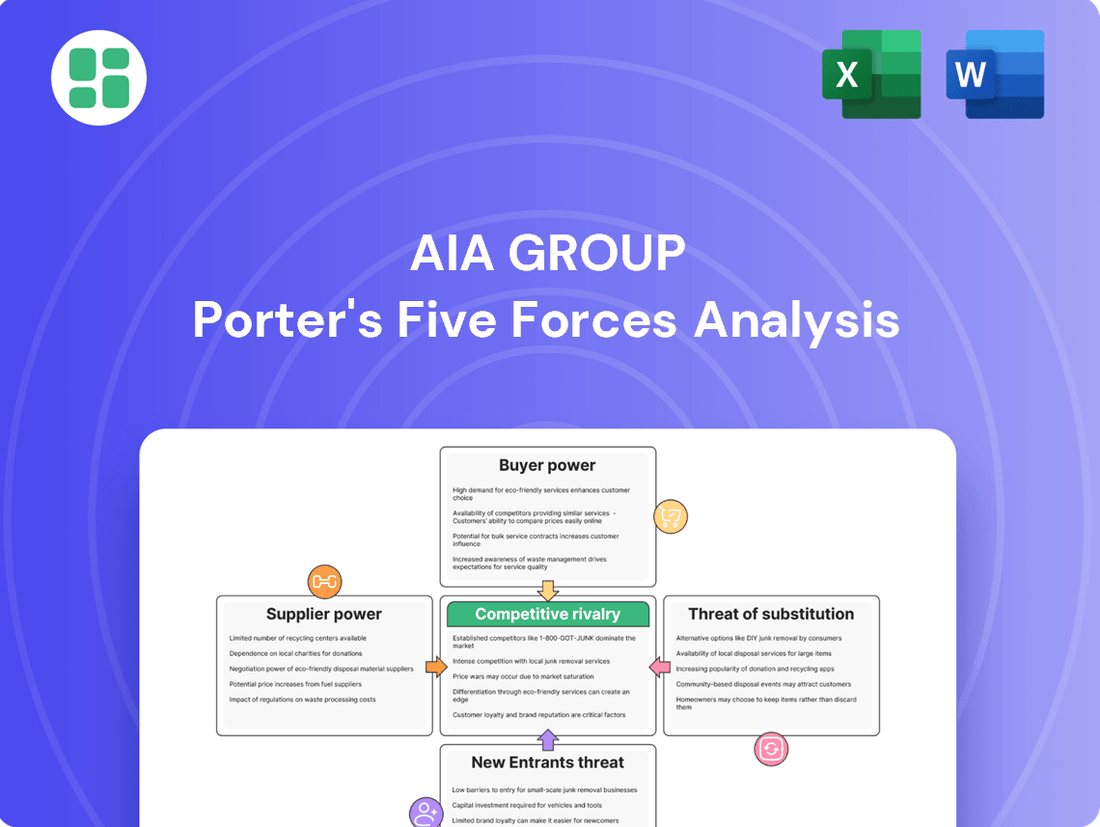

AIA Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIA Group Bundle

AIA Group operates within a dynamic insurance landscape where bargaining power of buyers and the threat of substitutes can significantly impact profitability. Understanding these pressures is crucial for strategic planning.

The complete report reveals the real forces shaping AIA Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AIA Group, like all insurers, depends on reinsurers to manage substantial risk exposures, especially for major or infrequent claims. This reliance means reinsurers hold a degree of bargaining power.

While the global reinsurance market is competitive, specialized reinsurance needs or concentrated risk pools can amplify the leverage of certain reinsurers. For instance, in 2024, the global reinsurance market size was estimated to be around $300 billion, indicating significant capacity but also potential for specialized providers to command higher prices for niche coverages.

This leverage can translate into higher costs for AIA when transferring risk, directly affecting its profitability and the pricing of its own insurance products. The ability of reinsurers to influence terms and pricing is a key factor in AIA's operational costs.

The insurance sector's growing reliance on digital solutions, including advanced analytics and cloud infrastructure, positions technology and data providers as key players in AIA Group's supply chain. AIA's need for specialized software and AI capabilities means that vendors with unique or critical offerings can wield considerable influence.

For example, in 2024, many insurance firms, including those similar to AIA, are investing heavily in data analytics platforms to improve customer insights and operational efficiency. Companies offering proprietary algorithms or specialized cloud services that are difficult to replicate could command higher prices or more favorable terms, impacting AIA's cost structure and operational agility.

AIA Group's reliance on its vast agency force as a primary distribution channel means that experienced and successful agents hold significant sway. The demand for specialized actuaries and IT professionals, particularly those with expertise in areas like AI and data science, is exceptionally high across Asia's dynamic financial landscape. In 2024, the competition for these skilled individuals intensified, potentially increasing recruitment and retention expenses for AIA.

Healthcare Providers and Networks

AIA Group's accident and health insurance business relies on a network of healthcare providers, including hospitals and clinics. The bargaining power of these suppliers is a key consideration.

In 2024, the concentration of high-quality healthcare providers in specific markets significantly impacts their negotiating leverage with insurers like AIA. Markets with fewer specialized facilities or a dominant hospital group tend to see higher costs passed on to insurers, directly affecting claim expenses for AIA's accident and health products.

Regulatory environments also play a crucial role. For instance, in regions where healthcare pricing is heavily regulated, the bargaining power of providers might be somewhat curtailed, offering AIA more predictable cost structures. Conversely, less regulated markets can empower providers to command higher rates.

- Provider Concentration: Markets with a limited number of specialized medical centers or a few large hospital systems often grant these providers greater bargaining power.

- Regulatory Frameworks: Government regulations on healthcare pricing and service provision can either amplify or diminish the bargaining power of suppliers.

- Claim Costs: The ability of providers to negotiate higher fees for services directly influences the overall cost of claims for AIA's accident and health insurance policies.

Marketing and Advertising Agencies

AIA Group's substantial investment in marketing and brand building across its varied Asian markets means it relies on external agencies. While the sheer number of marketing and advertising agencies available generally keeps their bargaining power in check, specialized agencies with proven track records in the insurance sector or deep regional market understanding can negotiate more favorable terms. For instance, in 2024, the global advertising market saw significant growth, with digital advertising spend alone projected to reach over $600 billion, indicating a robust demand for agency services.

However, the competitive landscape within the advertising industry itself acts as a counter-balance. This intense competition among agencies often prevents any single agency from wielding excessive leverage over a large client like AIA. Agencies are constantly vying for new business, which can lead to more competitive pricing and service offerings.

- Agency Specialization: Agencies with deep expertise in insurance marketing or specific Asian markets can command higher fees.

- Competitive Landscape: The large number of agencies competing for business limits their overall individual bargaining power.

- AIA's Scale: AIA's significant marketing spend gives it leverage in negotiations with most agencies.

The bargaining power of AIA Group's suppliers is generally moderate, influenced by the concentration of providers and the availability of alternatives. Key suppliers include reinsurers, technology providers, healthcare facilities, and marketing agencies.

In 2024, the reinsurance market, while large at an estimated $300 billion, can see concentrated power among specialized reinsurers, potentially increasing costs for AIA. Similarly, critical technology vendors offering unique AI or cloud solutions can command higher prices due to the specialized nature of their offerings and the high demand for such expertise in the insurance sector.

| Supplier Type | Key Influence Factors | 2024 Context/Impact on AIA |

|---|---|---|

| Reinsurers | Specialization, Risk Pool Concentration | Global market size ~$300 billion; specialized coverages can command higher prices, impacting AIA's risk transfer costs. |

| Technology Providers (AI, Cloud) | Proprietary Offerings, Ease of Replication | High demand for data analytics and AI; unique solutions can lead to higher costs for AIA, affecting operational agility. |

| Healthcare Providers | Market Concentration, Regulatory Environment | Concentrated markets with few specialized facilities can increase claim expenses for AIA's accident and health products. |

| Marketing Agencies | Specialization, Agency Competition | Global advertising market robust; specialized insurance agencies can negotiate better terms, but overall competition limits extreme leverage. |

What is included in the product

This analysis of AIA Group's competitive environment reveals the intensity of rivalry, the bargaining power of customers and suppliers, and the threat of new entrants and substitutes, all crucial for understanding AIA's strategic positioning.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for AIA Group.

Customers Bargaining Power

Customers in the Asia-Pacific region benefit from a vast selection of life and health insurance providers. This includes established pan-Asian companies, specialized local insurers, and various bancassurance partnerships, offering a diverse range of products and services.

This abundance of choice significantly empowers customers. They can readily compare policies, premiums, and customer service levels across multiple providers, forcing insurers to compete fiercely on value and affordability. For instance, in 2024, the Asia-Pacific insurance market is projected to see continued growth, with numerous new entrants and product innovations further intensifying this competitive landscape.

Customers are becoming more aware of pricing, especially with readily available online comparison tools. This trend is particularly noticeable in the insurance sector for products that are seen as more standard, like basic life and savings plans. For instance, in 2024, a significant portion of consumers actively used price comparison websites before purchasing insurance, indicating a direct impact on how companies like AIA Group can set their premiums for these offerings.

The proliferation of online platforms and aggregators has dramatically shifted power towards customers. For instance, in the insurance sector, comparison websites allow consumers to easily view and compare policies from various providers, including AIA Group, side-by-side. This accessibility to information, product details, and customer reviews empowers individuals to make more informed purchasing decisions, thereby increasing their leverage when negotiating prices or demanding better service.

Low Switching Costs for Certain Products

For certain straightforward insurance products, customers may face minimal hurdles when switching providers, especially if they discover more favorable terms or enhanced services elsewhere. This dynamic compels insurers like AIA Group to prioritize customer loyalty by offering superior value and cultivating robust client relationships.

The ease with which customers can switch providers for basic insurance offerings directly influences pricing and service expectations. For instance, in the competitive life insurance market, a customer seeking a simple term life policy might compare quotes online and switch with relative ease if another insurer offers a lower premium for similar coverage.

- Low Switching Costs: Customers can readily move between insurers for standard insurance products, impacting provider competition.

- Customer Retention Focus: AIA Group must emphasize value-added services and relationship management to keep customers.

- Price Sensitivity: The ability to switch easily makes customers more sensitive to pricing differences, pushing insurers to offer competitive rates.

Demand for Tailored and Value-Added Services

Customers, particularly those with significant assets, are increasingly seeking bespoke insurance and financial management solutions. This includes specialized investment products and integrated wellness initiatives, such as AIA Vitality, which offers health incentives. In 2024, the demand for such personalized services continued to rise, giving customers more leverage.

Insurers capable of customizing their products and offering comprehensive financial and health guidance can attract and keep clients. However, this trend empowers customers who expect this level of tailored service.

- Growing Demand for Personalization: High-net-worth individuals are a key demographic driving the demand for tailored financial and insurance products.

- Value-Added Services: Initiatives like AIA Vitality, which links insurance premiums or benefits to health behaviors, exemplify the value-added services customers now expect.

- Customer Leverage: The ability of customers to seek out and demand these customized offerings significantly increases their bargaining power in the insurance market.

The bargaining power of customers for AIA Group in 2024 remains substantial due to the highly competitive Asia-Pacific insurance landscape. With numerous providers offering a wide array of products, consumers can easily compare options, pushing insurers to focus on value and competitive pricing. This environment means AIA Group must continuously innovate and offer superior customer experiences to retain its market share.

| Key Factor | Impact on AIA Group | Supporting Data (2024 Estimates/Trends) |

| Abundance of Choice | Increases customer leverage, forcing competitive pricing and service. | Asia-Pacific insurance market projected for continued growth, with new entrants intensifying competition. |

| Price Transparency | Customers actively use comparison tools, impacting premium setting. | Significant portion of consumers use online comparison sites before purchasing insurance. |

| Low Switching Costs (for basic products) | Drives focus on customer retention and value-added services. | Ease of switching for simple term life policies incentivizes competitive quotes. |

| Demand for Personalization | Customers seek tailored solutions, increasing expectations for customized offerings. | Growing demand for bespoke financial and wellness-linked insurance products. |

Preview Before You Purchase

AIA Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for AIA Group, detailing the competitive landscape within the insurance industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing actionable insights into AIA's strategic positioning. You can trust that what you preview is precisely what you'll download, enabling you to leverage this valuable information without delay.

Rivalry Among Competitors

The Asia-Pacific insurance landscape is intensely competitive, with numerous large global and regional players vying for market share. AIA Group contends with established international insurers, robust local companies, and significant pan-Asian entities such as Prudential, China Life, and Manulife. This crowded market means AIA must consistently innovate and offer compelling value propositions to stand out.

Product differentiation in the insurance sector, particularly for core life and health offerings, presents a significant challenge for AIA Group. Many policies share fundamental features, pushing competition towards price, which can erode profitability.

AIA Group's strategy to counter this involves substantial investments in building a strong brand reputation and expanding its distribution networks. For instance, in 2023, AIA reported a 10% increase in its Value of New Business (VONB) to $3.9 billion, partly driven by enhanced customer engagement and tailored product solutions.

Beyond product features, AIA focuses on value-added services such as wellness programs and digital health platforms. These initiatives aim to create a more holistic customer experience, differentiating AIA from competitors who may offer similar insurance products but lack these complementary services.

AIA Group faces intense competitive rivalry driven by aggressive expansion across all distribution channels. This includes strengthening its vast proprietary agency forces, deepening bancassurance relationships, and notably, investing heavily in digital-direct channels to capture a broader market share.

In 2023, AIA reported that its agency channel continued to be the primary engine of growth, with new business value (NBV) from this channel showing robust performance, underscoring the importance of this direct sales force in a competitive landscape.

The push to optimize and expand these channels isn't just about reach; it's a strategic imperative to boost sales productivity and customer acquisition in a market where rivals are equally aggressive in their distribution strategies.

Regulatory Changes and Market Dynamics

Evolving regulatory landscapes, such as China's C-ROSS II and Hong Kong's HKFRS17/RBC regime, are compelling insurers like AIA Group to recalibrate product offerings and capital management. This regulatory pressure intensifies competition as companies vie for capital-efficient business models, directly impacting strategic decisions and market positioning.

Market shifts, particularly the growing consumer demand for health and retirement solutions, further fuel competitive responses across the industry. Insurers are actively innovating and adapting their portfolios to capture these burgeoning market segments, leading to a more dynamic and aggressive competitive environment.

- Regulatory Impact: China's C-ROSS II and Hong Kong's HKFRS17/RBC implementation necessitate significant adjustments in product design and capital allocation, increasing the cost of doing business and sharpening competitive edges.

- Market Demand Drivers: Increased appetite for health and retirement products creates opportunities but also intensifies rivalry as multiple players strive to meet this demand, often through aggressive pricing or enhanced product features.

- Capital Efficiency Focus: The pursuit of capital-efficient business models becomes a critical differentiator, forcing companies to optimize their operations and product mix to remain competitive under new regulatory frameworks.

Digital Transformation and Insurtech Innovation

The insurance industry is experiencing intense competition driven by digital transformation and insurtech innovation. Companies like AIA are facing pressure from agile startups leveraging advanced technologies to offer streamlined, customer-centric solutions. This shift necessitates significant investment in digital capabilities to remain competitive.

AIA Group, like its peers, is actively pursuing digital transformation. In 2023, the company continued to invest in enhancing its digital platforms and data analytics. For instance, AIA’s digital strategy includes expanding its online service capabilities and exploring AI for improved underwriting and claims processing, aiming to boost efficiency and customer engagement.

- Insurtech Investment: Global insurtech funding reached approximately $7.1 billion in 2023, indicating a strong influx of capital and innovation into the sector, directly impacting traditional insurers.

- Digital Adoption: By the end of 2024, it's projected that over 70% of insurance customer interactions will occur digitally, pushing incumbent players to accelerate their online presence and service offerings.

- AI in Underwriting: Insurers are increasingly adopting AI for underwriting, with some reporting a 10-20% reduction in processing times for certain risk assessments.

Competitive rivalry within the Asia-Pacific insurance market is fierce, with AIA Group facing strong competition from established global insurers, regional powerhouses like Prudential and Manulife, and significant local players. This intense environment compels AIA to continuously innovate its product offerings and distribution strategies to maintain its market position.

AIA's strategy to combat this rivalry includes substantial investments in its agency force, bancassurance partnerships, and digital channels, aiming to enhance sales productivity and customer acquisition. For example, in 2023, AIA reported a 10% increase in its Value of New Business (VONB) to $3.9 billion, partly driven by these distribution enhancements.

The rise of insurtech and digital transformation further intensifies this competition, with agile startups leveraging technology to offer streamlined solutions. AIA is responding by investing in its digital platforms and exploring AI for improved underwriting and claims processing, a trend supported by global insurtech funding reaching approximately $7.1 billion in 2023.

| Competitor | Key Markets | 2023 VONB (Approx.) | Strategic Focus |

|---|---|---|---|

| Prudential | Asia, Africa | Undisclosed (Significant presence) | Health & Protection, Digital Growth |

| Manulife | Asia, Canada | Undisclosed (Strong Asian presence) | Digital Transformation, Wealth & Asset Management |

| China Life | China | Undisclosed (Dominant in China) | Diversification, Digitalization |

SSubstitutes Threaten

Individuals and businesses have a wide array of direct investment options available, bypassing insurance-linked savings plans. These include actively managing portfolios of stocks and bonds, investing in real estate, or channeling funds into exchange-traded funds (ETFs) and mutual funds. For instance, in 2024, global equity markets saw significant activity, with major indices like the S&P 500 reaching new highs, demonstrating the potential for direct investment growth.

The attractiveness of these substitutes is heavily tied to prevailing market conditions and interest rate trends. When interest rates are low, traditional savings accounts offer minimal returns, pushing investors toward potentially higher-yield direct investments. Conversely, during periods of high interest rates, fixed-income securities become more appealing substitutes for insurance products that may offer lower guaranteed returns.

Government social security and healthcare programs in Asia-Pacific present a threat of substitutes for AIA Group. For instance, in 2024, countries like Singapore and Hong Kong continue to bolster their public pension and healthcare schemes, offering a foundational safety net. While these programs may not fully replace private insurance needs, they can reduce demand for certain AIA products, particularly among individuals with lower disposable incomes who rely more heavily on state provisions.

Larger corporations, especially those with robust financial standing, increasingly explore self-insurance and advanced internal risk management as alternatives to traditional insurance products. This trend is fueled by a desire to reduce premiums and gain greater command over their risk profiles. For instance, in 2024, many Fortune 500 companies continued to expand their captive insurance arrangements, retaining more risk internally to potentially lower long-term costs and customize coverage to their specific needs.

Alternative Financial Products for Savings and Wealth Management

The threat of substitutes for AIA Group's savings and wealth management products is significant. Beyond traditional insurance-linked savings plans, consumers can turn to a wide array of alternative financial products. These include structured notes offering capital protection with potential upside, annuities provided by banks or specialized non-insurance entities, and comprehensive wealth management services from independent financial advisors or large financial institutions.

These substitutes compete directly for consumer capital earmarked for savings and wealth accumulation. For instance, as of late 2024, global wealth management industry assets were projected to exceed $100 trillion, indicating a vast pool of capital that AIA must contend with from non-traditional competitors.

- Structured Products: Offer diverse risk-return profiles, often with capital guarantees, appealing to risk-averse investors.

- Annuities from Non-Insurance Entities: Banks and investment firms increasingly offer annuity-like products, providing guaranteed income streams.

- Independent Financial Advisors: Provide personalized investment advice and access to a broader range of investment vehicles, bypassing traditional insurer products.

- Digital Wealth Management Platforms: Robo-advisors and online investment platforms offer low-cost, accessible alternatives for managing savings and investments.

Emergence of Fintech and Niche Digital Solutions

Fintech and specialized digital platforms are increasingly offering unbundled financial services and niche protection products that can directly substitute for specific parts of traditional insurance policies. These innovators often excel in convenience, cost-effectiveness, or by targeting very specific risks, presenting a significant competitive threat.

For instance, the rise of peer-to-peer lending platforms and digital investment apps provides alternatives to traditional savings and investment products offered by insurers. In 2024, the global fintech market was valued at over $1.1 trillion, demonstrating substantial growth and its increasing capacity to disrupt established financial services.

- Digital Insurance Platforms: Companies like Lemonade offer renters and homeowners insurance through a mobile app, utilizing AI for faster claims processing and often at a lower price point than traditional insurers.

- Embedded Finance: Financial services, including insurance, are being integrated directly into non-financial platforms and purchase journeys, reducing the need for standalone insurance products.

- Specialized Protection: Niche providers are emerging to cover specific risks, such as cyber insurance for small businesses or travel insurance for specific destinations, directly competing with broader policy offerings.

The threat of substitutes for AIA Group is substantial, stemming from a diverse range of financial products and services that compete for consumer capital. These substitutes include direct investments in stocks, bonds, real estate, ETFs, and mutual funds, which offer flexibility and potentially higher returns, as evidenced by the S&P 500's strong performance in 2024. Additionally, government social security and healthcare programs in Asia-Pacific provide a basic safety net, potentially reducing demand for certain AIA products, especially among those with lower incomes.

Large corporations are increasingly opting for self-insurance and captive insurance arrangements, a trend amplified in 2024, to manage risk internally and potentially lower costs. Furthermore, fintech innovations and digital platforms are unbundling financial services, offering niche protection products and convenient, low-cost alternatives like robo-advisors, which are rapidly gaining traction in the burgeoning global fintech market valued at over $1.1 trillion in 2024.

| Substitute Category | Examples | Key Appeal | 2024 Market Context |

|---|---|---|---|

| Direct Investments | Stocks, Bonds, ETFs, Mutual Funds, Real Estate | Flexibility, Potential for higher returns, Capital growth | Global equity markets reached new highs, demonstrating growth potential. |

| Government Programs | Social Security, Public Healthcare | Basic safety net, Reduced reliance on private insurance for essential needs | Continued strengthening of public schemes in key Asian markets. |

| Corporate Risk Management | Self-insurance, Captive insurance | Cost reduction, Customized risk control, Premium savings | Expansion of captive arrangements by Fortune 500 companies. |

| Fintech & Digital Platforms | Robo-advisors, P2P lending, Digital insurance | Convenience, Low cost, Niche product offerings, Speed | Global fintech market valued over $1.1 trillion; rise of digital insurance providers. |

| Alternative Savings Products | Structured notes, Bank annuities, Wealth management services | Capital guarantees, Guaranteed income streams, Personalized advice | Global wealth management assets projected to exceed $100 trillion. |

Entrants Threaten

Entering the life insurance sector, particularly with ambitions as broad as AIA Group's across Asia, necessitates immense capital. Think about the costs involved: setting up robust underwriting systems, maintaining substantial regulatory reserves to protect policyholders, and building a vast network of operations and distribution channels. These aren't small figures; they represent a significant hurdle for any new player looking to compete on a similar scale.

The insurance industry in Asia-Pacific, including markets where AIA Group operates, is characterized by a stringent regulatory landscape. New entrants face significant barriers due to rigorous licensing procedures, capital adequacy requirements, and consumer protection mandates that differ across countries. For instance, in 2024, many Asian markets continue to update their solvency regulations, requiring substantial capital injections that can deter smaller, less-capitalized new companies.

The threat of new entrants for AIA Group is significantly shaped by the substantial need for extensive distribution networks. Building a robust presence, whether through a dedicated agency force, strategic bancassurance alliances, or advanced digital platforms, demands considerable time, capital, and deep understanding of local markets. For instance, in 2024, AIA continued to invest heavily in expanding its digital capabilities and agent training programs across Asia, recognizing that a strong distribution backbone is essential to effectively reach and serve its diverse customer base, thereby creating a barrier for newcomers.

Brand Trust and Reputation

The insurance industry, particularly for long-term protection and savings, fundamentally relies on trust. AIA Group, having operated for over a century, has cultivated significant brand recognition and customer loyalty. This deep-seated trust acts as a substantial barrier for new entrants aiming to establish a foothold.

Newcomers must invest heavily and demonstrate consistent reliability over extended periods to even begin to rival AIA's established reputation. For instance, in 2024, customer retention rates for established insurers often remain significantly higher than those for newer entities, reflecting this trust deficit.

- Brand Trust: Insurance is inherently a trust-based industry.

- Customer Loyalty: AIA's long history fosters strong customer loyalty.

- Reputation Barrier: New entrants struggle to build comparable trust and reputation.

- Long-Term Products: Trust is crucial for products like life insurance and savings plans.

Expertise in Actuarial Science and Risk Management

The life insurance industry, including players like AIA Group, is heavily protected by the significant expertise required in actuarial science and risk management. New entrants face a steep climb in developing the necessary skills for accurate product pricing, risk assessment, and long-term solvency management. This deep technical knowledge is not easily replicated, acting as a substantial barrier.

For instance, the complex calculations involved in life insurance pricing and reserving demand highly specialized actuarial talent. Companies like AIA invest heavily in these professionals, who are crucial for profitability and regulatory compliance. The scarcity of such expertise means new companies would struggle to attract and retain the necessary talent to compete effectively.

- High Barrier to Entry: The need for specialized actuarial and risk management skills significantly deters new companies from entering the life insurance market.

- Talent Acquisition Challenge: Developing or acquiring the necessary actuarial talent and robust risk management infrastructure is a costly and time-consuming endeavor for potential new entrants.

- Competitive Advantage for Incumbents: Established players like AIA Group benefit from their existing pool of experienced actuaries and sophisticated risk management frameworks, providing a distinct competitive edge.

The threat of new entrants for AIA Group is relatively low due to substantial capital requirements, stringent regulations, and the need for extensive distribution networks. For example, in 2024, many Asian insurance markets continued to enforce rigorous capital adequacy rules, making it difficult for underfunded newcomers to gain a foothold. Furthermore, building the necessary trust and actuarial expertise takes considerable time and investment, creating a significant barrier for potential competitors.

| Factor | Impact on AIA Group | Evidence (2024 Data/Trends) |

|---|---|---|

| Capital Requirements | High Barrier | Significant upfront investment needed for licensing, reserves, and infrastructure. |

| Regulatory Landscape | High Barrier | Stringent licensing, solvency, and consumer protection rules vary by country. |

| Distribution Networks | High Barrier | Establishing extensive agency forces or digital platforms requires substantial time and capital. |

| Brand Trust & Loyalty | High Barrier | AIA's long history fosters customer loyalty, making it hard for new entrants to gain trust. |

| Expertise (Actuarial/Risk) | High Barrier | Requires specialized talent for pricing, risk management, and solvency, which is scarce. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AIA Group is built upon a robust foundation of data, including AIA's annual reports and investor presentations, alongside industry-specific reports from reputable sources like Statista and IBISWorld.