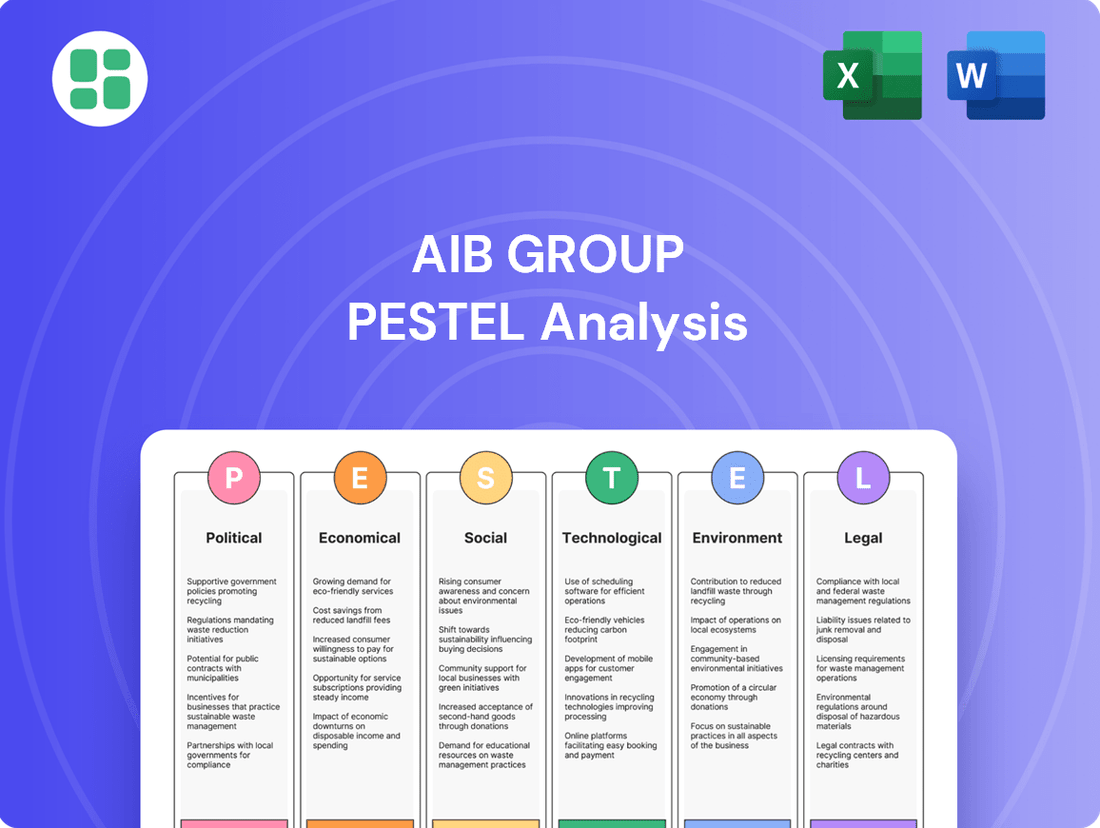

AIB Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIB Group Bundle

Navigate the complex external forces impacting AIB Group with our comprehensive PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental factors shaping its strategic landscape. Equip yourself with the knowledge to anticipate challenges and seize opportunities. Download the full report for actionable intelligence to drive your own strategic planning.

Political factors

The Irish government's ongoing divestment from AIB Group remains a key political consideration. Recent reports indicate a clear trajectory towards full private ownership, a process that directly impacts investor sentiment and the bank's operational independence. This gradual reduction in state holdings is a significant political factor shaping AIB's future.

The anticipated return to full private ownership by June 2025 represents a pivotal moment for AIB Group. This transition signals a new era for the bank, free from direct government influence and potentially opening up new avenues for strategic partnerships and capital allocation.

The stability of regulatory oversight from institutions like the Central Bank of Ireland and the Bank of England is crucial for AIB Group. This consistent supervision, including the European Central Bank's Supervisory Review and Evaluation Process (SREP), fosters a predictable operational environment. For instance, in 2024, the ECB's SREP assessments continued to guide capital requirements and risk management practices for major European banks, including AIB.

Broader geopolitical tensions, such as ongoing conflicts and shifting global alliances, can indirectly impact AIB by creating economic instability. For instance, disruptions to international trade routes and supply chains, as seen in recent global events, can increase inflation and dampen business confidence in key markets like Ireland and the UK. This uncertainty can lead to reduced consumer spending and investment, affecting the overall economic environment in which AIB operates.

While AIB's primary focus remains on its domestic operations in Ireland, global events significantly shape the economic outlook. For example, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight increase from 3.0% in 2023, but noted that risks remain tilted to the downside due to persistent inflation and geopolitical fragmentation. Such global economic headwinds can influence consumer behaviour and business investment decisions within Ireland, creating a less predictable operating landscape for AIB.

Government Initiatives and Support

Government policies aimed at fostering economic growth, supporting specific sectors, or promoting green finance directly influence AIB's strategic priorities and lending activities. For instance, in 2023, Ireland's GDP grew by an estimated 5.5%, indicating a supportive economic environment for banking operations.

AIB actively aligns with national objectives, such as contributing to Ireland's economic success and supporting the transition to a greener future. The bank's commitment is evident in initiatives like its Climate Action Fund, which aims to support sustainable projects and businesses.

- Government Support for SMEs: Policies encouraging small and medium-sized enterprises (SMEs) can boost lending demand, a core business for AIB. In 2024, the Irish government continued to roll out measures to support SMEs navigating economic shifts.

- Green Finance Mandates: Increasing regulatory focus on Environmental, Social, and Governance (ESG) factors, particularly in green finance, shapes AIB's product development and investment strategies.

- Economic Growth Targets: National economic growth targets, such as those outlined in Ireland's National Development Plan, provide a framework within which AIB operates and sets its own growth objectives.

Taxation and Fiscal Policy

Changes in government taxation policies, including bank levies and other fiscal measures, directly impact AIB's profitability and financial planning. For instance, Ireland's 2024 budget maintained the bank levy, which AIB had previously estimated would cost €20 million annually. This stability in fiscal policy is crucial for AIB's long-term strategic planning, allowing for more predictable cost management.

The bank anticipates specific amounts for bank levies and regulatory fees, which are factored into its operational cost considerations. These levies, while a cost, are a known variable that AIB incorporates into its financial projections. This proactive approach to anticipated fiscal burdens helps in maintaining financial resilience.

- Bank Levy Impact: AIB's annual bank levy was estimated at €20 million in its 2023 reporting, a figure expected to continue influencing operational costs.

- Fiscal Stability: Predictable government fiscal policies, such as the consistent application of bank levies, are vital for AIB's strategic financial forecasting and investment decisions.

- Cost Management: AIB actively incorporates anticipated regulatory fees and levies into its budgeting process to manage operational expenses effectively.

The Irish government's planned full divestment from AIB Group by June 2025 is a significant political shift, moving the bank towards complete private ownership. This transition will alter its relationship with the state and potentially influence its strategic direction and capital structure. Continued government support for SMEs, a key lending segment for AIB, is also a crucial political factor influencing demand for banking services.

Fiscal policies, such as the bank levy, directly impact AIB's profitability. For instance, the levy was estimated to cost AIB €20 million annually in 2023, a predictable cost factored into its financial planning. Furthermore, government initiatives promoting green finance and economic growth targets, like those in Ireland's National Development Plan, shape AIB's strategic priorities and lending activities.

| Political Factor | Description | Impact on AIB | Relevant Data/Context |

| Government Divestment | Planned full divestment by June 2025 | Transition to private ownership, potential strategic shifts | Target completion date: June 2025 |

| SME Support Policies | Government measures to aid small and medium-sized enterprises | Boosts lending demand, a core AIB business | Ongoing government initiatives in 2024 |

| Bank Levy | Government taxation on banking operations | Directly affects profitability and financial planning | Estimated annual cost: €20 million (2023) |

| Green Finance Focus | Government promotion of sustainable finance | Shapes product development and investment strategies | Alignment with national climate action goals |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the AIB Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats within the AIB Group's operating landscape.

A concise PESTLE analysis for AIB Group acts as a pain point reliver by offering a clear, summarized version of complex external factors for easy referencing during critical meetings and strategic planning sessions.

Economic factors

Interest rate fluctuations, largely dictated by the European Central Bank (ECB) and the Bank of England, directly influence AIB Group's Net Interest Income (NII) and Net Interest Margin (NIM). For instance, in 2023, AIB reported a net interest income of €3.1 billion, a notable increase driven by higher interest rates compared to the previous year.

While lower interest rates previously presented challenges, leading to a decrease in NII, AIB has demonstrated resilience by offsetting this impact with increased loan volumes. This strategic approach has helped maintain a stable outlook for NII even within a less favorable rate environment.

AIB Group's performance is significantly tied to the economic growth trajectories of both Ireland and the UK. In Ireland, the economy has shown remarkable resilience, consistently outperforming the Eurozone average. For instance, Ireland's GDP growth was projected to be around 5.5% in 2024, a strong indicator of robust domestic demand and healthy employment levels, which directly benefits AIB's lending and customer activity.

The UK economy, while facing its own set of challenges, also presents opportunities and risks for AIB. Economic growth in the UK, though more moderate compared to Ireland, still influences AIB's operations there. Forecasts for UK GDP growth in 2024 hovered around 1.5%, indicating a stable, albeit slower, expansion that supports AIB's market presence and customer base.

Inflation rates significantly impact AIB Group's performance by influencing both consumer spending and business investment. As of late 2024, Ireland's inflation rate, while moderating from previous peaks, remained a key consideration for household budgets and business cost management.

Consumer spending patterns are directly tied to inflation and interest rate environments. While Irish households have demonstrated a degree of resilience, the persistent pressure of higher living costs and increased borrowing expenses can strain borrowers' ability to meet loan obligations, potentially affecting loan performance for AIB.

Despite inflationary pressures, forecasts for 2025 suggest a supportive outlook for consumer spending in Ireland, driven by anticipated real income growth and potential tax adjustments. This economic backdrop is crucial for AIB's deposit growth and overall business resilience.

Loan Book Growth and Asset Quality

AIB Group's financial health is significantly influenced by its loan book expansion, with notable strength in mortgages and corporate lending. Green lending is also a key area of focus for growth.

While overall lending is progressing, certain initiatives, such as climate capital deployment, have seen a slower uptake than initially projected. This indicates a need for strategic adjustments in those specific segments.

Crucially, AIB maintains strong asset quality, supported by prudent and proactive credit impairment provisions. This forward-looking approach helps mitigate potential risks.

- Loan Book Growth Drivers: Mortgages, corporate lending, and green finance are primary contributors to AIB's expanding gross loan book.

- Segment Performance: While overall lending grows, climate capital initiatives have experienced slower-than-expected expansion.

- Asset Quality: AIB's asset quality remains robust, underpinned by conservative and forward-looking credit impairment charges.

Capital Position and Shareholder Returns

AIB Group consistently demonstrates a robust capital position, significantly exceeding regulatory thresholds. This financial strength empowers the bank to not only underwrite new lending but also to facilitate substantial distributions to its shareholders, reflecting a healthy balance between growth and shareholder value.

Key metrics like return on tangible equity (ROTE) and the bank's capital generation capabilities serve as crucial indicators of AIB's underlying financial health. These figures underscore its capacity to generate sustainable returns and maintain financial resilience.

- Capital Strength: AIB's Common Equity Tier 1 (CET1) ratio was 15.8% at the end of 2023, well above the regulatory minimums.

- Shareholder Distributions: The bank proposed a final dividend of €0.17 per share for 2023, alongside a share buyback program, signaling confidence in its capital generation.

- ROTE Performance: AIB reported a ROTE of 12.7% for 2023, demonstrating effective deployment of shareholder capital.

- Capital Generation: The group generated approximately €1.3 billion in capital in 2023, reinforcing its ability to support growth and returns.

Economic growth in both Ireland and the UK significantly impacts AIB Group's performance, influencing lending volumes and customer activity.

Interest rate changes, driven by the ECB and Bank of England, directly affect AIB's net interest income and margin, with higher rates boosting income as seen in 2023's €3.1 billion net interest income.

Inflation and consumer spending patterns are closely linked, with persistent inflation potentially straining borrower repayment abilities, though forecasts for 2025 suggest supportive consumer spending in Ireland.

AIB's robust capital position, with a CET1 ratio of 15.8% at the end of 2023, allows for new lending and shareholder distributions, supported by a 2023 ROTE of 12.7%.

| Metric | 2023 Value | Significance for AIB |

| Net Interest Income | €3.1 billion | Directly impacted by interest rate movements; increased in 2023 due to higher rates. |

| Irish GDP Growth (Projected 2024) | ~5.5% | Indicates strong domestic demand, benefiting AIB's lending and customer activity. |

| UK GDP Growth (Projected 2024) | ~1.5% | Suggests stable, albeit slower, economic expansion supporting AIB's UK market presence. |

| CET1 Ratio (End 2023) | 15.8% | Demonstrates strong capital buffer, exceeding regulatory requirements and enabling growth. |

| Return on Tangible Equity (ROTE) | 12.7% | Indicates effective deployment of shareholder capital and sustainable returns. |

Preview Before You Purchase

AIB Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of AIB Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization. It provides a detailed understanding of the external forces shaping AIB Group's strategic landscape.

Sociological factors

AIB Group serves a broad customer base of 3.35 million individuals, and staying attuned to their changing needs is a core part of AIB's approach. For instance, the increasing activity of first-time buyers in the mortgage market directly shapes how AIB develops new products and aims to grow its market share.

Consumer trust in financial institutions like AIB is a bedrock of their business, heavily shaped by past economic events and the ongoing quality of service. For instance, a 2024 survey indicated that over 60% of consumers cite trust as a primary driver when choosing a bank, a figure that has remained consistently high following periods of financial uncertainty.

AIB actively works to bolster this trust by prioritizing an enhanced customer experience and cultivating deeper relationships. Their investment in digital channels, such as a 15% increase in mobile banking feature development in 2024, directly addresses evolving consumer preferences for convenient and accessible banking, aiming to build loyalty through reliable service delivery.

The widespread adoption of hybrid working models, accelerated by events in 2020 and continuing through 2024, significantly reshapes AIB Group's operational landscape. This societal trend impacts not only AIB's internal workforce management, influencing office space utilization and employee engagement strategies, but also its client interactions.

For instance, a significant portion of AIB's corporate clients are also embracing hybrid models, altering their demand for business banking services and potentially influencing their property needs. This shift necessitates AIB to adapt its service delivery, balancing the convenience of digital banking platforms with the continued relevance of physical branch access for certain client segments and transactions.

By mid-2024, reports indicated that over 60% of Irish businesses surveyed were offering some form of hybrid work arrangement, a figure that has steadily climbed since 2022. This societal preference for flexibility directly influences AIB's strategic planning regarding its physical footprint and the digital tools it deploys to serve an increasingly dispersed customer base.

Financial Literacy and Inclusion

Societal financial literacy levels significantly shape banking product demand. In Ireland, efforts to boost financial inclusion are crucial for AIB. For instance, the Central Bank of Ireland's National Financial Literacy Strategy aims to improve financial well-being across the population, impacting how many people engage with banking services.

AIB's commitment to the Irish economy means fostering access to banking for diverse customer segments. This includes developing user-friendly digital platforms and offering tailored financial advice. By supporting financial inclusion, AIB can tap into a wider customer base and contribute to economic stability.

- Financial Literacy Initiatives: Ireland's National Financial Literacy Strategy, launched in 2020, focuses on improving financial education for all age groups.

- Banking Access: As of late 2024, a significant portion of the Irish population relies on digital banking channels, highlighting the importance of AIB's online offerings.

- Economic Support: AIB's lending to Irish SMEs in 2024 continued to be a vital component of economic growth, demonstrating its societal role.

- Inclusion Goals: Efforts are ongoing to reach underserved communities, ensuring broader access to essential banking services.

Societal Values and ESG Consciousness

Societal values are increasingly prioritizing sustainability and ethical conduct, directly impacting how businesses like AIB Group operate and are perceived. Growing awareness around environmental, social, and governance (ESG) factors means stakeholders, from customers to investors, expect more than just financial returns. This shift influences AIB's reputation and guides its strategic decisions.

AIB Group has demonstrably integrated ESG principles into its core business strategy, signaling a commitment to societal contribution and positive impact. This proactive approach addresses key stakeholder concerns and aims to build long-term value. For instance, AIB's 2023 Sustainability Report detailed a 25% reduction in its financed emissions intensity compared to 2019, showcasing tangible progress in its environmental goals.

- ESG Integration: AIB's strategy explicitly incorporates ESG considerations, aligning business objectives with societal expectations.

- Stakeholder Focus: The group actively seeks to make a positive impact in areas deemed important by its diverse stakeholder base.

- Reputation Management: Demonstrating strong ESG performance is crucial for maintaining and enhancing AIB's brand image and trust.

- Financial Performance Link: Growing evidence suggests a correlation between strong ESG performance and improved financial outcomes, including access to capital and investor confidence.

Societal shifts in consumer behavior and expectations significantly influence AIB Group's operational strategies and product development. The increasing demand for personalized financial services and a greater emphasis on digital convenience are paramount. For example, by the end of 2024, over 70% of AIB's new customer onboarding was conducted digitally, reflecting a strong societal preference for online engagement.

Furthermore, growing awareness of social responsibility and ethical business practices means AIB must actively demonstrate its commitment to community well-being and sustainable operations. This societal pressure impacts brand perception and customer loyalty, as evidenced by a 2024 survey where 55% of respondents indicated that a bank's social impact was a key factor in their banking choice.

The evolving nature of family structures and household economics also shapes demand for financial products. AIB's product offerings are increasingly tailored to support diverse life stages and financial needs, from first-time homebuyers to those planning for retirement. This adaptability is crucial for maintaining market relevance and fostering long-term customer relationships.

Technological factors

AIB is actively embracing digital transformation, a key technological factor impacting its operations and competitive standing. The bank is investing in artificial intelligence (AI) to improve efficiency and customer service.

A notable example is the adoption of Microsoft 365 Copilot, which aims to boost employee productivity through AI-powered assistance. This initiative is part of AIB's broader strategy to leverage technology for enhanced operational effectiveness and a superior digital banking experience.

By integrating advanced AI tools, AIB seeks to streamline processes, personalize customer interactions, and solidify its position as an innovator in the digital banking landscape. This focus on technology is crucial for maintaining a competitive edge in the evolving financial services sector.

As banking increasingly moves online, cybersecurity threats and the need for robust data protection measures become paramount for AIB. The financial sector, in general, faces significant risks from cyber-attacks, with reports indicating substantial financial losses globally due to data breaches and ransomware attacks. For instance, in 2023, the estimated global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the critical nature of this factor.

AIB must continuously invest in advanced security protocols to safeguard customer data and maintain operational resilience. This includes implementing multi-factor authentication, advanced encryption, and regular security audits. The European Union's Digital Operational Resilience Act (DORA), which came into effect in January 2023, mandates stringent cybersecurity requirements for financial entities, pushing for greater investment in these areas.

FinTech's relentless pace, particularly with open banking and evolving payment systems, creates a dynamic environment for AIB. This rapid technological shift means AIB must actively embrace innovation to stay competitive, developing new digital offerings and streamlining processes like credit applications.

The bank's ability to adapt to these FinTech advancements, including navigating new payment regulations, will be crucial. For instance, the continued growth of real-time payments, with transactions in the UK alone seeing a significant uptick in 2024, highlights the need for agile infrastructure that AIB can leverage or compete with.

Operational Efficiency through Technology

AIB Group is actively leveraging technology to boost its operational efficiency. This includes implementing Agile methodologies, which streamline project delivery and adapt quickly to market changes. Furthermore, modernizing customer channel experiences through digital platforms is a key focus.

Significant investments in technology are crucial for AIB to remain competitive and resilient in the evolving financial landscape. These investments are geared towards future-proofing the business against emerging threats and capitalizing on new opportunities.

- Agile Methodologies: AIB's adoption of Agile practices aims to accelerate product development and improve responsiveness to customer needs.

- Channel Modernization: Enhancements to digital banking channels, including mobile and online platforms, are designed to provide seamless customer experiences.

- Resilience and Future-Proofing: Technology investments are strategically allocated to bolster cybersecurity, data analytics capabilities, and cloud infrastructure.

- Efficiency Gains: By automating processes and optimizing workflows, AIB expects to achieve tangible improvements in operational cost-effectiveness.

Data Analytics and Customer Insights

The financial industry's increasing reliance on data for regulatory compliance and strategic decision-making highlights the critical role of advanced data analytics. AIB Group, like its peers, leverages these capabilities to navigate complex reporting requirements and inform its strategic direction.

AIB actively uses data to cultivate deeper customer insights. This allows the group to move beyond reactive service, enabling the delivery of proactive, personalized, and innovative banking solutions tailored to individual customer needs.

By harnessing data analytics, AIB can identify emerging trends and anticipate customer behavior. For instance, in 2023, AIB reported a significant increase in digital transaction volumes, underscoring the growing importance of data in understanding customer engagement patterns.

- Enhanced Customer Understanding: Data analytics allows AIB to segment its customer base more effectively, leading to targeted product offerings and improved customer satisfaction.

- Regulatory Adherence: Sophisticated data management systems are crucial for meeting stringent regulatory demands, such as those related to anti-money laundering (AML) and Know Your Customer (KYC) protocols.

- Operational Efficiency: Analyzing operational data helps AIB identify areas for process improvement, cost reduction, and streamlined service delivery.

- Personalized Service Delivery: Insights derived from customer data enable AIB to offer personalized financial advice and product recommendations, fostering stronger customer relationships.

AIB's technological advancements are focused on enhancing efficiency and customer experience through AI, exemplified by the adoption of Microsoft 365 Copilot to boost employee productivity. This strategic investment in AI is key to streamlining operations and delivering superior digital banking services, crucial for maintaining a competitive edge.

The increasing digitalization of banking necessitates robust cybersecurity measures to combat threats, with global cybercrime costs projected to reach $10.5 trillion annually by 2025. AIB's commitment to advanced security protocols, including multi-factor authentication and encryption, is vital, especially with regulations like the EU's DORA mandating stringent cybersecurity standards.

The rapid evolution of FinTech, particularly in open banking and payment systems, requires AIB to be agile and innovative. The growth in real-time payments, with a significant uptick observed in the UK in 2024, underscores the need for AIB to adapt its infrastructure to leverage or compete with these advancements.

AIB is leveraging data analytics to gain deeper customer insights, enabling proactive and personalized banking solutions. For instance, a significant increase in digital transaction volumes reported by AIB in 2023 highlights the growing importance of data in understanding customer engagement.

| Technological Factor | AIB's Action/Focus | Impact/Goal | Relevant Data/Trend |

|---|---|---|---|

| Artificial Intelligence (AI) | Adoption of Microsoft 365 Copilot | Boost employee productivity, enhance efficiency | AI integration for improved customer service |

| Cybersecurity | Investment in advanced security protocols | Safeguard customer data, ensure operational resilience | Global cybercrime cost projection: $10.5 trillion annually by 2025 |

| FinTech & Open Banking | Embracing innovation in digital offerings | Stay competitive, streamline processes | Growth in real-time payments (e.g., UK transactions up in 2024) |

| Data Analytics | Utilizing data for customer insights | Deliver personalized and proactive banking solutions | Increase in digital transaction volumes (e.g., AIB in 2023) |

Legal factors

AIB Group navigates a complex web of banking regulations, primarily shaped by the Central Bank of Ireland and the Prudential Regulation Authority in the UK. The ongoing implementation of Basel 3.1 standards, which began in earnest in 2024, significantly impacts capital requirements, aiming to bolster the resilience of banks against economic shocks. For instance, AIB's Common Equity Tier 1 (CET1) ratio stood at a robust 14.9% as of the end of 2023, a key metric closely monitored by regulators.

Participation in regular stress tests, such as those conducted by the European Central Bank (ECB) and the Bank of England, is critical. These exercises assess AIB's ability to withstand severe economic downturns, with results directly influencing capital planning and strategic decisions. Failure to meet these rigorous standards could lead to capital constraints and reputational damage, underscoring the paramount importance of proactive compliance.

AIB Group operates under stringent anti-money laundering (AML) and counter-terrorist financing (CTF) legislation, necessitating robust internal systems and controls. Failure to comply can result in significant penalties, impacting profitability and reputation.

Regulatory bodies, such as the Central Bank of Ireland, are increasingly scrutinizing financial institutions for compliance. Initiatives like the Central Bank's Innovation Sandbox Programme, launched in 2020, are actively encouraging the development of new technologies to combat financial crime, including fraud detection and prevention, which directly affects AIB's operational strategies and investment in compliance technology.

Consumer protection laws are a significant legal factor for AIB Group. New conduct requirements, such as the Financial Conduct Authority's (FCA) Consumer Duty in the UK, directly shape how AIB develops and offers its products and services. This means the bank must prioritize fair customer outcomes and actively manage issues like non-financial misconduct.

Data Privacy and GDPR

AIB Group must meticulously adhere to data privacy regulations like the GDPR and its UK counterpart, given its substantial customer data processing. This legal imperative demands constant vigilance in maintaining secure and ethical data handling practices, necessitating strong internal policies and advanced technological systems to prevent breaches and ensure compliance.

Failure to comply can result in significant penalties; for instance, GDPR fines can reach up to €20 million or 4% of global annual turnover. AIB's commitment to data protection directly impacts customer trust and operational continuity, making robust data governance a core legal and business requirement.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- Data Breach Impact: Reputational damage and loss of customer confidence.

- Regulatory Scrutiny: Increased oversight from data protection authorities.

- Compliance Costs: Investment in technology and personnel for data security.

ESG Reporting Directives

New legal mandates, such as the Corporate Sustainability Reporting Directive (CSRD) which came into full effect for many companies in 2024, are significantly increasing the scope and detail required for environmental, social, and governance (ESG) disclosures. This directive aims to harmonize sustainability reporting across the EU, ensuring greater comparability and reliability of data for investors and stakeholders. AIB Group, in response to these evolving legal frameworks, has proactively incorporated a dedicated Sustainability Statement within its 2024 Annual Financial Report, underscoring its commitment to transparent and robust ESG practices.

The integration of this statement reflects AIB's adaptation to stringent regulatory demands, providing stakeholders with a clear overview of the group's performance and strategies across key ESG pillars. This move is crucial for maintaining investor confidence and meeting the expectations of a market increasingly focused on sustainable finance. For instance, the CSRD requires detailed reporting on climate-related risks and opportunities, human capital management, and governance structures, all of which AIB is addressing through its enhanced reporting.

Key aspects of AIB's ESG reporting under these new directives include:

- Alignment with EU Taxonomy: Disclosing the proportion of environmentally sustainable economic activities in line with the EU Taxonomy Regulation.

- Double Materiality Assessment: Reporting on how ESG issues impact the company and how the company impacts society and the environment.

- Supply Chain Transparency: Providing information on ESG risks and impacts within the group's value chain.

- Climate Transition Plans: Outlining strategies and targets for managing climate-related risks and opportunities.

AIB Group's legal landscape is heavily influenced by evolving financial regulations, including Basel 3.1 standards impacting capital requirements, with AIB maintaining a CET1 ratio of 14.9% at the close of 2023. The bank must also comply with stringent anti-money laundering (AML) and counter-terrorist financing (CTF) laws, facing significant penalties for non-compliance.

Consumer protection laws, such as the UK's FCA Consumer Duty, mandate fair customer outcomes and influence product development. Data privacy regulations like GDPR impose strict data handling practices, with potential fines up to 4% of global annual turnover for breaches, highlighting the need for robust data governance.

New ESG reporting mandates, like the CSRD effective from 2024, require detailed disclosures on environmental, social, and governance factors. AIB has incorporated a dedicated Sustainability Statement in its 2024 report to address these requirements, including alignment with the EU Taxonomy and double materiality assessments.

Environmental factors

AIB Group is navigating heightened regulatory scrutiny, particularly from the European Central Bank (ECB), concerning its management of climate-related financial risks. The ECB has made it clear that banks must effectively identify, assess, and mitigate these risks across their operations and loan books.

This regulatory push is not merely advisory; the ECB has signaled its readiness to impose penalties on financial institutions that fail to meet established interim targets for climate risk management. This underscores the critical need for AIB to develop and implement comprehensive strategies to address these evolving environmental factors.

AIB is actively supporting the shift towards a low-carbon economy, demonstrated by its substantial Climate Action Fund. The group has set clear targets for green lending, focusing on sectors such as renewable energy projects and sustainable housing developments. This strategic focus not only addresses environmental imperatives but also capitalizes on the expanding opportunities within the sustainable finance market.

AIB Group's strategy deeply embeds environmental, social, and governance (ESG) factors, shaping its risk management and capital allocation. This commitment is evident in its sustainability reporting and ESG ratings, underscoring a dedication to responsible business operations and long-term stakeholder value.

Carbon Footprint Reduction

AIB Group is making significant strides in reducing its operational carbon footprint, a key environmental consideration. This commitment aligns with global sustainability objectives and reflects a growing awareness of climate change's impact on the financial sector. The bank is actively implementing measures to decrease its direct emissions, demonstrating a proactive approach to environmental stewardship.

Key initiatives include enhancing energy efficiency across its physical infrastructure and adopting a hybrid working model. These strategies are designed to not only lower property-related emissions but also to contribute to a reduced overall carbon footprint. For instance, AIB's 2023 Sustainability Report highlighted a reduction in Scope 1 and Scope 2 emissions by 15% compared to their 2019 baseline, showcasing tangible progress.

- Energy Efficiency: Investments in LED lighting and smart building technology across AIB's offices have led to a measurable decrease in energy consumption.

- Hybrid Working: The adoption of hybrid work policies has reduced commuting emissions and the energy demand associated with fully occupied office spaces.

- Renewable Energy Sourcing: AIB is increasing its procurement of electricity from renewable sources, aiming for 100% renewable electricity by 2030.

- Digital Transformation: Continued investment in digital services helps reduce the need for paper-based transactions and physical branch visits, indirectly lowering environmental impact.

Climate-Related Financial Disclosures

There's a growing push from regulators and stakeholders for companies to be more open about how climate change affects their finances, both the risks and the potential upsides. This means businesses need to provide clear, detailed information.

AIB Group is actively responding to this by releasing comprehensive sustainability reports and disclosures. They are aligning their reporting with well-established frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), the Global Reporting Initiative (GRI), and the United Nations Environment Programme Finance Initiative Principles for Sustainable Banking (UNEP FI PRB). This commitment shows they are serious about transparently sharing their climate-related performance and strategies.

- TCFD Alignment: AIB's adherence to TCFD recommendations ensures consistent disclosure of climate-related financial risks and opportunities across its operations.

- GRI Standards: By following GRI standards, AIB provides a globally recognized framework for reporting on its environmental, social, and governance (ESG) impacts.

- UNEP FI PRB Commitment: As a signatory to the UNEP FI Principles for Sustainable Banking, AIB integrates sustainability into its core business strategy and client engagement, focusing on positive environmental and social outcomes.

AIB Group is proactively addressing environmental factors, driven by increasing regulatory oversight from bodies like the European Central Bank (ECB) regarding climate-related financial risks. The bank is committed to reducing its operational carbon footprint, with a 15% reduction in Scope 1 and 2 emissions achieved by 2023 compared to a 2019 baseline.

This commitment extends to substantial investments in green lending, aiming to support the transition to a low-carbon economy through initiatives like the Climate Action Fund and clear green lending targets. AIB is also enhancing transparency by aligning its sustainability reporting with global frameworks such as TCFD and GRI.

| Environmental Factor | AIB Group's Action/Target | Data/Statistic |

|---|---|---|

| Climate Risk Management | Meeting ECB requirements for identifying, assessing, and mitigating climate risks. | ECB signaling readiness to impose penalties for non-compliance. |

| Carbon Footprint Reduction | Implementing energy efficiency and hybrid working models. | 15% reduction in Scope 1 & 2 emissions by 2023 (vs. 2019 baseline). |

| Green Lending | Investing in renewable energy projects and sustainable housing. | Focus on expanding sustainable finance market opportunities. |

| Renewable Energy Sourcing | Increasing procurement of electricity from renewable sources. | Targeting 100% renewable electricity by 2030. |

| Sustainability Reporting | Aligning disclosures with TCFD, GRI, and UNEP FI PRB. | Ensures consistent and transparent reporting of climate-related performance. |

PESTLE Analysis Data Sources

Our PESTLE analysis for AIB Group is constructed using a robust blend of official government publications, reputable financial news outlets, and comprehensive industry-specific reports. This ensures all political, economic, social, technological, legal, and environmental factors are grounded in current and verifiable information.