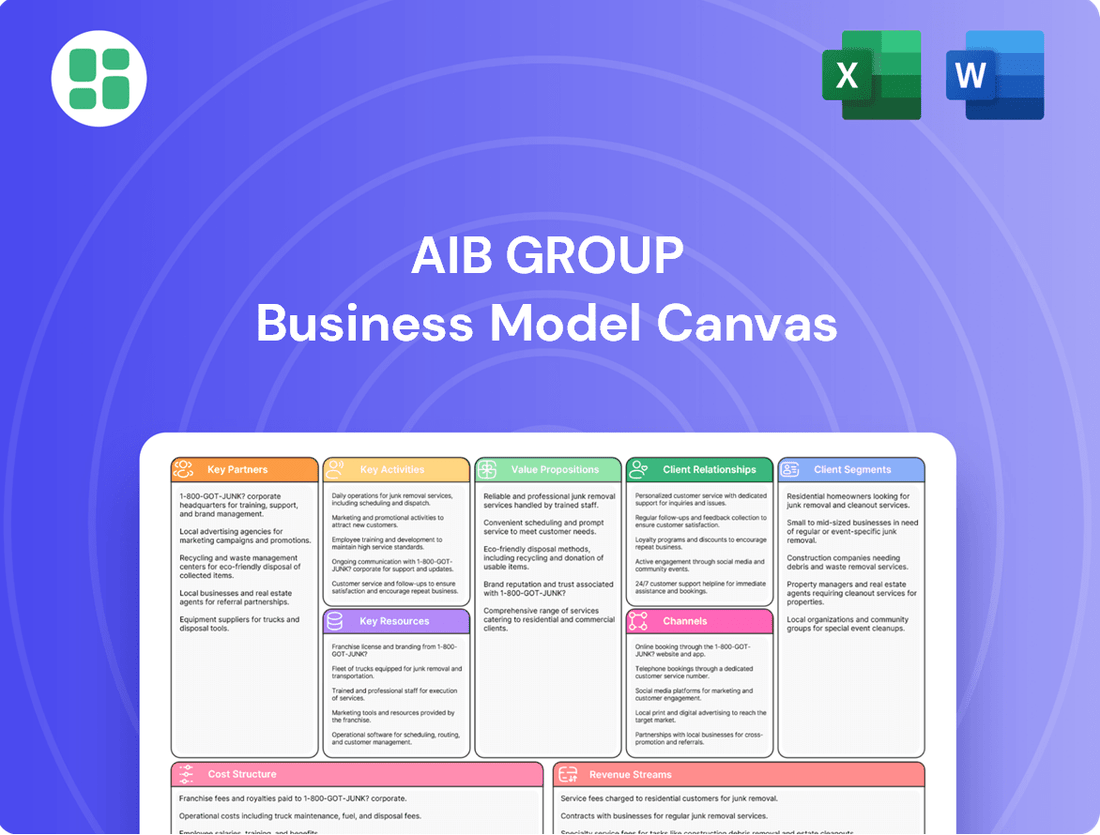

AIB Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIB Group Bundle

Unlock the strategic blueprint behind AIB Group's success with our comprehensive Business Model Canvas. This detailed document reveals how AIB creates and delivers value, manages key resources, and generates revenue in the competitive financial sector. Ideal for anyone looking to understand or replicate their winning formula.

Partnerships

AIB Group actively partners with leading technology providers, notably Infosys and Microsoft, to drive its digital transformation initiatives. These collaborations are instrumental in modernizing the bank's IT infrastructure and developing cutting-edge AI-powered solutions, aiming to significantly boost operational efficiency and customer engagement.

These strategic alliances enable AIB to leverage specialized expertise in application development and maintenance, adopting agile methodologies to deliver advanced digital tools and improve overall customer experience. In 2024, AIB continued to invest heavily in technology, with a significant portion of its operational budget allocated to digital enhancements and cloud migration projects, underscoring the critical role of these technology partnerships.

AIB actively cultivates strategic alliances with fintech firms to accelerate innovation and broaden its product portfolio. For instance, in 2023, AIB partnered with Paycheck Plus to enhance payroll services for its business customers. These collaborations are crucial for integrating cutting-edge technologies, improving digital banking experiences, and launching novel products like their green mortgage offerings, which saw a 15% increase in applications in early 2024.

AIB Group's key partnerships with payment service providers like Payzone and Fiserv are foundational to its merchant services operations. These collaborations are crucial for enabling a wide array of payment transactions for AIB's customer base, both individuals and businesses.

These strategic alliances directly support AIB Merchant Services, ensuring that payment processing is both efficient and reliable. By leveraging the expertise of partners such as Fiserv, AIB can offer robust and up-to-date payment solutions, thereby enhancing its competitive edge in the market.

The integration with these providers not only streamlines the payment experience but also diversifies AIB's revenue streams. For instance, in 2024, the continued reliance on such partnerships is expected to drive growth in transaction volumes and merchant acquiring fees, a significant contributor to the bank's overall financial performance.

Mortgage and Insurance Brokers/Tied Agents

AIB collaborates with external mortgage brokers, exemplified by its relationship with Haven, and also engages tied agents like Irish Life Assurance plc for life assurance and pension products. This strategic approach significantly broadens AIB's market penetration by leveraging the established networks and specialized expertise of these partners. For instance, in 2024, the Irish mortgage market saw continued activity, with brokers playing a crucial role in facilitating transactions for a substantial portion of new mortgages. This allows AIB to offer a more complete financial ecosystem to its customers without the need for extensive in-house development across all specialized financial services.

These partnerships are vital for AIB to effectively serve a wider customer base by providing access to specialized financial solutions. By working with entities like Irish Life Assurance plc, AIB can offer a robust suite of protection and long-term savings products. This strategy is particularly effective in markets where specialized knowledge and existing client relationships are key differentiators. In 2023, the life assurance sector in Ireland reported significant new business premiums, underscoring the demand for these products and the value of partnerships that facilitate their distribution.

- Extended Market Reach: Partnerships with mortgage brokers and tied agents allow AIB to access customer segments they might not otherwise reach.

- Product Diversification: These collaborations enable AIB to offer a broader range of financial products, including life assurance and pensions, enhancing its value proposition.

- Cost Efficiency: Outsourcing specialized product development and distribution through partners can be more cost-effective than building these capabilities internally.

- Market Responsiveness: Partnering with established brokers and agents allows AIB to adapt more quickly to changing market demands and customer preferences in specific product areas.

Sustainability and Community Initiatives

AIB actively collaborates with a diverse range of organizations and initiatives to drive its sustainability and community engagement goals. These partnerships are crucial for deploying its Climate Action Fund, which aims to finance green projects and support the transition to a low-carbon economy.

In 2024, AIB continued to strengthen its commitment to environmental, social, and governance (ESG) principles through these strategic alliances. For example, its support for green lending initiatives helps businesses and individuals invest in sustainable solutions, contributing to a healthier planet.

- Climate Action Fund Deployment: Partnerships are key to channeling AIB's Climate Action Fund into impactful green projects, fostering innovation in renewable energy and energy efficiency.

- Green Lending Support: Collaborations with industry bodies and environmental organizations enhance AIB's green lending products, making sustainable finance more accessible.

- Community Well-being Contributions: AIB partners with charities and social enterprises to address societal needs, reinforcing its role as a responsible corporate citizen.

- Alignment with Purpose: These alliances directly support AIB's overarching purpose of building a sustainable future, enhancing its corporate social responsibility profile and stakeholder trust.

AIB Group's strategic partnerships are multifaceted, encompassing technology providers like Microsoft and Infosys for digital transformation, fintechs for product innovation, and payment processors such as Payzone and Fiserv for merchant services. These collaborations are essential for enhancing operational efficiency, expanding product offerings, and ensuring seamless transaction capabilities. In 2024, AIB continued to leverage these alliances to drive digital advancements and bolster its market position.

Further extending its reach, AIB partners with mortgage brokers and tied agents like Irish Life Assurance plc to access wider customer segments and offer a diversified product suite, including life assurance and pensions. These relationships are crucial for market penetration and providing comprehensive financial solutions. Additionally, AIB engages in sustainability-focused partnerships to deploy its Climate Action Fund and promote green lending, reinforcing its commitment to ESG principles.

| Partner Type | Key Partners | Strategic Benefit | 2024 Focus/Data |

|---|---|---|---|

| Technology | Microsoft, Infosys | Digital transformation, AI solutions, IT modernization | Continued investment in cloud migration and AI-powered customer engagement. |

| Fintech | Paycheck Plus | Product innovation, enhanced services (e.g., payroll) | Accelerating development of new digital banking features. |

| Payment Services | Payzone, Fiserv | Merchant services, efficient payment processing | Driving growth in transaction volumes and merchant acquiring fees. |

| Distribution (Mortgages/Insurance) | Haven, Irish Life Assurance plc | Market reach, product diversification (life assurance, pensions) | Leveraging established networks in a dynamic Irish mortgage market. |

| Sustainability | Industry bodies, environmental organizations | Climate Action Fund deployment, green lending support | Supporting green lending initiatives and community well-being projects. |

What is included in the product

A detailed, pre-written business model canvas for AIB Group, outlining its core customer segments, value propositions, and revenue streams.

This canvas provides a clear, structured overview of AIB's operational framework, ideal for strategic planning and stakeholder communication.

The AIB Group Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of how the company creates, delivers, and captures value, simplifying complex strategies for easier understanding and actionable insights.

Activities

AIB's core activities revolve around delivering a full spectrum of banking services. This includes managing customer deposits, processing payments, and offering diverse lending solutions to individuals, small businesses, and large corporations.

These operations encompass the essential day-to-day banking functions, meticulous account management, and proactive support for all customer financial requirements, ensuring seamless transactions and financial well-being.

In 2024, AIB continued to focus on enhancing its digital offerings, with a significant portion of customer interactions and transactions occurring through its online and mobile platforms, reflecting a growing trend in digital banking adoption.

AIB Group's core activity involves originating and meticulously managing a varied loan portfolio. This encompasses everything from mortgages for individuals and loans for small and medium-sized enterprises (SMEs) to larger corporate lending and tailored financing for significant infrastructure or development projects.

Central to this is robust credit assessment and ongoing risk management. AIB actively pursues growth in new lending areas, with a notable focus on green and transition finance, reflecting a strategic shift towards supporting sustainable economic development.

In 2023, AIB reported a significant increase in its net interest income, driven by a growing loan book and higher interest rates. The bank’s total loans and advances to customers stood at €81.3 billion at the end of 2023, demonstrating substantial activity in loan origination and management.

AIB Group's key activities in wealth management and investment services are primarily delivered through its Capital Markets segment and its subsidiary, Goodbody. These services are designed to help customers not only manage their existing assets but also to actively grow their wealth over time.

The core of these offerings includes personalized financial advice, a wide array of investment products tailored to different risk appetites, and dedicated private banking services. This comprehensive approach aims to provide a holistic solution for clients seeking to secure and enhance their financial future.

In 2024, Goodbody, AIB's wealth management arm, reported significant growth, with assets under management reaching €23.5 billion by the end of the first half of the year. This demonstrates a strong client uptake and successful execution of AIB's strategy to expand its presence in the wealth management sector.

Digital Transformation and Innovation

AIB Group's key activities heavily involve continuous investment in digital transformation. This includes adopting cutting-edge technologies like artificial intelligence and cloud computing to significantly improve customer experiences, optimize internal operations, and create innovative digital offerings. Think of it as constantly upgrading their digital toolbox to stay ahead.

Specific initiatives focus on enhancing online banking platforms and mobile app functionalities, making them more intuitive and user-friendly. Furthermore, AIB is integrating AI-powered digital assistants to provide quicker and more personalized customer support, aiming to resolve queries efficiently and improve overall satisfaction.

In 2024, AIB continued its digital push, with significant investments allocated to these areas. For instance, their digital channels saw a substantial increase in customer engagement, reflecting the success of these enhancements. These efforts are crucial for:

- Improving Customer Experience: Offering seamless digital interactions and personalized services.

- Streamlining Operations: Automating processes and increasing efficiency through technology.

- Developing New Digital Products: Creating innovative solutions that meet evolving customer needs.

- Enhancing Security: Implementing robust digital security measures to protect customer data.

Risk Management and Regulatory Compliance

AIB Group prioritizes comprehensive risk management, actively identifying and mitigating credit, operational, and market risks to safeguard financial stability. In 2024, AIB continued to invest in advanced risk analytics and controls, a critical component of its strategy given the evolving economic landscape.

Maintaining strict adherence to regulatory requirements and robust governance frameworks are paramount. This includes compliance with directives from the Central Bank of Ireland and other relevant authorities, ensuring AIB operates within legal and ethical boundaries. For instance, AIB's capital ratios remain strong, with its Common Equity Tier 1 (CET1) ratio consistently exceeding regulatory minimums, demonstrating its commitment to a sound financial footing.

- Robust Risk Mitigation: AIB's proactive approach to managing credit, operational, and market risks is a core activity, ensuring resilience.

- Regulatory Adherence: Strict compliance with financial regulations, including those from the Central Bank of Ireland, is fundamental to AIB's operations.

- Governance Excellence: Maintaining strong corporate governance practices underpins all of AIB's activities, fostering trust and accountability.

- Financial Stability: In 2024, AIB's CET1 ratio of 16.4% (as of Q1 2024) highlights its strong capital position, a testament to its effective risk management.

AIB Group's key activities are centered on providing a comprehensive suite of banking and financial services. This includes managing customer accounts, processing transactions, and offering a wide range of lending products to individuals and businesses. The group also actively engages in wealth management and investment services through its subsidiary, Goodbody, aiming to help clients grow their assets.

Continuous investment in digital transformation is a critical activity, enhancing customer experience and operational efficiency through technologies like AI and cloud computing. Furthermore, robust risk management and strict adherence to regulatory requirements are paramount, ensuring the group's financial stability and operational integrity.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Lending & Credit Management | Originating and managing diverse loan portfolios, from mortgages to corporate finance. | Total loans and advances to customers: €81.3 billion (end of 2023) |

| Wealth Management | Providing financial advice and investment products through Goodbody. | Assets under management by Goodbody: €23.5 billion (H1 2024) |

| Digital Transformation | Investing in technology to improve customer experience and operations. | Significant increase in customer engagement via digital channels (2024) |

| Risk Management & Compliance | Mitigating risks and adhering to regulatory frameworks. | CET1 ratio: 16.4% (Q1 2024) |

Preview Before You Purchase

Business Model Canvas

The AIB Group Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no surprises and full transparency. Once your order is complete, you'll gain immediate access to this comprehensive Business Model Canvas, ready for your strategic analysis and planning.

Resources

AIB Group's financial capital is its bedrock, encompassing significant customer deposits and a robust shareholder equity base. This substantial financial foundation, augmented by strong access to capital markets, is crucial for AIB's core lending operations and its ability to pursue strategic growth opportunities.

As of the end of 2023, AIB Group reported total customer deposits of €66.2 billion, underscoring its deep retail and business banking relationships. Shareholder equity stood at €11.5 billion, providing a solid buffer and capacity for expansion.

AIB Group's human capital, comprising over 10,000 skilled employees, is a cornerstone of its operations. This extensive workforce brings expertise to diverse banking functions, customer service, and specialized financial advisory, directly impacting service quality and business development.

AIB's commitment to its people is evident in its continuous investment in employee development programs and robust diversity and inclusion initiatives. These efforts cultivate a high-performing, adaptable workforce capable of navigating the evolving financial landscape.

AIB Group's technology infrastructure is a cornerstone of its operations, featuring robust IT systems and secure data centers that underpin its digital banking services. In 2024, the group continued to invest heavily in these areas to ensure reliability and scalability.

Digital platforms are critical for customer engagement, offering seamless access to banking products and services. AIB's commitment to enhancing these platforms aims to provide intuitive user experiences and drive digital adoption across its customer base.

The group leverages extensive customer data, processed through advanced analytics and AI tools, to personalize offerings and improve operational efficiencies. This data-driven approach is key to understanding customer needs and developing innovative banking solutions.

Brand Reputation and Customer Trust

AIB's brand reputation, a cornerstone of its business model, is deeply entrenched in Ireland and the UK. This reputation, forged over decades of reliable service, translates directly into customer trust, a critical intangible asset. In 2023, AIB reported high levels of customer satisfaction, a testament to this enduring trust.

This strong brand equity is instrumental in AIB's ability to attract and retain customers across its diverse service offerings. The bank's commitment to customer-centricity, evidenced by its consistently positive customer feedback, underpins its market position. For instance, in early 2024, AIB continued to be recognized for its customer service initiatives.

- Established Brand Reputation: AIB benefits from decades of service in Ireland and the UK, fostering significant customer trust.

- Customer Trust as an Asset: This trust is a vital intangible asset, directly impacting customer acquisition and retention.

- High Customer Satisfaction: Consistently high customer satisfaction scores in 2023 and early 2024 validate the strength of AIB's brand.

- Market Position: Brand equity and trust are key drivers for AIB's competitive advantage across all customer segments.

Physical Network (Branches & ATMs)

Despite the increasing digital adoption, AIB Group's physical network of branches and ATMs, especially its significant presence across Ireland, continues to be a cornerstone of its business model. This physical infrastructure ensures broad accessibility for customers, particularly for essential cash services and for those who prefer face-to-face interactions. As of the end of 2023, AIB operated a substantial network, underscoring its commitment to serving diverse customer needs through both digital and physical channels.

These physical touchpoints are crucial for fostering relationship-driven banking, catering to segments like small businesses and older customers who may rely more heavily on in-person services. The extensive branch network allows for personalized advice and support, reinforcing customer loyalty and trust. This dual approach, blending digital convenience with physical accessibility, is a key differentiator for AIB in the competitive Irish banking landscape.

- Extensive Branch Network: AIB maintains a significant physical branch presence across Ireland, serving as vital hubs for customer interaction and financial services.

- ATM Accessibility: The Group's ATM network provides convenient access to cash and other self-service banking functions for customers nationwide.

- Relationship Banking: Physical branches facilitate the building and maintenance of strong customer relationships, particularly important for business clients and personal banking needs.

- Digital Complementarity: While digital channels are growing, the physical network complements these by offering essential services and support, ensuring a comprehensive banking experience.

AIB Group's key resources are multifaceted, encompassing its substantial financial capital, a skilled and dedicated workforce, and a robust technological infrastructure. These elements are foundational to its ability to offer a comprehensive range of banking services and maintain its competitive edge in the market.

The group's financial strength, evidenced by significant customer deposits and shareholder equity, provides the necessary capital for lending and strategic investments. Complementing this is its human capital, with over 10,000 employees driving innovation and customer service. Furthermore, AIB's investment in advanced technology and digital platforms ensures efficient operations and enhanced customer experiences.

| Key Resource | Description | 2023/2024 Data/Facts |

| Financial Capital | Customer deposits and shareholder equity, access to capital markets. | Customer deposits: €66.2 billion (end 2023). Shareholder equity: €11.5 billion (end 2023). |

| Human Capital | Skilled employees, expertise in banking functions, customer service, and advisory. | Over 10,000 employees. Continuous investment in development and diversity initiatives. |

| Technology Infrastructure | Robust IT systems, secure data centers, digital platforms, data analytics, and AI tools. | Continued heavy investment in 2024 for reliability and scalability. Leverages customer data for personalization and efficiency. |

| Brand Reputation | Decades of reliable service in Ireland and the UK, fostering customer trust. | High levels of customer satisfaction reported in 2023 and early 2024. Recognized for customer service initiatives. |

| Physical Network | Branch and ATM network, particularly strong presence across Ireland. | Substantial network of branches and ATMs as of end 2023, ensuring broad accessibility and supporting relationship banking. |

Value Propositions

AIB Group provides a complete spectrum of financial services, acting as a single destination for all banking and investment needs. This includes everything from everyday personal accounts and mortgages to specialized corporate lending and sophisticated wealth management solutions.

This extensive product range serves a broad customer base, encompassing individuals seeking personal finance management, small and medium-sized enterprises requiring business growth capital, and large corporations needing complex financial structuring and international services.

In 2024, AIB Group reported a significant increase in its customer base across all segments, driven by the convenience of its integrated offerings. For instance, their retail banking division saw a 5% growth in new account openings, while corporate banking services expanded by 7% in terms of loan book value, underscoring the demand for their comprehensive financial solutions.

Customers enjoy a superior digital banking experience, featuring intuitive mobile apps and online portals, complemented by AI assistants for swift service access. This focus on digital convenience is a core value proposition for AIB Group.

AIB's commitment to digital innovation is evident in its continuous investment in technology. For instance, in 2023, AIB reported a significant increase in digital transactions, with over 70% of customer interactions occurring through digital channels, highlighting the success of their enhanced digital offerings.

The bank's ongoing digital transformation ensures that both routine banking tasks and more complex financial operations are handled with seamless efficiency and cutting-edge solutions, directly benefiting the end-user.

AIB Group distinguishes itself through specialized expertise and a relationship-centric approach, especially within its corporate and commercial banking divisions. This means clients benefit from deep sector knowledge and financial advice crafted specifically for their needs, fostering trust and long-term partnerships.

This personalized service is a cornerstone of AIB's strategy, enabling them to effectively support client growth and financial objectives. For instance, in 2023, AIB reported a strong performance in its corporate banking segment, with net lending increasing by 3% year-on-year, reflecting successful client engagement and tailored solutions.

Commitment to Sustainability

AIB Group actively champions sustainability by offering a suite of green financial products. This includes initiatives like green mortgages and dedicated climate action funds, designed to assist both individuals and businesses in their transition towards a lower-carbon future.

This focus on eco-friendly finance strongly appeals to a growing segment of environmentally aware customers and corporations. By providing financial solutions that align with Environmental, Social, and Governance (ESG) objectives, AIB Group positions itself as a partner in achieving sustainability goals.

As of 2024, AIB's commitment is reflected in tangible actions:

- AIB Green Mortgage: Offering preferential rates for energy-efficient homes, encouraging sustainable housing choices.

- Climate Action Funds: Investing in businesses and projects that drive decarbonization and environmental solutions.

- Sustainability Reporting: Transparently detailing progress towards ESG targets, building trust with stakeholders.

Financial Security and Stability

AIB Group, as a well-established and regulated financial institution, offers a significant value proposition of financial security and stability to its customers. This is particularly crucial in the banking sector where trust and reliability are fundamental. Customers can be confident that their deposits and investments are safeguarded by robust regulatory frameworks and AIB's strong financial standing.

This inherent stability is a cornerstone of AIB's appeal, especially during times of economic uncertainty. In 2024, AIB maintained a strong capital position, with its Common Equity Tier 1 (CET1) ratio reported at 13.9% as of the first half of 2024, well above regulatory requirements. This demonstrates AIB's resilience and its capacity to absorb potential shocks, reassuring customers about the safety of their funds.

- Regulatory Compliance: AIB operates under strict regulatory oversight from the Central Bank of Ireland and other relevant authorities, ensuring adherence to stringent capital adequacy and liquidity requirements.

- Strong Capital Ratios: Maintaining healthy capital ratios, such as the aforementioned CET1 ratio, signifies AIB's financial strength and its ability to withstand economic downturns.

- Deposit Protection: Customer deposits are protected by the Ireland Deposit Guarantee Scheme, which guarantees eligible deposits up to €100,000 per depositor, per bank, providing an additional layer of security.

AIB Group offers a comprehensive suite of financial services, acting as a one-stop shop for all banking and investment needs, from personal accounts to complex corporate solutions.

This broad offering caters to a diverse clientele, including individuals, SMEs, and large corporations, ensuring tailored financial support for each segment.

The bank's commitment to digital innovation provides customers with a seamless and efficient banking experience through intuitive apps and AI-powered assistance.

AIB's focus on specialized expertise and relationship building, particularly in corporate banking, fosters trust and long-term partnerships by offering tailored advice.

Furthermore, AIB champions sustainability by providing green financial products, aligning with the growing demand for environmentally conscious banking solutions.

AIB Group's value proposition is significantly bolstered by its reputation for financial security and stability, underpinned by strong capital ratios and regulatory compliance.

In the first half of 2024, AIB maintained a robust Common Equity Tier 1 (CET1) ratio of 13.9%, exceeding regulatory minimums and reinforcing customer confidence.

| Value Proposition | Description | Supporting Data (2024 unless stated) |

|---|---|---|

| Comprehensive Financial Services | One-stop shop for all banking and investment needs. | 5% growth in retail new accounts; 7% expansion in corporate loan book value. |

| Digital Excellence | Seamless and efficient banking via intuitive apps and AI. | Over 70% of customer interactions via digital channels (2023 data). |

| Specialized Expertise & Relationships | Deep sector knowledge and tailored advice, especially for corporate clients. | 3% year-on-year increase in corporate net lending (2023 data). |

| Sustainability Focus | Offering green financial products and supporting ESG goals. | Launch of AIB Green Mortgage and Climate Action Funds. |

| Financial Security & Stability | Trust and reliability backed by strong capital and regulation. | CET1 ratio of 13.9% (H1 2024); Deposits protected by Ireland Deposit Guarantee Scheme. |

Customer Relationships

For its corporate, commercial, and wealth management clients, AIB Group champions a personalized relationship management strategy. Dedicated relationship managers are assigned to offer tailored advice and bespoke solutions, fostering a high-touch client experience.

This approach is built on a deep understanding of individual client needs, aiming to cultivate enduring, trust-based partnerships. In 2024, AIB reported a strong focus on client retention, with its relationship management model contributing to a significant portion of its new business generation.

AIB Group empowers customers with extensive self-service options across its digital channels. This includes sophisticated online banking portals and intuitive mobile applications, allowing for seamless account management, transaction processing, and information retrieval. In 2024, AIB reported a significant increase in digital transaction volumes, with over 80% of customer interactions occurring through these self-service platforms, highlighting their widespread adoption and effectiveness.

AIB actively nurtures its customer relationships by embedding itself within local communities. In 2024, the bank continued its sponsorship of the GAA All-Ireland Football Championship, a significant cultural touchstone in Ireland, reaching millions of fans and reinforcing its brand presence. This deep engagement goes beyond financial services, building trust and fostering a sense of shared identity with its customer base.

Automated Service and Support

AIB Group is enhancing customer relationships through sophisticated automated service and support channels. These systems, often powered by artificial intelligence, are designed to handle a significant volume of routine customer inquiries swiftly and accurately, ensuring a consistent service experience.

This automation is crucial for efficiency, allowing AIB to address common questions and requests without delay. For instance, in 2023, AIB reported a substantial increase in digital engagement, with millions of customer interactions handled through their mobile app and online platforms, many of which are automated.

- Increased Efficiency: Automated systems resolve a higher percentage of customer queries, reducing wait times.

- AI-Powered Support: AI chatbots and virtual assistants provide instant responses to frequently asked questions.

- Resource Optimization: Human support staff are freed up to manage more complex or sensitive customer issues.

- 24/7 Availability: Automated support ensures customers can receive assistance at any time, day or night.

Direct Customer Support (Call Centres & Branches)

AIB Group continues to leverage direct customer support through its call centres and physical branch network, acknowledging that while digital channels are prevalent, traditional touchpoints remain crucial. This strategy ensures that customers with complex needs or those who prefer face-to-face interaction can still access personalized assistance and resolve issues effectively. This blended approach is vital for maintaining strong customer relationships and catering to a broad spectrum of preferences.

In 2024, AIB reported that a significant portion of customer queries were still handled through their contact centres, demonstrating the ongoing reliance on these channels. For instance, their call centres managed millions of inbound calls annually, with a focus on resolving a wide array of banking inquiries and providing guidance on financial products. The branch network, though evolving, continues to serve as a vital hub for more involved transactions and personalized financial advice, reinforcing AIB's commitment to accessibility.

- Branch Network Presence: AIB maintained a substantial branch footprint across Ireland in 2024, offering in-person banking services and expert financial advice.

- Call Centre Volume: Millions of customer calls were handled annually by AIB's call centres, addressing inquiries ranging from account management to loan applications.

- Customer Preference: The continued high volume through traditional channels highlights the enduring customer preference for direct interaction for specific banking needs.

- Issue Resolution: Direct support channels are critical for resolving complex issues that may not be easily addressed through self-service digital platforms.

AIB Group cultivates customer relationships through a multi-faceted approach, blending personalized relationship management for corporate clients with extensive digital self-service options for all. This strategy is reinforced by community engagement and the strategic use of automated support for efficiency, while still valuing direct interaction through call centres and branches for complex needs.

| Relationship Channel | 2024 Focus/Activity | Customer Impact/Data |

|---|---|---|

| Personalized Relationship Management | Tailored advice and bespoke solutions for corporate, commercial, and wealth management clients. | Contributed to significant new business generation; fosters trust-based partnerships. |

| Digital Self-Service | Online banking portals and mobile applications for seamless account management. | Over 80% of customer interactions via digital channels in 2024; significant increase in digital transaction volumes. |

| Community Engagement | Sponsorship of cultural events like the GAA All-Ireland Football Championship. | Reinforces brand presence and builds trust through shared identity. |

| Automated Support | AI-powered chatbots and virtual assistants for swift query resolution. | Handles routine inquiries efficiently, freeing up human staff for complex issues; 24/7 availability. |

| Direct Customer Support | Call centres and physical branches for complex needs and preferred interaction. | Millions of inbound calls handled annually; branches serve as hubs for involved transactions and advice. |

Channels

AIB's extensive branch network in Ireland and the UK provides a vital physical touchpoint for customers. This network facilitates face-to-face interactions, offering personalized advice and handling essential cash transactions. As of the end of 2023, AIB operated approximately 170 branches across Ireland, a cornerstone of its customer engagement strategy.

AIB's digital banking platforms, encompassing its online portal and mobile app, serve as the core for customer interaction, allowing for seamless transactions, account management, and remote service access. These channels are consistently updated to boost user experience and introduce new features, reflecting a commitment to digital innovation.

In 2023, AIB reported a significant increase in digital engagement, with over 1.5 million active digital customers. The mobile app alone saw a 20% year-over-year increase in transaction volume, highlighting its growing importance in customer banking habits.

ATMs and self-service kiosks are vital for AIB Group, offering customers 24/7 access to essential banking functions like cash withdrawals and deposits. These machines are crucial for maintaining accessibility, especially for routine transactions, complementing both their digital offerings and physical branch presence.

In 2024, AIB Group continued to invest in its ATM network to ensure widespread availability. While specific transaction numbers are proprietary, the industry trend shows a sustained reliance on ATMs for cash services, with reports indicating millions of transactions processed annually across major banking networks in Ireland.

Customer Contact Centres

AIB Group's customer contact centres are pivotal for direct customer engagement, offering telephonic support for inquiries, issue resolution, and assistance across their banking product suite. These centers are increasingly leveraging digital integration, notably AI-powered assistants, to streamline operations and improve customer experience.

In 2024, AIB continued to invest in its contact centre capabilities, aiming to enhance both efficiency and customer satisfaction. For instance, a significant portion of customer queries are now handled through digital channels, freeing up human agents for more complex issues.

- Telephonic Support: Dedicated teams provide direct assistance for a wide range of banking needs.

- Digital Integration: AI chatbots and virtual assistants handle routine queries, improving response times.

- Issue Resolution: Contact centres are equipped to resolve a variety of customer banking problems efficiently.

- Product Assistance: Customers receive guidance and support for AIB's diverse banking products and services.

Partnership Networks and Tied Agents

AIB Group actively utilizes partnership networks, including mortgage brokers and insurance providers, to expand its product distribution and customer reach. These collaborations are crucial for extending AIB's market penetration beyond its direct channels.

In 2024, the banking sector continued to see significant reliance on intermediary channels for product sales. For instance, mortgage brokers played a vital role in the UK mortgage market, with estimates suggesting they facilitated over 75% of all new mortgages in the first half of 2024. This highlights the importance of such partnerships for financial institutions like AIB.

- Mortgage Brokers: Facilitate access to AIB's mortgage products for a wider range of borrowers.

- Insurance Providers: Enable cross-selling of insurance products, enhancing customer value propositions.

- Payment Service Networks: Streamline transaction processing and expand digital payment offerings.

AIB Group employs a multi-channel strategy to connect with its diverse customer base, blending physical presence with digital convenience. This approach ensures accessibility for various banking needs, from routine transactions to complex financial advice.

The bank's extensive branch network, complemented by ATMs, provides essential physical touchpoints. Simultaneously, robust digital platforms and responsive contact centres cater to evolving customer preferences for remote and immediate service.

Strategic partnerships further broaden AIB's reach, enabling wider product distribution and customer acquisition.

| Channel | Description | Key 2023/2024 Data/Trends |

|---|---|---|

| Branches | Physical presence for face-to-face service and cash transactions. | Approx. 170 branches in Ireland (end of 2023). |

| Digital Platforms (Online & Mobile) | Seamless transactions, account management, remote service access. | Over 1.5 million active digital customers (2023); 20% YoY increase in mobile app transaction volume. |

| ATMs & Kiosks | 24/7 access for cash withdrawals, deposits, and essential functions. | Continued investment in network availability in 2024; millions of transactions processed annually across networks. |

| Contact Centres | Telephonic support for inquiries, issue resolution, and product assistance. | Increased digital integration, including AI assistants; focus on efficiency and customer satisfaction. |

| Partnerships (Brokers, etc.) | Expanded product distribution and customer reach through intermediaries. | Mortgage brokers facilitated >75% of new mortgages in UK (H1 2024); crucial for market penetration. |

Customer Segments

AIB's personal banking customers represent a core segment, encompassing individuals and households utilizing a wide array of everyday financial services. This includes essential offerings like current and savings accounts, personal loans, mortgages, and credit cards, catering to diverse financial needs across the population.

The group's reach extends across a broad demographic spectrum. From young adults opening their first bank accounts and first-time homebuyers securing mortgages, to established homeowners managing multiple financial products, AIB aims to be a partner throughout their financial journey.

In 2024, AIB reported a significant portion of its customer base falling into this personal banking category, with millions of current accounts actively managed. This segment is crucial for AIB's retail deposit base and loan origination volumes, underscoring its importance to the group's overall financial health and market presence.

AIB Group recognizes Small and Medium-sized Enterprises (SMEs) as a vital customer segment, providing a comprehensive suite of financial products. These include essential business accounts, flexible commercial loans, accessible overdraft facilities, and efficient payment solutions designed to support their day-to-day operations and growth aspirations.

This segment is particularly important for driving local economic expansion, with AIB offering specialized financial advice to help these businesses navigate their unique challenges and opportunities. For instance, in 2023, SMEs accounted for over 99% of all businesses in Ireland, highlighting their significant contribution to the national economy and AIB's strategic focus on supporting them.

AIB's corporate and commercial segment caters to a broad range of large businesses, from multinational corporations to local enterprises. These clients often require sophisticated financial services such as corporate lending, tailored treasury solutions, and expert advice on capital markets. AIB leverages its deep sector knowledge to provide these specialized offerings.

In 2023, AIB's Net Interest Income (NII) for its Irish banking division, which heavily serves this segment, reached €2.2 billion, demonstrating the significant scale of its operations with corporate clients. The bank actively engages in providing complex financing structures and advisory services to support the growth and strategic objectives of these entities.

Wealth Management Clients

AIB's wealth management client segment primarily comprises high-net-worth individuals and families who require sophisticated investment advice, comprehensive portfolio management, and personalized private banking services. These clients often seek to preserve and grow their capital, plan for intergenerational wealth transfer, and access exclusive financial opportunities.

AIB caters to this segment through its dedicated wealth management offerings and strategic partnerships, notably with its subsidiary Goodbody. Goodbody, a leading Irish stockbroker and wealth manager, provides AIB clients with access to expert financial planning, investment strategies, and a broad range of financial products. This integrated approach allows AIB to deliver tailored solutions that meet the complex needs of its affluent clientele.

In 2024, the demand for personalized wealth management services continued to rise, driven by economic uncertainties and a growing desire for expert guidance. AIB's focus on building long-term relationships and offering a holistic suite of services positions it well to capture a significant share of this market. For instance, Goodbody reported strong growth in assets under management in recent years, reflecting the increasing trust placed in its advisory capabilities by discerning clients.

- Target Audience High-net-worth individuals and families seeking expert financial guidance.

- Services Offered Investment advice, portfolio management, private banking, and estate planning.

- Key Partnerships Integration with Goodbody for specialized wealth management solutions.

- Market Focus Capital preservation, wealth growth, and intergenerational wealth transfer.

Green and Sustainable Finance Seekers

Green and Sustainable Finance Seekers represent a rapidly expanding customer base for AIB. This segment is characterized by a strong commitment to environmental, social, and governance (ESG) principles, actively looking for financial products that align with their values. They are particularly interested in solutions that support climate action and the transition to a low-carbon economy.

AIB is strategically catering to these clients by offering a range of specialized financial instruments. These include green mortgages designed to incentivize energy-efficient home purchases, climate action loans that fund environmentally beneficial projects, and dedicated financing options for renewable energy installations and sustainable infrastructure development. This focus reflects a growing market demand, with sustainable finance experiencing significant growth globally.

- Growing Market Demand: The global sustainable finance market is projected to reach trillions of dollars, with increasing investor and consumer preference for ESG-aligned products.

- AIB's Green Mortgage Offering: AIB's green mortgage initiative offers preferential rates for homes with high energy efficiency ratings, encouraging sustainable homeownership.

- Climate Action Loans: These loans support businesses and individuals in undertaking projects such as solar panel installation, electric vehicle fleet upgrades, and energy efficiency retrofits.

- Focus on Renewable Energy: AIB provides financing solutions for wind, solar, and other renewable energy projects, contributing to Ireland's renewable energy targets.

AIB's customer segments are diverse, ranging from individuals and SMEs to large corporations and a growing base focused on sustainable finance. The bank offers tailored financial products and services to meet the unique needs of each group, from everyday banking to complex corporate lending and wealth management.

Cost Structure

Staff costs represent a major component of AIB Group's expenses, encompassing salaries, benefits, and other compensation for its extensive employee base. This includes remuneration for frontline branch personnel, crucial back-office support teams, and highly skilled financial experts across various departments. For instance, in 2023, AIB reported staff-related expenses of approximately €1.2 billion, reflecting the significant investment in its human capital.

AIB Group's cost structure heavily features ongoing, substantial investments in technology and digital initiatives. This includes significant expenditure on IT infrastructure, driving digital transformation, acquiring software licenses, bolstering cybersecurity measures, and maintaining its digital platforms. For instance, in 2023, AIB announced plans to invest €1 billion in technology over the next five years, underscoring the critical role these costs play in their strategy.

These technology outlays are not merely operational expenses but are fundamental to AIB's ability to innovate and deliver competitive digital services to its customers. This commitment ensures they remain at the forefront of the digital banking landscape, a key differentiator in today's market.

AIB Group's significant investment in its physical branch network translates into substantial fixed costs. These include expenses for rent, utilities, and ongoing property maintenance across its numerous locations, contributing to a considerable portion of its operational overhead.

Even with the increasing prevalence of digital banking, AIB continues to incur significant expenses related to its physical infrastructure. In 2023, AIB reported property expenses of €233 million, reflecting the ongoing commitment to maintaining its branch presence.

Regulatory and Compliance Costs

AIB Group faces substantial regulatory and compliance costs, a necessary expense to navigate the intricate financial sector. These costs are driven by the need to adhere to evolving legal and ethical standards, ensuring the bank operates responsibly and maintains trust with stakeholders. In 2024, the banking industry, including AIB, continued to see significant investment in compliance functions.

Key components of these costs include:

- Salaries for compliance teams: Employing legal experts, risk managers, and compliance officers to monitor and implement regulatory changes.

- Technology for reporting: Investing in systems and software to accurately generate and submit regulatory reports to authorities.

- Regulatory fees and levies: Payments made to financial regulators for oversight and supervision, which can fluctuate based on economic conditions and new mandates.

For instance, in 2023, European banks collectively spent billions on regulatory compliance, a trend that is expected to persist. These expenditures are not merely operational but are foundational to AIB's license to operate and its long-term stability.

Marketing and Sales Expenses

AIB Group's cost structure includes significant expenditure on marketing and sales. This covers everything from broad advertising campaigns and brand promotion to the direct costs associated with their sales force activities. These investments are crucial for attracting new customers and effectively promoting their diverse range of banking products, ultimately driving customer acquisition and maintaining a strong market presence.

In 2024, AIB Group continued to invest heavily in marketing and sales to bolster its customer base and product offerings. For instance, their digital marketing efforts, including social media engagement and targeted online advertising, represent a substantial portion of this expenditure. The bank also maintains a dedicated sales force across its branches and through specialized channels, incurring costs for salaries, commissions, and training.

- Marketing Campaigns: Expenditures on national and regional advertising, digital marketing, and sponsorships.

- Sales Force Costs: Salaries, commissions, and training for branch staff and dedicated sales personnel.

- Brand Promotion: Investment in public relations, corporate social responsibility initiatives, and brand building activities.

- Customer Acquisition Costs: Expenses directly tied to acquiring new accounts and customers through various channels.

AIB Group's cost structure is characterized by significant investments in its people, technology, and physical presence. Staff costs, including salaries and benefits for its large workforce, represented a substantial portion of expenses. For example, in 2023, staff-related expenses were around €1.2 billion. Technology investments, such as a €1 billion commitment over five years starting in 2023, are crucial for digital transformation and innovation. The bank also incurs considerable fixed costs associated with its extensive branch network, with property expenses amounting to €233 million in 2023.

| Cost Category | 2023 Data (Approximate) | Key Drivers |

| Staff Costs | €1.2 billion | Salaries, benefits, compensation for employees |

| Technology Investment | €1 billion (over 5 years from 2023) | Digital transformation, IT infrastructure, cybersecurity |

| Property Expenses | €233 million | Rent, utilities, maintenance of physical branches |

Revenue Streams

Net Interest Income (NII) is AIB Group's fundamental revenue engine. It's the profit AIB makes from the spread between the interest it earns on loans and investments and the interest it pays out on customer deposits and other borrowings. This core activity directly fuels the bank's profitability.

In 2023, AIB reported a robust Net Interest Income of €3.7 billion, a significant increase from previous periods. This highlights the bank's ability to effectively manage its lending and deposit portfolios to generate substantial income from interest rate differentials.

AIB Group derives substantial income from a variety of fees and commissions. These include revenue generated from card services, wealth management offerings, insurance products, payment processing, and advisory services.

This diverse fee and commission income is crucial as it helps to diversify AIB’s revenue streams, making them less sensitive to fluctuations in interest rates. For instance, in 2023, AIB reported a significant portion of its income came from non-interest income, reflecting the importance of these fee-based services.

AIB Group generates significant revenue through lending fees and charges. This includes fees for originating loans, arrangement fees for corporate finance deals, and various other charges tied to its diverse lending products. These fees are a crucial component of the income generated from its substantial loan portfolio.

In 2024, AIB Group's net interest income, which is closely linked to its lending activities, remained robust. For instance, the bank reported a net interest income of €2.7 billion for the first nine months of 2024, demonstrating the consistent contribution of its lending book to its financial performance.

Wealth Management and Investment Product Sales

Income from wealth management services, encompassing asset management fees, brokerage commissions, and the sale of various investment products, is a key component of AIB Group's non-interest income. This revenue stream highlights the expanding capabilities and market penetration of AIB's wealth management division.

In 2024, AIB's focus on growing its wealth management offerings has demonstrably paid off, contributing significantly to its overall financial performance. The bank has seen a healthy uptick in assets under management, directly translating into higher fee-based income.

- Asset Management Fees: Generated from managing client portfolios.

- Brokerage Fees: Earned on facilitating client trades in securities.

- Investment Product Sales: Revenue from selling mutual funds, bonds, and other financial instruments.

Foreign Exchange and Treasury Income

AIB Group generates significant revenue from foreign exchange (FX) transactions and its treasury operations. This income stems from facilitating currency exchanges for customers and managing the bank's own financial exposures.

Treasury activities also contribute substantially, encompassing the bank's management of its liquidity and interest rate positions. For instance, AIB Group's net interest income, a key component of treasury earnings, reached €3.2 billion in 2023, reflecting strong performance in managing its balance sheet.

- Foreign Exchange Income: Revenue from facilitating client FX transactions.

- Treasury Operations: Income generated from managing the bank's liquidity and interest rate risks.

- Financial Market Activities: Broader income from other market-related operations.

- Net Interest Income: A significant contributor, reflecting effective balance sheet management, with €3.2 billion reported in 2023.

AIB Group's revenue streams are diverse, extending beyond its core Net Interest Income. Fee and commission income plays a vital role, encompassing revenues from card services, wealth management, insurance, and payment processing. This diversification helps mitigate risks associated with interest rate fluctuations.

In 2023, AIB Group's Net Interest Income reached €3.7 billion, underscoring the strength of its lending and deposit operations. Furthermore, the bank's fee and commission income demonstrated a healthy contribution, reflecting the success of its expanded service offerings and customer engagement strategies.

The bank also generates income from lending fees and charges, including origination and arrangement fees. Wealth management services, such as asset management and brokerage, are increasingly important revenue contributors, with significant growth observed in assets under management in 2024.

| Revenue Stream | 2023 (EUR Billion) | 2024 (YTD - EUR Billion) | Key Drivers |

|---|---|---|---|

| Net Interest Income | 3.7 | 2.7 (9 months) | Lending volume, deposit base, interest rate spreads |

| Fee & Commission Income | Significant portion of total | Growing | Card services, wealth management, insurance, payments |

| Lending Fees & Charges | Substantial | Consistent | Loan origination, corporate finance arrangements |

| Wealth Management Income | Growing | Healthy uptick in AUM | Asset management, brokerage, investment product sales |

Business Model Canvas Data Sources

The AIB Group Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. This ensures each component accurately reflects current business operations and market positioning.