AIB Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIB Group Bundle

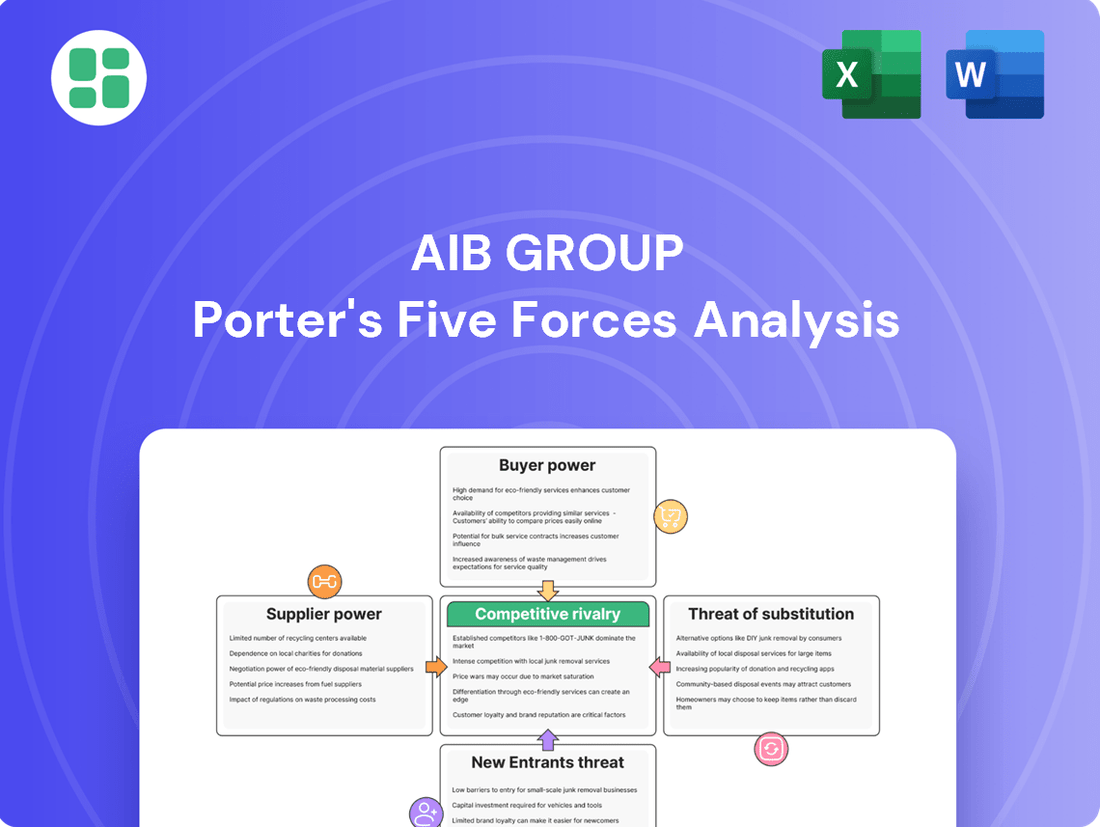

AIB Group faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers playing crucial roles in its market landscape. Understanding these dynamics is key to navigating the financial services sector.

The complete report reveals the real forces shaping AIB Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AIB Group's reliance on technology and software providers presents a significant aspect of supplier bargaining power. These vendors supply critical IT infrastructure, specialized software, and essential cybersecurity solutions. The cost of these services, especially for core banking systems and cloud infrastructure, can represent a substantial portion of AIB's operational expenses.

The bargaining power of these technology suppliers is often elevated when their offerings are proprietary, deeply integrated into AIB's existing systems, or when switching providers would incur substantial costs and operational disruption. For instance, the complexity of migrating core banking platforms or data analytics tools can create high switching costs, giving these vendors considerable leverage. The increasing demand for advanced digital solutions and robust cybersecurity in the financial sector further solidifies the position of key technology partners.

AIB Group's reliance on wholesale funding markets, bond markets, and institutional investors means these suppliers hold considerable sway. Their bargaining power is directly linked to prevailing market liquidity and the prevailing interest rate environment. For instance, during periods of tight liquidity, the cost of borrowing for AIB can escalate significantly, impacting profitability.

Investor confidence in AIB's creditworthiness is a crucial factor. A strong credit rating generally lowers borrowing costs, while any perceived weakening can lead to higher yields demanded by suppliers. In 2023, AIB Group's net interest margin was 1.69%, demonstrating the direct impact of funding costs on its core profitability.

The availability of skilled professionals in areas critical to AIB Group, such as advanced technology, cybersecurity, regulatory compliance, and in-depth financial analysis, directly influences the company's operational expenses and its capacity for innovation. A constrained labor market, characterized by high demand for these specialized talents, invariably amplifies the bargaining power of employees. This often translates into increased wage pressures and more significant hurdles in attracting and retaining qualified personnel.

Payment Network Operators

Payment network operators, such as Visa and Mastercard, wield considerable bargaining power over AIB Group. Their global infrastructure and established brand recognition are critical for AIB's card services and transaction processing. These networks dictate transaction fees and operational rules, impacting AIB's cost structure.

- Dominant Market Share: Visa and Mastercard collectively process a vast majority of global card transactions, giving them significant leverage.

- Network Effects: The more merchants and consumers use their networks, the more valuable they become, creating a strong barrier to entry for competitors.

- Interchange Fees: These operators set interchange fees, a primary revenue source for them and a cost for banks like AIB, influencing profitability.

- Technological Investment: Continuous investment in secure and efficient payment technologies further solidifies their position and their ability to dictate terms.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers, such as external consultants, auditors, and legal firms, wield significant bargaining power over AIB Group. Their specialized knowledge is critical for navigating the intricate and evolving regulatory frameworks in both Ireland and the United Kingdom. This dependence is amplified by the growing compliance demands placed on financial institutions.

The increasing complexity of financial regulations, particularly in the wake of events like the 2008 financial crisis and ongoing updates in areas such as anti-money laundering (AML) and data privacy (e.g., GDPR), necessitates expert external guidance. For instance, in 2023, financial services firms globally saw compliance costs rise, with many reporting increased spending on external legal and consulting services to manage these obligations effectively.

- High Switching Costs: AIB Group faces substantial costs and disruptions when changing its primary compliance advisors due to the deep integration of their services and the need for continuity in regulatory filings.

- Limited Availability of Specialized Expertise: The pool of highly specialized consultants and legal professionals with deep understanding of Irish and UK banking regulations is not vast, concentrating power among a few key players.

- Essential Nature of Services: Non-compliance can lead to severe penalties, reputational damage, and operational disruptions, making these services indispensable and elevating the suppliers' leverage.

The bargaining power of AIB Group's suppliers is a critical factor, particularly concerning technology providers and wholesale funding sources. These entities can exert significant influence due to proprietary systems, high switching costs, and market liquidity conditions. For instance, AIB's net interest margin of 1.69% in 2023 highlights the direct impact of funding costs, a key supplier-driven expense.

Payment networks like Visa and Mastercard also hold substantial power due to their dominant market share and network effects, dictating transaction fees. Similarly, specialized regulatory and compliance consultants possess strong leverage because of the limited availability of expertise and the high costs associated with changing advisors. This dependence on specialized knowledge and essential services amplifies supplier influence.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on AIB Group |

|---|---|---|

| Technology Providers | Proprietary systems, high switching costs, integration complexity | Increased IT infrastructure and software costs, potential operational disruption if switching |

| Wholesale Funding Markets & Institutional Investors | Market liquidity, interest rate environment, investor confidence | Fluctuating borrowing costs, direct impact on net interest margin (e.g., 1.69% in 2023) |

| Payment Networks (Visa, Mastercard) | Dominant market share, network effects, interchange fees | Transaction processing costs, influence on card service profitability |

| Regulatory & Compliance Consultants | Specialized expertise, high switching costs, essential nature of services | Elevated consulting fees, reliance on external advice for compliance |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to AIB Group's banking operations.

Instantly identify and address competitive threats with a comprehensive overview of AIB Group's Porter's Five Forces, empowering proactive strategic adjustments.

Customers Bargaining Power

For many of AIB Group's core banking products, such as standard current accounts and basic savings accounts, the effort and cost for individual customers to switch providers are quite low. This is particularly true as initiatives promoting account portability become more widespread, making it easier for customers to move their banking relationships. In 2024, the ease of digital account opening and management further reduces these barriers, giving customers more leverage to find better deals.

Customers now have an incredible amount of information at their fingertips. Comparison websites, sophisticated financial apps, and countless online reviews mean they can easily see how AIB Group's offerings stack up against competitors. This ease of access has significantly boosted customer awareness.

This heightened transparency empowers customers to demand better terms and superior digital experiences. For instance, in 2024, the average user of a banking comparison site could access data from over 50 different financial institutions, making it simpler than ever to find the best deals on everything from savings accounts to mortgages.

In competitive lending and deposit markets, customers are highly attuned to interest rates. For instance, in 2024, the average variable mortgage rate in Ireland hovered around 3.5%, making even minor rate differences a significant factor in customer choice. This price sensitivity compels AIB to align its offerings with market benchmarks, potentially impacting its net interest margin.

Large Corporate and Business Clients

Large corporate and business clients wield significant bargaining power within the banking sector, particularly with institutions like AIB Group. These clients often have dedicated relationship managers who understand their complex financial needs. Their substantial transaction volumes and borrowing requirements allow them to negotiate more favorable terms, including lower fees and interest rates, and to secure customized financial solutions tailored to their specific operations.

This power is amplified by their ability to easily switch banking providers if their demands are not met. For instance, in 2024, major corporations were observed to be actively seeking out banks offering competitive pricing on lending facilities and efficient digital transaction platforms. AIB's ability to retain and attract these high-value clients hinges on its capacity to offer compelling value propositions that go beyond standard banking services.

- Significant Transaction Volumes: Large businesses process millions in transactions, giving them leverage.

- Borrowing Needs: Substantial loan requirements enable negotiation on interest rates.

- Customized Solutions: Clients demand bespoke financial products and services.

- Switching Costs: The ease with which large clients can move their business to competitors underscores their power.

Rise of Digital-First Banking and Fintech

The rise of digital-first banking and fintech platforms significantly amplifies the bargaining power of customers for AIB Group. These new entrants, often unburdened by legacy infrastructure, offer competitive rates and user-friendly interfaces, directly challenging traditional banks. For instance, by the end of 2023, fintech adoption globally reached 75%, indicating a strong customer preference for digital solutions.

This proliferation of choices means customers can easily switch providers if they find better deals or more convenient services elsewhere. AIB must therefore focus on enhancing its digital capabilities to meet these evolving expectations. In 2024, many fintechs are offering lower transaction fees and faster onboarding processes, directly impacting customer loyalty to incumbent banks.

- Increased Competition: Digital-only banks and fintechs provide customers with a wider array of banking options.

- Enhanced Customer Expectations: Seamless user experiences and innovative features from fintechs raise the bar for digital banking services.

- Price Sensitivity: Fintechs often compete on price, forcing traditional banks to review their fee structures and interest rates.

- Switching Behavior: Customers are more willing to switch banks for better digital offerings and competitive pricing, as evidenced by rising fintech adoption rates.

The bargaining power of customers for AIB Group is substantial, driven by low switching costs for many retail banking products and a highly informed customer base. In 2024, the ease of digital onboarding and management further empowers individuals to seek better terms. This transparency, fueled by comparison sites and financial apps, allows customers to readily assess AIB's offerings against competitors, leading to increased demands for competitive pricing and superior digital experiences.

Price sensitivity is particularly acute in lending and deposit markets. For instance, in 2024, the average variable mortgage rate in Ireland was around 3.5%, making even slight rate differences a key decision factor for customers. This compels AIB to remain competitive, potentially impacting its net interest margins.

Large corporate clients also exert significant influence due to their substantial transaction volumes and borrowing needs. These clients can negotiate favorable terms, including lower fees and customized financial solutions, and can easily switch providers if their demands aren't met. By 2024, major corporations were actively seeking banks offering competitive lending rates and efficient digital platforms, highlighting the need for AIB to provide compelling value propositions.

| Factor | Impact on AIB | 2024 Data/Trend |

|---|---|---|

| Switching Costs (Retail) | High Leverage for Customers | Low due to digital account opening and portability initiatives. |

| Information Availability | Increased Customer Awareness & Power | Widespread use of comparison sites and financial apps. |

| Price Sensitivity (Mortgages) | Pressure on Interest Margins | Average variable mortgage rates around 3.5% in Ireland. |

| Corporate Client Power | Negotiation on Rates & Fees | Active seeking of competitive pricing and digital solutions by large businesses. |

Full Version Awaits

AIB Group Porter's Five Forces Analysis

This preview showcases the complete AIB Group Porter's Five Forces Analysis, providing a comprehensive examination of competitive forces within the banking sector. The document you see here is precisely what you will receive upon purchase, offering an in-depth look at supplier power, buyer bargaining power, threat of new entrants, threat of substitutes, and industry rivalry as they pertain to AIB Group.

Rivalry Among Competitors

AIB faces significant competition from established domestic players like Bank of Ireland and Permanent TSB. This mature market environment fuels intense rivalry across key banking services, including mortgages, personal loans, and business banking.

This competitive landscape often translates into aggressive pricing strategies and a constant drive for product innovation as banks vie for customer acquisition and retention. For instance, in 2023, the Irish mortgage market saw significant competition, with lenders actively adjusting rates and offering incentives to attract new borrowers.

In the United Kingdom, AIB Group contends with intense rivalry from established high-street banks, including giants like HSBC, Barclays, and Lloyds Banking Group, which possess significant market share and brand loyalty. This is further amplified by the rapid growth of agile, digital-first challenger banks such as Monzo and Starling Bank, which are capturing market share through innovative technology and customer-centric approaches.

Competition in both Ireland and the UK frequently drives aggressive pricing, especially for popular offerings like mortgages and business loans. This intense rivalry can squeeze AIB's profit margins, making efficiency improvements and a shift towards more valuable services crucial for sustained profitability.

Innovation in Digital Banking Services

Competitive rivalry in digital banking is intense as players like AIB Group are continuously pushing the boundaries of innovation. Rivals are heavily investing in and launching new digital features, advanced mobile banking apps, and sophisticated online platforms. This aggressive pursuit aims to capture and retain the growing segment of tech-savvy customers who expect seamless, intuitive digital experiences. For instance, in 2023, the Irish digital banking market saw significant growth, with mobile banking transactions increasing by an estimated 15%, highlighting the critical need for AIB to match or exceed these advancements to maintain its market position.

AIB must actively keep pace with these rapid innovations to remain competitive. This involves not only offering cutting-edge digital functionalities but also ensuring a consistently superior user experience. The ability to provide personalized services, leverage data analytics for tailored offerings, and maintain robust security protocols are key differentiators. Failure to do so could lead to customer attrition, especially as challenger banks and fintech firms introduce disruptive digital solutions. In 2024, AIB's digital transformation efforts are focused on enhancing its mobile app's capabilities, including AI-driven personalized financial advice and faster payment processing, to counter these competitive pressures.

- Digital Feature Investment: Competitors are allocating substantial resources to develop and deploy new digital banking features, aiming to enhance customer engagement and acquisition.

- Mobile App Advancement: Banks are prioritizing the enhancement of their mobile banking applications, focusing on user experience, functionality, and the integration of personalized services.

- Customer Retention Strategies: The drive for innovation is largely fueled by the need to attract and retain a digitally adept customer base that demands convenience and advanced digital tools.

- Market Share Impact: AIB's ability to innovate in its digital offerings directly impacts its capacity to compete effectively and maintain or grow its market share against rivals.

Market Share Battles in Key Segments

AIB Group operates in a highly competitive landscape where market share is constantly contested across its core segments, including retail banking, corporate finance, and wealth management. For instance, in the Irish retail banking sector, AIB, along with its main rivals like Bank of Ireland and Permanent TSB, engages in aggressive pricing and promotional activities to attract and retain customers.

Competitors frequently introduce innovative digital banking solutions and personalized financial products to differentiate themselves. In 2023, AIB reported a net interest margin of 1.69%, a key indicator of profitability that is directly influenced by competitive pressures on lending and deposit rates.

- Retail Banking: Intense competition on mortgage rates and current account offerings is a constant feature.

- Corporate Finance: Winning mandates for large corporate deals requires competitive advisory fees and strong relationship management.

- Digital Innovation: Competitors are rapidly enhancing their mobile banking apps and online services, forcing AIB to invest heavily in technology to keep pace.

- Customer Retention: Loyalty programs and superior customer service are critical differentiators in a market where switching costs are decreasing.

Competitive rivalry within AIB Group's operating markets, particularly Ireland and the UK, remains exceptionally high. This intensity is driven by a mix of traditional banking giants and increasingly agile digital-first challengers, all vying for customer acquisition and retention across retail, corporate, and wealth management segments.

In 2023, the Irish banking sector saw continued competition, with AIB's net interest margin standing at 1.69%, reflecting pricing pressures. The digital banking space is particularly dynamic, with rivals heavily investing in mobile app advancements and personalized features. For instance, mobile banking transactions in Ireland grew by an estimated 15% in 2023, underscoring the need for AIB to innovate rapidly.

In the UK, AIB faces established players like HSBC and Barclays, alongside disruptive fintechs. This forces a constant drive for product innovation and competitive pricing, especially in mortgages and business loans. AIB's 2024 strategy includes enhancing its mobile app with AI-driven advice to counter these pressures and maintain market share.

| Market Segment | Key Competitors | Competitive Tactics | Impact on AIB |

|---|---|---|---|

| Irish Retail Banking | Bank of Ireland, Permanent TSB | Aggressive mortgage rates, promotional offers | Pressure on net interest margin (1.69% in 2023) |

| UK Banking | HSBC, Barclays, Lloyds, Monzo, Starling | Digital innovation, competitive pricing, customer experience | Need for continuous investment in technology and service |

| Digital Banking | Various fintechs and traditional banks | Advanced mobile features, AI personalization, faster payments | Requirement for rapid feature deployment and superior UX |

SSubstitutes Threaten

Fintech lending and payment platforms present a significant threat of substitution for AIB Group. Specialized companies are offering alternative lending solutions, such as peer-to-peer lending, and payment services like digital wallets, which bypass traditional banking infrastructure. This can directly impact AIB's revenue streams, especially within the consumer and small business markets.

For instance, the global fintech market was valued at approximately $111.8 billion in 2023 and is projected to grow substantially. In 2024, the adoption of digital payments continues to surge, with mobile payment transaction values expected to reach trillions globally, indicating a strong consumer shift towards these alternative channels.

Customers increasingly turn to non-bank investment platforms and robo-advisors, bypassing traditional banking services for wealth management. For instance, in 2024, the global robo-advisor market was projected to reach over $2.1 trillion in assets under management, demonstrating a significant shift in consumer preference.

These alternatives often present a compelling value proposition through lower fee structures or highly specialized investment strategies that AIB's broader offerings might not match. Independent financial advisors also provide personalized guidance, directly competing for AIB's wealth management clientele.

While still in their early stages for widespread use in everyday transactions, cryptocurrencies and other digital assets present a potential threat to traditional banking services. These emerging technologies could eventually offer alternative ways for individuals and businesses to store value and make payments, potentially lessening the dependence on established systems like those provided by AIB. For instance, the global cryptocurrency market capitalization fluctuated significantly in 2024, demonstrating growing investor interest and the increasing sophistication of these digital assets.

Corporate Self-Funding and Treasury Solutions

Large corporate clients are increasingly exploring alternatives to traditional bank lending, a trend that intensifies the threat of substitutes for AIB Group. These clients might leverage direct access to capital markets, such as issuing bonds or equity, to secure funding. In 2024, the global bond issuance market continued to show robust activity, with corporations actively tapping into this avenue for substantial capital raises, potentially bypassing banks like AIB for certain financing needs.

Furthermore, sophisticated treasury management systems and the issuance of commercial paper offer viable substitutes for corporate funding. Companies can manage their liquidity and short-term financing needs internally or through these more agile instruments. For instance, the commercial paper market provides corporations with a flexible way to obtain short-term funds, often at competitive rates, reducing their dependence on bank credit lines.

This shift diminishes AIB's traditional role as a primary financier for these large entities. As corporations gain more autonomy and expertise in managing their financial operations, they may reduce their reliance on AIB for loans, impacting the bank's market share in corporate lending. By 2024, many large corporations had significantly enhanced their in-house treasury capabilities, allowing them to navigate financial markets more independently.

- Direct Capital Markets Access: Corporations can issue bonds or equity, bypassing traditional bank loans.

- Internal Treasury Management: Enhanced in-house capabilities allow for greater financial autonomy.

- Commercial Paper Issuance: A flexible alternative for short-term corporate funding needs.

- Reduced Reliance on Banks: These substitutes diminish the necessity of traditional bank financing for large clients.

Non-Bank Financial Service Providers

The threat of substitutes from non-bank financial service providers is a significant concern for AIB Group. A growing number of entities like credit unions, building societies, and specialized lenders are increasingly offering products that directly compete with AIB's core services, such as mortgages and personal loans.

These alternative providers often possess greater agility and can concentrate on specific niche markets, allowing them to tailor their offerings and potentially provide more competitive rates or specialized customer service. For instance, in 2024, the Irish credit union sector continued to expand its mortgage lending, with total mortgage lending by credit unions reaching €1.5 billion by the end of Q3 2024, representing a 12% increase year-on-year.

- Credit Unions: Offering competitive rates on personal loans and mortgages, often with a community-focused approach.

- Specialized Lenders: Focusing on specific segments like buy-to-let mortgages or business finance, providing tailored solutions.

- Fintech Companies: Disrupting traditional banking with digital-first platforms for lending and payments, appealing to tech-savvy consumers.

The threat of substitutes for AIB Group is substantial, driven by evolving customer preferences and technological advancements. Fintech platforms offering streamlined lending and payment solutions, alongside non-bank lenders and investment platforms, directly challenge AIB's traditional revenue streams.

For example, by the end of 2024, digital payment transaction values globally were projected to exceed $15 trillion, highlighting a significant migration away from traditional banking channels. Furthermore, the global robo-advisor market was anticipated to manage over $2.1 trillion in assets under management in 2024, indicating a strong shift towards automated wealth management services.

| Substitute Type | Key Characteristics | Impact on AIB Group | 2024 Data/Projection |

| Fintech Lending & Payments | Digital-first, lower fees, specialized services | Reduced loan origination and payment processing fees | Global fintech market valued at ~$111.8 billion in 2023; mobile payments projected to reach trillions in 2024 |

| Robo-Advisors & Non-Bank Investment Platforms | Automated investment management, niche strategies | Loss of wealth management and advisory fees | Global robo-advisor AUM projected to exceed $2.1 trillion in 2024 |

| Direct Capital Markets Access (Corporate) | Issuing bonds/equity, commercial paper | Decreased corporate lending and treasury services revenue | Robust global bond issuance activity in 2024; enhanced corporate treasury capabilities |

| Credit Unions & Specialized Lenders | Niche focus, community banking, competitive rates | Competition for retail and SME lending, particularly mortgages | Irish credit union mortgage lending up 12% YoY to €1.5 billion by Q3 2024 |

Entrants Threaten

Digital-only challenger banks, like Revolut and Monzo, pose a significant threat due to their lower operational costs and advanced technology. These nimble players can quickly introduce innovative products and user-friendly interfaces, attracting customers with competitive fees and seamless digital experiences. For instance, by mid-2024, challenger banks continued to capture market share, particularly from younger demographics who prioritize digital convenience.

Fintech startups are increasingly securing banking licenses or specialized authorizations, such as those for e-money institutions. This shift allows them to directly offer a wider array of financial services, previously the domain of traditional banks. For instance, in the UK, the Financial Conduct Authority (FCA) has seen a rise in fintech firms seeking full authorization, with over 100 new fintech firms authorized in 2023 alone, indicating a growing trend of these companies moving beyond niche services.

Large technology companies, often referred to as Big Tech, represent a significant potential threat to traditional financial institutions like AIB. These companies possess enormous customer bases, established brand loyalty, and substantial financial resources, enabling them to invest heavily in new ventures. For instance, in 2024, companies like Apple and Google continued to expand their offerings in digital payments and financial management tools, directly competing for customer engagement in core banking services.

While regulatory hurdles exist, the sheer scale and technological prowess of Big Tech firms allow them to potentially disrupt the financial services landscape. Their ability to leverage vast amounts of user data for personalized offerings and their existing digital infrastructure provide a competitive advantage. AIB, like other incumbent banks, must remain vigilant and innovative to counter this long-term threat, which could see market share eroded by these tech giants.

Regulatory Changes Promoting Open Banking

Regulatory shifts, such as the implementation of Open Banking directives like PSD2 in Europe, significantly reduce entry barriers for new players. These regulations mandate that incumbent banks share customer data, with explicit consent, with authorized third-party providers. This opens the door for fintech firms and other innovators to build new financial services and applications on top of existing banking infrastructure, thereby increasing competitive pressure.

The impact of Open Banking is substantial, as it democratizes access to financial data and services. For instance, by 2024, it's estimated that over 70% of UK consumers and businesses will have used an Open Banking-enabled service. This trend empowers new entrants to offer specialized, often more user-friendly, digital solutions that can directly challenge traditional banking models by leveraging this shared data ecosystem.

- Lowered Barriers: Open Banking regulations compel banks to share data, reducing the foundational requirements for new financial service providers.

- Increased Competition: Fintech companies can now more easily enter the market with innovative, data-driven offerings.

- Consumer Choice: Customers benefit from a wider array of specialized financial products and services.

- Technological Advancement: The push for data sharing accelerates the adoption of new technologies within the financial sector.

Niche Financial Service Providers

Niche financial service providers pose a significant threat by targeting specific underserved segments or specialized financial products. These new entrants can meticulously build a loyal customer base within these niches before considering broader market expansion. For instance, fintech startups focusing solely on micro-investing or specialized lending can gain traction without needing to replicate AIB's extensive service portfolio.

These specialized players effectively chip away at AIB's market share in particular areas, creating competitive pressure without engaging in a head-on, full-spectrum service battle. This strategy allows them to operate with lower overheads and a more focused marketing approach. In 2024, the digital banking sector saw a surge in such niche players, with reports indicating a 15% increase in specialized fintech applications approved by regulators in the UK and Ireland, directly impacting traditional banking revenue streams.

- Targeted Market Penetration: Niche providers can achieve deep penetration within specific customer segments that may be less prioritized by larger institutions.

- Agile Operations: Their focused business models often allow for greater agility and faster adaptation to evolving customer needs in their chosen niche.

- Lower Barrier to Entry: Specializing in a single service or product can reduce the capital and regulatory hurdles compared to establishing a full-service bank.

- Customer Loyalty: By offering highly tailored solutions, these entrants can foster strong customer loyalty, making it harder for larger banks to win them back.

The threat of new entrants for AIB Group remains significant, driven by digital challengers, specialized fintechs, and Big Tech. Open Banking regulations continue to lower barriers, enabling these players to offer innovative, customer-centric services. For instance, by mid-2024, challenger banks were actively gaining market share, particularly among younger demographics who value digital convenience.

Fintech firms are increasingly obtaining banking licenses or specialized authorizations, allowing them to offer a broader range of financial products. In 2023 alone, over 100 new fintech firms in the UK received authorization, signaling a trend towards direct competition with traditional banks. Big Tech companies, with their vast customer bases and resources, also pose a threat, expanding into digital payments and financial management tools in 2024.

| Threat Type | Key Characteristics | Impact on AIB | Example (2024 Trend) |

|---|---|---|---|

| Digital Challengers | Lower costs, advanced tech, user-friendly interfaces | Market share erosion, particularly among younger demographics | Continued growth in customer acquisition by firms like Monzo and Revolut |

| Fintech Startups | Specialized services, regulatory authorization, niche focus | Competition in specific product areas, potential for broader disruption | Increased number of fintechs seeking full banking licenses |

| Big Tech | Large customer base, strong brand loyalty, substantial resources | Direct competition in payments and financial management, data leverage | Expansion of services like Apple Pay and Google Pay |

| Niche Providers | Targeted segments, specialized products, agile operations | Loss of revenue in specific service areas, reduced customer loyalty | Rise of micro-investing and specialized lending platforms |

Porter's Five Forces Analysis Data Sources

Our AIB Group Porter's Five Forces analysis is built upon a robust foundation of data, including AIB's annual reports, financial statements, and investor presentations. We also incorporate industry-specific data from reputable financial news outlets and market research reports to provide a comprehensive view of the competitive landscape.