AIA Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIA Group Bundle

Navigate the complex external forces shaping AIA Group's future with our comprehensive PESTLE Analysis. Understand how political stability, economic shifts, social trends, technological advancements, environmental regulations, and legal frameworks are impacting this insurance giant. Gain a strategic advantage by leveraging these critical insights to refine your market approach and anticipate future challenges. Download the full PESTLE Analysis now for actionable intelligence that drives informed decision-making.

Political factors

AIA Group's operations across the Asia-Pacific region are significantly impacted by the political stability of its key markets. For instance, in 2024, countries like Hong Kong, while a major hub, have navigated periods of political sensitivity which can affect investor confidence and business operations. The stability of governments in markets like Singapore and Malaysia, which are crucial for AIA, underpins the security of its investments and ensures consistent business continuity.

Favorable government policies are a strong tailwind for AIA. In 2024, many governments in Southeast Asia are actively promoting financial inclusion and long-term savings, often through supportive regulations for the insurance sector. For example, initiatives aimed at encouraging retirement planning or health insurance uptake can directly translate into increased market penetration and profitability for AIA, as seen with recent policy adjustments in countries like Vietnam to bolster the life insurance market.

Governments across Asia-Pacific are actively shaping the insurance landscape, with evolving regulatory frameworks impacting operations. For instance, in 2024, several markets are reviewing or implementing updated solvency requirements, such as the Risk-Based Capital (RBC) framework, which could necessitate adjustments in capital allocation for insurers like AIA. These changes directly influence operational costs and the feasibility of strategic expansion, making proactive adaptation essential for maintaining compliance and a competitive edge.

Geopolitical shifts and the evolving landscape of international trade agreements across Asia significantly influence AIA Group's cross-border business. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes several key Asian markets, offers a framework for reduced tariffs and streamlined investment, potentially benefiting AIA's regional expansion. Conversely, trade disputes, such as those impacting supply chains or investment sentiment in 2024, could introduce volatility and operational challenges for AIA's diverse Asian portfolio.

Anti-Money Laundering (AML) and Anti-Terrorism Financing (ATF) Regulations

AIA Group, like all financial institutions, must meticulously adhere to global and local Anti-Money Laundering (AML) and Anti-Terrorism Financing (ATF) regulations. Governments worldwide are intensifying their oversight and enforcement in these critical areas. This means AIA needs strong compliance systems and thorough customer due diligence to prevent financial crimes and safeguard its reputation. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting how institutions like AIA manage risk and report suspicious activities.

The increasing focus on AML/ATF compliance translates into significant operational requirements for AIA. These include investing in advanced technology for transaction monitoring, conducting regular staff training, and maintaining detailed audit trails. Failure to comply can result in hefty fines and severe reputational damage. In 2023, global AML fines for financial institutions reached billions of dollars, underscoring the high stakes involved.

- Increased Scrutiny: Regulators are demanding more robust AML/ATF programs, pushing for proactive risk management rather than reactive measures.

- Technological Investment: Financial institutions are investing heavily in AI and machine learning for more effective transaction monitoring and anomaly detection.

- Global Harmonization Efforts: International bodies like FATF are working to harmonize AML/ATF standards across jurisdictions, creating a more complex but unified regulatory landscape.

- Reputational Risk: A strong AML/ATF framework is crucial for maintaining customer trust and avoiding negative publicity associated with financial crime facilitation.

Healthcare Policy and Public Health Initiatives

Government policies on healthcare reform and public health significantly shape the demand for AIA Group's health and accident insurance. For instance, the US Affordable Care Act (ACA) expanded health insurance coverage, potentially impacting the market for private plans. Conversely, in some regions, increased public healthcare investment might temper demand for private alternatives.

Government initiatives promoting preventative care and wellness programs present new avenues for AIA. For example, many governments in Asia, including Singapore and South Korea, have been actively encouraging healthier lifestyles through public campaigns and subsidies for health screenings. These efforts can align with AIA's focus on health and wellness, creating opportunities for product development and partnerships.

The evolving landscape of healthcare policy, including potential shifts in public spending and regulatory frameworks, directly influences AIA's operational environment. For 2024-2025, continued discussions around healthcare cost containment and the integration of digital health solutions by governments will be key factors to monitor. For example, the World Health Organization's 2024 report highlighted the growing trend of governments investing in digital health infrastructure, which could create opportunities for insurers to offer integrated digital health services.

- Government healthcare spending: Fluctuations in public health budgets can directly affect the market size for private insurance.

- Public health initiatives: Campaigns promoting wellness and preventative care can boost demand for related insurance products.

- Regulatory changes: New healthcare laws or reforms can alter the competitive landscape and product offerings.

- Digital health integration: Government support for digital health platforms may create opportunities for insurers to partner and offer new services.

Political stability across AIA's key Asia-Pacific markets remains a critical factor influencing investor confidence and operational continuity. For instance, the political climate in Hong Kong during 2024 presented sensitivities that could impact business operations. Conversely, the stable governance in markets like Singapore and Malaysia in 2024 provides a secure environment for AIA's investments and ensures consistent business operations.

Government policies that encourage financial inclusion and long-term savings are beneficial for AIA. Many Southeast Asian nations in 2024 are implementing regulations supportive of the insurance sector, such as those aimed at boosting retirement planning. Vietnam, for example, adjusted policies in 2024 to strengthen its life insurance market, directly aiding AIA's growth.

Evolving regulatory frameworks in Asia-Pacific are actively reshaping the insurance industry. By 2025, several markets are expected to finalize updated solvency requirements, like the Risk-Based Capital (RBC) framework, which will necessitate capital adjustments for insurers such as AIA. These regulatory shifts directly impact operational costs and strategic expansion feasibility.

What is included in the product

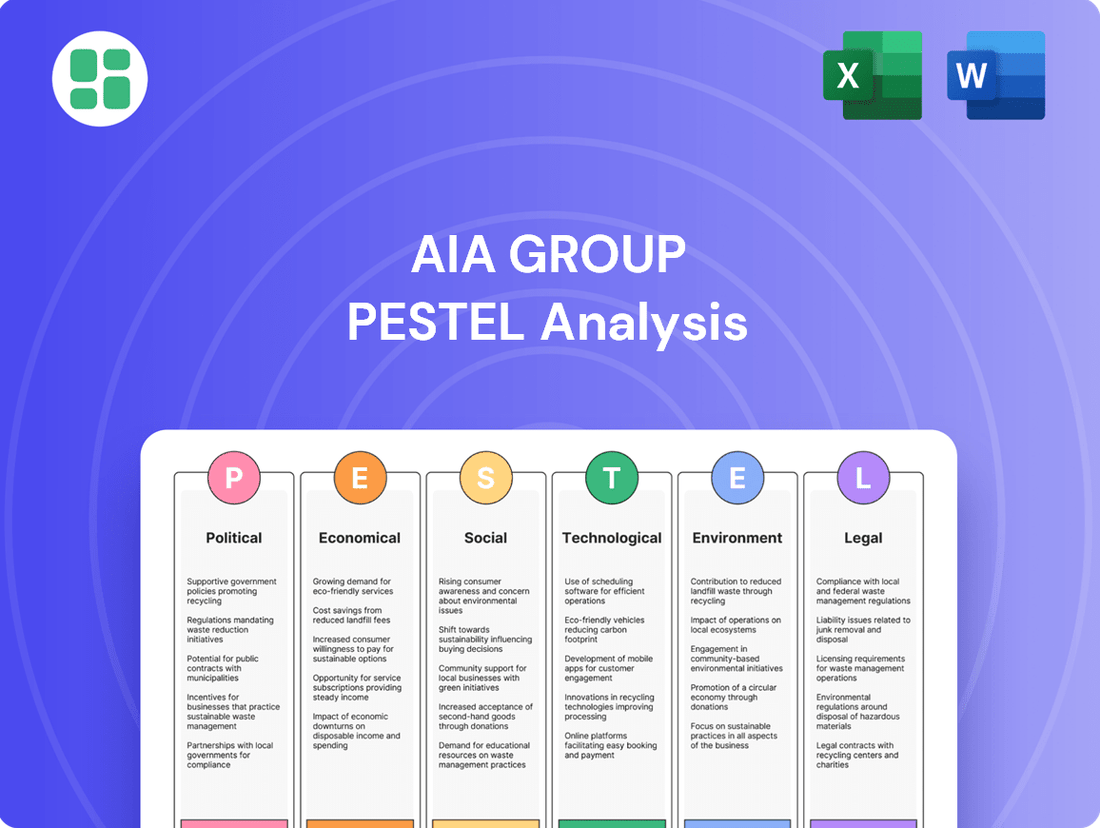

This PESTLE analysis of AIA Group examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic planning.

It provides a comprehensive overview of the external landscape, highlighting key trends and their implications for AIA Group's growth and risk management.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying the complex external factors impacting AIA Group.

Economic factors

Robust economic growth in Asia-Pacific, with many economies projected to expand significantly in 2024 and 2025, fuels a burgeoning middle class. This demographic shift directly translates into increased disposable incomes, creating a fertile ground for demand in insurance and savings products, which AIA Group is well-positioned to capture.

AIA's financial performance is intrinsically linked to the sustained Gross Domestic Product (GDP) growth across its primary operational regions. For instance, countries like Vietnam and the Philippines have shown strong GDP growth rates exceeding 5% in recent years, indicating a larger addressable market for AIA's offerings as more individuals can afford financial protection and wealth accumulation solutions.

Inflation directly impacts AIA Group by increasing the cost of claims payouts and eroding the real value of future financial obligations. For instance, if inflation accelerates, the cost of medical treatments or life insurance claims can rise unexpectedly, impacting profitability. Conversely, stable inflation allows for more predictable financial planning and pricing of insurance products.

Interest rate movements are a critical factor for AIA Group's financial performance. Higher interest rates generally boost investment returns on AIA's substantial asset portfolio, which is crucial for meeting long-term liabilities. However, rapidly rising rates can also impact the valuation of existing bond holdings. For example, in early 2024, central banks globally maintained higher interest rates, which generally benefited insurers' investment income, though market volatility remained a concern.

AIA Group operates in numerous countries, making it susceptible to currency exchange rate fluctuations. These shifts can significantly affect its reported earnings as local currencies are converted back to its primary reporting currency. For instance, a strengthening of the Hong Kong Dollar against other Asian currencies could reduce the reported value of AIA's earnings generated in those markets.

High volatility in exchange rates introduces considerable financial risk. It can complicate essential cross-border transactions, such as dividend payments or intercompany loans, and makes strategic capital allocation decisions more challenging for the group. This uncertainty requires robust hedging strategies to mitigate potential negative impacts on profitability and financial stability.

Consumer Purchasing Power and Disposable Income

The growing consumer purchasing power across Asia, particularly in emerging economies, directly fuels demand for AIA's life, health, and savings products. As disposable incomes rise, individuals and families increasingly allocate funds towards financial security and future planning. For instance, in 2024, the Asian Development Bank projected continued economic growth across Southeast Asia, with many nations experiencing a significant increase in per capita income, creating a larger pool of potential customers for insurance and investment solutions.

This trend is evident in the increasing penetration of life insurance and savings products in markets like Vietnam and the Philippines, where middle-class expansion is a prominent feature. AIA's strategic focus on these growing markets aligns with the rising ability of consumers to afford and prioritize long-term financial well-being. The World Bank reported in 2024 that several Asian economies were on track to further reduce poverty rates, translating into more disposable income for a larger segment of the population.

- Rising Disposable Income: Many Asian economies are experiencing robust GDP growth, leading to higher per capita incomes and increased spending capacity.

- Prioritization of Financial Security: As economic stability improves, consumers are more inclined to invest in life and health insurance for protection and future planning.

- Growing Middle Class: The expansion of the middle class across Asia means a larger demographic with the financial means to access AIA's diverse product portfolio.

- Increased Savings Propensity: With greater financial stability, individuals are more likely to save and invest for long-term goals, benefiting AIA's savings and investment-linked products.

Capital Market Performance and Investment Returns

AIA Group's financial health and ability to deliver returns are directly tied to how its investments perform in global capital markets. When equity markets are robust and bond yields are steady, AIA benefits from stronger investment returns. These returns are vital for fulfilling promises to policyholders and for the company's overall profitability.

For instance, in the first half of 2024, AIA reported a 1.1% increase in its value of new business (VONB) to $2.1 billion, reflecting a resilient performance despite market fluctuations. The group's investment portfolio plays a significant role in this, with asset allocation strategies constantly adapting to market conditions to maximize returns while managing risk.

- Strong Equity Markets: Positive equity performance directly boosts AIA's investment income, enhancing profitability and the ability to meet long-term policyholder liabilities.

- Bond Yield Stability: Stable or rising bond yields provide a predictable income stream, crucial for the solvency and financial stability of insurance companies like AIA.

- Economic Growth Impact: Broader economic growth often correlates with better capital market performance, creating a favorable environment for AIA's investment strategies and overall business expansion.

- Market Volatility: Periods of high market volatility can negatively impact investment returns, potentially affecting AIA's profitability and capital adequacy ratios.

The economic landscape in Asia continues to be a primary driver for AIA Group, with projected GDP growth across key markets supporting increased consumer spending power. This rising disposable income directly translates into greater demand for insurance and savings products. For example, in 2024, the Asian Development Bank forecast that many Southeast Asian economies would see GDP growth rates above 5%, further expanding the addressable market for AIA's offerings.

Inflationary pressures and interest rate fluctuations remain critical considerations for AIA. While higher interest rates can boost investment income on AIA's substantial asset portfolio, they also increase the cost of claims. For instance, central banks maintained higher rates through early 2024, which generally supported insurers' investment returns but also introduced market volatility concerns. Managing these economic variables is key to AIA's profitability and long-term financial stability.

Currency exchange rate volatility poses a significant risk for AIA Group, impacting its reported earnings when converting local currencies to its reporting currency. For example, a strengthening Hong Kong Dollar could reduce the reported value of earnings from other Asian markets. Effective hedging strategies are therefore essential to mitigate these fluctuations and ensure financial stability across its diverse operational regions.

| Economic Factor | Impact on AIA Group | Supporting Data/Trend (2024-2025) |

|---|---|---|

| GDP Growth (Asia-Pacific) | Increased consumer spending, larger addressable market | Projected GDP growth above 5% in several Southeast Asian economies (ADB forecast) |

| Inflation | Higher claims costs, erosion of real value of liabilities | Global inflation rates remain a concern, impacting cost of living and medical expenses |

| Interest Rates | Boosts investment income, but can affect bond valuations; market volatility | Central banks maintained higher rates in early 2024, benefiting investment income but increasing market risk |

| Currency Exchange Rates | Fluctuations impact reported earnings and cross-border transactions | Volatility in Asian currencies against major reporting currencies like HKD |

What You See Is What You Get

AIA Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of AIA Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed examination of how these external forces shape AIA Group's market position and future growth opportunities.

Sociological factors

Asia's rapidly aging populations, with increasing life expectancies, are creating a substantial demand for retirement planning, long-term care, and health insurance. For instance, by 2030, it's projected that over 25% of the population in East Asia will be aged 65 and above, highlighting a significant market opportunity.

AIA is well-positioned to leverage these demographic shifts by innovating and offering specialized financial products and services designed to meet the needs of an aging demographic. This includes developing robust annuity plans and comprehensive health coverage options that provide financial security and support for individuals in their later years.

The expanding middle class and continuous urbanization across Asia are significantly boosting financial literacy and the appreciation for insurance. This demographic shift, particularly evident in countries like Vietnam where the middle class is projected to reach 56 million by 2030, creates a substantial and growing market for AIA's diverse financial products. These consumers are increasingly seeking robust protection and savings vehicles, aligning perfectly with AIA's strategic focus.

Growing health awareness is a significant driver for AIA Group. In 2024, global health and wellness spending is projected to reach over $5 trillion, indicating a strong consumer focus on well-being. This trend directly fuels demand for health and accident insurance products, as individuals increasingly seek financial protection against health-related issues.

AIA can capitalize on this by integrating innovative health and wellness programs into its insurance offerings. For instance, by partnering with wearable tech companies or offering discounts for healthy lifestyle choices, AIA can attract and retain health-conscious customers. This proactive approach aligns with the evolving consumer desire for holistic health management, not just reactive insurance coverage.

Financial Literacy and Education Levels

Growing financial literacy and educational attainment are key sociological shifts impacting AIA. As more people understand sophisticated financial instruments, they are more receptive to AIA's insurance and savings solutions. This trend, evidenced by rising global education metrics, shortens sales cycles and builds customer confidence.

For instance, in 2024, the Organisation for Economic Co-operation and Development (OECD) reported that a significant portion of adults across member countries showed improved financial literacy skills. This directly translates to a more informed consumer base for AIA.

- Increased receptiveness to complex financial products like insurance and savings plans.

- Shorter sales cycles and reduced customer acquisition costs for AIA.

- Enhanced customer trust and higher adoption rates for AIA's offerings.

- A more informed consumer base better able to understand AIA's value proposition.

Cultural Attitudes Towards Savings and Protection

Cultural attitudes towards savings and protection are a significant driver for AIA Group's business, particularly in Asia. Deep-rooted values in many Asian societies emphasize saving for the future and ensuring family security. This cultural propensity directly aligns with the core benefits offered by insurance and long-term savings products, creating a natural demand for AIA's services.

AIA can effectively leverage these cultural inclinations by tailoring its marketing and product messaging. By highlighting how its offerings support familial well-being and future financial stability, AIA reinforces the perceived value of its solutions. For instance, in 2024, the savings rate in many emerging Asian economies remained robust, with countries like Singapore and Hong Kong consistently showing high household savings ratios, often exceeding 20% of disposable income, underscoring the ingrained cultural habit of financial prudence.

- Cultural Emphasis on Family: Many Asian cultures prioritize collective well-being and intergenerational support, making life insurance and savings plans attractive for safeguarding family futures.

- Prudent Financial Habits: A strong cultural inclination towards saving rather than immediate consumption is evident across numerous Asian markets, creating fertile ground for long-term financial products.

- Trust and Long-Term Relationships: Building trust is paramount, as consumers often prefer established institutions that demonstrate commitment and reliability, aligning with AIA's long-standing presence.

- Growing Middle Class: The expanding middle class in Asia, with increased disposable income and a greater awareness of financial planning needs, further amplifies the demand for savings and protection solutions.

Sociological factors significantly shape AIA Group's market landscape, particularly in Asia. The region's rapidly aging population, with life expectancies increasing, drives demand for retirement planning and health insurance. For example, by 2030, over 25% of East Asia's population is projected to be 65 or older, presenting a substantial market opportunity for AIA's specialized products like annuities and health coverage.

The growing middle class and urbanization also boost financial literacy and the appreciation for insurance. In Vietnam, the middle class is expected to reach 56 million by 2030, increasing demand for AIA's diverse financial products as consumers seek protection and savings vehicles. Furthermore, heightened health awareness, with global health spending exceeding $5 trillion in 2024, directly fuels demand for health and accident insurance, aligning with AIA's focus on well-being.

Cultural attitudes towards savings and family security are also key. Many Asian societies emphasize future planning and familial protection, making AIA's insurance and savings products highly relevant. This is reflected in robust savings rates in emerging Asian economies, with countries like Singapore and Hong Kong consistently showing household savings ratios above 20% of disposable income in 2024, highlighting ingrained financial prudence.

| Sociological Factor | Impact on AIA | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Aging Population | Increased demand for retirement and health solutions. | Over 25% of East Asia's population aged 65+ by 2030. |

| Expanding Middle Class & Urbanization | Higher financial literacy and demand for insurance. | Vietnam's middle class to reach 56 million by 2030. |

| Growing Health Awareness | Boosts demand for health and accident insurance. | Global health & wellness spending projected over $5 trillion in 2024. |

| Cultural Savings & Family Focus | Stronger receptiveness to long-term savings and life insurance. | High household savings ratios (e.g., >20% in Singapore/Hong Kong) in 2024. |

Technological factors

AIA is leveraging the surge in digital adoption, with a significant portion of its customer interactions now occurring online. For instance, in 2023, AIA reported a substantial increase in digital customer engagement, with mobile app usage and online policy management seeing double-digit growth across key markets.

This shift necessitates a robust online presence, with AIA investing in user-friendly platforms to streamline the customer journey from initial inquiry to policy purchase and ongoing service. Their focus on digital sales platforms aims to broaden market reach and cater to the growing preference for convenient, self-service options.

AI and ML are transforming AIA's underwriting by speeding up risk assessments and enabling personalized pricing, leading to more accurate evaluations. For instance, by analyzing vast datasets, AI can identify subtle risk patterns that human underwriters might miss, potentially reducing adverse selection and improving profitability.

In claims processing, these technologies streamline operations, allowing for faster payouts and a better customer experience. AIA's adoption of AI-powered claims automation can reduce processing times by up to 50%, a significant improvement that directly impacts customer satisfaction and operational efficiency.

AIA Group is increasingly leveraging big data analytics to understand its customers better. By analyzing vast datasets, AIA can pinpoint specific customer behaviors, preferences, and unmet needs. This granular insight allows for the creation of highly tailored insurance products and marketing efforts that resonate more effectively with individual segments.

This data-driven strategy is proving effective in boosting customer loyalty. For instance, in 2023, AIA reported a strong customer retention rate, partly attributed to its enhanced ability to anticipate and meet evolving customer demands through advanced analytics. The insights gained also highlight emerging market trends and potential new product avenues for AIA to explore.

Cybersecurity and Data Privacy Protection

AIA Group's reliance on digital channels for customer engagement and operations necessitates strong cybersecurity. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the significant financial and reputational risks of data breaches. AIA must invest heavily in advanced security protocols to safeguard sensitive customer information, which is crucial for maintaining client trust and operational continuity.

Adherence to data privacy regulations, such as the General Data Protection Regulation (GDPR) and similar frameworks across its operating regions, is non-negotiable. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. AIA's commitment to data privacy directly impacts its ability to operate legally and maintain its market standing.

- Cybersecurity Investment: AIA's expenditure on cybersecurity is vital to protect against escalating threats.

- Regulatory Compliance: Strict adherence to data privacy laws like GDPR is essential to avoid penalties and maintain customer confidence.

- Data Breach Impact: The financial and reputational damage from a data breach can be severe, underscoring the need for robust protection.

Insurtech Partnerships and Innovation

AIA Group is actively engaging with insurtech firms to drive innovation and maintain a competitive edge. These collaborations allow AIA to leverage specialized expertise in areas such as telematics and the Internet of Things (IoT), accelerating the development of new products and services. For instance, by partnering with insurtech startups, AIA can gain access to agile development methodologies and novel approaches to customer engagement.

These strategic alliances are crucial for enhancing AIA's market position. By integrating cutting-edge technologies and innovative solutions developed through these partnerships, AIA can offer more tailored and efficient insurance products. This focus on technological advancement is a key component of AIA's strategy to adapt to evolving customer needs and market dynamics.

- Insurtech collaboration AIA is forging partnerships with insurtech startups to co-create innovative insurance solutions.

- Technology adoption The group is embracing technologies like telematics and IoT to enhance product offerings and customer experiences.

- Agile development Partnerships provide access to agile development frameworks, speeding up the introduction of new insurance products.

- Expertise infusion Collaborations bring specialized expertise, offering fresh perspectives on product design and service delivery in the insurance sector.

Technological advancements are reshaping AIA's operational landscape, pushing for greater digital integration and efficiency. The group's investment in AI and machine learning is particularly noteworthy, enhancing underwriting accuracy and claims processing speed, with AI-powered automation potentially reducing claims processing times by up to 50%.

AIA is also prioritizing cybersecurity, a critical area given the projected global cost of cybercrime reaching $10.5 trillion annually in 2024, to protect sensitive customer data and maintain trust. Furthermore, strategic collaborations with insurtech firms are enabling AIA to integrate cutting-edge technologies like IoT, fostering innovation and a more competitive market presence.

Legal factors

AIA Group navigates a labyrinth of insurance regulations throughout Asia, impacting everything from initial licensing and capital adequacy to product approvals and how they interact with customers. For instance, in 2024, AIA Hong Kong faced scrutiny regarding its sales practices, highlighting the ongoing need for vigilance in market conduct.

Adherence to these varied and often stringent rules is not merely a suggestion; it's a critical requirement to prevent hefty fines, retain operating licenses, and guarantee the company's legitimacy in each market it serves. Failure to comply can lead to significant financial and reputational damage.

AIA Group must navigate a growing landscape of strict data privacy regulations across Asia-Pacific, mirroring GDPR's influence. For instance, in 2024, countries like Singapore with its Personal Data Protection Act (PDPA) continue to emphasize customer consent and data security, impacting how AIA handles sensitive policyholder information. This requires significant investment in secure data infrastructure and transparent consent management systems.

AIA Group must navigate an increasingly stringent regulatory landscape focused on consumer protection. For instance, in 2024, regulators across key Asian markets, including Hong Kong and Singapore, have intensified scrutiny on sales practices and product transparency, leading to higher compliance costs for insurers. Ensuring clear communication of policy terms and efficient complaint handling is paramount to avoiding penalties and maintaining customer loyalty.

Anti-Trust and Competition Laws

AIA Group must diligently adhere to anti-trust and competition laws across all its operating regions. These regulations are designed to prevent any single entity from dominating the market or engaging in practices that harm fair competition. For instance, in 2023, the European Commission continued its scrutiny of various sectors, including financial services, for potential anti-competitive behavior, underscoring the global importance of compliance.

Failure to comply can result in significant penalties, including hefty fines and reputational damage. AIA's commitment to ethical market participation means proactively ensuring its business strategies, pricing, and product offerings do not create monopolies or unfairly disadvantage competitors. This proactive stance is vital for maintaining trust with regulators and consumers alike.

- Regulatory Scrutiny: AIA operates in markets with robust competition authorities that actively monitor mergers, acquisitions, and market conduct.

- Compliance Costs: Maintaining compliance involves ongoing legal counsel, internal audits, and potential adjustments to business practices, representing a significant operational cost.

- Market Access and Growth: Strict adherence to competition laws is fundamental for AIA to maintain its license to operate and pursue growth opportunities without legal impediments.

Taxation Laws and Treaties

Changes in corporate tax rates across key AIA markets like Singapore and Hong Kong, and potential adjustments to premium taxes, directly influence AIA Group's net income and operational costs. For instance, if Singapore were to increase its corporate tax rate from the current 17%, it would directly impact AIA's bottom line in that significant market.

International tax treaties, particularly those governing cross-border financial flows and subsidiary operations within the Asia-Pacific, are crucial for AIA's tax efficiency. Navigating these treaties allows for optimized profit repatriation and minimizes potential double taxation, a key consideration for a multinational insurer.

AIA's financial planning and profitability are significantly shaped by evolving tax landscapes. For example, the OECD's Base Erosion and Profit Shifting (BEPS) initiative, and its implementation across various Asian nations, could necessitate adjustments in how AIA structures its intercompany transactions and reports its profits globally.

- Corporate Tax Rate Impact: A 1% increase in corporate tax in a major market like China could reduce AIA's net profit by tens of millions of dollars, depending on the profit generated there.

- Premium Tax Variations: Fluctuations in premium tax rates, which can range from 0% to over 10% in some Southeast Asian countries, directly affect the cost of insurance products for consumers and AIA's revenue.

- Treaty Benefits: Favorable tax treaties can reduce withholding taxes on dividends paid between subsidiaries, enhancing AIA's ability to reinvest profits across its regional operations.

- BEPS Compliance: Adapting to BEPS measures might require AIA to increase its tax provision or restructure certain operations to maintain tax neutrality, impacting reported earnings.

AIA Group's operations are deeply intertwined with evolving legal frameworks across Asia. In 2024, heightened regulatory scrutiny on sales practices, as seen with AIA Hong Kong, underscores the constant need for compliance. Strict adherence to data privacy laws, like Singapore's PDPA, mandates robust security and transparent consent management, impacting how sensitive policyholder data is handled.

Furthermore, anti-trust and competition laws require AIA to ensure fair market practices, preventing monopolies and protecting competitors, a global trend highlighted by ongoing EU financial sector reviews. Navigating these varied legal requirements incurs significant compliance costs, including legal counsel and audits, but is essential for market access and sustained growth.

Tax regulations, including corporate and premium taxes, directly influence AIA's profitability. For instance, changes in Singapore's corporate tax rate from 17% would impact AIA's net income. International tax treaties and initiatives like the OECD's BEPS framework necessitate careful structuring of intercompany transactions to optimize tax efficiency and avoid double taxation.

| Legal Factor | Impact on AIA Group | Example/Data (2024/2025 Focus) |

|---|---|---|

| Regulatory Compliance | Operational continuity, license retention, avoidance of fines | AIA Hong Kong sales practice scrutiny in 2024; Singapore PDPA compliance |

| Data Privacy Laws | Customer trust, data security investments, consent management | GDPR-like regulations across Asia; emphasis on customer consent |

| Competition Law | Market access, growth strategies, reputational integrity | Scrutiny of financial services for anti-competitive behavior |

| Taxation (Corporate & Premium) | Net income, operational costs, profitability | Potential impact of Singapore corporate tax rate changes (currently 17%) |

| International Tax Treaties & BEPS | Tax efficiency, profit repatriation, intercompany transactions | OECD BEPS implementation across Asian nations |

Environmental factors

Climate change is fueling more frequent and intense natural disasters, a significant concern for AIA, especially in Asia's disaster-prone areas. This trend directly impacts AIA through increased property and health insurance claims, potentially straining financial reserves. For instance, the Asia-Pacific region experienced an estimated $100 billion in economic losses from natural disasters in 2023, a figure that is projected to rise.

Effectively assessing and pricing these escalating climate-related risks is paramount for AIA's long-term financial health. The company must adapt its underwriting models to account for evolving weather patterns and their impact on mortality and morbidity rates, ensuring solvency amidst growing uncertainty.

Growing investor, regulatory, and public scrutiny on Environmental, Social, and Governance (ESG) factors significantly influences AIA's investment strategies and corporate operations. For instance, by the end of 2023, AIA Group reported that its investment portfolio aligned with net-zero carbon emissions by 2050, demonstrating a commitment to sustainable investing.

Adopting strong ESG practices, including the development of sustainable investment portfolios and a focus on responsible business conduct, enhances AIA's reputation and attracts socially conscious capital. This strategic approach is crucial as global sustainable investment assets are projected to reach $50 trillion by 2025, highlighting a significant market opportunity for companies like AIA that prioritize ESG.

The global sustainable investing market is experiencing significant growth, with assets under management projected to reach $50 trillion by 2025, according to Bloomberg Intelligence. This presents a substantial opportunity for AIA to integrate environmental, social, and governance (ESG) criteria into its investment strategies, potentially attracting a growing base of ethically-minded investors and insurers.

Green finance initiatives, such as the issuance of green bonds, are becoming increasingly prevalent. AIA can leverage these trends by developing and promoting green insurance products, such as those linked to renewable energy projects or offering discounts for eco-friendly practices, thereby tapping into a market segment eager to align financial decisions with environmental consciousness.

Resource Scarcity and Operational Footprint

Resource scarcity, particularly concerning water and energy, presents a growing challenge for global businesses like AIA Group. Managing the company's operational environmental footprint, such as energy consumption within its extensive office network, is becoming paramount. For instance, in 2023, global energy demand grew by 2% according to the IEA, highlighting the increasing pressure on resources.

Implementing eco-efficient practices offers a dual benefit: reducing operational costs and significantly enhancing brand image among environmentally conscious stakeholders. AIA's commitment to sustainability can translate into tangible savings and a stronger market position.

- Water Scarcity: Regions where AIA operates may face increasing water stress, impacting operational continuity and costs.

- Energy Consumption: Offices and data centers are significant energy users; efficiency improvements can lead to substantial cost reductions. For example, many companies are targeting a 10-20% reduction in office energy use by 2025 through smart building technologies.

- Waste Management: Reducing waste generated from operations, including paper and electronic waste, contributes to a smaller environmental footprint.

- Supply Chain Impact: Ensuring suppliers also adopt sustainable resource management practices is crucial for AIA's overall environmental performance.

Regulatory and Reporting Requirements on Climate Risk

Regulators worldwide are intensifying scrutiny on climate risk for financial institutions. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) and the Task Force on Climate-related Financial Disclosures (TCFD) framework are setting benchmarks for transparency. AIA Group must establish sophisticated systems to identify, measure, and report these evolving climate-related financial exposures, embedding them within its comprehensive enterprise risk management processes to ensure compliance and strategic resilience.

The increasing regulatory push necessitates substantial investment in data analytics and expertise. AIA needs to build capabilities to quantify physical risks, such as extreme weather events impacting asset values, and transition risks, like policy changes affecting carbon-intensive investments. By 2024, many financial regulators, including those in the UK and Singapore, have signaled intentions to enhance climate risk reporting mandates, requiring more granular detail and forward-looking scenario analysis.

- Mandatory Disclosures: Growing number of jurisdictions require financial firms to disclose climate-related financial risks, aligning with frameworks like TCFD.

- Risk Management Integration: Regulators expect climate risk assessment to be a core component of enterprise-wide risk management, not an isolated exercise.

- Data and Analytics Investment: Developing robust climate risk reporting requires significant investment in data infrastructure, scenario modeling, and specialized talent.

- Evolving Standards: AIA must remain agile to adapt to rapidly evolving regulatory expectations and reporting standards across its diverse operating markets.

AIA faces increasing risks from climate change, with more frequent natural disasters impacting its operations and claims, especially in Asia where economic losses from such events reached an estimated $100 billion in 2023. The company must adapt its underwriting to account for changing weather patterns and their effect on health, ensuring financial stability. Furthermore, there's growing pressure from investors, regulators, and the public to focus on Environmental, Social, and Governance (ESG) factors, with global sustainable investment assets projected to hit $50 trillion by 2025, presenting a significant opportunity for AIA to align its strategies with sustainability goals.

Resource scarcity, like water and energy, also poses challenges, necessitating efficient operational practices. For instance, global energy demand rose by 2% in 2023, underscoring the need for energy efficiency in AIA's operations, which can lead to cost savings and enhanced brand image. Regulators are also demanding greater transparency on climate risks, with frameworks like TCFD becoming standard, requiring significant investment in data and analytics to meet evolving reporting mandates by 2024.

| Environmental Factor | Impact on AIA | Data/Trend |

|---|---|---|

| Climate Change & Natural Disasters | Increased insurance claims, strain on financial reserves | Asia-Pacific economic losses from natural disasters: ~$100 billion (2023) |

| ESG Scrutiny | Influence on investment strategies, need for sustainable practices | Global sustainable investment assets projected: $50 trillion by 2025 |

| Resource Scarcity (Energy/Water) | Operational costs, need for efficiency | Global energy demand growth: 2% (2023) |

| Regulatory Pressure (Climate Risk) | Need for enhanced reporting, data analytics investment | Increased regulatory mandates expected by 2024 (e.g., UK, Singapore) |

PESTLE Analysis Data Sources

Our PESTLE analysis for AIA Group is built on a robust foundation of data from reputable financial institutions, government reports, and leading industry publications. We integrate economic indicators, regulatory updates, and technological advancements to provide a comprehensive view.