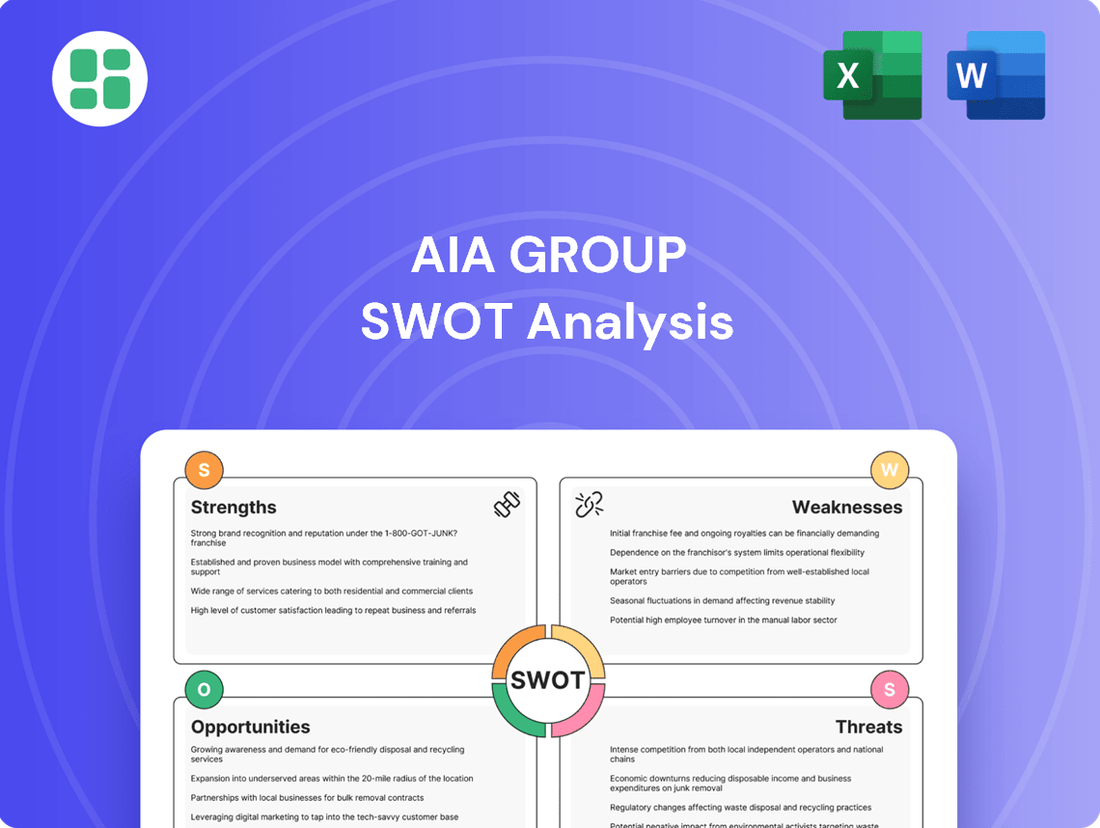

AIA Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIA Group Bundle

AIA Group's robust brand recognition and extensive distribution network are significant strengths, poised to capitalize on Asia's growing middle class. However, navigating diverse regulatory landscapes and intense competition presents key challenges. Understanding these dynamics is crucial for strategic planning.

Want the full story behind AIA's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AIA Group showcases impressive financial strength, evidenced by an 18% surge in its Value of New Business (VONB) to US$4.71 billion and a 12% uplift in operating profit after tax (OPAT) per share for the full year 2024. This robust performance underscores the company's operational efficiency and market penetration.

Further bolstering its financial standing, AIA maintained a strong shareholder capital ratio of 236% in 2024. The group also committed to a significant US$1.6 billion share buyback program during the same year, signaling confidence in its future prospects and a dedication to enhancing shareholder value.

The positive financial momentum carried into the first quarter of 2025, with VONB experiencing a healthy 13% increase. This sustained growth highlights AIA's consistent ability to generate value and expand its business across key markets.

AIA stands as the largest independent publicly listed pan-Asian life insurance group, a significant strength that underpins its market leadership. Operating across 18 diverse markets in the Asia-Pacific region, AIA benefits from a robust and resilient business model built on this extensive geographical footprint. This broad presence positions the company to effectively tap into the substantial long-term growth opportunities within the life and health insurance sectors across Asia.

AIA's proprietary Premier Agency network stands as a formidable strength, a key differentiator in the insurance landscape. This exclusive agency force was responsible for over 75% of the Group's new business value (VONB) in the first quarter of 2025, highlighting its immense contribution and effectiveness.

This vast and productive distribution channel is further bolstered by continuous investment in agent recruitment and sophisticated digital tools. These resources empower agents to deliver expert advice and cultivate enduring relationships with clients, a crucial element for sustained growth and customer loyalty.

Advanced Digital Transformation and AI Integration

AIA Group has made substantial strides in its digital and AI capabilities, completing a major technology, digital, and analytics transformation. This involved migrating over 90% of computing processes to the cloud and automating a significant portion of its core operations, setting a strong foundation for future innovation.

The company's current strategic focus is on integrating generative AI across its business. In 2024 alone, AIA deployed 53 generative AI use cases, impacting distribution, operations, and customer service. This proactive AI adoption is designed to boost efficiency, elevate customer experiences, and support agent development.

Examples of this AI integration include AI-powered tools for agent training, such as role-playing simulations. These advancements demonstrate AIA's commitment to leveraging cutting-edge technology to enhance its competitive edge and operational effectiveness in the evolving financial services landscape.

Robust ESG Commitment and Initiatives

AIA Group exhibits a robust commitment to Environmental, Social, and Governance (ESG) principles, underpinning its long-term strategy. This dedication is formalized through a comprehensive five-pillar ESG strategy, ensuring a structured approach to sustainability.

The company's efforts in 2024 highlight this commitment, with over 496 million individuals reached through health and wellness programs. Furthermore, AIA achieved a significant 25% reduction in Scope 1 and Scope 2 emissions compared to its 2019 baseline, demonstrating tangible environmental progress. These achievements have been further validated by multiple industry recognitions for its sustainable business practices.

- Comprehensive Five-Pillar ESG Strategy: AIA has established a clear framework for its sustainability efforts.

- Extensive Health and Wellness Reach: In 2024, over 496 million people were engaged through health and wellness initiatives.

- Significant Emissions Reduction: A 25% decrease in Scope 1 and Scope 2 emissions from a 2019 baseline was achieved.

- Industry Recognition for Sustainability: Multiple accolades underscore AIA's commitment to sustainable practices.

AIA Group's financial performance in 2024 was exceptionally strong, with a 18% increase in Value of New Business (VONB) to US$4.71 billion and a 12% rise in operating profit after tax (OPAT) per share. This robust financial health is further evidenced by a solid shareholder capital ratio of 236% and a US$1.6 billion share buyback program in 2024, demonstrating management's confidence and commitment to shareholder returns. The positive trend continued into Q1 2025 with a 13% VONB growth, highlighting sustained operational momentum.

AIA's market leadership as the largest independent publicly listed pan-Asian life insurance group, operating across 18 diverse markets, provides a significant competitive advantage. This extensive geographical footprint allows AIA to capitalize on the substantial long-term growth potential in the Asian life and health insurance sectors. The proprietary Premier Agency network is a key differentiator, contributing over 75% of the Group's VONB in Q1 2025, showcasing its effectiveness as a distribution channel.

The company's strategic investment in digital and AI capabilities is a major strength, with over 90% of computing processes migrated to the cloud and significant automation of core operations. AIA's proactive integration of generative AI, deploying 53 use cases in 2024 across distribution, operations, and customer service, is enhancing efficiency and customer experience. AI-powered agent training tools, like role-playing simulations, further solidify this technological advantage.

AIA's strong commitment to ESG principles, guided by a comprehensive five-pillar strategy, is a core strength. In 2024, the group reached over 496 million individuals through health and wellness programs and achieved a 25% reduction in Scope 1 and 2 emissions from its 2019 baseline. These environmental and social initiatives have garnered multiple industry recognitions, reinforcing AIA's reputation for sustainable business practices.

| Key Strength Indicators | 2024/Q1 2025 Data | Significance |

| VONB Growth | 18% (FY24), 13% (Q1 2025) | Demonstrates strong new business generation and market demand. |

| Shareholder Capital Ratio | 236% (FY24) | Indicates robust financial stability and capacity for growth. |

| Premier Agency Contribution | >75% of VONB (Q1 2025) | Highlights the critical role of its proprietary distribution channel. |

| AI Use Cases Deployed | 53 (2024) | Shows significant progress in leveraging AI for operational enhancement. |

| Health & Wellness Reach | >496 million individuals (2024) | Underscores commitment to social impact and community well-being. |

What is included in the product

Delivers a strategic overview of AIA Group’s internal and external business factors, highlighting its strong brand, market presence, and growth opportunities in Asia, while also acknowledging potential regulatory challenges and competitive pressures.

Offers a clear understanding of AIA Group's competitive landscape, helping to identify and mitigate potential threats and capitalize on emerging opportunities.

Weaknesses

AIA's substantial operations in mainland China, a key engine for growth, also present a significant vulnerability. Fluctuations in Chinese consumer sentiment, potential economic slowdowns, and the dynamic nature of regulatory reforms introduce considerable uncertainty. This exposure means that shifts in policy or economic conditions within China can directly impact AIA's financial performance and strategic outlook.

The impact of regulatory shifts is already evident. For example, the move to Hong Kong's Electronic Mandatory Pension Fund (EMPF) resulted in lost fee income for AIA. Furthermore, in the first quarter of 2025, a downward revision of long-term investment return assumptions specifically affected the Value of New Business (VONB) in mainland China, underscoring the sensitivity to these external factors.

AIA Group's financial performance is significantly tied to investment market conditions. In 2024, the company experienced lower investment income, with a particular impact noted from declining Chinese yields, which pressured profitability. This sensitivity means that shifts in market performance can create challenges for AIA's earnings.

The group observed negative investment variances, highlighting the direct effect of market downturns on its financial results. Furthermore, reduced assumptions for long-term investment returns directly influenced the calculation of Value of New Business (VONB), indicating a more cautious outlook based on prevailing market trends.

While the AIA Group saw an overall improvement in its Value of New Business (VONB) margin, specific markets faced headwinds. For instance, AIA Singapore's VONB margin saw a notable decline of 16.8 percentage points in 2024. This dip was a direct consequence of a deliberate strategic pivot towards products with longer-term savings components, demonstrating how shifts in product strategy can directly influence profitability within individual segments.

Intense Competition in Asia-Pacific

The Asia-Pacific insurance landscape is a battleground, with giants like Prudential, Manulife, China Life Insurance, and Zurich Insurance Group vying for dominance. These established players are not standing still; they are actively pursuing growth and introducing new products and services, especially in lucrative markets such as Hong Kong, Singapore, and mainland China. This fierce rivalry can indeed challenge AIA's ability to maintain its market share, influence pricing strategies, and ultimately impact its profitability.

The competitive intensity in the region means AIA faces constant pressure to differentiate itself and innovate rapidly. For instance, in 2023, the Asia-Pacific insurance market saw significant investment in digital transformation by many competitors, aiming to enhance customer experience and operational efficiency. This trend is expected to continue through 2024 and into 2025, requiring AIA to invest heavily in technology and marketing to stay ahead.

- Aggressive Expansion by Rivals: Competitors are actively increasing their presence and product offerings across key Asian markets.

- Innovation Pressure: The need to constantly innovate in product development and service delivery is paramount due to competitor actions.

- Market Share and Pricing Challenges: Intense competition can lead to price wars and difficulties in expanding market share without significant concessions.

- Profitability Strain: Increased marketing spend and competitive pricing can put a strain on profit margins for all players, including AIA.

Potential Challenges in Agent Productivity and Recruitment in Certain Markets

While AIA's agency model is a core strength, maintaining agent numbers and productivity presents ongoing challenges in specific markets. For instance, in China, the post-pandemic period saw a notable decline in agent numbers, impacting the overall sales force size.

AIA is actively working to counter this trend through enhanced digital tools and focused recruitment initiatives. However, if these efforts don't fully offset sustained declines or difficulties in attracting and retaining top-tier talent, it could hinder the group's new business growth trajectory.

- China Agent Decline: Post-pandemic, China experienced a significant drop in agent numbers, illustrating regional challenges.

- Digital & Recruitment Focus: AIA is investing in digital capabilities and recruitment drives to bolster its agency force.

- Impact on Growth: Sustained difficulties in agent retention and attraction could impede new business expansion.

AIA's significant exposure to mainland China, while a growth driver, introduces substantial risk due to economic volatility and evolving regulatory landscapes. For example, a downward revision of long-term investment return assumptions in Q1 2025 directly impacted the Value of New Business (VONB) in China, highlighting this sensitivity. Furthermore, AIA's profitability is directly linked to investment market performance, as seen in 2024 with lower investment income, particularly impacted by declining Chinese yields.

| Weakness | Impact | Data Point/Example |

| China Market Sensitivity | Economic and regulatory shifts in China can significantly affect financial performance and growth outlook. | Q1 2025: Downward revision of long-term investment return assumptions impacted China VONB. |

| Investment Market Dependence | Fluctuations in investment returns directly influence profitability and key metrics like VONB. | 2024: Lower investment income, impacted by declining Chinese yields, pressured profitability. Negative investment variances observed. |

| Competitive Intensity | Rivals actively expanding and innovating in key Asian markets challenge market share and pricing power. | 2023-2024: Increased competitor investment in digital transformation requires AIA to also invest heavily to maintain competitiveness. |

| Agency Force Management | Maintaining agent numbers and productivity, especially in markets like China, presents ongoing challenges. | Post-pandemic China saw a decline in agent numbers, impacting the sales force size and potentially new business growth. |

Preview Before You Purchase

AIA Group SWOT Analysis

This is the actual AIA Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive breakdown of the company's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing AIA Group's market position and future growth potential.

Opportunities

The Asia-Pacific region offers significant long-term growth prospects for life and health insurance, fueled by robust structural drivers. These include substantial private savings, expanding and maturing populations, heightened health consciousness, and relatively low insurance penetration. These demographic and economic forces translate into enduring demand for AIA's offerings.

AIA is making significant strides in expanding its footprint across mainland China, a key growth market. The company has secured regulatory approvals to establish new branches in provinces such as Anhui, Shandong, Chongqing, and Zhejiang, demonstrating a clear commitment to this strategy.

This aggressive expansion allows AIA to tap into a vast customer base, potentially reaching over 340 million individuals across 14 distinct geographies. This represents a substantial opportunity for new business acquisition and market penetration in largely untapped regions.

The plan includes a rapid build-out of agent forces within each new branch, aiming to quickly establish a strong sales presence and capitalize on the immense market potential. This focus on agent recruitment is crucial for driving sales volume and achieving rapid scaling.

AIA Group has a prime opportunity to deepen its commitment to digitalization and AI. By integrating advanced technologies like generative AI and AI-driven underwriting, the company can significantly boost its operational efficiency. This focus is particularly relevant as the global insurtech market is projected to reach $100 billion by 2025, highlighting a strong demand for such innovations.

These technological advancements can streamline critical processes such as claims handling and customer service. For instance, AI-powered platforms can personalize customer interactions, leading to improved engagement and satisfaction. AIA's continued investment in these areas is crucial for solidifying its standing as a forward-thinking digital insurer, especially as digital health platforms gain traction in the market.

Growing Demand for Health and Wellness Solutions

AIA's commitment to fostering Healthier, Longer, Better Lives directly taps into the escalating global demand for integrated health and wellness solutions. This strategic alignment is a significant opportunity for growth. For instance, in 2024, the global wellness market was projected to reach over $5.6 trillion, highlighting the vast potential.

Through programs like AIA Vitality and strategic alliances with health technology innovators, AIA is well-positioned to deliver a spectrum of services. These include proactive preventative care, accessible telemedicine, and crucial mental wellness support, thereby diversifying revenue and enhancing customer engagement beyond conventional insurance offerings.

- Expanding Health Tech Partnerships: AIA can further leverage technology by investing in or partnering with companies offering AI-driven diagnostics, personalized nutrition plans, and remote patient monitoring.

- Developing Digital Wellness Platforms: Creating a more robust digital ecosystem that integrates fitness tracking, health coaching, and mindfulness resources can attract and retain a health-conscious customer base.

- Tailoring Wellness Packages: Offering customized wellness packages that cater to specific demographic needs or health concerns, such as corporate wellness programs or solutions for aging populations, presents a significant growth avenue.

- Data-Driven Health Insights: Utilizing the data generated from its wellness programs can provide AIA with valuable insights into customer health trends, enabling more targeted product development and personalized health recommendations.

Strategic Partnerships and Product Diversification

AIA has significant opportunities to forge new strategic alliances with fintech, healthtech, and data analytics firms, building on its existing successful collaborations. These partnerships can unlock innovative product development, strengthen distribution networks, and provide entry into previously untapped customer bases. For instance, in 2024, AIA continued to invest in digital health platforms, aiming to integrate wellness programs more deeply into its insurance offerings.

Diversifying its product portfolio is another key avenue for growth. By developing and promoting products that cater to evolving customer demands, such as the increasing need for long-term savings solutions, AIA can secure new market share. The company's focus on retirement solutions in markets like Singapore, which saw a 7% increase in demand for such products in 2024, exemplifies this strategic direction.

- Fintech and Healthtech Alliances: AIA can leverage partnerships to integrate advanced analytics and digital health services, enhancing customer engagement and product innovation.

- Data Analytics Integration: Collaborations can provide AIA with deeper insights into customer behavior, enabling personalized product offerings and more effective risk assessment.

- Product Diversification: Expanding into areas like long-term savings and retirement planning addresses growing market needs and captures new customer segments.

- Enhanced Distribution: Strategic partnerships can open up new channels to reach diverse customer groups, including younger demographics and emerging markets.

AIA Group is well-positioned to capitalize on the growing demand for integrated health and wellness solutions, a market projected to exceed $5.6 trillion globally in 2024. Through initiatives like AIA Vitality and partnerships with health tech firms, the company can offer preventative care, telemedicine, and mental wellness support, thereby diversifying revenue streams and deepening customer engagement.

Threats

The global economic climate presents significant challenges, with the International Monetary Fund (IMF) forecasting global growth to slow to 2.9% in 2024, down from 3.2% in 2023, signaling potential headwinds for AIA. Geopolitical instability, particularly in regions like the Middle East and Eastern Europe, can disrupt supply chains and impact investment portfolios, potentially affecting AIA's asset management performance and overall profitability.

Changes in regulatory landscapes across AIA's operating regions pose a significant threat. For instance, the shift to Hong Kong's Electronic Mandatory Pension Fund (EMPF) has directly impacted fee income, highlighting the financial consequences of regulatory evolution.

Further compounding this, product repricing initiatives in key markets such as Malaysia and Thailand, driven by regulatory pressures, can compress profit margins and necessitate strategic adjustments to product portfolios.

Effectively managing and adapting to these dynamic regulatory shifts is paramount for AIA to sustain its profitability and competitive edge in the long term.

The Asian insurance landscape is fiercely competitive, with established global and regional players like Prudential, Manulife, China Life Insurance, and Zurich aggressively expanding and innovating. These competitors are increasingly focusing on digital distribution and customized product development, which could put pressure on AIA's pricing strategies and increase customer acquisition costs as they vie for market share.

Exposure to Interest Rate Fluctuations and Investment Risks

AIA Group faces significant threats from fluctuating interest rates, particularly in markets like China where yields have been persistently low. This environment directly impacts AIA's investment returns, a crucial driver of its profitability. For instance, a prolonged period of low yields can compress the margins on AIA's long-term savings products, a core offering for the company.

The company's substantial investment portfolio is exposed to market volatility, and a sustained downturn could impair the value of its embedded capital. While AIA employs a prudent investment strategy, the broader economic climate, including inflation and potential policy shifts, introduces ongoing risks that can affect asset valuations and future earnings potential.

- Persistent Low Yields: Declining interest rates, especially in key Asian markets, can reduce investment income.

- Margin Compression: Lower yields on assets can shrink profitability for long-term savings and insurance products.

- Investment Portfolio Risk: Market downturns or interest rate hikes can negatively impact the value of AIA's substantial investment holdings.

- Economic Sensitivity: AIA's financial performance is closely tied to macroeconomic conditions and interest rate environments across its operating regions.

Shifting Customer Preferences and Technological Disruption

Customer preferences are evolving quickly, with a strong lean towards digital interactions and tailored services. This shift poses a challenge to AIA's established agency-focused approach. For instance, a 2024 survey indicated that over 70% of consumers prefer managing their insurance policies digitally, highlighting a significant demand for online self-service options.

While AIA is actively pursuing digital transformation, falling behind on adopting new technologies or failing to meet changing consumer expectations could hinder customer acquisition and retention. The company's 2024 digital investment plan aims to address this, but the pace of technological change and potential disruption in distribution channels remain key concerns. A failure to adapt could see AIA lose market share to more agile, digitally native competitors.

- Digital Preference Growth: Consumer surveys in 2024 showed a significant increase in preference for digital channels for insurance management.

- Personalization Demand: Customers increasingly expect personalized product offerings and communication, requiring advanced data analytics capabilities.

- Disruptive Technology Impact: Emerging technologies like AI-powered underwriting and blockchain for claims processing could reshape the industry landscape.

- Distribution Model Evolution: A potential shift away from traditional agent-led sales towards direct-to-consumer digital platforms presents a strategic threat.

Intensifying competition from both established insurers and agile fintech disruptors presents a significant threat to AIA Group's market position. Competitors are increasingly leveraging digital channels and personalized offerings, potentially eroding AIA's customer base and pricing power. For example, in 2024, several regional insurers launched innovative digital platforms that saw rapid customer adoption, indicating a shift in consumer preference away from traditional models.

SWOT Analysis Data Sources

This analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry forecasts to provide a robust and accurate SWOT assessment for AIA Group.