Afarak SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Afarak Bundle

Afarak's market position hinges on its specialized ferrochrome production capabilities, a key strength in a niche but vital industry. However, understanding the full scope of its operational challenges and the dynamic global commodity market requires a deeper dive.

Unlock the complete picture behind Afarak's competitive edge and potential vulnerabilities with our comprehensive SWOT analysis. This in-depth report provides actionable insights and strategic context, essential for investors and industry professionals alike.

Gain access to a professionally written, fully editable report that reveals Afarak's true market potential and strategic opportunities. Equip yourself with the detailed analysis needed to make informed decisions and capitalize on growth prospects.

Strengths

Afarak Group's vertically integrated business model, spanning from chrome mining to ferroalloy production, offers a significant competitive advantage. This integration provides granular control over the entire value chain, from raw material sourcing to the delivery of finished products. In 2023, Afarak reported that its integrated operations contributed to a stable supply of key inputs, mitigating the impact of external market volatility.

Afarak's deliberate focus on specialty alloys is a significant strength, as these materials are crucial for stainless steel and other high-performance steels. This strategic emphasis allows the company to operate in a more lucrative market segment, often commanding better pricing compared to basic metals.

The company's commitment to this niche is evident in its production figures. In the first quarter of 2025, specialty alloys represented a substantial 68% of Afarak's total output. This marks a notable increase from the 55% share seen in 2024, clearly demonstrating a strategic pivot towards higher-margin product lines.

Afarak has made significant strides in operational cost efficiency, evidenced by an 8.2% reduction in production costs per unit in the first quarter of 2025 compared to the prior quarter. This achievement stems from strategic initiatives in optimizing procurement processes, streamlining operational workflows, and investing in advanced automation technologies. Such a disciplined approach to cost management is vital for maintaining a competitive edge in the fluctuating commodity markets, allowing Afarak to navigate industry challenges effectively.

Diversified Geographic Operations

Afarak's diversified geographic operations, with mining in Turkey and South Africa and processing in Germany, significantly reduce operational risk. This spread is crucial, as evidenced by the Q1 2025 period where challenges in South African mines due to heavy rainfall were mitigated by the robust performance of its Turkish operations. This global presence not only balances regional issues but also provides access to varied markets and essential resources.

The company's strategic placement of assets allows for operational resilience. For instance, despite a reported 15% decrease in output from its South African mines in early 2025 due to weather disruptions, Afarak's Turkish operations maintained strong production levels, contributing positively to the overall financial results for the first half of 2025. This geographic diversification directly translates to a more stable revenue stream.

- Reduced Risk Exposure: Mining in Turkey and South Africa, processing in Germany.

- Operational Offset: Turkish mines compensated for Q1 2025 South African rainfall impacts.

- Market Access: Global footprint enables entry into diverse markets and resource acquisition.

Healthy Balance Sheet and Financial Stability

Despite facing a challenging 2024 marked by reduced revenue and EBITDA, Afarak demonstrated resilience by maintaining a strong financial position. The company successfully lowered its interest-bearing debt, concluding the year with stable cash reserves. This financial prudence is further underscored by a low gearing ratio, indicating a conservative approach to leverage.

Afarak's commitment to financial health is also evident in its dividend policy, which targets a payout of at least 10% of EBITDA. This strategy not only aims to reward shareholders but also reflects the company's confidence in its ongoing financial stability and ability to generate consistent returns.

- Healthy Balance Sheet: Afarak maintained a sound financial condition despite a challenging 2024.

- Debt Reduction: The company successfully reduced its interest-bearing debt by the end of 2024.

- Stable Cash Reserves: Afarak ended 2024 with stable cash reserves, indicating liquidity.

- Low Gearing Ratio: A low gearing ratio signifies financial prudence and reduced financial risk.

Afarak's vertical integration is a key strength, controlling the entire chrome value chain from mining to ferroalloy production. This integration ensures a stable supply of raw materials, as seen in 2023 when it helped mitigate external market volatility. The company's strategic focus on specialty alloys, which accounted for 68% of its output in Q1 2025, up from 55% in 2024, positions it in a higher-margin segment of the market.

Operational cost efficiency has improved significantly, with a 8.2% reduction in production costs per unit in Q1 2025 compared to the previous quarter, driven by procurement optimization and automation. Furthermore, Afarak's diversified geographic presence, with mining in Turkey and South Africa and processing in Germany, reduces operational risk; for example, Turkish operations offset impacts from heavy rainfall in South African mines in Q1 2025.

Financially, Afarak demonstrated resilience in 2024, reducing debt and maintaining stable cash reserves despite revenue challenges. A low gearing ratio indicates financial prudence, and the company targets a dividend payout of at least 10% of EBITDA, reflecting confidence in its financial stability.

| Metric | 2024 (End) | Q1 2025 |

|---|---|---|

| Specialty Alloys Output Share | 55% | 68% |

| Production Cost Reduction (QoQ) | N/A | 8.2% |

| Interest-Bearing Debt | Reduced | N/A |

| Cash Reserves | Stable | N/A |

What is included in the product

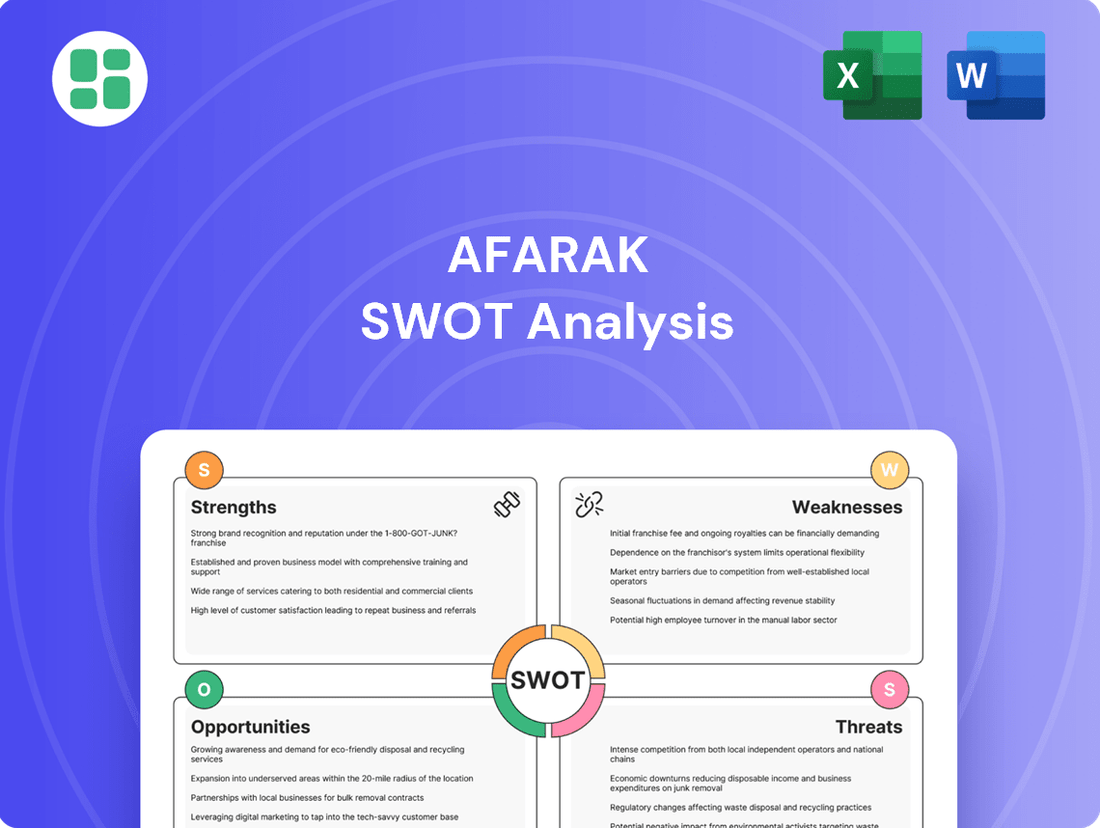

Analyzes Afarak’s competitive position through key internal and external factors, highlighting its strengths in specialized alloys and opportunities in growing markets, while acknowledging weaknesses in operational efficiency and threats from volatile commodity prices.

Highlights key internal and external factors to proactively address potential market challenges and capitalize on opportunities.

Weaknesses

Afarak's operations are deeply tied to the unpredictable swings in commodity prices, particularly chrome ore and ferroalloys. This makes its financial performance quite sensitive to market shifts.

The company experienced this firsthand in the latter half of 2024, when a notable drop in chrome ore prices directly squeezed its revenues and profit margins. This event underscores the significant vulnerability to price volatility.

Consequently, forecasting Afarak's revenue and profitability becomes a complex exercise due to these inherent market fluctuations.

Afarak's profitability is closely tied to the demand for stainless steel and specialty steels. In 2024, the company faced historically low demand, particularly in Europe, which directly impacted its revenue and profit margins. This sensitivity to market cycles means sustained weakness in key customer industries poses a significant risk to Afarak's financial performance.

While Afarak operates across multiple regions, which offers some diversification, specific geographical operational risks remain a concern. These localized challenges can still significantly impact production levels, even with a broader operational footprint.

For example, in Q1 2025, Afarak experienced a substantial 26.8% drop in production from its South African mines. This downturn was directly attributed to adverse weather conditions, specifically heavy rainfall, highlighting how localized environmental events can create significant operational disruptions and lead to temporary production shortfalls.

Dependence on Energy Costs

Afarak's ferroalloy production is inherently energy-intensive, making the company particularly vulnerable to shifts in global energy prices. For instance, in 2024, escalating electricity costs in key operational regions like Europe have directly impacted production economics, potentially squeezing profit margins. This reliance on energy makes maintaining global competitiveness a constant challenge, as higher input costs can disadvantage Afarak against competitors in areas with lower energy tariffs.

The company's operational expenses are significantly influenced by these energy costs. While Afarak actively pursues energy optimization strategies, the sheer scale of these expenditures means that external energy market volatility continues to pose a substantial risk. For example, a significant surge in natural gas prices, a key component in many energy contracts, could directly translate into lower profitability for Afarak's European facilities.

This dependence on energy costs presents a notable weakness:

- Energy Intensity: Ferroalloy manufacturing requires substantial amounts of electricity and heat, directly linking operational costs to energy market fluctuations.

- Geographic Vulnerability: Operations in regions with high energy prices, such as parts of Europe in 2024, face greater margin pressure and competitive disadvantages.

- Margin Squeeze: Fluctuations in energy prices can directly impact Afarak's profitability, potentially reducing its ability to invest in growth or return value to shareholders.

- Competitiveness Impact: Higher energy costs can make Afarak's products less competitive on the global market compared to producers in regions with cheaper energy sources.

Competition from Low-Cost Imports

Afarak faces intense competition from lower-priced ferroalloys, particularly from nations such as India, Kazakhstan, Russia, and China. This influx of cheaper imports directly challenges Afarak's pricing power, potentially leading to reduced selling prices and compressed profit margins. For instance, in 2023, global ferrochrome prices experienced volatility, influenced by oversupply from certain regions, impacting producers like Afarak.

The ability of these competitors to produce at lower costs, often due to factors like cheaper labor or less stringent environmental regulations, creates a significant disadvantage for Afarak. This price pressure can erode market share if Afarak cannot match the cost efficiencies of its rivals. The International Stainless Steel Forum reported that global stainless steel production, a key end-user for ferroalloys, saw a slight increase in 2023, but the competitive landscape for raw material supply remained challenging.

Maintaining profitability becomes a considerable hurdle when confronted with such cost-competitive imports. Afarak must continually seek operational efficiencies and cost reductions to remain competitive in this environment. The company's financial reports often highlight the impact of raw material costs and global market pricing on its performance, underscoring the sensitivity to these competitive pressures.

Afarak's reliance on commodity prices, especially chrome ore and ferroalloys, makes its financial results highly susceptible to market fluctuations. This was evident in late 2024 when falling chrome prices directly impacted revenues and profit margins, highlighting a significant vulnerability to price volatility.

The company's profitability is also closely linked to the demand for stainless and specialty steels. In 2024, weak demand, particularly in Europe, led to reduced revenue and profit margins, demonstrating a sensitivity to economic cycles that can significantly harm financial performance.

Geographical operational risks persist, as seen in Q1 2025 when heavy rainfall in South Africa caused a 26.8% drop in mine production, illustrating how localized environmental issues can disrupt operations and create temporary output shortfalls.

The energy-intensive nature of ferroalloy production makes Afarak vulnerable to rising energy costs. In 2024, escalating electricity prices in Europe directly squeezed production economics and profit margins, posing a challenge to global competitiveness against regions with lower energy tariffs.

Full Version Awaits

Afarak SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Afarak's Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the complete, in-depth analysis.

Opportunities

The global stainless steel market is experiencing robust expansion, with projections indicating a rise from $164.9 billion in 2024 to $177.92 billion in 2025. This upward trend, expected to reach $248.39 billion by 2029, is a direct result of growth in key sectors like manufacturing, construction, and automotive.

This increasing demand for stainless steel, particularly for its corrosion-resistant properties, creates a significant opportunity for Afarak. The company's ferroalloy products are essential components in the production of stainless and specialty steels, positioning Afarak to capitalize on this expanding market.

After a difficult 2024, the ferroalloy market is showing signs of a potential recovery in 2025, with a slightly bullish outlook anticipated. Analysts are projecting a modest upturn in demand, which could translate into improved market prices for key ferroalloys.

This potential demand rebound, possibly fueled by broader economic stimulus measures and strengthening underlying industrial activity, is a significant opportunity for producers like Afarak. Improved market conditions could lead to enhanced profitability and a more stable operating environment.

For instance, global ferroalloy prices, which experienced significant volatility in 2024, are projected by some market research firms to stabilize and potentially see a 3-5% increase in key segments by mid-2025, driven by renewed construction and automotive sector activity.

Afarak is poised for significant growth through its Turkish operations, which have already demonstrated impressive momentum. Mining activities in Turkey surged by 18.4% in the first quarter of 2025, indicating robust underlying demand and operational efficiency.

This strong performance in Turkey provides a stable foundation for future expansion. The company's strategic plan includes a substantial 25% production capacity increase, largely driven by a new plant in Saudi Arabia slated for operation by mid-2026.

By leveraging the enhanced capacity from the new plant and continuing to capitalize on the successful Turkish operations, Afarak can achieve greater economies of scale. A continued focus on these low-risk, high-performing Turkish assets will be key to solidifying stability and driving overall growth.

Increasing Focus on Sustainable Practices and ESG

The mining and metals industry is increasingly prioritizing Environmental, Social, and Governance (ESG) factors. This includes a stronger push for energy efficiency, minimizing waste, and incorporating recycled materials into operations. Afarak's commitment to sustainable growth directly addresses this evolving landscape, which could lead to greater investor interest and a stronger social license to operate.

Companies that actively adopt sustainable practices are better positioned to gain a competitive advantage and mitigate long-term operational and reputational risks. For instance, in 2024, the global sustainable finance market reached an estimated $3.7 trillion, demonstrating significant investor appetite for ESG-aligned businesses. Afarak's strategic alignment with these trends presents a clear opportunity.

- Growing Investor Demand: A significant portion of institutional investors now integrate ESG criteria into their investment decisions, with over 70% of global asset managers considering ESG factors in 2024.

- Enhanced Social License: Demonstrating strong ESG performance can improve community relations and reduce the likelihood of operational disruptions.

- Risk Mitigation: Proactive management of environmental and social impacts can prevent costly regulatory fines and reputational damage.

- Operational Efficiencies: Investments in energy efficiency and waste reduction can lead to substantial cost savings over time.

Technological Advancements and Digital Logistics

Technological advancements, particularly the integration of Artificial Intelligence (AI) into mining operations, offer significant opportunities for Afarak. AI can enhance environmental, social, and governance (ESG) practices by improving data analysis for sustainability reporting and enabling predictive maintenance, thereby reducing downtime and operational costs. For instance, Afarak's collaboration with GreenTech Logistics is designed to streamline distribution, targeting a 15-20% reduction in inefficiencies. This focus on technological adoption is projected to yield further cost savings and optimize the entire supply chain.

Leveraging these innovations can lead to:

- Enhanced Operational Efficiency: AI-driven analytics can optimize resource allocation and production schedules.

- Improved ESG Performance: Technology aids in better monitoring and management of environmental impact and social responsibility.

- Cost Reductions: Predictive maintenance and optimized logistics directly contribute to lower operating expenses.

- Supply Chain Optimization: Partnerships and technology adoption can create a more resilient and cost-effective supply chain.

The expanding global stainless steel market, projected to reach $248.39 billion by 2029, presents a significant opportunity for Afarak due to its essential role in ferroalloy production. The anticipated recovery in the ferroalloy market in 2025, with a potential 3-5% price increase in key segments, further bolsters Afarak's prospects for improved profitability.

Afarak's strong performance in Turkey, marked by an 18.4% surge in mining activities in Q1 2025, provides a stable base for growth, complemented by a planned 25% production capacity increase with a new Saudi Arabian plant by mid-2026. The increasing global investor focus on ESG factors, with over 70% of asset managers considering them in 2024, aligns with Afarak's sustainability commitments, potentially attracting greater investment and enhancing its social license to operate.

Technological advancements, such as AI integration in mining and optimized logistics through partnerships like the one with GreenTech Logistics targeting 15-20% inefficiency reduction, offer Afarak avenues for enhanced operational efficiency, cost savings, and supply chain resilience.

| Market Opportunity | Projected Growth (2024-2029) | Afarak's Relevance/Impact |

|---|---|---|

| Global Stainless Steel Market | $164.9B (2024) to $248.39B (2029) | Afarak's ferroalloys are key inputs. |

| Ferroalloy Market Recovery | Modest upturn expected in 2025; 3-5% price increase in key segments | Potential for improved profitability and stable operations. |

| Turkish Mining Operations | 18.4% surge in Q1 2025 | Provides a stable foundation for expansion. |

| ESG Investment Trend | Over 70% of global asset managers consider ESG in 2024 | Afarak's sustainability focus attracts investor interest. |

| Technological Integration (AI, Logistics) | Targeting 15-20% inefficiency reduction | Enhances efficiency, reduces costs, and optimizes supply chain. |

Threats

The ferroalloy sector, including companies like Afarak, remains susceptible to unpredictable swings in raw material costs, especially chrome ore, and elevated energy expenses. These price volatilities directly squeeze production costs and profitability. For instance, Afarak experienced a negative impact on its financial performance in 2024 due to a significant drop in chrome ore prices.

Afarak faces significant headwinds from intense global competition, particularly from regions with lower production costs. This pressure from imports can directly impact market prices for alloys, potentially squeezing Afarak's profit margins. For instance, in 2024, the ferroalloys market experienced volatility driven by increased supply from emerging producers, making it challenging for established players to maintain pricing power.

The broader alloy production sector is also grappling with excess capacity. This oversupply situation means that profitability across the industry, including for manufacturers like Afarak, is likely to remain constrained. As of early 2025, industry analysts noted that global stainless steel production, a key end-market for many alloys, continued to outpace demand growth in certain segments, exacerbating the overcapacity issue.

Global geopolitical tensions, such as ongoing conflicts and evolving trade relationships, present a significant threat to Afarak. These tensions can directly impact supply chains, leading to disruptions and increased costs, as seen with the Red Sea shipping crisis in early 2024 which caused significant delays and surcharges for many industries. This instability can hinder the procurement of essential raw materials and complicate the export of finished goods, directly affecting operational efficiency and financial performance.

Stricter Environmental Regulations and Compliance Costs

Afarak's ferroalloy production is inherently energy-intensive, contributing to significant carbon emissions. This puts the company directly in the crosshairs of increasingly stringent environmental regulations worldwide. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023 and will fully apply from 2026, imposes costs on carbon-intensive imports, potentially impacting Afarak's competitiveness if its production remains carbon-heavy.

These evolving environmental mandates, particularly those focused on climate-related financial disclosures and decarbonization targets, present a tangible threat. Compliance with stricter emissions standards, waste management protocols, and reporting requirements will likely translate into higher operational costs for Afarak. Furthermore, these regulations could impose operational restrictions, potentially limiting production volumes or necessitating costly upgrades to existing facilities to meet new environmental benchmarks.

- Increased Compliance Costs: Meeting new emissions standards and reporting requirements can significantly raise operational expenses.

- Operational Restrictions: Stricter regulations may limit production capacity or necessitate costly process modifications.

- Carbon Pricing Mechanisms: Initiatives like the EU's CBAM could add direct costs to carbon-intensive production, impacting profitability.

- Reputational Risk: Failure to adapt to environmental expectations could damage Afarak's brand image and stakeholder relationships.

Economic Downturns and Reduced Steel Demand

Economic downturns, particularly those affecting the construction and automotive sectors, directly reduce the demand for stainless steel, impacting Afarak's sales volumes and pricing power. A slowdown in major economies like Europe, where stainless steel demand was historically low in 2024, poses a significant threat.

This vulnerability was evident as the company navigated challenging market conditions throughout 2024. For instance, European stainless steel demand experienced a notable contraction, directly affecting producers like Afarak.

- Global economic slowdown: Reduced industrial activity and consumer spending curb demand for steel products.

- Sector-specific downturns: Weakness in construction, automotive, and manufacturing directly impacts stainless steel consumption.

- European market weakness: Historically low demand in Europe during 2024 highlighted Afarak's sensitivity to regional economic performance.

Afarak faces intense global competition, particularly from lower-cost producers, which pressures alloy prices and profit margins. For example, the ferroalloys market in 2024 saw increased supply from emerging producers, impacting pricing power.

Overcapacity in the alloy production sector, exacerbated by slower demand growth in key markets like stainless steel in early 2025, continues to constrain profitability for companies like Afarak.

Geopolitical instability, such as shipping disruptions experienced in early 2024, can impede raw material procurement and product exports, increasing costs and affecting operational efficiency.

Rising energy costs and volatile raw material prices, especially for chrome ore, directly impact Afarak's production expenses and financial performance, as seen with negative impacts in 2024 due to falling chrome ore prices.

SWOT Analysis Data Sources

This Afarak SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations, ensuring a robust and accurate strategic assessment.