10 million customer engagements in 2024; enhanced brand connection with younger demographics. |

| Sponsorships | GAA (All-Ireland Senior Football Championship) | Fosters deep brand loyalty and community integration; reinforces image as supporter of Irish culture. |

| Community Investment | AIB Community €1 Million Fund | Continued significant financial backing for local charities and community projects in 2024. |

| Public Relations | Financial performance reporting, ESG updates | Net Interest Income of €1.47 billion (H1 2024); 24% reduction in absolute financed emissions (vs. 2019, 2023 report). |

Price

AIB strategically positions its loan interest rates to be competitive in the Irish and UK financial landscapes. This includes offerings for mortgages, personal loans, and business financing, with rates actively managed against market benchmarks. For instance, as of early 2024, AIB's variable mortgage rates often hovered around the 3% to 4% mark, depending on loan-to-value ratios, aiming to attract a broad customer base.

The bank's pricing is significantly shaped by the European Central Bank's (ECB) monetary policy, with recent ECB rate hikes in 2023 and early 2024 directly impacting AIB's lending costs and subsequently its customer-facing rates. Market demand also plays a crucial role; for example, increased demand for green mortgages might see AIB offering slightly more attractive terms on these specific products.

AIB provides a range of interest rate options, such as fixed-rate mortgages which offer payment stability, variable rates that fluctuate with market conditions, and specialized green rates designed to incentivize environmentally friendly investments. These options are adjusted based on prevailing market conditions and individual customer creditworthiness, ensuring a tailored approach to lending.

AIB's pricing for deposit and savings accounts aims to be competitive, drawing in customer funds while meeting the bank's liquidity targets. This strategy is crucial in the current economic climate, where interest rate differentials significantly impact customer choices.

In the first half of 2024, AIB reported a robust net interest income, partly fueled by the elevated interest rate environment. This highlights their success in leveraging higher rates, while also carefully managing the allocation of funds between instant access and term deposit products to optimize their balance sheet.

For instance, as of early 2024, AIB offered competitive rates on various savings accounts, with some variable rate options reaching around 3.5% for certain tiers, alongside fixed-term deposits that could yield closer to 4.5% for longer durations, reflecting the prevailing market conditions.

AIB Group's fee and commission income is a vital component of its revenue, stemming from a wide array of services. This includes earnings from transaction processing, the advice and management of wealth, and the sale of insurance products. In 2023, AIB reported a notable increase in net fee and commission income, reaching €1.2 billion, up from €1.1 billion in 2022. This growth is largely attributed to higher customer engagement and increased transaction volumes across its expanding customer base.

The bank structures its fees to align with the value delivered to customers, ensuring that charges are fair and transparent. This approach not only supports the bank's profitability but also strengthens its customer relationships by offering specialized services. These diverse fee-based revenue streams are crucial for AIB's strategy to diversify its income beyond traditional net interest income, providing greater financial resilience.

Flexible Financing and Credit Terms

AIB Group's flexible financing and credit terms are a cornerstone of its marketing mix, designed to broaden product accessibility. The bank provides a range of options, including personalized business financing and varied mortgage loan-to-value ratios, ensuring a fit for diverse customer needs. This approach is informed by an understanding of both the intrinsic value of their offerings and competitive market pricing, aiming to present compelling credit arrangements.

For instance, AIB's mortgage offerings in 2024 and 2025 continue to feature competitive loan-to-value ratios, often up to 90% for first-time buyers, making homeownership more attainable. Business clients can access tailored credit lines and term loans, with recent data indicating a focus on supporting SMEs with flexible repayment schedules. These terms are strategically set to align with market conditions and competitor offerings, ensuring AIB remains an attractive financial partner.

- Tailored Business Financing: AIB offers bespoke credit solutions for businesses, adapting to specific operational needs and growth phases.

- Flexible Mortgage LTVs: The bank provides a spectrum of loan-to-value ratios on mortgages, with options catering to different risk appetites and deposit levels, including up to 90% LTV for eligible borrowers in the 2024-2025 period.

- Competitive Credit Arrangements: AIB's credit terms are benchmarked against market rates and competitor offerings to ensure they are both attractive and financially sound.

- Accessibility Focus: The overarching strategy is to remove financial barriers, making AIB's diverse product suite accessible to a wider customer base.

Sustainability-Linked Pricing

AIB Group's sustainability-linked pricing is a key element of its marketing strategy, directly supporting its environmental goals. This approach offers financial incentives for customers to make greener choices, such as reduced interest rates on mortgages for homes with high energy efficiency ratings.

This pricing strategy is designed to encourage sustainable behavior among AIB's customer base, aligning individual actions with the bank's broader commitment to climate action. By making green choices more financially attractive, AIB aims to drive demand for eco-friendly products and services.

AIB's Climate Action Fund is a significant beneficiary of this strategy. The deployment of this fund, which supports various environmental initiatives, is bolstered by the increased uptake of sustainability-linked products. For instance, AIB reported that by the end of 2023, its green mortgage portfolio had grown significantly, with over €1 billion in new green mortgages issued in Ireland, reflecting customer adoption of these incentives.

- Incentivizing Green Choices: Lower rates on mortgages for energy-efficient homes encourage customers to invest in sustainability.

- Climate Action Fund Support: The strategy directly contributes to the deployment of AIB's Climate Action Fund, channeling capital towards environmental projects.

- Market Growth: By the end of 2023, AIB saw over €1 billion in new green mortgages issued in Ireland, demonstrating customer engagement with these offerings.

AIB's pricing strategy for loans, particularly mortgages and business financing, is highly competitive, often aligning with or slightly undercutting market benchmarks. For example, in early 2024, AIB's variable mortgage rates typically ranged from 3% to 4%, contingent on loan-to-value ratios.

The bank's deposit rates are also structured to attract funds, with variable savings accounts offering around 3.5% and fixed-term deposits potentially yielding up to 4.5% for longer durations as of early 2024, reflecting the prevailing interest rate environment.

AIB's fee structure aims for transparency and value, contributing significantly to its revenue. In 2023, net fee and commission income reached €1.2 billion, an increase from €1.1 billion in 2022, driven by heightened customer activity.

Sustainability-linked pricing, such as reduced mortgage rates for energy-efficient homes, is a growing segment. By the end of 2023, AIB had issued over €1 billion in new green mortgages in Ireland, demonstrating strong customer uptake.

| Product Category | Pricing Feature | Example Rate (Early 2024) | Key Driver | 2023 Performance Indicator |

|---|---|---|---|---|

| Mortgages (Variable) | Competitive rates, LTV dependent | 3% - 4% | ECB Policy, Market Demand | >€1bn green mortgages issued |

| Savings Accounts (Variable) | Attracts customer funds | ~3.5% | Liquidity Targets, Market Rates | N/A |

| Fixed-Term Deposits | Higher yields for longer terms | Up to 4.5% | Market Conditions | N/A |

| Fees & Commissions | Value-based charges | N/A | Customer Engagement | €1.2bn net fee & commission income |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for AIB Group is grounded in a comprehensive review of official company disclosures, including annual reports and investor relations materials. We also incorporate insights from industry-specific publications, market research reports, and AIB's own digital presence to capture their product offerings, pricing strategies, distribution channels, and promotional activities.