AIB Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIB Group Bundle

Curious about AIB Group's strategic positioning? This glimpse into their BCG Matrix reveals how their products are performing in terms of market share and growth. Understand which are generating cash and which might be liabilities.

Don't miss out on the full picture! Purchase the complete AIB Group BCG Matrix to unlock detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investment and product portfolio.

Stars

Green and sustainable lending is a cornerstone of AIB Group's strategy, driving significant growth. The bank has committed €19.1 billion to its €30 billion Climate Action Fund as of H1 2025, demonstrating a substantial investment in environmental initiatives.

This commitment translates into tangible lending, with new green lending comprising 36% of AIB's total new lending in the first half of 2025. This strong performance reflects alignment with global environmental, social, and governance (ESG) trends and Ireland's broader economic transition towards a lower-carbon future.

The bank's proactive approach to sustainable finance is resonating with a wide range of customers, attracting both individual retail clients and larger corporate entities seeking to finance their own sustainability goals.

AIB's robust digital transformation has positioned its personal loan applications as a star performer. In 2024, a remarkable 87% of personal loan applications were submitted online, showcasing AIB's leading digital proposition. This high digital adoption signifies a rapidly expanding and highly penetrated growth channel within the personal banking sector.

First-time buyer mortgages, especially those with a green focus, are a cornerstone for AIB. The Irish mortgage market is showing resilience, and AIB is a major player in new mortgage origination. This segment is particularly important as it taps into both the desire for homeownership and the increasing consumer interest in environmentally friendly options.

Green mortgages are a standout performer within AIB's first-time buyer offerings. In the first half of 2025, these sustainable home loans accounted for a remarkable 58% of all new mortgage lending. This strong uptake highlights AIB's successful strategy in aligning its product development with evolving market trends and customer preferences for eco-conscious living.

Corporate Lending to FDI Sector

AIB Group stands out as the leading Irish corporate bank for Foreign Direct Investment (FDI), a position bolstered by Ireland's consistently attractive economic and regulatory environment for international businesses. This leadership translates into robust growth in the bank's corporate lending activities, reflecting a significant market share within this crucial economic segment.

The bank's strategic emphasis on supporting FDI is a direct response to the sustained flow of international investment into Ireland, a trend that is expected to continue. This focus allows AIB to capitalize on a dynamic and growing sector, further solidifying its role as a key financial partner for global companies establishing or expanding their presence in the country.

- AIB's FDI Lending Growth: In 2024, AIB reported a substantial increase in its corporate lending book, with a notable portion attributed to FDI clients. This growth outpaced the overall market, underscoring AIB's dominant position.

- Market Share Dominance: The bank holds an estimated 35% market share in corporate lending to FDI-backed entities in Ireland, a testament to its deep relationships and tailored financial solutions for these businesses.

- Economic Environment Impact: Ireland's favorable corporate tax rates and skilled workforce continue to attract FDI, providing a fertile ground for AIB's lending operations in this sector.

- Sectoral Focus: Key sectors receiving AIB's FDI lending include technology, pharmaceuticals, and financial services, reflecting the primary areas of international investment in Ireland.

Climate Capital Segment

The Climate Capital segment, a recent addition to AIB Group's strategic framework, is specifically designed to finance substantial renewable energy and infrastructure developments. This initiative targets projects across Ireland, the UK, Europe, and North America, positioning AIB to capitalize on the burgeoning demand for sustainable development financing.

This segment represents a significant growth avenue for AIB, with the bank aspiring to achieve a leading position in funding the global energy transition. The rapid allocation of capital within this segment underscores AIB's commitment and the considerable potential observed in the climate finance market.

- Market Focus: Large-scale renewable and infrastructure projects in Ireland, UK, Europe, and North America.

- Strategic Goal: To become a market leader in financing the energy transition.

- Capital Deployment: Rapid deployment of funds indicates strong commitment and market potential.

AIB's digital personal loans are a clear star performer, with 87% of applications in 2024 submitted online. This high digital adoption indicates a rapidly expanding and well-penetrated growth channel within personal banking.

Green mortgages are also a standout, making up 58% of AIB's new mortgage lending in H1 2025. This strong uptake highlights the bank's successful strategy in aligning product development with customer preferences for eco-conscious living.

AIB's leading position in corporate lending to Foreign Direct Investment (FDI) clients in Ireland further solidifies its star status. The bank holds an estimated 35% market share in this segment, driven by Ireland's attractive economic environment for international businesses.

The Climate Capital segment, focused on large-scale renewable energy and infrastructure, is another star. AIB aims for market leadership in financing the energy transition, with rapid capital deployment demonstrating strong commitment and market potential.

| Category | Key Metric | 2024/H1 2025 Data | Significance |

|---|---|---|---|

| Digital Personal Loans | Online Application Rate | 87% (2024) | High digital penetration, strong growth channel |

| Green Mortgages | Share of New Mortgage Lending | 58% (H1 2025) | Alignment with customer demand for sustainability |

| FDI Corporate Lending | Estimated Market Share | 35% | Dominant position in supporting international investment |

| Climate Capital | Strategic Focus | Leading financing for energy transition | Capitalizing on demand for sustainable development |

What is included in the product

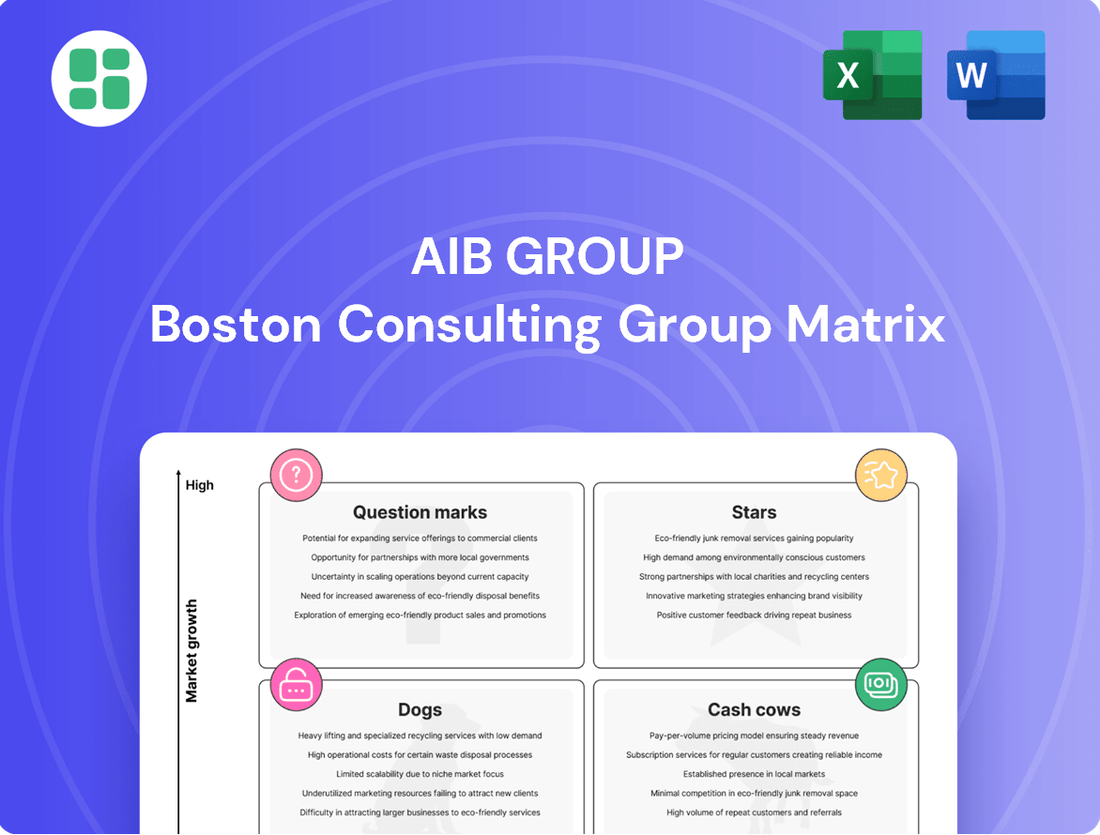

The AIB Group BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting which units to invest in, hold, or divest for optimal portfolio management.

AIB Group BCG Matrix: A clear visual of business unit performance, easing the pain of resource allocation decisions.

Cash Cows

Traditional retail deposits are a cornerstone for AIB Group, acting as a classic cash cow. At the close of 2024, AIB held a substantial €109.9 billion in customer deposits, a figure that remained remarkably stable into the first quarter of 2025. This extensive and dependable funding base significantly reduces the bank's reliance on more expensive wholesale funding.

These stable, low-cost deposits are crucial for funding AIB's lending operations, generating consistent net interest income. The minimal need for significant growth investments in this mature segment allows it to contribute steadily to the group's profitability, embodying the characteristics of a cash cow within the BCG matrix.

AIB's established residential mortgage portfolio represents a significant cash cow. Beyond new lending, AIB holds a substantial share of the Irish residential mortgage market, with its existing portfolio of non-green and established mortgages consistently generating interest income. This mature segment, while experiencing low growth, provides a predictable and steady cash flow for the bank, underpinning its financial stability.

AIB's dominance in the Irish business banking sector, evidenced by its 49% market share in business main current accounts, positions this segment as a significant cash cow. This commanding presence translates directly into a consistent and substantial inflow of low-cost funding, crucial for supporting the group's overall financial health and lending activities.

The high volume of transactions processed through these accounts generates reliable fee income, contributing steadily to AIB's profitability. Operating within a mature market, this segment benefits from established customer relationships and a predictable revenue stream, characteristic of a strong cash cow.

Core Corporate and Commercial Banking Relationships

AIB Group's core corporate and commercial banking relationships in Ireland are a prime example of a Cash Cow. These long-standing connections with established businesses provide a stable and predictable revenue stream for the bank. The deep integration of AIB’s services into these clients’ operations means consistent profitability with significantly lower marketing and acquisition expenses than for newer business segments.

This segment is characterized by its high market share within the Irish corporate banking landscape. For instance, in 2023, AIB reported a net interest margin of 1.77%, reflecting the efficiency of serving these established, lower-risk relationships. The bank’s extensive client base in this area ensures ongoing demand for its lending, transaction, and advisory services.

- High Market Share: Dominant position in the Irish corporate and commercial banking sector.

- Stable Revenue: Consistent income generation from a mature client base.

- Low Acquisition Costs: Reduced expenses due to established, long-term client relationships.

- Comprehensive Product Suite: Cross-selling opportunities across various banking services to existing clients.

Wealth Management Solutions

AIB Group's wealth management division, boasting €17 billion in Assets Under Management (AUM) as of early 2024, operates as a significant Cash Cow. This segment generates a stable, fee-based income stream, contributing reliably to the group's overall financial health. The mature client base ensures consistent revenue generation, largely insulated from the volatility of interest rate movements.

- Stable Fee-Based Income: The €17 billion AUM translates into predictable revenue through management fees.

- Mature Client Base: This demographic typically exhibits lower churn and consistent investment patterns.

- Diversified Revenue Stream: Wealth management income complements other banking activities, reducing overall group risk.

- Resilience to Interest Rate Changes: Fee-based income is less directly impacted by interest rate fluctuations compared to net interest margins.

AIB Group's established retail deposit base, totaling €109.9 billion at the end of 2024, functions as a quintessential cash cow. This substantial and stable funding source minimizes the need for more costly wholesale financing, directly supporting lending activities and generating consistent net interest income. The low growth and maturity of this segment allow it to be a reliable profit contributor.

| Segment | BCG Category | Key Financial Metric (2024 Data) | Strategic Implication |

|---|---|---|---|

| Retail Deposits | Cash Cow | €109.9 billion customer deposits | Low-cost funding, stable net interest income |

| Residential Mortgages | Cash Cow | Significant market share, consistent interest income | Underpins financial stability, predictable cash flow |

| Business Banking | Cash Cow | 49% market share in business main current accounts | Low-cost funding, reliable fee income |

| Corporate & Commercial Banking | Cash Cow | Net Interest Margin of 1.77% (2023) | Stable revenue, low acquisition costs |

| Wealth Management | Cash Cow | €17 billion Assets Under Management (AUM) | Stable fee-based income, diversified revenue |

Preview = Final Product

AIB Group BCG Matrix

The AIB Group BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, is designed to provide actionable insights into AIB Group's business portfolio. You can confidently expect the same high-quality, ready-to-use strategic tool that will empower your decision-making processes.

Dogs

AIB's extensive branch network, while a historical strength, now presents a challenge with its older or less utilized locations potentially falling into the 'dog' category of the BCG matrix. This is driven by a significant shift in customer behavior towards digital banking, leading to declining footfall in these physical spaces. In 2024, AIB's focus on a streamlined branch presence and a reduced property footprint directly addresses this by aiming to mitigate the higher operational and maintenance costs associated with these underperforming assets in a low-growth market.

Legacy IT systems within AIB Group, despite ongoing digital transformation efforts, represent a significant challenge. These older systems are often expensive to maintain, with estimates suggesting that a substantial portion of IT budgets in large financial institutions are allocated to keeping these systems running rather than innovation. For instance, in 2024, many banks reported that over 50% of their IT spending was directed towards maintaining legacy infrastructure.

These systems typically offer limited agility and may not directly contribute to a competitive edge in the rapidly evolving banking landscape. Their inability to seamlessly integrate with newer technologies can hinder operational efficiency and slow down the introduction of new customer-facing products. This means they are unlikely to be growth drivers, instead acting as resource drains.

The burden of legacy IT can directly impact a company's ability to adapt and innovate, potentially leading to a decline in market share if competitors leverage more modern and efficient systems. The cost of maintaining these systems, coupled with their lack of future growth potential, positions them as potential 'Dogs' in a BCG matrix analysis, requiring careful consideration for modernization or eventual replacement.

AIB Group's strategic moves, like divesting its GB SME business and transferring UK green loans, illustrate the 'dog' category in the BCG matrix. These actions reflect a deliberate shedding of underperforming or non-strategic assets. For instance, in 2023, AIB continued its strategic review of its UK operations, which included assessing the future of its remaining UK mortgage portfolio, a move consistent with exiting 'dog' assets.

Certain Niche, Low-Demand Traditional Products

Certain niche, low-demand traditional products within the banking sector can become significant drains on resources. These are offerings that, while once relevant, have experienced a persistent drop in customer interest. Without substantial innovation or a strong market presence, they fail to generate meaningful revenue and can consume a disproportionate amount of administrative time and effort, essentially acting as cash traps for the AIB Group.

For instance, consider the market for physical check processing. While still used by some businesses, its overall demand has plummeted. In 2023, the Federal Reserve reported a continued decline in check volume, with electronic payments becoming the dominant method. For a bank like AIB, maintaining the infrastructure and personnel to support a shrinking check processing operation might yield minimal returns while incurring significant operational costs.

- Declining Customer Demand: Products like traditional passbook savings accounts or specialized, outdated loan types are seeing reduced uptake.

- High Administrative Costs: Maintaining legacy systems and manual processes for these products often outweighs the revenue they generate.

- Low Revenue Generation: Minimal transaction volumes and fees contribute to a poor return on investment.

- Cash Trap Potential: Continued investment in these products without a clear path to revitalization can divert capital from more profitable ventures.

Underperforming UK Commercial Segments

Within AIB Group's UK commercial operations, certain segments may be classified as Dogs in the BCG Matrix. These are typically areas with low market share and low growth, often characterized by intense competition and limited differentiation. For instance, commercial lending focused on sectors not prioritized under the new Climate Capital strategy, or deposit products in saturated, low-interest-rate markets, could fall into this category.

These underperforming segments require careful consideration. While AIB UK as a whole remains profitable, these specific niches might be draining resources without generating commensurate returns. The bank needs to assess whether these areas can be revitalized or if a strategic scaling back or divestment is the more prudent course of action.

For example, in 2024, the UK commercial real estate lending market faced headwinds due to higher interest rates and economic uncertainty, potentially impacting AIB's market share and growth in that specific niche. Similarly, traditional business current accounts in a highly digitized and competitive landscape might represent a low-growth, low-share area for AIB UK.

- Low Market Share: Segments lacking a significant competitive advantage or unique selling proposition.

- Low Growth: Markets characterized by stagnation or decline, offering limited opportunities for expansion.

- Resource Drain: Areas that consume capital and management attention without delivering substantial returns.

- Strategic Re-evaluation: The need to analyze whether to invest in turnaround, divest, or harvest these underperforming assets.

Dogs in AIB Group's portfolio represent business units or products with low market share and low growth potential. These often require significant investment to maintain but offer minimal returns, acting as cash drains. For instance, AIB's continued efforts to reduce its physical branch footprint in 2024 reflect a strategy to divest or minimize exposure to these underperforming, high-cost legacy assets.

Question Marks

AIB Group is strategically investing in advanced AI-driven analytics, aiming to significantly boost both customer experience and operational efficiency. This focus on AI is designed to unlock deeper customer insights and streamline internal processes, positioning the company for future growth.

While AIB's commitment to AI is strong, the market share and widespread adoption of many specific advanced AI tools remain in their early stages. This indicates a nascent market where innovation is key, but broad market acceptance is still developing.

These AI initiatives represent a high-potential growth area for AIB, but currently face low market penetration. Consequently, achieving significant market traction will necessitate substantial ongoing investment in research, development, and implementation.

AIB Group's strategic investments in new fintech partnerships and ventures position these initiatives within the Question Marks quadrant of the BCG Matrix. These collaborations, often involving substantial capital outlay, are geared towards exploring nascent but potentially disruptive financial technologies and services. For example, AIB's participation in the €25 million funding round for Wayfly, a digital lending platform, exemplifies this strategy. Wayfly, while showing early promise in streamlining loan applications, currently holds a minimal market share, necessitating careful monitoring and further investment to assess its growth trajectory.

Expanding Climate Capital into new, emerging international markets beyond its established strongholds in Ireland, the UK, Europe, and North America would position it as a question mark within the BCG matrix. While these new territories offer significant growth potential, mirroring the overall trajectory of climate-focused finance, the initial market share for Climate Capital would likely be low due to unfamiliarity and nascent regulatory frameworks.

For instance, while the global green finance market reached an estimated $1.2 trillion in 2023, with significant growth in established regions, penetration in frontier markets remains nascent. Entering these less developed markets carries substantial risk, including political instability, currency fluctuations, and varying levels of environmental policy enforcement, all of which could impact initial investment returns and operational success.

Emerging Digital-Only Product Offerings for New Demographics

AIB could explore digital-only products targeting younger, tech-savvy demographics, such as Gen Z and younger Millennials. These offerings, potentially including specialized savings accounts with gamified features or micro-investment platforms, would be positioned in the question mark quadrant of the BCG matrix. The goal would be to capture a high-growth segment, but success hinges on rapid customer acquisition and differentiation from nimble fintech competitors.

For instance, consider the burgeoning digital banking market. In 2024, global fintech adoption reached 75%, with younger demographics showing the highest engagement. AIB's challenge would be to carve out significant market share quickly, as these segments are often early adopters of new technologies and can switch providers with ease.

- Target Demographic: Digitally-native consumers, primarily Gen Z and younger Millennials, who prioritize seamless online experiences and mobile-first solutions.

- Product Examples: Gamified savings accounts, micro-investment apps, digital-only credit products with transparent fee structures, and personalized financial planning tools.

- Market Context: The digital banking sector is experiencing rapid growth, with an increasing number of neobanks and fintechs offering innovative products. In 2024, the digital banking market was valued at over $25 billion globally and is projected to grow significantly.

- Strategic Challenge: To achieve rapid market penetration and build brand loyalty in a competitive landscape, requiring substantial investment in user experience, marketing, and potentially strategic partnerships.

Specialized Sustainability Consultancy Services for Businesses

AIB Group is strategically expanding its sustainability focus by introducing specialized consultancy services for its business clients. This initiative positions AIB to capture growth in the burgeoning advisory market, aligning with its broader green finance agenda.

This new service area represents a significant strategic shift for AIB, moving beyond traditional banking into a high-potential advisory space. While the bank's commitment to sustainability is clear, these consultancy services are in their nascent stages, meaning they currently hold a low market share.

Significant investment in client acquisition and service development will be crucial for AIB to scale these sustainability consultancy offerings effectively. The bank will need to demonstrate tangible value and expertise to attract businesses seeking guidance on their environmental, social, and governance (ESG) strategies.

- Strategic Expansion: AIB's move into sustainability consultancy diversifies its service portfolio and taps into a growing demand for ESG expertise.

- Market Position: As a new entrant in this advisory niche, AIB faces the challenge of building market share from a low base, requiring aggressive client outreach.

- Growth Potential: The global sustainable finance market is projected for substantial growth, with consultancy services expected to be a key enabler for businesses navigating complex ESG regulations and opportunities. For instance, the sustainable investment market reached over $35 trillion globally in 2024, indicating a strong underlying demand for related advisory services.

- Client Acquisition Focus: Success hinges on AIB's ability to attract and retain businesses by offering tailored, value-driven sustainability solutions.

AIB Group's exploration of new digital-only financial products for younger demographics represents a classic Question Mark in the BCG Matrix. These initiatives target a high-growth segment, but currently possess low market share, demanding significant investment to gain traction.

The success of these digital offerings hinges on rapid customer acquisition and differentiation in a competitive fintech landscape. AIB must effectively capture this tech-savvy audience, which is known for its agility in adopting new financial technologies.

For example, in 2024, global fintech adoption stood at 75%, with younger generations leading the charge. AIB's challenge is to secure a meaningful share of this market quickly, as these consumers are quick to switch providers.

| Initiative | Market Share | Growth Potential | Investment Need | Strategic Focus |

| Digital-only products for Gen Z/Millennials | Low | High | High | Customer Acquisition & Differentiation |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from AIB Group's financial statements, internal performance metrics, and market research reports to accurately assess product portfolio positioning.