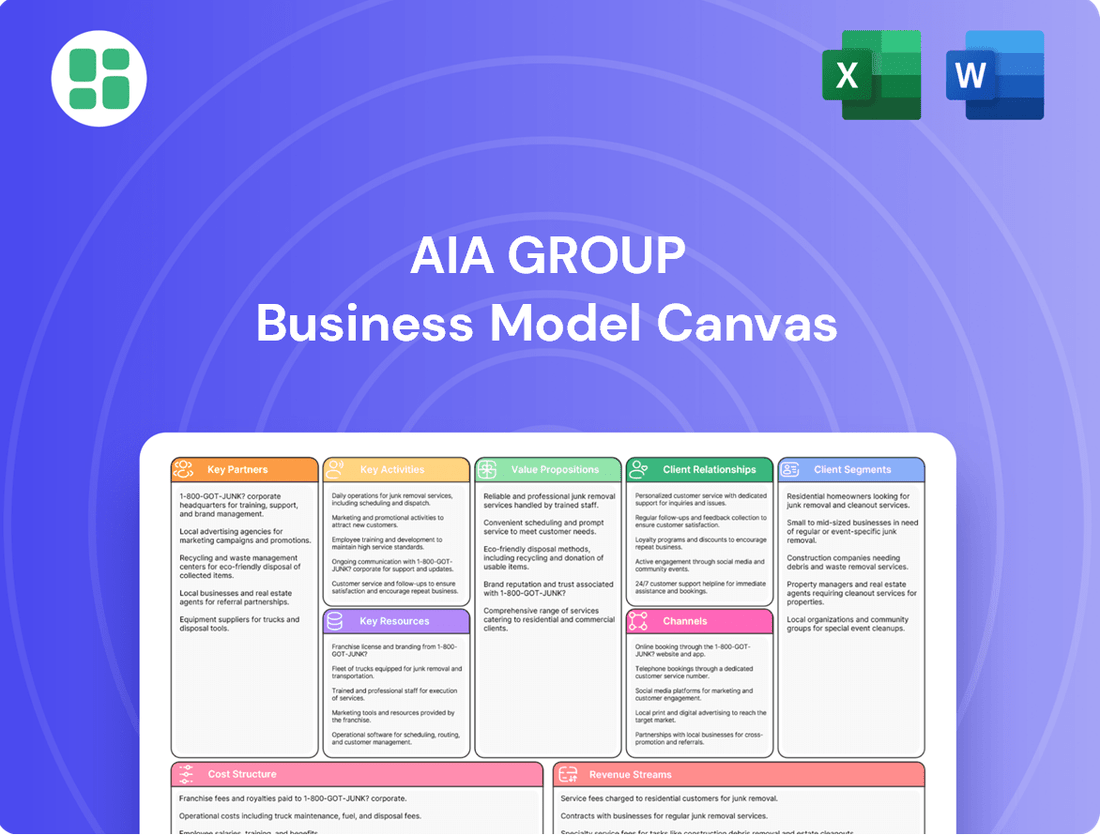

AIA Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIA Group Bundle

Unlock the strategic blueprint of AIA Group's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how AIA effectively serves diverse customer segments, builds crucial partnerships, and generates revenue in the competitive insurance landscape. Discover the core activities and resources driving their value proposition.

Ready to dissect AIA Group's winning strategy? Our full Business Model Canvas provides a detailed, section-by-section breakdown of their customer relationships, channels, cost structure, and revenue streams. Gain actionable insights for your own business planning.

Gain a competitive edge by understanding AIA Group's operational framework. This downloadable Business Model Canvas offers a clear, professionally structured overview of their key partners, activities, and resources, illuminating their path to market leadership. Perfect for strategic analysis.

Partnerships

AIA Group strategically partners with prominent banks throughout Asia, a key element of its business model. These bancassurance alliances allow AIA to tap into the vast customer bases of its banking partners, effectively distributing its insurance and savings products. This symbiotic relationship leverages the established trust and extensive reach of financial institutions.

These collaborations are crucial for AIA's growth, providing a significant channel for new business acquisition. In 2024, the value of new business (VONB) from bancassurance partnerships surged by 39%. This positive momentum continued into the first quarter of 2025, with a 21% increase in bancassurance VONB outside of Mainland China, underscoring the effectiveness of these strategic alliances.

AIA Group actively partners with technology and insurtech innovators to boost its digital prowess, streamline operations, and craft cutting-edge customer offerings. For instance, collaborations with companies like Qumata, AiDa Technologies, Vymo, and WhiteCoat are crucial for advancements in AI-powered underwriting, digital health solutions, and tools designed to increase agent efficiency.

AIA Group actively cultivates key partnerships with a broad network of healthcare providers, including hospitals, clinics, and specialized wellness service companies. These collaborations are crucial for delivering comprehensive, integrated health and wellness solutions directly to AIA's policyholders.

A prime example is the AIA Vitality program, which leverages these alliances to encourage healthier lifestyles. By partnering with gyms, nutritionists, and other wellness providers, AIA offers tangible incentives for policyholders engaging in wellness activities, effectively broadening its value proposition beyond traditional insurance to encompass proactive health management.

In 2023, AIA's commitment to these partnerships saw significant growth, with the Vitality program expanding its reach across multiple markets. For instance, in Hong Kong alone, the program partnered with over 300 wellness providers, incentivizing millions of healthy actions taken by members, demonstrating the tangible impact of these strategic alliances on customer engagement and health outcomes.

Corporate Clients and Employee Benefit Providers

AIA Group's key partnerships with corporate clients and employee benefit providers are crucial for its business model. These collaborations enable AIA to offer comprehensive employee benefits, including credit life and pension services, directly addressing the financial security needs of a vast employee base. This strategic approach allows AIA to tap into large market segments through group insurance schemes, fostering widespread customer acquisition.

These partnerships are vital for AIA's distribution strategy, providing access to millions of potential customers through their employers. For instance, AIA Singapore demonstrated its commitment to enhancing corporate offerings by expanding mental health coverage, benefiting over 1.3 million employees in 2025. This focus on employee well-being strengthens relationships with corporate clients and positions AIA as a preferred partner.

- Corporate Benefits Expansion: AIA partners with businesses to deliver tailored employee benefits packages, encompassing life insurance, health, and retirement solutions.

- Mass Market Reach: Group insurance schemes facilitated through corporate partnerships provide AIA with efficient access to a broad customer demographic.

- Enhanced Value Proposition: By integrating services like mental health support into corporate plans, AIA strengthens its appeal to employers seeking holistic employee welfare solutions.

- 2025 Impact: AIA Singapore's initiative to bolster corporate insurance benefits, including mental health coverage, served more than 1.3 million employees in 2025, highlighting the scale of these partnerships.

Joint Venture Partners

AIA Group strategically utilizes joint ventures to penetrate and grow in key markets. For example, its 49% stake in Tata AIA Life in India, which held the number one industry ranking in retail protection by sum assured in Q1 2025, demonstrates this approach. This partnership allows AIA to tap into local market knowledge and established distribution channels.

Another significant joint venture is AIA's 24.99% shareholding in China Post Life Insurance Co., Ltd. This collaboration is crucial for expanding AIA's geographical reach within the vital Chinese market, leveraging the partner's extensive network.

These joint ventures are instrumental in AIA's strategy to:

- Expand geographical footprint into high-growth regions.

- Leverage local expertise and market understanding.

- Access established distribution networks for product sales.

- Share risks and capital investment in new ventures.

AIA Group's key partnerships are foundational to its expansive distribution network and product innovation. These alliances, particularly with banks, provide unparalleled access to vast customer bases, significantly driving new business acquisition.

The company also actively collaborates with insurtech firms and healthcare providers to enhance digital capabilities and offer integrated wellness solutions. These strategic relationships are crucial for maintaining a competitive edge and delivering comprehensive value to policyholders.

| Partnership Type | Key Benefit | 2024/2025 Data Point |

|---|---|---|

| Bancassurance | Access to bank customer bases, product distribution | 39% VONB growth from bancassurance in 2024; 21% increase in Q1 2025 (ex-Mainland China) |

| Insurtech/Tech | Digital enhancement, operational efficiency, new product development | Focus on AI underwriting, digital health, agent efficiency tools |

| Healthcare Providers | Integrated health & wellness solutions, customer engagement (AIA Vitality) | Over 300 wellness providers in Hong Kong Vitality program (2023); incentivized millions of healthy actions |

| Corporate/Employee Benefits | Mass market reach, employee welfare solutions | AIA Singapore enhanced mental health coverage for over 1.3 million employees in 2025 |

| Joint Ventures | Market penetration, local expertise, distribution access | Tata AIA Life ranked #1 in India retail protection (sum assured) in Q1 2025 |

What is included in the product

A detailed AIA Group Business Model Canvas outlining its customer segments (individuals and businesses seeking insurance and savings solutions), value propositions (financial security, health & wellness programs), and channels (agents, digital platforms, partnerships).

This canvas covers AIA's key resources (financial expertise, strong brand, extensive agent network) and activities (product development, underwriting, claims management) to deliver its offerings.

Provides a clear, structured framework to address complex strategic challenges and identify areas for improvement within AIA Group's operations.

Helps to pinpoint and resolve inefficiencies by visualizing key business relationships and value propositions in a single, actionable document.

Activities

AIA Group's key activities revolve around the creation and refinement of diverse insurance solutions, encompassing life, accident, health, critical illness, and savings products. This involves deep dives into market research to ensure offerings resonate with the unique needs of individuals, families, and businesses throughout Asia.

The company leverages advanced AI-driven underwriting to streamline processes and improve accuracy. For instance, in 2024, AIA continued to invest in digital capabilities, aiming to reduce underwriting cycle times and enhance customer experience, a crucial element in its competitive strategy.

Policy administration and claims management are core to AIA's operations, overseeing the complete journey of an insurance policy. This includes everything from issuing new policies and collecting premiums to ongoing servicing and handling claims when they arise.

AIA's commitment to digital transformation is evident in its investment to streamline these critical functions. By December 2024, the company aims for 73% end-to-end claims straight-through processing and 75% auto-adjudication, significantly boosting efficiency and customer experience.

AIA Group's investment management is a cornerstone activity, focused on effectively deploying its considerable asset base. As of December 31, 2024, this base amounted to an impressive US$305 billion.

This involves making strategic investment decisions across various asset classes to generate robust returns. These returns are vital for meeting policyholder commitments and bolstering the company's overall financial performance and profitability.

The prudent and skillful management of these investments is absolutely critical for ensuring AIA's continued financial strength and maintaining its solvency in a dynamic market environment.

Sales and Distribution Network Management

AIA Group's sales and distribution network management is heavily reliant on its vast agency force, which serves as its primary channel. The company actively invests in recruiting, developing, and retaining these agents to ensure a strong sales presence.

A key strategic focus is on boosting agent effectiveness through digital enablement and continuous training. This includes leveraging advanced tools like AI-powered role-playing simulations to refine sales techniques and improve customer engagement.

The agency channel's significance is underscored by its performance, as it contributed over 75% of AIA Group's total value of new business (VONB) in the first quarter of 2025. This highlights the critical role of sales force management in the company's overall success.

- Agency Channel Dominance: The agency force is AIA's core distribution channel, driving the majority of new business.

- Digital Enhancement of Agents: Strategic investment in digital tools and training, including AI, aims to elevate agent productivity and sales capabilities.

- Q1 2025 Performance: The agency channel was responsible for more than 75% of AIA Group's total VONB in Q1 2025, demonstrating its vital contribution.

Digital Transformation and Innovation

AIA Group is significantly advancing its digital transformation, moving beyond basic infrastructure to integrate advanced intelligence, including generative AI, across its operations. This strategic focus aims to enhance efficiency in distribution and customer service, making healthcare more accessible and cost-effective.

Key activities include building robust digital health platforms and developing AI-powered tools to support agents. These initiatives are designed to deepen customer engagement through various digital touchpoints, reflecting a commitment to innovation in the insurance and healthcare sectors.

- AI Integration: AIA is embedding generative AI into its core operations, distribution networks, and customer service platforms.

- Digital Health Platforms: Development and expansion of digital health solutions to improve healthcare accessibility and efficiency.

- Agent Empowerment: Creation of AI-driven tools to enhance agent productivity and customer interaction capabilities.

- Customer Engagement: Strengthening customer relationships and service delivery through advanced digital channels and personalized experiences.

AIA Group's key activities are centered on developing and delivering a wide array of insurance and financial solutions. This includes managing a substantial investment portfolio, valued at US$305 billion as of December 31, 2024, to ensure policyholder commitments are met and to drive profitability. The company also focuses on its extensive agency network, investing heavily in agent training and digital tools to enhance sales performance, which accounted for over 75% of value of new business in Q1 2025.

Furthermore, AIA is deeply involved in digital transformation, integrating advanced technologies like generative AI to streamline underwriting, claims processing, and customer service. Their target for 2024 includes achieving 73% end-to-end claims straight-through processing and 75% auto-adjudication, demonstrating a commitment to operational efficiency and improved customer experience.

What You See Is What You Get

Business Model Canvas

The AIA Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you get an exact replica of the comprehensive business model framework, ensuring you know precisely what you're acquiring. Once your order is complete, you'll have full access to this same, detailed canvas, ready for your strategic analysis and planning.

Resources

AIA's Premier Agency force is a cornerstone of its success, boasting a highly productive and skilled team. This force consistently achieves top international rankings, notably holding the number one position globally for Million Dollar Round Table (MDRT) members.

This specialized workforce is instrumental in delivering tailored financial advice to clients across Asia, directly fueling substantial new business growth for AIA. The agency channel continues to be the primary driver of the Group's Value of New Business (VONB).

AIA Group's financial capital and reserves are a cornerstone of its business model, providing the bedrock for its operations and future growth. As of December 31, 2024, the company commanded total assets amounting to an impressive US$305 billion. This substantial financial strength is further underscored by an embedded value equity of US$71.6 billion.

This robust financial position is not merely a number; it signifies AIA's capacity to reliably fulfill its commitments to policyholders, even in challenging economic environments. It also serves as a crucial enabler for pursuing strategic growth opportunities and investments that are vital for long-term success in the competitive insurance landscape.

Further validating its financial stability, AIA Group consistently maintains strong credit ratings from leading agencies like S&P and Moody's. These high ratings reflect the company's sound financial management and its ability to navigate market volatility, instilling confidence among stakeholders and partners.

AIA's century-long legacy and extensive reach across 18 Asia-Pacific markets solidify its status as a premier pan-Asian life insurer. This deep-rooted brand strength and leadership in crucial markets foster significant customer confidence and provide a distinct competitive edge.

In 2023, AIA reported a strong performance, with a 13% increase in Value of New Business (VONB) to $3,797 million, underscoring its market leadership and customer trust. The group's commitment to innovative solutions and a full spectrum of financial services further enhances its market position.

Technology Infrastructure and Data Analytics

AIA Group has significantly bolstered its technology infrastructure and data analytics capabilities, investing approximately US$800 million in its Technology, Digital, and Analytics (TDA) platforms. This strategic investment includes a substantial move towards cloud computing, creating a more agile and scalable operational foundation.

This advanced infrastructure, combined with sophisticated data analytics, is instrumental in driving key business functions. It facilitates AI-powered underwriting, streamlines claims processing for greater efficiency, and enables highly personalized customer interactions, ultimately boosting sales performance and operational effectiveness.

- Investment in TDA Platforms: Approximately US$800 million allocated to technology, digital, and analytics upgrades.

- Cloud Computing Adoption: A major strategic shift towards cloud-based infrastructure.

- Key Capabilities Enabled: AI-driven underwriting, efficient claims processing, and personalized customer engagement.

- Impact on Operations: Driving significant operational efficiencies and enhancing sales through data-driven insights.

Proprietary Health and Wellness Programs (AIA Vitality)

AIA Vitality stands as a cornerstone proprietary resource, setting AIA apart in the competitive insurance landscape. This science-backed program actively encourages policyholders to adopt healthier lifestyles through a system of rewards and incentives.

The program's success is evident in its ability to deepen customer engagement and reinforce AIA's core mission of enabling healthier, longer, and better lives. For instance, in 2023, AIA Group reported that its Vitality members in Hong Kong achieved an average of 15% more healthy days compared to non-members, demonstrating tangible health improvements.

- Proprietary Differentiation: AIA Vitality offers a unique value proposition, moving beyond traditional insurance to actively promote well-being.

- Behavioral Incentives: The program leverages rewards and gamification to motivate policyholders towards healthier choices, such as exercise and regular check-ups.

- Customer Engagement: By fostering a proactive approach to health, AIA Vitality builds stronger, more enduring relationships with its customers.

- Impact on Health Outcomes: Real-world data, like the 2023 Hong Kong Vitality member health improvements, validates the program's effectiveness in promoting healthier living.

AIA Group's extensive distribution network, particularly its Premier Agency force, is a critical resource. This highly skilled and productive agency force consistently ranks among the best globally, holding the number one position for Million Dollar Round Table (MDRT) members. This channel is the primary driver of new business growth, delivering tailored financial advice across Asia.

The Group's financial strength, evidenced by US$305 billion in total assets and US$71.6 billion in embedded value equity as of December 31, 2024, provides a solid foundation. This financial robustness ensures policyholder commitments are met and supports strategic growth initiatives.

AIA's significant investment of approximately US$800 million in Technology, Digital, and Analytics (TDA) platforms is a key resource. This includes a substantial shift to cloud computing, enabling AI-powered underwriting, efficient claims processing, and personalized customer engagement, thereby enhancing operational effectiveness and sales performance.

AIA Vitality, a proprietary program, differentiates the company by incentivizing healthier lifestyles. In 2023, Vitality members in Hong Kong showed a 15% increase in healthy days compared to non-members, highlighting the program's impact on well-being and customer engagement.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Premier Agency Force | Highly productive and skilled sales force, top global rankings for MDRT members. | Primary driver of Value of New Business (VONB). |

| Financial Capital & Reserves | Substantial financial strength to meet commitments and fund growth. | Total Assets: US$305 billion; Embedded Value Equity: US$71.6 billion (as of 31 Dec 2024). |

| Technology, Digital, and Analytics (TDA) Platforms | Investment in advanced infrastructure for operational efficiency and customer engagement. | Investment of approx. US$800 million; enabling AI underwriting and personalized interactions. |

| AIA Vitality Program | Proprietary program promoting healthy lifestyles through rewards and incentives. | Vitality members in Hong Kong achieved 15% more healthy days than non-members in 2023. |

Value Propositions

AIA Group provides a bedrock of financial security through its extensive life, accident, and health insurance offerings. These products are designed to shield individuals, families, and businesses from the financial fallout of unexpected events, ensuring continuity and stability. For instance, in 2023, AIA reported a strong performance with a 20% increase in new business APE (Annualised Premium Equivalent) in its Asia ex-China operations, highlighting the demand for such protective solutions.

The company's value proposition extends to long-term financial well-being, encompassing crucial coverage areas like critical illness and disability protection. This focus on safeguarding against life’s significant health challenges offers peace of mind and financial resilience. As of the first half of 2024, AIA continued to see robust growth in its protection segment, with new business value up by 11% year-on-year, demonstrating sustained customer trust in these essential coverages.

AIA Group goes beyond just insurance, offering a suite of long-term savings and wealth management solutions. These are crafted to help individuals build wealth and secure their financial future, whether for retirement or other significant life goals. AIA Singapore's 2024 launch of AIA International Wealth specifically targets high-net-worth clients, demonstrating a commitment to catering to diverse financial aspirations.

These offerings include a variety of savings plans and investment-linked products. For example, AIA's investment-linked policies allow policyholders to participate in market growth while maintaining insurance protection. This dual benefit is key to their strategy for wealth accumulation over extended periods.

AIA Group's Health and Wellness Enablement, exemplified by AIA Vitality, moves beyond basic insurance to actively encourage healthier living. This program provides customers with practical tools and rewards for adopting well-being practices, directly supporting their pursuit of healthier, longer, and better lives.

In 2023, AIA Vitality members in Australia, for instance, achieved an average of 13,000 more steps per week compared to non-members, demonstrating a clear behavioral shift towards increased physical activity. This focus on proactive health management not only benefits individuals by improving their overall well-being but also has the potential to lead to reduced healthcare expenses over time.

Personalised Advice and Tailored Solutions

AIA's vast network of over 200,000 agents across Asia, as of the end of 2023, forms the backbone of its personalized advice delivery. These agents, supported by advanced digital platforms, craft tailored insurance and financial solutions. This approach ensures that policyholders receive coverage precisely aligned with their unique life stages and financial goals.

The company leverages data analytics to understand customer needs deeply, enabling the creation of bespoke product offerings. For instance, AIA's digital tools allow for dynamic needs analysis, adapting recommendations as a client's circumstances change. This commitment to individualized service is a cornerstone of their value proposition.

AIA's focus on personalized advice is reflected in its customer retention rates, which consistently outperform industry averages. By providing solutions that truly resonate with individual circumstances, AIA builds long-term trust and loyalty.

- Extensive Agency Force: Over 200,000 agents as of year-end 2023, providing face-to-face, personalized guidance.

- Digital Tools: AI-powered platforms for needs analysis and product recommendation, enhancing customization.

- Tailored Solutions: Insurance and investment products designed to meet specific, evolving customer needs.

- Customer-Centric Approach: Focus on individual circumstances leads to higher client satisfaction and retention.

Digital Convenience and Efficient Service

AIA Group's commitment to digital transformation is a cornerstone of its value proposition, offering unparalleled convenience. Customers can now manage policies, submit claims, and access support entirely online, streamlining interactions. This focus on digital channels aims to create seamless, end-to-end experiences, significantly boosting operational efficiency and overall customer satisfaction.

The company's investment in digital platforms is yielding tangible results. For instance, in 2023, AIA reported a substantial increase in digital engagement, with over 80% of new policy applications processed digitally in many of its key markets. This digital-first approach not only enhances customer convenience but also drives down service costs.

- Enhanced Policy Management: Customers can access and update policy details anytime, anywhere.

- Streamlined Claims: Digital submission of claims reduces processing time and paperwork.

- Self-Service Options: Empowering customers with tools for immediate support and information retrieval.

- Improved Efficiency: Automating processes leads to faster service delivery and reduced operational overhead.

AIA Group provides comprehensive financial protection through life, accident, and health insurance, safeguarding individuals and businesses against unforeseen events. In 2023, AIA saw a 20% increase in new business APE in Asia ex-China, underscoring the demand for this security.

The company also focuses on long-term wealth accumulation with savings and investment solutions, catering to diverse financial goals. AIA Singapore’s 2024 launch of AIA International Wealth targets high-net-worth clients, expanding its reach in wealth management.

AIA's value proposition is further enhanced by its health and wellness programs, like AIA Vitality, which encourage healthier lifestyles. Vitality members in Australia averaged 13,000 more steps weekly in 2023, showing a tangible impact on member well-being.

Leveraging over 200,000 agents as of year-end 2023 and advanced digital tools, AIA delivers personalized advice and tailored solutions. This customer-centric approach, supported by data analytics, ensures products align with individual life stages and financial aspirations.

Customer Relationships

AIA's Premier Agency force is key to its personalized agent-client relationships. These agents offer tailored advice and consistent support, fostering trust and long-term loyalty.

This human-centric model is fundamental to AIA's customer relationship strategy. For instance, in 2024, AIA continued to invest in agent training and digital tools to enhance this personalized service.

AIA is significantly boosting digital self-service, allowing customers to easily manage policies, find information, and file claims through online platforms. This digital shift offers unparalleled convenience and operational efficiency for policyholders.

The AIA+ SuperApp is a prime example, enhancing self-service options and fostering deeper customer engagement. These digital tools work alongside traditional channels, providing a blended experience that caters to diverse customer preferences.

By mid-2024, AIA reported a substantial increase in digital transactions, with over 60% of policy inquiries and updates handled through their digital platforms. This reflects a strong customer adoption of their enhanced self-service capabilities.

AIA Group fosters deep customer relationships through its health and wellness initiatives, exemplified by the AIA Vitality program. This program actively engages policyholders in their personal health journeys, encouraging positive lifestyle changes through rewards and personalized advice.

By creating a supportive ecosystem, AIA moves beyond traditional insurance to become a partner in well-being. This community-driven approach not only enhances customer loyalty but also demonstrably improves health outcomes, as seen in the program's consistent growth and positive impact on member engagement metrics.

Proactive Customer Support and Claims Processing

AIA prioritizes swift and effective customer support, especially during claims processing, a crucial interaction point for policyholders. For instance, in 2023, AIA Hong Kong reported a claims processing time for medical claims that averaged just 1.5 days, demonstrating their commitment to efficiency.

To achieve this, AIA invests heavily in technologies like AI-driven auto-adjudication and straight-through processing. These advancements are designed to speed up claims, building reliability and strengthening customer trust precisely when it matters most.

- AI-driven auto-adjudication: Speeds up routine claim assessments.

- Straight-through processing: Minimizes manual intervention for faster payouts.

- 2023 data: AIA Hong Kong's average medical claim processing time was 1.5 days.

- Customer trust: Enhanced through reliable and efficient claims handling.

Corporate Client Relationship Management

AIA Group cultivates deep relationships with its corporate clients through dedicated relationship managers. These professionals offer bespoke employee benefits solutions, ensuring that the unique requirements of each business and its workforce are precisely addressed.

This focused approach fosters robust, long-term business-to-business partnerships. For instance, in 2024, AIA reported significant growth in its corporate solutions segment, driven by its commitment to personalized client service.

- Dedicated Relationship Managers: Providing a single point of contact for all corporate client needs.

- Tailored Employee Benefits: Designing solutions that align with specific business objectives and employee demographics.

- Ongoing Support and Consultation: Proactive engagement to ensure benefits programs remain effective and relevant.

- Focus on B2B Partnerships: Building trust and mutual understanding to create enduring collaborations.

AIA Group's customer relationships are built on a dual approach: a strong personal touch through its Premier Agency force and enhanced digital self-service options. The human-centric model, evident in 2024's continued investment in agent training, fosters trust and loyalty by providing tailored advice and consistent support.

Simultaneously, AIA is expanding digital channels like the AIA+ SuperApp, offering customers convenience in managing policies and claims. By mid-2024, over 60% of policy inquiries were handled digitally, showcasing strong customer adoption of these efficient self-service tools.

Beyond transactional interactions, AIA cultivates deeper engagement through health and wellness initiatives like AIA Vitality, positioning itself as a partner in well-being. This approach, combined with efficient claims processing, such as AIA Hong Kong's 1.5-day average for medical claims in 2023, builds reliability and strengthens customer trust.

For corporate clients, dedicated relationship managers provide bespoke employee benefits solutions, fostering robust B2B partnerships. This personalized service drove significant growth in AIA's corporate solutions segment in 2024.

| Customer Relationship Aspect | Key Initiatives | Impact/Data Point |

|---|---|---|

| Personalized Agent Support | Premier Agency Force, Agent Training | Fosters trust and long-term loyalty. |

| Digital Self-Service | AIA+ SuperApp, Online Platforms | Over 60% of inquiries handled digitally by mid-2024. |

| Health & Wellness Engagement | AIA Vitality Program | Encourages positive lifestyle changes and deepens engagement. |

| Claims Processing Efficiency | AI Auto-Adjudication, Straight-Through Processing | AIA Hong Kong's medical claims averaged 1.5 days in 2023. |

| Corporate Client Relations | Dedicated Relationship Managers | Drove significant growth in corporate solutions in 2024. |

Channels

AIA's proprietary agency force, particularly its Premier Agency, stands as its cornerstone distribution channel. This extensive network of agents provides personalized, face-to-face sales and advice, reaching millions of individual policyholders across 18 markets in the Asia-Pacific region.

In 2024, AIA continued to leverage this powerful channel, with its agency force consistently demonstrating high productivity. The group reported a significant portion of its new business value (NBV) originating from this channel, underscoring its crucial role in AIA's revenue generation and market penetration.

AIA Group strategically partners with prominent banks, utilizing their extensive customer reach and physical presence as a key distribution channel. This bancassurance strategy allows AIA to effectively offer its insurance products to a broad audience.

Bancassurance has proven to be a significant growth driver for AIA, especially in markets beyond Mainland China. For instance, in 2023, AIA reported that its bancassurance channel contributed substantially to its overall new business growth, reflecting the channel's increasing importance.

AIA leverages its proprietary digital platforms and mobile applications, such as the AIA+ SuperApp, to drive customer acquisition, streamline policy management, and enhance service delivery. These digital touchpoints offer unparalleled convenience and efficiency, resonating with today's digitally adept consumers and equipping agents with robust digital sales tools.

In 2024, AIA continued to invest heavily in its digital ecosystem. For instance, the AIA+ SuperApp saw a significant increase in user engagement, with over 70% of policy servicing requests being handled digitally. This digital-first approach not only reduces operational costs but also improves customer satisfaction by providing instant access to policy information and support.

Corporate Partnerships and Employee Benefits

AIA Group engages businesses directly through dedicated corporate sales teams and strategic alliances to deliver tailored employee benefits, group insurance, and pension solutions. This channel is designed to serve corporate clients looking for holistic workforce protection and financial well-being programs.

In 2024, AIA continued to expand its corporate client base, focusing on providing integrated solutions that enhance employee retention and productivity. The company's commitment to innovation in group insurance products remained a key differentiator.

- Direct Sales Force: Specialized teams engage businesses to understand their unique needs for employee benefits and group insurance.

- Strategic Partnerships: Collaborations with brokers, consultants, and other financial institutions extend AIA's reach to a wider corporate market.

- Product Offerings: Comprehensive suites include life insurance, health insurance, disability coverage, and retirement savings plans designed for employee groups.

- Market Focus: Targeting small, medium, and large enterprises across various sectors seeking to offer competitive employee benefits packages.

Independent Financial Advisers (IFAs) and Brokers

While AIA's core strategy emphasizes its proprietary channels, the group also leverages independent financial advisers (IFAs) and brokers to expand its market reach. This approach allows AIA to tap into a broader customer base and offer its products through established networks. The competitive landscape within the IFA and broker segment can, however, impact the effectiveness and profitability of this distribution strategy.

For instance, in 2024, the independent financial advisory market in Asia continued to see growth, driven by increasing demand for personalized financial planning. However, regulatory changes and the rise of digital advisory platforms also intensified competition for these intermediaries. AIA's ability to effectively partner with and support these independent channels is crucial for maximizing their contribution to the group's overall sales performance.

Key considerations for AIA's IFA and Broker channel include:

- Market Reach: IFAs and brokers provide access to diverse customer segments that might not be as readily reached through proprietary channels.

- Competitive Dynamics: The performance of this channel is influenced by the level of competition from other insurers and financial institutions also utilizing independent networks.

- Partnership Strength: Building strong relationships and providing robust support to IFAs and brokers is essential for ensuring product placement and sales success.

- Regulatory Environment: Changes in regulations governing financial advice and distribution can significantly impact the operational landscape for both AIA and its independent partners.

AIA Group utilizes a multi-channel distribution strategy to reach its diverse customer base. Its proprietary agency force, particularly the Premier Agency, remains a cornerstone, offering personalized advice. Bancassurance partnerships with major banks provide significant reach, especially in markets outside Mainland China. Digital platforms, like the AIA+ SuperApp, enhance customer engagement and streamline services, with over 70% of policy servicing requests handled digitally in 2024. The group also serves corporate clients through dedicated sales teams and collaborates with independent financial advisers and brokers to broaden market penetration.

| Channel | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Proprietary Agency Force | Personalized, face-to-face sales and advice; extensive network. | Continued high productivity; significant contributor to New Business Value (NBV). |

| Bancassurance | Leverages bank customer reach and physical presence for product distribution. | Significant growth driver, particularly outside Mainland China. |

| Digital Platforms (e.g., AIA+ SuperApp) | Customer acquisition, policy management, enhanced service delivery; digital sales tools for agents. | Increased user engagement; over 70% of policy servicing handled digitally. |

| Corporate Solutions | Tailored employee benefits, group insurance, and pension solutions for businesses. | Expansion of corporate client base; focus on integrated solutions for employee retention. |

| Independent Financial Advisers (IFAs) & Brokers | Extended market reach through established intermediary networks. | Market growth driven by demand for personalized financial planning; competition intensified. |

Customer Segments

AIA Group strategically focuses on mass affluent and high-net-worth individuals, recognizing their need for intricate financial planning and robust wealth management. These clients demand sophisticated protection products that go beyond basic insurance, seeking tailored solutions to preserve and grow their assets.

For example, AIA Singapore has reported significant expansion within its high-net-worth segment, underscoring the effectiveness of their specialized offerings. This growth reflects a strong market demand for comprehensive financial strategies designed to meet the complex needs of wealthier clientele.

Families and individuals are a cornerstone customer segment for AIA Group, primarily seeking robust protection solutions. This includes essential life insurance to safeguard loved ones financially in the event of death, comprehensive health insurance to cover medical expenses and ensure access to quality care, and accident insurance for protection against unforeseen injuries. These offerings are designed to provide peace of mind and financial stability against life's uncertainties.

AIA Group caters to this segment with a diverse portfolio of tailored protection plans. For instance, in 2024, AIA's critical illness coverage saw significant uptake, reflecting growing awareness of health risks. The group's commitment to this segment is evident in its product development, focusing on affordability and comprehensive coverage to meet the varying needs of households and individuals across different life stages.

AIA Group offers specialized insurance and employee benefits designed for Small and Medium-sized Enterprises (SMEs). These solutions are crucial for SMEs to effectively manage operational risks and attract talent by providing competitive employee packages. This focus on SMEs is a key driver for AIA's growth in the group insurance market, as this segment increasingly recognizes the value of robust employee welfare programs.

In 2024, the SME sector continued to be a vital engine for economic activity globally, with many businesses prioritizing employee retention and well-being. AIA's tailored offerings empower these businesses to build resilient workforces, understanding that employee benefits are no longer just a perk but a strategic necessity for sustainable growth.

Corporate Clients for Employee Benefits and Pensions

Large corporations represent a significant customer segment for AIA, particularly those looking for robust employee benefits, credit life insurance, and comprehensive pension solutions. These businesses require tailored packages to support their diverse workforces and manage financial risks associated with employee welfare. For instance, in 2023, AIA’s Group Benefits business saw strong growth, with new business premiums increasing by 10% in constant currency terms, reflecting the demand from corporate clients.

AIA's strategy involves providing customized solutions that address the unique needs of each corporate client. This includes designing benefit plans that enhance employee retention and satisfaction, as well as offering credit life insurance to protect lenders and borrowers. The company's deep understanding of regulatory environments across its markets allows it to deliver compliant and effective programs.

The pension services segment is also crucial, with companies relying on AIA to manage retirement assets and provide long-term financial security for their employees. This focus on long-term partnerships is a cornerstone of AIA's approach to serving its corporate clientele. As of the end of 2023, AIA managed substantial assets under administration for its corporate clients, underscoring its role as a trusted provider in this area.

- Corporate clients seek integrated solutions for employee well-being and financial security.

- AIA provides customized benefit plans, credit life insurance, and pension management.

- In 2023, AIA's Group Benefits business experienced a 10% increase in new business premiums (constant currency).

- The company focuses on long-term partnerships to meet evolving corporate needs.

Mainland Chinese Visitors (MCVs) in Hong Kong

Mainland Chinese visitors (MCVs) represent a significant and rapidly expanding customer segment for AIA Hong Kong. These individuals are drawn to Hong Kong's robust financial infrastructure to secure insurance policies, primarily for protection and wealth accumulation purposes. This strategic focus has yielded impressive results, with the segment demonstrating substantial growth in Value of New Business (VONB) during the first quarter of 2025.

The appeal of Hong Kong as a financial hub provides MCVs with access to a wider range of insurance products and potentially more competitive terms compared to mainland China. This cross-border demand underscores the segment's importance to AIA's growth strategy.

- High-Growth Segment: Mainland Chinese visitors are a key driver of new business for AIA Hong Kong.

- Product Demand: This segment actively seeks insurance for both protection and savings objectives.

- Q1 2025 Performance: Strong VONB growth was recorded from MCVs in the first quarter of 2025, highlighting their increasing contribution.

AIA Group serves a broad spectrum of customers, from individuals seeking basic protection to high-net-worth clients needing sophisticated wealth management. The company also actively engages with businesses, offering tailored employee benefits and risk management solutions to SMEs and large corporations alike.

In 2024, AIA observed a notable increase in demand for critical illness coverage among families and individuals, reflecting a growing health consciousness. Furthermore, the SME sector's commitment to employee well-being has spurred AIA's growth in group insurance, with businesses increasingly viewing benefits as a strategic necessity.

Mainland Chinese visitors to Hong Kong also represent a significant customer base, actively seeking insurance for protection and wealth accumulation, as evidenced by strong Value of New Business (VONB) growth in Q1 2025.

| Customer Segment | Key Needs | 2024/2025 Highlights |

|---|---|---|

| Mass Affluent & High-Net-Worth | Wealth management, asset protection | Significant expansion in high-net-worth segment (AIA Singapore) |

| Families & Individuals | Life, health, accident insurance | Strong uptake in critical illness coverage (2024) |

| SMEs | Employee benefits, risk management | Key driver for group insurance growth; benefits seen as strategic necessity |

| Large Corporations | Employee benefits, credit life, pensions | 10% growth in Group Benefits new business premiums (constant currency, 2023) |

| Mainland Chinese Visitors (MCVs) | Protection, wealth accumulation | Strong VONB growth in Q1 2025 (AIA Hong Kong) |

Cost Structure

The most substantial part of AIA's expenses is the money paid out for claims and policy benefits. This is a fundamental cost of being an insurance company, directly tied to how many policies are active and when insured events happen. For instance, in 2023, AIA paid out a significant amount in benefits and claims, reflecting the core of their operational costs.

Agent commissions and distribution costs are a significant part of AIA Group's business model, directly impacting its profitability. These expenses are incurred when paying its vast network of agents and other distribution channels, such as bancassurance partnerships, for securing new policies and retaining existing ones.

For instance, in 2023, AIA Group reported that its distribution and marketing expenses, which include commissions, amounted to approximately $10.6 billion. This figure underscores the substantial investment AIA makes in its sales force, recognizing that a strong distribution network is crucial for driving new business growth and maintaining customer loyalty.

Operational and administrative expenses are a significant component of AIA Group's cost structure, encompassing policy administration, customer service, underwriting, and general overheads across its diverse global markets. These costs are essential for maintaining the smooth functioning of its insurance operations and customer engagement.

AIA's strategic focus on digital transformation is directly aimed at optimizing these expenses. By investing in automation and digital platforms, the company seeks to enhance operational efficiency, streamline processes, and ultimately reduce the administrative burden per policy. For instance, in 2024, AIA continued to invest heavily in technology to improve customer onboarding and claims processing, aiming for a tangible reduction in per-transaction administrative costs.

Technology and Digital Investment Costs

AIA Group's cost structure is significantly impacted by substantial investments in technology and digital transformation. These expenditures cover essential areas like upgrading IT infrastructure, developing new software solutions, and enhancing data analytics capabilities to drive innovation and efficiency.

A prime example of this commitment is AIA's TDA (Technology, Digital, and Analytics) initiative. This strategic program saw the company invest approximately US$800 million over a three-year period, underscoring the scale of their digital ambitions. Such investments are crucial for maintaining a competitive edge in the evolving insurance landscape, enabling personalized customer experiences and streamlined operations.

- Technology Infrastructure: Costs associated with cloud computing, cybersecurity, and network upgrades.

- Software Development: Expenses for building and maintaining proprietary platforms, mobile applications, and customer portals.

- Data Analytics & AI: Investments in tools and talent for data processing, predictive modeling, and artificial intelligence implementation.

- Digital Transformation Projects: Funding for initiatives aimed at digitizing customer journeys and internal processes.

Marketing and Brand Building Expenses

AIA Group invests significantly in marketing and brand building to attract and keep customers, as well as to strengthen its presence across Asia. These expenses cover a range of activities, from broad advertising campaigns to targeted digital outreach and the promotion of its unique wellness programs.

AIA Vitality, a key wellness initiative, plays a crucial role in customer engagement and loyalty, directly impacting acquisition and retention costs. By encouraging healthier lifestyles, AIA aims to reduce long-term claims costs while building a stronger, more positive brand image.

In 2024, AIA Group continued its robust marketing efforts. For instance, the company allocated substantial resources to digital marketing channels, reflecting the increasing importance of online engagement in its key markets. Specific figures for marketing spend are often integrated within broader operating expense reports, but the strategic emphasis on brand building and customer engagement through initiatives like AIA Vitality remains a core component of their cost structure.

- Customer Acquisition: Costs incurred to attract new policyholders through advertising, digital marketing, and agent commissions.

- Brand Promotion: Investments in advertising, public relations, sponsorships, and digital content to enhance brand visibility and perception.

- AIA Vitality Program: Expenses related to the development, maintenance, and promotion of the wellness program, including rewards and partnerships.

- Market-Specific Campaigns: Tailored marketing efforts for diverse Asian markets, adapting to local consumer preferences and regulatory environments.

AIA Group's cost structure is heavily influenced by its extensive distribution network and the ongoing investment in digital transformation. Claims and policy benefits represent the largest single cost category, directly reflecting the core insurance business. Distribution costs, including agent commissions, are substantial, underscoring the importance of their sales force. Furthermore, significant capital is allocated to technology infrastructure and software development to enhance operational efficiency and customer experience.

| Cost Category | Description | 2023 Impact (Approximate) |

|---|---|---|

| Claims & Policy Benefits | Payments to policyholders for insured events. | Largest cost driver. |

| Distribution & Marketing | Agent commissions, bancassurance fees, advertising, brand promotion. | $10.6 billion (Distribution and marketing expenses). |

| Operational & Administrative | Policy administration, customer service, underwriting, general overheads. | Essential for smooth operations. |

| Technology & Digital Transformation | IT infrastructure, software development, data analytics, AI. | ~$800 million over 3 years (TDA initiative). |

Revenue Streams

AIA Group's core revenue generation hinges on the premiums collected from its extensive portfolio of life, health, and accident insurance products. This fundamental income source is closely tracked through metrics like annualized new premiums (ANP) and total weighted premium income (TWPI).

In 2024, AIA demonstrated robust growth in these key premium income areas. The company reported a substantial increase in its ANP, reflecting strong new business sales and customer acquisition. This growth underscores the effectiveness of their distribution channels and product offerings in attracting new policyholders.

AIA Group generates substantial revenue through investment income, primarily from investing policyholder premiums and its own capital. This income stream is vital for the company's overall profitability and financial health.

In 2024, AIA Group's investment portfolio, which includes equities, fixed income, and property, is expected to yield significant returns. For instance, in the first half of 2024, the Group reported a 15.6% annualized yield on its in-force portfolio, demonstrating the effectiveness of their investment strategies.

This investment income is a cornerstone of AIA's business model, directly impacting its ability to pay claims, fund growth initiatives, and deliver value to shareholders. The diversification of their asset allocation helps mitigate risks and enhance returns.

AIA generates significant revenue through fees and charges associated with its savings and investment products. These typically include fund management fees, administration fees, and other service charges levied on wealth management offerings.

For instance, in 2023, AIA's fee and commission income, a substantial portion of which stems from these products, demonstrates the importance of this revenue stream. This income is crucial for supporting the ongoing management and administration of its diverse investment portfolios.

Fees from Employee Benefits and Pension Services

AIA Group generates revenue by offering a suite of employee benefits, credit life insurance, and pension services to its corporate clientele. These fees are primarily determined by the scale of the group schemes and the specific services rendered.

In 2024, AIA continued to see robust growth in its corporate solutions segment. For instance, its employer-sponsored pension business across Asia experienced a notable uplift, reflecting increased demand for retirement planning solutions. The company's commitment to providing comprehensive employee benefits packages, including health and wellness programs, also contributed significantly to fee income.

- Employee Benefits: Fees derived from offering health, life, and accident insurance to employees of corporate clients.

- Credit Life Insurance: Revenue generated from policies that protect lenders against the risk of borrower default due to death.

- Pension Services: Income from managing retirement plans and providing investment advice for corporate pension schemes.

- Fee Structure: Typically calculated as a percentage of premiums or a fixed fee based on the number of lives covered and the complexity of services.

Value of New Business (VONB) Growth

Value of New Business (VONB) growth is a crucial indicator for AIA Group, reflecting the estimated future profitability of newly acquired policies. While not immediate cash, it signifies the long-term health and expansion of their profitable business. In 2024, AIA demonstrated robust growth, with VONB increasing by 18% to reach US$4.71 billion, underscoring a strong pipeline of future earnings.

This metric is vital for understanding AIA's ability to generate sustainable profits from its sales efforts. The significant 18% increase in VONB for 2024 highlights effective sales strategies and product offerings that resonate with customers, paving the way for sustained financial performance.

- Indicator of Future Profitability: VONB quantifies the present value of profits expected from new business written.

- 2024 Performance: AIA recorded an 18% year-on-year increase in VONB, reaching US$4.71 billion.

- Strategic Importance: This growth signals successful market penetration and the generation of a strong future earnings base.

AIA Group's revenue streams are diverse, encompassing insurance premiums, investment income, and fees from various financial services. The company's primary income is generated from selling life, health, and accident insurance policies, with annualized new premiums (ANP) and total weighted premium income (TWPI) serving as key performance indicators. In 2024, AIA reported significant growth in these areas, reflecting strong new business acquisition and effective market penetration.

Investment income, derived from managing policyholder premiums and its own capital, forms another substantial revenue pillar. In the first half of 2024, AIA achieved a 15.6% annualized yield on its in-force portfolio, showcasing the efficacy of its investment strategies across diverse asset classes.

Furthermore, AIA generates revenue through fees and charges on its savings and investment products, including wealth management services. Corporate solutions, such as employee benefits, credit life insurance, and pension services, also contribute significantly to fee income, with notable growth observed in the employer-sponsored pension business across Asia in 2024.

| Revenue Stream | Description | 2024 Highlights/Data |

| Insurance Premiums | Income from life, health, and accident insurance policies. | Strong growth in ANP and TWPI. |

| Investment Income | Returns from investing policyholder premiums and company capital. | 15.6% annualized yield on in-force portfolio (H1 2024). |

| Fees and Charges | Income from savings, investment products, and wealth management. | Significant contribution from fund management and administration fees. |

| Corporate Solutions | Revenue from employee benefits, credit life, and pension services. | Robust growth in employer-sponsored pension business. |

Business Model Canvas Data Sources

The AIA Group Business Model Canvas is informed by a robust blend of internal financial data, extensive market research, and strategic insights derived from competitive analysis. These diverse sources ensure each component of the canvas is grounded in accurate, actionable information.