AIA Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIA Group Bundle

Discover how AIA Group masterfully crafts its product portfolio, from life insurance to wealth management, to meet diverse customer needs. This analysis delves into their strategic pricing, ensuring competitive value and accessibility across different market segments.

Uncover AIA Group's sophisticated distribution channels, reaching customers through agents, bancassurance, and digital platforms, and explore their impactful promotional strategies designed to build trust and brand loyalty.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for AIA Group. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

AIA Group's Comprehensive Life Insurance product line offers a diverse range of solutions, including whole life, term life, and universal life policies. These are designed to meet varied needs across different life stages and financial objectives, ensuring robust long-term financial security for policyholders and their families. For instance, in 2024, AIA reported a 15% increase in new business in its Asia markets, reflecting strong demand for these foundational protection products.

AIA's Product strategy extends beyond life insurance to robust accident and health solutions. These plans are designed to provide a safety net for medical expenses, critical illnesses, personal accidents, and disability, ensuring customers have financial backing when they need it most. This comprehensive approach directly supports AIA's core mission of enabling healthier, longer, and better lives.

In 2023, AIA's Health and Protection segment, which includes accident and health products, saw significant growth. For instance, the company reported a 10% year-on-year increase in annualized premium equivalent (APE) for this segment in its interim results, highlighting strong customer demand for these vital coverages.

AIA's product strategy centers on a diverse range of flexible savings and investment-linked plans. These are crafted to assist individuals in achieving distinct financial goals, from securing a comfortable retirement to funding their children's education. For instance, the GlobalFlexi Savings Insurance Plan exemplifies this approach by offering adaptable features like currency conversion choices and flexible withdrawal options.

These offerings are engineered to deliver robust returns, a critical factor for wealth accumulation. Simultaneously, they prioritize customer needs for liquidity and the ability to diversify their investments across various asset classes. As of the first half of 2024, AIA reported a strong solvency position, with its embedded value of new business growing by 15%, underscoring the attractiveness and financial soundness of its product suite.

Tailored Employee Benefits and Corporate Services

AIA Group's tailored employee benefits and corporate services are designed to be a key component of their marketing mix, specifically addressing the needs of businesses. These offerings include comprehensive employee benefits packages, credit life insurance, and robust pension services. By providing these, AIA helps companies bolster their employee welfare programs, which is crucial for talent retention in today's competitive landscape. For instance, in 2024, AIA reported significant growth in its corporate business segment, driven by demand for such integrated solutions.

These corporate solutions are not one-size-fits-all; AIA emphasizes customization to align with the unique requirements of various industries and business sizes. This adaptability is vital for businesses looking to offer benefits that truly resonate with their workforce. AIA's commitment to tailoring these services ensures that clients can effectively manage employee financial security and long-term planning, contributing to a more stable and motivated workforce. The company's strategic focus on these B2B offerings supports its broader market penetration goals.

- Employee Benefits: Comprehensive health, life, and disability coverage options.

- Credit Life Insurance: Protection for loan and credit facilities, safeguarding both lenders and borrowers.

- Pension Services: Facilitating retirement planning and management for employees.

- Customization: Solutions are adapted to specific industry needs and corporate structures.

Digital Health and Wellness Ecosystems

AIA Group's Product strategy prominently features digital health and wellness ecosystems, exemplified by AIA Vitality. These platforms are integrated into their insurance products, aiming to actively encourage healthier lifestyles among policyholders. By doing so, AIA enhances the core value of its offerings beyond traditional risk protection, shifting towards proactive well-being.

These digital ecosystems provide tangible benefits, including incentives for maintaining healthy habits, convenient access to telemedicine services, and tailored wellness programs. This focus on preventive health and continuous engagement significantly strengthens the customer relationship and the overall value proposition of AIA's insurance solutions.

By the end of 2023, AIA Vitality had expanded its reach, with over 14 million members globally, demonstrating significant traction in promoting healthier living. For instance, in Hong Kong, AIA Vitality members saw a 25% increase in physical activity levels compared to non-members in 2023. This active engagement translates directly into a more resilient customer base and reduced long-term claims, aligning with AIA's strategic goals.

- AIA Vitality's Global Reach: Over 14 million members worldwide by year-end 2023, underscoring the broad adoption of their digital health and wellness approach.

- Behavioral Impact: AIA Vitality members in Hong Kong exhibited a 25% uplift in physical activity in 2023, highlighting the effectiveness of incentives in driving healthier behaviors.

- Value Enhancement: The integration of digital platforms elevates insurance products by fostering preventive health and ongoing customer engagement, creating a stickier customer base.

- Strategic Alignment: This product strategy supports AIA's long-term vision of promoting well-being, which can lead to improved customer retention and potentially lower claims costs over time.

AIA Group's product portfolio is robust, encompassing a wide array of life insurance solutions like whole, term, and universal life policies designed for long-term financial security. This is complemented by comprehensive accident and health offerings, providing crucial financial support for medical needs and critical illnesses. Furthermore, AIA offers flexible savings and investment-linked plans to help customers achieve specific financial goals, such as retirement or education funding. The company also provides tailored employee benefits and corporate services, including pension solutions, to businesses seeking to enhance their employee welfare programs.

| Product Category | Key Features | 2023/2024 Data Point |

| Life Insurance | Whole, Term, Universal Life | 15% increase in new business in Asia markets (2024) |

| Accident & Health | Medical, Critical Illness, Disability | 10% year-on-year increase in APE (Interim 2023) |

| Savings & Investment | Retirement, Education Funding, Flexible Plans | 15% growth in embedded value of new business (H1 2024) |

| Corporate Solutions | Employee Benefits, Credit Life, Pensions | Significant growth in corporate business segment (2024) |

| Digital Health & Wellness | AIA Vitality | Over 14 million members globally (End 2023) |

What is included in the product

This analysis provides a comprehensive breakdown of AIA Group's marketing mix, examining their product offerings, pricing strategies, distribution channels, and promotional activities to understand their market positioning and competitive advantages.

Streamlines understanding of AIA Group's 4Ps marketing strategy, alleviating the pain of complex analysis by providing clear, actionable insights.

Offers a concise overview of AIA's 4Ps, resolving the challenge of quickly grasping marketing effectiveness for busy executives.

Place

AIA's Premier Agency Network is a cornerstone of its distribution strategy, recognized globally for its strength. This network of dedicated agents offers tailored financial guidance, fostering enduring customer connections. In 2024, AIA reported that its agency channel continued to be a primary engine for new business, underscoring its vital role in the Group's sustained market dominance throughout Asia.

AIA Group significantly amplifies its market reach through robust bancassurance partnerships with prominent banks across its Asian territories. For instance, in 2024, AIA Hong Kong continued its strong collaboration with major banking groups, facilitating access to insurance solutions for millions of bank customers. These alliances are vital for AIA to tap into extensive client networks, driving sales efficiency and deepening market penetration.

AIA Group complements its established agency and bancassurance networks with direct sales and telemarketing efforts. These channels provide alternative pathways for customer engagement and product acquisition, often targeting specific customer demographics or specialized insurance products.

This strategic multi-channel deployment enhances AIA's market reach and accessibility. For instance, in 2024, AIA's digital initiatives, which often leverage direct and telemarketing capabilities, contributed to a significant portion of new business premiums, demonstrating the growing importance of these alternative channels in reaching a broader customer base.

Robust Digital Platforms and Online Presence

AIA Group has made substantial investments in its digital infrastructure, launching advanced online platforms and mobile apps. These tools are designed to boost customer interaction, simplify policy management, and drive sales efficiency. For instance, by the end of 2024, AIA aimed to have over 70% of its customer transactions conducted digitally.

These digital capabilities are crucial for enhancing customer convenience and streamlining internal operations. They also provide vital support for AIA's sales agents, enabling them to serve clients more effectively. The integration of AI is a key part of modernizing their insurance products and elevating the overall customer journey.

The company's digital strategy focuses on embedding AI and other advanced technologies to transform core insurance offerings. This commitment to digital modernization is expected to significantly improve customer satisfaction and operational agility. In 2023, AIA reported a 25% year-on-year increase in digital channel sales, underscoring the success of these initiatives.

- Digital Transformation Investment: AIA has prioritized digital transformation, channeling significant resources into online platforms and mobile applications.

- Customer Engagement & Policy Management: These digital tools enhance customer convenience, allowing for easier policy management and interaction.

- Sales and Agent Productivity: The platforms are designed to streamline sales processes and boost the productivity of AIA's agent network.

- AI Integration: A key focus is embedding Artificial Intelligence to modernize insurance offerings and improve the overall customer experience.

Broad Pan-Asian Geographic Reach

AIA Group boasts an extensive network, operating in 18 markets across the Asia-Pacific region. This broad geographic reach, achieved through wholly-owned branches, subsidiaries, and joint ventures, allows AIA to cater to a wide array of insurance needs throughout the continent. For instance, in 2024, AIA continued its strategic expansion within Mainland China, opening several new branches to capture a larger share of this rapidly growing market.

This pan-Asian presence is a cornerstone of AIA's strategy, enabling them to diversify risk and capitalize on varying economic cycles and demographic trends. The company's commitment to expanding its footprint is evident in its ongoing investments in key growth markets.

- 18 Markets: AIA operates across a significant portion of the Asia-Pacific, offering diverse insurance solutions.

- Strategic Expansion: Continued focus on expanding presence in high-growth markets like Mainland China, with new branches opening in 2024.

- Diverse Penetration: Utilizes wholly-owned branches, subsidiaries, and joint ventures to establish strong local market penetration.

- Customer Access: This wide reach directly translates to increased access to a larger and more diverse customer base across the region.

AIA's extensive physical presence across 18 Asia-Pacific markets is a critical component of its marketing mix, ensuring broad customer access and localized service delivery. This geographical footprint, supported by a mix of wholly-owned entities and strategic joint ventures, allows AIA to deeply penetrate diverse markets. For example, new branches were established in Mainland China in 2024, reflecting a targeted strategy to capitalize on this high-growth region.

The company's distribution network is multi-faceted, encompassing a strong premier agency force, extensive bancassurance partnerships with leading banks, and direct sales channels including telemarketing and digital platforms. This integrated approach ensures that AIA can reach a wide spectrum of customers, from those who prefer personalized advice from an agent to those who value the convenience of digital transactions.

AIA's digital transformation is a key enabler of its place strategy, with substantial investments made in online platforms and mobile applications by the end of 2024, aiming for over 70% of customer transactions to be digital. This focus on digital accessibility enhances customer convenience and supports agent productivity, demonstrating a commitment to modernizing service delivery.

The strategic placement of AIA's services, both physically through its expansive network and digitally via advanced platforms, directly contributes to its market leadership. By being present where customers are, and offering accessible channels for engagement, AIA solidifies its position as a preferred insurance provider across Asia.

| Channel | 2024 Focus/Activity | Impact on Place |

|---|---|---|

| Premier Agency Network | Primary engine for new business in 2024 | Ensures localized, personalized service delivery across numerous physical locations. |

| Bancassurance Partnerships | Continued strong collaboration with major banks in 2024 | Leverages existing bank branch networks for broad customer access. |

| Digital Platforms & Apps | Aiming for >70% digital transactions by end of 2024; 25% YoY digital sales increase in 2023 | Enhances accessibility and convenience, extending reach beyond physical locations. |

| Geographic Reach | Operates in 18 Asia-Pacific markets; new branches in Mainland China in 2024 | Maximizes market penetration and customer accessibility across diverse regions. |

What You See Is What You Get

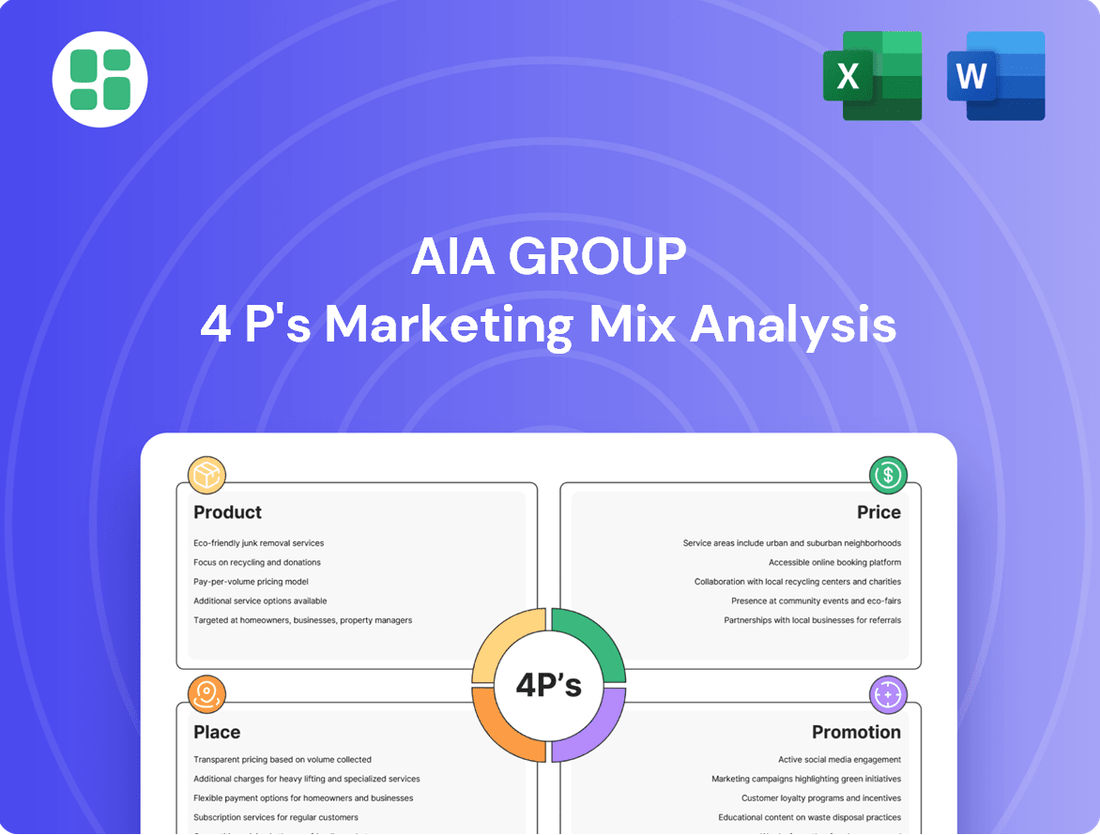

AIA Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of AIA Group's 4P's Marketing Mix covers Product, Price, Place, and Promotion in detail, providing actionable insights.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use. Dive into the strategic elements that define AIA's market presence and understand their approach to product development, pricing strategies, distribution channels, and promotional activities.

Promotion

AIA Group leverages extensive integrated advertising campaigns across both traditional and digital platforms to significantly boost brand awareness and clearly articulate its core value proposition. A prime example is their 'Rethink Healthy' initiative, which actively seeks to dismantle conventional notions of health and champion a comprehensive view of overall well-being.

These strategically crafted campaigns are specifically designed to connect with a broad spectrum of audiences throughout Asia. By doing so, AIA aims to inspire individuals to adopt healthier lifestyles, ultimately contributing to longer and better lives, a mission supported by their consistent investment in impactful marketing communications.

AIA Group actively connects with its audience across diverse digital and social media channels, employing content marketing, targeted online ads, and engaging campaigns to capture the attention of today's digitally-native consumers.

These digital outreach efforts are strategically designed to deliver pertinent information and cultivate online communities dedicated to enhancing health awareness and financial understanding, reflecting a commitment to educating and empowering its customer base.

For instance, in 2024, AIA's commitment to digital engagement saw a significant increase in social media followers and website traffic, with campaigns focused on financial planning for retirement and wellness programs resonating strongly, particularly among younger demographics.

AIA Group actively manages its public relations and corporate communications to foster transparency and trust. In 2024, the company continued to issue press releases detailing its robust financial results, with reported operating profit after tax reaching approximately $3.7 billion for the first half of 2024.

The company's commitment to Environmental, Social, and Governance (ESG) initiatives is a key focus in its communications. AIA Group's 2023 ESG report highlighted a 20% reduction in its operational carbon footprint compared to 2019 levels, demonstrating tangible progress in sustainability.

These efforts, including the publication of comprehensive annual reports and dedicated ESG reports, reinforce AIA's image as a leading insurer that prioritizes responsible business practices and community engagement, thereby strengthening its corporate reputation.

Community Engagement and Sponsorship Programs

AIA Group actively engages with communities through various sponsorship programs, underscoring its dedication to societal well-being. A prime example is the AIA One Billion initiative, which strives to involve a significant portion of the population in health and wellness pursuits. This commitment was further highlighted in 2024 with AIA's continued support for initiatives focused on mental health awareness and access to healthcare services across its key markets in Asia.

These community-focused efforts serve a dual purpose: they bolster AIA's brand presence and directly align with its core mission of enabling healthier, longer, and better lives. For instance, in 2024, AIA Hong Kong partnered with local charities to promote active aging, reaching over 50,000 seniors through fitness workshops and health screenings.

- Community Health Focus: AIA's programs in 2024 concentrated on improving physical and mental health outcomes in Asian communities.

- Brand Reinforcement: Sponsorships like the AIA Singapore Premier League continue to build brand visibility and positive association.

- Impact Measurement: AIA aims to measure the tangible impact of its community engagement, with over 10 million people reached globally through health and wellness programs by early 2025.

Customer Education and Financial Literacy Initiatives

AIA Group actively invests in customer education and financial literacy, recognizing its crucial role in empowering individuals. These initiatives aim to equip customers and the public with essential knowledge on financial planning, the intricacies of insurance benefits, and effective health management strategies. For instance, in 2024, AIA Thailand launched a comprehensive digital platform offering personalized financial advice and educational modules, reaching over 500,000 users by mid-year.

The company employs a multi-faceted approach, utilizing workshops, accessible online resources, and strategic collaborations with educational institutions. This commitment extends to fostering a deeper understanding of how insurance products contribute to long-term financial security and protection. AIA Singapore's partnership with Ngee Ann Polytechnic in 2025 resulted in a series of financial wellness seminars that saw an average attendance of 200 students per session, highlighting a tangible impact on younger demographics.

- Financial Planning Workshops: AIA regularly conducts workshops across various markets, focusing on topics like retirement planning and investment basics.

- Online Educational Resources: The company provides a wealth of articles, videos, and interactive tools on its websites, covering insurance, health, and wealth management.

- Partnerships with Educational Institutions: Collaborations with universities and colleges aim to integrate financial literacy into academic curricula and student outreach programs.

- Health Management Programs: AIA's initiatives also emphasize proactive health management, linking physical well-being to financial stability.

AIA Group's promotional strategy centers on integrated campaigns that emphasize health and financial well-being, reaching diverse audiences across Asia. Their digital engagement saw increased followers and website traffic in 2024, with campaigns on retirement planning and wellness resonating strongly, particularly with younger demographics.

Public relations efforts in 2024 highlighted robust financial performance, with a reported operating profit after tax of approximately $3.7 billion for the first half of the year, alongside a 20% reduction in operational carbon footprint by 2023. Community engagement, including the AIA One Billion initiative and support for mental health in 2024, reinforces their mission, with over 10 million people reached globally by early 2025.

Customer education is a key focus, with AIA Thailand's 2024 digital platform reaching over 500,000 users and partnerships like AIA Singapore's with Ngee Ann Polytechnic in 2025 impacting student financial literacy.

| Initiative | Focus Area | Key Metric/Outcome | Year |

|---|---|---|---|

| Rethink Healthy | Overall Well-being | Brand Awareness & Value Articulation | Ongoing |

| Digital Engagement | Financial Planning & Wellness | Increased Social Media Followers & Website Traffic | 2024 |

| ESG Reporting | Sustainability | 20% Reduction in Operational Carbon Footprint (vs. 2019) | 2023 |

| AIA One Billion | Health & Wellness Pursuits | Over 10 Million People Reached Globally | By Early 2025 |

| AIA Thailand Digital Platform | Financial Advice & Education | Over 500,000 Users Reached | Mid-2024 |

Price

AIA Group employs actuarial risk-based pricing models as a cornerstone of its pricing strategy. These sophisticated models meticulously assess the inherent risks of various insurance products and customer demographics, ensuring premiums are precisely calibrated to cover potential claims and operational expenses. This approach underpins AIA's financial stability and profitability.

These models are dynamic, continuously incorporating critical factors such as mortality rates, morbidity trends, and projected investment returns. For instance, in 2024, AIA Hong Kong adjusted pricing for certain critical illness plans, reflecting updated morbidity data and a more conservative outlook on future investment yields, aiming for a 3-5% premium increase on average for affected policies.

AIA Group's pricing strategy for its product bundles, such as those seen in their 2024 offerings, often emphasizes the holistic value proposition. This includes not just core insurance coverage but also integrated riders, extensive benefits, and supplementary services like AIA Vitality's wellness incentives. For instance, a bundled critical illness plan might incorporate enhanced hospital cash benefits and rehabilitation support, reflecting a higher perceived value compared to standalone policies.

The company actively employs value-based product bundling to provide customers with comprehensive solutions at competitive price points. These bundles are designed to offer greater coverage or unique features, such as accelerated death benefits or premium waivers under specific conditions, which might be more cost-effective than purchasing individual components separately. This approach aligns pricing directly with the enhanced benefits and convenience delivered to the policyholder.

Customization remains a key element, allowing AIA to tailor these bundled offerings to individual customer needs and risk profiles. Pricing is adjusted to reflect the specific combination of coverage, riders, and services selected, ensuring that customers pay for the benefits they value most. This personalized approach, evident in their 2025 product development pipelines, reinforces the perception of fair value and customer-centricity.

AIA Group's pricing strategy is finely tuned to the competitive dynamics across its key Asian markets, ensuring its insurance and investment products are both attractive to consumers and financially viable for the company. For instance, in 2023, AIA reported a strong performance with a 17% increase in new business value (NBV) to $3.7 billion, demonstrating its ability to gain market share through effective pricing.

The company actively balances its ambition for market leadership with a commitment to long-term profitability, understanding that aggressive pricing can sometimes erode margins. This careful calibration is essential as AIA navigates diverse economic conditions and customer needs throughout Asia, a region experiencing significant growth and evolving financial services demands.

To maintain this competitive edge, AIA continuously analyzes competitor pricing structures and broader market trends. This diligent approach allows them to adjust their own pricing models, ensuring they remain a compelling choice for customers while safeguarding their financial health and ability to deliver sustainable returns, a strategy reflected in their consistent growth in embedded value.

Flexible Payment Structures and Options

AIA Group recognizes that affordability and convenience are key drivers for customer adoption. To address this, they offer a range of flexible payment structures and options designed to accommodate diverse financial needs. This includes choices in premium payment frequencies, such as monthly, quarterly, or annual payments, allowing customers to align their insurance costs with their cash flow.

These adaptable payment methods are crucial for making insurance products accessible to a broader demographic, from individual policyholders to large corporate clients. By providing this flexibility, AIA aims to reduce financial barriers and enhance the overall customer experience, ensuring their offerings are attainable and manageable for a wider audience.

- Premium Payment Frequencies: AIA offers monthly, quarterly, and annual payment options.

- Payment Methods: Various convenient payment channels are available, including direct debit, online portals, and mobile apps.

- Customer Choice: This flexibility empowers customers to select the payment schedule that best suits their personal or business finances.

- Market Reach: Such options are instrumental in expanding AIA's market reach by catering to a wider spectrum of financial capacities.

Incentive-Based Pricing and Loyalty Programs

AIA Group strategically employs incentive-based pricing, most notably through its AIA Vitality program. This initiative directly links premium discounts and other benefits to policyholders who engage in and demonstrate healthy lifestyle choices. For example, in 2023, AIA Hong Kong reported that over 1.5 million members were actively participating in Vitality, showcasing the program's broad reach and customer engagement.

This approach incentivizes healthier living, which in turn can lead to a reduction in long-term claims costs for AIA. By encouraging preventative health measures, the company fosters a mutually beneficial relationship where customers benefit from lower costs and improved well-being, while AIA benefits from a healthier risk pool. This aligns with their broader strategy of promoting lifelong health and protection.

Key aspects of AIA's incentive-based pricing include:

- Premium Reductions: Policyholders can earn discounts on their insurance premiums by achieving specific health milestones or maintaining healthy habits.

- Reward Points: Participation in wellness activities, such as gym visits or health screenings, earns members points that can be redeemed for rewards, including discounts on AIA products or partner offerings.

- Behavioral Economics: The program leverages behavioral economics to motivate sustained engagement with health and wellness, creating a positive feedback loop for customers.

- Data-Driven Insights: AIA utilizes data from the Vitality program to gain insights into customer health trends, enabling more personalized product development and risk management.

AIA Group's pricing is fundamentally driven by actuarial risk assessment, ensuring premiums reflect the likelihood and cost of claims. This is augmented by value-based bundling, where comprehensive packages offer enhanced benefits at competitive price points. Flexibility in payment structures and incentive-based pricing through programs like AIA Vitality further tailor affordability and encourage healthier customer behaviors.

| Pricing Strategy Component | Description | 2024/2025 Data/Examples |

| Risk-Based Pricing | Utilizes actuarial models to set premiums based on mortality, morbidity, and investment return projections. | AIA Hong Kong adjusted critical illness plan pricing in 2024 due to updated morbidity data, expecting a 3-5% average premium increase. |

| Value-Based Bundling | Offers comprehensive product packages with integrated riders and supplementary services for enhanced value. | Bundled critical illness plans in 2024 included enhanced hospital cash benefits and rehabilitation support, increasing perceived value. |

| Competitive Pricing | Adjusts pricing to remain attractive in key Asian markets while ensuring profitability. | AIA achieved a 17% increase in new business value to $3.7 billion in 2023, indicating successful market penetration through pricing. |

| Incentive-Based Pricing (AIA Vitality) | Links premium discounts and rewards to policyholder engagement in healthy lifestyle choices. | Over 1.5 million members in AIA Hong Kong actively participated in Vitality in 2023, demonstrating program impact. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for AIA Group is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also leverage data from industry publications, market research reports, and competitive intelligence to ensure a robust understanding of their strategies.