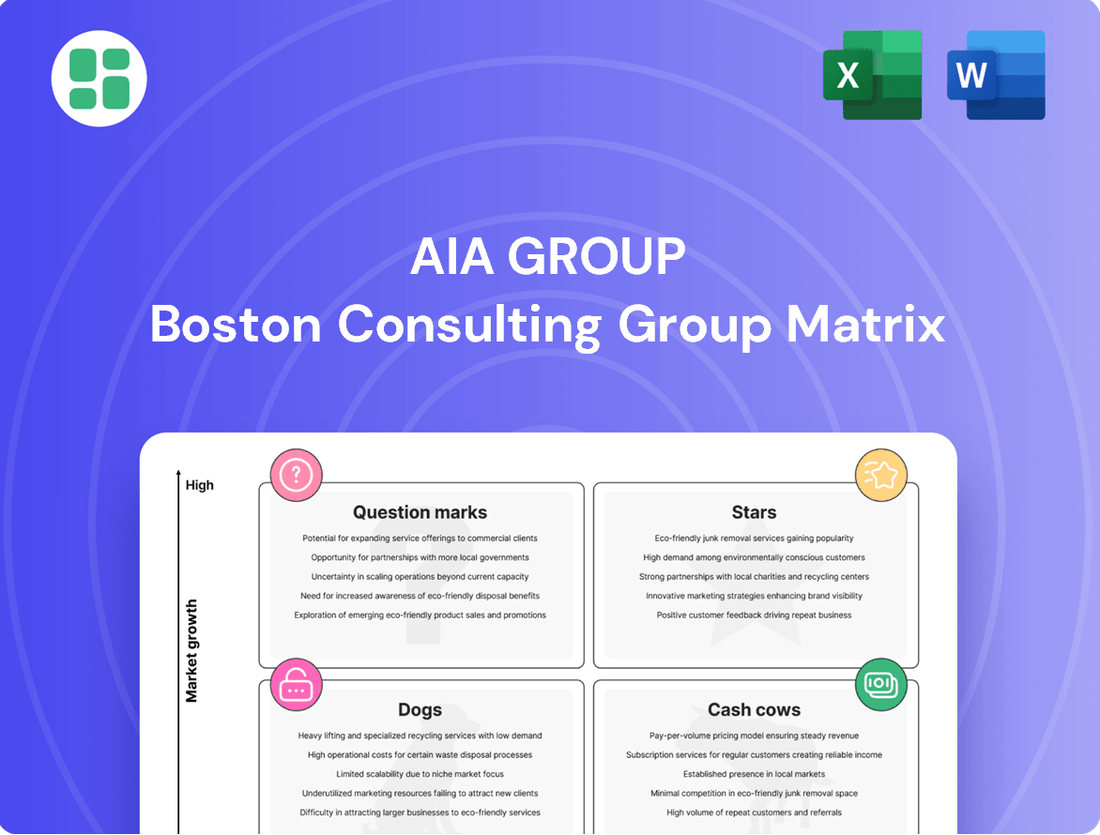

AIA Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIA Group Bundle

Curious about AIA Group's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understand the foundational insights and see where their market share and growth potential truly lie.

To unlock the full strategic advantage, purchase the complete AIA Group BCG Matrix. Gain a comprehensive quadrant-by-quadrant breakdown, data-driven recommendations, and actionable insights to optimize your investment and product development strategies for sustained growth and competitive dominance.

Stars

AIA Group is experiencing robust expansion in key Asian markets. In 2024, Hong Kong saw its Value of New Business (VONB) surge by an impressive 23%, while Mainland China recorded a 20% increase in VONB.

This remarkable performance is largely fueled by mainland Chinese visitors actively seeking offshore insurance products and higher investment returns in Hong Kong. This trend highlights AIA's strong position within a dynamic and growing market segment.

The Premier Agency Model is a significant driver of AIA Group's success, accounting for more than 75% of the Group's total Value of New Business (VONB) in the first quarter of 2025. This proprietary model emphasizes building lasting customer connections, augmented by advanced digital tools.

This strategic approach fosters greater agent productivity and attracts more talent to the team. Consequently, AIA solidifies its dominant position in agency-led sales, particularly within rapidly expanding markets.

AIA Group's commitment to digital transformation is evident through its substantial investments in Technology, Digital, and Analytics (TDA). In 2024 alone, the company successfully rolled out 53 Generative AI use cases, significantly reshaping its insurance services.

These advancements, including AI-driven underwriting and claims processing, are not just about efficiency; they directly boost agent productivity and elevate the customer experience. This strategic embrace of technology positions AIA as a frontrunner in capitalizing on digital opportunities within the evolving insurance landscape.

Expansion into New Geographies in China

AIA Group's strategic expansion within China, particularly in Q4 2024, demonstrates a clear focus on capturing untapped market potential. The acquisition of four new licenses signals a deliberate move into high-growth geographies, aiming to diversify its operational footprint beyond established urban centers.

This expansion is underpinned by an aggressive strategy to build agent forces in these new locations. AIA China plans to rapidly recruit and train agents, reflecting a commitment to deep market penetration and capturing new business opportunities in regions identified for their economic dynamism and demographic advantages.

- Geographical Focus: AIA China secured four new licenses in Q4 2024, targeting provinces with significant untapped market potential.

- Agent Force Growth: Plans are in place to rapidly expand the agent force in each new branch to accelerate market penetration.

- Market Opportunity: This expansion targets regions with high potential for new business, aligning with AIA's growth objectives in the Chinese market.

Long-term Savings and Protection Products

AIA Group's long-term savings and protection products are a cornerstone of their strategy, particularly in dynamic markets. Singapore, for instance, exemplifies a strategic shift towards wealth management, making these products a high-growth area.

These offerings are designed to meet the sophisticated needs of both affluent individuals and a growing segment of new immigrants. This focus directly translates into substantial contributions to the company's new business value, underscoring their importance.

- High Growth Potential: Markets like Singapore are seeing a strategic pivot towards wealth management, boosting demand for these products.

- Customer Focus: Products cater to the evolving needs of affluent customers and new immigrants, a key demographic.

- Value Contribution: These offerings are significant drivers of new business value for AIA Group.

- Market Adaptation: AIA is adept at tailoring solutions to specific market demands and customer segments.

AIA Group's operations in Hong Kong and Mainland China represent its "Stars" in the BCG Matrix, exhibiting high growth and market share. Hong Kong's Value of New Business (VONB) grew 23% in 2024, while Mainland China saw a 20% increase, driven by strong demand for offshore products.

The Premier Agency Model, contributing over 75% of Q1 2025 VONB, underpins this success by enhancing agent productivity and customer relationships. Furthermore, AIA's strategic expansion into four new Chinese provinces in late 2024, coupled with significant investments in AI, solidifies its position as a market leader poised for continued stellar performance.

| Market | 2024 VONB Growth | Key Driver | Strategic Focus |

|---|---|---|---|

| Hong Kong | 23% | Offshore insurance demand from Mainland visitors | Wealth management products |

| Mainland China | 20% | Expanding agency force, digital transformation | New provincial licenses, agent recruitment |

What is included in the product

This BCG Matrix overview analyzes AIA Group's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

AIA Group BCG Matrix provides clarity on business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

AIA Group's established markets, such as Hong Kong and Thailand, represent significant cash cows. In 2024, these regions continue to demonstrate robust performance, reflecting AIA's dominant market share in life insurance premiums. The company's strong brand recognition in these mature economies translates into predictable and substantial cash flows, underpinning its financial stability.

AIA Group's consistent generation of high embedded value (EV) and operating profit after tax (OPAT) firmly places its core insurance businesses in the Cash Cows quadrant of the BCG Matrix. In 2024, AIA reported its EV equity reached an impressive US$71.6 billion, a testament to the long-term value built within its operations.

Furthermore, the company's OPAT demonstrated robust growth, increasing by 12% per share in 2024. This financial strength signifies that AIA's mature insurance segments are generating substantial cash flows, exceeding the capital required to maintain their market position and operations.

AIA Group's robust capital management, highlighted by a strong capital adequacy ratio of 236% at the close of 2024, positions it firmly as a cash cow. This financial strength translates directly into substantial shareholder returns.

The company further underscored its cash cow status by approving a 10% increase in its final dividend for 2024, alongside a significant US$1.6 billion share buyback program. These actions effectively return excess capital generated from its operations to investors, a hallmark of mature, high-performing businesses.

Diversified and Resilient Business Model

AIA's business model is built for strength and adaptability, which is key to its consistent cash flow. In 2024, this resilience was evident with double-digit growth in the Value of New Business (VONB) across all its operating segments. This widespread success means AIA isn't overly dependent on any one area, ensuring a steady stream of revenue.

This diversification is a significant advantage. It allows AIA to navigate different economic conditions and market trends effectively, smoothing out potential bumps. When one region or product line faces challenges, others can compensate, maintaining overall financial stability and predictable cash generation.

- Diversified Revenue Streams: Growth across multiple segments in 2024 demonstrates broad market penetration.

- Resilience to Market Fluctuations: Reduced reliance on any single market or product line enhances stability.

- Consistent VONB Growth: Double-digit increases in VONB across all segments in 2024 underscore strong operational performance.

- Stable Cash Generation: The combined effect of diversification and consistent growth supports predictable cash inflows.

In-force Business and Recurring Earnings

AIA's in-force business represents a significant cash cow, generating substantial recurring earnings. This is fueled by successive layers of profitable new business, creating a stable and predictable revenue stream from existing policies. This robust in-force book requires minimal new investment for maintenance, a hallmark of mature, high-performing assets.

For instance, AIA Group reported a 1.6% increase in its annualized premium equivalent (APE) to $17.7 billion for the full year 2023. This growth in new business directly contributes to the expanding base of recurring earnings from its in-force policies, underscoring its cash cow status.

- Recurring Earnings Foundation: AIA's in-force business provides a consistent and reliable stream of income, built upon a vast portfolio of existing policies.

- Low Maintenance Investment: The mature nature of this business segment means that capital required for its upkeep is relatively low, enhancing profitability.

- Profitability Driver: Profitable new business written in prior periods continues to generate earnings, solidifying its position as a key cash generator for the group.

- 2023 Performance: The company's APE growth in 2023 to $17.7 billion highlights the ongoing success in expanding this valuable in-force business.

AIA Group's established markets, such as Hong Kong and Thailand, represent significant cash cows. In 2024, these regions continue to demonstrate robust performance, reflecting AIA's dominant market share in life insurance premiums. The company's strong brand recognition in these mature economies translates into predictable and substantial cash flows, underpinning its financial stability.

AIA Group's consistent generation of high embedded value (EV) and operating profit after tax (OPAT) firmly places its core insurance businesses in the Cash Cows quadrant of the BCG Matrix. In 2024, AIA reported its EV equity reached an impressive US$71.6 billion, a testament to the long-term value built within its operations.

Furthermore, the company's OPAT demonstrated robust growth, increasing by 12% per share in 2024. This financial strength signifies that AIA's mature insurance segments are generating substantial cash flows, exceeding the capital required to maintain their market position and operations.

AIA's business model is built for strength and adaptability, which is key to its consistent cash flow. In 2024, this resilience was evident with double-digit growth in the Value of New Business (VONB) across all its operating segments. This widespread success means AIA isn't overly dependent on any one area, ensuring a steady stream of revenue.

| Metric | 2023 Value | 2024 Trend | Implication for Cash Cow Status |

| Embedded Value (EV) Equity | US$71.6 billion (2024) | Strong Growth | Indicates significant underlying value and future earnings potential. |

| Operating Profit After Tax (OPAT) per share | 12% increase (2024) | Robust Growth | Demonstrates strong profitability from core operations. |

| Value of New Business (VONB) | Double-digit growth across all segments (2024) | Consistent Expansion | Highlights broad-based success and expanding future cash flows. |

| Annualized Premium Equivalent (APE) | US$17.7 billion (2023) | Continued Growth | Shows ongoing success in acquiring new profitable business, feeding the in-force book. |

Full Transparency, Always

AIA Group BCG Matrix

The AIA Group BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the comprehensive strategic analysis ready for your immediate use. You can be confident that the insights and structure presented here are precisely what you'll be working with to inform your business decisions. This is your final, professional-grade report, designed for clarity and immediate application within AIA Group's strategic planning.

Dogs

Certain AIA segments, like those in Malaysia and Thailand, faced headwinds in 2024 due to the repricing of medical products. This led to softer demand and temporary underperformance in these specific areas, even as the group maintained overall strength. For instance, AIA Malaysia saw its value of new business (VONB) growth impacted by these pricing adjustments.

AIA Group's legacy products, often older insurance policies that haven't kept pace with market evolution or technological innovation, can be categorized as dogs in the BCG matrix. These offerings may struggle to attract new customers, generating just enough revenue to cover their costs without contributing to significant growth.

For instance, traditional participating whole life policies, while once popular, might now face stiff competition from more flexible and digitally integrated products. In 2024, AIA Group reported that while its overall new business value (NBV) grew, the contribution from older, less adaptable product lines would naturally be lower, potentially representing a drag on overall portfolio performance.

These products often require ongoing administrative support and capital allocation but offer limited potential for expansion or enhanced profitability. Their presence in the portfolio can divert resources that could be better invested in high-growth areas or newer, more competitive offerings.

Within AIA Group's extensive 18-market presence, there are likely smaller, less developed insurance markets where the company holds a low market share. These regions, characterized by stagnant growth, present a challenge for substantial investment, as returns are expected to be minimal. For instance, if AIA's market share in a particular emerging market is only 3% and the overall annual growth rate for the insurance sector in that market is a mere 2%, it falls squarely into the Dogs category.

Inefficient Traditional Distribution Channels

Inefficient traditional distribution channels, such as legacy agency models or physical branch networks that haven't been fully digitized, can be categorized as 'dogs' within AIA's BCG Matrix. These channels often carry higher operational costs and exhibit lower new business conversion rates when contrasted with AIA's more advanced, digitally integrated platforms. For instance, while specific figures for AIA's legacy channels are proprietary, the broader insurance industry in 2024 continues to see a significant cost-per-acquisition advantage for digital channels over traditional ones, often in the range of 20-30% savings.

These less efficient channels may represent a declining market share or a segment where AIA is investing less due to its strategic focus on digital transformation. The challenge lies in managing these existing channels to minimize losses while transitioning customers and resources to more profitable, modern distribution methods.

- Higher operational costs: Traditional channels often involve significant overheads like physical infrastructure and manual processes.

- Lower conversion rates: Compared to streamlined digital sales funnels, traditional methods may struggle to convert leads efficiently.

- Declining relevance: Customer preference is increasingly shifting towards digital engagement and self-service options.

- Resource drain: Continued investment in these channels can divert resources from more promising growth areas.

Specific Investment Portfolios Impacted by Yields

Investment portfolios deeply affected by prolonged low interest rates or sluggish equity markets in particular regions can be categorized as 'dogs' within an AIA Group BCG Matrix framework. These assets, though not physical products, tie up significant capital without yielding adequate returns, thereby diminishing the group's overall profitability.

For instance, portfolios heavily weighted towards fixed-income securities in markets with persistently low yields, such as Japan or parts of Europe, might struggle to generate meaningful income. In 2024, many developed economies continued to grapple with inflation, leading central banks to maintain higher interest rates than in previous years, but certain regional markets still experienced subdued growth, impacting bond portfolio performance.

- Underperforming Fixed Income: Portfolios with a substantial allocation to long-duration bonds in regions where interest rates have remained stubbornly low or are expected to decline slowly.

- Stagnant Equity Holdings: Equity investments in specific sectors or geographic markets that have shown minimal growth or negative returns over extended periods, failing to keep pace with broader market trends.

- Capital Consumption: These 'dog' portfolios represent capital that could be redeployed into higher-growth potential areas, highlighting an inefficiency in capital allocation.

- Impact on Profitability: The drag from these underperforming assets can significantly reduce the net return on investment for the entire portfolio, impacting AIA Group's financial health.

AIA Group's legacy products, such as older participating whole life policies, can be considered 'dogs' in the BCG matrix. These offerings often struggle to attract new customers, generating just enough revenue to cover costs without significant growth, as seen with the impact of medical product repricing in Malaysia and Thailand in 2024.

These 'dog' segments, including less developed markets with low market share and stagnant growth, or inefficient traditional distribution channels, represent areas where AIA may have minimal expansion potential and lower returns. For instance, a 3% market share in a 2% growing insurance market exemplifies a 'dog' scenario.

Investment portfolios heavily affected by prolonged low interest rates or sluggish equity markets in specific regions also fall into the 'dog' category. These assets tie up capital without yielding adequate returns, potentially reducing overall profitability for AIA Group, as observed in certain fixed-income markets in 2024.

| Category | Description | 2024 Impact Example | Key Challenges |

| Legacy Products | Older, less adaptable insurance policies | Lower contribution to new business value (NBV) growth | Competition from modern products, limited innovation |

| Underdeveloped Markets | Markets with low AIA market share and stagnant growth | Minimal potential for substantial investment returns | Low market penetration, slow sector growth |

| Inefficient Distribution Channels | Legacy agency models or non-digitized branches | Higher operational costs, lower conversion rates | Declining customer preference for traditional methods |

| Underperforming Investments | Portfolios in low-yield fixed income or stagnant equity markets | Tying up capital without adequate returns | Persistent low interest rates, regional economic slowdowns |

Question Marks

AIA's presence in markets like Cambodia and Myanmar, characterized by low insurance penetration and strong economic growth, positions them as question marks within the BCG matrix. These nascent markets demand substantial investment to cultivate market share, yet offer considerable long-term growth prospects.

AIA Group is strategically investing in new digital health platforms and broader health ecosystem ventures, aiming to move beyond its core insurance business. These are considered question marks, as they represent high-growth potential but are still in the early stages of development, requiring significant capital infusion to establish market presence and achieve profitability. For instance, AIA's commitment to digital transformation saw a notable increase in its technology and digital spending in 2023, reflecting this focus on new ventures.

While AIA has made strides in AI, advanced generative AI applications are in their nascent stages of deployment, posing significant question marks for the company. These cutting-edge tools demand considerable investment in infrastructure and rigorous testing to ensure scalability and demonstrate a clear return on investment.

Tailored Products for Specific Untapped Demographics

AIA Group is actively developing tailored products to tap into specific, underserved demographics within the Asia-Pacific region. This strategy aligns with a BCG Matrix approach, focusing on potential Stars or Question Marks that require significant investment and aggressive marketing to capture market share.

For instance, AIA launched a digital-first insurance solution in Vietnam in 2024, specifically designed for young gig economy workers, a demographic previously facing limited access to traditional insurance products. This initiative aims to build brand loyalty and establish a strong foothold in a rapidly growing segment.

- Targeting the "Silver Economy": Development of specialized health and wealth management products for the aging population, considering their unique healthcare needs and retirement planning requirements.

- Micro-insurance for Emerging Markets: Offering affordable, bite-sized insurance policies catering to low-income individuals and small businesses in countries like Indonesia and the Philippines, addressing basic protection needs.

- Digital Health Solutions: Creating integrated health and wellness platforms that include personalized health tracking, telemedicine access, and preventative care programs, particularly appealing to tech-savvy millennials and Gen Z.

- Family Protection Plans: Designing comprehensive insurance packages that cover multiple family members, including critical illness and education protection, targeting young families with growing financial responsibilities.

Strategic Alliances and Joint Ventures in New Areas

AIA Group's strategic alliances and joint ventures in nascent markets or with unproven distribution models often represent question marks within a BCG-style analysis. These collaborations are geared towards future expansion but currently hold a limited market presence, reflecting their experimental nature.

For instance, AIA's 2024 initiatives exploring digital-first insurance products in emerging economies, like its partnership with a fintech firm in Vietnam to offer micro-insurance, exemplify this. While these ventures tap into potentially vast customer bases, their current revenue contribution is modest, and their long-term success is still being determined.

- Exploratory Partnerships: AIA's ventures into new product lines, such as parametric insurance or embedded insurance solutions, via strategic alliances are classified as question marks due to their unproven market acceptance and early-stage development.

- Geographic Expansion: Joint ventures aimed at entering markets with underdeveloped insurance penetration, like certain African nations where AIA has established a presence through partnerships, are question marks because their market share is currently small relative to the significant growth potential.

- Technological Integration: Collaborations focused on integrating advanced AI for personalized underwriting or blockchain for claims processing, while promising, are question marks as their widespread adoption and revenue impact are yet to be fully realized.

- Distribution Model Innovation: Alliances with non-traditional distribution channels, such as e-commerce platforms or social media influencers, to reach younger demographics represent question marks, as their effectiveness in generating substantial sales volumes is still under evaluation.

AIA's ventures into new digital health platforms and broader health ecosystem initiatives are classified as question marks. These represent high-growth potential but are in early development stages, requiring significant capital to establish market presence. For example, AIA's increased technology and digital spending in 2023 highlights this focus on new ventures.

Emerging markets with low insurance penetration but strong economic growth, such as Cambodia and Myanmar, are also question marks for AIA. These markets necessitate substantial investment to build market share, though they offer considerable long-term growth prospects.

New product lines like parametric or embedded insurance, often developed through strategic alliances, are question marks due to unproven market acceptance and early-stage development. Similarly, collaborations for integrating advanced AI in underwriting or blockchain for claims processing are question marks as their widespread adoption and revenue impact are yet to be fully realized.

AIA's 2024 digital-first insurance product launch in Vietnam for gig economy workers exemplifies a question mark strategy. This targets a growing segment previously underserved by traditional insurance, aiming to build brand loyalty and establish a strong foothold.

| Initiative | BCG Classification | Rationale | Investment Focus | Potential Impact |

|---|---|---|---|---|

| Digital Health Platforms | Question Mark | High growth potential, early stage | Technology & Digital Spending (increased in 2023) | Market share in health ecosystem |

| Cambodia & Myanmar Markets | Question Mark | Low penetration, high growth potential | Market development & investment | Long-term market leadership |

| Parametric Insurance | Question Mark | Unproven market acceptance | Strategic alliances & product development | Niche market penetration |

| AI for Underwriting | Question Mark | Early stage adoption | Technological integration & testing | Improved underwriting efficiency |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.